Here’s a preview of what we’ll cover this week:

Macro: Jackson Hole, and What to expect now?; How is the Labor Market?; Inflation expectations are high, but wrong

Markets: How Markets React To Jackson Hole; Value stocks > Growth Stocks - This Week; FOMC realizes Tariffs as primary driver of inflation; NVO is showing UNH-type recovery

Digital Assets: Ether Soars to New Heights

Lumida Curations: Powell Warns of Economic Risks; Marks Urges Caution in Markets; AI Drives Up Healthcare Costs

Events

Ram Ahluwalia Joins the Real-World Asset Summit

Fed Governor Bowman’s speech, following SEC Chair Atkin’s speech, a few weeks ago, represents a major turn in federal policy towards digital assets.

And ‘reputation risk’ - a catch all for bringing down the hammer - is gone.

I will discuss where we go from here in tokenization and digital assets in my keynote.

You can sign up for the summit here.

How To Save Taxes Like The Rich And Famous?

Most portfolios are designed for pre-tax returns.

But the wealthy think differently: they optimize for after-tax performance using a Long/Short portfolio.

In high-tax brackets, the difference is often 1–2% in net return annually.

ThtA massive edge when compounded.

How does tax-loss harvesting work in a long/short portfolio?

Say, you start with a 130/30 strategy, you invest $100, and go long for $130 and short for $30.

In a traditional (long-only) portfolio, you can only harvest tax losses when stocks go down.

But with long/short:

You can harvest losses when your longs fall, and

Also when your shorts rise

Result: You can harvest tax losses in any market, not just during downturns, making the strategy more flexible and tax-efficient than a long-only approach.

Why Tax saving strategies work?

Losses can be recognized immediately.

Gains can be deferred,

Short-term gains are taxed at up to 40.8%.

Long-term gains top out at 23.8%.

This tax asymmetry is the foundation of after-tax alpha.

AI now allows these strategies to scale efficiently across portfolios, not just in hedge funds.

Lumida Wealth’s TaxShield™ strategy puts this into action:

AI-powered long/short construction

Custom tax overlays

Real-time harvesting of short-side losses

(We partner with a proven third-party firm that has several Bn in AUM to execute the strategy.)

All of it is designed to maximize after-tax returns.

If you’re sitting on or expecting a large capital gains tax, this is a great strategy.

Book a Call or learn more about tax aware long-short here.

Macro

Jackson Hole, and What to expect now?

Markets rallied sharply following Powell’s speech at Jackson Hole

This is a common phenomenon. Markets sell off in anticipation of a major economic report. Then on the day of the report - CPI, NFP, or a Fed speech - markets rally when the outcome is better than feared.

While Powell’s views leaned hawkish, his acknowledgement of the weakness in the labor market spurred a market rally.

Powell noted that slowing in both labor demand AND the growth in labor supply have led to lower NFP. (This is a theme we have discussed over the last several newsletters.)

Chair Powell delivered a hawkish-leaning message.

Powell all but used the word stagflation: “Risks to inflation are tilted to the upside and risks to employment to the downside. A challenging situation when our goals are in tension like this.”

The Fed also scrapped its make-up strategy.

Powell noted, “There was nothing intentional or moderate about the inflation that arrived… Accordingly, we eliminated the make-up strategy.”

The odds for September rate cut had dropped to 57% before the meeting.

Odds since the meeting rose to 80% on polymarket fuelling a sharp rally.

SPY finally ended its 4-day streak of red, and had a 1.45% increase, and is now back at the all time high.

The 100 stocks that dropped most from August 13th to yesterday’s close surged over 4% on average.

Meanwhile, the top performers from 8/13-8/21 still edged higher, but their gains tapered to just over 1%.

This suggests continued mean reversion and rotation into non-consensus names, small caps, rate sensitive names and consumer discretionary names. We have a good weight of our portfolio in these ideas (see Better Mortgage, American Eagle, Sky West, United Airlines).

