Here’s a preview of what we’ll cover this week:

Macro: Inflation Pressures, Tariffs Impact

Market: Fast Corrections Are Bullish, International Markets Outrun Us Markets, Hedge Funds Are Buying Us Equities, Oracle Q3 Earning Highlights, Tsla Vs Nvda

Ai: Manus Ai, The Uae Wants More Chips, Ai Growth Signals, Who Gets Nvidia’s Most Advanced Chips? Where Is Apple’s Intelligence? Nvidia’s Boomerang Deals, Coreweave’s Ai Expansion

Lumida in the Spotlight

Thank you Geoff!

Geoff Yang is a founding partner at Redpoint Ventures and a seasoned investor behind companies like Juniper Networks, MySpace, and TiVo. With 35+ years in venture capital, he’s helped shape the tech landscape.

Want to give it a listen? : Extending Healthspan through Data and Science

The Lumida Non-Consensus Podcast offers deep dives into markets, macro trends, and investing insights you won’t hear anywhere else. Stay ahead—subscribe now!

Interested in our investment strategies? Schedule a call to learn how we can help you navigate the markets.

First Things First

Are We There Yet?

This is the question my kids ask whenever we do a drive longer, than say, 8 minutes.

It also reflects the increasingly short-term orientation in markets.

There’s a lot to get into so let’s dive right in.

Over the last few weeks, we have been studying Q4 ’18 as a market analogy. We have also referenced the momentum correction in the summer of 2015 in a prior newsletter.

In Q4’ 18, there was a 19% stock market correction. The correction was bookended with a Trump trade war in October and ended with Trump on Christmas Eve saying it’s a good idea to buy stocks.

We also had a slowdown in GDP growth then and we see that now. Although the GDP numbers now are worse than then. (Average hours worked is also compressing).

Another key difference between Q4 ‘18 and now is that valuations are much higher today. And even when you control for earnings growth, the market multiples are still elevated.

You can see that in the S&P 500 PEG ratio now vs. 2018:

Back in Q4 ‘18, the correction started with a 16x forward PE and ended at a cool 14x forward PE ratio.

This time the correction started with a 22x forward PE and is now around 20x.

So, the market is in a situation where growth is slower and valuations are higher.

We are also seeing downward revisions to earnings as analysts mark down forecasts due to the recent correction.

This is consistent with the idea we have shared over the last two months in various newsletters called ‘The Bubble in Quality’.

Does this mean the end is near? Not really. Let’s keep going…

Let’s take stock of a few of the bubbles.

Palantir is down 40% from its all-time-high. You might not guess that from this logarithmic chart:

JPMorgan is down 20%.. Jamie Dimon personally sold hundreds of millions worth of stock near the highs.

We noted JPMorgan as a name at risk and Financials as well a few newsletters back.

MicroStrategy

Costco is down 18% from its high… and still has a 47x PE ratio.

SoftBank backed ARM is down 42% from its high and below its IPO price.

It’s good to visually examine the leaders of any group.

The current correction was triggered on the day Trump ejected Zelensky from the White House. But there were warning signals as Meta started to soften after its 20-day run-up (and is now well below its blockbuster earnings. We re-entered.)

At the technical level, it seems to us that many stocks have room to rally from deeply oversold levels.

Even though there are still quite a few bubbles out there that have not deflated, markets don’t move in a straight line.

Often you get a reflex bounce just when sentiment is at its worst.

Putin rejecting a peace deal on Thursday may be the kind of event that marked a low in Sentiment.

Trump last weekend did not rule out a recession which caused aggressive selling on Monday.

These two events led to wash out conditions on Thursday and set the stage for Friday’s rally.

We noticed on Friday that quite a few animal spirit names rallied sharply. That’s a sign that retail investors haven’t thrown in the towel yet.

Animal spirits can potentially fuel multiple expansion.

However, we do need to see positive newsflow this coming week - such as a peace deal, a stop to the drip drip drip news of tariffs (where do we stand with Europe?).

The most bearish element to current dynamic is that traders continue to buy aggressive call options and create these significant one-day rallies.

These one-day rallies are then reversed and then some.

We had another one of these this past Friday.

If you’ve been following our newsletter for the last few months, you will recognize that the green everywhere on the screen is a sign of excess enthusiasm.

We liked this analysis from BofA’s Flow Show Report studying prior corrections.

The study includes the set of conditions to look for at the bottom.

Note: Corrections are relatively rare – only 11 declines of 10% or more since 1998.

The BAML team and Hartnett (who skews bearish in general) says S&P could be a buy at 5300. That would be just above the levels of the early August Yenmageddon correction.

