Here’s a preview of what we’ll cover this week:

Macro: Fed’s Bullish On The Economy; Watch the Long End

Markets: Still a Bull Market; Time For Mainstream Ideas; The Ignored Value; Out Of Semis Into Software; Google Is Expanding; Disney And OpenAI Deal;

Lumida Curations: Prediction Markets Are The New Information Layer; The DeFi Regulatory Mismatch; Magnesium Is the Migraine Hack

Lumida Wealth Is Hiring

I am looking for a Director of Client Service (NY/NJ) to join our leadership team at Lumida Wealth.

The cheat code to create wealth is to join a rapidly growing company.

Must have deep experience in alternative investments, understand trusts and estate, and wealth management, and tech forward.

This is your chance to shoot your shot.

Target Total Comp: $300k

Apply here.

Unprecedented Investments in Defense Tech

Pete Hegseth has previewed DOD spending plans. I’m surprised this hasn’t received much coverage. We believe it’s an opportune time to “Front Run the Pentagon”.

The next decade of defense spending won’t be about planes, ships, or missiles.

It will be about systems that can see, decide, and act without humans in the loop.

Trump’s $200Bn Golden Dome project is a step in that direction.

Golden Dome is a nationwide defense architecture that tracks missiles, drones, and hypersonic threats across space, air, and ground in real time.

You can’t build that with people and legacy platforms.

You need autonomy.

You need AI.

A system like Golden Dome requires persistent sensing, automated threat detection, real-time data fusion, and autonomous command-and-control.

This is where defense budgets are headed. We believe there are a number of private market opportunities that can become brands and successful investments like Anduril in the next few years.

Lumida Ventures is actively working on investment opportunities in defense technology.

If you’re an accredited investor or qualified purchaser, sign up here to receive priority communications.

We have previously done successful deals with Coreweave, Canva, QXO and Kraken - all of which have markups or realizations at gains.

You can read our success stories here.

Out Of Semis Into Software

I did a Tesla FSD livestream on why I am bearish on semiconductors.

Now that markets have recovered to the “Sam Altman Highs”, I believe we’re going to see rotation out of semiconductors and into software.

The issue is that hype exceeds reality on semiconductor spend.

