Here’s a preview of what we’ll cover this week:

Macro: Healthcare, See’s Candies, The Bubble in Quality

Market: NVDA’s $1T Capex Call, Cruise Control Trade (NCLH), TSMC Mispricing Opportunity, Small Cap Value Rotation, Earnings Season Highlights

AI: Raising Kids in the Age of AI, AI-Driven Warfare, Where Google Is Headed Next

The Nvidia Superbowl

The great thing about financial markets is you have a Superbowl every week.

FOMC meetings, CPI print, initial claims releases, and Nvidia earnings.

Nvidia this week reported results that once again exceeded expectations.

The main headline was Jensen’s forecast that we will see $1 Tn in capex spend on Nvidia GPUs by 2028.

That’s a 3x increase from current levels, and a pull forward of the forecast by 2 years.

The funny thing about Jensen’s forecasts is that he continues to make seemingly outlandish forecasts for AI adoption… and he continues to stick the landing and beat expectations on revenue and earnings.

(We should note the ‘hyperscalars’ are reinforcing that thesis in their own transcripts - so Jensen is merely summarizing what his customers are telling him as part of their capacity planning process.)

In our March 16th newsletter titled “Is the Datacenter theme dead yet?. We reviewed the earnings transcripts of the players - big and small - and concluded that the datacenter theme was alive and well.

The decline in stock market prices in March and April did not reflect the underlying backlog and demand growth.

Indeed, until the Department of Defense allocates a material amount of spend towards AI it’s hard to see the Capex trend breaking anytime soon despite Jim Chanos’s misgivings.

The Cisco bubble ended when EPS estimates missed and telco investment started to decline. We simply aren’t there yet, and the customer quality in this capex cycle (big tech companies + government) is more durable than the dotcom cycle (telcos + startups).

Within the datacenter theme, we continue to marvel at the pricing of Taiwan Semiconductor which trades at 15.6X forward PE – despite a 20% run-up in the last week.

The name is essential in the supply chain and has multiple forecasted years of 20% year-over-year revenue growth. (ASML meanwhile is seeing lower demand for its advanced EUV technology from TSMC and trading at much higher multiples.)

The main risk to the name, and the semi complex more generally, are threats from China. Defense Secretary described a threat from China as ‘imminent’.

This is why we don’t put all our eggs in one basket. Risk is a genuine feature of the world we live in. Maybe Hegseth is right, maybe Hegseth wants Asia to step up its investment in defense like Europe (more likely).

Would China Invade Taiwan?

It bears repeating that China’s modern army is not battle tested. There are significant unemployment issues in China’s youth. It’s hard to see parents get excited about sending their only child to war. And then you have an 8 to 10 hour journey to send your Aramada over the sea — there’s no possibility of suprise.

More likely scenario is you would see an embargo - a flotilla of ships around Taiwan - to disrupt trade rather than a hot conflict.

Analysts are raising TSMC’s earnings estimates causing the multiple to compress even as the price increases. It’s a funny thing to see.

I don’t see anyone else talking about this.

We’ve increased our weight to TSMC to approximately 6% which is a significant overweight (just ahead of United Health and behind Google in terms of our top positions).

On the topic of AI, I recommend listening to this interview with AI thought leader Michael Parekh.

I talk to Michael each quarter just after Nvidia reports. This episode will get you up to speed on what matters.

- NVDA earnings and the rise of Sovereign AI.

- Key takeaways from Trump’s Middle East visit.

- Tariffs on semiconductors and their global impact.

- The xAI and Grok merger.

Macro

Healthcare

Healthcare as a percentage of GDP continues to increase decade after decade as boomers and entitlement spending grows.

Over the last few weeks, we have increased our weight to healthcare stocks.

This opportunity strikes me like the 2023 ‘banking crisis’ in financials all over again.

There are many quality names thrown out - a classic baby thrown out with the bathwater.

Notable, healthcare and defensives have been leading the last two weeks as Mag 7 type stocks recover to normalized valuation.

We are not alone in buying healthcare stocks. Healthcare executives are loading up.

There are all sorts of reasons around why insiders sell stock - they need liquidity to pay taxes, diversify, etc. The buy stock for only one reason.

