Here’s a preview of what we’ll cover this week:

Markets: Druckenmiller's Next Moves; Are We In A Bubble?; The AI Data Center Opportunity at a Discount; The Real Bottleneck In AI; NCLH is a bargain

Macro: December Rate Cuts?; Rate Cuts Can’t Save Labor Market

Digital Assets: Harvard’s Move Into Bitcoin; JPM Launches Its Deposit Token; Coinbase and the IPO Token Window

Lumida Curations: Microsoft’s AI “Pause”; AI Boom Doesn’t Meet the Bubble Definition; Overcooked Food Drives Inflammation

Cantor: Decentralized GPU Lending

I attended the Cantor Crypto & Ai Energy Conference this week - easily the best conference in Digital Assets.

Met many interesting startups around AI and Crypto.

I had an interesting conversation with David Choi, founder of Usd.Ai. They are trying to solve the GPU financing problems.

What’s interesting is they raised a couple billion dollars via the issuance of a stablecoin on-chain, and they’re using that to fund the lending. You can watch our chat here.

We are hosting a holiday party/social hour for the Lumida family on on Tuesday, November 18. The guest list includes an exclusive group of founders, investors, and leaders, coming together for an evening of quality conversations, shared insights, and meaningful relationship-building.

We would love to have our readers in the social hour as well. Sign up here.

How To Reduce Your Tax Liability

Every spring, investors write one of their biggest checks of the year to the IRS.

However, you can save your taxes and contribute to economic and social welfare instead.

The solution is Solar Investment Tax Credit (ITC). It allows investors to offset federal taxes by financing qualified solar projects.

The credit covers 30% of a project’s cost, with potential “bonus” credits for systems built with U.S. materials or located in low-income or energy-transition communities.

In practical terms, an investor with a $100,000 tax bill could put roughly $60,000 into a qualified solar project and reduce their tax liability by nearly 40%, while also earning passive income from power generation.

Corporates have been doing this for years; in 2024 alone, more than $20 billion in solar credits were traded, up four-fold from the year before.

Lumida ventures have been actively exploring deals to help our investors reduce their tax liabilities. If you’d like to be on our priority list, sign up with the form here.

We also offer tax mitigation strategies for our wealth management clients.

Lumida Tax Shield deploys a proven long short tax harvesting strategy that helps you offset your capital gains with short-term losses, and reduce your tax liability substantially. You can sign up for a consultation call here.

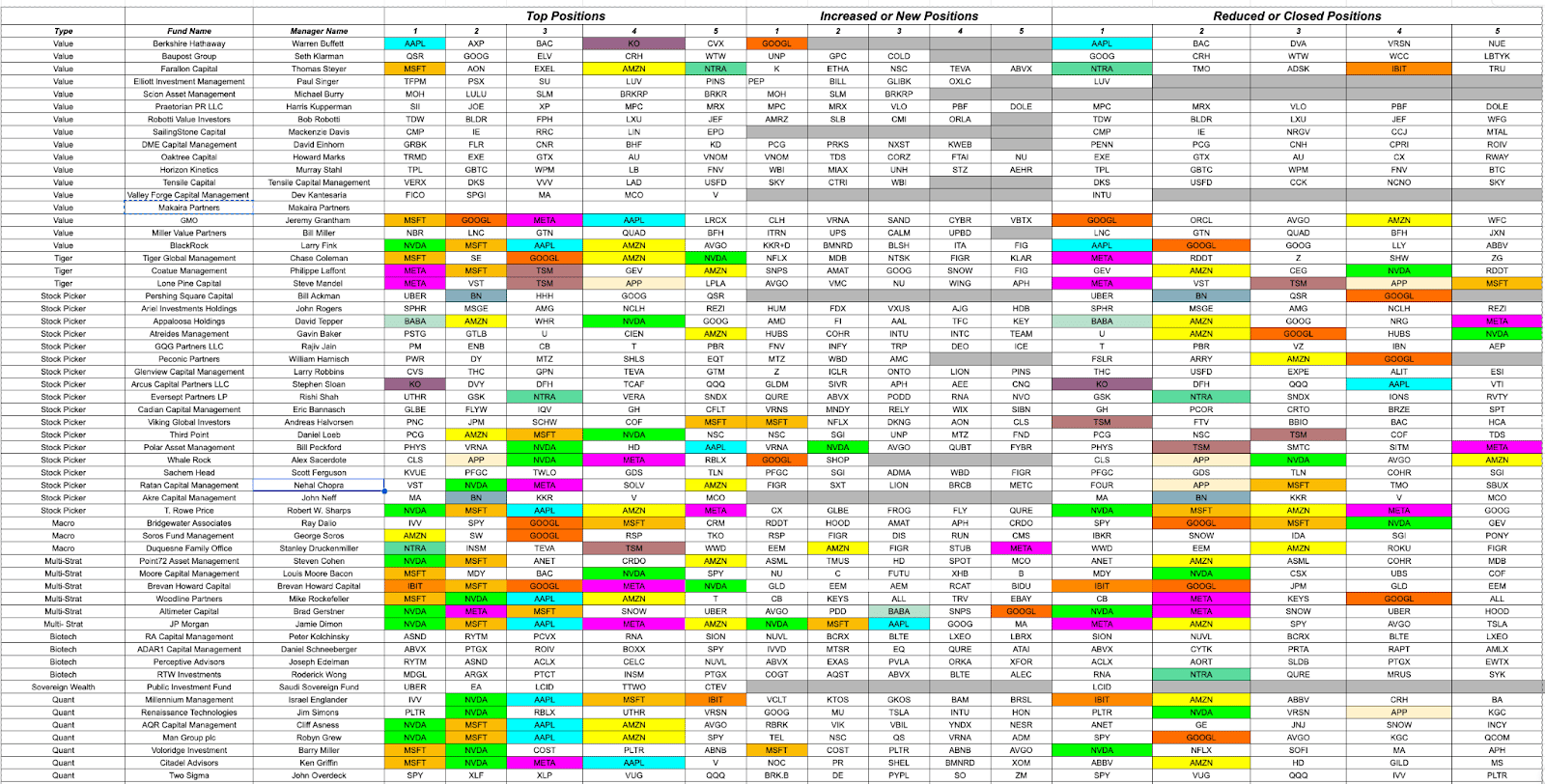

Lumida’s 13F Review

Lumida tracks some of the best and brightest hedge funds, including specialist funds that most people have never heard about.

You can download our 13F analysis grid here; it records top positions, additions, and reductions for over 70 hedge funds. It’ll help you see where instructional flows are headed.

I also did a quick livestream from my FSD on the insights from the 13Fs with one call-out.

Watch it here.

