Here’s a preview of what we’ll cover this week:

Macro: Housing: Melting up against Odds; U.S. Fiscal Mess Meets Private Equity Turnaround

Markets: Markets are Funny; 13Fs Season Is Here; Energy on a tentative recovery; Multiples Aren’t Apples to Apples

AI: A Gold Rush in Payments; US Dollar Hegemony 2.0; USA; Bitcoin Super Power; Ethereum; What’s Up With it?

Lumida Curations: Stablecoins Rise as Dollar Dominates; Powell Criticized as ‘Too Late’; The Hidden Cost of Payments

This week, in non-consensus investing, we featured Avic Roy from Roy Policy Research, to discuss whether healthcare, at its discounted valuation, is a value trap or bargain. Here’s what we cover:

Why AI is secretly driving healthcare costs higher instead of lowering them.

The Obamacare “three-legged stool” that collapsed under its own design.

How Switzerland cracked universal healthcare with market forces?

The hidden monopolies in regional hospitals that quietly inflate costs.

Why biotech has been in a “lost decade” and what could spark the next wave.

How to actually use 13F filings to find an edge in biotech investing.

Bitcoin as a long-term hedge against U.S. fiscal collapse — not just inflation.

Watch the video here.

Featured In

This week, I was invited to the Milk Road Macro with John Gillen.

We discussed:

What impact stablecoins have on the movement of money

Trump’s changes to the FOMC

How AI is creating a K-shaped series of outcomes

And much more

Here is a link to the complete podcast - strong recommendation. We cover a range of topics.

Equity vs Credit

Credit investors look for what can go wrong.

Equity investors look for what can go right.

Credit investors are last in line to lose.

Equity investors are first in line to lose capital.

The paradox is that credit investors stay awake at night fearing the worst, while equity investors stay awake dreaming of the best.

Markets are Funny

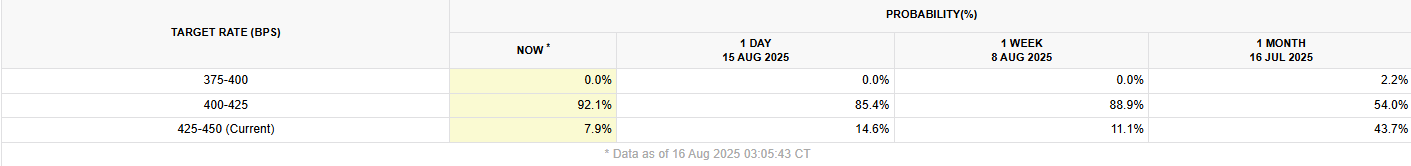

After a weak non-farm payrolls print this past August - an echo of last year as we noted last week - markets sold off.

Markets then re-priced September rate cut probabilities from 20% to 92.1%.

Then markets rallied.

Small caps are now beating other style boxes since the April lows.

Fully 80% of our names are in small caps incidentally. Markets are taking turns rallying either large cap tech or small cap value.

Rates are coming down - both short end and long rates - despite Ray Dallio’s doomerism.

This means small caps - which often have high debt and interest rate exposure - are going to rally.

Small caps are now beating large cap tech off the April lows.

This is a good case study on how a macro view influences positioning.

Plus, it’s a contrarian idea.

Every ‘smart’ HF is trained to short small caps and use it as a funding source to hedge other risk.

They did this with Ethereum too.

Those HFs need to cover their small cap shorts.

We’ve been writing about small caps for a while (see below).

Norwegian Criuse lines is one investment in this theme. But, there are plenty of others - such as Better Mortgage.

Or, American Eagle. Or, homebuilders. Or, small banks like Live Oak.

There’s a lot out there as this left for dead category rallies due to short-covering, tax cuts, and greater fiscal spending.

13Fs Season Is Here

The latest 13Fs have been released. As we always do, we’ll have a deep dive on this sector.

Our view: the healthcare bottom is finally in. We were early and wrong here.

