Here’s a preview of what we’ll cover this week:

Macro: The Misconception Around Labor Market

Markets: Lumida’s 2026 Stock Picks; Is Goldilocks Priced In?

Digital Assets: Stablecoins Aren’t Eating Banks—Yet

Lumida Curations: The Mag 7’s Grip Is Loosening; Markets Are Defying the Fed; Hydration Signals Aren’t One-Size-Fits-All

HAPPY NEW YEAR

These is perhaps the best New Year resolutions I came across this week.

‘Where there is hatred, let me sow love,

Where there is injury, pardon,

Where there is doubt, faith,

Where there is despair, hope,

Where there is darkness, light,

Where there is sadness, joy.’

Wishing everyone peace, light, love and laughter in 2026.

(h/t St. Francis of Assisi)

Venezuela News

Here’s a 9-minute livestream titled “The Donroe Doctrine” explaining my reaction.

From a markets perspective, I believe Oil Services will do well. (Look at names in the OIH ETF). Overall, we don’t view this as creating risk for markets.

We’ll share ideas next weekend.

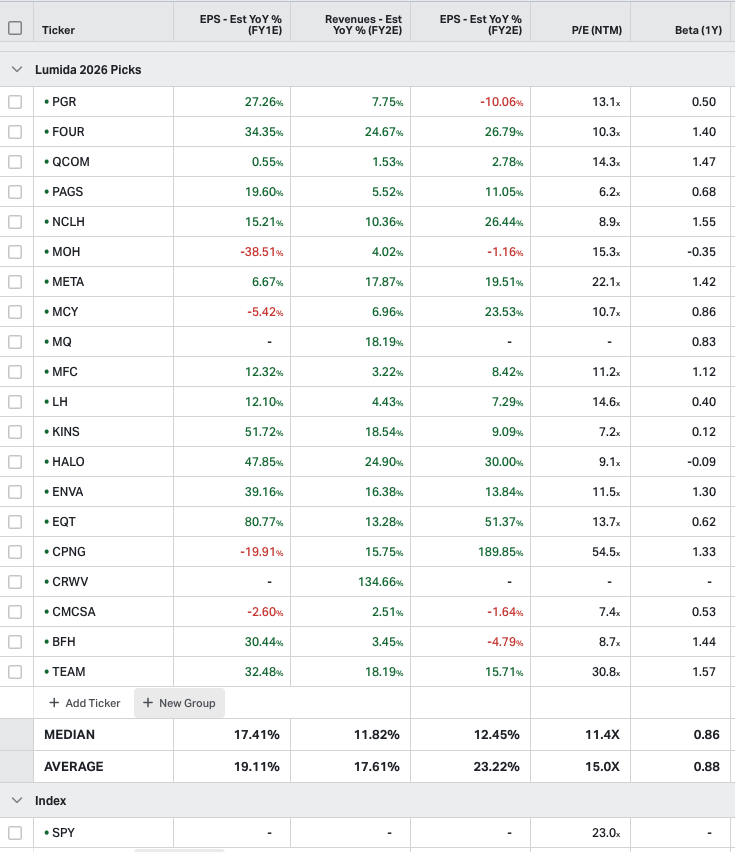

New Years Gift: Lumida 2026 Stock Picks

We’ve curated an exciting stock stuffer featuring 20 of our top picks.

The common thread across these names is that they’re non-consensus—exactly where alpha is found. You can download the picks here.

Let’s walk through the ideas.

EQT - Our Energy Pick for the AI Power Decade

Natural gas is becoming a critical input for U.S. computing power.

AI, data centers, and electrification are driving demand that looks increasingly structural, not cyclical. EQT sits at the center of that shift.

EQT is one of the largest natural gas producers in North America, with both upstream scale and midstream infrastructure.

EQT has signed long-duration data-center contracts that extend roughly 20 years, offering exposure to AI-driven power demand at a far more reasonable valuation than the data-center or semiconductor complex.

Management highlights regional demand already exceeds current supply.

Export optionality is the second leg.

LNG agreements with Sempra, NextDecade’s Rio Grande project, and Commonwealth position EQT to benefit if U.S. gas exports tighten domestic markets over time.

This adds flexibility without requiring aggressive volume growth.

The execution backdrop has improved materially.

Revenues and net income are up roughly 30% year over year, per-unit costs hit record lows in Q3, and EQT generated more than $2.3 billion in free cash flow over the past four quarters, translating to a ~7% free-cash-flow yield.

The risk is straightforward: EQT is still exposed to natural gas pricing.

A prolonged oversupply would pressure margins and slow capital returns, particularly given the company’s debt load.

But if AI power demand and LNG exports reshape gas markets as expected, EQT offers a clean, cash-generative way to play the theme.

PagSeguro (PAGS) — Deep Value in Brazilian Fintech

PagSeguro trades like a broken fintech, but the underlying business looks far more durable than the valuation implies.

PAGS has evolved from a payments processor into a full-stack fintech platform serving Brazilian SMBs and consumers through PagBank.

Payments remain the entry point, but the real value sits in the attached banking services: deposits, secured credit, insurance, and investments.

That ecosystem has allowed PagSeguro to grow earnings while many global fintech peers have struggled with funding costs and margin compression.

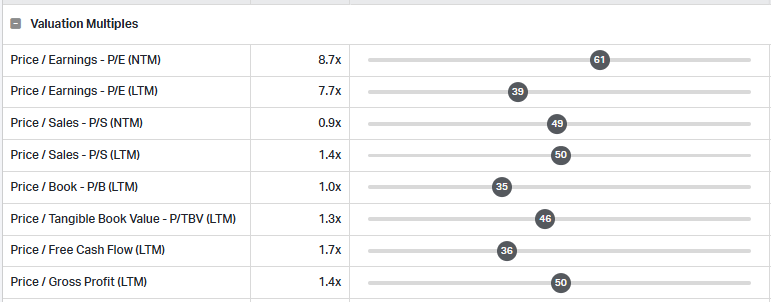

PAGS trades at roughly 6–7x earnings, under 1x sales, and generates exceptionally high free cash flow, with FCF yields north of 20%.

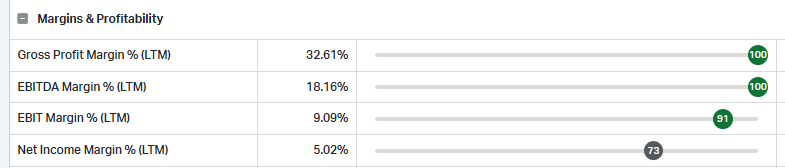

Margins remain strong—EBITDA margins in the mid-40s—and capital return is real.

Dividends and buybacks together imply a double-digit shareholder yield, which is rare in fintech.

Credit is the swing factor. Management has been conservative, focusing on secured lending and prioritizing profitability over aggressive market share gains.

That has kept losses contained even as Brazilian rates stayed high. If rates normalize, operating leverage could surprise to the upside.

The risk is clear: Brazil remains competitive and macro-sensitive.

Nubank and StoneCo set a high bar, and if transaction growth stalls or credit costs rise, PAGS could remain optically cheap for longer. But at today’s valuation, the market is already pricing in a lot of bad news.

Meta Platforms (META) — The Value Stock in Mag-7 Land

Meta is the rare Magnificent Seven stock that still trades like it hasn’t fully earned its place.

We talked about META’s mispricing in November - the stock is up 11% since then, but the potential is still ahead.

The market is treating META as a “show-me” AI story, but the fundamentals already say it has.

On valuation alone, Meta stands out.

At roughly ~20–22x forward earnings, META is the cheapest name in Mag-7 land by a wide margin.

Meta generates some of the strongest margins in large-cap tech, with operating margins north of 40% and returns on capital that rival — and in some cases exceed — its peers.

In other words, investors are paying less for a business that already prints cash.

The growth engine is advertising, and AI is making it more powerful.

Management disclosed that the annualized run-rate of its AI-powered advertising stack has surpassed $60 billion (30% of 2025 revenue).

Recommendation systems across Facebook, Instagram, and Threads are improving engagement, driving more time spent and better ad performance.

That virtuous cycle shows up directly in revenue growth and pricing power.

Capex is the concern, but it’s also the opportunity.

Yes, Meta is spending aggressively on AI infrastructure, and that has created anxiety.

But we’ve seen this movie before — Google faced the same skepticism before AI-driven efficiency showed up in results.

Meta’s cash flow profile gives it the flexibility to invest without sacrificing profitability, and early returns suggest those investments are already paying off.

The risk is execution.

If AI monetization lags expectations or capex continues to rise without incremental returns, the valuation discount could persist.

