Here’s a preview of what we’ll cover this week:

Macro: Shift to Bilateral Tariff Policy; Tariff Impacts; Recession?; Size vs. Returns; Lessons from Dubai, XLF

Markets: Tesla or Nvidia?; Money in Value Stocks; Amazon + Nvidia; NAFTA Auto Trade; PDF Parsing; Dell or HPE?; Chrome or Apollo?

AI: GPT 4 to GPT 5

Digital Assets: Treasury payments on-chain?

Lumida in Spotlight

Lessons from Dubai

For more insights, check out this video from our visit to the Dubai Atlantis.

Dubai is emerging as a hub for capitalism. An incredible amount of wealth was created in the desert.

In this video, I walk thru the Atlantis Hotel - a structure that has no rival in the United States.

ALTIMETER vs. LUMIDA

Altcap delivered impressive 2024 results up 39% handily beating the S&P 500.

That's impressive by any measure.

Observations:

(1) We both had long positions in META and NVDA

(2) Altimeter runs a highly concentrated portfolio focused solely on growth tech.

I run a portfolio of 30 to 40 names across multiple themes and countries - a classic 'capital appreciation' fund

(3) Altimeter runs a hedge fund - so every LP has the same return profile.

We run SMAs with Charles Schwab as a custodian.

Therefore each account has somewhat different holdings depending on when they joined.

(For example, we would not buy UBER for an account that signs up tomorrow. 'You make your money on the buy.')

We have hired an auditor to calculate the time-weighted returns and certify our performance.

It will come down to the wire.

I think we will either win or lose this bet by a few points. (It's hard to say because we have dozens of accounts and you need a 3rd party to run time-weighted return calculations.)

(4) From a Sharpe ratio perspective, I have no doubt we would outperform here due to greater thematic diversification including more value stocks.

(5) From a Return over Drawdown I would expect we would outperform for the same reason.

(6) Our biggest winners last year was the Datacenter thematic bet, but also names like ENVA, LPLA, APP, CLS, FLEX, ASPI, DAVE

But the bet is Total Return.

(7) We are not including returns from Alternative assets like CoreWeave, Crypto, or Brad Jacobs QXO.

Public equities only.

We should have the audit done around the end of the month.

In any case, Altcap's performance is impressive when compared to the universe of hedge funds.

Kudos.

Brad also has a quality pod I enjoy listening to called the BG2 pod which we curate on Lumida Wealth.

I am eager to see how this plays out.

How did we do vs. Bill Ackman?

That's a decisive beat, but candidly many people did that including the S&P 500

One lesson: You don’t concentration risk to do well

The trade-off is you need to turn over a lot more rocks

The world is inherently risky and idiosyncratic risk should be diversified away as much as you can

It’s just math. ‘Be the casino, not the player’

Visit our website to learn about our ETF and let us know your interest.

The Bubble in Quality?

Over the last few years, Costco, Walmart, and Amazon have steamrolled weaker retail brands.

They have better prices. Better convenience. Wider selection. Curbside delivery. $1 hot dogs.

What’s not to like?

Now, Costco and Walmart are 'going parabolic' and in bubble territory.

That doesn’t mean the bubble is bursting tomorrow - a lot of wealth creation is in riding the bubble up while maintaining presence of mind.

Some data points:

Costco's forward PE is 56x. We've never seen that in its history.

This is Costco’s FWD PE ratio.

Walmart's Forward PE is now 38.6x. We've never seen that in its history.

Here’s Walmart historical valuation:

Both of these stocks are pricier than Nvidia and various names in the fabled Mag 7.

Consider:

Nvidia : 32x

Meta: 28x

Google: 21.3 X

Where else can you find the Bubble in Quality?

Well, FICO was a big bubble - it just capitulated yesterday after a 20% drawdown.

Here’s how FICO unfolded. (Note: We owned FICO for the 1H of 2024. Great business. Munger: “Buy great businesses at fair valuations.)

Here are the other bubbles in “Quality Stocks”.

