Here’s a preview of what we’ll cover this week:

Macro: The U.S. Economy Keeps Defying the Bears; Rate Cut Odds Soar Higher; How was the Labor Market Data?

Markets: The Dot Com Flashback; Time To Buy Quality; Fear Is Maxed Out; Software Vs AI Update; Opportunity In Panic; Coreweave; Positioning For An Oil Rebound?; The Return Of Animal Spirits?

Digital Assets: Bitcoin’s Free Fall

Lumida Curations: Future of Work; Silicon Valley’s Blind Spot on Defense; The 2–4 AM Wake-Up Call

Lumida hosted a holiday party this Tue evening in NYC.

Fun fact: the event was hosted by a member of our telegram group; we had not met before. He found us through the DCG Genesis debacle, and invested in Coreweave Pre-IPO and made money on some of our stock picks.

Thanks David!

I did a podcast from my FSD on our way back from the event. View it here.

This is the Season to Mitigate Tax

Every spring, investors write one of their biggest checks of the year to the IRS.

However, you can save your taxes and contribute to economic and social welfare instead.

Actions taken today can mitigate income tax owed to the IRS in the spring.

The solution is Solar Investment Tax Credit (ITC). It allows investors to offset federal taxes by financing qualified solar projects.

In practical terms, an investor with a $100,000 tax bill could put roughly $60,000 into a qualified solar project and reduce their tax liability by nearly 40%.

Corporates have been doing this for years; in 2024 alone, more than $20 billion in solar credits were traded, up four-fold from the year before.

We have a limited capacity on this opportunity; so if you have a substantial tax bill, now is the time to act!

Go to our website at www.lumidawealth.com and click ‘Learn More’ to learn about this and other tax mitigation opportunities.

We also offer tax mitigation strategies for our wealth management clients.

Macro

The U.S. Economy Keeps Defying the Bears

Earnings season just confirmed how resilient the U.S. economy is.

Over the last three months, more than 70% of companies beat expectations on both earnings and revenues, versus long-term averages closer to the low 60s.

The share of companies raising guidance is sitting near the top of its historical range.

Real GDP has been growing around 4% annualized in Q2 and Q3.

Productivity has also ticked upwards thanks to AI and automation.

Overall, these statistics suggest the economy isn’t on the brink of recession as some headlines might suggest; it is the backdrop of an economy that can keep surprising to the upside.

How was the Labor Market Data?

Overall, this week’s labor market releases painted a mixed picture.

September payrolls rose by about 120,000 versus expectations of 50,000.

However, the unemployment rate has ticked up to the mid-4s due to increasing labor force participation, which rose to 62.4%.

There is undoubtedly anxiety in labor markets. That’s not enough to cause a recession.

Take a step back: we have a baby boomer economy, led by services, and funded by transfer payments, and significant capex and federal spending.

There’s no recession coming folks.

Interestingly, this uptick in participation has coincided with a decline in crypto markets.

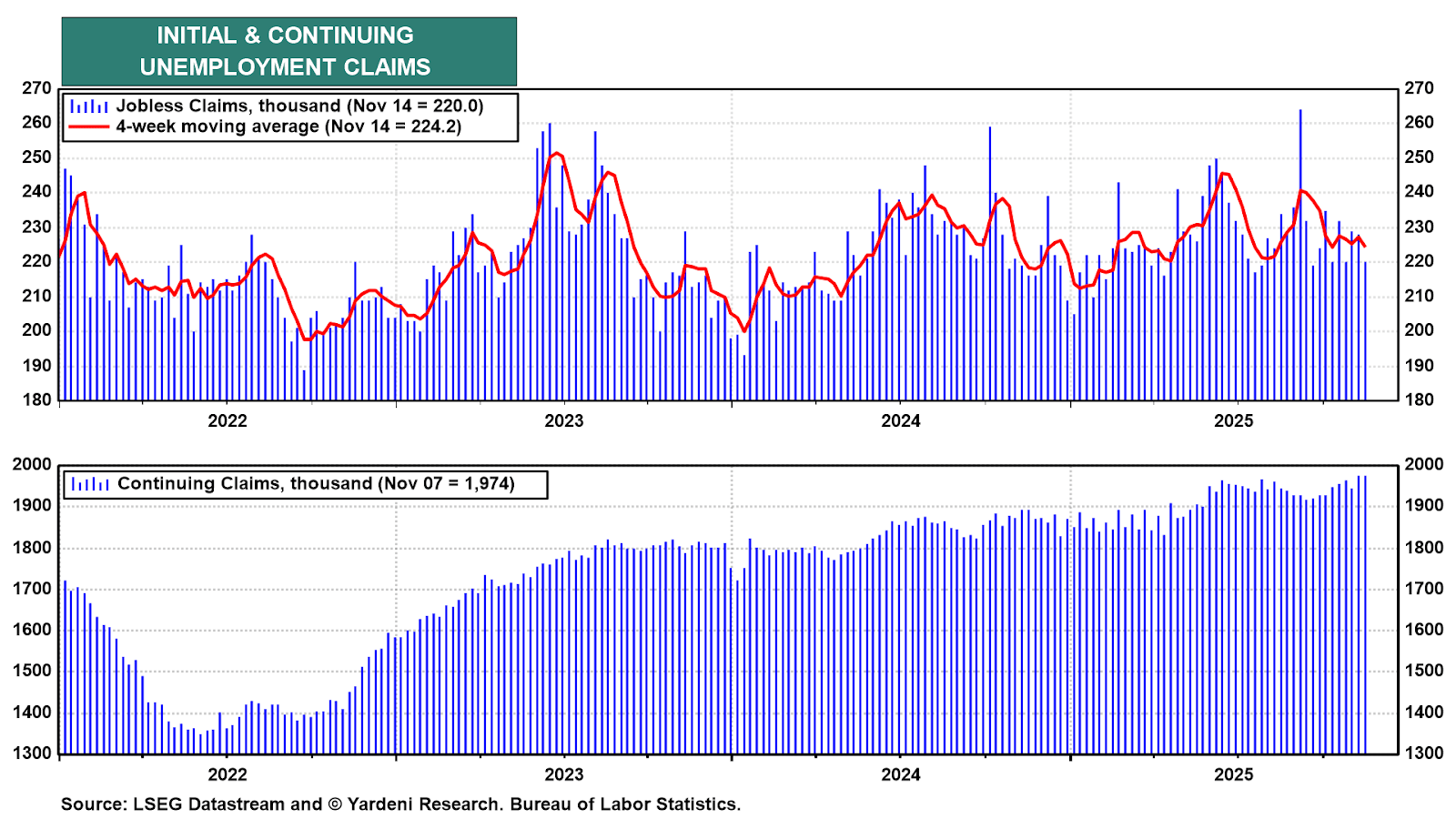

Under the surface, the story is “low fires, low hires.” Initial jobless claims remain low and within the post-covid range.

However, continuing claims rose by about 5% YoY, which means it is taking longer to land a new job, especially for younger workers and recent college grads.

We have observed a similar pattern across the last few months.

Companies are retaining workers, and implementing AI, which reflects in higher output without increasing hours worked.

This indicates a structural change in the labor market, which rate cuts aren’t likely to fix.