But in a Mag-7 cohort trading at premium multiples, Meta remains the underpriced growth story hiding in plain sight.

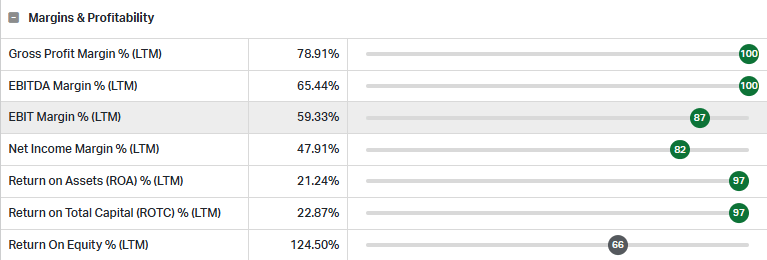

Marqeta (MQ) — Payments Infrastructure at an Inflection Point.

Marqeta sits behind many of the most disruptive payment use cases—BNPL, on-demand delivery, expense management, and digital wallets.

Its API-first platform allows customers to issue cards, control spend, and move money in real time.

That makes Marqeta a critical layer for companies like Block, DoorDash, and Affirm.

The opportunity is not flashy growth—it’s becoming embedded.

The near-term story has been painful.

Revenue concentration, especially with Block, contract repricing, and delayed profitability have weighed on sentiment.

But beneath that noise, the business is stabilizing.

Total processing volume continues to grow, gross margins remain high (~70%), and operating losses are narrowing materially.

Management is guiding toward GAAP profitability in 2026, and the balance sheet provides runway—Marqeta holds significant net cash and continues to buy back stock.

Valuation reflects deep skepticism.

The stock trades near trough multiples on sales and gross profit, despite still growing and operating in structurally expanding digital payments markets.

If execution improves even modestly—through customer diversification, cost control, or normalized pricing—the operating leverage is meaningful.

The risk is execution and concentration. If Block volumes weaken or new customer ramps disappoint, the turnaround takes longer.

But at this price, the market is already assuming Marqeta never quite gets there. That’s what makes it interesting.

Qualcomm (QCOM) — The Underappreciated AI at the Edge Play

Qualcomm is not trying to be Nvidia, and that’s exactly why it works.

While the market has focused on AI in the data center, Qualcomm is positioning itself where inference actually scales: on-device, at the edge, and inside cars.

At the core, QCOM still benefits from its dominant position in mobile silicon and licensing, but the business mix is changing.

Non-Apple revenue is growing faster, and automotive and IoT are becoming real contributors.

Qualcomm’s AI strategy is centered on low-power, high-performance inference rather than brute-force training.

That matters as AI workloads move closer to users and devices.

Valuation reflects skepticism.

Qualcomm trades around ~14–15x forward earnings—well below most large-cap semis—despite strong free cash flow, a solid dividend, and consistent buybacks.

The market is still discounting handset cyclicality and Apple dependence, even as management has been explicit about reducing that exposure over time.

Meanwhile, margins remain healthy and returns on capital are strong, suggesting the core franchise is intact.

AI upside is optionality, not the base case.

Partnerships in automotive AI, edge accelerators, and sovereign compute (including early-stage Middle East initiatives) offer long-term growth without needing immediate perfection.

The risk is timing: handset demand could remain sluggish and AI revenues will ramp gradually, not overnight.

But at this multiple, investors are being paid to wait for a business that is steadily becoming less cyclical and more strategic.

Manulife Financial (MFC) — A Cash Compounder with Asia Optionality

Manulife is not a growth stock in the Silicon Valley sense. It’s a balance-sheet business, and right now the balance sheet is doing most of the work.

MFC combines life insurance, wealth management, and asset management, with a footprint that matters most in Asia. That exposure is the differentiator.

Sales momentum in Asia—particularly Hong Kong and broader APAC—has been strong, driven by rising savings rates, retirement demand, and underpenetrated insurance markets.

This is long-duration, high-margin growth that does not depend on aggressive underwriting or leverage.

At the same time, Manulife is throwing off cash. Free cash flow yields are high, capital ratios are conservative, and shareholder returns are consistent.

The stock offers a solid dividend, steady buybacks, and trades at a valuation that implies little growth—despite evidence that growth is happening where it matters most.

Management has also been quietly repositioning toward higher-return businesses, including private credit and wealth solutions, which should lift ROE over time.

The risk is not existential, it’s cyclical.

Earnings can wobble with interest rates, mortality assumptions, or regulatory shifts—particularly in Asia.

Valuation is no longer distressed, and upside likely comes from compounding rather than multiple expansion.

MFC works in a portfolio because it pays you to wait.

Comcast (CMCSA) — The Ignored Value Trade

It’s hard to justify owning sovereign bonds in a world where inflation stays higher for longer and real yields remain uncertain.

Public markets offer alternatives that pay you to wait—Comcast is one of them.

We had talked about this before, and it paid back our trust - up 10% since the call.

The stock still has potential as markets recognize the ignored value in it.

CMCSA had been left for dead as cord-cutting dominates the narrative. Cable subscriber losses are real, but the stock price assumes far more damage than the business is actually experiencing.

At roughly 7x forward earnings and near a 20% free cash flow yield, the market is effectively pricing in a permanent decline.

Comcast has grown revenue and free cash flow in recent years, and expectations are for continued stability.

Its businesses generate recurring cash flow, and management has consistently returned capital through buybacks, steadily shrinking the share count.

This is disciplined capital allocation.

The overlooked upside sits in Content & Experiences—NBCUniversal, Peacock, Universal Pictures, DreamWorks, Sky, and theme parks—roughly 38% of revenue.

Live sports anchor engagement, Peacock has scaled to 41 million paid subs with strong ad growth, and long-term NBA rights lock in premium content.

The risk is broadband disruption and content missteps.

But Comcast pairs connectivity with content optionality, trades cheaper than peers, and throws off cash.

Why own sovereign debt when you can own Comcast?

Atlassian (TEAM) — Mission-Critical Software, Temporarily Out of Favor

Atlassian has been our pick in software for some time. We flagged it in November, and the stock has risen 8% since then.

Jira, Confluence, and Trello sit at the center of how modern teams build software, manage projects, and collaborate.

Once embedded, these tools are sticky—net retention remains strong, and Atlassian continues to deepen its footprint inside large enterprises.

The near-term problem is not demand, it’s digestion.

TEAM is in the middle of a complex transition: moving customers to the cloud, investing heavily in AI features like Rovo, and absorbing higher R&D spend.

That has pressured margins and kept reported profitability weak, even as revenue continues to grow at a healthy clip and gross margins remain elite.

The market has focused on near-term earnings pain and valuation optics, not long-term operating leverage.

What gets overlooked is the durability of the model.

Atlassian generates recurring subscription revenue, serves over 300,000 customers (including most of the Fortune 500), and benefits from secular trends toward distributed work, automation, and AI-assisted productivity.

As cloud migration matures and R&D intensity normalizes, margins should expand meaningfully.

The risk is execution.

If cloud migrations stall, AI monetization disappoints, or competition from Microsoft and ServiceNow intensifies, the re-rating takes longer.

But after a sharp drawdown, TEAM is priced like a growth company that stopped growing—which it hasn’t.

Mercury General (MCY) — A Recovery Trade with Real Risk

Mercury General is a classic turnaround story, operating where few insurers want to be: California.

Years of wildfire losses, frozen rate approvals, and underwriting pressure pushed MCY to the brink. The market still prices it that way. But the operating reality is changing.

Regulatory conditions have finally shifted. California has begun approving meaningful rate increases, allowing insurers to reprice risk closer to economic reality.

Mercury has responded by tightening underwriting, raising premiums, and shrinking exposure where returns don’t make sense. The results are showing up.

Underwriting profitability has improved materially, combined ratios have come down, and recent quarters reflect a business moving out of survival mode and into recovery.

At the same time, MCY trades like a distressed insurer despite normalized earnings power.

The stock sits near low-teens earnings multiples with a strong free cash flow yield, assuming catastrophe losses remain within modeled ranges.

Investment income is also rising as higher rates flow through the portfolio, adding another earnings lever.

The bear case is obvious and real.

Mercury remains highly concentrated in California, and another severe wildfire season could quickly erase progress.

Capital flexibility is limited, and volatility will never disappear in this business.

But that risk is well understood—and heavily discounted.

For investors willing to accept catastrophe risk, the payoff is asymmetric.

Progressive (PGR) — The Best Operator in a Tough Business

Auto insurance is cyclical, regulated, and capital-intensive.

Progressive has found the way to win - consistently.

The company’s edge is data.

Progressive’s telematics, pricing models, and underwriting discipline allow it to price risk more accurately than peers, gain share when others pull back, and protect margins when loss costs rise.

