Here’s a preview of what we’ll cover this week:

Macro: Economy Is Strong Heading Into 2026; Productivity Is The Missing Variable

Markets: Why did Nvidia buy Groq?; Bullish On Markets; The Bubble In OpenAI’s 70% Gross Margins; Coupang Call Paid Dividends

Digital Assets: Banks As The Next Mag 7? Where Are We In The Digital Asset Cycle?

Lumida Curations: Structure Matters More Than Speed in AI Investing; Why the Fed Can’t Abandon the 2% Inflation Target?; Protein Isn’t the Problem

Lumida’s Twelve Days of Christmas :)

Look, we aren’t the best singers but we know how to make the tough calls!

Click the link above if you want to enjoy a chuckle.

Thank you for being a part of our journey.

Watch the video here.

Home Alone is a Christmas Classic.

But, here’s a thought.

How much would the Home Alone pizza order cost today?

In the original Home Alone (1990), the McCallisters famously ordered 10 pizzas for a grand total of about $122.50.

Fast forward to today…

If you placed the same order, you’d likely be looking at around $200 or more, depending on your pizzeria of choice.

In other words, over the roughly 35 years since Home Alone was released, the implied average annual inflation rate on that pizza order is about 1.6% to 1.7% per year.

All things considered, that inflation rate is not bad as compared to healthcare, education, insurance and housing costs which have ballooned since then.

Why?

1) Pizza prices are set in a hyper competitive unregulated market.

2) The Federal government did not try to make Pizza a universal human right that is ‘inclusive and accessible’.

3) Baumol’s cost disease - super under-rated theory

Overall view: Home Alone doesn’t really seem realistic in 2025.

Why did Nvidia buy Groq?

I remember first interviewing the CEO, Jonathan Ross, on my podcast Lumida Non-Consensus Investing a few years ago.

I had seen a Youtube video of him demonstrating the LPU and the speed of inference at a tradeshow no one ever heard of.

Then when he joined the pod he explained ‘Groq is not Grok as in Twitter Grok, but Groq’.

I was listening to that show again this weekend. You might want to give it a listen. There’s a lot we were very early on.

The main point of the podcast is ‘learning in public’. Interviewing people who have unique vantage points into different sectors.

Dylan Patel, founder of SemiAnalysis, was another early podcast guess before his Substack blew up.

Kyle Samani was another one when Solana was exiting its bear market.

Subscribe to the podcast here on Youtube, Spotify or Apple.

Act on Early Trends Early

The main takeaway from all of this - act on trends early. Usually there is signal from a faint observation. By the time that faint insight becomes received fact, prices have gone up quite a bit.

One of my main lessons this past year is to act earlier and more decisively around those.

Trend shifts start as a faint glimmer - often more like a question than an answer like “Haven’t restaurants bottomed here? Isn’t Bitcoin going to benefit from the Federal Reserve Bank Term Loan facility? Isn’t TSM too cheap at 15x?”.

Recent examples of applying this include dialing up or exposure to Molina Health, Comcast, Chili’s (EAT), and others.

2026 Stock Picks

Incidentally, we did a bottoms up review of finding those mispriced assets in the ecosystem. There are easily dozens and dozens of mispriced securities out there — often in sectors such as software, recent IPOs, healthcare, consumer finance and so on. (Maybe even hombuilders or building supply materiasls given Trump’s shift to housing affordabiltiy, but I’m not sure there.)

This gives me confidence that the bull market has plenty of room to run. We’re going to see rotations and mean reversion from sold off sectors that have strong earnings growth.