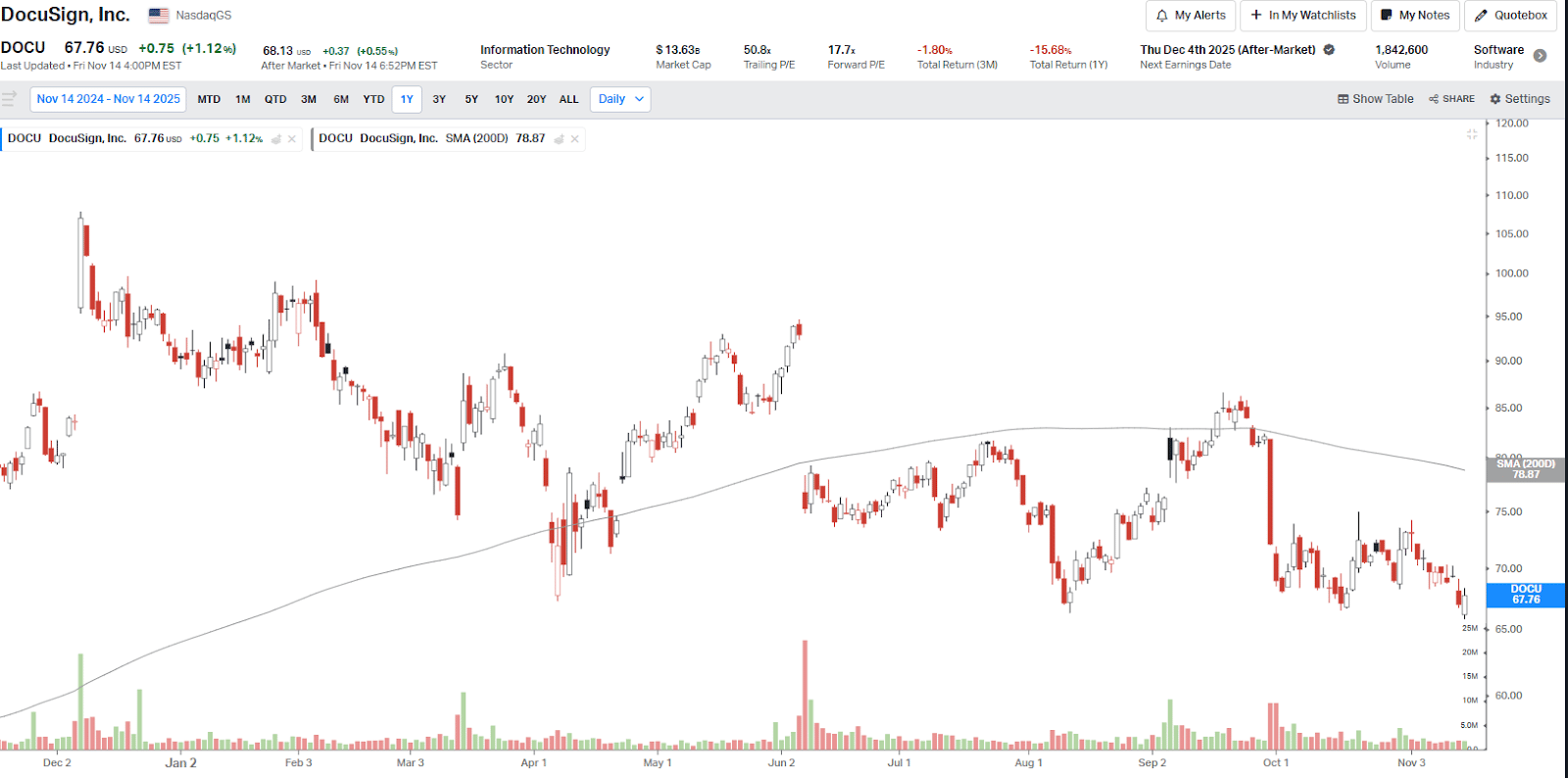

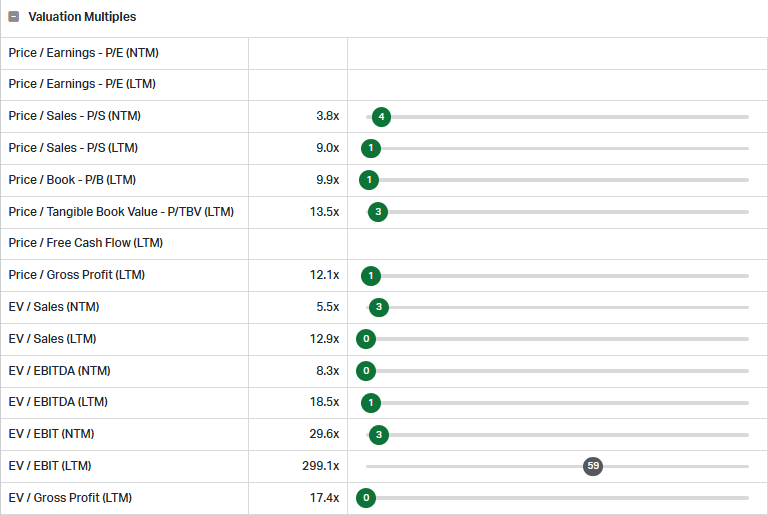

13F filings show Druckenmiller, Paul Tudor (Tudor Investment Corporation) and Jim Simons (Renaissance Technologies) have substantial positions in Docusign (DOCU) - the bull case is strong here.

They are the leader in the e-signature industry, and are expanding their product portfolio to capture a wider customer lifecycle.

The initial results for product development are solid. CEO Alan Teegerson: "IAM has quickly become the fastest growing new product in DocuSign's history."

They have growing revenues, negative net debt, and a pristine balance sheet.

The company trades at a 17.3 Forward P/E and 7.3% FCF yield.

However, the revenue growth has stalled in the last few quarters, and is in high single digits now.

Management needs strong execution in product launches to bring revenue growth to its former pace.

We don’t own this and are analyzing it further, that free cash flow yield is enticing as is the the market position. This is a stock you want to “stalk” - wait for the lows to be in the rear view mirror.