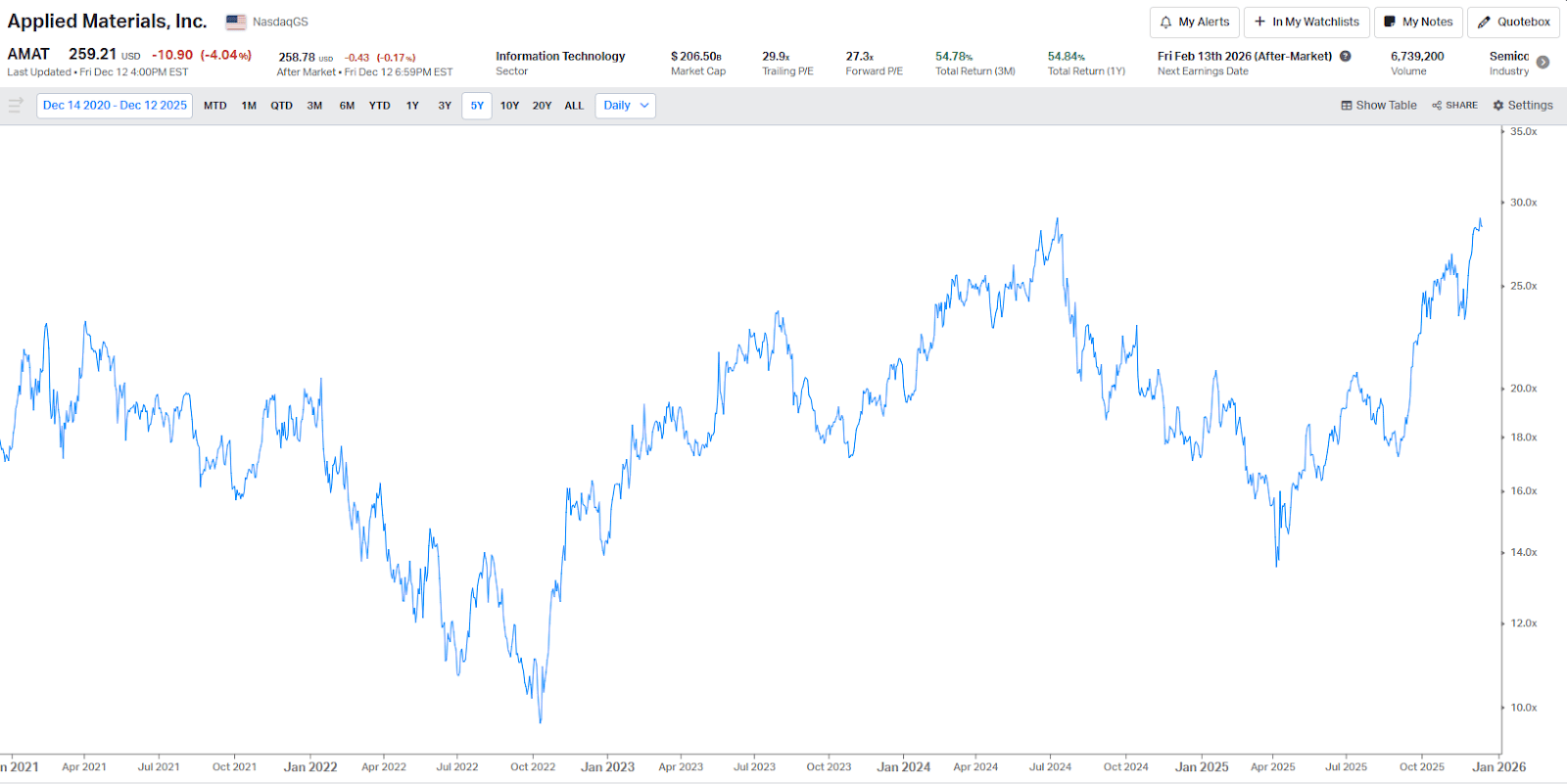

Take a look at the valuation multiple for Applied Materials for example. We are now in the nosebleed section.

Investors are questioning how OpenAI will achieve its $1 Tn in committed spend with sub-$20 Bn in revenue.

That’s going to take a lot of debt financing…and debt providers are already holding back (see Oracle for example). It will also take a lot of equity financing.

But, OpenAI is already raising from Softbank for Project Stargate which is equivalent to ‘last call’.

OpenAI will need to cover approximately $207Bn in capital shortfall by 2030, as per HSBC, and it won’t be generating profit till then.

We are also seeing intesifying competition from well-financed players like Google and Meta.

It’s hard to see a world where AI isn’t simply a free product (like other Google and Meta products) and how OpenAI fares in that world.

We wrote about Software a few weeks ago, and continue to see this theme do well.

We are positioned for this with exposure to ESTC and Workday, and a short position in SOX ETF.

Software and semis are both subsectors in technology, and we have observed they tend to compete with one another for capital. When one is overbought, the other is oversold, and vice versa.

Software has been beaten down.

But, these names have earnings growth, free cash flow and buybacks and distribution.

The “AI kills software” narrative that dominated two years ago is largely priced in now.

Some software companies will struggle. But others are actually benefiting.

They already have installed customer bases. They can layer in AI.

They can become AI-relevant without blowing up their balance sheets.

Atlassian Corp is an example. Read our thesis on this name here.

The answer is not the analysis of whether it can or cannot.

The approach to answer this is ‘what is priced into markets’.

If debt ratings start to come under pressure, then the cost of capital rises. When that happens, the perception around capex will be more restrained.

And even a perception of slower spending is enough to move asset prices. This is being increasingly priced into the markets.

The bubble in AI is in Private Markets, but it will impact the semiconductor supply chain.

We are of the view that Meta is still cheap, and Nvidia at a sub-25x forward PE is attractive.

But the overall theme can be under pressure as we see a continued shift to value and “Main Street” type opportunities (look at retailers crank for example).

Macro

Fed’s Bullish On The Economy

The Fed cut 25 bps this week as expected. Since September 2024, the Fed has cut 175 bps, bringing the federal funds rate into the mid-3% range.

Powell signals Fed is now “well positioned.”

His speech highlighted consumers are strong, business confidence is solid, and the economy is growing.

Powell: “Available indicators suggest that economic activity has been expanding at a moderate pace. Consumer spending appears to have remained solid, and business fixed investment has continued to expand.”

“The consumer continues to spend. So it looks like the baseline will be solid growth next year.”

The main takeaway from the Fed is the dot plot and the Summary of Economic Projections.

The FOMC sees a pickup in growth next year, and a decline in inflation, and growth in productivity. We agree with that outlook - and it’s a constructive tonic for risk assets.

Don’t forget the stimulus checks too, which will serve as a boost to “Main Street”.

Look at the Retail ETF index and you can see markets are already discounting spend in the quarters ahead:

This indicates the Fed is underwriting productivity growth- something I’ve been emphasizing for a while.