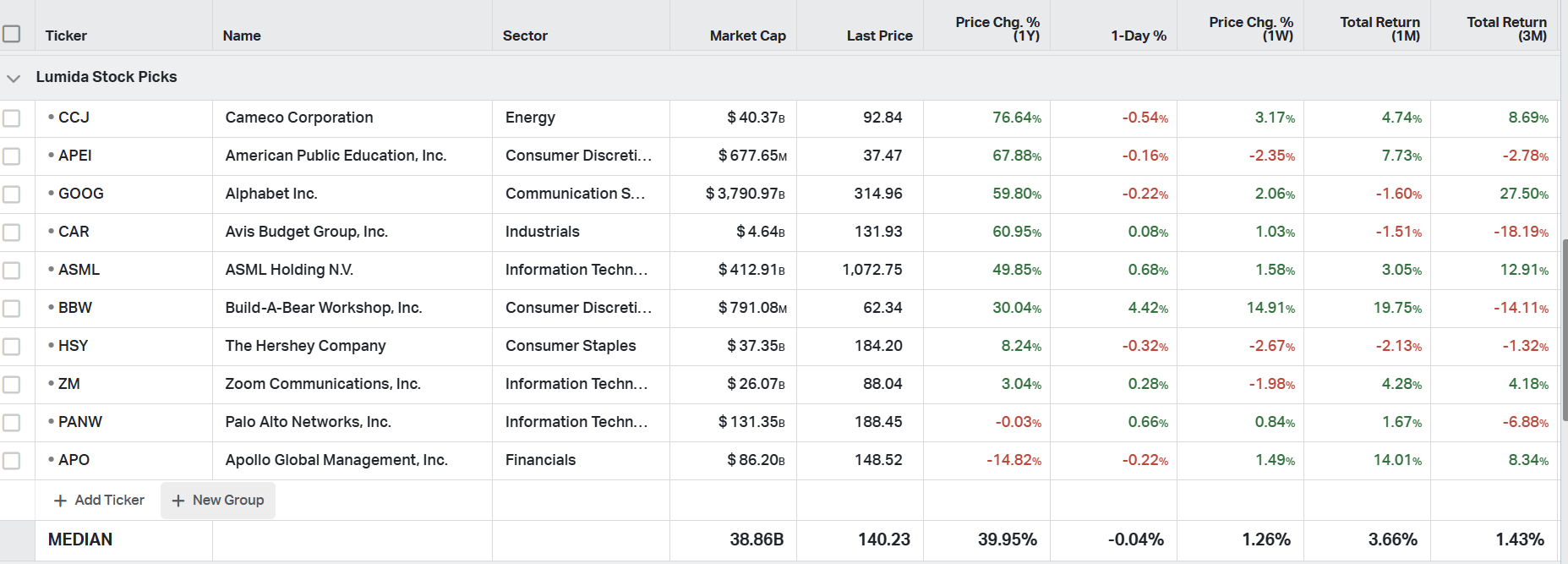

Incidentally, I was looking at our 2024 stock picks. They are up 39% on an equal weight basis. There’s a lesson in there.

Avis was the worst performer in that list last year, now it’s up 60% YTD.

The main lessons for me is:

We tend to get in trends early. Stay in the trends longer. It takes about 1.5 to 2 years for a trend to play out.

Speaking of, Restaurants have been in a bear market for about 1.5 years. It’s time to start looking for a bull market there and we have increased our exposure to names like Shake Shak (SHAK) and Chili’s (EAT).

Nvidia spent $20Bn on Groq’s acquisition - this is Nvidia’s largest purchase ever.

I must say - all of the takes on X - including Gavin Baker’s seem wrong to me.

Note: a 1,000 word explanation for a large M&A transaction might be a hint that people are over-thinking things.

Here’s our thesis…

Google one month ago hit all-time highs and became a darling, in part on the success of the TPU. Analyst see Google as the first credible threat to Nvidia’s dominance.

(This is a complex topic in its own right which we won’t get into here, overall, we view Nvidia as maintaining strong position.)

The team that built Google’s original TPU founded Groq. It’s really that simple.

If you want a shot at Nvidia’s 75% margins, you buy Groq. The acquisition was Defensive.

Yes, there is an inference angle to it. Groq specializes in high-speed inference. And, Nvidia’s rival AMD is differentiating our inference.