That advantage showed up again recently: premium growth remains strong, combined ratios are well below industry averages, and returns on equity remain exceptional.

The recent pullback has more to do with normalization fears than fundamentals.

After a period of unusually strong underwriting results, investors worry margins may compress as competition intensifies and advertising spend rises.

That’s a fair concern—but it ignores Progressive’s history.

When the cycle turns, Progressive tends to take share, not give it back.

Valuation now looks reasonable for a company with durable underwriting economics, strong free cash flow, and disciplined capital management.

At low-teens earnings multiples, the market is assuming peak profitability is behind us.

The risk is that loss trends reaccelerate, regulators push back on pricing, or competitors close the technology gap.

But even in tougher environments, Progressive has proven it can adapt faster than the industry.

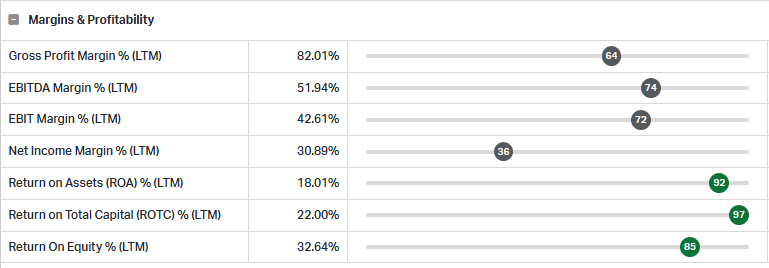

Halozyme (HALO) — Cash-Flow Biotech with a Clock

Halozyme is not a typical biotech. It doesn’t live or die by binary trial outcomes.

Its ENHANZE drug-delivery platform is embedded inside some of the world’s most successful biologics, quietly collecting royalties as partners scale blockbuster drugs like Darzalex and Phesgo.

That model has turned Halozyme into a cash-flow machine, with exceptional margins, strong free cash flow, and a capital-light royalty stream that most biotechs can only dream of.

The numbers reflect that quality.

Revenue growth remains strong, profitability is among the best in biotech, and capital returns are real.

At a single-digit forward earnings multiple, the market is valuing Halozyme closer to a mature pharma than a high-margin platform business with multiple growth levers.

The hesitation is about time, not execution.

ENHANZE’s core U.S. patent expires in 2027, and investors worry about what Halozyme looks like in the 2030s.

Management is responding by extending the platform internationally, layering in new delivery technologies through acquisitions like Elektrofi, and reinvesting aggressively while today’s royalty cash flows are abundant.

Still, the risk is real.

If next-generation delivery platforms fail to gain traction or partners renegotiate economics post-patent, growth could slow materially. Halozyme must prove it can reinvent before the clock runs out.

Today, though, the market is pricing the cliff, not the cash.

Bread Financial (BFH): Mispriced Credit Optionality

Bread Financial is strategically positioned across the high-optionality sectors of consumer credit, Buy Now Pay Later (BNPL), and private-label cards.

It trades at ~8–9x earnings and roughly book value, despite generating strong cash returns.

Recent quarters showed resilient profitability, with solid net income, rising tangible book value, and improved asset yields.

Importantly, Bread benefits from deposit-based funding, which has helped offset higher interest expense and stabilize net interest margins in a volatile rate environment.

The company’s private-label and co-branded partnerships remain sticky, embedded directly at the point of sale for large retailers.

Credit sales have continued to grow modestly, and are expected to pick up further as consumers stay resilient.

Management has also been disciplined on capital allocation, returning cash via buybacks while maintaining ample liquidity.

The risk is consumer credit delinquencies increase.

Credit losses remain elevated, delinquencies could rise if the labor market softens, and regulatory scrutiny around fees and consumer lending is intensifying.

Bread also runs with higher leverage than traditional banks, which amplifies downside in a sharper downturn.

Still, at today’s valuation, the market appears to be pricing in a severe and prolonged credit event.

If losses stabilize and earnings normalize even modestly, BFH offers asymmetric upside with meaningful capital return along the way.

Norwegian Cruise Line (NCLH): Boomer Demand Meets Operating Leverage

If you’ve been following our newsletter, you’d know NCLH, and love it like we do.

Norwegian Cruise Line is a clean expression of a powerful, underappreciated demographic trend: aging but affluent consumers prioritizing experiences over goods.

Baby boomers remain the core cruise customer, and this cohort has both the time and balance sheet to keep traveling.

That demand has proven resilient even as inflation and higher rates pressured other discretionary categories.

Operationally, NCLH is past the hardest part of the post-pandemic recovery.

Pricing has held up, load factors continue to improve, and forward bookings are running ahead of prior years with record advance ticket sales.

Management expects load factors to exceed 105% in 2026, reflecting strong mix, onboard spend, and disciplined revenue management.

Capacity growth is modest and planned, with new ships supporting roughly mid-single-digit capacity CAGR through 2028 rather than flooding the market.

The leverage to earnings normalization is significant.

NCLH trades around ~8–9x forward earnings, a discount to history and peers, despite improving margins and steady revenue growth.

As fuel costs stabilize and operating efficiencies scale, incremental revenue should fall meaningfully to the bottom line.

The risk is leverage. Debt remains elevated, limiting flexibility if demand softens or refinancing costs rise.

Competitive intensity from Carnival and Royal Caribbean, along with policy risks such as new cruise taxes, could also pressure margins.

