Here’s a preview of what we’ll cover this week:

Macro: PCE Adds Support For December Cut; How’s the Labor Market?; AI Is A Productivity Engine

Markets: Growth Vs. Value; The EU’s War On Meta; How Far Can Netflix Drop?; Google Is Catching Up Fast; Defense Tech: The Next Structural Growth Lane; The Midterm Election Tailwind; Trump Bump?; International Equities Are Leading

Digital Assets: All Markets On Chain; The Founder Behind Polymarket

Lumida Curations: Bitcoin’s Four-Year Cycle Is Breaking Down; AI Is On Track to Run at Near-Zero Energy Cost; Alcohol Truly Delivers “Empty Calories”

Spotlight

I was in Miami this week, attending the Art Basel 2025 - funny thing: I don’t invest in art. I invest in businesses - investments that generate cash flows.

I did two livestreams with exciting investors from the event. You can watch them here:

I also visited San Francisco on the way back for a housewarming party hosted by Vance Spencer- Framework Ventures.

Got a chance to use Waymo during this trip - I have been a big fan of Google, and Waymo is one of the reasons why. I did two livestreams during my rides.

The Rise of Defense Tech

The last twenty years were about software.

The next 5 years are about hardware.

Many of the most valuable companies in the world are hardware: Nvidia, TSM, Tesla, etc.

Where are we focused for our next theme?

Defense Tech.

It is entering a new phase with Trump's latest focus on the US drug war.

Agencies, like Southern Command, the Coast Guard, DHS, are now receiving multi-year budget increases to be spent on robotics and autonomous systems.

This is driving real demand for Defense AI startups.

Drone and imaging companies are helping track small narcotics vessels across millions of square miles.

AI platforms are mapping fentanyl networks the same way they once mapped insurgent cells.

Counter-drone systems from Ukraine are now deployed at the southern border to defeat cartel drones.

Anthony Antognoli, Coast Guard’s program executive officer, notes “It is impossible to do that work with humans and patrol cutters alone.”

“Our vision is to have robotics and autonomous systems as the foundation for the way the Coast Guard operates its missions.”

Autonomy is becoming the center of military operations.

These counternarcotics and border security missions are becoming reliable growth engines for Defense technology companies focused on autonomy, robotics, and applied AI.

Lumida Ventures is working on an exciting deal with a Pre-IPO company in Defense technology. Sign up here to be on the priority communications list if are an accredited investor or qualified purchaser.

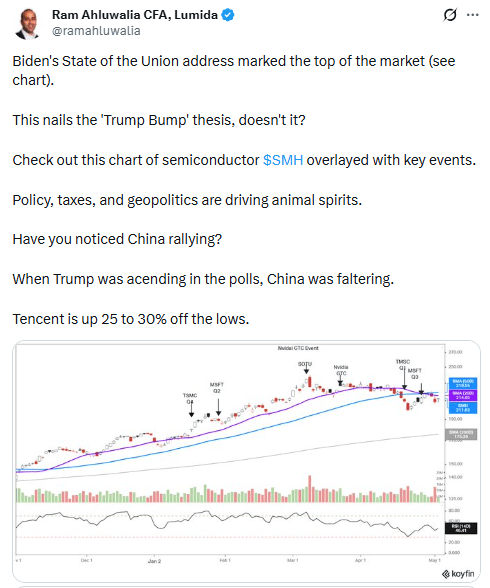

Wither Trump Bump?

Back in 2024, I shared a thesis called the ‘Trump Bump’

(See this thread for the evidence of a Trump Bump in equity markets leading up to the election.)

I am seeing evidence after the blue sweep in October that markets are starting to discount a DNC win in Congress.

I expect a continued back and forth on this theme in markets.

1) What’s the biggest sector winner since those elections?

Healthcare stocks.

2) Solar stocks stand to benefit in a DNC regime.

First Solar (FSLR) is cranking.

3) How about Day care service providers, and other family benefits?

Bright Horizons (BFAM) is cranking off the lows post election.

4) META brought on UFC chief and Trump friend Dana White on its board and terminated a DNC aligned advisor after the election.

Meta had an unusual sell off post election.

5) Crypto assets have also sold off hard post election results.

What other examples do you see?

(Below is my thread showing the Trump Bump hypothesis before it was Consensus.)

It’s Time To Take Action!

Rooftop and solar tax credits are set to wipe down at the end of December, and investors are rushing to cash in this opportunity.

And, why shouldn’t they?

Solar Investment Tax Credit (ITC) allows you to offset federal taxes by financing qualified solar projects.

In practical terms, an investor with a $100,000 tax bill could put roughly $60,000 into a qualified solar project and reduce their tax liability by nearly 40%.

Corporates have been doing this for years; in 2024 alone, more than $20 billion in solar credits were traded, up four-fold from the year before.

Lumida can help you avail these solar tax credits, and reduce your tax liability substantially.

We have a limited capacity on this opportunity; so, now is the time to act!