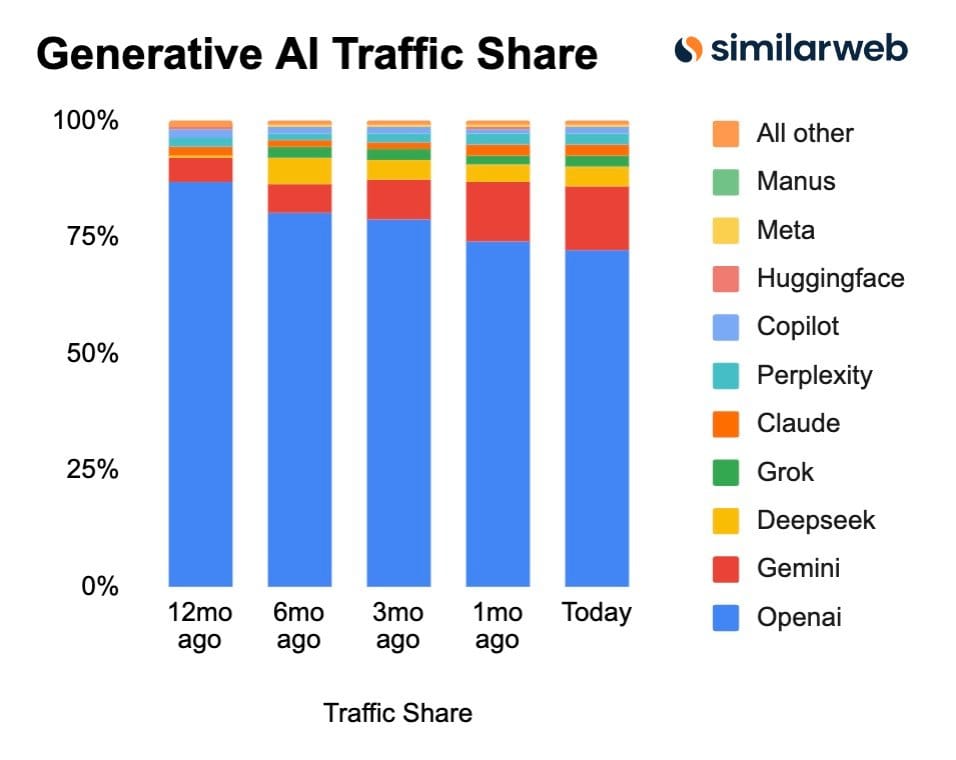

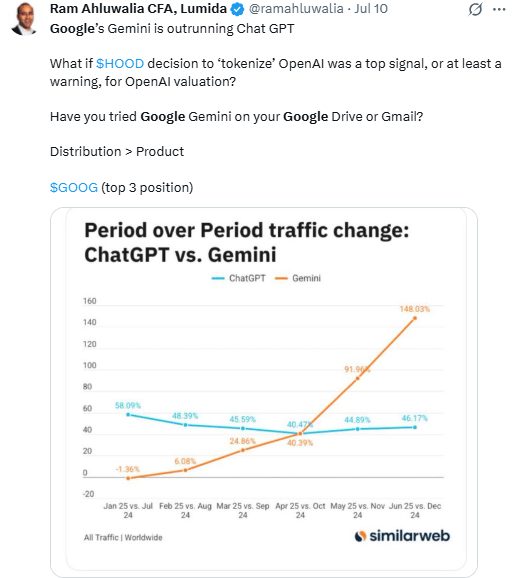

Google is another top pick across hedge fund land.

Google is gaining ground on OpenAI. And, the stock, is much cheaper than OpenAI.

If OpenAI were publicly traded, the $500 Bn paper value company would be down 30% after Sam Altman’s disastrous interview with Brad Gerstner.

Google has also Waymo, Youtube and other apps people use daily. Google is a Consumer Staple. Warren Buffett loves Consumer Staples - Coke, Amex, See’s Candy - no wonder he picked it up.

We picked up Google when it was non-consensus.

Here’s our tweet from July- back then, it had a P/E NTM of 17-18x

Compare that valuation to 26X today due to a strong run of 36% in 3 months and 56% in one year.

The Shift To Quality

Overall, Q3 filings highlight an emphasis on quality, which I think is a theme we'll see going forward.

We saw hedge funds picking up names like S&P Global.

They are home of the S&P 500 indices, making revenues from licensing the S&P indices.

What a great business model. If you want to reference S&P trademarks, you have to pay them.

If you're going to have a BlackRock S&P 500 ETF, you have to pay S&P 500 for the right to use the mark.

Moody's is also another pick by a number of different funds.

Both of these names were below their 200-day moving average not too long ago and that’s when long-term oriented hedge funds like to sweep in.

I also noticed an accumulation of certain restaurant stocks.

This is a theme we've been watching for over a year now. We sold them in May last year back when they were topping.

Some of these restaurants are great quality compounders with good business models like Chili's.

We have talked about how restaurants were over-valued and topped in May of last year. They’ve been in a bear market and we are patiently waiting for these compounders to bottom.

You can read our analysis here.

Druckenmiller's Next Moves

Druck’s portfolio now runs 65 names and about $4.1 billion in capital per his 13F.

After previously running with virtually no FAAMG exposure, Druckenmiller opened new positions in Amazon, Meta, and Alphabet.

Taiwan Semiconductor is another holding.

If you’ve been following us, you know we’ve owned these positions for quite a while.

Welcome Druck.

Meta and Alphabet are our top 2 positions as well.

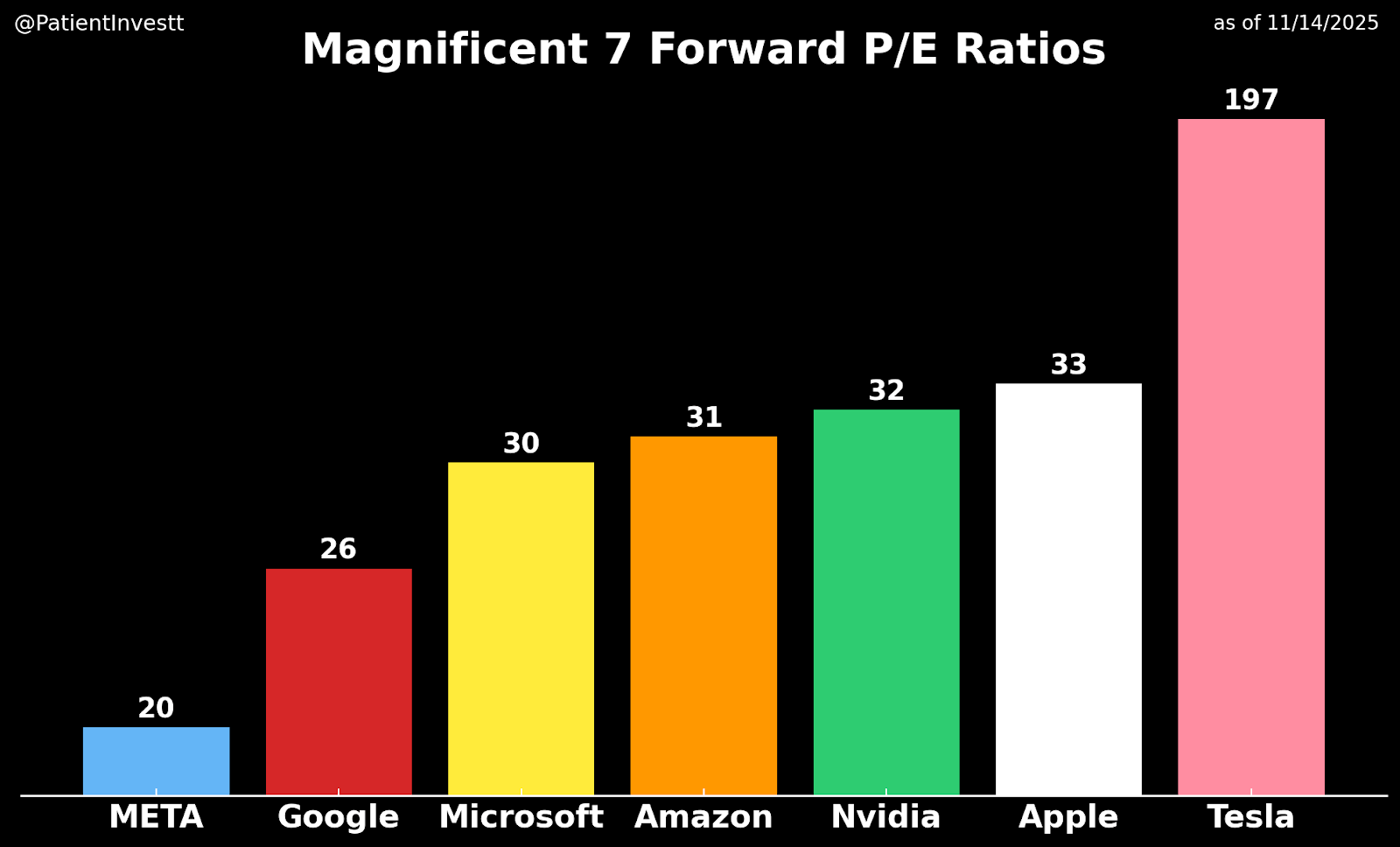

On Meta, we believe the name had an overreaction to earnings. It is clearly the mispriced asset in Mag-7 land.