But, M&A deals, often hinge on one primary consideration. Not a laundry list of pros and cons.

Keeping Groq’s TPU know how out of the hands of a competitor is the imperative. This also is consistent with Nvidia capturing the team and licensing the tech rather than doing a whole business acquisition.

Google’s fanfare 30 days ago is exactly what led to Groq’s acquisition today. You can imaging a conversation with Jonathan Ross and Jensen:

“We have some interest around the TPU IP we’ve built here given Google’s recent success. We are fielding interest from a number of parties. We think Nvidia is the leader. At the same time we need to do right by our shareholders. Does it make sense to have a conversation?”

Left independent, Groq represented a latent risk. If a rival bought it, the knowledge could have seeded a serious challenge to Nvidia’s moat.

There’s also a strategic alignment angle that matters.

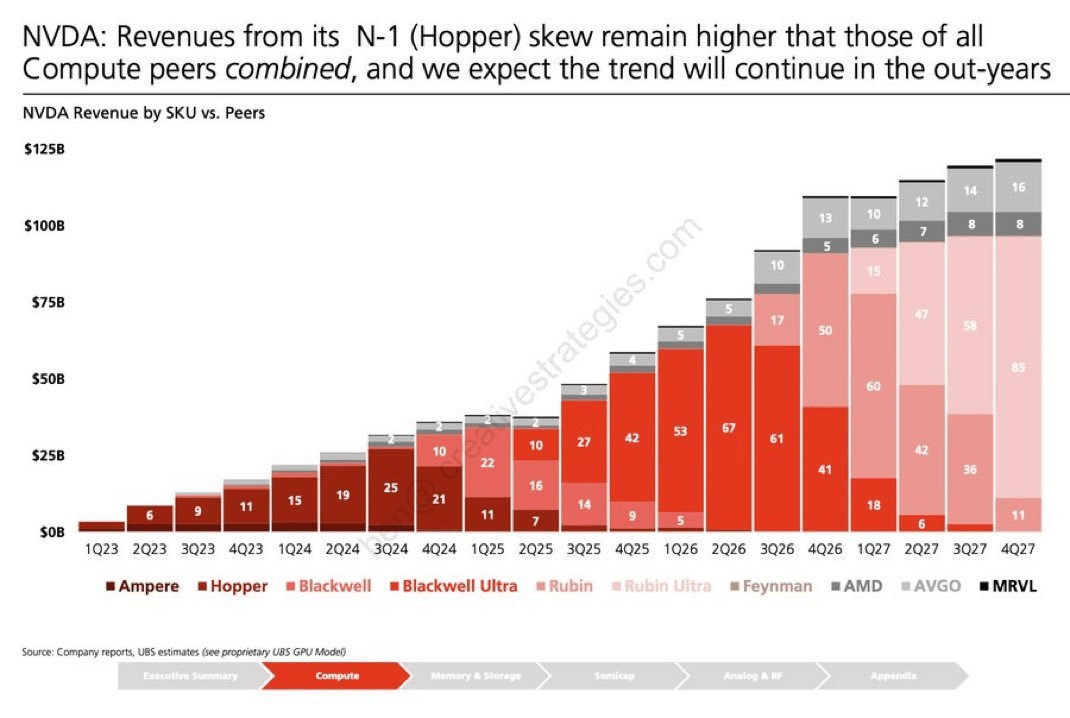

Nvidia is no longer selling chips. It’s selling entire data center solutions—full racks, integrated systems, turnkey AI infrastructure. Blackwell is the clearest signal for this.

Groq was operating with the same philosophy: inference not as a component, but as a system-level product. Racks, software, deployment—end to end.

Groq strengthens Nvidia’s ability to think and sell at the systems level, while preventing an alternative architecture from scaling outside Nvidia’s control.

This acquisition solidifies Nvidia’s leadership position, and sets them up for the future.

We think AMD is going to struggle in the after effects of this purchase. AMD is also over-valued relative to Nvidia and not growing as fast.