Click here to know more about this and other tax mitigation opportunities. You can also book a free consultation call here, and learn how Lumida can help you save taxes.

Macro

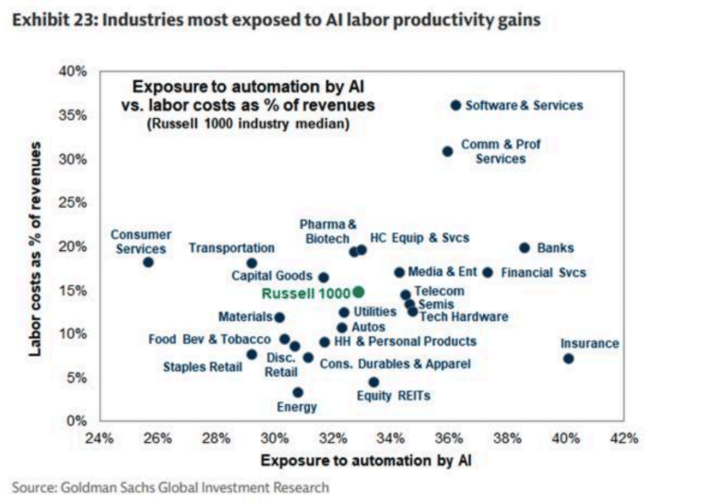

AI Is The Productivity Engine

The benefits of AI are appearing in a number of industries.

Slower price growth is increasingly being driven by productivity gains, especially in service-heavy sectors where AI and workflow automation are starting to reduce unit labor costs.

We’re already seeing the results:

Goldman Sachs estimates that generative AI could raise labor productivity by ~1.5% per year over a decade and add roughly 7% to global GDP.

PwC’s 2025 AI Jobs Barometer notes that industries “most exposed” to AI saw 3x higher growth in revenue per employee than the least exposed sectors.

When firms can produce more with the same headcount, or hold staffing flat while output rises, the pressure to pass through higher prices diminishes.

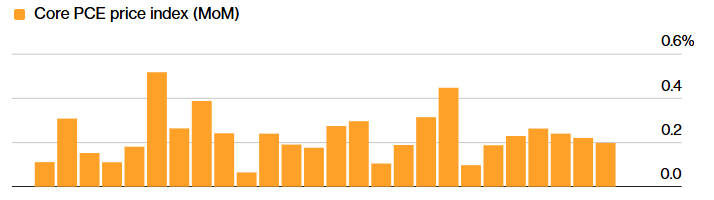

Lower PCE also means Fed will have one less thing to worry about for the December meeting.

We think the Dec rate cut is almost certain at this point - the economy doesn’t need it, but markets are pricing it.

Inflation Is Behaving Well

The inflation print for September came in exactly where pro-rate cut policymakers hoped:

Moderate, stable, and below 3% on both headline and core.

How’s the Labor Market?

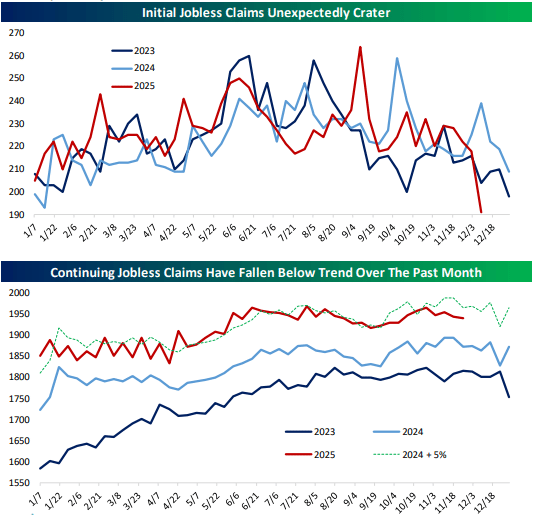

This week, we got two divergent data points on the labor market.

Initial jobless claims print delivered one of the sharpest surprises of the year.

Initial claims cratered to their lowest level since 2022, and excluding that period, the lowest since 1969.

Remember how everyone thought the labor market was cracking over the summer? Next time you see those headlines, just take a deep breadth and remember how bad the data quality is.

The economy is an organism, fuelled by earnings and population growth, and it exhales. The data that we use to measure it (outside of corporate earnings) are skewed, noisy, and have massive standard errors.

Continuing claims, which had been drifting 5% higher YoY through the fall, abruptly rolled over as well.

All of this is quite bullish - especially for breadth and consumer discretionary stocks.

Take a look at how Dollar Tree, Dollar General, American Eagle and other retailers are doing.

Costco (over-priced bubble stock) meanwhile is giving back ground to names investors ignored.

The ADP Report is Garbage

The ADP report showed a contrasting view with payrolls declining by 32000 in Nov.

What do we make of it? Nothing!

ADP reports have structural deficiencies.

Simply put, ADP clients aren’t representative of the U.S. labor market.

Trends in Offshoring, contract work, gig economy, (illegal) immigration change the data.