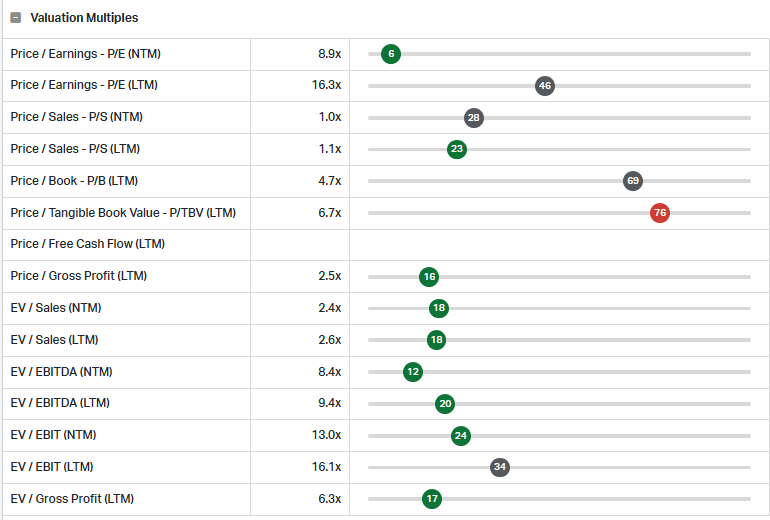

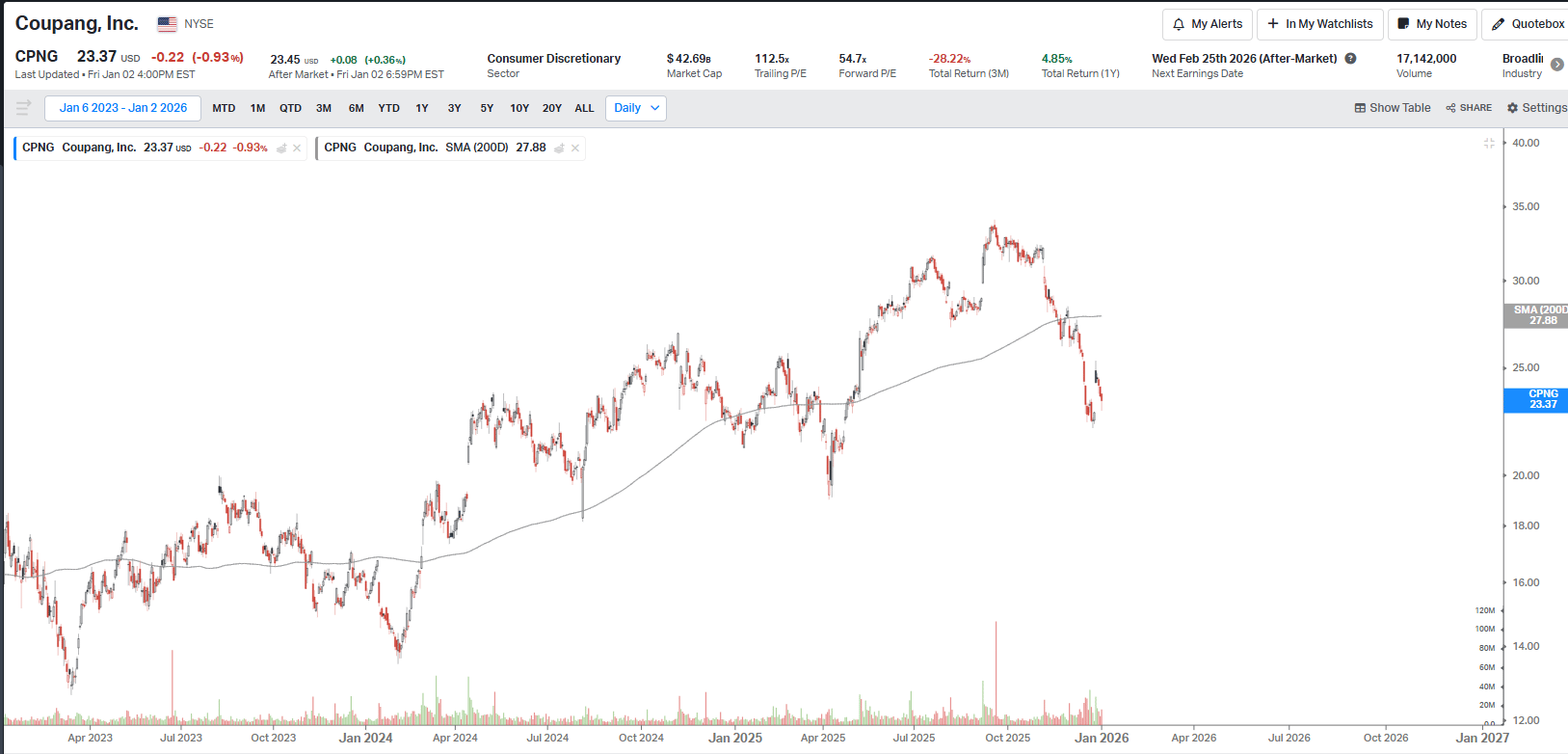

Coupang (CPNG): Logistics Moat, Not a Data Breach Story

Coupang featured in our last two newsletters, and it has now made it to a consecutive third - Elite levels.

The customer data breach did not change its fundamentals - the over reaction made the business a bargain.

Last week’s news also offered clarity around the possible repercussions of the breach, and they were better than most feared.

Coupang’s real advantage is not e-commerce. It is the logistics density.

The company has already built the hardest asset: a nationwide, vertically integrated fulfillment network that enables same-day and next-day delivery at scale.

That moat is extremely difficult to replicate and is now being leveraged across higher-margin adjacencies including Eats, advertising, fintech, and media.

The financials reflect this transition from growth to operating leverage. Revenue has grown at high double-digit rates over the last three quarters.

Gross margins are near 30%, at the top of their historical range. Most importantly, gross profit growth (~30%) is now outpacing revenue growth (~18%), signaling improving unit economics.

The key risk remains valuation: a high trailing P/E implies execution must remain strong. But structurally, Coupang’s logistics moat and improving economics remain intact.

CoreWeave (CRWV): Downside Priced, Upside Misunderstood

CoreWeave is yet another regular feature for Lumida ledgers - it had been volatile, gaining around 33% since our Nov 15 call, and then erasing all of it. Now, it sits around 10% higher, with Friday’s jump.

Market’s focus remains on Coreweave’s leverage, customer concentration, and execution risk, pushing valuation down sharply.

As a result, much of the downside scenario is already reflected in the price.

What’s overlooked is the structure of the business.

CoreWeave’s debt is largely collateralized by Nvidia GPUs—some of the most scarce and valuable assets in the AI ecosystem.

These are not stranded assets; they are in constant demand, monetizable, and reusable across training and inference workloads.

This materially limits true balance sheet risk compared to traditional leveraged growth companies.

Demand visibility is another underappreciated factor. CoreWeave carries roughly $55 billion in contracted backlog, reflecting persistent undersupply of AI compute.

Enterprises and hyperscalers continue to seek dense, purpose-built GPU capacity, and CoreWeave has positioned itself as a critical supplier.

That backlog provides unusually strong revenue visibility for a company still viewed as speculative.

CoreWeave has the Nvidia put - Nvidia has committed to utlizing any unallocated CoreWeave datacenter capacity. Nvidia is a quality counter-party. OpenAI is not.

The bear case is real: high interest expense reduces flexibility, customer concentration remains elevated, and delays in capacity buildouts could pressure near-term results.

A slowdown in AI spending would amplify volatility.

But those risks are well known—and priced in. We believe the relevant metric to look at is P/S ratio - and CoreWeave is cheap relative to peer group.

What’s not is the upside if CoreWeave executes on its backlog and benefits from operating leverage as utilization scales. This is a high-risk stock, but increasingly an asymmetric one.

Kingstone Companies (KINS): Scarcity Creates the Opportunity

Kingstone is a small insurer operating in one of the most dislocated property markets in the U.S.: New York homeowners.

As larger carriers retreat from the state due to regulatory friction and catastrophe exposure, Kingstone is doing the opposite—leaning into disciplined growth with tighter underwriting and selective risk taking.

That supply vacuum matters.

Insurance is a business where exits create pricing power, and Kingstone is a beneficiary.

The turnaround is already visible.

The company has posted record profitability, driven by improved risk selection and the rollout of its “Select” homeowners product, which materially reduced claim frequency versus legacy books.

With competitors pulling back, displaced policyholders are flowing to the remaining underwriters, allowing Kingstone to grow premiums without sacrificing underwriting discipline.

Returns on equity and margins now screen at the high end of the industry despite the company’s micro-cap status.

Valuation remains reasonable at roughly 7x earnings, reflecting lingering skepticism from past missteps and the market’s general aversion to small insurers.

That skepticism is not unfounded. Kingstone remains concentrated in New York, exposed to regulatory decisions and weather-related severity.

A spike in catastrophe losses or missteps in geographic expansion could quickly pressure results.

If underwriting discipline holds, Kingstone’s recovery may be more durable than the market expects.