The P/E NTM is 20.4x now.

The bear case is their rising spend on capex, and the lag behind Google and OpenAI in the AI race.

Wasn’t that the same story for Google not too long ago?

Meta’s earnings miss was related to a one-time tax charge, without which the EPS would have been $7.25, a beat compared to analysts’ consensus of $6.72.

The rising capex, which ran fear amongst investors, is driving returns.

Zuckerberg (CEO) in Q3 earnings mentioned “The annual run‑rate going through our completely end‑to‑end AI‑powered ad tools has passed $60 billion.”

He also noted “More than a billion monthly active [users] already use Meta AI, and we see usage increase as we improve our underlying models.”

It is also helping them increase user engagement: “Across Facebook, Instagram, and Threads, our AI recommendation systems are delivering higher quality and more relevant content, which led to 5% more time spent on Facebook in Q3 and 10% on Threads.”

More time on the app means more engagement for ads, and higher revenues for Meta.

It is clearly a mispriced opportunity - Lumida and Druckenmiller agree.

We also like Synchrony Financial (SYF).

It is a leading consumer finance company in the US, primarily focused on private-label credit cards, promotional financing, and installment lending.

We like the consumer finance category overall (including names like Bread Financial, Enova, etc.) and this name as well.

Synchrony is growing in elective health - a category that is seeing greater and greater discretionary spending.

Purchase volumes in the segment rose by 8% and receivables rose 13%.

Management also announced strategic partnership with Dental Intelligence, used by over 9,000 dental practices.

It joined Synchrony's more than 40 health care software solution partnerships designed to strengthen patient provider relationships.

Moreover, the company also has strong partnerships with major retailers like Amazon and Walmart, positioning favorably within the competitive landscape.

The P/E NTM is 8x, and FCF yield is 37%. That looks like a private market valuation.

Q3 revenue was $3.8Bn (+5% QoQ) with net income at $1.05Bn (+11% QoQ).

The bear case? Revenues have flatlined since 3Q24, and have stayed around $3.8Bn mark.

Loan receivables also decreased by 2% YoY. SYF also lowered the high range of their revenue guidance this quarter. That looks like disciplined underwriting.

The name is like owning a high quality bond in the portfolio. Why own Treasury bonds when you can own Synchrony?

On the other side of the ledger, Druckenmiller exited Microsoft, Eli Lilly, Viking Therapeutics, and a handful of winners that had become consensus darlings.

Net-net, this 13F says he wants exposure to:

US Consumer

Upstream exposure to AI and industrial power.

He’s willing to re-embrace select megacap platforms now that the narrative has cooled.

If you’ve been following our newsletter for some time, you’d know that’s exactly what we have been talking about.

Game recognize Game.

Macro

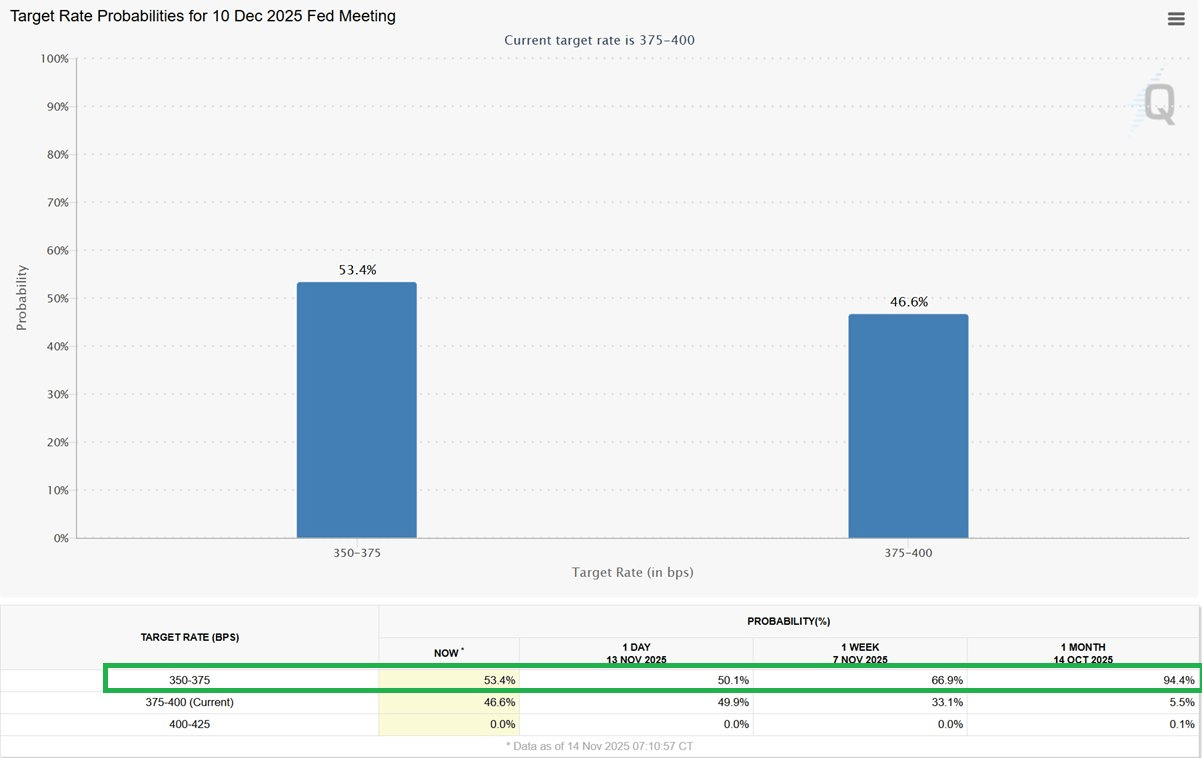

December Rate Cuts?

Take a look at the implied probability of a December rate cut.

1 month ago, at market peak, there was a 94% probability of a December rate cut.

Now there is a 52% probability of a December rate cut.

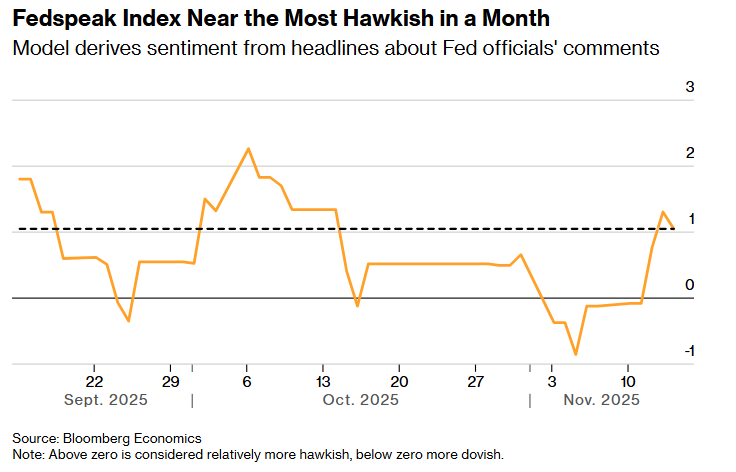

The decline in probability started after Powell's Presser where he noted December rate cuts are 'not a foregone conclusion'.