Small cap stocks exploded 3.8% higher for their biggest gain since April.

We have been bullish on them for a while. Check out our last newsletter.

How Markets React To Jackson Hole?

One should expect a typical summer slowdown, and weakness immediately following the Jackson Hole speech.

If we look at the last 4 Jackson hole conferences, the market dipped in the aftermath.

The surge in optimism, in part driven by short covering, should lead to cooling in the weeks ahead.

There’s no need to chase the Friday rally if you’re offsides.

How is the Labor Market?

Powell noted a "marked slowing in both the supply of and demand for workers"..

Rising downside risks to employment could materialize quickly via higher layoffs.

We had written about it in a previous newsletter. Check it here.

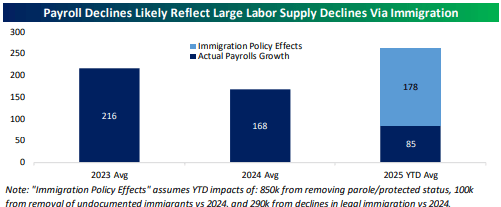

Payroll declines likely stem more from immigration policy curbing labor supply than demand destruction.

2025 YTD payroll growth is at 85k jobs versus 216k in 2023 and 168k in 2024.

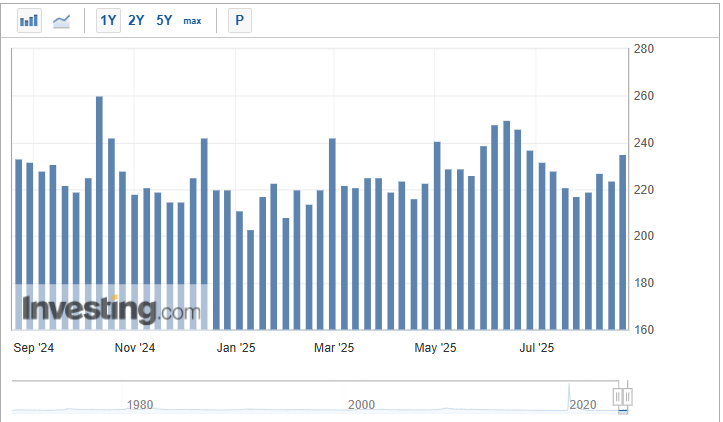

Initial and continuing jobless claims also had a mild uptick which we believe is due to seasonal factors.

Meanwhile, Yardeni notes employers are holding on to their existing workers.

The unemployment rate remains at 4.2%.

Teenagers and recent college grads and unskilled workers are finding it hard to land a job.

(Hope they are learning AI skills at the very least!?)

The duration of unemployment is increasing, consistent with a cooling but normal labor market.

Inflation expectations are rising

On inflation, Powell downplayed tariff impacts as "relatively short lived" one-time increase and unlikely to spark broad reacceleration given labor weakness.

The Fed sees room to ease without igniting demand-led inflation.

Yet market signals suggest otherwise.

1) July CPI rose 2.7% YoY, core at 3.1%, with producer prices heating up on soaring goods and services.

2) Inflation nowcasts for August peg headline CPI at 2.84%, core 3.05%.

3) US inflation swaps broke signal higher embedded inflation.

We view all of this as markets over-reacting. Consumers expect inflation of 4%+.

One client we talked to explained how by going direct their costs are lower after tariffs - they are purchasing from Ali Baba instead of thru a middleman.

The supply chain is re-factoring itself.