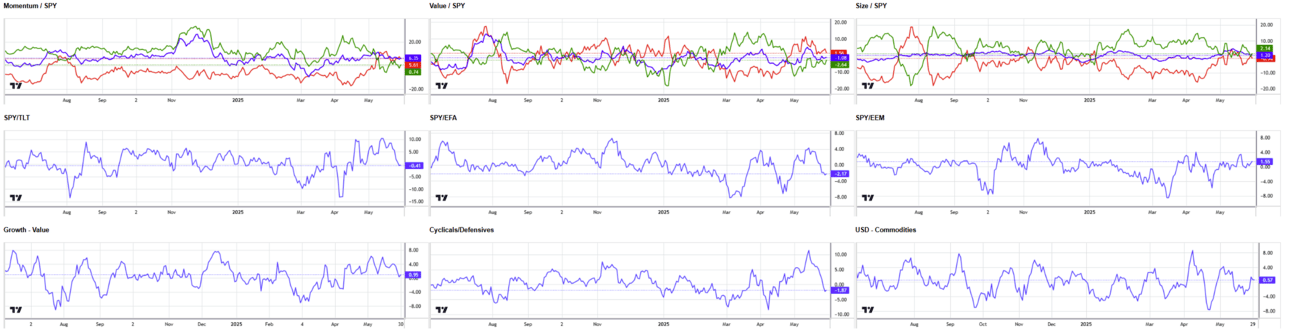

Over the last few weeks we’ve seen high momentum stocks pull back. We took steps two weeks ago to trim our high beta and high momentum exposures mainly due to this chart below:

This shows weakening in momentum breadth. (I’m not aware of any tool that can create this view. Get on the waitlist at lumidaai.com for when we release to the public.)

These are new capabilities we did not have a few months ago - they will help us guide when to lean into our high momentum and EPS growth ideas that served us very well last year (names like App Lovin, Celestica, ASPI, etc.) and they help us understand when to focus on defensives.

Most of our recent buys are in utilities (NEE) and healthcare.

One of the names we picked up that we wrote about recently is El Pollo Loco (ticker: LOCO).

The name has done very well. The only regret I have here is not having a greater position size to the name. But, that would mean selling Google, TSMC or dozens of other ideas that we believe have positive expectation and are mispriced assets.

A name that has not done well for us is Hudson Pacific Properties (HPP) - a deep value idea in commercial real estate. We wrote about this back in March so won’t recap it here.

The name appeared to be bottoming and we had a good entry. Liberation Day however had different plan.

Also, higher long-term interest rates are hurting the stock prices of not only small caps - but small caps with lots of debt like HPP. Fortunately, our position size here is small.

So, that’s the flip size of having not enough LOCO.

We do believe small cap value as a category is setting up for a strong rally. It might be in Q4 when the Fed likely cuts rates further and we have the conditions for an animal spirits rally.

There are many quality businesses in small cap land that, like HPP, have simply too much debt on their balance sheet. In our analysis, the debt can be serviced and paid - and the firm’s book value is higher than the market value.

But, in the short run none of that matters while macro and factor movements in stock prices drive the name.

Here’s a chart of the free cashflow yield in HPP:

The last time the FCF Yield was at this level was April 2023 and October 2023 - both led to outstanding returns after.

We look at this as a scenario where the reward is greater than the risk. We know the position will be volatile, so best to use a smaller position size. After all, there are other ideas like HPP in small cap land (like Better Mortgage or Ziff Davis) that have different stories but should all benefit from an asymmetric return profile on average.

The key is the term on average.

By holding several positions like this - each with a smaller position size - we can diversify the idiosyncratic company risk and over time capture the edge from analysis.

We also like to pair these deep value ideas with momentum and growth concepts. We do that alongside thematic tilts to areas we think have unusual reward vs. risk – such as American banks, international value, the data center theme.

The combination of momentum and mean reversion in a portfolio across themes we believe is the best way to position and invest.

Overall, we continue to see bargains in the marketplace. Certain names have fully recovered their valuations – but it’s not too hard to find mispricings.