The market will bottom when the probability of a December rate cut can't get any lower.

Either this probability runs to 0% (no rate cuts) or it turns around and runs to 100%.

Thus far, at least five Fed officials are pushing back on rate metrics.

Here’s what Schmid, President of Kansas Fed, said on Friday: “I do not think further cuts in interest rates will do much to patch over any cracks in the labor market. [Labor Market] stresses more likely than not arise from structural changes in technology and immigration policy.”

“However, cuts could have longer-lasting effects on inflation as our commitment to our 2% objective increasingly comes into question.”

Fed Governor Kashkari leans hawkish: “The anecdotal evidence and the data we got just implied to me underlying resilience in economic activity, more than I had expected.”

“I can make a case depending on how the data goes… I can make a case to hold, and we’ll have to see.”

This Fed Funds futures market is the watchpoint.

Rate Cuts Can’t Save the Labor Market

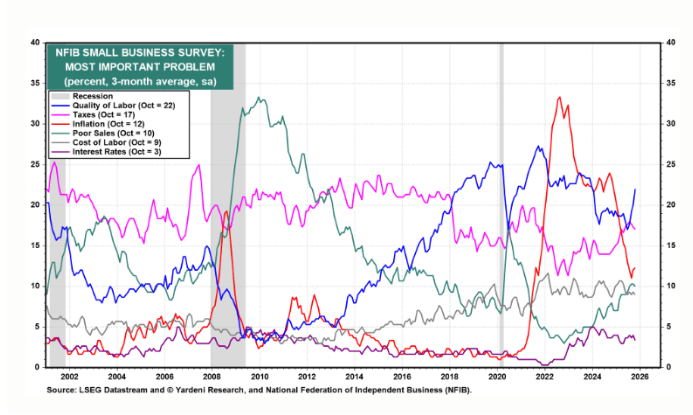

The NFIB survey shows the top problem for small businesses today isn’t weak demand or tight money. It’s people.

22% of small business owners now say “quality of labor” is their most important problem. Taxes, inflation, and even “poor sales” all rank lower.

That tells you the labor market challenge is a skills mismatch, not a shortage of openings.

This is not a problem the Fed can fix with a rate cut. Easier money doesn’t magically create welders, coders, or AI-literate back-office staff.

The solution is productivity.

We need investments in technology: software, AI, and robotics that lets each worker produce more per hour and reduces reliance on hard-to-find labor.

It is another reason why we are bullish on AI’s promise.

Markets

Are We In A Bubble?

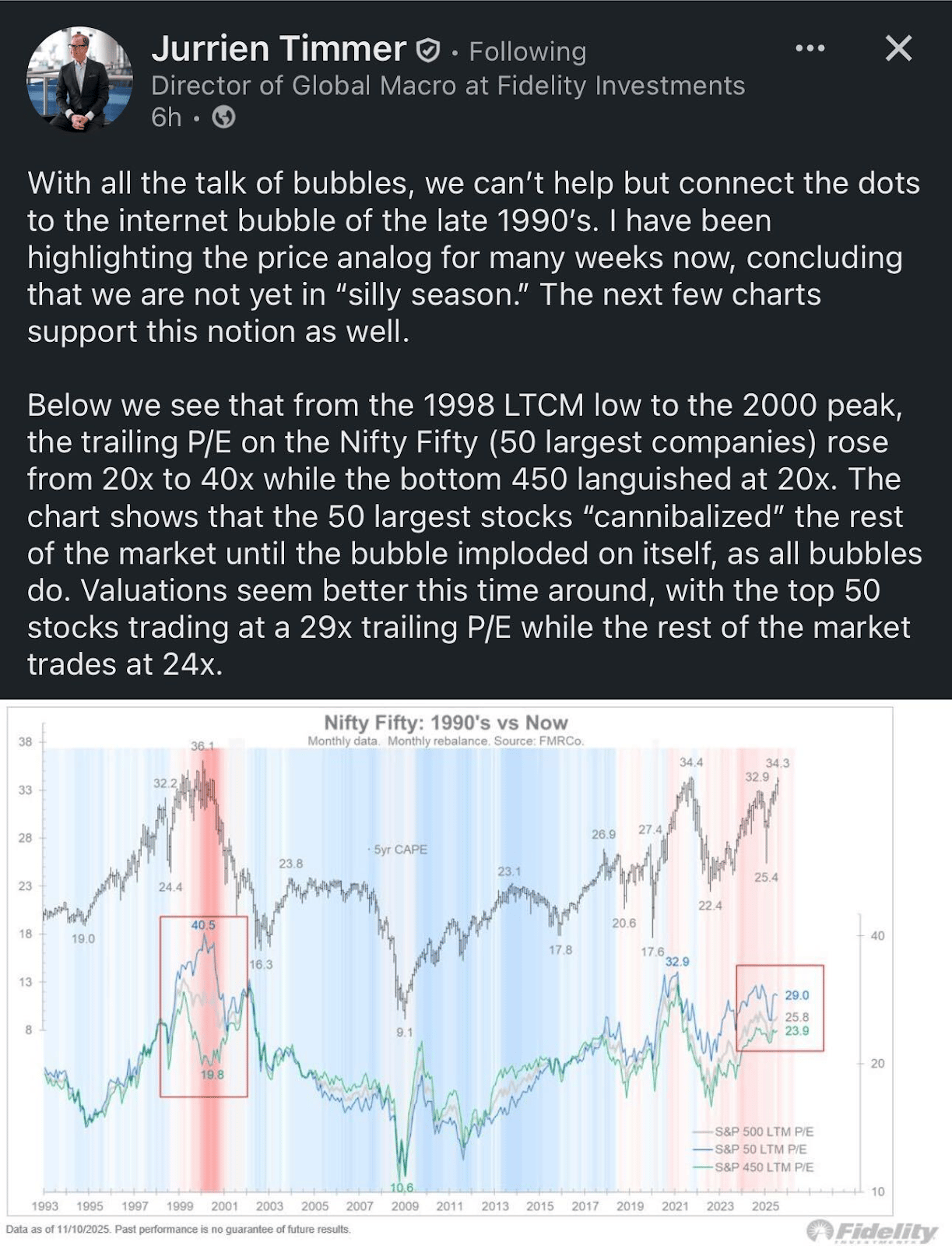

The bubble headlines are dramatic, and a glance at stock valuations will second it.

The top 50 stocks are trading around 29× trailing earnings, while the remaining 450 companies sit near 24×.

That’s a premium, but it’s nowhere close to the late-1990s dynamic where leadership multiples doubled from 20× to 40× while the rest of the market flatlined.

Today, a narrow group of leaders is outperforming because they are delivering real earnings backed by high margins and consistent cash flows.

This is fundamentally different from the speculative melt-up of the 1990s with no cash flow underneath.