Animal Spirits Taking a Breather

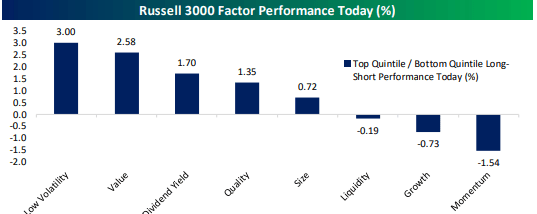

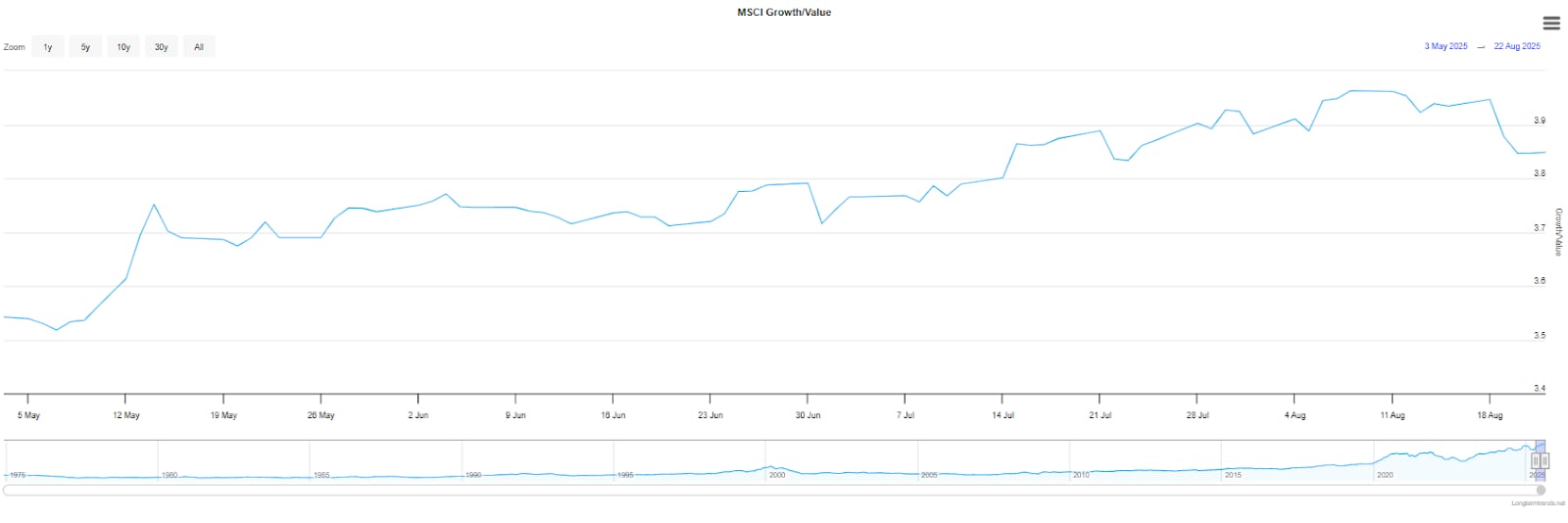

Value stocks > Growth Stocks - This Week

This week, we saw a significant change in investor preference.

Capital rotation into value and defensive stocks accelerated, pulling funds away from growth and momentum into low volatility, and value.

Value stocks climbed 1.93%, outpacing growth's modest 0.70% gain.

Value stocks, particularly those in the real estate, utilities, and consumer staples sectors, showed strong gains.

In contrast, growth stocks in technology and communication services suffered, as concerns over stretched valuations and lower future growth.

The Russell 1000 Value ETF (IWD) outperformed the Russell 1000 Growth ETF (IWF), with the former rising 1.72% compared to the latter’s 1.55%.

Low-volatility stocks significantly outperformed high-momentum growth stocks, gaining over 2.5%.

Investors were prioritizing safety, even if it means sacrificing higher returns from riskier growth sectors.

Meanwhile, defensive stocks, such as those in healthcare and energy, also benefitted from the rotation, outperforming broader indices.

On Friday, small cap stocks rose 3.8% higher for their biggest gain since April (and second-biggest since the election last November).

Unprofitable tech companies, facing the brunt of noise around the fading AI boom, saw a 5.3% gain to their highest levels since 2022.

Credit spreads were tight across both investment grade and high yield bonds, and 10y real yields fell by the second-most since April.