That’s another 5 to 6% down from here.

Hartnett is looking for cash levels to recover from near all-time lows. That makes sense. By contrast, Buffett has sold his stock down and built cash levels.

We’re going to learn a lot how Mr. Market evolves this coming week with Fed commentary.

Overall, we believe when earnings season starts next month around April 15th the strong earnings will help.

Between now and earnings season, we expect continued volatility until Trump policy volatility ends.

However, the persistency of traders in buying dips and the lack of responsiveness in the Vix and lack of tightening in the 10-year bond yields remains a concern for us.

Take a look at the S&P vs. TLT spread in August vs now.

What’s happening is that European bond yields are competing for capital.

When bonds are overbought, they act like a spring coil and also represent panic.

Markets are at a key juncture now where many ETFs and securities just had a bounce off their 200 day moving averages:

Staples

Financials

And many dipped below the 200 Day Moving Average and are bouncing up towards it such as:

Industrials

Software

Healthcare

The instinct of many traders will be to sell these as they rally.

The longer these indices remain below the 200 Day Moving Average the more risk there is in the market.

We are also seeing a pick-up in hedge fund buying in recent weeks. They also picked up buying in early December 2018 about one-month early — these indicators by themselves are not sufficient but they help paint a picture.

What could propel strength is significant positive newsflow especially on tariffs and geopolitics.

In Q4 ‘18, Apple was the leader in tech. Here’s how that stock performed. Notice the key technical level highlighted here:

The key name and theme to watch we believe is NVIDIA and the semiconductor index.

Although we do have positive seasonality now, we don’t think we are at an ‘all clear’.

We would expect some giveback from the Friday rally.

Notably, NVIDIA Forward PE is near historically low levels where buyers have stepped in. Nvidia was one of the best performers this week.

Bitcoin has also managed to back over its 200 day moving average.

That supports a return of Animal Spirits.

When we back test Animal Spirit strategies in the IWM index (e.g., unprofitable hype stocks), we see they remain over-valued relative to their benchmark.

We can get a bounce there, but we’d expect it is short lived.

Here’s how cheap stocks in the S&P 500 look:

That category looks interesting.

Here’s a strategy of owning the cheapest stocks in the QQQ from our Lumida AI analytics tool

This strategy is long cheap, profitable stocks, with positive earnings revisions and momentum.

This is a classic quant strategy - and it is why many quant shops including Citadel and Millennium have posted negative returns in recent months.

Notice the strategy started working a few days ago - leading the market. NVIDIA did the same.

This strategy hit a drawdown associated with historical bottoms.

We have some good seasonality on tap this week as well - St. Patrick’s day is often bullish.

Our short-term outlook is to expect a bounce this week, with some Monday giveback of some of the Friday gains.

Notably, analyst estimates have not dropped during this correction.