For this to look like a true bubble, you’d need to see:

Multiples for the leaders detach completely from earnings

The rest of the market stagnate at low valuations

Flows chasing price action rather than fundamentals

None of those conditions are present today.

Leadership remains expensive, but not unhinged, and as long as earnings keep coming through, valuation gravity hasn’t broken.

A lot of the excess in valuation is in names like Tesla, Apple, and Costco.

Take those out of the S&P and valuations look pretty good.

The AI Data Center Opportunity at a Discount

Coreweave is trading in the $75-78 range - its lowest since May. It has declined by ~25% since its earnings.

Markets have overreacted, and I see a mispriced opportunity here.

In Q3, revenue hit $1.36B, up 134% year-over-year with operating income turning positive at $52M.

Losses narrowed to 22 cents per share from $1.82 last year, even as the company scales 32 data centers. The backlog rose to $55B compared to $30B a quarter earlier.

The valuations are at their all-time lows.

The stock sold off (1) in anticipation of lock-up expiry and (2) after management narrowed their 2025 revenue guidance to $5.05 billion to $5.15 billion from the previous $5.15 billion to $5.35 billion.

It was due to third party construction delays in constructing two new facilities.

Nonetheless, management commentary shows the delay won’t affect company’s revenues:

“The customer affected by the current delays has agreed to adjust the delivery schedule and extend the expiration date. As a result, we maintain the total value of the original contract and the customer preserves their capacity for the full duration of the initial agreement."- Michael Intrator (CEO)

He further added: “The infrastructure, which is undergoing a delay, is not going to impact our backlog and our ability to extract the full value from the contracts that we're going to deliver on."

Intrator also highlights Coreweave is "diversifying data center providers” and has “set up our own self-build efforts, including Kenilworth and Lancaster, Pennsylvania”.

He adds: "As the individual builds become smaller relative to the size of the entire portfolio of data centers that we are running, the impact of being a couple of weeks late will become less and less meaningful in the general accounting of what’s going on."

Overall, Coreweave’s management seems optimistic on their solutions to infrastructure delays, and this gives us a reason to be bullish.

Interestingly, Coreweave’s backlog is now greater than its market cap.

This extract from Cantor also has an interesting take on why Coreweave is a bargain.

The Real Bottleneck In AI

AMD expects its AI data center revenue to grow roughly 80% annually for the next 3-5 years.

AI demand is running full throttle. But, the system is straining on the physical side.

We just talked about coreweave’s infrastructure delays. Microsoft also shared similar comments.

Satya Nadella warns he has chips sitting idle because he doesn’t have enough “warm shells” (completed buildings with power) to plug them into.

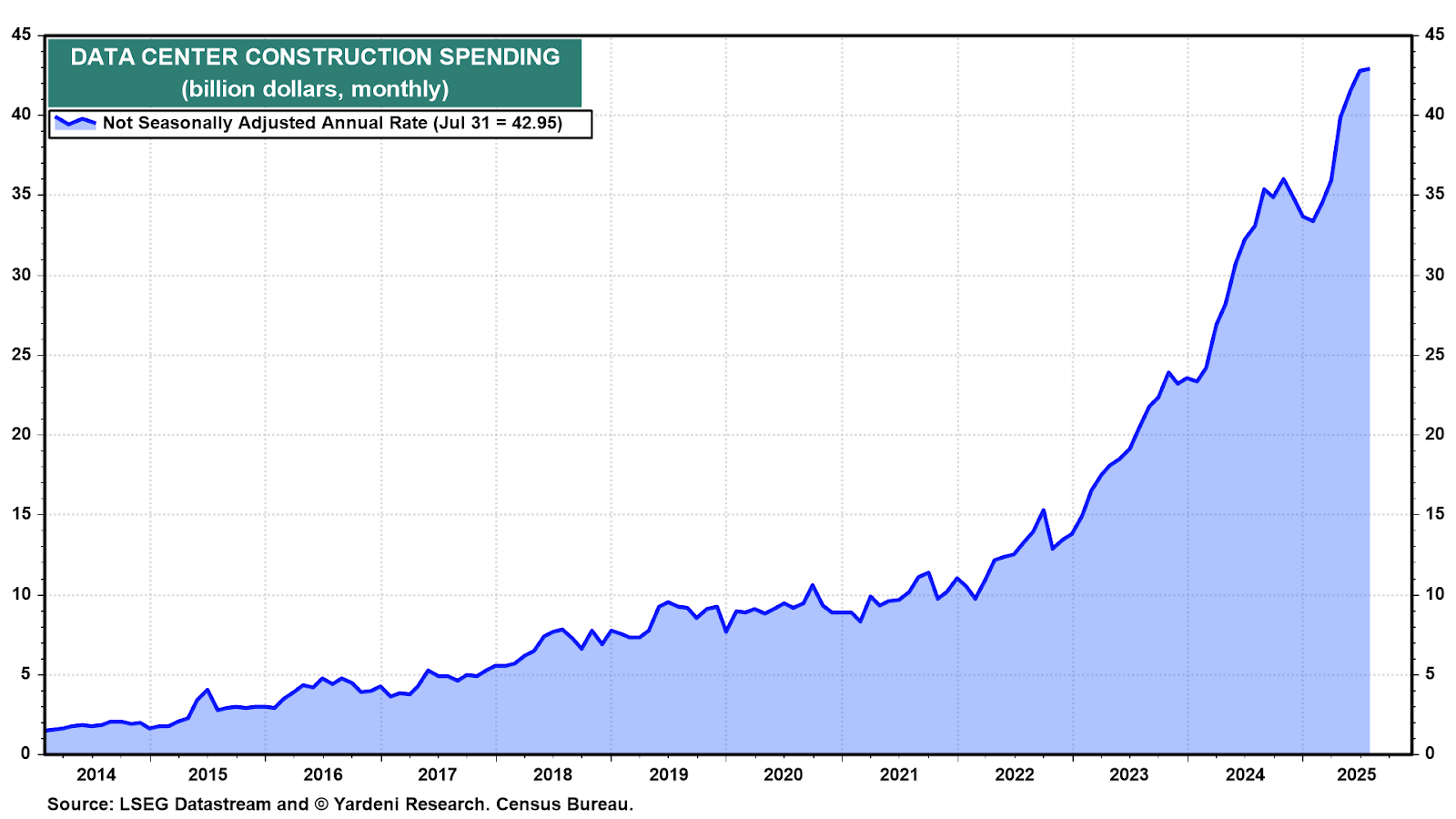

The demand for AI infrastructure today is unparalleled in history. The U.S. is already constructing data centers at a record pace, with monthly starts hitting all-time highs.

Electricity usage tells the same story: data centers consumed 183 TWh last year, and that total is projected to more than double by 2030.

The physical world needs to expand rapidly to meet AI ambitions.

The industry is exploring every possible solution: natural gas, renewables, and the return of nuclear.

Google’s Project Suncatcher is targeting solar-powered TPUs stationed in orbit to bypass terrestrial constraints altogether.

The underlying message: the AI boom is running into real-world bottlenecks that require massive investments to resolve.

The winners will be the picks and shovels: firms that can solve power, permitting, and grid capacity at scale.

We love the 'natural gas will power datacenters' theme.