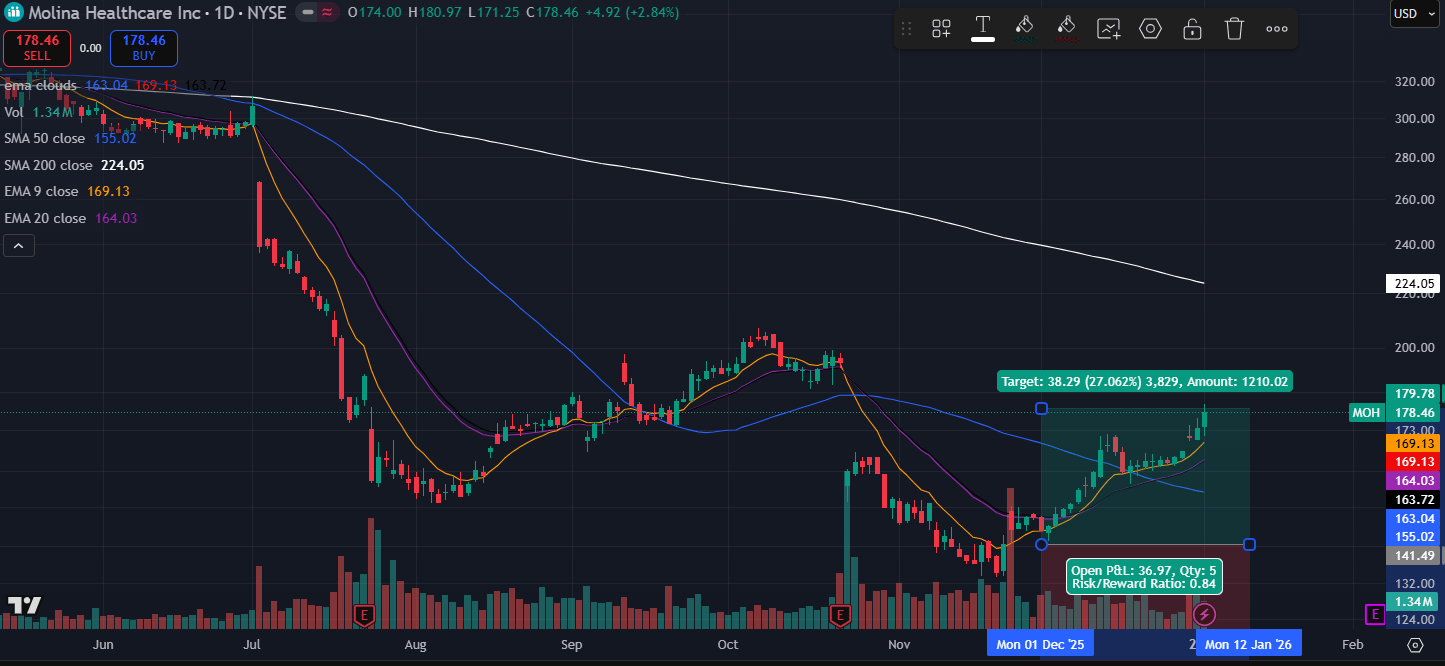

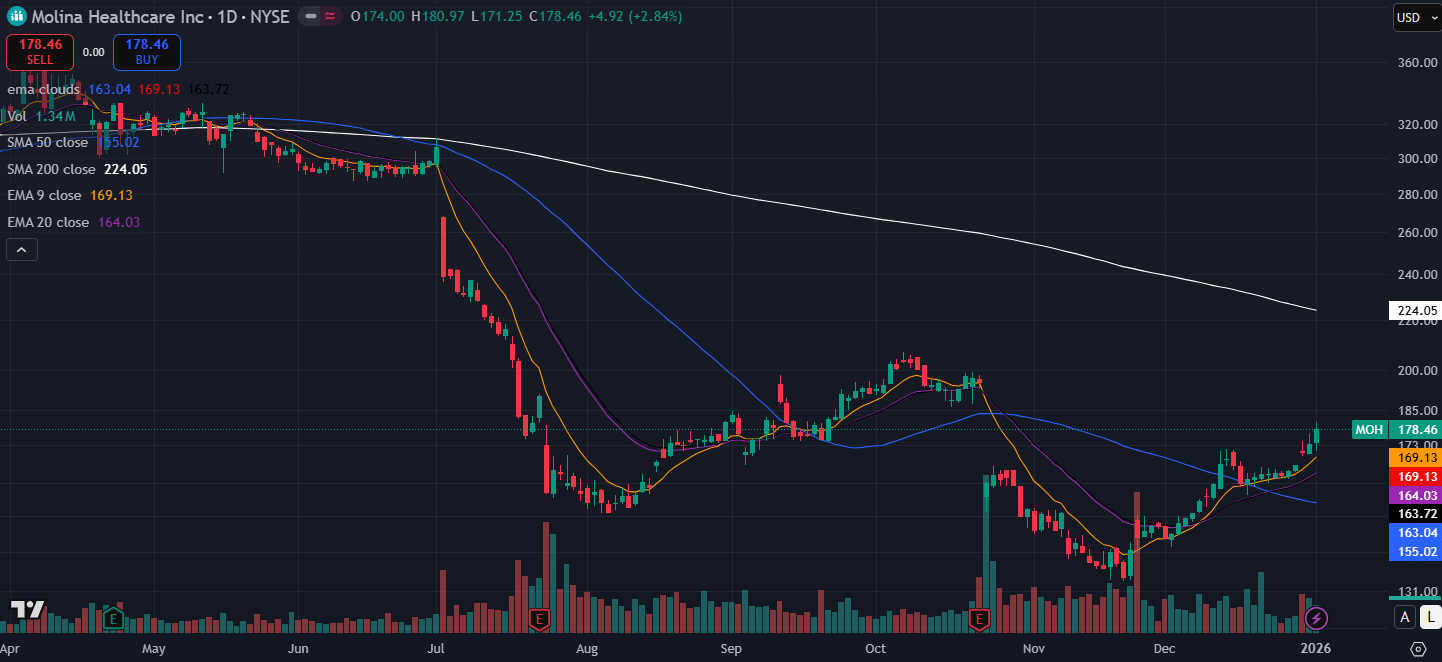

Molina Healthcare (MOH): Priced for Disaster, Positioned for Recovery

Molina has spent the past year being treated as the weak link in managed care.

The stock was down sharply, margins were hit by a spike in medical loss ratios, and management cut full-year EPS guidance multiple times.

We flagged the hidden value in MOH on 30th Nov, and the stock took off post call, gaining ~27%.

Molina is a pure-play Medicaid operator, serving roughly 5.7 million members across 19 states.

MOH is now entering a period where Medicaid rate increases are catching up to elevated medical costs, setting the stage for margin recovery in 2026.

Valuation reflects deep pessimism.

The stock trades near ~8x FY2 forward earnings, among the lowest levels in its recent history, despite delivering ~20% ROE and aggressively returning capital.

Shareholder yield is near 20%, implying the market expects buybacks to be cut materially. That’s a hard assumption to justify if earnings stabilize.

The bear case is clear: medical costs could remain elevated, Marketplace losses may persist, and further regulatory changes could delay recovery. Management execution has also been uneven.

But after a 50% drawdown and multiple guide-downs, much of that risk is already priced in. If margins normalize even modestly, Molina doesn’t need heroics—just mean reversion.

Labcorp (LH) — A Quality Compounder at an Inflection Point

Labcorp is a classic quality compounder and indexed to the Aging Demographics trend. Older boomers means more testing.

As one of the largest global diagnostics and life sciences platforms, LH benefits from long-term tailwinds—aging demographics, rising chronic disease, and growing demand for specialty and oncology testing.

After several years of portfolio reshaping and post-COVID normalization, the business is quietly stabilizing.

The market’s skepticism is largely centered on margin pressure and regulatory overhangs, particularly around PAMA reimbursement cuts and cost inflation.

Those risks are real, but increasingly visible and, in our view, largely reflected in the valuation.

At ~15x forward earnings and a mid-single-digit free cash flow yield, LH trades closer to a utility multiple than a scaled healthcare services leader with strong barriers to entry.

Management’s focus on operational discipline is beginning to show.

The Launchpad initiative targets $100–125 million in annual cost savings, while recent acquisitions in genetics and specialty diagnostics should support higher-quality revenue mix over time.

Importantly, Labcorp generates consistent free cash flow and maintains an attractive shareholder yield, providing downside support.

The bear case hinges on slower margin recovery if reimbursement pressure persists or integration benefits disappoint.

However, with leverage manageable, demand stable, and efficiency initiatives underway, LH offers a compelling risk-reward skew: limited downside if conditions muddle through, and meaningful upside if margins normalize.

Shift4 Payments (FOUR) — the Payments Backbone of Hotels and Stadiums

Shift4 represents a scaled, profitable payments platform that is quietly consolidating share across some of the most complex and sticky verticals in commerce.

Its core advantage lies in owning the full payments stack across hospitality, restaurants, gaming, and sports—markets where reliability, speed, and integration matter more than price.

This has allowed Shift4 to build deep merchant relationships, high switching costs, and industry-leading margins.

The company is translating that positioning into results. Gross profit growth remains strong, free cash flow is robust, and EBITDA margins sit well above most fintech peers.

The Global Blue acquisition meaningfully expands Shift4’s reach into luxury and international retail, strengthening its Unified Commerce strategy and broadening its addressable market.

Over time, this positions Shift4 as a multi-vertical payments consolidator rather than a niche processor.

Valuation also tells part of the story.

After a sharp sell-off, the stock trades at a far more reasonable forward multiple despite structurally higher margins and cash generation than many peers.

The market appears to be pricing in a prolonged slowdown, even as management continues to execute and reinvest at attractive returns.

That said, the risks are real. Leverage increased post-acquisition, same-store sales have shown volatility, and competition remains intense.

Integration execution will matter.

But if management delivers on deleveraging and sustains mid-teens growth, today’s price reflects far more downside fear than upside potential—setting up an asymmetric long-term opportunity.

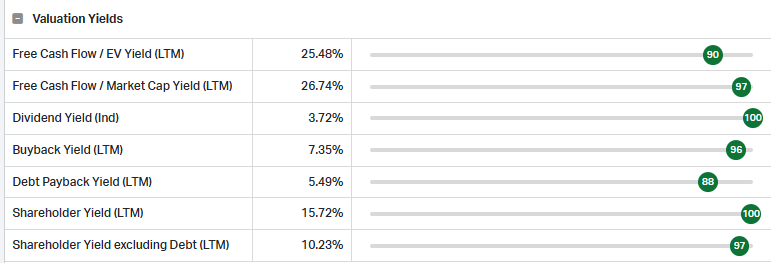

Enova International (ENVA) — A Cash-Generating Fintech Levered to Underserved Credit

Enova was a 2025 stock pick, and we’re brining it back for 2025.

Enova is a non-prime lender that recently secured a bank charter. The bank charter will enable Enova to reduce and diversify its funding costs boosting earnings.

Its core advantage is not balance sheet size, but underwriting precision.

Using machine-learning models built over decades of credit data, Enova prices risk dynamically across consumer and small-business loans, allowing it to grow profitably in niche segments.

The results show up clearly in the numbers.

Revenues and originations continue to grow at double-digit rates, driven by strong demand from small businesses and resilient consumer credit performance.