AMD has a trailing PE of 112X and a forward PE of 38X.

Nvidia, by contrast, is priced at 47x PE and a forward PE of 27X.

AMD has lagged as of late, while Nvidia isn’t too far off from All Time Highs.

I can’t understand owning AMD here.

The Rise Of Defense Tech

The last twenty years were about software.

The next 5 years are about hardware.

Many of the most valuable companies in the world are hardware: Nvidia, TSM, Tesla, etc.

Where are we focused for our next theme?

Defense Tech.

It is entering a new phase with Trump's latest focus on the US drug war.

Agencies, like Southern Command, the Coast Guard, DHS, are now receiving multi-year budget increases to be spent on robotics and autonomous systems.

This is driving real demand for Defense AI startups.

Drone and imaging companies are helping track small narcotics vessels across millions of square miles.

AI platforms are mapping fentanyl networks the same way they once mapped insurgent cells.

Counter-drone systems from Ukraine are now deployed at the southern border to defeat cartel drones.

Anthony Antognoli, Coast Guard’s program executive officer, notes “It is impossible to do that work with humans and patrol cutters alone.”

“Our vision is to have robotics and autonomous systems as the foundation for the way the Coast Guard operates its missions.”

Autonomy is becoming the center of military operations.

These counternarcotics and border security missions are becoming reliable growth engines for Defense technology companies focused on autonomy, robotics, and applied AI.

Lumida Ventures is also focused on investing in defense tech.

We have had a string of successful investments across CoreWeave, Kraken, and Brad Jacobs QXO, and Canva. All of these have had markups or realizations.

Do reach out now if you want to be in the flow of our next deal.

If you are an accredited investor or qualified purchaser, sign up here to receive communications about our private deals.

Macro

Economy Is Strong Heading Into 2026

This week’s data releases were solid, and they reinforced a simple point:

The economy is stronger and broader than most expected.

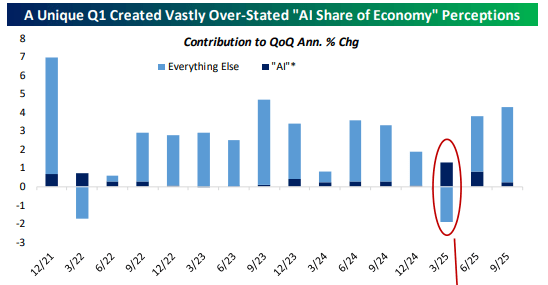

Q3 GDP grew 4.4%, well ahead of consensus and GDPNow - the underlying message was even better.

Unlike the fears that followed Q1, growth is no longer narrowly concentrated in AI-related spending.

Consumption remained firm, exports rebounded, government spending contributed modestly, and—critically—investment stopped being a drag.

Growth across Q2 and Q3 has meaningfully broadened, with non-AI categories accounting for roughly 85% of total growth over the past two quarters.

That distinction matters.

Q1 briefly created the illusion that AI was the sole pillar holding the economy up, raising concerns that a slowdown in AI funding could undermine overall stability.

The latest data points to the opposite conclusion. AI is additive, not singular.

Growth is being driven by services demand, recovering exports, stabilizing inventories, and renewed capex.

That mix makes the expansion far more durable than the narrow-growth narrative implied.

Productivity Is The Missing Variable

Core PCE came in at 2.9%, in line with consensus expectation. It has now run above 2% for 19 consecutive quarters.

Yet inflation has not reaccelerated in a way that would normally accompany this level of economic activity.

The missing variable is productivity.

GDP per private hour worked rose over 4% annualized in the quarter, with the underlying trend now running closer to 2%+—a clear break from the post-GFC norm.

It reflects a structural improvement in output per worker.

Since COVID, firms have aggressively adopted AI, automation, and software-driven workflows to offset labor scarcity and rising costs.

Processes that once required incremental hiring are now scaling digitally. Output is rising without a proportional increase in labor or input expenses. This reflects in rising corporate earnings and margins.