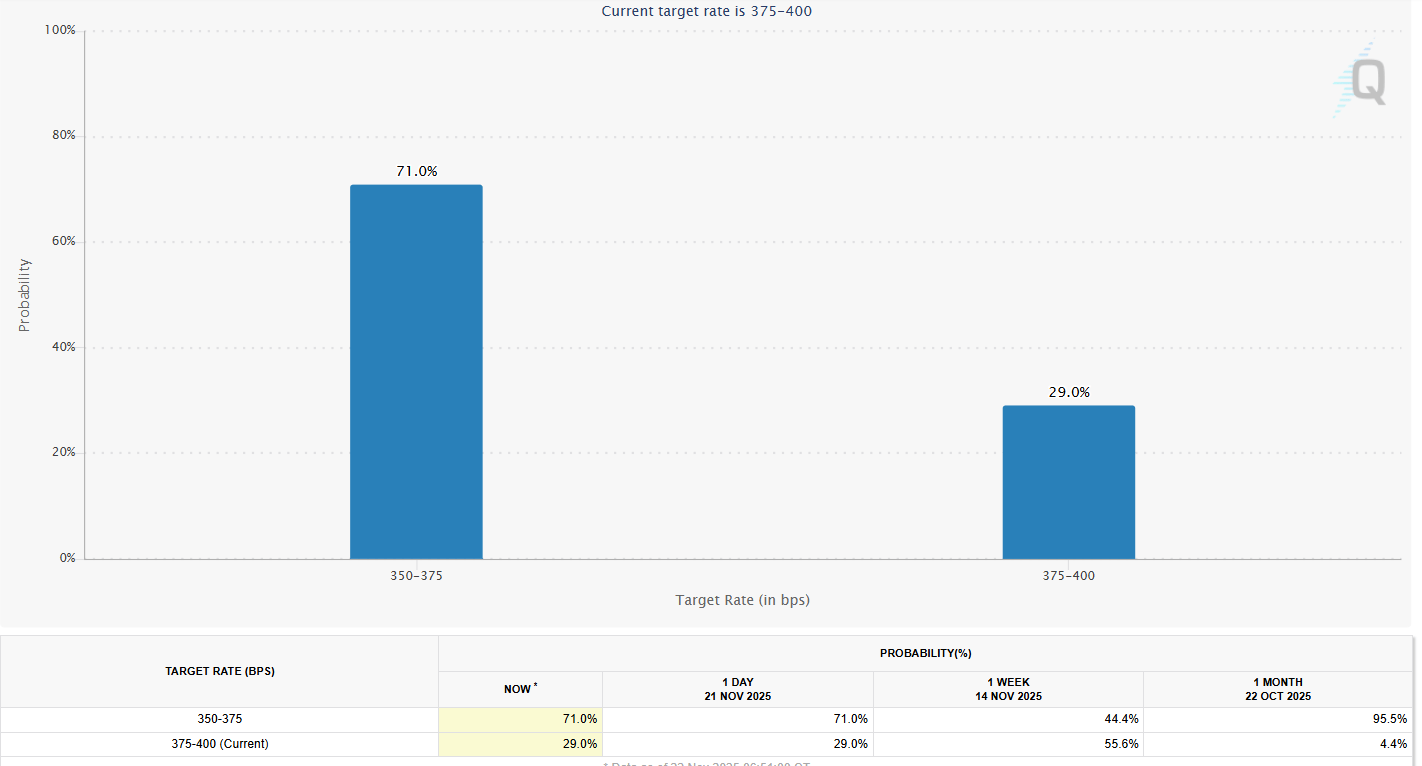

Rate Cut Odds Soar Higher

NY Fed John Williams’ comments on Friday raised the rate cut odds back to 70% from 33% a day earlier.

The S&P surged on Friday after these comments.

The Dec Fed rate cut probability is the most crucial to watch.

Governor Williams: “My assessment is that the downside risks to employment have increased as the labor market has cooled, while the upside risks to inflation have lessened.”

“Therefore, I still see room for a further adjustment in the near term to the target range.”

Our view remains that the economy is growing and doesn’t need rate cuts. But, rate cuts are coming so we will position accordingly.

Markets

The Dot Com Flashback

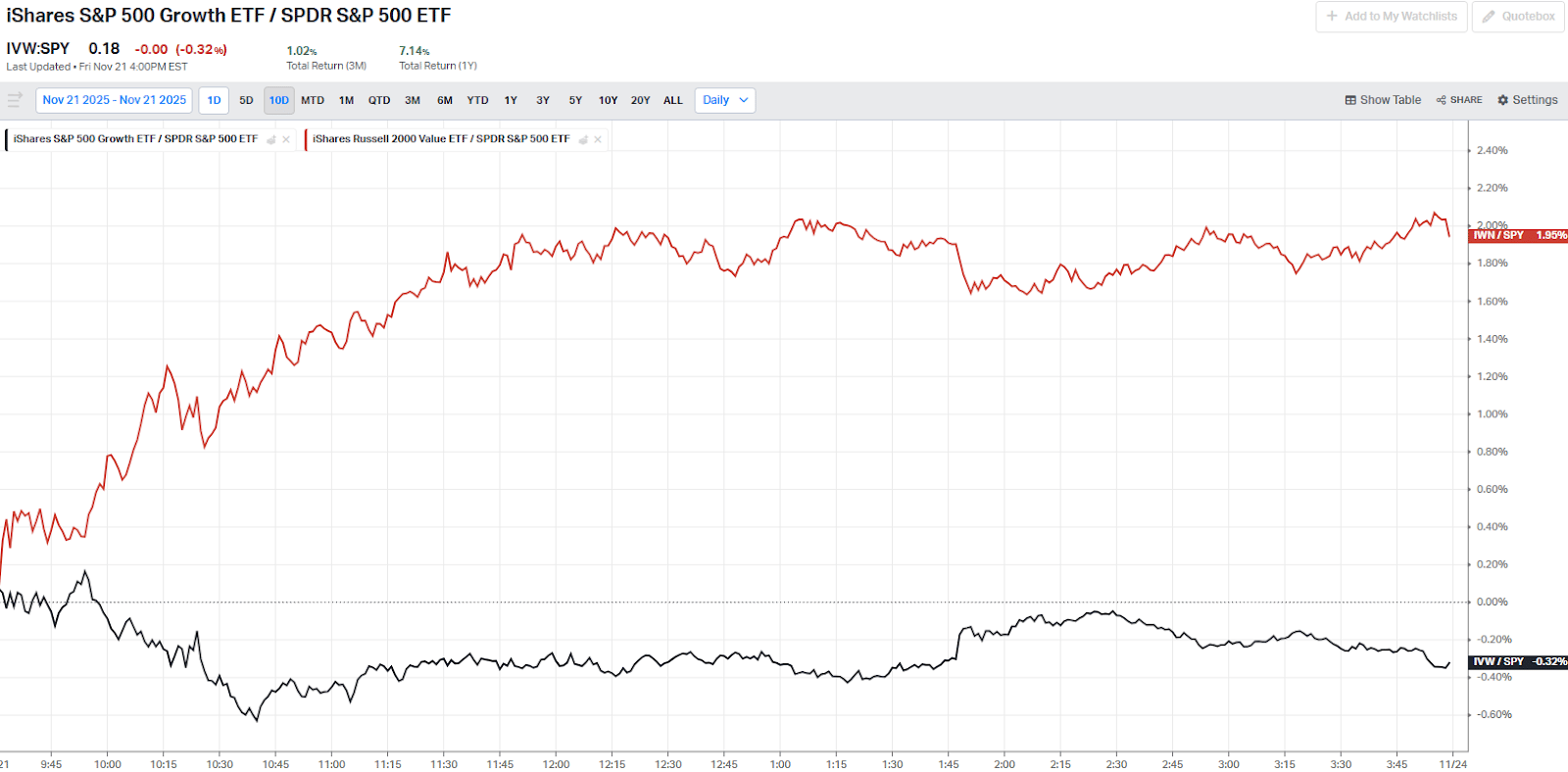

Small-cap value led the tape on Friday, while large cap growth names were on the losing end.

