Here’s a preview of what we’ll cover this week:

Macro: Consumer Credit Is Stable and Improving; Loan Demand Is Strong; AI-Driven Underwriting and Calibration Are Material Levers; Cruise demand is resilient and experience-led; Challenger’s Report Was Dramatic

Markets: Restaurants Remain Bearish; The Crypto Pullback Is an Attention Reset; Hyperscalers Ignite a Memory Supercycle; Samsung Eyes U.S. Card Market

Digital Assets: The Fed: Stablecoins Move Markets; Tokenization Is the Bridge Between Worlds; Banks Vs. Non-Banks

Lumida Curations: Banks Quietly Reenter the Crypto Arena; AI Enters Its Goldilocks Phase; Olive Oil Supercharges Your Fast

Spotlight

This week, I attended the Asset on Blockchain (AOB) conference at the Harvard club. It was exciting to meet SEC chair Paul Atkins - a fan of his leadership.

We need interpretive guidance (not rule by enforcement), an industry SRO, and Congressional action.

I wrote an op-ed in the WSJ with Arthur Levitt - former SEC chairman- last fall laying out a framework for responsible crypto regulation. I read it again today, and it still makes sense. You can read it here.

I did a livestream on the conference’s highlights - you can watch it here.

DNC Sweep - What to Make of It?

Markets sold off this week as the same time as a DNC sweep took place in various gubernatorial and city elections this week.

These counter-trend elections following a Presidential election are typical. Still, the margins combined with high turnout contain signal.

We believe the read-thrus are:

1) Consumers want ‘stability’ not fast-action cockpit fighter televised diplomacy from week to week. The electorate just can’t process that much information and it’s overwhelming.

2) Inflation remains an election issue. Trump won on bringing down grocery prices and immigration. The year-to-date focus has shown a shift on international politics and tariffs.

Democrats are starting to own the inflation message now.

Going into next year, we’d expect both parties to continue to err on the side of stimulative monetary and fiscal policy as we start look towards the midterms

That’s bullish.

Also, stock prices rise with earnings. Markets, we believe, have now priced in the DNC sweep and we suggest being fully invested as we approach year-end.

We’d expect record retail sales ahead to close out the year.

How To Reduce Your Tax Liability

Every spring, investors write one of their biggest checks of the year to the IRS.

However, you can save your taxes and contribute to social welfare instead.

The solution is Solar Investment Tax Credit (ITC). It allows investors to offset federal taxes by financing qualified solar projects.

The credit covers 30% of a project’s cost, with potential “bonus” credits for systems built with U.S. materials or located in low-income or energy-transition communities.

In practical terms, an investor with a $100,000 tax bill could put roughly $60,000 into a qualified solar project and reduce their tax liability by nearly 40%, while also earning passive income from power generation.

Corporates have been doing this for years; in 2024 alone, more than $20 billion in solar credits were traded, up four-fold from the year before.

Lumida has been actively exploring tax mitigation strategies to help our investors reduce their tax liabilities.

If you’d like to be on our priority list, sign up using the form here. If you’d like more details on how Lumida can help you reduce your tax liability, write to [email protected].

We are hosting Lumida Holiday 2025 on 3rd Dec - the event brings together founders, family offices, and investors to share ideas, discuss opportunities, and have fun. We would love to host you. Please sign up here.

Earnings Highlight: Consumer Finance

We turn our focus to consumer finance companies this week. Their earnings offer great read throughs on consumers’ health, lending patterns, and their confidence in the economy.

Consumer Credit Is Stable and Improving

The U.S. consumer remains far healthier than the headline narrative suggests.

Each week, our team analyzes the earnings calls across a variety of sectors to glean insight into the economy.

The performance data from LendingClub, SoFi, and Upstart show a picture of consumers meeting their commitments and even declining delinquencies.

Credit risk is normalizing, and the economy remains stable.

Loan Demand Is Strong

Discover’s CEO Michael Shepherd noted: “Card spending growth remained positive and personal loan demand was strong as consumers continue to manage household balance sheets proactively.”

These signals show consumers are confident in the economy, and they are willing to take on more loans, helping demand growth.

AI-Driven Underwriting and Calibration Are Material Levers

AI is quietly reshaping consumer finance from the inside out.