Powell highlighted this in his speech. “Productivity has just been almost structurally higher for several years now."

We are already observing glimpses of the future.

This week, McDonalds launched their fully automated restaurant chain in Texas, which does not involve any human staff at all.

This is a concept store. But it’s a preview of what’s to come.

Watch the Long End

The key risk to monitor is the long end of the curve.

We saw in September 2024 what happens when the Fed cuts but long rates rise driven by bond vigilantes. You have to watch that carefully.

I think this time is different.

Markets perceive a cooling labor market, not because labor is weak, but because growth in labor supply and demand is lower.

That’s just the physics of the system.

Importantly, corporate income and personal income tax receipts remain strong. And, consumer spending is strong.

These are reliable indicators for the real progress of the economy.

Our thinking is that consumer discretionary linked categories will do well next year, and healthcare, and leaders in technology (esp software).

We’re still sorting out our views on homebuilders - we believe this category would rally if the 10-year breaks below 4%. It’s hard to get a view on that.

Add in tax cuts and rebates, and you have a setup for improving consumer confidence and spending next year.

Markets

Still a Bull Market

The Dow Jones and S&P are cranking higher, while tech index Nasdaq lags.

The category broke out to all time highs.

Small caps are outperforming other categories.

Value is also outperforming growth. (Take a look at our newsletter called the “Revenge of Warren Buffett” which anticipated this shift.)

We expect that to continue next year - benefitting from lower interest rates, and consumer stimulus.

We continue to believe high beta categories of animal spirits have put in a local top. Robinhood, Palantir, Bitcoin, Uranium stocks are lagging.

Meanwhile, quality names like ICE and S&P Global are quietly rallying. We suggested buying those on this day a few weeks back. Read it here.

Markets look constructive into the year-end.

We’re near all-time highs, yet consumer confidence is near the lows.

That disconnect matters.

Confidence is low not because the economy is collapsing, but because people are anxious.

Why are they anxious? Doom scrolling.

Geopolitics. Headlines. Televised news. Social media. Constant doom-scrolling.

That’s driving sentiment, not fundamentals.

Market tops don’t form when people are anxious.

Historically, major tops come after long periods of euphoria.

You see it in positioning. You see it in sentiment. You see it in behavior.

That’s not what a market top looks like.

This is a classic “wall of worry” market.

I was speaking with an RIA recently who joked that his office feels like a therapy couch.

Clients come in trying to reconcile how bad the world feels with the fact that markets are still holding near highs.

That tension tells you a lot.

People don’t trust the rally. They’re cautious. They’re hedged. They’re worried they’re missing something.

That’s not how bubbles end.

Wary bulls are the best kind of bulls.

When sentiment stays skeptical and positioning isn’t euphoric, rallies tend to persist longer than people expect.

This doesn’t mean there won’t be pullbacks. In fact, the 1H of a midterm election often does see a 7% on average pull back.

But, those pullbacks are buyable.

The Ignored Value

It’s hard to make the case to own bonds in a “higher for longer” inflation environment.

There are plenty of public markets securities that offer dividend yield and earnings growth.

Why own Sovereign debt? I wanted to deep dive into one example of that.

This is not a bad idea for the conservative part of your portfolio - and value is working now.

A lot of attention now is on Warner Brother. We see ignored value in Comcast Corp which also has unique IP and content.