We can draw a parallel here from the post-dot-com bubble era.

In the 5 years following the 2000s bubble burst, tech indices lost almost 30% of their market cap, while small-cap value names compounded close to 90%.

In 2025, markets had again been discounting Ziff Davis - it lost 44% in the last 1 year, while SPY gained 13%.

However, in the rotational move on Friday, Ziff Davis received the love and rose 7.7%.

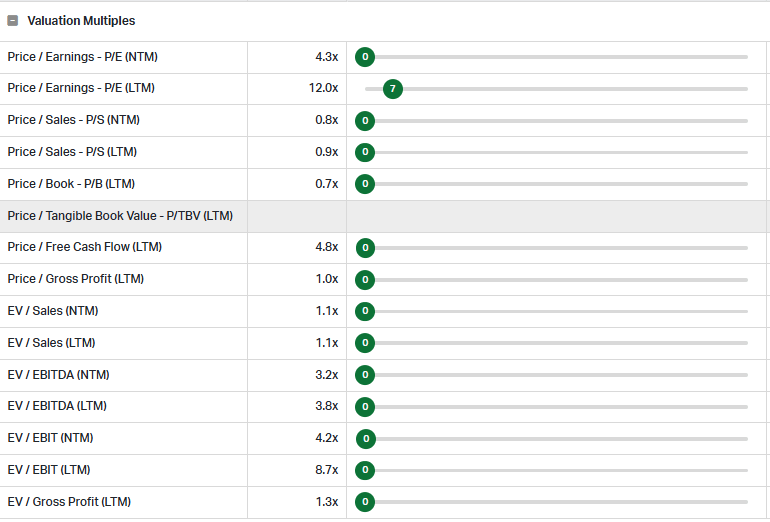

Ziff Davis is a $1.3B digital media and tech company that now trades around 4.3x P/E NTM with a FCF yield at 21%.

The latest quarter was solid.

Revenue grew nearly 3% YoY to $364M, marking the fifth consecutive quarter of growth, with an adjusted EBITDA margin a little above 34%.

Adjusted EPS rose 7% to $1.76, helped by buybacks that retired roughly 3.3M shares.

Free cash flow was $71M, up 18% YoY, and trailing-twelve-month FCF is about $261M, which management is recycling into what they believe is ROIC-productive M&A and repurchases.

The bear case?

Roughly 60% of revenue is still tied to advertising, gaming & entertainment, which declined by about 4% YoY. This revenue stream is highly cyclical.

Nonetheless, the mix is improving: three of the five segments are growing.

Health & wellness is up 13% YoY. Cybersecurity, and performance marketing are all positive as well.

We own some of this in small cap value.

The Revenge of Warren Buffett

In February, I wrote a newsletter called ‘The Bubble in Quality’. We noted how stocks like Costco and other high quality businesses (FICO, etc.) were sporting bubble valuations.

Costco’s PE went from 50x to 45x since then. I still wouldn’t own it.

But, other quality names have sold off quite a bit and may present attractive entries. They aren’t bargain basement prices. But, are cheap historically.

Buffett is back in the market and has picked up quite a bit of Google - one of our top 3 positions.

As Animal Spirits fade, we believe a rotation into its opposite - quality and value may be in order.

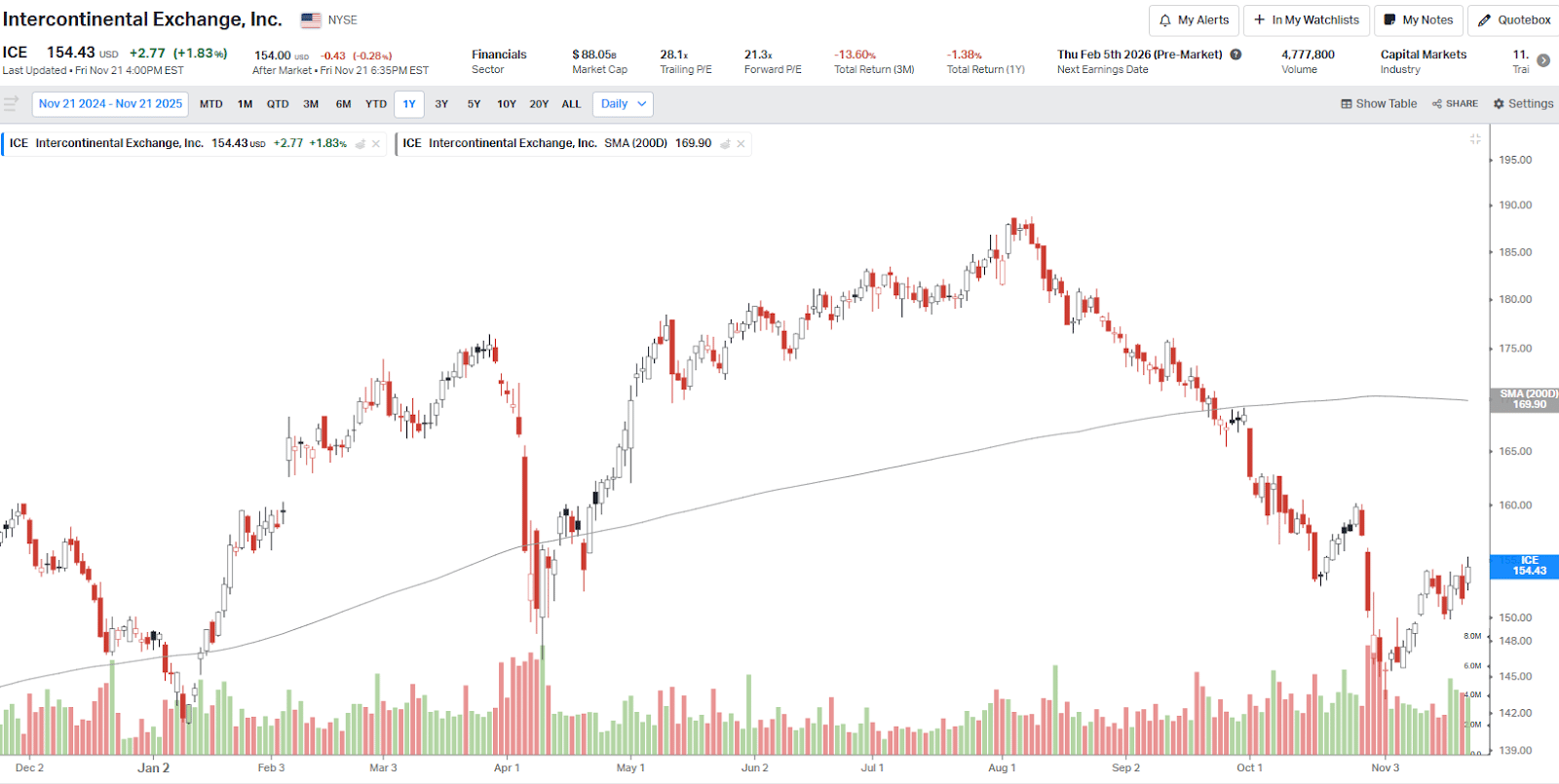

We got two “quality” Buffett type stocks this week: Intercontinental Exchange (ICE), and S&P Global (SPGI).