But, with Buffett loading up on United Health and seemingly many other hedge funds - and the subsequent rally - there’s enough of a gestalt shift to move this into higher gear.

The fundamental backdrop is that insurers will be hiking premiums. That will drive revenue and earnings.

The simplest way Buffett would look at this is “Will United Health be here in 50 years? And, is it a good price?”.

The answer is yes.

Housing: Melting Up Against the Odds

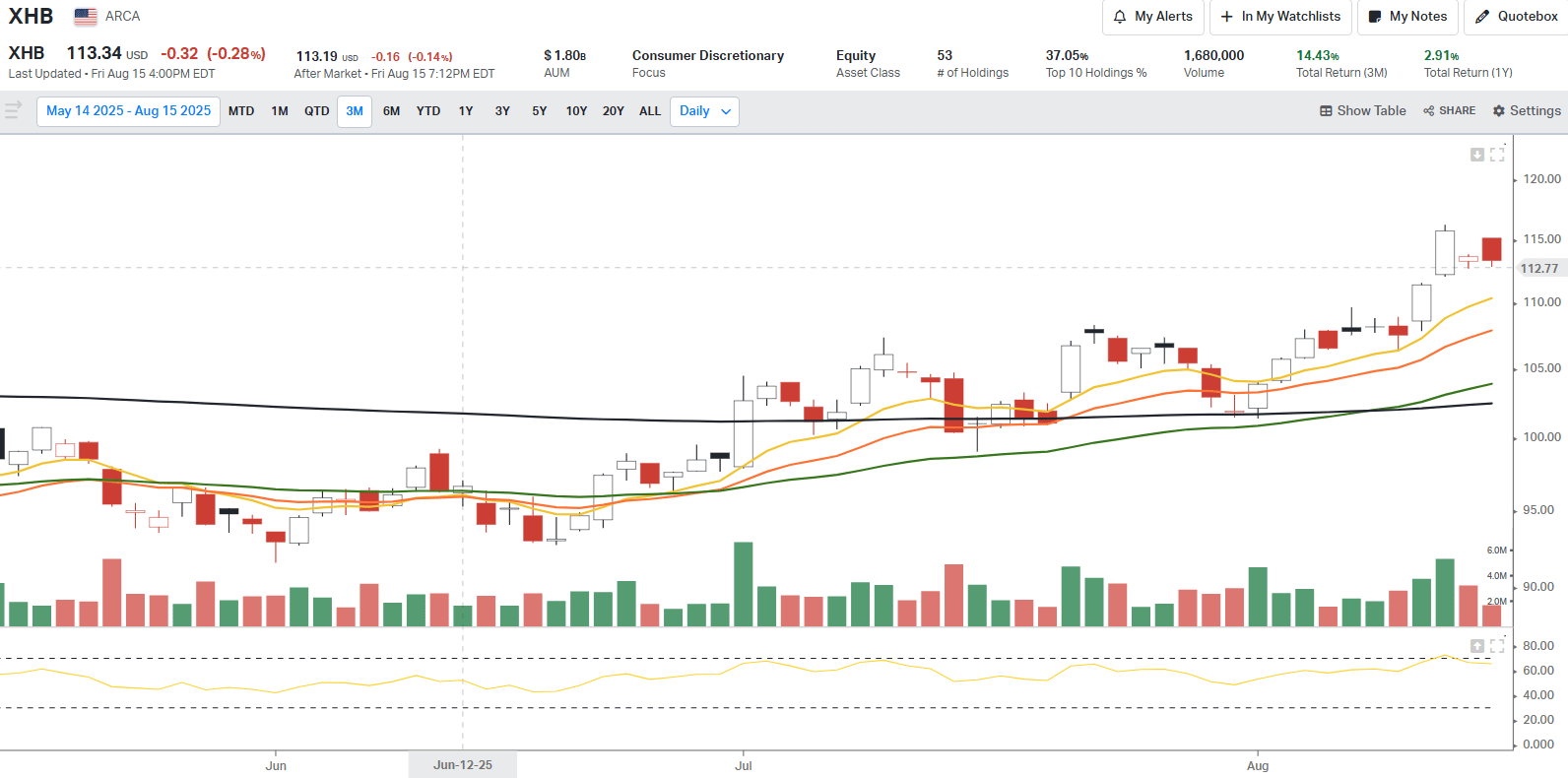

Homebuilders are ripping higher, and the data supports them.