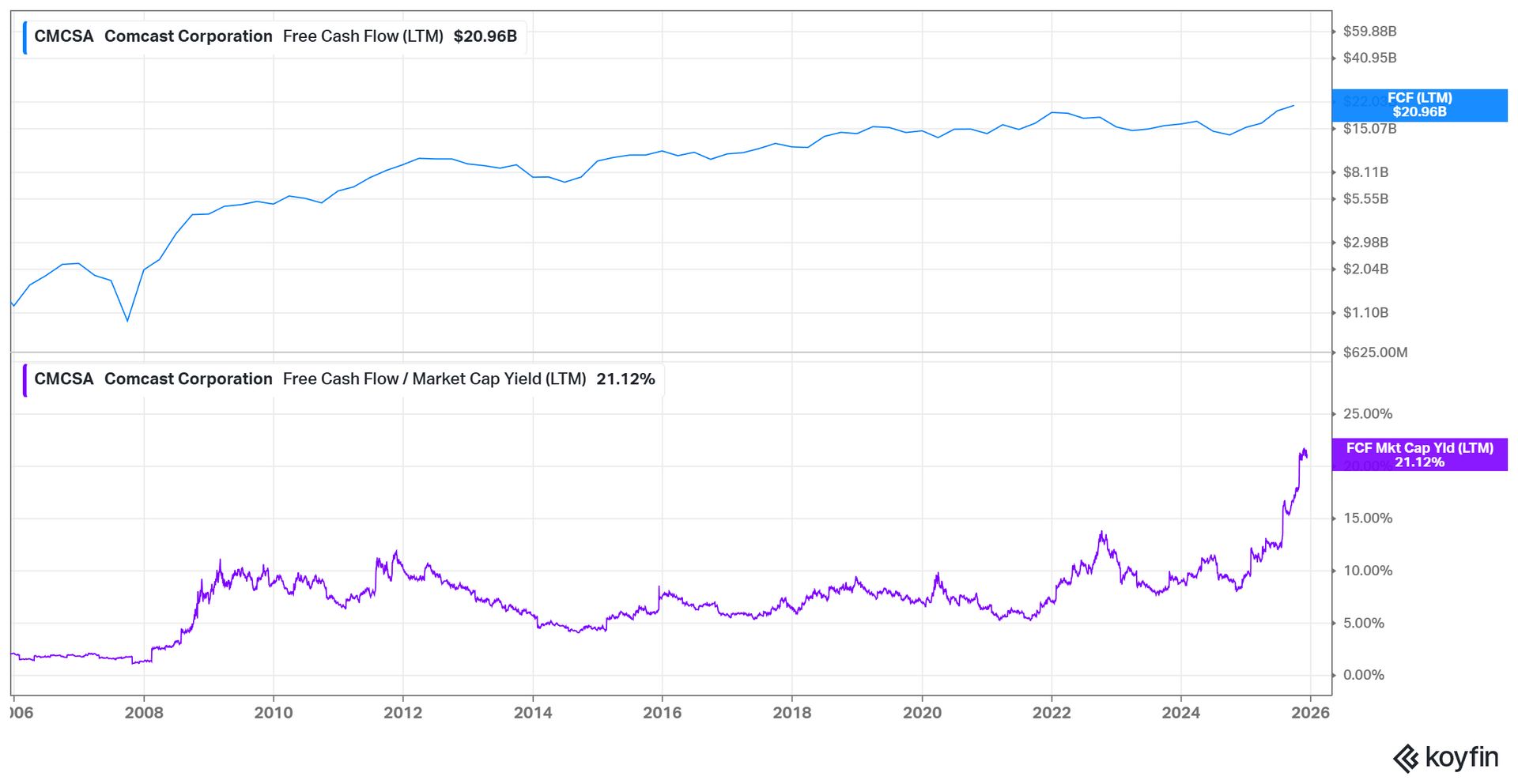

Comcast (CMCSA) has value in premium content libraries, supported by strong free cash flow.

CMCSA’s stock has languished as cable cord cutting continues and its overall membership declines. We think it’s overdone with the name at 7x forward PE and a 20% free cashflow yield.

You have to believe that free cashflow yield is going to get cut in half. It’s hard to see that…

In fact, Comcast has grown their revenues and free cashflow in recent years, and analysts expect that to continue.

Comcast’s businesses generate steady, recurring cash flow from its business lines.

Comcast has been doing buybacks for years. They are prudent allocators of capital. Take a look at its outstanding sharecount.

Take a look at Comcasts PE ratio. We’ve never seen it this low…and revenue and cashflow is growing.

How about the technicals?

Comcast is sitting at multi-year support…despite the business growing during this time period.

The distance of price from the 200 day moving average is also severe. This is a “mean reversion” opportunity.

Comcast also has valuable IP content that could make it an attractive asset for failed suitors of Warner Brothers. IP content has a lot of value in the age of AI. (See Disney’s deal with OpenAI for example.)

Comcast owns NBC Universal. They explored combining these assets along with the streaming business - but ultimately lost out to Netflix’s top bid for Warner Brothers.

This is where Comcast’s story gets interesting.

Its Content & Experiences segment—NBCUniversal, Peacock, Universal Pictures, DreamWorks, and Sky Studios—accounts for roughly 38% of revenue and delivers the upside.

Live sports, including Sunday Night Football, keep viewers glued to NBCUniversal.

Streaming platform Peacock now has 41 million paid subscribers, benefiting from higher subscription prices and over 20% growth in advertising revenue.

Comcast secured exclusive NBA broadcast and streaming rights in an 11-year, $76B deal through 2035–36.

Comcast is also simplifying its portfolio with divestitures.

Comcast is focus on higher-growth assets—NBC, Peacock, Universal Studios, theme parks, Xfinity, and Sky.

The bear case?

