Here’s a preview of what we’ll cover this week:

Markets: Big Tech Is Spending More Than Ever on AI; AI Capex Is Paying Back; Bubble Talk Is Lazy Analysis; Open AI To Go Public; AI & Productivity: Carmax (?!); Power Is The New Bottleneck

Macro: Automobile Sales Show Consumer Strength; The Hawkish Rate Cut

Digital Assets: The Future Is Hybrid Finance; Visa’s Stablecoin Superhighway; Flows From Gold To BTC?

Lumida Curations: America’s Supply Chain Reset; How To Fix Your Sleep Cycle?

Spotlight

This week on Bits + Bips, I joined Austin Campbell, Chris Perkins, and Joseph Chalom (Ex-BlackRock and Co-CEO of SharpLink) for an insightful conversation on:

Why the Fed cut rates despite a ‘Goldilocks’ economy

How AI is causing labor market shocks

Stablecoins going mainstream in FX and settlement

How JPMorgan, Citi, and others are quietly racing into blockchain

Japan’s first yen-backed stablecoin and the future of cross-border money

Why CZ’s pardon and Mike Selig’s CFTC role matter for crypto’s next chapter

You can watch the Bits and Bips podcast here.

Lumida Wealth Is Hiring

I am looking for a VP of Sales to join our leadership team at Lumida Wealth.

The cheat code to create wealth is to join a rapidly growing company.

This is your chance to shoot your shot.

Requirement:

Must have seen the epic movie: Glengarry Glen Ross.

Target comp: $250 K to $350K and equity.

Apply here to see the full job description.

This week, I was in Vegas to attend Money 2020.

There are a lot of financial institutions that want to do tokenization.

They have no idea what they're doing.

They're doing POCs that don't make any sense.

I mean, there are FIs doing tokenization of assets in their data warehouses.

I talked to the sales guy three times. He explained it three times, but it still didn’t make any sense.

I told him: “it's just a database with tokens”

He's like: “yes, but they're automated actions”.

But, those are called workflows. Zapier can do an automated workflow for you.

You don't need tokenization for that.

The clear takeaway: Everything is getting tokenized.

Watch the livestream here.

Earnings Season Highlights: Big Tech

This week was an important one for the markets with hyperscalers’ earnings and the FOMC meeting.

Sam Altman is saying he wants to spend $1 Tn+ on capex… and they are doing $13 bn in revenue. Even if revenue 10xs — the spend does not make any sense.

Rather than buy OpenAI, you should front-run Sam Altman. Take a look at this post more for the analysis.

Concertely, what that means is owning the supply chain — and the most mispriced part of the supply chain is the datacenter energy space. Liquid natural gas will play an important role in enabling turbines and generators to power datacenters.

Elon Musk’s Memphis datacenter is nat gas powered. We’ll see a lot more of this in the future.

