Here’s a preview of what we’ll cover this week:

Macro: Positive Sentiment In Utilities; Global Rates Decline

Markets: Labor Supply is Squeezing; Credit Markets Signal Confidence; Dining Demand Holds; Ad Markets Are Growing

AI: GPT 5 is Here

Lumida Curations: Stablecoins Are Moving Upstream, Rally Built on 2008-Type Valuations, USDC Proved Its Resilience

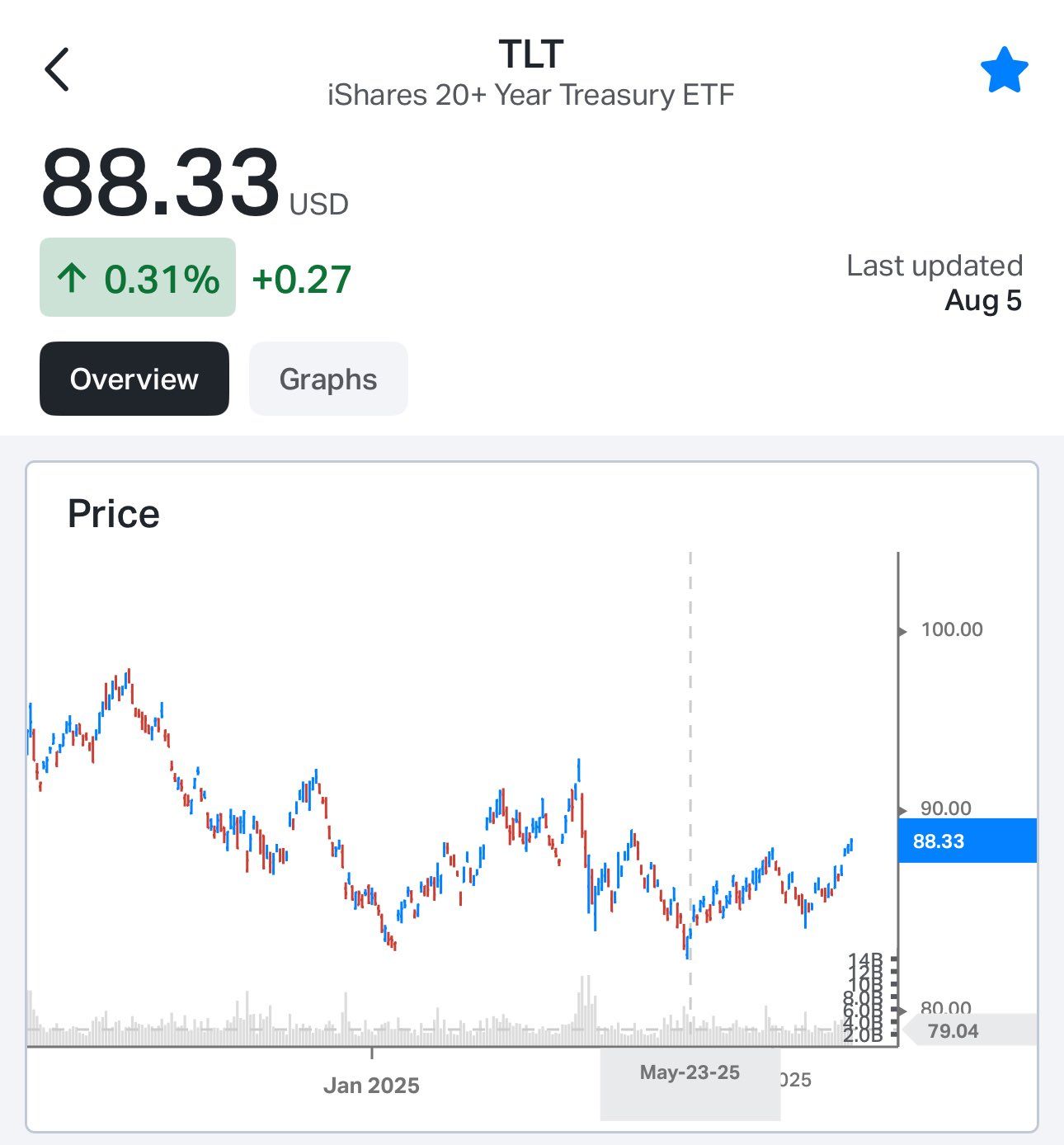

Back in May, I noted long-term real yields were high and attractively priced.

Ray Dalio had caused a quasi-panic with his debt spiral talk.