ADP spikes/dumps in yields tend to mean-revert.

It’s noise. Look out for any over-reactions.

Overall, the underlying message around labor markets is unchanged:

It is cooling - we are in a “low-hire-low-fire” environment.

Businesses are leveraging AI and automation to increase output without increasing workforce, which is reflected in higher productivity, and improved earnings.

The December rate cut won’t fix the labor market, but it will most likely create asset-based inflation.

Markets

Growth vs. Value

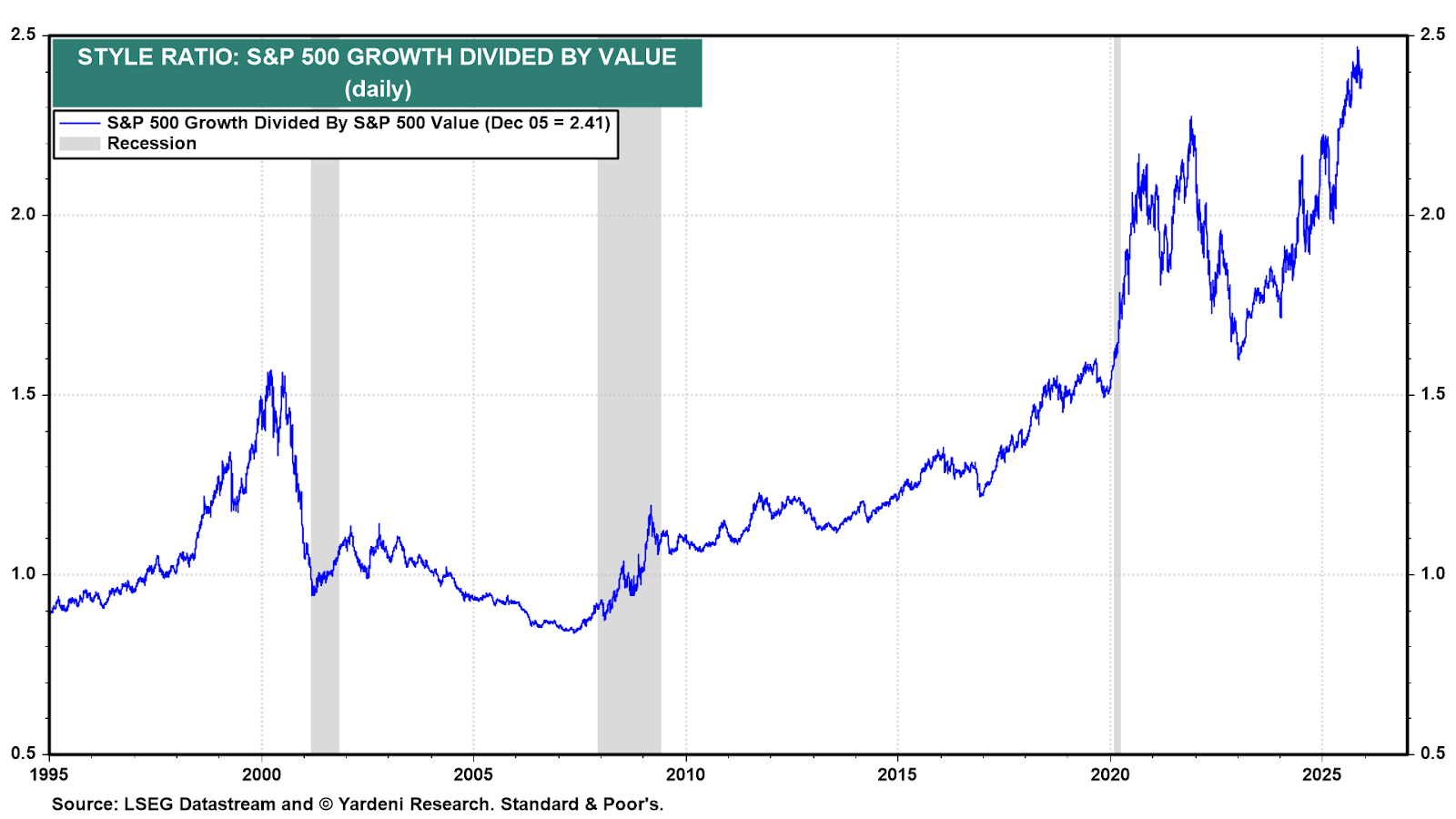

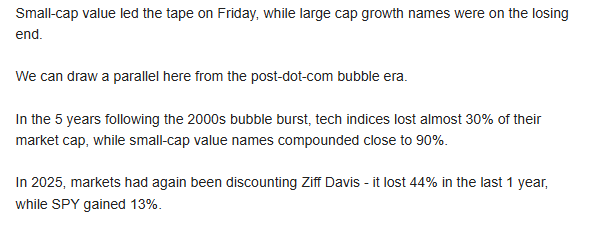

Every few months I like to trot out this growth to value chart.