Operators, from SoFi to Upstart, emphasized how data science, model calibration, and real-time cash-flow analytics are becoming the new edge in lending.

If you are still not convinced with AI’s potential, you should also read our last newsletter, where we discuss how hyperscalers are using AI to boost their returns.

Baby Boomers: Cruise Demand Is Resilient And Experience-Led

Cruise line earnings confirm the pattern visible across the economy: consumers are confident, and they keep spending - No recession in sight!

Consumers are spending on travel, and their preferences continue to focus on toward experiences.

Jason Liberty, CEO of Royal Caribbean, noted: “Consumers continue to prioritize experiences and make room in their budgets for meaningful vacations… Roughly three-fourths of consumers intend to spend the same or more on vacations over the next 12 months.”

Demand remains historically strong.

Harry Sommer, CEO of Norwegian Cruise Line, said: “Bookings… marked the strongest third quarter in company history, with bookings up over 20% from last year,” adding that intent is “at or near record levels.”

This strength is pulling bookings further forward.

Josh Weinstein, CEO Carnival Corporation, highlighted: “Booking trends have continued to improve, nicely outpacing capacity growth at higher prices… with nearly half of 2026 already on the books at higher prices.”

Restaurants Remain Bearish

CAVA reported Q3 earnings this week. Revenue rose ~20% YoY to ~$289.8M. EPS was $0.12, about 1c below consensus and slightly down vs last year’s $0.13.

Management trimmed FY25 revenue guidance to 3–4% increase, causing a 4% stock decline.

CAVA’s transcripts offer insights on what’s working for restaurants (and what is not!).

Brett Schulman (Cava CEO): “Consumers today face a challenging environment; we’re not seeing anything geographically to call out… it’s more around the macro environment and the pressure on the consumer.”

Overall, Full-service restaurants remain in a bearish market. The dining basket (EAT, CAKE, TXRH, DRI, etc.) slid to new lows during Q3 earnings.

