Here’s a preview of what we’ll cover this week:

Macro: US Economy Stays Steady; Labor Market Is Cooling; Is Automation Replacing Workers?

Markets: Everyone Is In Markets; Exploiting the Low-Beta Anomaly; Cruise Line Names Shined This Week; Coupang- The Opportunity In Sell-Off; Ripple Effect Of OpenAI’s Raise

Lumida Curations: Code Red or Code Slow?; The AI Bubble Isn’t the End of the AI Boom; Morning Cortisol Is the Longevity Lever

Are Boomers the Lenders Last Resort?

Overall, we are seeing a re-leveraging of corporate balance sheets.

And, governments continue to spend and increase debt outsanding.

In equilibrium, it is impossible for all three groups to lever up at the same time.

That leaves consumers as the lenders of last resort.

Consumers - specifically Baby Boomers - are sitting on record home equity and have strong balance sheets.

Boomers are now the lender of last resort.

And, they are doing this with $5 Tn in private credit outstanding and ownership of Treasuries.

This goes back to a theme we have written about before…

Lowering short-term rates is likely to have differing effects on household spend than the Fed anticipated previously.

Lowering short-rates may decrease boomer spending.

What is the direction of long-term rates?

A big question…

What is the direction of long term rates?

(1) On-shoring of supply chains adds to inflation pressure

(2) Massive capex build-out increases demand for borrowing in corporate debt markets

Most are high quality borrowers in the Mag 7 arena (see Amazon) but vendor financing will expand the high yield debt market

(3) Markets struggling to digest new offerings (see Oracle)

(4) Greater M&A increasing demand for debt (see Warner Brothers bid)

(5) Less foreign demand for US Treasuries and more demand for hard assets such as gold

Hard to see a world where long-term rates head lower.

The counter to all of this:

(1) A strong boost in productivity rates to combat inflation

(2) Labor market breakdown (unlikely)

Why All This Matters?

(1) The rally from 1982 to 2021 was driven by a gradual lowering of long term rates.

If rates are headed higher, valuations will face headwinds.

(2) If you know the direction of long-term rates, you can position more accurately in rate sensitive names.

(3) Tech capex bingers are becoming more rate sensitive arguably as they borrow tens of billions of dollars where they did not before.

What do you think?

The Rise Of Defense Tech

Global defense spending is accelerating.

Europe is investing more in Defense as the U.S, pulls back.

World military expenditures rose 9% last year - the sharpest increase in more than three decades.

Defense budgets are rising across all geographies after recent geopolitical tensions.

These budget increases are creating massive demand for defense tech names, and venture capital has realized this.

In 2025, defense tech venture investment has already more than double last year’s total. We don’t see it stopping anytime soon.

The funding is concentrated in large, late-stage rounds of autonomy focused defense companies. Companies like Anduril and its peer group are benefitting from these financing rounds.

Those financings are only available to sophisticated private markets investors.

Lumida Ventures is also focused on investing in this category. We have had a string of successful investments across CoreWeave, Kraken, and Brad Jacobs QXO, and Canva. All of these have had markups or realizations.

Do reach out now if you want to be in the flow of our next deal.

If you are an accredited investor or qualified purchaser, sign up here to receive communications about our private deals.