Margins remain structurally high, with gross margins above 80% and ROE north of 20%, translating into substantial free cash flow.

At roughly 11–12x forward earnings, the stock trades at a discount to its own growth profile, despite buybacks and shareholder yields that signal confidence in the durability of earnings.

The market’s concern is understandable.

Enova operates with leverage, and any sharp economic slowdown or regulatory shift around high-APR lending could pressure credit quality or constrain growth.

Charge-offs have ticked up modestly, and reliance on debt funding amplifies cyclical risk.

Still, much of that caution appears priced in.

Enova has navigated multiple credit cycles, adjusted underwriting in real time, and emerged more profitable.

If credit conditions remain merely “normal,” ENVA offers a rare combination of growth, cash generation, and valuation support.

The Rise Of Defense Tech

The USA launched an attack on Venezuela this week, taking Maduro in custody.

China is on the brink of a war against Taiwan.

Russia is already at war with Ukraine. Iran and Israel has been the headline for over an year now.

The Geopolitical situation is getting tense, and countries know this.

Global defense spending is accelerating.

World military expenditures rose 9% last year - the sharpest increase in more than three decades.

Defense allocations are headed toward military autonomy and AI. Countries are aiming to have intelligent mechanisms that work on their own.

Anthony Antognoli, USCG’s executive officer: “Our vision is to have robotics and autonomous systems as the foundation for the way the Coast Guard operates its missions.”

“It is impossible to do that work [defense missions] with humans and patrol cutters alone.”

These spending increases are creating massive demand for defense tech names.

Venture capital has realized this.

In 2025, defense tech venture investment was already more than double 2024’s total. We don’t see it stopping anytime soon.

The funding is concentrated in large, late-stage rounds of autonomy focused defense companies.

Companies like Anduril and its peer group are benefitting from these financing rounds.

Those financings are only available to sophisticated private markets investors.

Lumida Ventures is also focused on investing in this category. We have had a string of successful investments across CoreWeave, Kraken, and Brad Jacobs QXO, and Canva. All of these have had markups or realizations.

Do reach out now if you want to be in the flow of our next deal.

If you are an accredited investor or qualified purchaser, sign up here to receive communications about our private deals.

Macro

The Misconception Around Labor Market

The biggest surprise this year might be a rebound in payroll employment growth.

You can see why in the claims data:

Initial jobless claims rolled over into year-end, and continuing claims have dropped at the same time.

That combination matters—it suggests the duration of unemployment is shrinking.

In other words, the labor market is healing at the margin even if the headlines still feel cautious.

It isn’t really a “no-hire, no-fire” framing.

Hiring activity is not dead.

In October, the pace of hiring looked relatively normal—about 5.1 million workers.

The issue is that hiring is basically matching separations tied to quits and layoffs.

In prior expansions, hiring typically ran ahead of separations.

Today, it’s closer to a “no-net-hiring” labor market: churn is happening, but the net adds are constrained.

AI and automation are the differentiator in this regime- this reflects in higher productivity and improved margins.

Markets

Is Goldilocks Priced In? Softbank financing OpenAI

I did a 20-minute explainer on how markets are already pricing in Goldilocks. Watch it here.

You can see it in positioning, sentiment, and what’s working in the tape.

The most bullish news this week was Softbank’s $40 Bn commitment to OpenAI.

Markets are trading around the sustainability of capex financing.

I was quite bearish on Tuesday evening…this news is positive and incremental and caused me to become constructive. So long as financing for capex is there, semiconductor markets will hang in there.

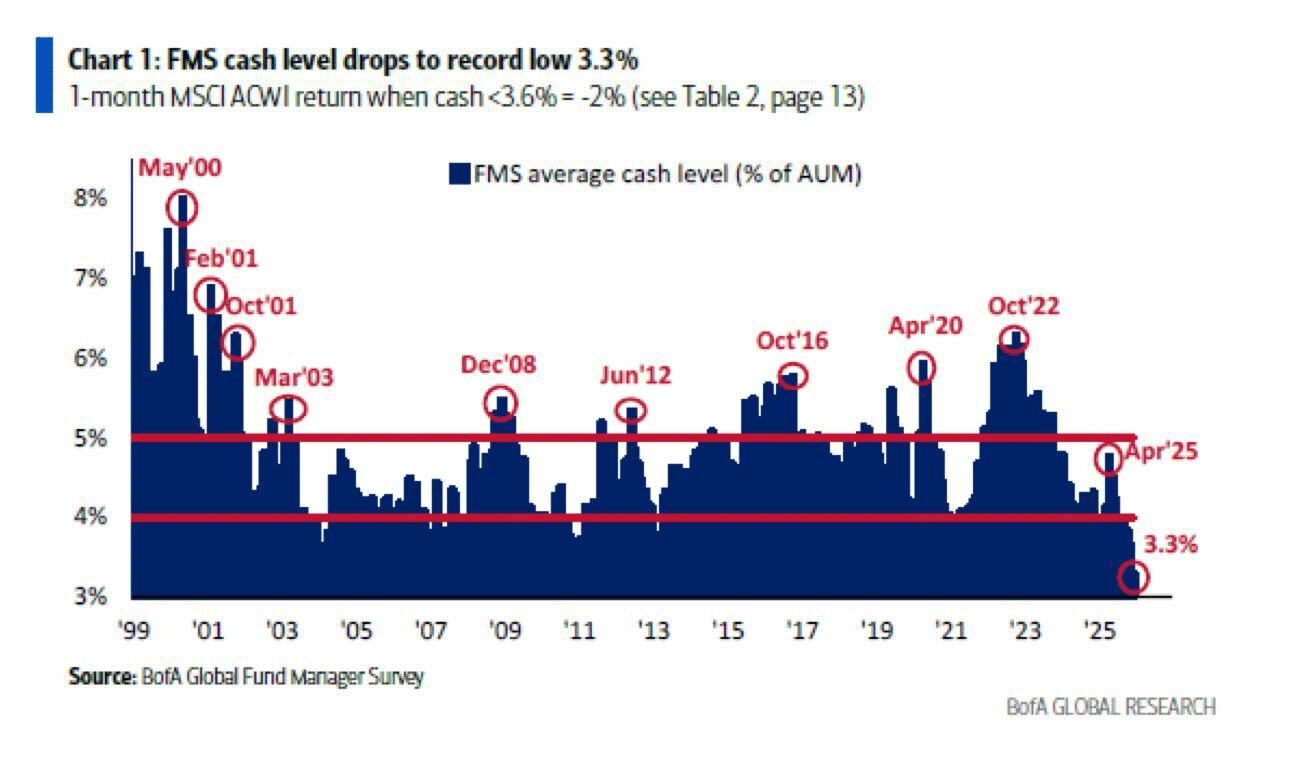

Positioning is the first tell.

Investor cash levels are at 3.3%. That’s very low. It means investors are already all in.

If you’re looking for incremental demand to keep pushing the market higher, the question becomes simple: who’s not overweight?

Now layer expectations on top.

We just finished ~4% GDP growth. It’s a Goldilocks economy.

Macro conditions are sound. There’s no recession. But the economy is not the same thing as the stock market.

The stock market is about expectations, and expectations right now are high.

When expectations are low (think April trade-war stress), it’s easy to exceed expectations. That’s a great time to buy.

When expectations are elevated, you look at history and you usually get weak performance.

Notice expectations were low in 2023... that was a 26% return year for the S&P.

The “smart money” is back in, too.

Coming off the April lows through most of September, hedge funds, institutions, and retail were basically in a turtle shell—post-traumatic stress disorder, too much cash, not investing—while the market ripped.

That rally was fueled by disbelief, even though the macro backdrop was Goldilocks and we just wrapped double-digit earnings growth (and the quarter before that, too).

Markets have figured it out now. People are back in.

Fundamental long/short managers are at the ~80th percentile of net exposure over the past three years. In April they were closer to the 15th–30th percentile. They went from turtle shell to fully back in—fast.

Sentiment is the second tell.

The Bank of America bull & bear indicator is at extreme levels—around 8.5. Everyone’s in the swimming pool. This is a contrarian indicator and it works when it’s at extremes.

December 2021 is a good reference point: elevated sentiment, stimulus checks, record earnings growth—and it was a terrible time to buy stocks.

Markets are forward-looking. Where we just left doesn’t matter. The setup ahead is what matters.

And it’s not hard to see why the “Fed rescue” narrative is shaky.

We just had 4% GDP growth. You don’t cut rates in 4% GDP growth.

Inflation is also still sticky enough that it’s hard to see how the Fed comes riding in to save risk assets if we get wobble.