That’s why we continue to believe the bull market will continue.

If you recall, in February we wrote a series of newsletters - one called ‘The Bubble In Quality’ and another around the Bubble in Animal Spirits.

TACO VS. BURRITO

Headline risk around tariffs remains real. However, markets as we noted last week are playing ‘The Boy Who Cried Wolf’ and looking thru Trump’s comments.

The old meme was ‘TACO’ - the idea that Trump will cave on tariff pressure. The new meme is ‘BURRITO’ - the idea that Trump will be overly aggressive in response to the TACO meme (see the tariff hikes on Europe shortly after Taco meme).

It’s Newton’s third law in action. (We think Burrito goes back to the Taco.)

The old meme We do believe we will see a whiff of inflation thru the summer. These tariffs are far more broad based than Trump 1.0. So, we could get a summer swoon.

We also saw higher than expected initial jobless claims.

(Notably, this phenomenon always seems to occur around the summer months - perhaps as swathes of the economy reconfigure itself for the summer season.)

However, by October those price shocks will be behind us.

Adopting a lower beta posture with overweights in healthcare and modulating momentum exposure as discussed above we think makes a lot of sense.

The American economy is oriented around services rather than goods.

So, retailing doesn’t matter so much to markets as does earnings growth for hyperscalars.

We see pockets of over-valuation: names like Netflix, Costco, and so forth.

But, there are other names that are fully valued.

And plenty of names that are under-valued given their backlogs and earnings growth.

Financials

Another area of the market we like are financials - both insurers and banks.

We picked up Capital One Financial (again). They closed the deal with Discover.

The business has a price to free cashflow ratio of 3.9x.

The U.S. consumer is stronger than people think. Delinquencies are coming down.

Consumer finance names linked to subprime lending we believe are especially attractive.

Their free cashflow generation is impressive, so are the valuations, and momentum.

Several of these names also look technically setup as well.

We believe there are many good names in this category and have multiple investments here.

Bread Financial is an especially interesting idea if you look at their EPS growth, valuation, and the quality of their management.

Their P/CF is 1.3, that’s a 70% freecashflow to marketcap and a 6% dividend yield, and are showing declines in delinquencies.

The name is also up 26% in the last 1 year demonstrating momentum.

See’s Candies

I was in the West Village this week and happened to walk past a See’s Candies.

I bought two boxes of chocolates for my wife, although somehow the chocolate as somehow boomeranged into my stomach over the course of the week.

The Bubble in Quality

The FICO Bubble has burst.

Greet business. Not a great price.

This was one of the names we noted in our ‘Bubble in Quality’ newsletter back in February.

Price is what you pay, value is what you get.

All to say, Buffett and Munger are ‘priced in’ — most quality stocks are in a bubble that is poised to underperform.

Even Berkshire Hathaway is underperforming on the very day that Buffett has passed the baton.

Baby Boomers Cruisin’