Our most recent investment was NewWest data: an Alberta based company that uses stranded natural gas to produce electricity with a $45M valuation.

Their bitcoin mining costs come to approximately $40K.

Their competitor is Crusoe Energy, which is valued at $10Bn - had a chance to meet them at the Cantor Conference.

Lumida ventures is now exploring deals within the defense technology sector - Think of FSD for drones.

You can get on our priority communication list by signing up for this form.

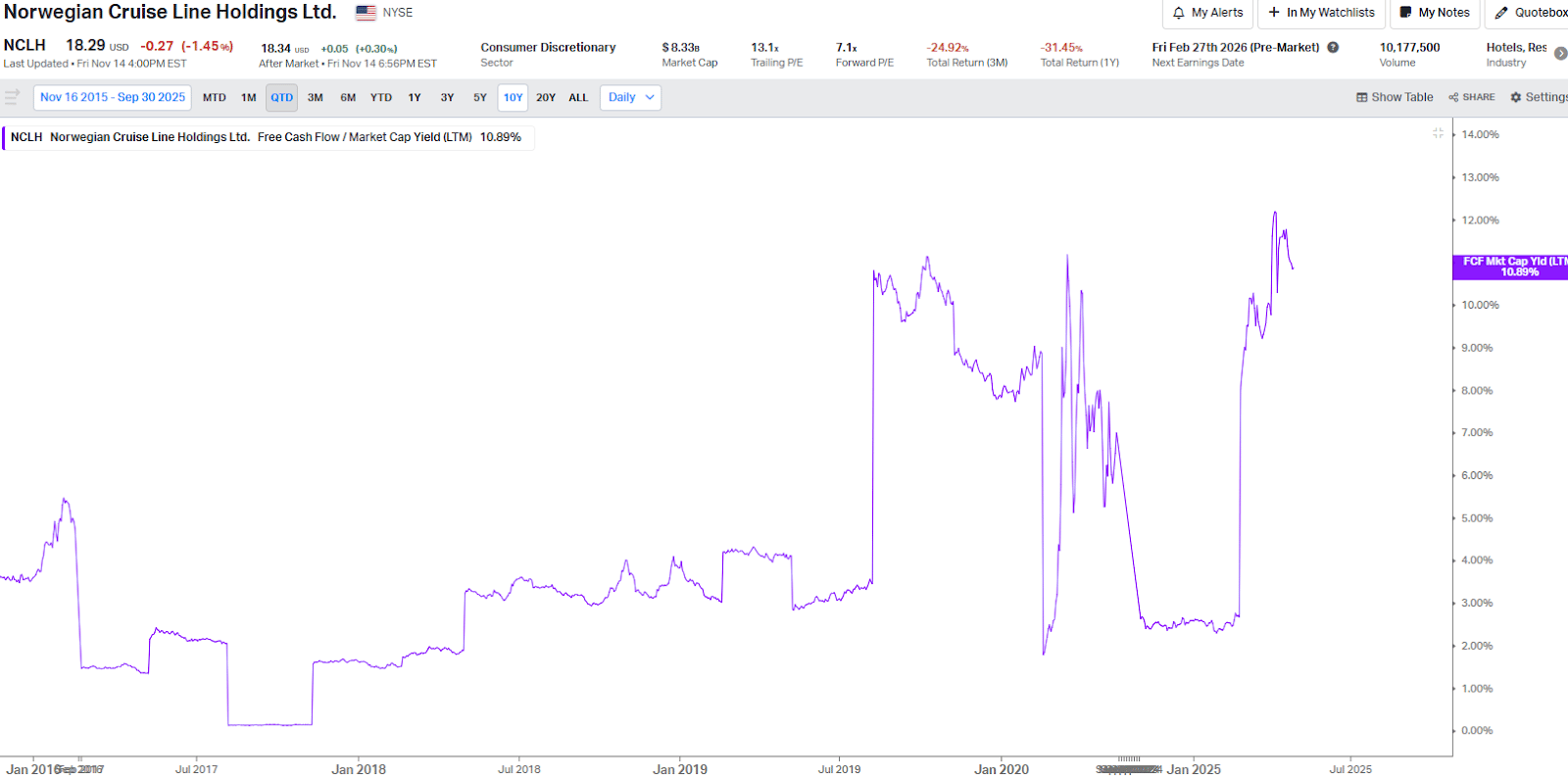

Norwegian Cruise Lines is a bargain

NCLH has dropped to its lowest price since June. The FCF yield is now at 11%, historically high levels, while P/E NTM has dropped to 7.1x - a bargain.

They announced their Q3 earnings last week. The revenue missed on Factset’s estimates, leading to a drawdown.

However, investors missed the broader picture.

NCLH had record high occupancy at 106.4%, beating management’s expectation of 105.5%. The management also had a higher earnings at $596M (+17% YoY), above previous guidance of $571M.

The company also raised its full-year earnings forecast, signaling confidence in continued healthy consumer demand.

We did an analysis on NCLH, and its rising structural demand thanks to the boomer’s economy. View it here.