Starlink disrupts cable broadband, and the last of the boomer generation cuts their cord. Netflix builds a behemoth and content for NBA slides and there’s no real M&A interest in the asset.

But unlike peers like Charter (CHTR), Comcast pairs connectivity with content optionality, trading at a lower PE (~4.5x vs 5.7x) and generating a 21% free cash flow yield—roughly five times what it spends on buybacks.

Why own sovereign debt when you can own Comcast?

Disclosure: We own Comcast

Google Is Expanding

Gemini is being rolled out as the first enterprise AI on the Pentagon’s GenAI.mil platform, designed to support millions of users.

Gemini is already embedded across Google’s core products - Docs, Gmail, Sheets, Search, and Cloud.

This is driving rapid adoption.

If AI shows up where people already work, they use it by default. There’s no behavior change required.

Google has three things most AI-native players don’t:

A massive installed user base

Deep enterprise and government relationships

Infrastructure that already runs mission-critical workloads

That combination lowers friction. It also lowers switching costs for users and buyers.

We wrote last week how Google is catching up against OpenAI. Read it here.

We won’t be the buyers of Google at current valuations - it was a solid purchase in July when AI-kills-search narrative led to massive drawdowns. It was priced at 20x P/E NTM then- today, it’s at 30x.

Why is Amazon lagging so much?

This post was at the bottom of the 2022 bear market.

Back then, Amazon’s PE was 100x.

After 3 years of growing earnings and going nowhere, the multiple is around 30X.

I’d still rather own META which is growing earnings faster and is priced at 21x.

The capex rising is the bear case for Meta.

But, their CFO and Mark can essentially ‘paint by numbers’ their earnings trajectory by controlling these levers.

And, I expect LLM competition to diminish.

Have a look at Jason’s take here.

DISNEY AND OPENAI DEAL

Disney announced that it is investing $1 Bn in OpenAI, and will use OpenAI's APIs.

A few observations:

1) Disney could have adopted the APIs without spending $1 bn and being a de facto committed customer

2) Does Disney have any competitive advantage in late stage ventures? Is Disney's responsibility capital allocation?

(No.)

3) Did Disney derive any competitive advantage from the investment?

(No.)

4) Disney did license its characters to OpenAI.

This part actually makes sense...

The mistake here - Disney should be receiving major revenue from OpenAI from licensing content.

Reddit is making money licensing its content, why isn't Disney.

5) Bog Iger over-paid for the Star Wars franchise.

Now he has done the deal with Open AI in reverse.

Bob is desperate to get some AI multiple in the stock.

Bob Iger is a highly over-rated CEO and is driven by ego not shareholder returns.

Investor Tip:

How is it possible for the S&P 500 to out-run GDP growth year after year? Is that sustainable?

Take a step back.

2023: S&P up 20%+

2024: S&P up 20%

2025: S&P up 16%

How is this possible?

GDP hasn't kept pace... We have deficits, wars, etc.

This is your self-test to understand markets.

Bill Gross famously got this wrong - the link between GDP and market returns - a decade ago.

Think about it for a minute before reading on.

The S&P can and will out-run GDP growth due to Earnings Growth.

Where does it come from?

1. Operating Leverage:

A company can grow revenue 5% but earnings will go up 12%.

GDP captures the top-line ('revenue').

Mr. Market focuses on the bottom line ('earnings')

The company gets disproportionate earnings due to fixed costs that don't scale with revenue.

2. Productivity Growth

The one free lunch. Companies become more efficient with technology, cost cutting, outsourcing, and lower input or energy costs.

Lower oil and nat gas prices directly boost corporate margins and reduce the cost of energy for consumers.

3. Interest expense

Lower interest rates enable firms to refinance debt.

This reduces left-tail insolvency risk, and increases corporate profits.

4. The Market Prices the Future, Not the Present

GDP is backward-looking.

Markets discount expected earnings 6–18 months ahead.

A weak GDP print today may coincide with falling inflation, lower rates, rising productivity, and future earnings growth—all bullish for equities.

Lumida Curations

Prediction Markets Are Becoming the New Information Layer

Once dismissed as gambling, prediction markets are rapidly emerging as real-time signals for public sentiment, economic outcomes, and major events - often faster and more accurate than traditional media.

The DeFi Regulatory Mismatch

DeFi exposes a growing gap between legacy financial regulation and internet-native markets, where trust shifts from intermediaries to code and responsibility increasingly sits with the user.

Magnesium Is the Migraine Hack

One of the most evidence-backed supplements for migraine, magnesium works by calming neuronal excitability and improving cerebral blood flow, targeting the biology of migraines at the root.

Meme

My thoughts on OpenAI..

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.