Take a look at TLT with the timing.

Uncanny timing down to the day.

Funny enough, you’d have been better off owning equities even if you expected bonds to rally.

This is what happened after the 10/26/2023 bottom in equities which coincided with the ‘higher for longer’ interest rates correction.

Back in 2023 & 2024, our view was consistently ‘higher for longer’.

Here are some lessons:

1) The principle of fading the crowd at extremes works across markets.

2) incorporating inter-market signals to understand different asset classes is effective.

The bond market and equity market interplay is real.

3) Simply because you have a view doesn’t mean you should express the view if your opportunity cost is higher (equities > bonds)

Lastly, the thought process at these inflection points is not high conviction declaration like:

‘bang! here we are rates are turning, go!’

It starts as a whisper - a series of observations and questions:

‘People are panicking. Isn’t this mispriced?

Shouldn’t this start to go the other way soon?’

By the time the move is underway and can be labelled as such a significant part of the move is already done.

My main learning from this is to act on those early thoughts quickly.

Lumida Deals: CoreWeave - $7B to $60B

One of Lumida’s first private deals was an allocation in CoreWeave, an AI-focused cloud infrastructure company.

At the time, we facilitated an investment for eligible clients at an approximate $7 billion valuation, sourced through our network (special thanks to Andrew S., a long-time friend and reader - uncompensated).

CoreWeave was a classic “East Coast” deal – priced efficiently, with institutional capital from Magnetar on the cap table rather than a traditional Silicon Valley venture structure.

Less than two years later, CoreWeave went public and its market capitalization has reportedly grown to over $60 billion, with the stock trading approximately 4x higher since its IPO.

Investors who entered at the $7 billion valuation may see an over 800% gross valuation increase.

To discover how we source private investments for eligible investors, visit lumidadeals.com.

Important: The figures above are approximate, based on public sources, and reflect gross valuations only. Actual returns may be significantly lower after fees, expenses, carried interest, and taxes. Past performance is not indicative of future results. Private investments are speculative, illiquid, and involve a high degree of risk, including possible loss of principal.

Macro

Positive Sentiment In Utilities

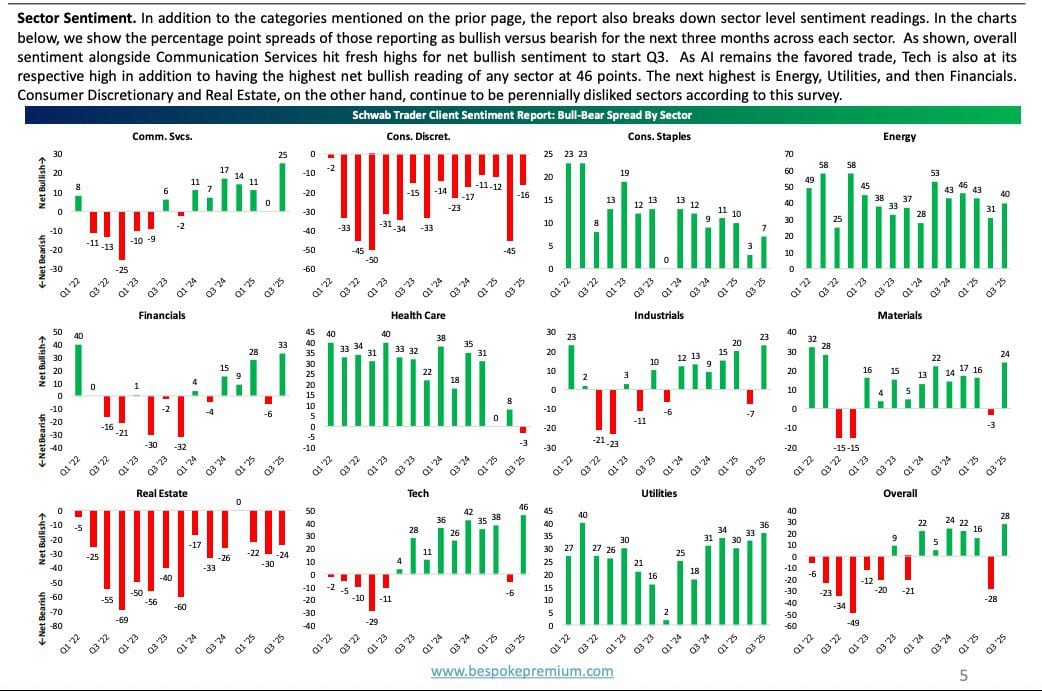

Overall, sector sentiment is improving for Q3.