Digital Assets

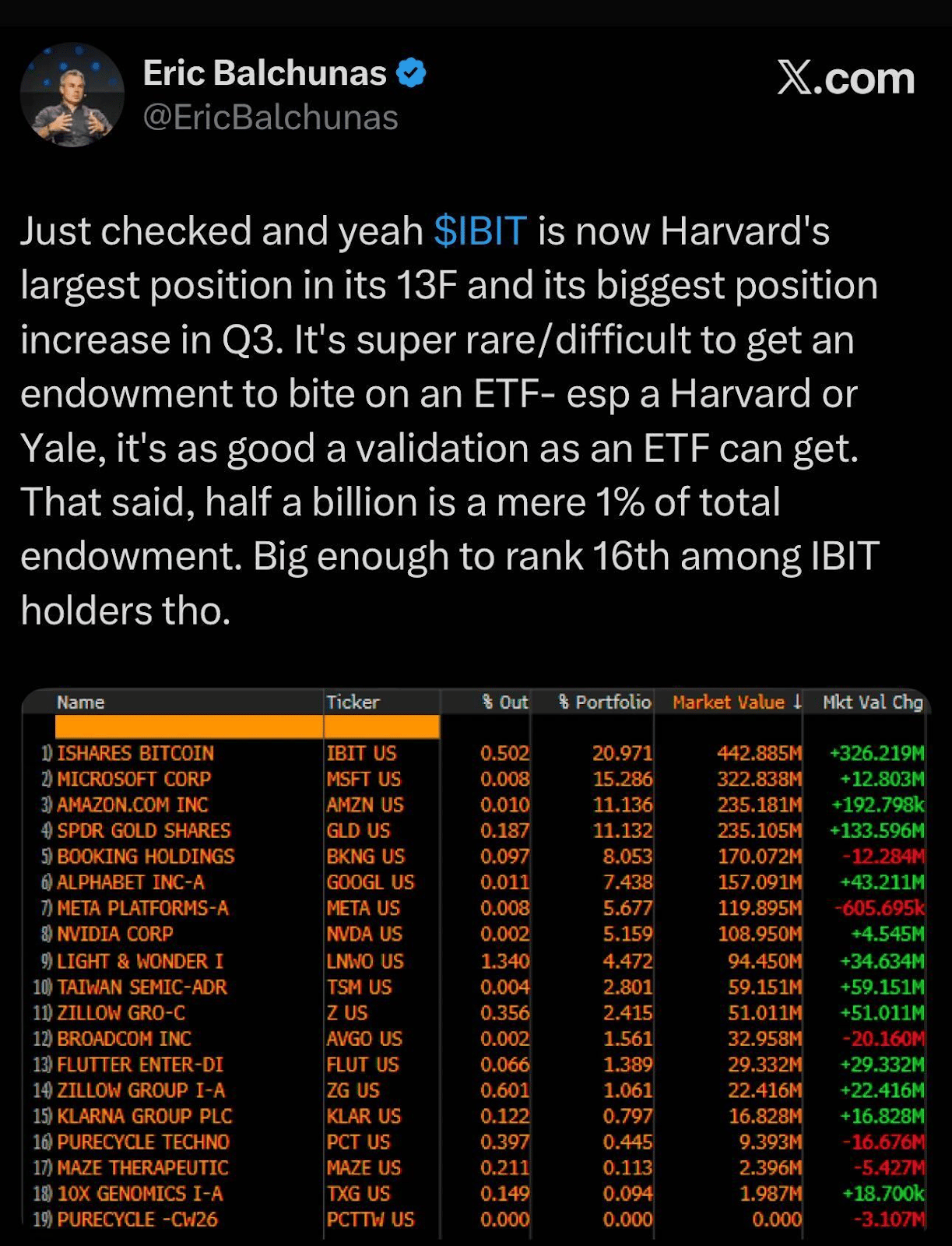

Harvard’s Move Into Bitcoin

Endowment funds move only when three things line up:

Regulatory clarity

Operational simplicity

Career-risk cover

The IBIT ETF solved all three at once.

It gave committees a compliant wrapper, removed custody headaches, and crucially, gave CIOs defensibility.

Once endowments enter an asset class, it creates structural demand.

These institutions rebalance on schedules. They buy dips, they size positions methodically, and they hold for years.

That is exactly the investor profile Bitcoin has never had at scale.

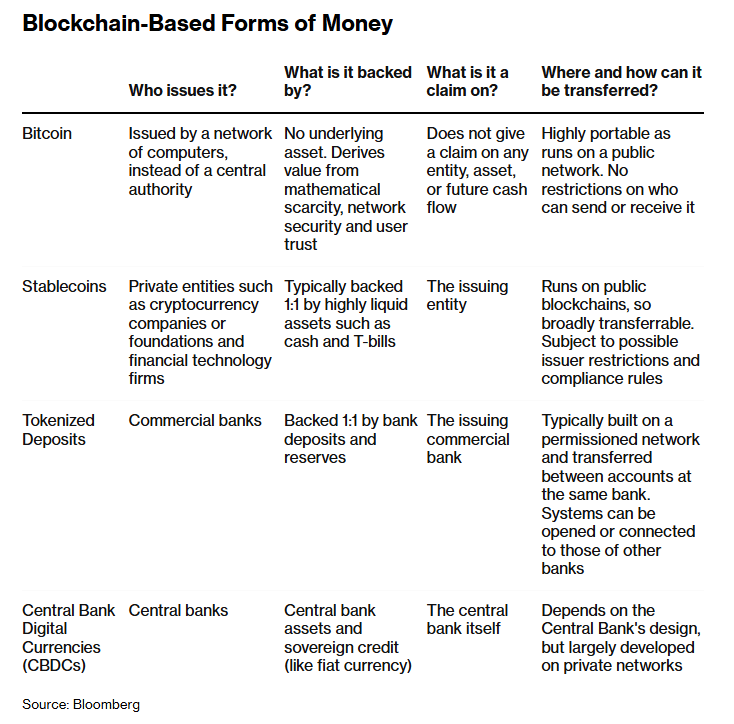

JPM Launches Its Deposit Token

JPMorgan’s rollout of a live deposit token marks a real shift in digital assets: the largest bank in the country is now settling dollars on a public blockchain, in production, with real clients.

This the beginning of a new settlement standard.

A deposit token is a tokenized JPMorgan dollar, a direct claim on the bank, moving at crypto speed.

It settles in seconds, works 24/7, and unlike stablecoins, it can be interest-bearing.

JPM already moves ~$3B a day on its internal tokenized network.

Once it adds euros and pounds, which are already trademarked, this becomes a global standard.

The bigger picture:

We’re entering a world with three types of digital dollars: stablecoins, CBDCs, and now bank-issued deposit tokens.

Each will serve a different segment, but deposit tokens have the attributes institutions want: regulatory clarity, yield, and the brand names they already trust.

This is how tokenization actually scales.

We dived deep into this concept a few weeks earlier; read the newsletter here.

Bitcoin and Digital Assets

We believe the Four Year cycle will haunt us again.

We believe the digital asset will attempt another run at $125 K. But, the rally likely gets sold as long-term HODLers continue to rotate out to new money.

Eth holders are selling to Tom Lee.

Bitcoin holders are selling to Blackrock ETFs and Eric Trump.

Every cycle there is a new buyer.

Microstrategy premium over NAV is nearly gone, that reduces the buying power for Bitcoin.

Q4 is generally bullish for these risk assets.

But, we believe folks should take advantage of that seasonal strength to rotate out on rallies

Broadly speaking, we have:

Attention and liquidity fragmentation (IPOs, DATs, etc.)

Stablecoins competing on payments use-cases

A Fed with mild, not excessive cuts, on offer

Coinbase and the IPO Token Window

For the first time since the 2017–2018 ICO boom, U.S. retail investors are getting a regulated path into primary token offerings. Coinbase is leading the transition.

Coinbase will curate roughly one offering a month, run a one-week subscription window, and use an algorithm to spread allocations rather than rewarding the fastest clicker or the biggest whale.

Projects are screened on team quality, token economics, and vesting, and there are explicit rules to curb dumping: flippers get penalized in future deals, and founders are locked up for six months.

This is “ICO 2.0,” but with gatekeepers, KYC, and incentives aimed at building durable markets.

Strategically, this pushes Coinbase further toward its stated goal of becoming an “everything exchange.”

Primary issuance feeds secondary trading, deepens its token roster, and pulls users back onshore who currently chase new listings overseas.

Over time, if this works, it gives Coinbase something like the role Nasdaq plays for equities: the default venue for new crypto listings.

The bigger story is access. Historically, the best token economics were captured by insiders, VCs, and offshore platforms.

A functioning primary market on Coinbase doesn’t level that field overnight, but it’s a step toward making early-stage digital assets look and feel more like an asset class U.S. investors can underwrite, rather than a grey-area side bet.

Lumida Curations

Microsoft’s AI “Pause”

Nadella explains that regulatory and sovereignty constraints forced Microsoft to re-architect AI capacity across the right geographies, workloads, and generations.

AI Boom Doesn’t Meet the Bubble Definition

Horowitz argues true bubbles require psychological surrender, and with skeptics still loud and demand structurally strong, AI is nowhere near that point.

Overcooked Food Drives Inflammation

High-heat cooking creates compounds the body struggles to clear, leading to chronic, system-wide inflammatory stress.

Meme

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.