ICE is a dominant market leader in derivatives and clearing. They own the NYSE and operate across asset classes.

The stock is down 17% from its high in July. P/E NTM has also compressed from 26.0x to 21.3x today.

In Q3, revenue was about $2.4B (+3% YoY), adjusted operating income grew 3% to $1.6B, and adjusted EPS hit $1.71 (+11% YoY).

ICE also bought Black Knight - a mortgage analytics software firm. The acquisition enhances ICE's competitive edge in Mortgage Technology, giving it over 50% market share in mortgage origination and servicing software.

We also like ICE’s CEO - Jeff Sprecher. It’s a Founder led business.

ICE has paid roughly 2Bn back to its shareholders in the last twelve months, with Shareholder Yield at 5%.

The bear case: you are paying a 28x P/E TTM multiple for a financial stock that grew revenues by 3% YoY in Q3.

However, management has guided towards a 7% increase in Q4 thanks to the strong performance within the exchange-aided business.

This business I put in the category of ‘quality compounder’. If you hold for 5 years, I expect it would compound well.

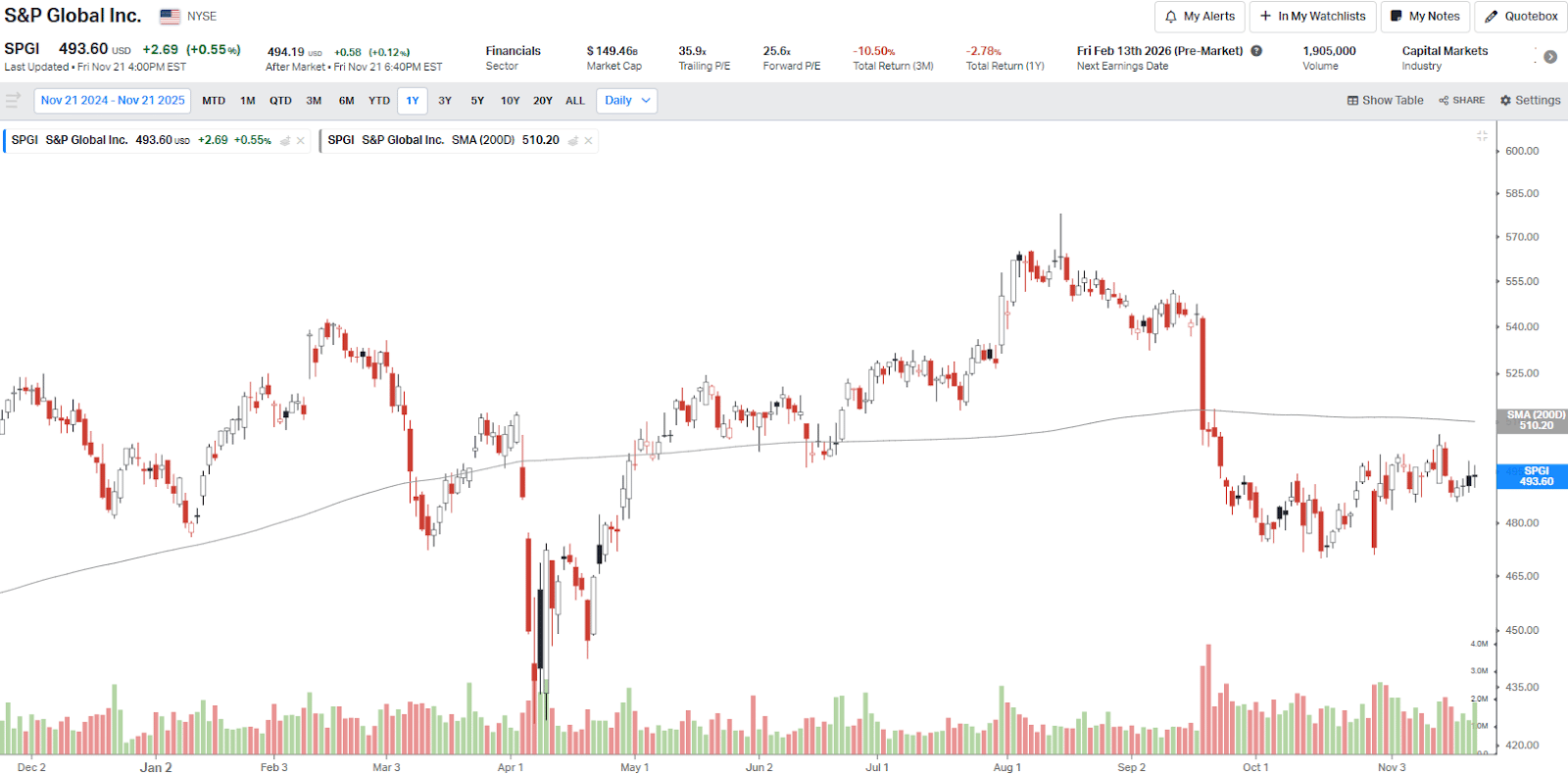

S&P Global

SPGI is another of our high quality picks this week. The firm makes money from licensing its indices to asset managers like BlackRock. They also run a ratings business.

These businesses will be around in 50 years - that’s a hallmark of “quality”.