Tech continues its long-run leadership with the strongest net bullish gain, but Utilities are surging.

73% of XLU is electric utilities, and their growth is demand-driven.

AI datacenter growth is at twice to four times the rate of traditional digital infrastructure.

Marc Levy says, “Some data centers could require more electricity than cities the size of Pittsburgh, Cleveland or New Orleans, and make huge factories look tiny by comparison.”

The IEA predicts data-center energy use will more than double by 2030, driven especially by AI compute demands.

Currently, the system is at its limits.

Google’s agreement to lower data-center demand during grid stress shows it.

Meta locked in a 20-year PPA to extend the life of the Clinton nuclear plant to support the AI load.

Silver Lake’s $400M bet on 3 GW of firm power (soon to be 6 GW) is the private-sector answer to grid strain.

The rising demand is causing price increases for customers as well.

PJM Interconnection, a mid-Atlantic grid operator, attributed its 7x price spike largely to AI load growth.

XLU is showing strength, and AI narrative supports it.

“Bored sectors”, Financials, Industrials, Materials, also show green shoots, while Consumer Discretionary and Real Estate remain stuck in the red.

Leadership isn't just in Tech.

It's being found in strategic infrastructure and value anchors that service demand.

Global Rate Decline

Global policy rates are trending lower, with BoA seeing a move from 4.4% to 3.9% over the next year.

In the U.S., fiscal math makes large discretionary cuts unlikely, leaving rate cuts as the primary lever.

For debt costs to stabilize, Fed Funds would need to be closer to 3.25%.

This backdrop supports our current positioning; long risk, leaning into sectors with earnings growth and reasonable valuations.

Financials, Utilities, and EM plays stand to benefit, as do select cyclicals.

Market

Labor Supply is Squeezing

Last week, I argued the real story in the payroll miss wasn’t that businesses stopped hiring; it was that we are running short on workers.

Now, Yardeni echoes that line: “It may be both … but the problem is mainly on the supply side.”

That’s exactly right.

Labor demand (job openings + employment) remains elevated, but labor supply has gone flat in 2025, no growth in available workers, just falling from the highs.

We’re staring at a structural shortfall.

What caused this? Policy.

The Trump-era border clampdown and ramped-up deportations haven’t slowed, they’ve shrunk the labor force.

The foreign-born workforce, once a buffer, is now shrinking.

Dallas Fed data show unauthorized immigration fell ~82% between December and March, from 105,000 to 19,000.

The NFAP notes a 735,000-person drop in labor force participation by immigrants since the start of the year.

Jerome Powell, unusually blunt, called it out too: in June, “labor demand is softening … and labor supply is diminishing.”

Here’s why that matters: if the labor shortage is real, the Fed cutting rates would be like stepping on the gas while driving into a stone wall, it inflates demand for workers into a choked pipeline, driving up wages and pushing inflationary pressure.

Cutting now solves nothing; it risks reigniting wage-price runs.

The chart explains how the labor situation pans out.

If the mass interior deportation case occurs, we are in for a serious labor shortage.

The unemployment rate metric will surely look good; it’s already at full employment, at 4.12%, down from 4.25%.

However, the flip-side is what matters.

Construction, care services, and hospitality businesses are fraying because they literally cannot find workers.

In short: this is a supply-led slowdown, and the cure is not monetary easing. The Fed must hold the line until we see a tangible return in labor-force growth. And so must we.

Credit Markets Signal Confidence

LendingTree’s (TREE) Q2 results offer a revealing window into consumer credit sentiment and the broader economy.

We owned this in passive accounts before earnings.

Management: “in Q2, there were 37 expansions compared to four contractions in opening up the number of loans they’re willing to offer,”

A sign that lenders are broadening their risk appetite and that households remain willing to take on credit.

Doug Lebda called small business loans “a real growth driver” hinting that entrepreneurial and SME activity is rebounding.

Jason Bangle remarked, “We expect strength going forward and significantly higher than Q2.”

Even with interest rates elevated, consumers are comfortable tapping home value for liquidity.

Notably, AI is emerging as both an efficiency tool and a demand engine.

Scott Perry highlighted “a tangible number of high-quality consumers being referred to LendingTree from the likes of ChatGPT,”.

Lebda mentioned, “AI unlocks potential that has never existed for us before.”

LendingTree is also opting for stability over stimulus; as Bangle put it, “We are not assuming any change in rates in the current guide,” yet still see momentum across segments.