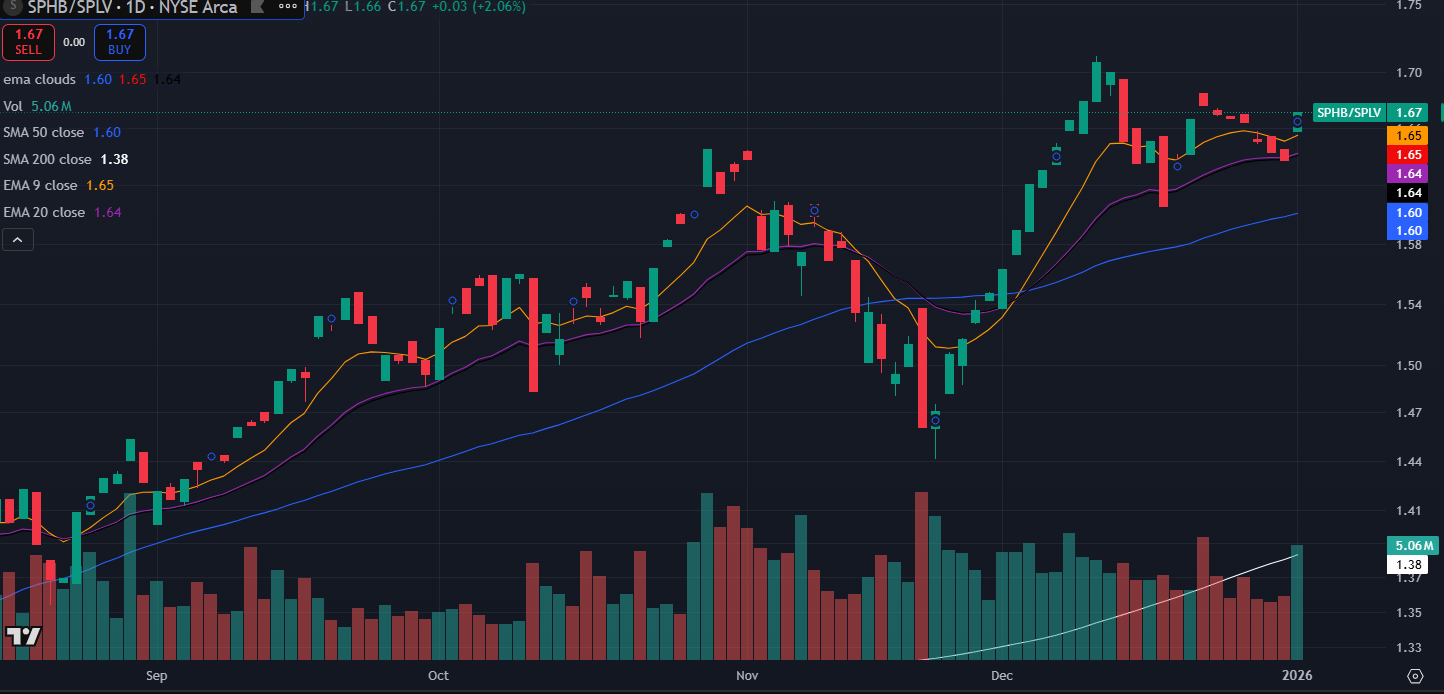

High beta is where you see the stress first.

The high beta vs low beta ratio is breaking trend—breaking down below the moving averages, with technical signals rolling over.

High beta had an extraordinary rally off the April lows—massive short squeeze.

But now you’re seeing the leaders lag.

Robinhood is down ~26% while the S&P is just a few points from all-time highs. That’s an example of high beta fragility.

Palantir is down less (~14%) but it’s flirting with a head-and-shoulders type setup—lower high, not clean.

Tesla tried the cup-and-handle breakout and failed, and failure of a bullish pattern is quite bearish.

So what works in a mean reversion tape?

Value over growth.

Growth vs value is lower highs, lower lows—downtrend. Value is beating growth. If you’re going to be invested, you should probably be in value over growth.

Value is near highs and still respecting its moving averages; growth hasn’t made new highs since October, which is classic weakness. The summary term is quality value.

And you can see it in individual names: Molina is straight up since late November—value + healthcare.

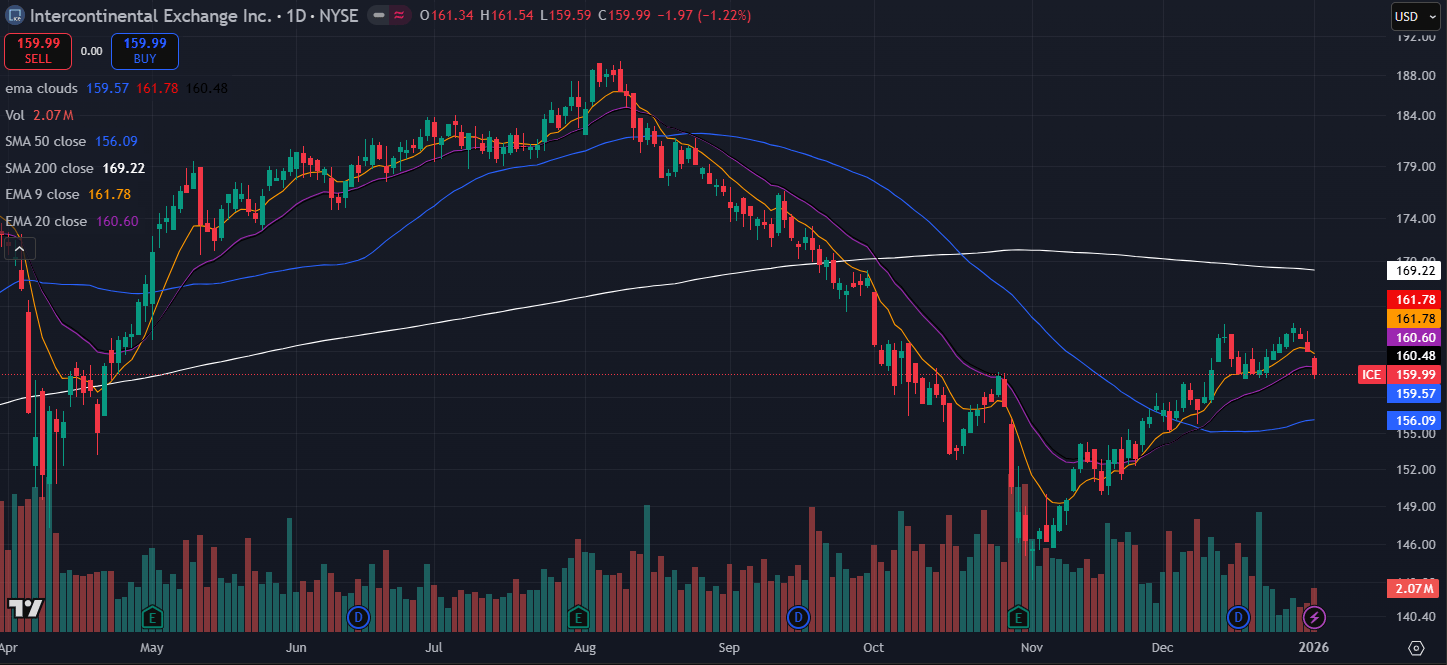

ICE has been outperforming since early November.

We flagged both these names in our earlier newsletters right when they were beaten down.

Tactically, where we stand today, we believe high beta can do a counter-trend rally.

What makes markets tricky is the medium term and short-term views can conflict. This is one of those times.

It’s important here not to buy the dip in stocks that had incredible runs in 2025 like Robinhood and Palantir - or at least rotate after a bounce. Remember Cava or Chipotle? These also had incredible runs. After their euphoric peaks, they lag. And I expect we’ll see that here also.

Semis are the third tell—and it’s all tied to OpenAI.

Semiconductors pulled back on news reports about concerns around OpenAI’s ability to fund its trillion dollars of obligations.

Then OpenAI leaked to the Wall Street Journal they’re planning to raise $100 billion, and semis rallied. The market is basically running a “we’re so back / it’s over” cycle around OpenAI.

Why it matters: $100 billion from OpenAI gets spent substantially on Nvidia, which flows to TSMC, Applied Materials, KLA, Lam Research—the whole supply chain.

$100 billion in revenue is substantial. Nvidia’s margin structure makes the market-cap math enormous.

But markets are forward-looking—and they’ve already discounted a substantial amount of that future spend in semis and Nvidia.

So now the debate is how much of that spend is real. That’s why you’re getting volatility.

The three things to watch in the first half of next year:

OpenAI financing—how does it go? It probably gets done, but does real smart money participate or not? If they don’t, it’s a very bad sign.