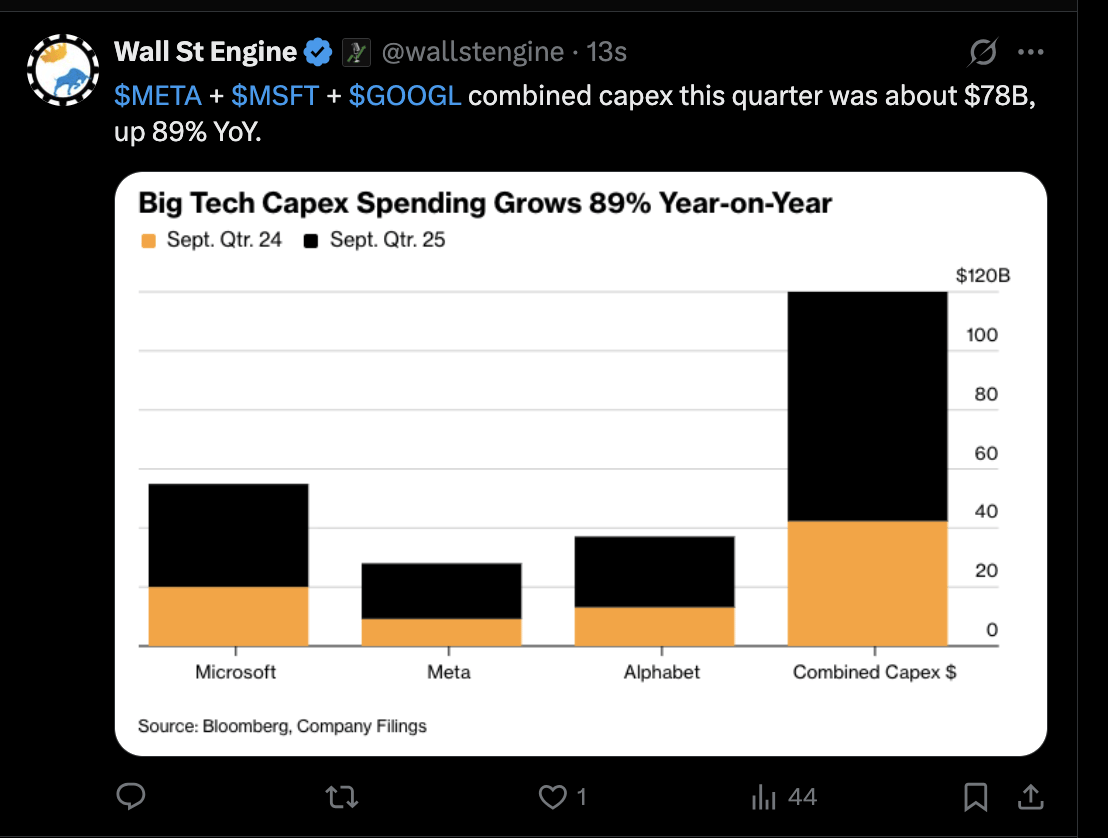

Big Tech Is Spending More Than Ever on AI

Capital spending at Big Tech has entered a new phase: coordinated acceleration.

Meta, Google, Microsoft and Amazon are scaling compute to stay ahead of AI demand and defend moats.

Alphabet’s CapEx hit $24 billion this quarter, almost double from last year, with 60 percent going to servers and 40 percent to data centers and networking.

CFO Ruth Porat said the company expects $91–93 billion in capex in 2025 and a “significant increase in 2026.”

Microsoft framed its expansion in similar terms.

Satya Nadella said the company will “increase total AI capacity by over 80 percent this year and roughly double our data-center footprint within two years.”

He also highlighted investments in the 2 GW Fairwater campus in Wisconsin as a model for next-generation AI plants.

Amazon’s CFO Brian Olsavsky echoed the pattern.

“Cash CapEx was $34.2 billion in Q3, roughly $125 billion for 2025, and we expect that amount to increase in 2026. Most [capex] is [for] expanding our data-center footprint for generative AI.”

Meta is not far behind.

CFO Susan Li told investors, “We currently expect 2025 CapEx at $70–72 billion. Compute needs have expanded meaningfully, and we expect to invest aggressively.”

Across the four companies, the capex is going in the same direction: GPUs, custom silicon, and data-center power.

Amazon and Microsoft both cited NVIDIA directly; Amazon added AMD and Intel; Alphabet continues to scale its in-house TPUs.

The ripple effects of the increasing AI Capex reach every layer of the supply chain: semiconductors, power utilities, fiber networks, cooling systems, and construction firms tied to hyperscale builds.

Nvidia, Coreweave and Nebius seem poised to win from the increasing demand. You should read our capex receiver thesis to help decide where to bet in the AI flywheel.

Meta Earnings

Meta’s stock dropped about 12% after one-time tax related earnings charges.

In April of 2024, Meta dropped 20% after earnings. That was a great time to buy the dip and we noted.

Take a look at Meta’s trailing valuation history. It’s not as oversold as Google was. But it does offer compelling value and warrants an overweight in our view. The risk is that Meta’s spend on capex and AI engineers causes earnings to slow.

Still, Meta’s earnings growth is strong. They have distribution. They have a right to win and a Founder led CEO that has a proven track record of pivoting from Desktop to Mobile, and now AI.

AI Capex Is Paying Back

The defining feature of this earnings season wasn’t the size of AI investment; it was the visibility of payback.

Big Tech is reporting customer adoption, backlog growth, and early monetization of their AI services.

Alphabet reported the sharpest acceleration in enterprise demand.

Sundar Pichai said the company has entered “the generative AI era.”

“AI Mode now has over 75 million daily active users… Most importantly, AI Mode is already driving incremental total query growth for Search.”