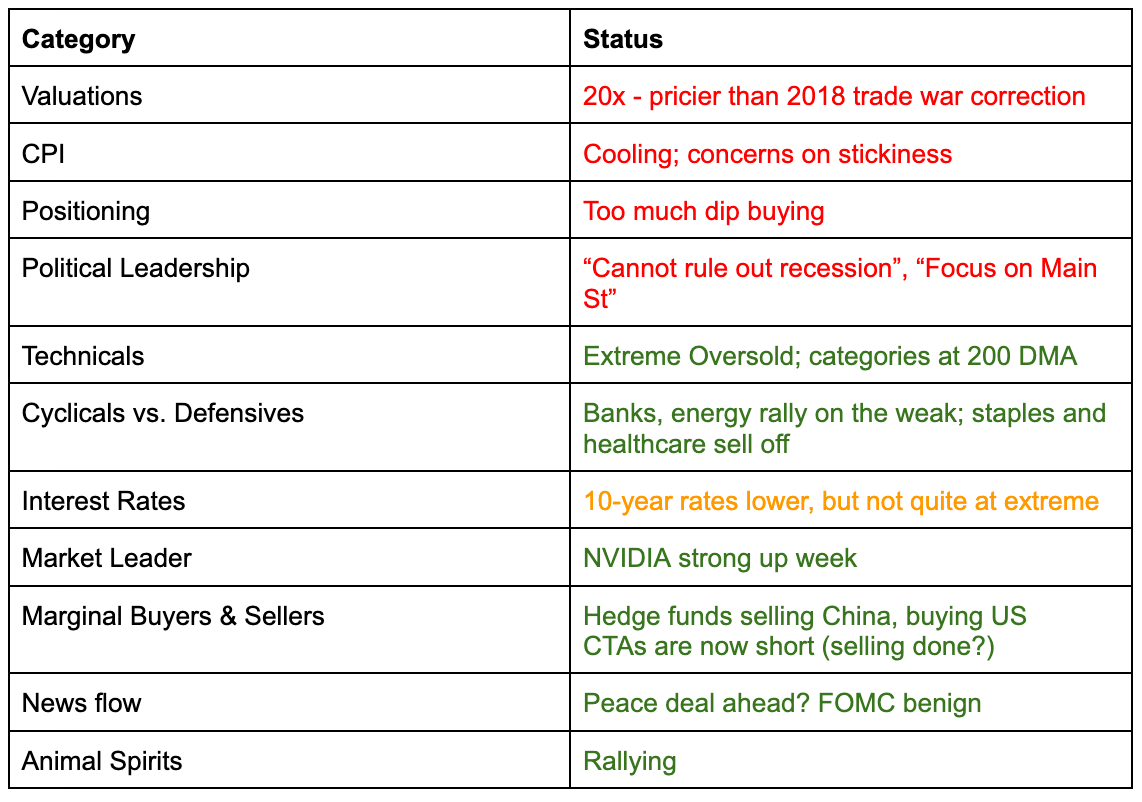

Overall, we have a mixed bag.

Speaking of earnings revision declines, ORCL reported Q3 FY25 earnings and the stock was down ~6% given weak guidance from management.

Last week, we noted Trump’s policy focus and how the admin is front-loading contractionary themes (e.g,. fiscal austerity, tight immigration, etc).

There’s a lot that will turn on DOGE. For example, suppose DOGE is successful in finding hundreds of billions in waste, fraud, and abuse in Social Security and Medicare/Medicaid Payments. We’re hopeful that’s the case.

On the other hand, the beneficiaries of that are likely Americans spending in America. It’s not a Nigerian Princess Fraud. They may likely be Americans taking advantage of a less than competent Federal Bureacracy.

A negative couple hundred billion in stimulus would mean less Netflix subscriptions, less Amazon orders, less AI subscriptions, less car buying, etc.

Understanding the size and scope of those cuts - and whether they are matched by tax cuts and the timing - is important.

We also note — it still is relatively easy to find shorts in this market, and difficult to find longs. That’s in part due to various trends breaking down but also we still have excessively high valuations.

Example: We looked at United Rentals. A quality business and leader in the space. The stock is down 20% off its high. But, when we look at its historical valuation - the stock is still relatively over-valued vs its history, and not by a little.

This is a one-off example. Now, apply that to many, many other securities where we are looking for a bargain. They are hard to find.

For this reason, we believe that a technical bounce is in the cards, but could be faded.

We also note that the % of stocks in the S&P 500 raising EPS estimates is declining.

Thought Experiment: Might we look back in three years and say that Palantir at 400x earnings and Microstrategy at 3x its NAV marked the top of a bubble? Does Netflix really deserve a 46x PE ratio?

As we noted earlier in the newsletter, valuations are much higher than they were in the Q4 2018 trade war correction. We cannot rule out the possibility of a steeper correction to bring in new buyers.

Positioning around international ideas including UK stocks, South Korea and other markets makes a lot of sense. We like certain themes in the United States as well - and we most of our exposure is here as well due to our benchmark - it’s just these are harder to find.

We have yet to see the type of ‘all clear’ clear panic condition that marks a bottom like we saw on August 5th.

Macro

Inflation Pressures

Key to watch are inflation pressures. We are hearing anecdotes that REITs may be increasing apartment rents soon.

Data shows small businesses may be raising prices as well.

Inflation is painful for stock market valuations. This is the most critical risk for equity markets.

An inflation comeback combined with growth concerns could cause a significant further correction or bear market. Trump’s team will need to show they are dropping global trade barriers and tariffs to ensure this outcome doesn’t take hold.

Tariffs on China aren’t really a concern; tariffs on automobiles are as they are a significant consumer spend category.

Wish to stay ahead of the market? Subscribe to our insights and schedule a call to re-align your portfolio.

Tariffs Impact

Market

Fast Corrections Are Bullish

This is the 5th fastest correction in history.

All prior corrections show higher prices 3, 6, and 12 months ahead. We agree with that view provided inflation remains controlled.

We noted last week that traditional put/call ratios may not be effective at identifying a market bottom.

This post supports that concept.

International Markets Continue To Outrun U.S. Markets.

We note that South Korea and Canada have attractive valuations.

Canada is right at the 200 day moving average.