Improved productivity helps keep inflation contained despite sustained demand. They are absorbing growth rather than transmitting it into prices.

Markets

It’s not a Bubble

Every time, market closes in on its all-time highs, the “bubble” headlines start to surface.

The data doesn't support it.

Start with cash flow. The median stock’s free cash flow yield is ~3.5% today, materially higher than it was at the peak of the Tech Bubble, when it bottomed near 1%.

In 1999–2000, investors were paying extreme prices for companies with little or no cash generation.

Today’s market is fundamentally different: profitability is widespread, and cash flows are real.

Valuations tell the same story.

Even before adjustments, today’s multiples are nowhere near dot-com extremes.

When the S&P 500’s forward P/E is normalized for profit margins, valuations sit close to their long-term average—far from bubble territory.

Elevated margins are not a mirage; they reflect structural shifts toward software intensity, automation, and capital-light models.

Those dynamics drive earnings—and earnings create value.

Investment breadth reinforces the point.

Capex is accelerating across both the Mag 7 and the S&P 493.

Bubbles are marked by capital scarcity outside a narrow leadership cohort.

This cycle looks different: investment is broadening.

When capex rises across the index, it signals confidence in future demand and profitability beyond a single theme.

Importantly, this is not speculative capex.

Spending is flowing into AI infrastructure, automation, software, and productivity-enhancing assets—the same forces underpinning durable margins and cash generation.

Companies are investing because returns justify it.

That is not what bubbles look like.

Here’s Jurrien Timmer’s tweet talking about returns since the beginning of the secular bull market.

We believe equity markets will continue to outperform.

However, near term, we might see some fluctuations due to mid-term elections risk and excessive sentiment which we discussed last week.

We wrote about it a few weeks earlier. Read here.

Our inference from a number of factors is that investors should maintain a strong tilt towards value.

We had a nice high beta lock-out rally on the heels of OpenAI’s plans for fianncing. That sparked a small short squeeze.

As I noted earlier, there are plenty of mispriced assets out there - including those growing 20% revenue YOY with 5% free cashflow growth.

It’s observations like this that will cause the rotation to value… Investors will compare assets and arrive at these conclusions independently.

Our conviction comes from our process. We are looking at hundreds of charts and running stock screeners and we keep saying ‘Why would I own [ random over-valued stock ] when I can own this?”

The Bubble In OpenAI’s 70% Gross Margins

OpenAI is showing ‘improved margins’ on its API compute.

I call bullshit.

Gross margin excludes the dominant economic cost of the product.

(1) Model Training Costs are the most significant cost to OpenAI.

Those are ‘below the line’ - it shows up as a Research Cost not Gross Margin.

Gross Margin is based on Inference Costs, not Training Costs.

We know LLM models go obsolete (GPT rendered 5.1 obsolete and so forth).

(2) OpenAI can make their margins look higher by using operating leases with datacenter companies like Coreweave

This effectively converts large capital expenditures (GPUs, power, cooling, real estate) into a rental model.

The right way to assess OpenAI is Return on Invested Capital (ROIC) and WACC.

Coupang Call Paid Dividends

Last week, we talked about CPNG, and how it had a headline sell off after the data breach news.

The stock sold off ~25% after Nov 04, but the fundamental business was intact.

It has revenue growth faster than Amazon, better valuation metrics, and no looming hyperscaler’s Capex risk.

This week, that call paid dividends. The stock had 3 green days, rising ~7% on Friday.

The reason?

Clarity around the breach.

The company disclosed that the breach was limited in scope, tied to a former employee, and did not involve sensitive financial data.

To put it in numbers, management estimates the data leak involved a few thousand customers instead of the 33 million initially assumed.

The news meant the worst-case scenarios being priced in were unlikely. Once that became clear, risk was repriced quickly.

The business was always solid, only the sentiment around it broke. That’s what we highlighted in our writeup. Read here.

Digital Assets

Banks As The Next Mag 7?