Palantir (PLTR): 200x

Crowdstrike (CRWD): 100x

Axon: 116x

Mongo DB (MDB): 91x

ARM: 97x

Atlassian (TEAM): 84x

Intuitive Surgical (ISRG): 73x forward PE

Plenty of others too - but those are the most egregious.

We are in rarefied territory.

I would expect Costco or Walmart to correct soon, possibly within days, although this is hard to call.

If you are a lucky Palantirian - your PEG ratio is now 7x and forward PE is 186x.

I like the PEG ratio to benchmark growth stocks. A growth stock is worth a valuation premium provided it is supported by earnings growth.

The PEG ratio, albeit imperfect, does a decent job of accounting for these elements and was popularized by Peter Lynch.

At this point, Palantir has discounted selling intelligence software to the Russians and China.

Take profits.

Here's a screen where you can see over-valuation across a range of stocks.v

What is a bubble?

A bubble is marked by a fanning out of these moving averages. Take a look at Palantir for example.

Notice the increased separation across the moving averages.

That’s a classic market.

Also, you have a major gap up – that’s a sign of peak sentiment which we discussed recently.

That peak sentiment event was triggered by Palantir’s stellar earnings results.

Stellar earnings is not enough to prevent a bubble popping.

The Nvidia bubble popped when Cathie Wood (ARKK) top ticked their purchase and just after it was declared most valuable business in the world.

That created a peak sentiment event.

This is where we previewed the risk of Nvidia bubble on June 1st when people were buying hand over fist:

Two weeks later, I posted this after Cathie Wood bought shares of Nvidia.

People want to ride the bubble with religious fervor - they don’t want to see a turd floating in the pool which breaks that picture. That event triggered a change in perception.

What causes the bubble to burst is a recognition moment.

As the bubble rides up, weaker and weaker hands participate that are riding on momentum and lottery ticket vibes.

The early investors start rotating out and finding new ideas. I already see people like @amistisinvesting talking new ideas. (The zealots never rotate out.).

The last leg of the bubble is the parabola.

The parabola leg generates massive returns. One or two weeks can generate several months of returns.

The parabola sets up what I call a “Devil’s Bargain”.

You see a high level of positive auto-correlation. Green days follow green days.

The expected value of tomorrow is positive and with high probability, even if the expected value 1 month later is negative with high probability.

That is the defining characteristic and paradox of these parabolas.

Remember ETHE - that was our best idea in 2024. That parabola ended the same way.

The key is to recognize you are in the parabola and remain hyper vigilant.

The exit cue for a parabola is a sharp red downward candle.

Psychologically, what happens is the buyers on the last day feel trapped and suckered. They create overhead supply.

The sharp down red candle means they feel a large amount of loss aversion. They want to get out and break even and recover some of their losses - they will sell rallies.

You should not be afraid of riding the bubble up - that’s how significant wealth is created.

The S&P moving from a forward PE of 14 to 24 is a type of bubble.

Multiple expansion is the number one driver of returns.

The key is exit discipline.

The sharp down red candle can sting - you can lose 10 or 15% in a day - but that’s about what you gained in the 1 week before. It really doesn’t matter. And that decision rule keeps you on the bubble train longer.

I have made several mistakes selling bubbles too early. For example, I sold FICO in the spring of last year after a tremendous run.

I sold Harrow after a 20 to 30% gain – we called that from the very bottom – and it went on to deliver a 400% return for investors. (The Harrow bubble has since popped.)

Here’s a chart of Palantir.

Take a look at this red candle in the middle of its upswing. That led to a short-term correction.

When does the bubble burst? When the red candle appears. Usually it is linked to an event or a CEO saying something that jars the narrative.

When Michael Saylor compared Microstrategy to NYC Commercial Real Estate that may have marked the top. (Boy was he on a roll up until then!)

When Frank Slootman announced his exit from Snowflake as CEO, that burst that bubble.

When Cisco missed earnings, that burst that bubble.

You can find a similar big red bar or set of bars in Tesla in recent weeks. (Their miss on new orders doesn’t help.)