The Trump Administration wants to disown current conditions and own future conditions. That supports the thesis the administration wants to get mortgage rates and the ten-year down.

Hedge Funds Are Buying U.S. Equities And Selling International

Oracle (ORCL) Q3 FY25 Earnings Highlights:

Key Metrics

Revenue: $14.13 billion, up 6.4% year-over-year, missing estimates of $14.39 billion.

Net Income: $2.94 billion, or $1.02 per diluted share, up 22% from $2.4 billion ($0.85/share) last year; adjusted EPS $1.47, below the $1.49 expected.

Comparable Revenue Growth: Total Cloud Revenue (IaaS + SaaS) +22% to $5.9 billion; Cloud Infrastructure (IaaS) +49% to $2.7 billion; Cloud Application (SaaS) +9% to $3.2 billion.

Q4 FY25 Guidance: Q4 guidance of 8-10% revenue growth ($15.43-$15.72 billion) and EPS of $1.61-$1.65 underperformed analyst expectations of $15.91 billion and $1.79, respectively, signaling potential slowdowns

Key Quotes from Management:

We can see that despite guidance declines, the management is positive that the overall theme and the growth story is intact.

"Record-level AI demand drove Oracle Cloud Infrastructure revenue up 49% in Q3—a much higher growth rate than any of our hyperscale cloud competitors." – Safra Catz, CEO, highlighting customer adoption of AI-driven solutions.

"We signed some of our largest deals ever this quarter—dozens of customers committing over $100 million each, some over $1 billion—because they see Oracle as the best platform for their AI and data workloads." – Larry Ellison, reflecting strong enterprise customer commitment.

Is the beloved Data Center theme still intact though? Let’s spot what the entire value chain has implied in their earnings in the recent past:

Sterling Infrastructure (STRL) – Q4 FY24:

"We believe 2024 will be another excellent year for Sterling. With the strong first quarter results along with our backlog position, we are trending toward the high end of our guidance." – Joe Cutillo, CEO

"The continued growth in data center projects has significantly contributed to our backlog, which increased 22% to $2.42 billion."

Powell Industries (POWL) – Q1 FY25:

"The strength in our fiscal 2025 first quarter reflects robust activity across our core industrial markets, including significant demand from data center projects." – Brett Cope, CEO

"Our backlog stands at $1.21 billion, up 11% sequentially, driven by large-scale electrical infrastructure projects tied to AI and cloud computing."

Seagate Technology (STX) – Q2 FY25:

"Mass capacity storage demand from cloud customers grew double digits year-over-year, reflecting the ongoing expansion of data center infrastructure for AI workloads." – Dave Mosley, CEO

"We’re seeing strong uptake of our 28-terabyte drives as hyperscalers scale their storage to meet AI and machine learning needs."

Note: We bought Seagate this Friday.

NVIDIA (NVDA) – Q4 FY25:

"Demand for Blackwell is amazing as reasoning AI adds another scaling law." – Jensen Huang, CEO

"We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter."

However, the growth-to-value rotation seems to be still in-effect, bubbles bursting and high valuations.

Visit our website to learn about our strategies or talk to our team about wealth management strategies tailored for this market cycle.

TSLA vs NVDA

The long NVDA and short TSLA market neutral pair trade is now up 27% YTD.

I do think animal spirits have a shot to bounce here, including Tesla, from deeply oversold levels however.

AI

Manus Ai : Breakthrough Or Not?

High performance CEOs:

Humor aside, Manus is making waves in the AI industry.

Manus AI is China’s latest autonomous AI agent taking the AI world by a storm.

Some call it a breakthrough. Others say it’s overhyped.

Beta access is in high demand. Codes are already being resold online.

Early tests show promise. It structures tasks well but the execution is said to be messy.

Will Manus AI redefine automation? Or is it just another experiment with big claims?

The Uae Wants More Chips. Why?

The UAE is making a big push for access to cutting-edge AI chips.

Sheikh Tahnoon bin Zayed is heading to Washington to meet with top U.S. officials.

What’s behind the UAE’s bold move? Could this shift the tech landscape?

Ai Growth Signals

The AI supply chain just sent a strong signal. Pay attention.

Foxconn sees AI server demand doubling in Q1 2025.

As a key NVIDIA supplier, this signals massive AI infrastructure growth.

Who Gets NVIDIA’s Most Advanced Chips?

Jack Dorsey was seen thanking NVIDIA for providing its most advanced AI clusters.

Where Is Apple's Intelligence?

Apple is getting turned into Apple sauce.

See our top call on AAPL within 1 day from back in December.

Stock is falling after delays in AI features, especially for Siri.