FOMC realizes Tariffs as primary driver of inflation

Walmart (WMT) had released their Q2 2026 earnings this week. Despite pressures from tariffs, the revenue was up 4%, beating estimates.

Their earnings provide a great see-through of the consumers’ purchasing power.

Doug McMillon noted, "The way things have played out so far, the impact of tariffs has been gradual enough that any behavioral adjustments by the customer have been somewhat muted."

McMillon explained, "Not surprisingly, we see more adjustments in middle and lower-income households than we do with higher-income households.

“In discretionary categories where item prices have gone up, we see a corresponding moderation in units at the item level as customers switch to other items or in some cases, categories."

All income cohorts grew, with upper-income leading gains.

John David Rainey said, "Comp sales grew 4.6%, reflecting ongoing share gains across key categories and all income cohorts with upper income households contributing the largest gains."

McMillon stated, "Back-to-school is usually something of an indicator of how the holidays will go, and we feel good about how it went for us in terms of units and dollars sold and inventory sell-through."

Consumers valued speed and convenience. Rainey noted, "Customers are responding as we lean into value with more rollbacks while also providing the convenience they desire."

About Tariffs, Doug McMillon outlined, "With regards to our U.S. pricing decisions, given tariff-related cost pressures, we're doing what we said we would do. We're keeping our prices as low as we can for as long as we can."

"But as we replenish inventory at post tariff price levels, we've continued to see our costs increase each week, which we expect will continue into the third and fourth quarters."

Markups were lower than expected, easing margin hits.

John David Rainey explained, "We ultimately realized lower markups than anticipated"

Last Wednesday, FOMC's meeting minutes from the July meeting were released.

They acknowledge disinflation had stalled, with tariffs exerting upward pressure on goods price inflation, as evidenced by recent increases in consumer prices.

Participants noted that tariff effects were becoming more apparent in the data, masking underlying inflation trends and potentially keeping core PCE inflation elevated at around 2.7%.

The committee realized tariffs as a primary driver of near-term inflation risks, expecting them to raise inflation this year and provide further upward pressure in 2026, before declining toward the 2% target by 2027.

Concerns over persistent tariff-induced inflation, led almost all officials to prefer maintaining rates unchanged, outweighing labor market weaknesses.

This was a major blow to rate cut odds declining during Wednesday, and Thursday.

NVO is showing UNH-type recovery

Glad, we were long in both NVO and UNH. You wish to get decisions like these right.

The stock was down 37% between 28th July and 6th Aug after the company slashed its year guidance, citing slower uptake of GLP-1 drugs.

On Aug 6th, its P/E NTM dropped to 10.8. For XLV, it was 16.4. For SPY, it was 22.8.

Since mid Aug, our opinion about the healthcare sector has been bullish; it had suffered from an overreaction, and the upside wasn’t priced.

This week, it rose on 5-consecutive days. It’s still -55% in 1 year.

Markets observed a general capital flow into YTD losers this week.

Investors were looking for discounted valuations in defensive sectors, and that helped XLV, XLP, and XLB.

Digital Assets

Ether Soars to New Heights

Ether just blasted off to a jaw-dropping record high this week, smashing its 2021 crypto bull market peak.

It rocketed to $4,866.73 on August 22, leaping 15% in a single day.

It officially topped the previous ATH of $4,866.40 from November 2021.

Ether has gained 40%+ this year. It’s even outpacing Bitcoin’s rally.

Ether’s smart contract application is the secret sauce fueling this rally.

Jackson Hole was a sentiment boost for markets holistically.

BTC also recovered 4%, after 4 consecutive red days.

Lumida Curations

Powell Warns of Economic Risks

Jerome Powell highlights the dangers of returning to the effective lower bound amid a new economic normal.

Marks Urges Caution in Markets

Howard Marks advises shifting to credit for portfolio defense after a prolonged bull run.

AI Drives Up Healthcare Costs

Avik Roy discusses how hospitals use AI to inflate billing rather than aid patients.

Meme

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In