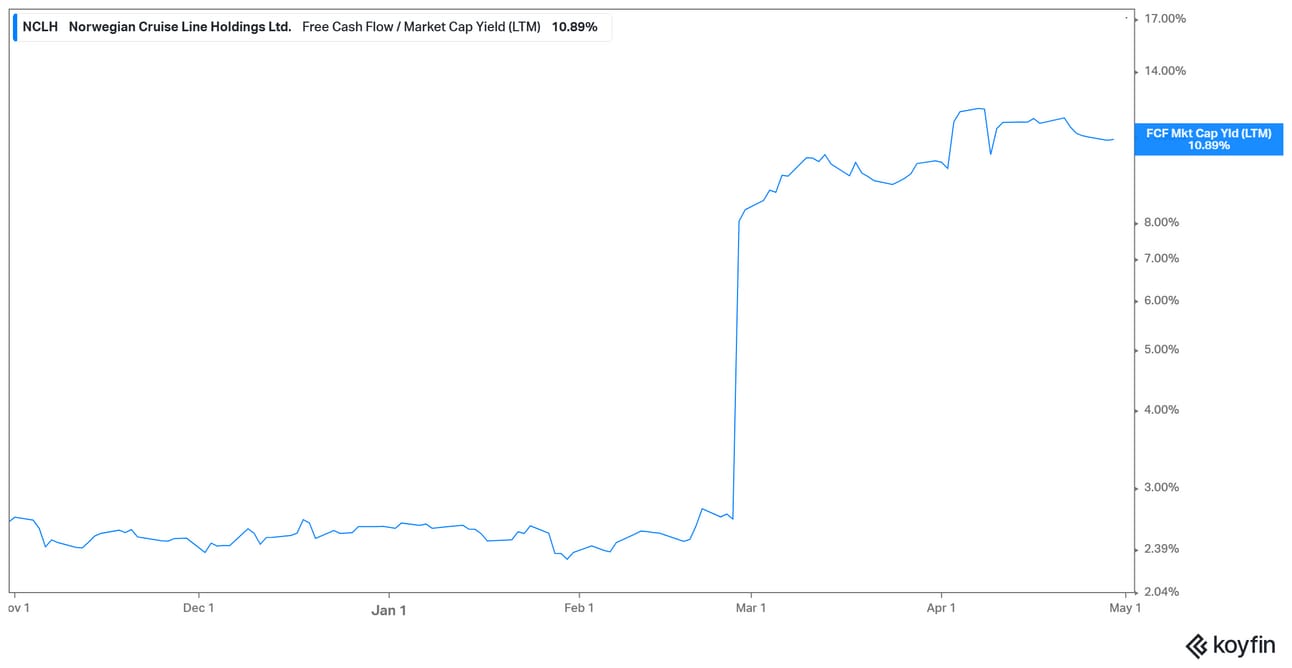

Norwegian Cruise Line Holdings Ltd. (NCLH) reported at the end of last month.

We find the idea intriguing, a 6.5% FCF yield and 95% ROE bundled with rising consumer confidence and baby boomers appetite to spend on travel.

NCLH Forward P/E

NCLH Free Cashflow Yield

Baby Boomers are increasingly splurging on experiences like cruises and vacations.

They control $60 Tn in wealth and are living longer than expected.

We believe consumer discretionary stocks are oversold - and many are priced for recession.

Where to focus though? Homebuilders, restaurants, automobiles, cruise lines, travel booking sites, retailers, etc?

We like cruise lines because they have backlogs and a more predictable earnings stream (outside pandemic scenarios).

It’s also hard to enter the category, and the category is less rate sensitive.

The category is also not tariff sensitive (although there are some risks here — cruise lines benefit financially from operating in international waters.)

Lets dive into the recent report.

Earnings Season Highlights

Momentum and Value Back?

May finished up strongly - 6% in the S&P.

The last two weeks had a retracement. That’s natural and healthy.

We may be setup for another run higher in June.

Momentum and Value have both pulled back (see the green line on the chart below).

The S&P has also lagged European markets and are due for mean reversion soon.

AI

Raising Kids in the Age of AI

Journey Over Destination

I do believe AI is going to turn the brains of Gen AI into mush. I say that as an optimist.

A friend of mine has teenage kids. None of them can sit thru a 2 hour movie. Let alone read a book that inspired the movie.

The dopamine on-tap is real and having effects that are re-shaping brain structure

(Take a look at the negative findings from Cannabis usage – best to adapt before you wait for long-term studies to come out and tell you what you already know.)

We are all using AI more often.

Outsourcing synthesis, writing, comprehension and storytelling.

College is one long course in prompt engineering.

I can see it when I interview recent graduates. A 3.8 GPA is no longer impressive.

My goals as a parent are to teach:

1. Critical thinking

2. Sustained Focus

3. Storytelling / Creativity

4. Kindness

Isn’t that the recipe for a flourishing and meaningful life in the Age of AI?

AI-Driven Warfare

Where Google Is Headed Next

We curated key insights from Sundar Pichai’s latest interview on the future of AI, Chrome, and Google's next big frontier.

He’s calling the next 3–5 years “unprecedented.”

And he's not just talking about search—he’s talking about full-scale industry transformation.

From AI infrastructure to global regulation, this thread covers the most important signals investors should be watching.

Meme of the week

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In