Ruth Porat noted: “Over 70% of existing Google Cloud customers use our AI products.”

Google Cloud’s backlog had climbed to $155 billion, up 82 percent year-over-year, with “more billion-dollar deals in nine months than the past two years combined.”

Sundar Pichai added adoption for AI products “is rapidly accelerating. In Q3, revenue from products built on our generative AI models grew more than 200% year-over-year.”

In May we noted Google was the only Mag 7 stock not priced for AI. We made it our largest position. It’s up 65% since this post.

Microsoft showed a similar curve.

Nadella noted Microsoft is seeing “increasing demand and diffusion of our AI platform and family of Copilots.”

The Copilot rollout is their first software product to monetise AI at scale: “More than 90 percent of the Fortune 500 now use Microsoft 365 Copilot… PwC added 155 thousand seats and credits it with saving millions of hours.”

Bookings strengthen the ROI story: commercial RPO reached $392 billion, up 51 percent Y/Y, while Azure AI usage rose more than 80 percent.

Amazon’s demand pipeline is just as aggressive.

Olsavsky said, “As fast as we’re adding capacity, we’re monetising it.”

At the application layer, Amazon’s retail AI assistant Rufus now touches 250 million active customers, who are “60 percent more likely to complete a purchase,” driving “over $10 billion in annualised incremental sales.” AI is moving directly into revenue conversion.

Meta’s version of AI demand is rooted in its ad and commerce ecosystem.

Mark Zuckerberg said the company’s “AI-powered ad tools have passed a $60 billion annual run rate,” and that the same models, driving engagement, also power business automation.

CFO Susan Li added, “Investments we’re making within our ads and organic engagement will enable strong revenue growth in 2026.”

The pattern is clear: AI spending is being validated by usage and backlog - it isn’t speculative anymore.

AI & Productivity: Carmax (?!)

CarMax cut 300 call center jobs due to the benefits of AI.

CarMax is a sub $10 Bn company. We don't own it.

But, the point is that productivity gains are spreading to broader parts of the economy, including small to mid-sized companies.

This is bullish for the real earnings growth of the economy and disinflation.

You are not bullish enough on the promise of AI.

Automobile Sales Show Consumer Strength

Auto makers closed Q3 with a tone of cautious confidence. Consumer demand remains resilient and tariff headwinds are easing faster than expected.

Consumer appetite for high-end and core models remains strong.

Ford’s CEO Jim Farley said they have added “up to 1,000 new jobs to increase F-Series production to recover lost volume and fulfill strong customer demand.”

President Andrew Frick highlighted that U.S. market share rose to 12.8 percent, led by flagship models: “The all-new Expedition is very strong, gaining over 3 points of segment share, with 75 percent of customers choosing high-end trims like Tremor.”

General Motors echoed that consumer health remains intact despite macro uncertainty.

CFO Paul Jacobson said, “History shows that rising unemployment usually has an impact, but right now we’re in good shape and seeing customers stay strong.”

Moreover, tariff impacts look more controlled now.

GM reported that its $3.4 billion EBIT included a $1.1 billion tariff impact: “a little less than we had expected.”

Ford expects similar relief.

CFO Sherry House cut the company’s 2025 tariff forecast in half: “We now expect tariffs will be a $1 billion net headwind for 2025, down from $2 billion.”

Taken together, the auto sector looks stable.

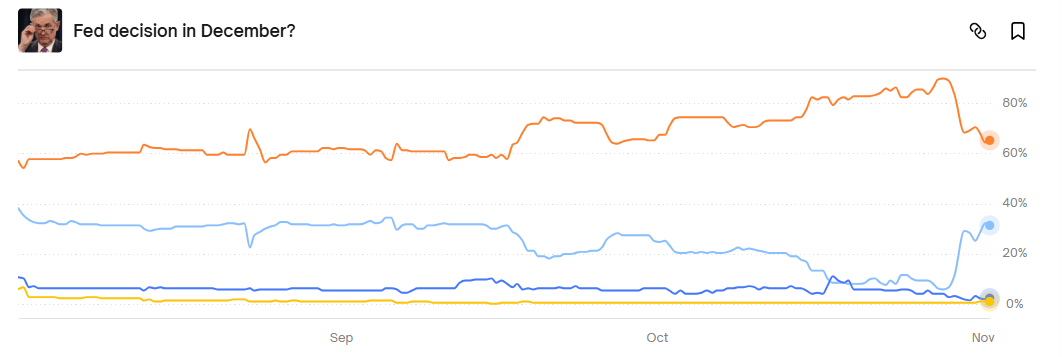

The Hawkish Rate Cut

The Fed delivered a 25 bps rate cut this week - its second in the last two meetings, but Jerome Powell’s future indications were hawkish.