Those bubbles have burst.

All bubbles eventually burst because you run out of new opportunities to have religious conversions into the bubble.

Alex Karp is the chief missionary of Palantir.

Michael Saylor is the chief missionary of Bitcoin. Frank Slootman is the chief missionary.

(I have a man crush on Frank Slootman because his writing on management is so good… those are all elements of bubble formation...an element of truth raised to nth power).

The red candle causes a shift in psychology from Fear of Missing Out to Fear of Losing Gains.

The fact is markets are underpinned by psychology. That’s rule #1.

Sir John Templeton “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Euphorias can occur at a stock-level and we are seeing signs of that now.

I still expect higher end of year index prices because Mr Market continues to deliver rolling corrections.

Financials, healthcare, datacenter - and now home builders - are on sale.

Still, a correction is above average possibility since we have twin bubbles in quality stocks and its opposing twin animal spirits. That’s unusual.

Warning: Don’t be a hero and try to short bubbles. I hope your stocks are in bubbles (meaning their multiple is expanding.)

Bubbles extend because people short into them. Those shorts become like soldiers in the Russian meatgrinder. They get chewed up and it adds fuel to the fire.

A lot of smart hedge funds like Kerrisdale shorted Microstrategy which fuels the bubble.

A lot of smart hedge funds were shorting Coinbase - that fuelled the bubble.

It’s not safe to short full stop - 99% of you will lose money.

For the 1%, at least wait until you have clear evidence of the right shoulder and don’t risk more than 1 to 2% of your capital on a such a position and it should be in your ‘play account’.

Macro

Policy

I mentioned last week that Trump is the first ‘Stock Market President’.

This headline is yet more evidence of that thesis.

Trump and the team are highly sensitive to market feedback.

Have you noticed tariff news is released Friday, then after Monday futures dump, Trump walks back the tone and a delay of tariffs is introduced?

This is good. It means Mr. Market is the Captain Now meme.

Trump is orienting around his long-term legacy which we discussed after his inauguration speech. He doesn’t want to screw the pooch.

The Rent Yields Are Too Damn High

Bessent this week also clarified that the administration's goal is to lower long-term rates and not short-rates (which would interfere with the Fed).

That’s 100% rational.

Lower long-term rates would lower mortgage rates and the cost of capital for capital investment.

It is a pro-growth objective and it is not inflationary.

This objective would appease the bond vigilantes like Druck who are concerned about Trump pressuring the Fed’s policy rate

Guess what lowers long term yields?

Trade deficits.

When you import merchandise and run a trade deficit, you are exporting bonds.

This is why China now owns trillions of bonds they don’t know what to do with.

China may have hacked the hell out of the United States…

but the U.S. stuffed China with trillions in U.S. IOUs — with plenty at 1.5% to 2.5% interest rates!

China is sitting on large mark to market losses and no one talks about it.

Trade deficits are when we send IOUs abroad to get real stuff today.

The irony is we need more trade deficits to finance American growth.

Tariffs: From Universal to Bilateral

This makes a LOT of sense.

Canada should let American banks enter and compete.

I had a chat with a buddy from Canada who is a PM.

He said: ‘Canada is protectionist. The banks need competition.’

France should let GM and Tesla compete on fair terms.

Why does France and the European commission have a 10% tariff on US auto exports?

Make it easier for American banks to compete.

Why are American tech firms routinely fined and shackled ad nauseum by the European Commission?

Stop that.

Why is Europe free-riding on American pharma R&D, and then resorting to cheap generics?

Pay for it.

Why are American farmers denied access to EU markets b/c of GMO labels?

China should allow U.S. social media to compete (although that will never happen).

Getting policy right is hard.

I like this iterative mode — very much like a startup.

There is no ego attached to policy.

The only way out of the ‘if you squeeze here, it gives there’ conundrum is bilateral and reciprocal tariffs —

PROVIDED the overall goal and vision is to get both countries to lower barriers.

Progress.