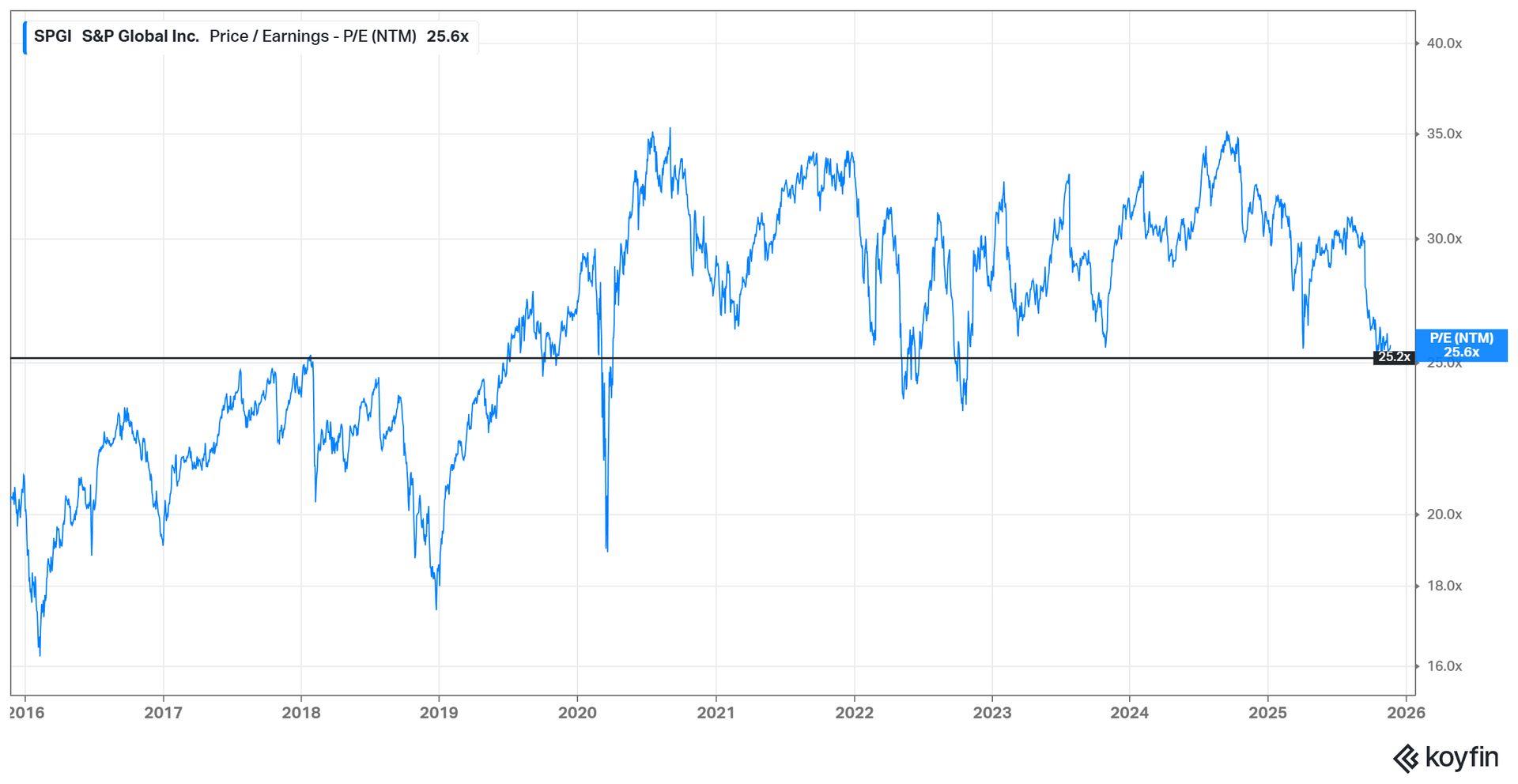

It trades at roughly 26x forward earnings.

In Q3 2025, revenue grew 9% YoY to $2.9B, operating margin expanded 330 bps to 52.1%, and adjusted EPS jumped 22% to $4.57.

Management has raised guidance on all metrics for Q4, and EPS is now expected to grow by ~14%.

Management has returned nearly $1.5B to shareholders year-to-date with Shareholder Yield of ~4%.

SPGI has a pristine business model, but the valuation is pricier than others. But, take a look at the trailing valuation multiple - you can see we are at levels that are typically met with institutions buying:

The bear case is that a prolonged slump in primary markets would hit Ratings and asset-linked fees.

Nonetheless, in Q3 earnings, management remarked 8% higher rating volumes expectations in 2026, and the same trend to continue till 2028.

Fear Is Maxed Out

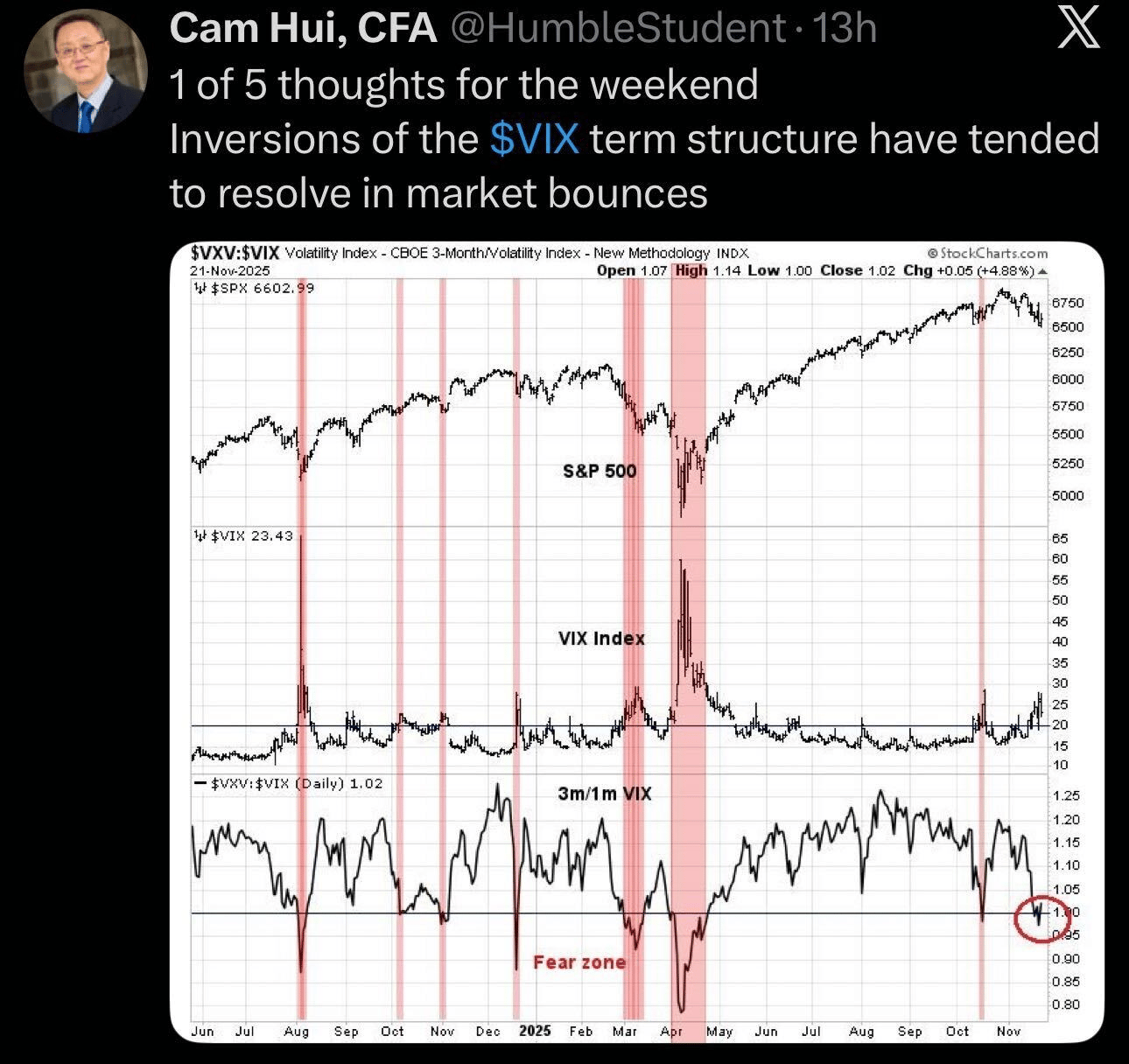

Inversions in the VIX term structure have pushed the 3-month/1-month VIX ratio into the “fear zone.”

It is the level that has historically lined up with short-term market lows and subsequent bounces.

A recovery might see capital rotating into oversold themes.

We had been running our net exposures at around 70 to 80% the last few weeks. We are close to 100% net exposure as of this Friday.

One theme we like around here is consumer discretionary.

Take a look at the chart. Looks poised to bounce around the 200 DMA.

Airline stocks, cruise lines and other travel & leisure that baby boomers spend on are the right focus in our view.

If you believe our ‘no recession’ thesis then these will do well.

The sector dipped significantly over the last few weeks, and is now trading at oversold levels.