U.S. home prices remain at/near record levels:

Redfin reports the median sale price is up year over year and sitting near highs ($443,462 in July; record set in June’s four-week window).

The S&P CoreLogic Case-Shiller national index continues to print annual gains.

Fuel is arriving from the trend of ever lowering mortgage rates.

Freddie Mac’s latest PMMS shows the 30-year fixed mortgage at 6.58%, the lowest level since October.

Chief economist Sam Khater: “Purchase application activity is improving as borrowers take advantage of the decline in mortgage rates.”

Lower mortgages are translating straight into price action across housing equities and construction, exactly the setup we’ve been expecting.

Mortgage rates are drifting down, XHB catching a bid, and refi/HELOC channels re-opening as households tap housing equity.

It is an on-the-ground liquidity loop that supports both activity and sentiment.

Positioning confirms it.

Homebuilder ETFs have been bid up on rate relief and improving price momentum.

XHB and peers surged on late-June inflation relief and drew bullish options flows in early August, a classic “follow-through” tell for a momentum market.

Recent prints and fund pages show the sector rallying into mid-August as traders lean into the upside.

Forward indicators and sell-side calls rhyme with this strength.

Goldman Sachs still projects positive home-price appreciation into 2025 (low-single digits).

Any cooling remains a moderation of acceleration, not a reversal of trend.

In other words: higher lows, higher highs, and a constructive tape for builders.

U.S. Fiscal Mess Meets Private Equity Turnaround

Privatizing Fannie Mae and Freddie Mac is the first step to reducing government debt.

The second is selling student loans.

I mentioned in a livestream in Chicago that an easy way to pay down the debt is for the federal government to sell its $1.8 trillion student loan portfolio. Here is the link.

(Maybe someone in DC took notice?)

Any sale of this portfolio would dwarf the size of the restructuring of Fannie Mae and Freddie Mac (FNM/FRE), which together guaranteed $12 trillion in mortgages but did so across many decades.

43.2 million borrowers hold federal student loans, with an average balance of about $37,000 each.

The U.S. government is considering the sale of its student loan portfolio as a way to address fiscal pressures.

However, the question: what guarantees Washington would provide to private buyers?

Federal student loans total roughly $1.6–1.8 trillion, accounting for over 90% of outstanding student debt.

Delinquency rates remain elevated, with more than one in ten borrowers behind on payments.

By comparison, a bulk sale of student loans would represent a single, concentrated transfer of federal liabilities into private markets.

The market impact could be significant.

One of the ways to bet on the idea of the Federal Government exiting student lending is to own Sallie Mae.

Markets

Energy, On a Tentative Recovery

Crude oil's recent consolidation in the low-to-mid $60s ($62–67 range) has lent fresh support to airlines and energy producers.

DAL is up 14% over the week. UAL also rose 12%. These are names we’ve written about and have exposure to.

Our investment in energy remains Riley Exploration (REPX). The name should rally if oil and natural gas prices increase.

Relatedly, identifying nat gas players that benefit from Trump’s deal with the European Union makes a lot of sense. We have views here and will share more in a subsequent newsletter.

Multiples Aren’t Apples to Apples

Valuation bears keep pointing to headline multiples, but context matters.

The S&P 500 of today is nothing like the S&P 500 of 1980.

Back then, the index was 70% asset- and labor-intensive manufacturing.

Today, nearly half the market cap sits in asset-light innovation sectors: tech, health care, and communications.

Asset-intensive industries (industrials, materials, energy, utilities) have shrunk from two-thirds of the index in 1980 to just 17% projected for 2025.