Growth remains over-priced vs. value, and investors are beginning to realize it.

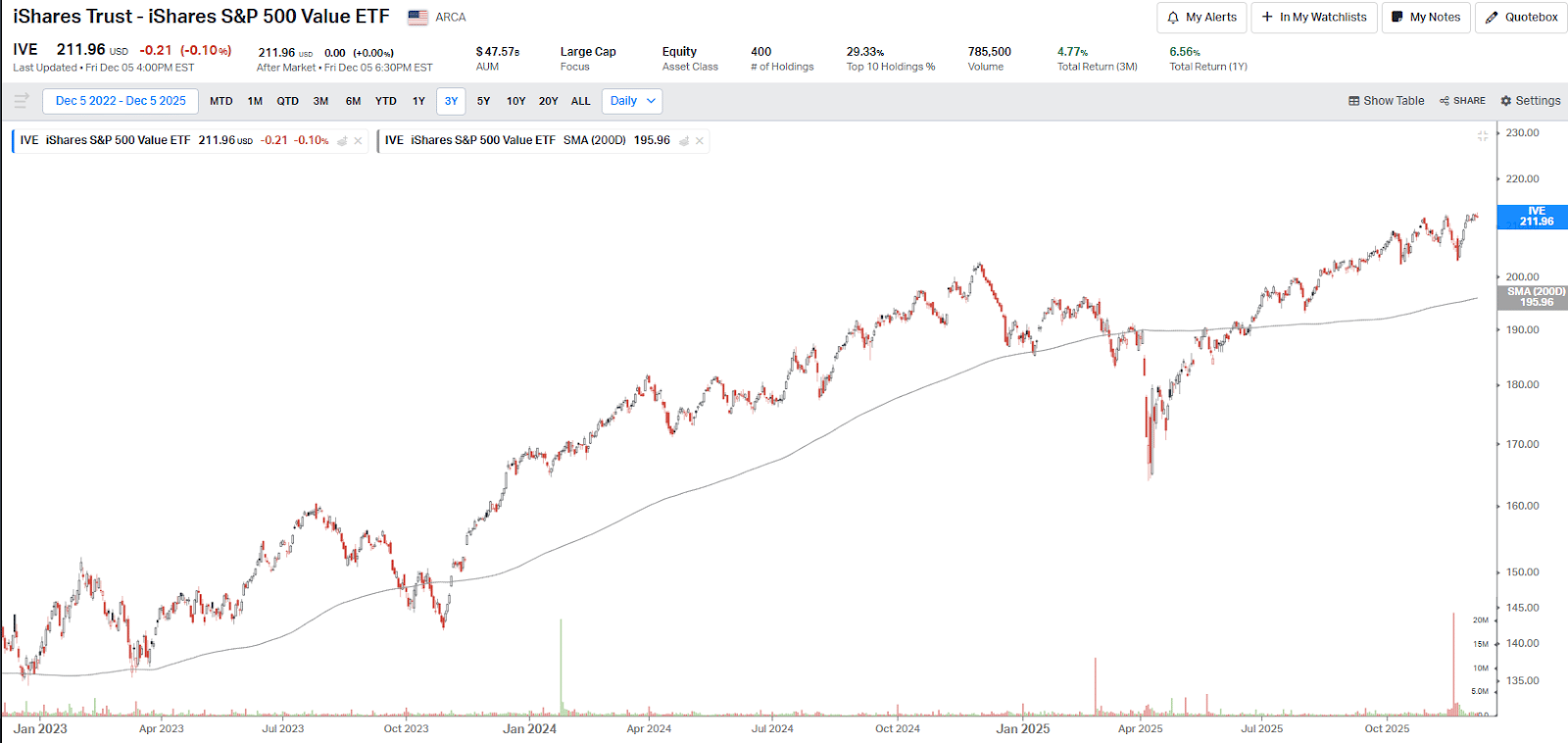

The S&P 500 Value ETF (IVE) ended this week near its All time highs, showing a strong recovery post its low in November.

Growth isn’t breaking down either. For the first time in months, it’s failing to lead.

It’s more pronounced when you look under the hood. Fintwit darling Axon is in a bear market, like Cava before it, like Chipotle before it, like Fico before it… It has a 176x trailing PE ratio.

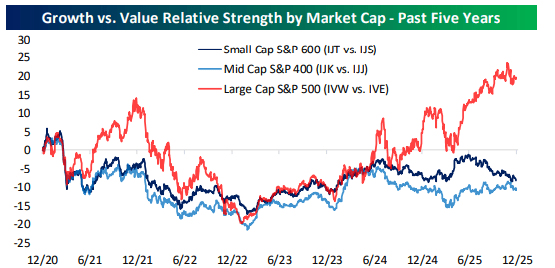

Small caps tell the same “tilt to value story” more clearly.

Over the past six months, small-cap value has steadily outperformed small-cap growth - a sign that breadth is widening beneath the index and that investors are reallocating toward businesses with tangible cash flow, pricing power, and lower duration sensitivity.