Here's an excerpt from the Wall Street Journal:

At a White House press conference later on Friday Trump suggested that the reciprocal tariffs could come in lieu of the 10-20% universal import duty plan at the center of his economic message during the campaign. He said he was inclined to do “mostly” reciprocal tariffs over global import duties.

Trump said that tariffs targeting automobiles, in particular, were under consideration.

Trump promised during his presidential campaign to advance legislation empowering him to hit any country that charges a duty on a US-made good with “the same exact tariff.”

He’s taken particular aim at the European Union’s value-added tax, a minimum standard rate of 15% that can go considerably higher for some countries, telling reporters on Monday that the levy went “through the roof.”

Goldman on Tariff Impact

‘We previously estimated that a sustained 25% tariff on imports from Canada and

Mexico would increase the effective US tariff rate by 7pp, implying a 0.7% increase

in US core PCE prices and a 0.4% hit to GDP.’

Ram wrote about this a week ago, check it here.

Marc, our client advisor, can help you understand these changes better. He is ex - Fidelity & we are happy to have him onboard. You can reach out to him via email, [email protected] or just book a slot with him on his calendly.

Still No Recession

- ISM in expansion

- ISM employment in growth mode

- GDP Now at 3.9%

- Earnings continue to beat

The economic backdrop improved significantly after one event: The Trump Election

Consumers, businesses, and corporations have more optimism and are spending more as a result. Economic Boom?

It's really that simple.

Size is the Enemy of Returns

We are in the part of the credit cycle where KKR buys high risk small biz loans from PatPal and sells the to institutions.

Loan demand and credit demand is up cycling.

This is also why I’d rather own the equity of these PE firms but I have no interest in the credit products they offer.

The more volume you push thru, the worse your underwriting standards.

Lumida has 3 preferred Private Credit firms we work with.

Most people will never have heard of them, but they are exceptional.

One is Atalaya, recently acquired by $OWL

These credit strategies generate a 12 to 20% coupon annually.

Much better than Treasuries after inflation costs and better than ‘high yield’

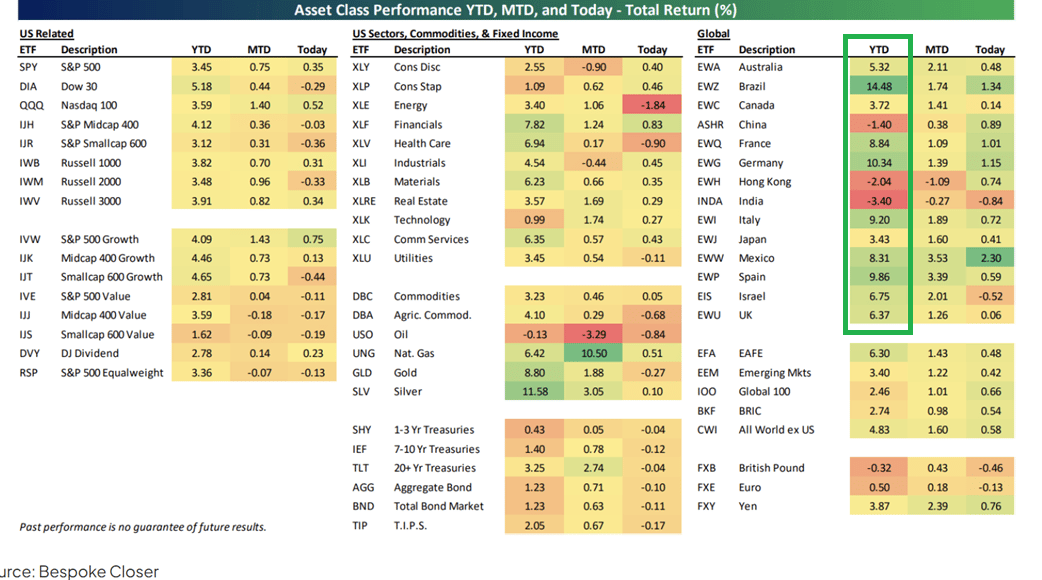

International vs. US Markets

Last week, I mentioned “when everyone is on the same side of the boat” (e.g., U.S. stocks) go to the other side of the boat.