Meanwhile, innovation-led, high-margin businesses now dominate the tape at ~49%.

This structural change makes simple multiple comparisons across cycles misleading.

A “statistically expensive” market on traditional metrics is also a very different market in composition, one tilted toward scalable, capital-efficient businesses with higher margins.

That’s why the surface-level P/E conversation misses the forest for the trees.

Digital Assets

A Gold Rush in Payments

Competition in the stablecoin space is already intense.

Circle and Tether dominate, sure, but now, PayPal, Paxos, Robinhood, they’re all building stablecoins.

Big banks like JPMorgan and Citibank are lining up through consortia.

More than 200 fintechs are queuing with national bank regulators for charters just to get in the game.

We’re seeing a gold rush; stablecoin investment is as hot as AI.

US Dollar Hegemony 2.0

Treasury Secretary Scott Bessent sees stablecoins as a path for trillions of dollars to flow into T-bills.

Stablecoins gives U.S. dollar global dominance.

In Argentina, one of the most popular consumer apps allows workers to get paid in USD-backed stablecoins, sidestepping currency risk.

To those braced for a BRICS backlash, think again

USA: Bitcoin Super Power?

Ethereum: What’s Up With it?

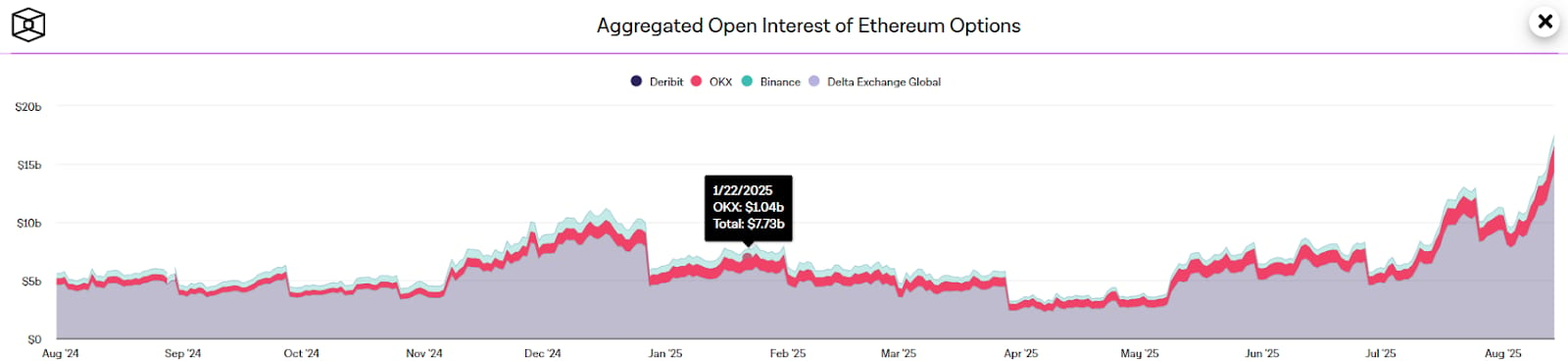

We were early on Ethereum, why?

Because stablecoin activity happens there.

Ethereum is programmable money: smart contracts, waterfall royalty streams, tokenized products.

We were quick to de-risk ETH earlier this week, before the pullback.

We like the backstory, but the gap-up on 12th drove the decision.

It turned out to be correct.

The current drop is driven by retail. Institutions are buying it.

We will re-enter again.

Lumida Curations

Stablecoins Rise as Dollar Dominates

Robinhood’s CEO highlights how Bitcoin began as a hedge, but stablecoins,backed by the unmatched trust in the U.S. dollar,are increasingly becoming the preferred choice worldwide.

Powell Criticized as ‘Too Late’

Scott Bessent argues that Jerome Powell’s data-driven approach lags behind economic realities, contrasting him with Alan Greenspan’s more forward-looking style.

Interchange fees of 2–3% on every card transaction act like a hidden tax on merchants, especially painful for retailers with razor-thin margins.

Meme

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In