“There were strongly differing views about how to proceed in December,” he said. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

After Powell’s comments, equities sold off and the 10-year yield climbed back above 4 percent.

Polymarket odds for a December cut dropped to 66% from 90%.

What’s funny is the economy doesn’t need rate cuts at all.

The labor market’s cooling is structural, not cyclical, and Powell acknowledged that reality.

“Conditions in the labor market appear to be gradually cooling,” he said.

The slowing supply “likely reflects a decline in the growth of the labor force due to lower immigration and labor force participation.”

He added, “Both layoffs and hiring remain low… we do not see the weakness in the job market accelerating.”

Overall, the moderation in job growth is due to slowing of both labor demand and supply. Businesses are relying on higher efficiency to cover the gap.

Productivity growth is picking up, unit labor costs are contained, and the economy is generating more output per worker.

This setup means lower rates aren’t likely to “fix” the labor market, but they are also not likely to reignite consumer inflation.

Instead, easier policy is more likely to fuel asset-price inflation, particularly in equities, as liquidity flows into productive and financial assets.

Markets

Zoom out.

Big banks are growing earnings.

Big tech are growing earnings. And briskly!

GM and consumer names are seeing growth.

Even names that sold off, like cruise lines, are seeing strong growth in their core business.

I first ask myself: ‘How is the underlying business doing? and, what about the core drivers?’ before looking at how it did versus expectations.