International stocks - including China - did very well this past week.

We think it will pull back so no need to chase it. But China is in a bull market.

Notice how many international markets are beating the S&P now. (Note this does not include Friday returns.)

Market

Retail Investors have built the largest equity allocation in history, surpassing even the Dot Com Bubble. Probably Fine.

Source: JP Morgan

Sell Tesla, Buy Nvidia

Remember the trade you were supposed to do but didn’t do?

Tesla is in a bear market now.

Imagine if it was all just a q4 animal spirits pump…

Reach out and learn more! You can book a session with Marc, our client advisor, on his calendly.

Capex on Nvidia is Looking Good

Take a look at these snapshots.

Nvidia is now at $130. We were scooping up the nameo after the DeepSeek fiasco in the $118s and discussed this in our last podcast live on the day of the Nvidia mini-crash.

Make Value Stocks Great Again

Enova hit an all time high today after strong earnings

It's also a LumidaWealth stocking stuffer stock

Enova outperformed most of the Mag 7 last year

They do retail subprime lending and have limited competition, lots of free cash-flow and buybacks.

Up 115% in 12 months and we’ve owned it for this time period as well.

Whomever said you can’t make money in value stocks is wrong

Often the less ‘sexy’ an investment the better the return: Waste management, lending, healthcare, midstream energy, private credit, online education.

Worst: Biotech, random lunar stocks, restaurants, movie studios, ‘fun stocks’ etc.

NAFTA Auto Trade

We expect Trump will arrive at a tarrif framework that is ultimately rational. It’s mostly bluster to strike better trade terms and open up foreign market.

The External Revenue Service is a misnomer. Tariffs are paid by importers.

AI: PDF Parsing Revolution

Progress

Ackman Loads up on Uber in January

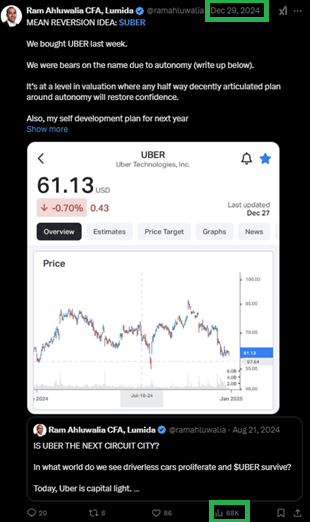

Here was our original call to buy Uber in late December - before Ackman. Uber is now $74.60 up from $61.13 in about 45 days. Not bad.

AI

GPT-5

Sam Altman says the leap from GPT-4 to GPT-5 will be as big as that of GPT-3 to 4 and the plan is to integrate the GPT and o series of models into one model that can do everything. Link to the tweet.

OpenAI is set to receive a $40 Billion investment from Softbank at a $260 Billion valuation - CNBC.Source link

Wondering what to do next?

Book a session with Marc, our client advisor & explore the world of wealth management further.

AI Data Centers

Click on the image to access the key interview insight snippets from our Lumida curations team.

Lumida was one of the first to interview Dylan back in Q4 2024 before he became a big deal on the Lex & BG2 podcasts. Listen to what Dylan had to say in his interview back then.

To catch our podcasts timely make sure to subscribe to Lumida Non Consensus Investing!

Lumida GPT

We asked Lumida GPT to furnish stats …

Check it out!

We can do this for any arbitrary ‘theme’ now: banks, insurance, miners, uranium, retailers, automotive, EVs.

More to come.

Digital Assets

Startup Government

'Move fast and break things'

Except... DOGE revealed that most things were already broken.

Now we are A/B testing tariff policy using Sunday night futures.

Prediction: Elon Musk will put Treasury payments on-chain.

That would most benefit Ethereum or Solana.

Sunlight is the ultimate disinfectant.

More please.

Main Insight

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

As Featured In