If rates drop, Lebda suggested it would “only accelerate debt,” potentially boosting volume but also shifting lender behavior.

Dining Demand Holds

Shake Shack’s Q2 performance points to a consumer dining environment that remains resilient even as inflationary pressures persist.

CEO Rob Lynch: “We have seen consistent sequential improvement in our traffic,” with shake shack sales growth improving from 1.8% in Q2 to 3.2% in July.

Diners are increasingly willing to spend on premium experiences. That willingness extends to higher price points.

Lynch noted guests were “willing to buy a $10 shake, which is the most expensive shake that we’ve ever launched”.

However, Inflation remains a factor, with beef costs up “low teens,” but Lynch expressed confidence they will “mitigate a lot of this beef inflation with supply chain and operational productivity,”.

Trade Flows Shift

Expeditors’ Q2 painted a picture of trade flows and global logistics.

Daniel R mentioned customers are moving “technology and other high-value inventory ahead of trade deadlines” and accelerating exports from “South Asia… as customers relocated sourcing to that region.”

The simultaneous rise in both airfreight and ocean volumes (+7% each) despite softening ocean rates suggests demand is holding up even as capacity expands, a sign that global trade flows remain healthy under the surface.

Ad Markets Are Growing

We owned Applovin (APP) going into earnings. Their results were a beat, 77% YoY revenue growth, and 81% EBITDA margin.

Adam Foroughi: “Eyeballs playing games play more games every single day. Inventory goes up. That drives growth on our platform..”

APP is now targeting more small businesses; “Our goal… any small business of any type can market on our platform.”

“We're going to be a product that can be very important to economies and job creation around the world.”

Management noted that a majority of the user base is outside the U.S., with roughly a 50/50 domestic/international revenue split excluding China.

With over 1B users, the opportunity extends beyond gaming.

“These are human beings doing a whole bunch of things”. Gaming only makes 10% of the time they spend on the phone. “The share of wallet from gaming is going to be a minority of the dollars.”

Hence, Foroughi believes they are going to add more than gaming options in a few years.

Moreover, Foroughi also was optimistic about AI.

The company sees “all… advertising… moving to AI,” eliminating manual targeting in favor of automated, goal-driven systems, with generative AI tools to help small businesses create ads that hold attention for 30–60 seconds instead of 3–6 on social platforms.

AI

GPT 5 is Here

OpenAI’s GPT-5 is being pitched by Sam Altman as the leap from standard displays to Retina, faster, more accurate, more reliable.

It’s not being labeled AGI, but Altman calls it a “significant step.”

On ARC-AGI-1, Grok 4 edges out GPT-5 with 68% versus 65.7%.

On SWE-Bench and Aider Polyglot, GPT-5 dominates, posting 74.9% and 88% respectively when its chain-of-thought mode is active.

On Humanity’s Last Exam, GPT-5 Pro scores 42% with tools, still behind Grok 4 Heavy’s 44.4%.

But on GPQA Diamond it comes out ahead at 89.4%, topping Grok’s 88.9% and Claude’s 80.9%.

Functionally, it unifies multiple variants, GPT-5, mini, nano, Thinking, Pro, into a single accessible lineup, extends context windows up to 256K tokens, and materially reduces hallucinations.

Despite these gains, market sentiment was mixed.

Elon Musk was quick to jab, calling Grok 4 “crushingly good” and promising Grok 5 before year-end.

Betting markets quickly repriced.

GPT‑4 retrograded sharply, previously perched at ~80% confidence, as Google’s Gemini surged to 77% probability of being deemed the best AI model by the end of August.

Grok remains ahead in certain complex reasoning tests, Gemini is gaining in perception, and the competitive edge now rests on sustained benchmark leadership, pricing strategy, and user experience rather than raw capability.

But, if we look at LLMs now, they have reached a level where their discussions deserve the same confidentiality as spousal or attorney-client privilege.

Self-destructing chats, like self disappearing selfies, are also inevitable given how much AI is advising on.

Lumida Curations

Stablecoins Are Moving Upstream to B2B

Cross-border payments are slow and costly, and businesses are turning to stablecoins for faster, cheaper settlement.

Rally Built on 2008-Type April Valuations

Earnings growth, disinflation, and a friendly regulatory backdrop outweigh one-off tariff shocks to inflation.

USDC Proved Its Resilience During SVB’s Collapse

While banks froze, USDC kept moving 24/7, rebounding to $1 within days after swift action and regulatory assurances.

Meme

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In