We wrote how small cap values are poised to benefit in this shift to quality two weeks back, and markets are playing out the tape. (I have a hazy crystal ball)

We flagged Ziff Davis as a beneficiary. The stock has risen 21% since then. Read the full thesis here.

(Note: We sold Ziff Davis this Friday, it was extended, might get it later.)

Historically, when IVE hits a 52-week high at the same time IVW fails to do so, value tends to outperform over the next 3, 6, and 12 months, with the spread widening along the horizon.

The EU’s War on Meta

The EU is going after Meta for integrating AI into WhatsApp.

This is really absurd.

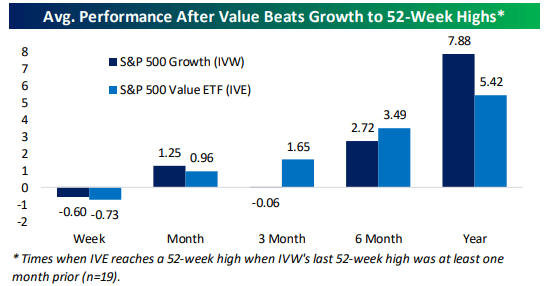

Meta is in near last place among Super Apps for AI dominance.

AI is a product feature for WhatsApp.

All apps must be reimagined as AI-native.

Any app that is not AI-native will disappear into the wastebin of history.

The EU wants Meta to offer competing chatbots.

That’s also absurd.

That’s like demanding Apple ship the iPhone with Samsung’s camera app.

Or requiring Tesla to install BYD’s drivetrain.

Or telling OpenAI to bundle Anthropic by default.

No regulator in their right mind forces a company to embed a rival’s core product into its own interface.

European regulators are treating AI as some separate market rather than the foundational layer of all software.

AI isn’t a standalone product category — it’s the new UX, the new distribution layer, the new operating system.

It’s anti-innovation, anti-consumer, and ultimately anti-competitiveness.

This is what regulatory over-reach looks like.

No wonder entrepreneurs continue to flee the EU for the United States.

Code Red For OpenAI

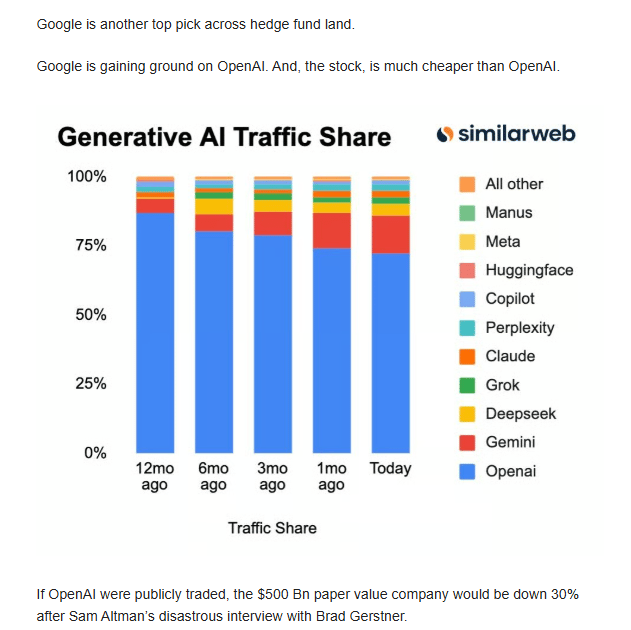

This week, Sam Altman shared a “Code Red” memo with OpenAI employees, and it tells exactly what we signaled a few weeks back.

People compare OpenAI to Amazon…but they forget Amazon made money for the vast majority of its history and could self-finance growth.

And the valuations were never as outrageous as OpenAI.

You can be an AI bull, like me, but at least differentiate winners and losers.

The competitive tides are turning against OpenAi, and the landscape is changing faster than expected.

Google’s Gemini 3.0 didn’t just post better benchmark scores; It demonstrated that an incumbent with global distribution, integrated products, and near-infinite compute can shrink technical gaps almost overnight.

OpenAI senses the fear.

The Code red memo signals OpenAI will reallocate resources away from longer-dated initiatives and back toward shoring up the core ChatGPT experience.

The focus will now be on enhancing speed, personalization, and reliability.

In the last few weeks, OpenAI has gone out of favor - if it was a listed stock, the drawdown would have been Figma-esque.

Look at the difference between the losses OpenAI and Anthropic will incur before becoming profitable.

Anthropic is also front running OpenAI for an IPO in 2026. This week, they signed law firm Wilson Sonsini to launch the IPO process and are seeking a valuation of $300 billion.

Overall, AI leadership is transitioning from model breakthroughs to the harder, more durable moats of deployment, infrastructure, and ecosystems.

Firms with cash flow and distribution scale - Google, not OpenAI - are structurally advantaged.

I did a Waymo video during this week’s SF trip, comparing Google and OpenAi. Watch it here. I discuss my views on Defense Tech there as well.