Investors worry about slow innovation.

Apple is a strong player. This could be a short-term dip.

But where will earnings growth come from?

NVIDIA’s Boomerang Deals

NVIDIA is reinforcing demand for its AI chips by funding the infrastructure that relies on them.

While Microsoft, Google, and Amazon are major customers, they are also developing custom AI chips to reduce dependence on NVIDIA’s GPUs.

To counter this shift, NVIDIA has backed AI cloud providers like CoreWeave, ensuring a steady market for its products.

In Project Osprey, NVIDIA committed $1.3 billion to rent computing power from CoreWeave — essentially securing a GPU-centric cloud provider.

By investing in cloud providers that buy its chips and then leasing capacity from them, NVIDIA embeds itself deeper into the AI supply chain.

The company is not just supplying hardware—it is shaping the market structure to sustain its dominance.

Its strategy has also fueled the rise of CoreWeave.

CoreWeave’s AI Expansion

CoreWeave has grown from an AI upstart to a multi-billion-dollar cloud provider in record time.

Once it was a niche player in GPU-powered cloud computing.

But now it is central to AI’s infrastructure boom.

Backed by NVIDIA, CoreWeave has secured key deals that have reshaped the AI cloud market:

$1.3B "Project Osprey" deal – Renting NVIDIA’s own GPUs back to them

$11.9B cloud services contract with OpenAI – Supporting large-scale AI compute

$30B+ expected IPO valuation – A tenfold return on NVIDIA’s $100M investment

CoreWeave’s rapid expansion is the result of strategic partnerships and AI’s growing demand for high-performance cloud computing.

With long-term contracts in place, it is emerging as an alternative to Big Tech in AI infrastructure.

The question remains: Can CoreWeave sustain this growth, or does its dependence on a few major customers pose a long-term risk?

NVIDIA’s Boomerang Deals | CoreWeave’s AI Explosion

Credit: Inspired by insights from Michael Parekh, RTZ #657 (03/13/25)

Lumida Curations

RenMac Podcast Insights

Hosts: Neil Dutta and Jeff DeGraaf

Key Insights:

Financials are outperforming globally, defying slowdown fears: “The economy is slowing, but it’s not a recession.”

Discretionary stocks present a contrarian opportunity, thriving during Fed easing in tough times.

Yields are likely to stay between 3.50% and 4.50%, with stability expected and no signs of credit market chaos.

Unchained Crypto Podcast Insights

Guests: Ram Ahluwalia, Alex Kruger, James Seyffart, and Travis Kling

Key Insights:

Steve Cohen warns fiscal austerity could cut GDP by 2.5%, risking a significant recession.

Market positioning and technicals are outweighing traditional data points, while large-cap stocks continue correcting despite deflated bubbles.

Bitcoin and stablecoins remain strong, but most altcoins face utility challenges, with sidelined capital showing little interest.

S&P Global Interview Insights

Guest: Larry Fink, CEO of BlackRock.

Key Insights:

Labor shortages in agriculture and construction are driving inflation higher, with key sectors under pressure over the next 6-9 months.

AI is expected to initially raise inflation but drive deflation long-term, while drones and AI are reshaping modern warfare and military needs.

BlackRock is leading global tech investments, partnering with NVIDIA, MGX, and Microsoft, while private credit markets are booming as banks tighten regulations.

Bloomberg Invest Insights

Guest: Bridgewater CEO, Nir Bar Dea

Key Insights:

Decades of globalization-driven growth have caused inequality and weakened Western manufacturing, with governments now prioritizing resilience over efficiency.

AI’s impact remains uncertain, with potential for a productivity revolution but risks of deepening inequality.

Bridgewater’s AI-driven strategy (AIIA) uses machine learning to generate alpha, offering uncorrelated and transformative approaches to finance.

Forward Guidance Podcast Insights:

Host: Felix Jauvin | Guest: Jeff DeGraaf

Key Insights:

Financials and banks are outperforming globally, defying slowdown fears, while energy stocks show strength despite bearish sentiment and ETF outflows.

REITs and discretionary stocks present contrarian opportunities, with REITs undervalued and discretionary stocks thriving during Fed easing in tough times.

Yields are expected to stay between 3.50% and 4.50%, with tight credit spreads signaling no major recession fears despite the yield curve inversion.

📌 Correction from Last Week:

In last week’s newsletter, we mistakenly marked a ✅ next to the prediction "A last-minute peace or commercial deal with Ukraine." That prediction has not materialized yet—our mistake for the premature checkmark! Thanks for reading closely.

High Yield Laughs

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In