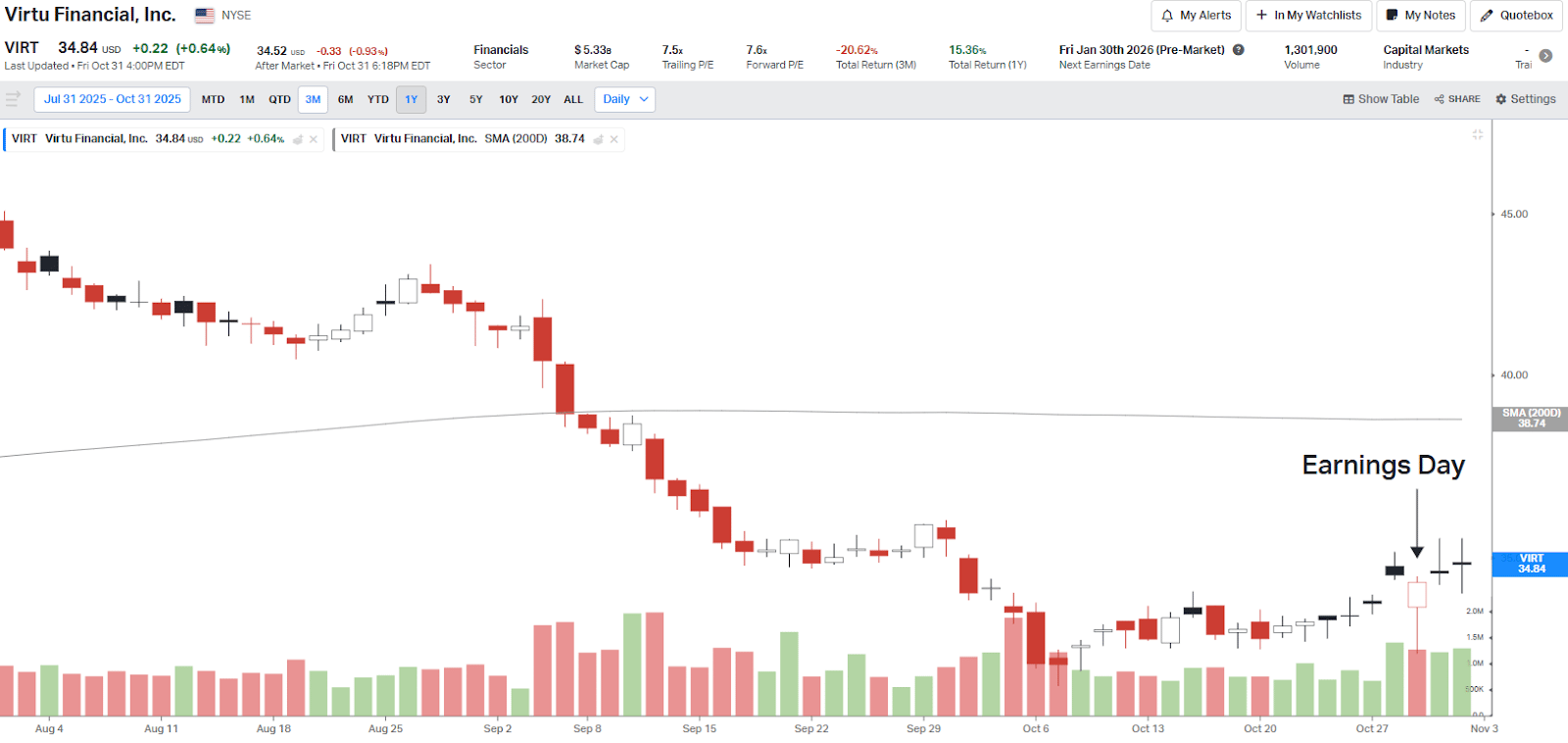

Take Virtu for example.

Strong double digit growth YOY and benefits from trends in ETF and retail trader growth.

Dropped due to a ‘miss’.

The core business is great.

We scooped it up on the gap down on Wednesday and are sitting on gains now.

This is a bread and butter tactic.

Bubble Talk Is Lazy Analysis

‘Bubble’ - every cycle gets the same label before it’s understood.

The 1999 analogs miss the point. This isn’t a liquidity-driven bubble. It’s a cash flow–backed investment cycle.

The top of the Nasdaq in 2000 was funded by debt, story stocks, and vaporware.

Today’s AI leaders are cash-rich, profitable, and reinvesting out of free cash flow.

NVIDIA, Microsoft, Alphabet, and Meta are financing record CapEx internally. The balance sheets are pristine, and the ROI math already works.

AI isn’t speculative; it’s productive.

Cloud margins are rising, GPU utilization is climbing, and enterprise adoption is accelerating. These are capital projects with yield.

As Jurrien Timmer notes, NVIDIA’s valuation may be high, but it is nowhere near dot-com extremes.

Cisco traded at 214× earnings in 2000; NVIDIA’s forward multiple is around 32×. The difference is that this time, earnings are compounding with each compute cycle.

Open AI To Go Public

OpenAI is planning a $1 Tn IPO in 2027.

That could potentially be the time to be cautious on AI stocks. (We'll have to assess then.)

2000s: Goldman Sachs IPO was a top signal

2007: Apollo and Blackstone

2021: SPAC and IPO boom ends

That large new issue would need to be absorbed.

We're going to learn a ton from their S-1 filing in 2026.

CMG needs a reality check

Chipotle is down 20.2% since it reported earnings.

1) Shareholders are running for the border

2) Investors are losing their appetite after Ackman’s 13F

3) Chipotle’s dwindling portion size is matched by dwindling returns.

Notably, it still remains pricier than META despite this pullback.

Management cites consumers in the 25 to 35 age cohort are pulling back.

CEO Boatwright cited a "broad-based pullback in frequency across all income cohorts" and pointed out, "the gap has widened, with low to middle-income guests further reducing frequency".

This group, which represents about 40% of total sales, is "dining out less often due to concerns about the economy, and inflation."

Interestingly, if you look at EAT's latest results, you'd see the opposite comments.

Kevin Hochman(CEO): "Under $60,000 household is actually growing faster than other cohorts right now."

The reason: " I think we've got the sweet spot of being positioned as a great value and then delivering a consistent experience when guests come in"- Kevin Hockman

Consumers switch to substitutes if you are falling behind.

This is business 101.

Here’s a hilarious video to understand why CMG is lagging.

Overall, restaurants remain in a bear market.