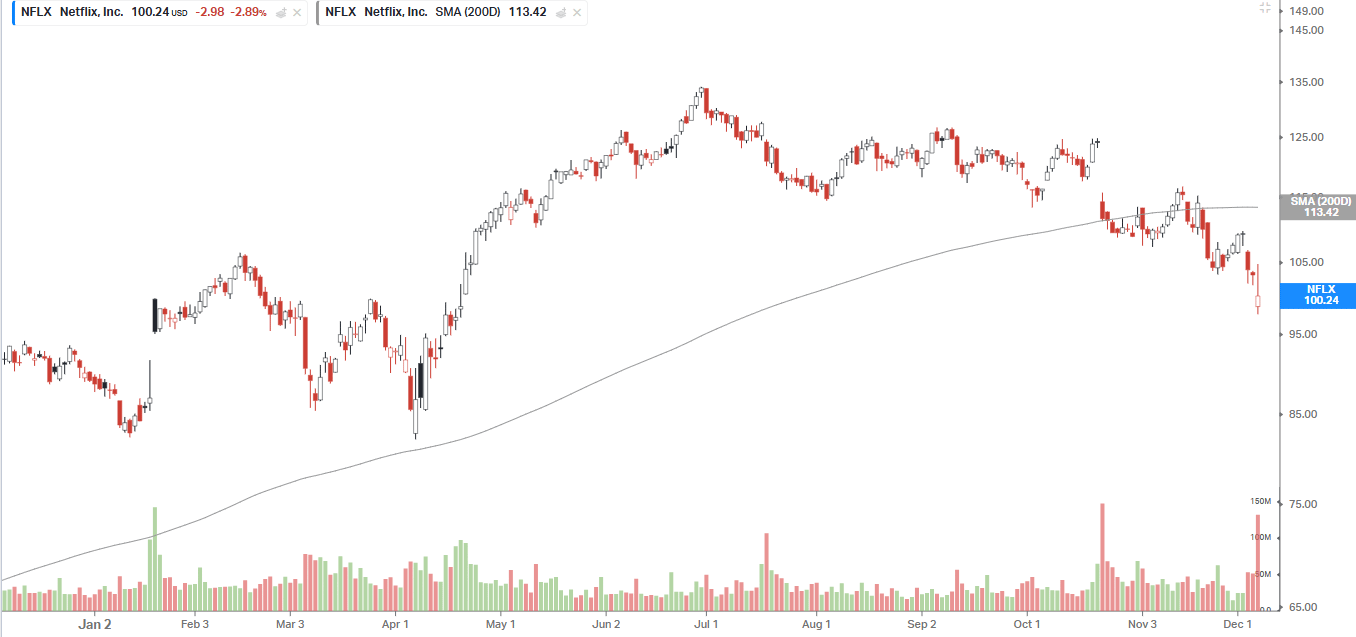

How Far Can Netflix Drop?

Netflix has lost 19% in the last 3 months. But, it's still more expensive than NVIDIA.

They recently announced the acquisition of Warner Bros at $82.7Bn, a ~30% premium to WBD’s current market cap.

We have been bullish on WBD- here’s our thesis from July- it pays to be contrarian.

The funny thing about that post… The one and only one reply asked sincerely “What is the bull case?”

Bro, the valuation and FCF yield was the bull case!

The best ideas are those that people struggle to recognize. Cognitive dissonance is a contrarian tell.

It goes in reverse too. Look at SoFi. How many people will hold on to this after the $1.5 Bn secondary sale this Friday?