We added to our Norwegian Cruise Lines position this Friday. We think it has bottomed.

Have a look at our thesis on NCLH from last week.

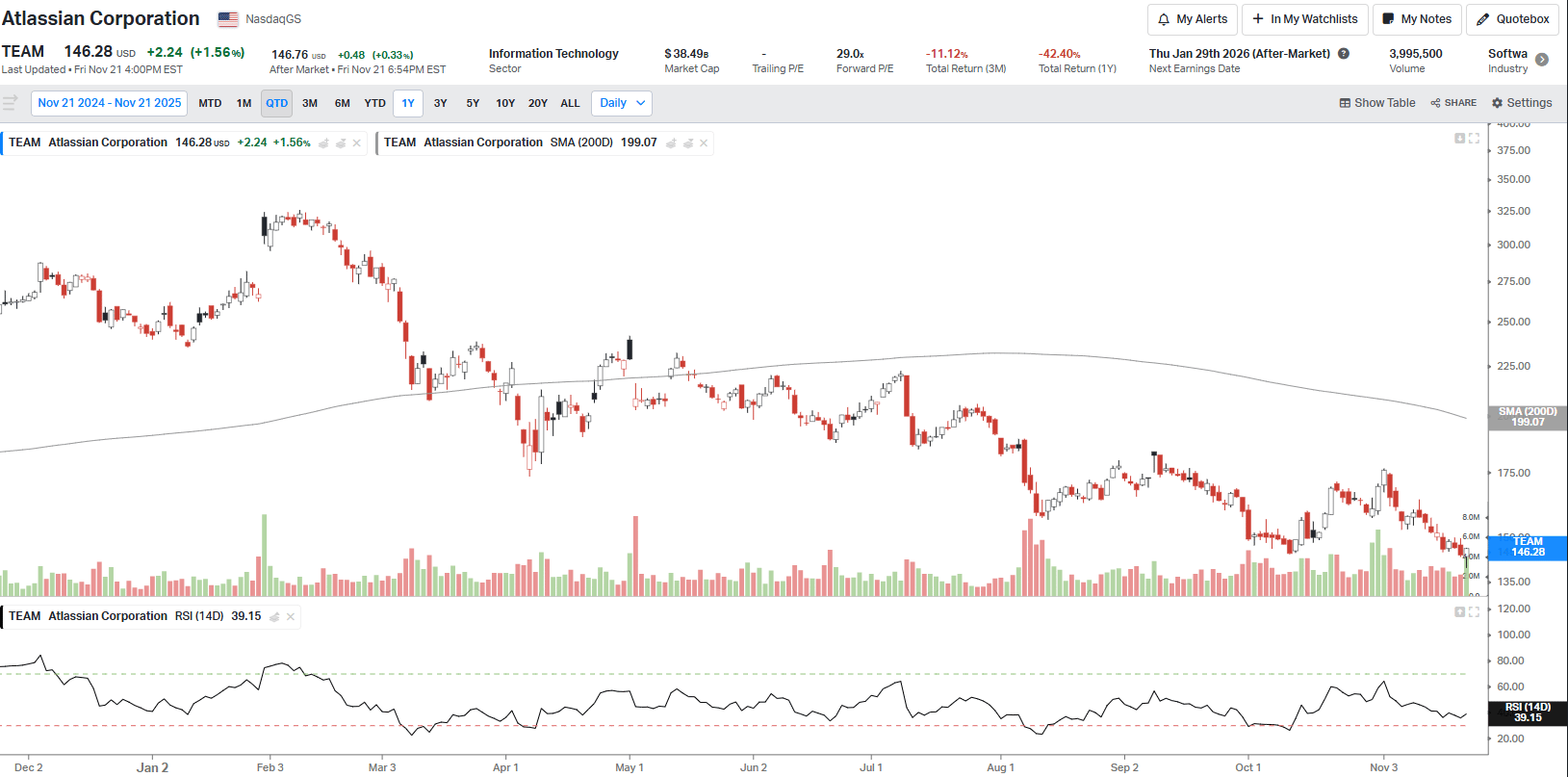

SOFTWARE VS AI UPDATE

I’ve been bearish and correct on software stocks since 2024.

The bear case is that AI is displacing software form factors.

Do we really need Salesforce? Adobe?

Corporates are allocating capex to AI POCs instead.

But, I am seeing at least two reasons indicating why the selling in software may be overdone.

This may be early, but it’s worth ‘stalking’.

Here are ideas.

Some SaaS stocks are actually indexed to AI growth in a “picks-and-shovels” way. They sold off with the broader theme.

People that say ‘valuations don’t matter’ are wrong. Both the software and restaurants call - two themes in a bear market in an otherwise strong bull market - were valuation driven.

Now is the time to look for themes with solid fundamentals that investors have ignored.

We added exposure to Atlassian Corp (TEAM) this week.

TEAM hasn’t really caught a break since its high in February, and is now available at a deep discount.

The P/E NTM has dropped to 29.0x from 84x in Feb - the lowest in its 10Y history. The FCF yield is at approximately 4%.

Revenue is growing ~20% with >80% gross margins.

Management is expanding the enterprise portfolio with Rovo AI while keeping a clean balance sheet and healthy FCF.

The stock has been de-rated on the “AI code-gen kills Jira” narrative, but management answers the risk in Q3 earnings.

CEO Mike Cannon-Brooks noted they are “not seeing any impact from this [AI coding] on any numbers” and that customers integrating code-generation tools show no change in usage and “really healthy user growth.”

This supports the view that Jira and the broader Atlassian suite remain embedded in developer workflows even as AI adoption rises.

Atlassian corp has a 3.2Bn Backlog in Q3, up 42% YoY.

The “>10K“ customer base has increased 13% to 53,000+ customers.

Over 85% of Fortune 500 companies use products from the Atlassian suite.

Overall, it’s a quality business, but there are some visible risks.

The EBIT margins have depressed as TEAM invests further into AI.

TEAM also failed to produce a GAAP positive bottom line in Q1’26 due to high stock based compensation (349M- 1% market cap).

Nvidia Earnings and the Datacenter Theme

I have a fully video dedicated to breaking down Nvidia’s earnings and the datacenter theme here if you want a full treatment.

The data-center trade has been under pressure for the last few weeks.

It started with Coreweave missing out on delivery schedule and Micheal Burry’s comments around GPU deprecation.

Michael Burry argues that hyperscalers are inflating profits by stretching GPU lives from roughly 3 years to 5–6 years.

If his argument is correct, It understates hyperscalers’ depreciation expense by ~$170B+ across 2026–28, inflating their capex returns.

However, Burry is wrong here.

Jensen Huang answered Burry’s argument in Nvidia’s latest earnings: “The A100 GPUs we shipped six years ago are still running at full utilization today, powered by a much stronger software stack.”

Similarly, Google has also been running datacenters on CPUs for over 10 years now, and they are still operational.

This is hard evidence on the actual useful life of a GPU.

The demand side for datacenters is also durable.

AI Capex has been increasing rapidly, and the long-awaited Nvidia earnings show it.

Nvidia’s data-center revenue grew at 60% YoY off a base that already exceeds $50 billion.

In this week’s earnings, Jensen Huang said “Demand for AI infrastructure continues to exceed our expectations."

He estimates “$3 trillion to $4 trillion in annual AI infrastructure build by the end of the decade.”

This capex is also translating into higher revenues and profitability for hyperscalers, which justifies continued investment in AI.