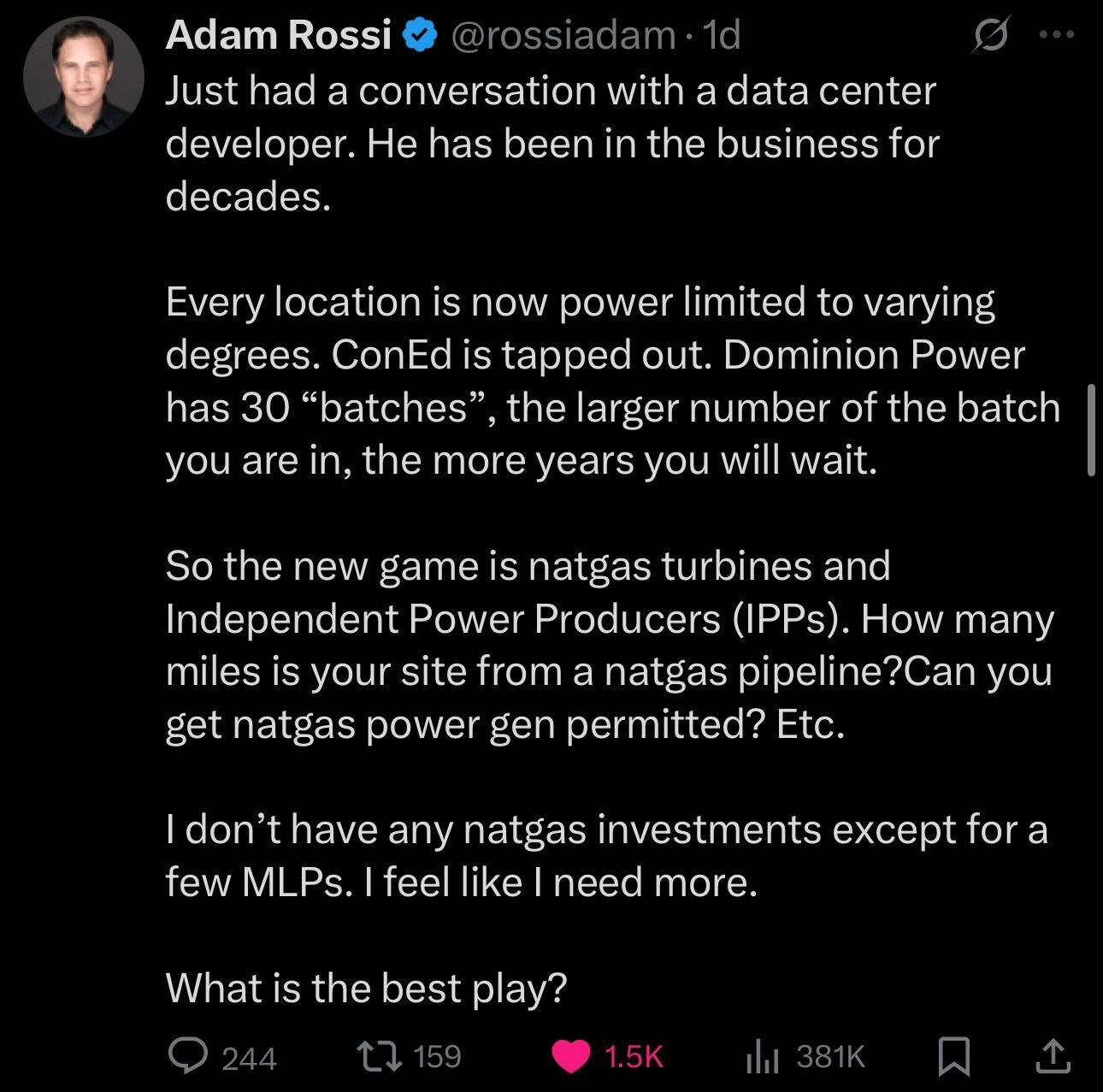

Power is the new bottleneck

Energy demand is quietly becoming the binding constraint on AI.

Recent projections suggest data-center electricity use will reach about 20 % of U.S. consumption by 2030, with AI alone accounting for roughly 15 %.

The winners will be natural-gas midstream players, private-market plays in modular generation, and turbine/generator firms servicing new builds.

Their earnings already reflect the demand.

Nat gas midstream backlogs are up ~60 % with ~90% of it being gas-related.