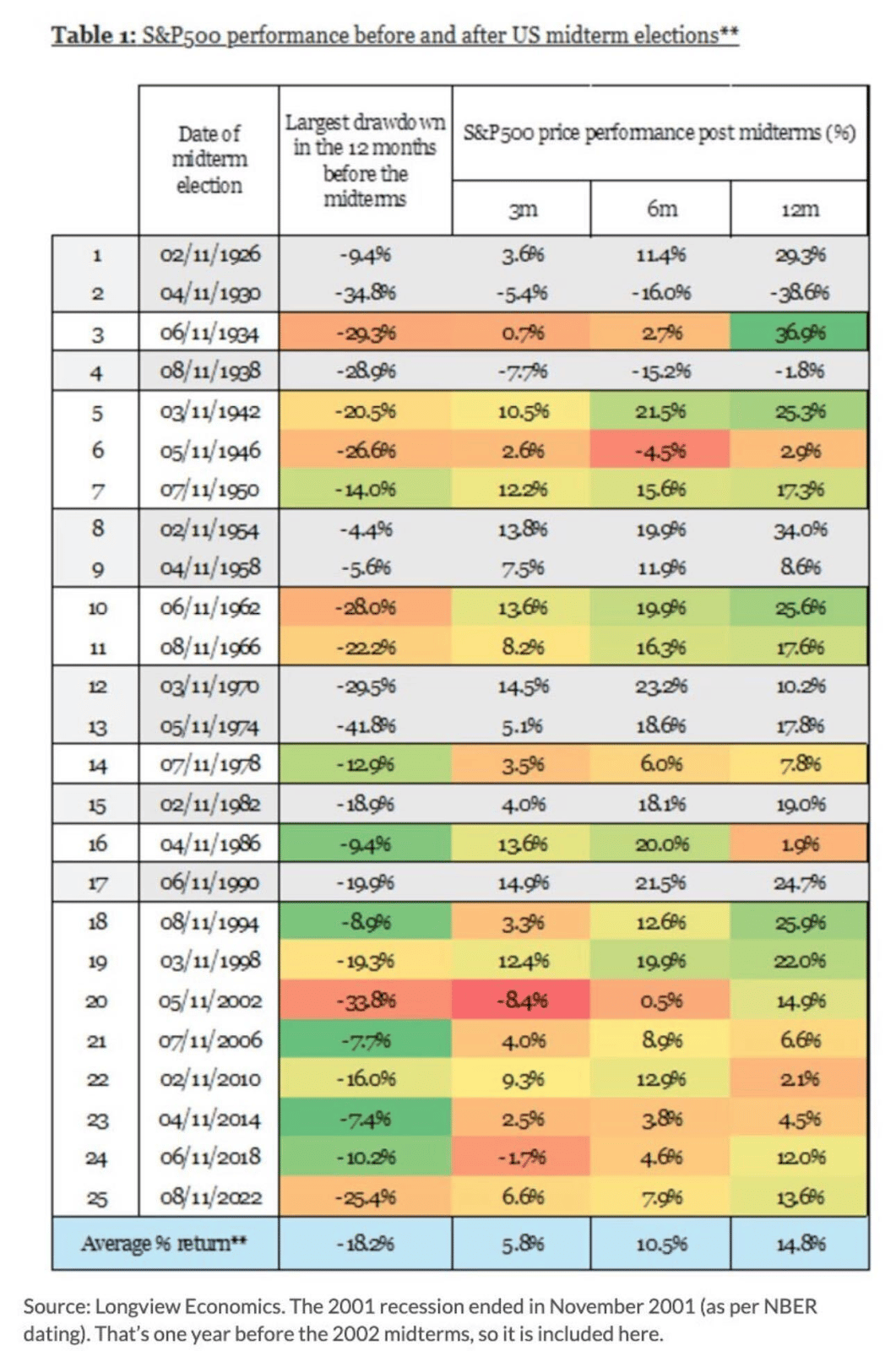

The Midterm Election Headwind and then Tailwind

Markets are going to gyrate in 1H 2026 as they assess the path of policy. A 7% drawdown would be normal and expected in the post-GFC era.

(We remain bullish looking three months out and expect all time highs. As for next week, we believe markets need some time to breathe and give back after an incredible rally.)

The SPY-election study shows markets almost always rally after midterm elections.

Across the last century, the S&P 500 has averaged:

+5.8% in the 3 months after midterms

+10.5% in 6 months

+14.8% in 12 months

These gains occurred even when the 12 months preceding the election saw large drawdowns.

With an expanding economy, higher corporate earnings, and rate cuts on radar, this seasonal pattern adds another structural tailwind.

The early market behavior is already tracking that script.

Digital Assets

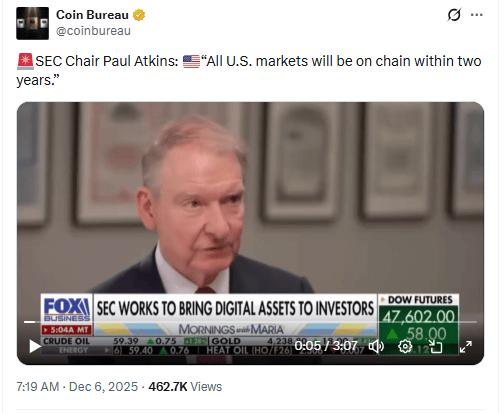

All Markets On Chain

SEC Chair Paul Atkins forecasts “All U.S. markets will be on chain within two years.”

Tokenization isn't just a futuristic idea anymore. It's becoming a rapidly accelerating reality, with enormous implications for market efficiency and transparency.

Paul Atkins believes placing securities on the blockchain will help remove opacity from the system. "There's much more transparency as to where it [a security] is."

Atkins also highlighted blockchain’s potential for T+0 settlement, which can help reduce the risk associated with trade settlement - "The idea of on-chain delivery versus payment is a prospect of de-risking the markets.”

Atkins points out that in the past, “The SEC was always a little bit behind the market,” but this is changing.

In fact, "We need to be embracing [new technology] to keep the United States at the forefront of cryptocurrencies and whatnot."

Tokenization will drive the next phase of market evolution, and the SEC’s support will ensure that the U.S. remains at the cutting edge.

The future of financial markets is on-chain, and it's coming fast.