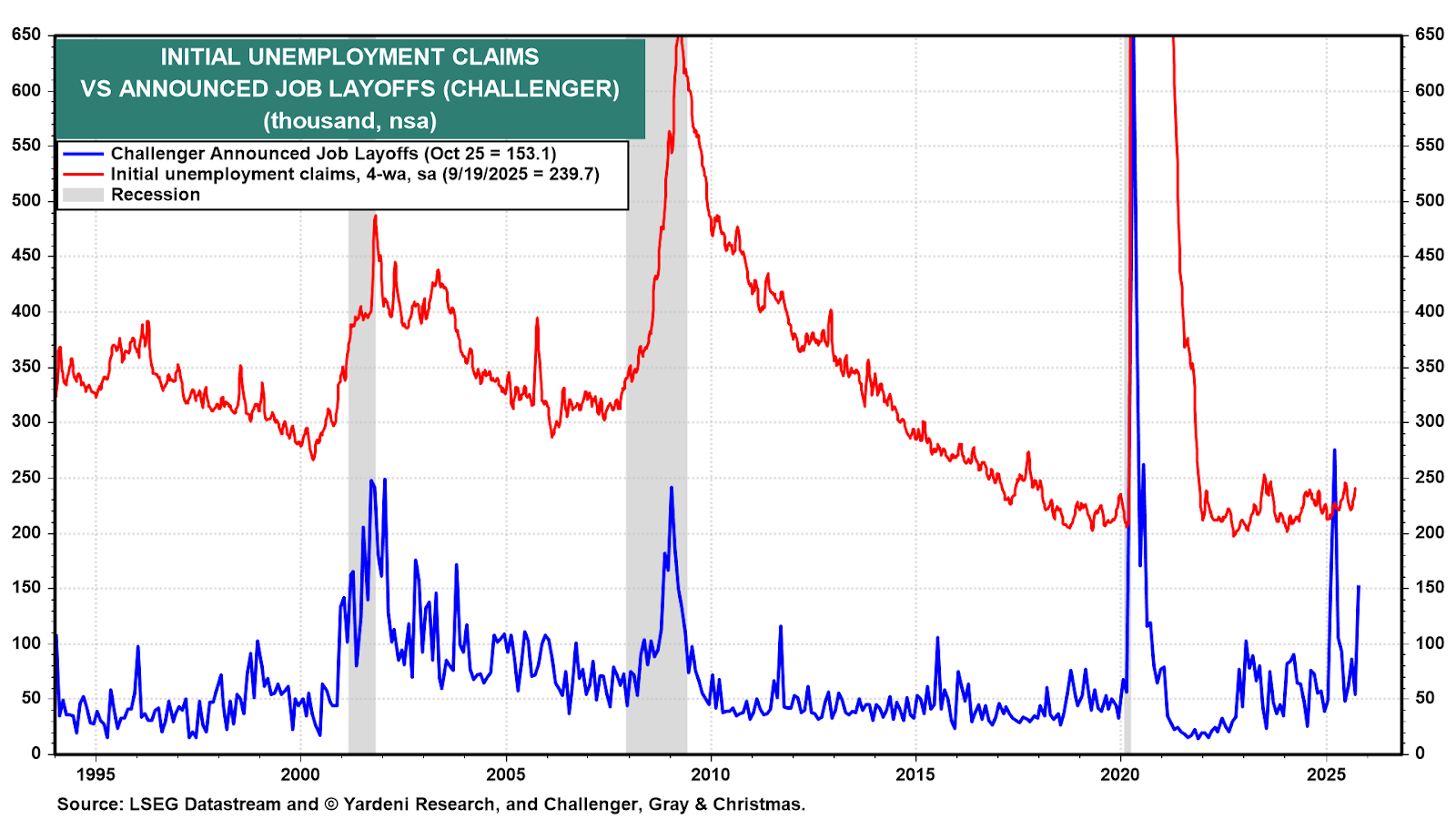

Challenger’s Report Was Dramatic

October saw 153,074 announced job cuts, concentrated in technology and warehousing.

These are industries, where automation and artificial intelligence are boosting output per worker and reducing labor demand.

We expect a number of those impacted in the tech industry will go on to start or join AI companies to drive a deepening of AI adoption across the economy.

The private payrolls this week showed 42,000 new jobs in October, following small declines in the prior two months.

While this number looks small, it is exactly where payrolls should be to keep the unemployment rate stable.

St. Louis Fed notes slower immigration and lower labor-force participation mean “the economy only needs to add ~50,000 jobs per month to keep unemployment stable… 75–100k would be meaningful positive news.”

Similarly, the Dallas Fed estimates the economy needs only 34,000 new jobs to maintain stability in the unemployment rate.

We have been talking about this for several months now; labor supply constraints are structural. Immigration has slowed, and labor force participation remains below pre-pandemic levels, especially among younger cohorts and working-age men.

This dynamic is reshaping the labor market: AI is replacing some forms of work, while boosting overall output.

Productivity is rising, and hiring needs are flattening. Meanwhile, earnings continue to march higher.

The labor market feels “soft” on headline job numbers but remains tight in supply - a mix that supports disinflation without signaling recession.

Markets

The Crypto Pullback Is an Attention Reset

The recent crypto drawdown is part of a broader unwind in high-momentum “attention assets.”

Bitcoin’s recent dip has moved in lockstep with weakness across gold, small-cap equities, uranium, and quantum-computing names like Rigetti.

These trades have risen and fallen together this year as investors crowd into the same high-beta exposures that dominate narrative cycles.

The root of the selloff traces back to the following factors:

Fed’s October meeting where Powell walked back prospects for a December cut.

Some concerns on the liquidity in the Treasury General Account (TGA).

Government shutdown that continues to extend and is a form of fiscal tightening

Hangover effect from the DAT IPO frenzy — many of which are now underwater or close to fair value (the exception is Canton Network…)

OGs rotating from long-held positions (see chart)

Our view is that it will be difficult for Bitcoin to break $125K this year.

We would need a surprise shock that the market is not anticipating, and most certainly would need December rate cuts or shadow appointment of a Dovish Fed leader.

This isn’t a structural crash as some articles might suggest. It's an attention rotation. Capital is simply cycling out of over-owned trades after a strong run.

Macro conditions remain constructive, regulatory momentum is improving, and institutional interest continues to deepen beneath the surface.

The shakeout looks less like the end of a cycle and more like a pause for breath in a crowded trade.