Tom Lee says JPMorgan and Goldman Sachs can become the next Mag 7 by rewriting their cost structures.

And, we agree.

AI and blockchain both attack the same problem: employee intensity.

Financial services has historically scaled by adding people: more compliance, more operations, more middle-office headcount.

Automation changes that.

AI reduces labor per dollar of revenue. Blockchain reduces reconciliation, settlement friction, and back-office complexity.

This results in structural margin expansion.

This leads to an important distinction:

When margins expand because demand is strong, it’s temporary.

When margins expand because workflows are digitized and automated, it’s durable.

That’s why Lee argues these banks will eventually trade more like tech companies:

Higher multiples, steadier margins, and operating leverage tied to software adoption rather than balance-sheet growth.

Overall, the structural benefit of AI and blockchain will further intensify the adoption of digital assets in mainstream finance.

We are already seeing the shift. Read our read throughs from bank earnings to see how banks are taking tokenization mainstream.

Where Are We In The Digital Asset Cycle?

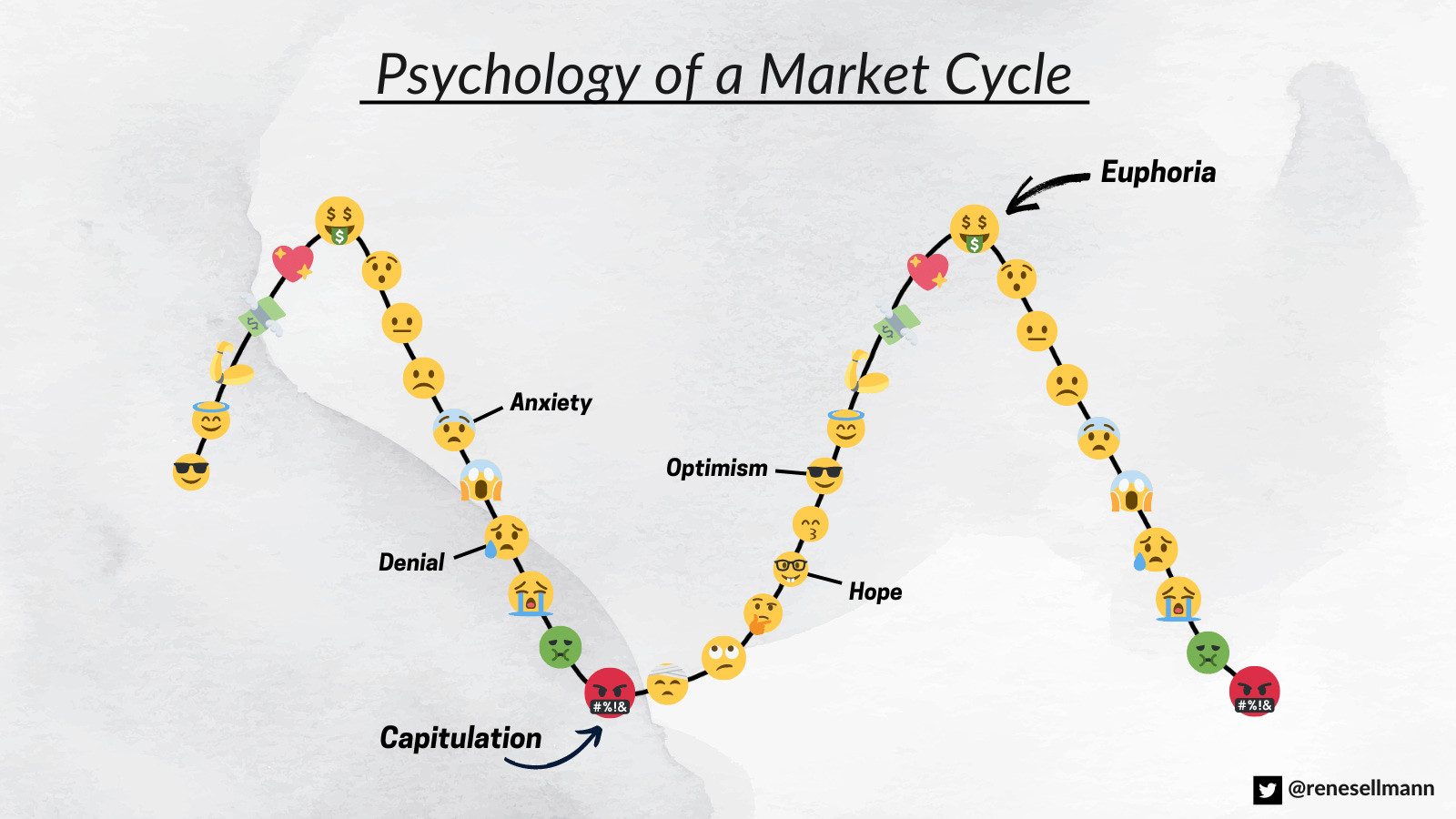

At the passage of the Genius Act, digital assets reached the peak of inflated expectations.

The narrative was clean.

“Valhalla was coming. Progress felt inevitable. Upside felt frictionless.”

But cycles don’t move in straight lines.

You don’t arrive at Valhalla without first climbing the Wall of Worry—and for digital assets, that wall was defined by the Gensler era.

Regulation, uncertainty, and enforcement pressure slowed momentum and tested conviction.

The inflection came after last year’s election.

In a remarkably short period, the market pulled forward expectations that would normally play out over years.

Bitcoin didn’t grind higher through successive phases—it compressed an entire year’s worth of price discovery into a one- to two-month window. From the mid-60s to new highs, quickly.

That compression was not random. It reflected a market where information moves faster, capital reallocates faster, and positioning resets more rapidly than in prior cycles.

That same structural shift showed up again when Bitcoin reached new all-time highs before the halving, something that had never occurred in earlier cycles.