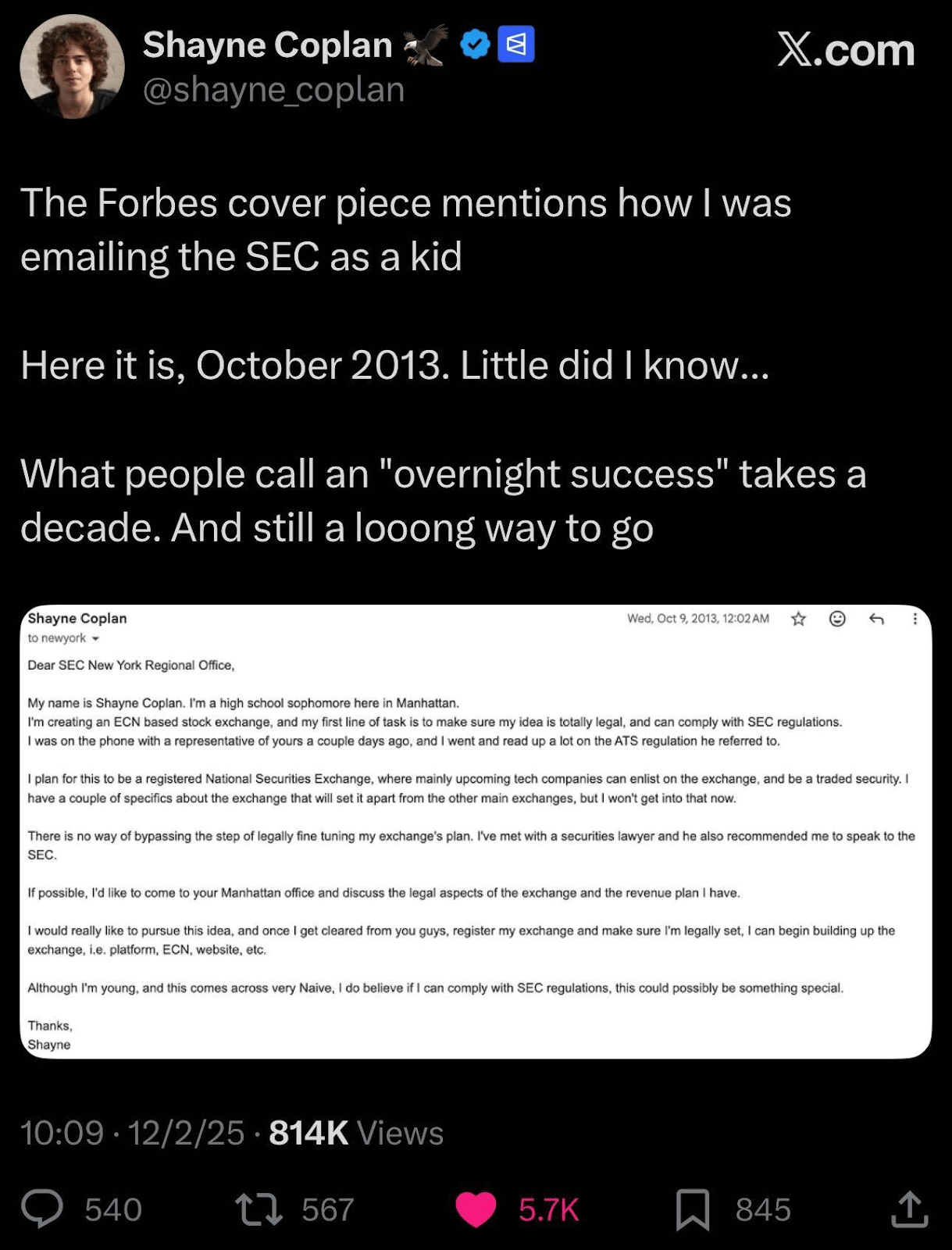

The Founder Behind Polymarket

Shayne Coplan has had quite the founder’s trajectory: a college dropout building the platform in three months during COVID, and now leading a $9 billion company.

Lumida Curations

Bitcoin’s Four-Year Cycle Is Breaking Down

Michael Saylor argues the halving no longer drives Bitcoin’s behavior: structural credit, derivatives growth, and TradFi adoption now set the real market cycle.

We believe the top is in for Bitcoin and we won’t cross $125K this year. It’s competing with two many narratives, and the DATs are a terrible investment category for the forseeable future.

Rallies will be sold.

AI Is On Track to Run at Near-Zero Energy Cost

Jensen Huang breaks down why accelerating compute efficiency is driving AI toward a future where it runs everywhere, all the time, on almost no power.

We are still many, many years away from Small Modular Reactors.

The fact that we have 80 nuclear submarines but can’t build an SMR tells you a lot about regulatory dysfunction and the challenges ahead.

Alcohol Truly Delivers “Empty Calories”

Andrew Huberman explains why alcohol is metabolized as a toxin, offering no usable nutrients and imposing a heavy processing cost on the body.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.