Midterm elections—generally you get a pullback in the first half. This year probably isn’t different. Healthcare outperformance could be discounting a change in Congress.

Growth-to-value and high beta—this rotation is already showing up, and it’s the cleanest expression of mean reversion.

One more thing: IPO supply.

There’s a lot of hope in markets—SpaceX and OpenAI at trillion-dollar valuations. That’s a lot of supply for markets to digest.

To buy a share, you’ve got to sell another share. We’ve seen the IPO boom and IPO hangover cycle before.

If the IPO ETF keeps bleeding out, it’s going to be hard to get an IPO market going.

That’s the setup.

The Power of Compounding

I have a client - a divorced mother of two teenagers.

She signed up in Spring 2024 with $3 MM in net worth.

Her income requirements were $250K after tax.

That means $300 K pre-tax. She also needs to combat inflation.

The probability of her achieving this goal objectively according to various planning tools was challenging.

She had a moderate risk tolerance.

So, we put her in two equity strategies (one active), and two higher yielding strategies that generate predictable cashflow so she can sleep at night and fund living and travel expenses.

We sprinkled some pre-IPO deals.

Two years later, her net worth is $5 MM+.

Now she could de-risk.

What we are doing now is ‘defeasing’ the income requirement with part of her portfolio.

We put the excess savings above her goal level into growth strategies.

Lesson 1: Compounding works.

Lesson 2: An ideal asset allocation must match the risk tolerance to ensure emotional adherence

Lesson 3: Bull markets are amazing for wealth creation.

There are many, many millionaire next door types that stuck to the process.

Don’t fall for this Guaranteed Mediocrity nonsense.

Lastly,

Lesson 4: your best odds of making serious money is at the end of a bear market when psychology is frigid and you don’t want to buy.

YOLOing when sentiment is flush is like buying high and selling lower.

Out-performance comes from being Non-Consensus and Correct.

Get to emerging trends early, and sell crowded and expensive themes.

Digital Assets

Stablecoins Aren’t Eating Banks—Yet

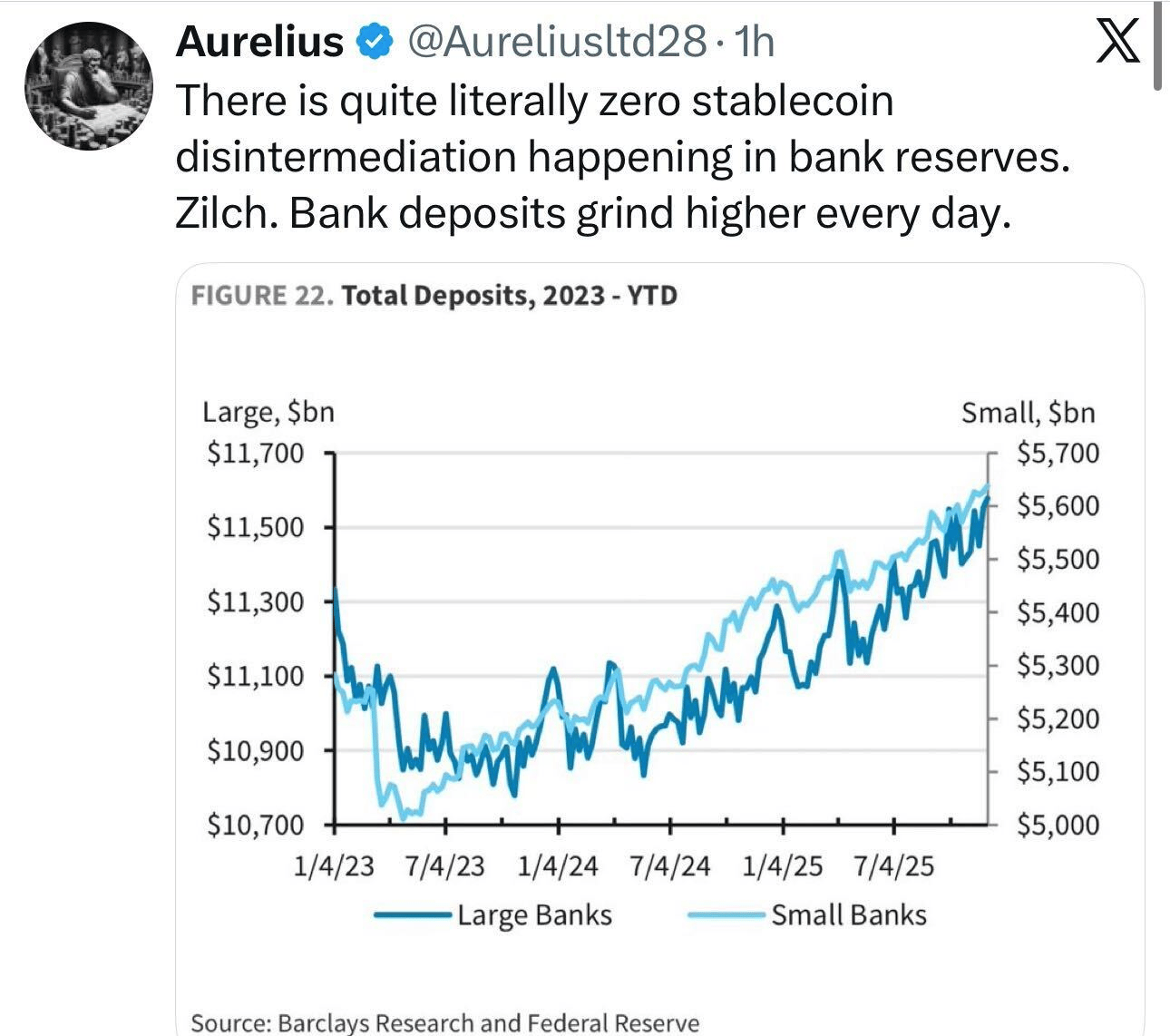

Despite persistent narratives around stablecoins “disintermediating” the banking system, the data tells a very different story.

Bank deposits—across both large and small institutions—continue to grind higher. There is no evidence of meaningful capital flight from traditional deposits into stablecoins at the system level.

In fact, deposits have steadily increased even as stablecoin market caps have grown, suggesting coexistence rather than substitution.

This matters because much of the bearish thesis around banks and bullish extrapolation for stablecoins rests on the assumption that digital dollars are hollowing out bank balance sheets.

That simply isn’t happening today.

Stablecoins currently function primarily as transactional instruments within crypto markets—used for trading, settlement, and on-chain liquidity—not as a wholesale replacement for savings vehicles, payroll accounts, or corporate cash management.

For now, stablecoins complement the financial system rather than disrupt it.

They improve speed and programmability at the edges but do not yet replicate the full utility stack of insured deposits, credit creation, and regulatory trust that banks provide.

The takeaway: digital assets may be reshaping how money moves, but not where it ultimately sits—at least not yet.

Lumida Curations

The Mag 7’s Grip Is Loosening

Markets are beginning to rotate beneath the surface, as leadership gradually broadens beyond the Mag 7 toward companies quietly benefiting from AI-driven productivity and margin expansion rather than headline growth.

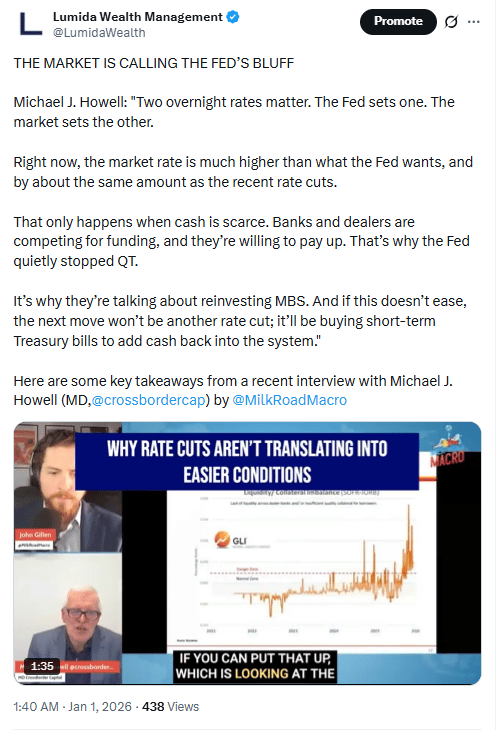

Markets Are Defying the Fed

Despite rate cuts, funding conditions remain tight as market-set rates stay elevated, signaling cash scarcity and forcing the Fed toward balance-sheet tools rather than conventional policy easing.

Hydration Signals Aren’t One-Size-Fits-All

Common dehydration checks like skin turgor or nail color can offer quick clues, but age and body composition meaningfully affect how reliable those signs actually are.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.