In latest reports, KMI’s leadership projects a 28 Bcf per day increase in natural gas demand by 2030, nearly double today’s level, driven by AI power loads.

Halliburton’s CEO Jeffrey Miller says: “The demand for power and for AI is like nothing I’ve ever seen in terms of demand growth.”

However, listed nat gas midstream players look inflated.

KMI, for instance, has a P/E NTM of 19.3 compared to P/E NTM of 16.0 of S&P 400 Mid caps.

Nonetheless, the private market offers some exciting opportunities.

In Alberta, innovative O&G companies are turning stringent flaring rules into an advantage.

Flaring regulations prohibit oil and gas producers from venting natural gas during oil production.

The alternative, capturing and transmitting the gas via pipeline, can be expensive, sometimes forcing operators to curtail mining.

This creates opportunities for firms that understand both oil operations and datacenters.

They capture excess gas, combust it to generate power, and use that electricity to mine crypto or run datacenters, earning revenue from both oil sales and mined assets.

Crusoe Energy pioneered a similar model and is now a $10B private company, though inaccessible to retail investors. New players are emerging with significant upside potential.

At Lumida, our team seeks undervalued assets often overlooked by the broader market, offering qualified investors opportunities typically reserved for institutions.

If you’d like to be considered for upcoming deals, please sign up using the form, or email [email protected]. We have several ideas in the industry with proven execution.

Moreover, Lumida ventures is actively exploring opportunities around tax mitigation to ensure you can optimize your after-tax returns. You can sign up with Lumida's Tax Shield, or write to [email protected] understand how our existing strategies work.

Digital Assets

The Future Is Hybrid Finance

Legacy finance is crossing the bridge into crypto.

This week, Western Union partnered with Anchorage Digital and Solana to launch USDPt, a stablecoin built for cross-border payments across 150 countries.

Anchorage Digital Bank, the only federally regulated stablecoin issuer, will mint and redeem USDPt under U.S. oversight. Solana provides the rails, and Western Union supplies the global distribution.

Traditional firms are no longer fighting crypto, they’re absorbing it. Instead of “disruption,” we’re seeing integration.

Legacy financial networks bring compliance, licensing, and consumer reach; digital-asset infrastructure adds speed, finality, and programmability.

The result is a new settlement architecture that feels inevitable in hindsight.

Anchorage’s co-founder Nathan McCauley called it a “landmark partnership,” and he’s right.

For decades, Western Union was synonymous with paper slips and remittance counters. Now it’s experimenting with blockchain rails to modernize dollar transfers in real time.

Solana’s low-cost throughput gives it the performance layer needed to make that work at scale.

The next decade of payments will be built on hybrid finance, not pure crypto or pure banking.

The winners will be firms that can merge regulatory credibility with blockchain speed, and those that move first are already defining the template.

Visa’s Stablecoin Superhighway

Visa just made its biggest on-chain move yet.

CEO Ryan McInerney announced the company will add support for four stablecoins across four blockchains, spanning two fiat currencies and convertible into 25 traditional currencies.

The goal: make digital dollars spendable anywhere Visa runs, which is practically everywhere.

The data tell the story.

In the fourth quarter, stablecoin-linked Visa card spend quadrupled from a year earlier. Since 2020, the company has processed $140 billion in crypto and stablecoin flows, including $100 billion in purchases using Visa credentials.

It now has 130 stablecoin-linked card programs in over 40 countries.

McInerney said Visa is also enabling banks to mint and burn their own stablecoins.

This move paints a broader picture: instead of crypto firms trying to replace the networks, the networks are absorbing the tech.

Stablecoins are becoming settlement assets on global payment rails.

This is what convergence looks like.

Flows From Gold To BTC?

Gold peaked in mid-2020 just before Bitcoin began its parabolic run.

The chart suggests we may be watching the sequel play out.

Liquidity cycles tend to move from hard collateral to high-beta assets once rate expectations flip and real yields stabilize. That transition favors crypto.

Lumida Curations

America’s Supply Chain Reset

With China controlling 90% of rare-earth refining, the U.S. is moving to restore domestic processing capacity and reduce dependency through reshoring and new investment initiatives.

How To Fix Your Sleep Cycle?

Late-night eating spikes glucose and wrecks deep sleep. Finishing dinner early and walking after meals improves recovery and next-morning energy.

Meme

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.