Jensen Huang highlighted Meta’s revenue conversion from AI in Nvidia’s earnings release.

“Meta reported over a 5% increase in ad conversions on Instagram and 3% gain on Facebook feed driven by generative AI-based GEM.”

Nonetheless, we might see datacenter theme lag. Technically the picture around semiconductors shows evidence of over-positioning.

COREWEAVE

AI Hedge Fund, Situational Awareness, loaded up on CoreWeave.

So did Paul Tudor Jones, Citadel and DE Shaw.

CoreWeave had a final unlock last week.

The stock hits a local low after every unlock

The same happened this time around.

The oversold RSI levels suggest an intermediate low has already occurred.

At a P/S of 3.6x with strong revenue growth, it's hard to see how this isn't up significantly in 12 months.

We had a deep dive on CRWV in our last newsletter. Read here.

Positioning For An Oil Rebound?

Oil is trading near one of its cheapest points in history when measured against money supply.

Each time we’ve been here, investors have argued “this time is different” and that prices can stay depressed.

Historically, that narrative has not held.

One of our bets in the oil industry is Riley Exploration Permian (REPX). It trades on a P/E NTM of 8x, with a FCF yield of 17%.

Q3 oil production grew more than 30% and upstream free cash flow was roughly $39 million on $82 million of revenue.

Management is integrating the Silverback acquisition, drilling more wells, and upgrading midstream capacity. It would support production volume growth and a 5–6% dividend even if oil stays range-bound.

The risk?

REPX has high sensitivity to oil price volatility, which has led to muted revenue growth and earnings de-growth over the last few quarters.

If the downturn in crude prices prolongs, it would pressure earnings and cash flows, hurting the stock’s long term returns.

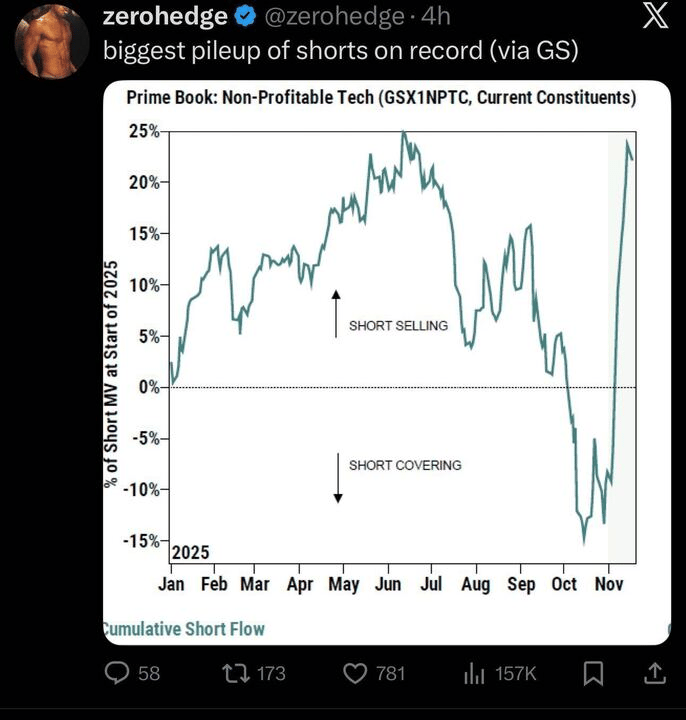

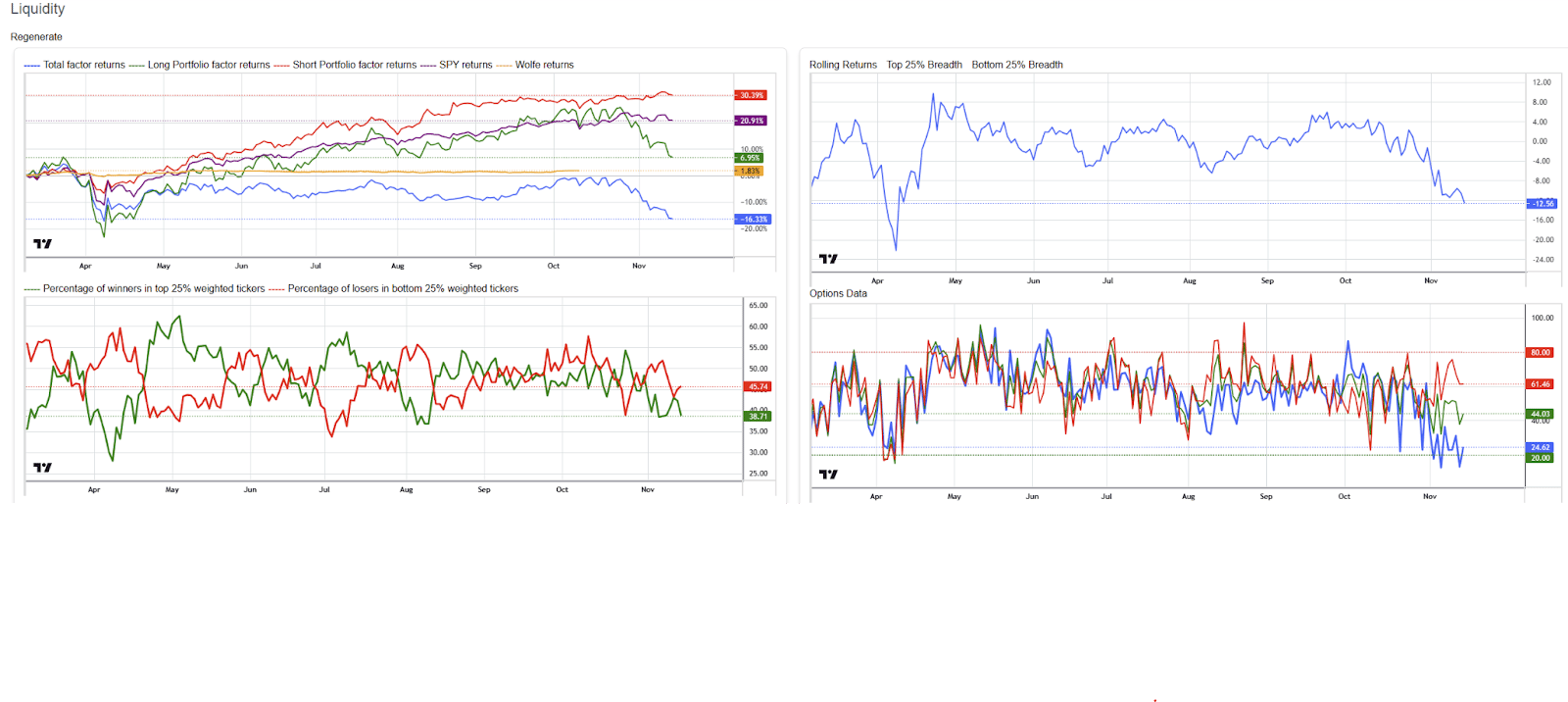

The Return Of Animal Spirits?

The 'Liquidity Factor' measures the performance of stocks with the highest turnover.

Notice how this factor continues to dip lower.

There has been a forced deleveraging amongst traders that own this basket.

And, the factor is now oversold.

Some of you may be thinking that this or that stock is down because of some news (e.g., ROE on GPUs, GLP1 innovation, credit risk, etc.)

No, it's not that.