Then over the summer, a wave of DATs and IPOs came to market.

New narratives. New tokens. New opportunities.

That was Valhalla - the peak of the cycle.

Retail investors chasing momentum got in with excitement.

These investors were not looking to compound patiently. They were chasing acceleration—lottery tickets, rocket ships, moon narratives.

But, something unexpected happened.

Digital asset trade slowed down, while other assets kept working.

Nvidia kept rising. Meta kept rising. Space stocks moved higher. Gold moved higher.

Predictably, many of those trades moved quickly from excitement into the trough of disillusionment.

“What did I buy?”

“I shouldn’t have owned this.”

“I just want out.”

That psychology is critical.

Over time, the relative underperformance of digital assets became unbearable. The opportunity cost became too visible to ignore.

Eventually, frustration forced capitulation.

And that moment—when investors sell not out of fear, but out of exhaustion—has historically marked something important.

The Start Of The New Cycle.

My primary approach to gaining exposure now is through Crusoe-style off-grid Bitcoin mining.

We partner with operators that use excess natural gas to mine bitcoin at an effective cost of $40K.

It doesn’t matter what your view on bitcoin is.

If you can produce at a much lower cost than the market price, there is a quasi-arbitrage to take advantage of.

We have put together a comprehensive guide on how off-grid bitcoin mining works, and the opportunity for investors. Check it here.

Lumida Curations

Structure Matters More Than Speed in AI Investing

As AI exposure becomes easier to access and more intermediated, investor outcomes increasingly depend not on picking the right theme, but on underwriting the structure, incentives, and discipline behind the investment.

Why the Fed Can’t Abandon the 2% Inflation Target

Bessent believes Changing the target before inflation is fully defeated would undermine Fed credibility, un-anchor expectations, and teach markets that policy goals shift when conditions get uncomfortable.

Protein Isn’t the Problem

When calories are controlled, higher protein—especially spread across meals—improves fat loss and muscle preservation. The real risk driver isn’t protein itself, but excess calories and obesity.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.