Datacenter and Chips Demand Remain Strong

Sandisk (SNKD) delivered a triple play for Q3; their results show the industry is seeing a sharp surge in demand from hyperscalers.

CEO David Goeckeler: “Demand for our NAND products continued to outpace our supply… customers are proactively seeking long-term commitments given the critical nature of our technology.”

Data center revenue surged 26% YoY. “We’re now working with five major hyperscale customers through active sales and strategic engagements.”

CFO Luis Visoso added that “our products are currently on allocation across all end markets.”

Notably, Micron and SK Hynix and other memory stocks were in the dumps for the better part of 2024 and earlier this year.

We believe investors should wait for a pullback here, not chase memory stocks.

A more interesting area to focus on would be Meta which we believe presents an attractive valuation entry. Meta is gradually becoming our largest holding.

Samsung Eyes U.S. Card Market

Samsung is making a serious push into consumer finance. The company is in advanced talks with Barclays to launch a U.S. credit card, with Visa likely to serve as the payment network.

The move signals Samsung’s ambition to go beyond devices, and build an ecosystem that ties together payments, savings, and loyalty much like their archrival Apple has.

Samsung’s internal documents describe a vision where a Samsung credit card earns cash back that flows into a Samsung Cash account, then a Samsung savings account, creating a seamless loop between spending and saving.

The company is also exploring high-yield savings, digital prepaid accounts, and buy-now-pay-later products - all designed to make its digital wallet indispensable.

For Barclays, the partnership represents a chance to rebuild its co-branded credit-card portfolio after losing American Airlines. The bank gains access to Samsung’s vast customer base - over 71 million active mobile users and 97 million customers across its U.S. businesses.

The race between Apple and Samsung now extends from smartphones to financial ecosystems.

Digital Assets

The Fed: Stablecoins Move Markets

Fed Governor Stephen Miran called stablecoins “a force to be reckoned with”, and agreed their rise could push interest rates lower.

“This innovation [stablecoins] has been unfairly treated as a pariah by some, but stablecoins are now an established and fast-growing part of the financial landscape.”

Miran said stablecoins are expanding the “net supply of loanable funds”.

When global investors hold dollar-backed tokens, they’re effectively financing the U.S. Treasuries and bank reserves.

He argues extra liquidity “puts downward pressure on r*, the neutral rate of interest,”.

If r* falls, the Fed’s baseline policy rate will follow.

We believe it’s way to early to draw these conclusions.

Further, issuance has shifted to the front-end of the curve where the Fed sets rates. And, stablecoins are funding on the front-end of the curve.

So, how exactly are stablecoins pushing down R*?

Further, we believe R* is a flawed economic concept that assumes a fairy tale equlibrium rate. Reality is complicated by concepts such as Animal Spirits as we’ve written about before.