It's just deleveraging across a correlated basket of stocks that people on Twitter own in unison.

eth

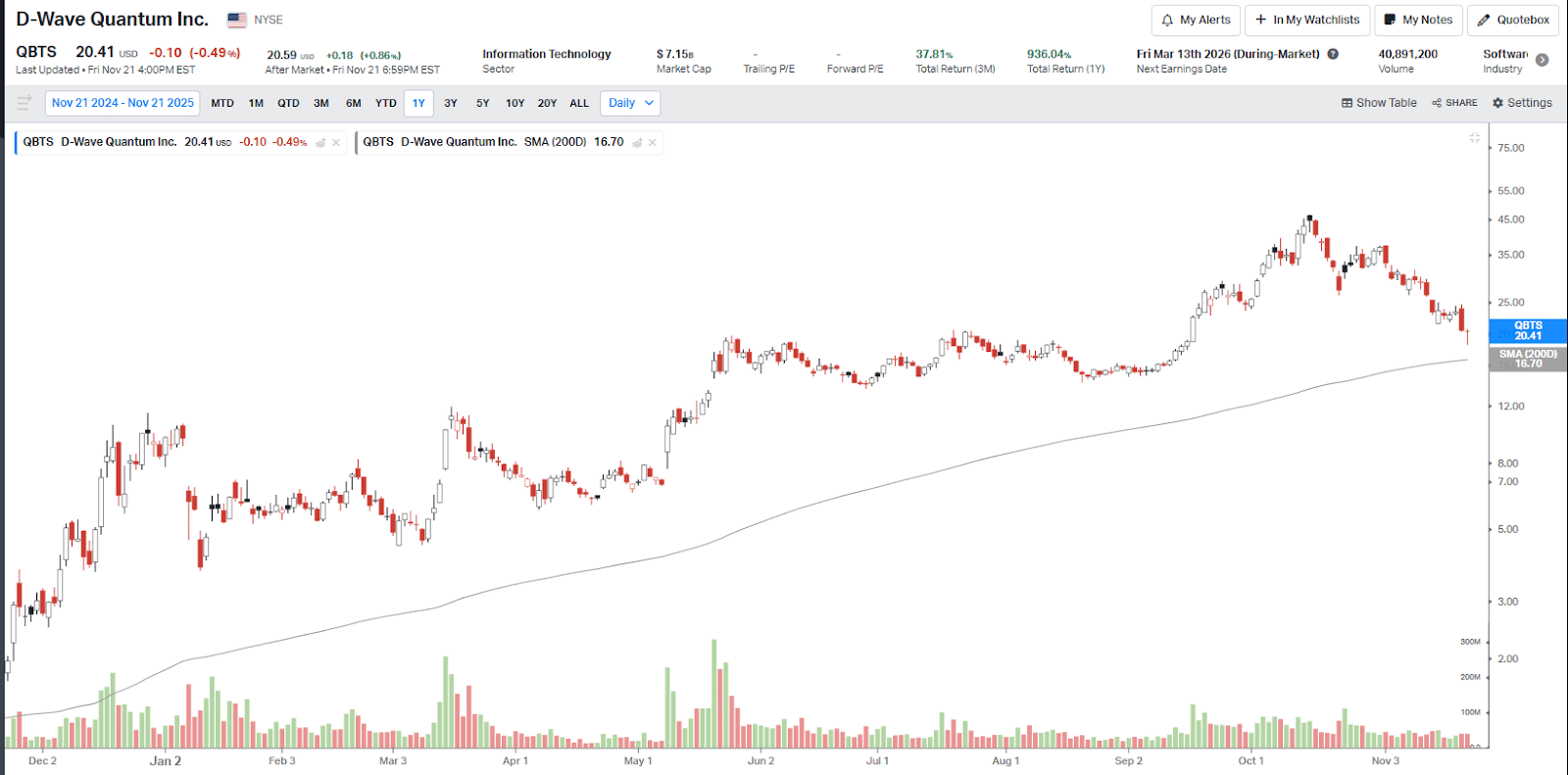

IonQ is a good example: the stock rose 300% between March to Oct, but has declined about 50% since its Oct high, returning to its June Levels.

The stock appears to have topped after JP Morgan helped them sell $1 Bn of stock to foolish faddish trend buyers.

We think the top is in for quantum stocks and any rallies will be sold. Better to focus elsewhere.

SoFi shows a similar pattern- it had a big run earlier in the year, but has declined by 21% since Nov high.

QBTS is no different - it has dipped by over 55% since its high in Oct.

We believe this rotation will continue from high beta names to quality compounders and value in near-term.

Get Lumida CoPilot on Your Apple Phone

Lumida is in the final stages of launching our app - our app is your copilot in the investment world. It uses advanced AI models to help you pick top stocks, themes and sectors.

If you’d like to be the amongst first few external testers., write to us on our X account or go to our website and click ‘Learn More’.

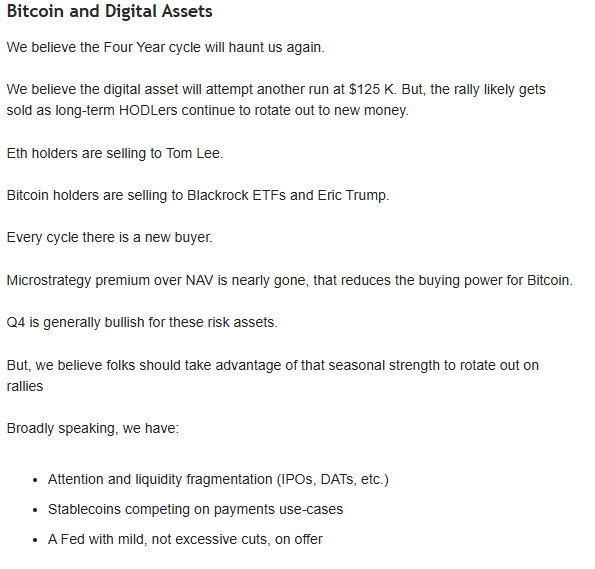

Digital Assets

Bitcoin’s Free Fall

Bitcoin has now dropped to 83K - its lowest since April.

Here’s what we wrote about it last week, and it has turned out accurate so far.

High-momentum “attention assets” have all been hit at once: Bitcoin, gold, small-caps, quantum names, and other story stocks.

These trades went up together as investors crowded into the same high-beta narratives; they are now coming down together as leverage is forced out of the system.

Under the surface, this unwind is being driven by:

Fed’s pushback on a December cut.

Hangover from the DAT IPO frenzy, most of which are now underwater or back to fair value.

OG crypto holders rotating out of long-held positions after a strong run.

Is Bitcoin oversold? Yes. Can it rally? Yes. Can it drop? Yes.

Why not focus on easier ponds to fish in?

You should read our view on attention assets from early November- it’ll help you interpret the broader market context.

Lumida Curations

Future of Work: Musk’s Vision vs. Bessent’s Reality

Elon Musk says AI could make work optional and money less relevant, but Scott Bessent argues history shows productivity booms create new roles rather than erase them.

Silicon Valley’s Blind Spot on Defense

For decades, the world’s top tech hub treated defense as a moral hazard, ignoring the one technology mission that ultimately determines national power.

The 2–4 AM Wake-Up Call

If you regularly wake between 2 and 4 AM feeling wired, it may be your liver flagging hidden stress, poor nutrition, and an overloaded metabolism.

Meme

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.