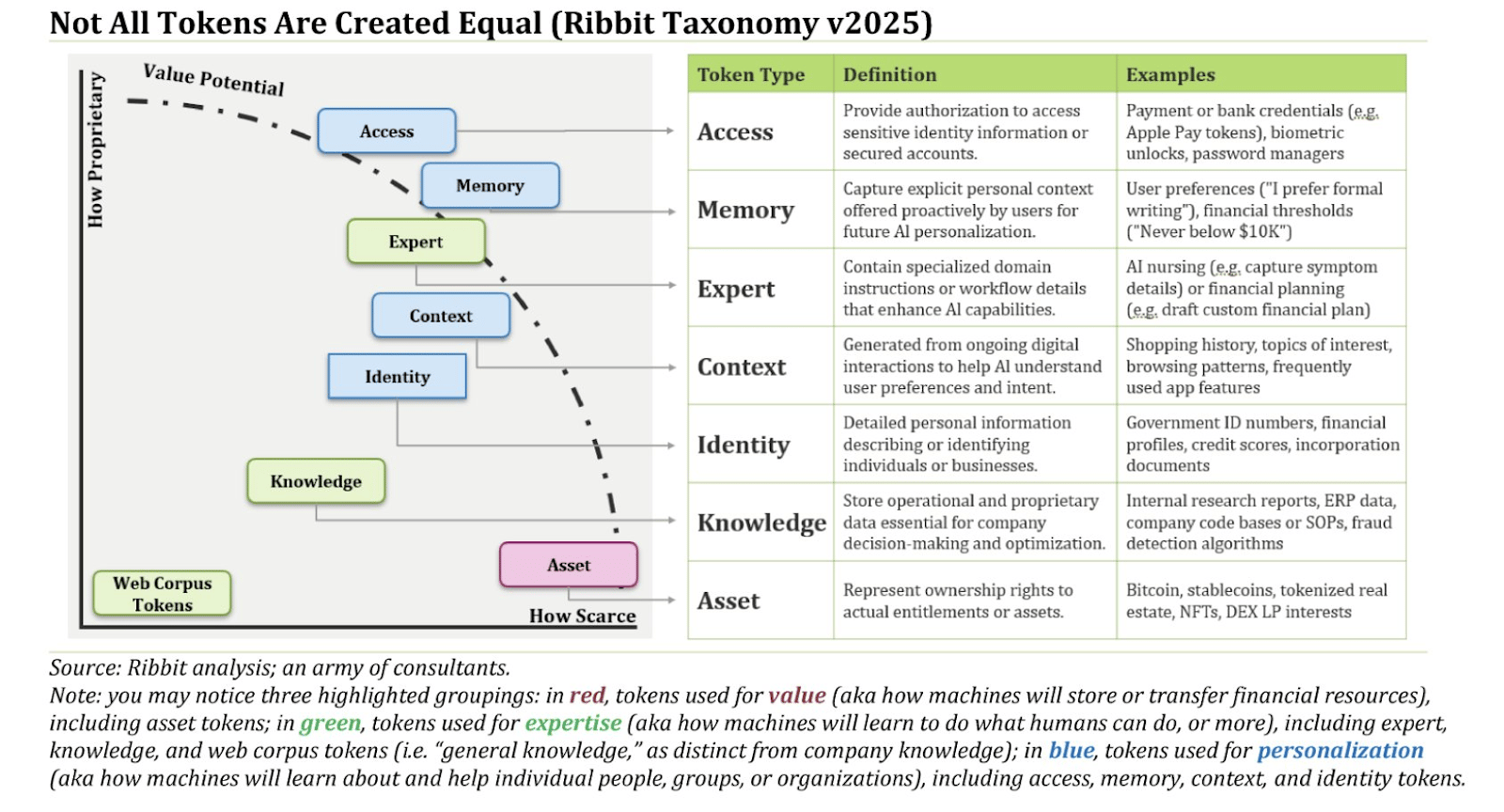

Tokenization Is the Bridge Between Worlds

Tokenization is emerging as the connective tissue between the physical and digital economies.

AI and robotics digitize how the world operates. Tokenization digitizes how the world owns.

Together, they create a feedback loop: AI builds smarter real assets; tokenization lets those assets trade, fractionalize, and move at internet speed.

The implications are massive.

Real-world assets, from energy infrastructure to real estate and data centers, are being pulled onto blockchain rails.

Tokenization doesn’t just make them tradable; it makes them programmable, composable, and eventually integrated with AI-driven financial systems.

Ribbit Capital explored this concept in their 2025 token letter; you can read it here.

BANKS VS. NON-BANKS

Since the GFC, banks continue to retreat from "owning the customer" and directly servicing them.

On the payments side, firms like Stripe are acquiring merchants and then working with banks on the back-end.

On the lending side, private credit firms acquire and service customers. Then a bank on the back-end provides the "lending to the lender" back leverage.

Now, SuperApps and neo-banks (also built on top of infra banks) are increasingly owning the customer.

Hard to foresee how anything will change this trend; and it takes risk out of the banking system.

Tokenization should accelerate this and a handful of banks - those that can gather deposits and source lending - should do quite well.

Lumida Curations

Banks Quietly Reenter the Crypto Arena

Michael Saylor says new regulatory clarity from the Fed, OCC, and FDIC is ushering traditional banks back into digital assets, signaling a fresh wave of institutional adoption.

AI Enters Its Goldilocks Phase

The AGI hype is cooling as AI settles into a balanced phase: steady, polytheistic progress driving real productivity rather than existential panic.

Olive Oil Supercharges Your Fast

Fasting isn’t about eating less. It’s about sending the right metabolic signals, and olive oil flips your body from storing energy to repairing itself.

Meme

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.