Macro

US Economy Stays Steady

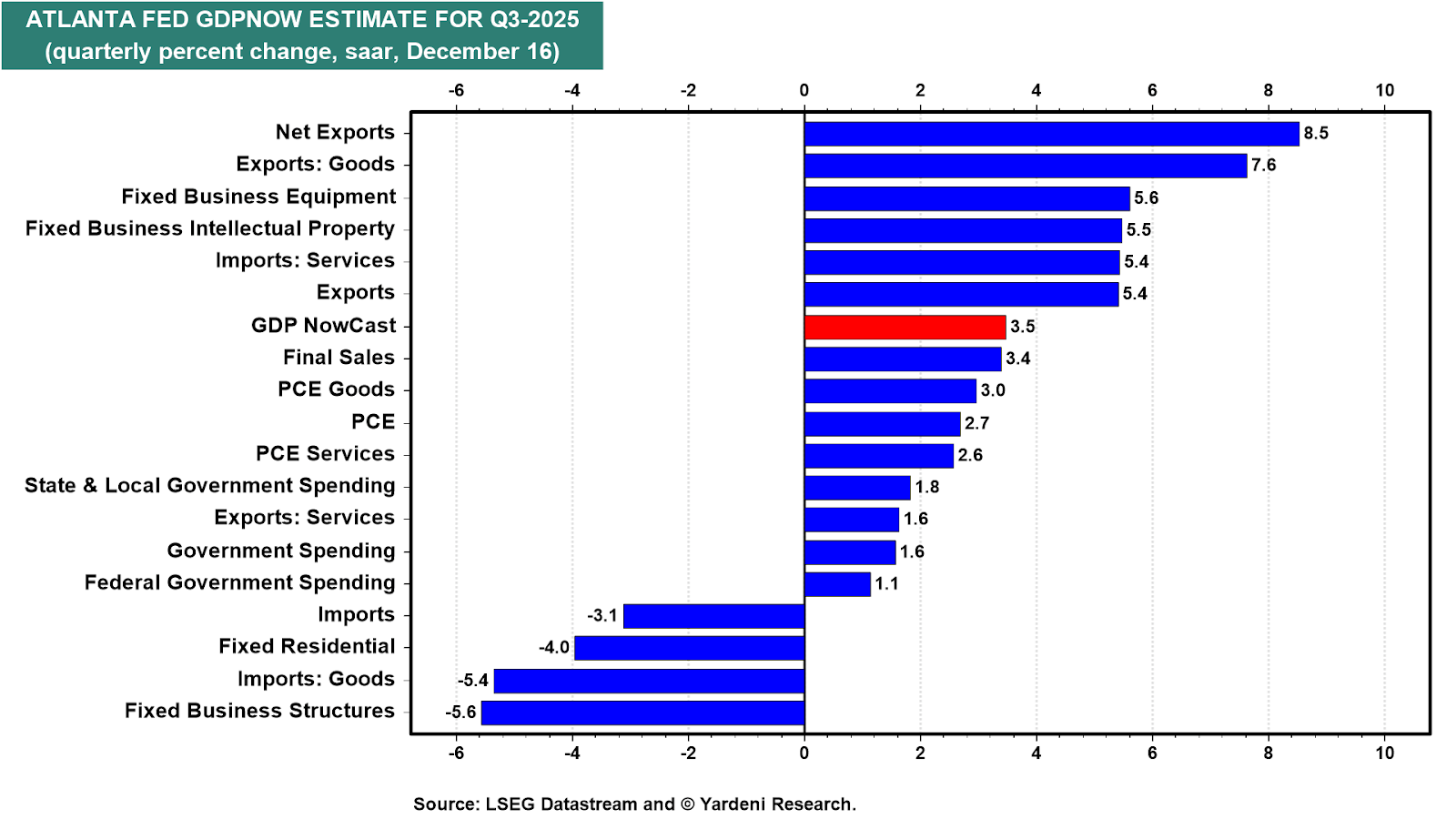

The US economy continues to grow against market expectations.

Real growth is tracking near 3.5%.

Growth is being carried by business investment in equipment and software, which shows businesses are confident and willing to invest.

Again, we have 1% of GDP growth coming from AI Investment - that’s not stopping anytime soon - especially if OpenAI raises $100 Bn!

Capex tied to productivity tends to persist across cycles, and acts as a solid indicator for future growth.

On the consumer side, we see a confident customer.

Headline retail sales look flat… but I expect this will beat. I was at the American Dream Mall this weekend. Number 2 mall in square footage in the United States.

It was packed as if the Fed just cut rates and handed out mall gift cards.

Households are still allocating toward discretionary categories tied to lifestyle and convenience, while pulling back where higher rates directly bite, like autos.

Another underestimated signal is on the supply side; Business formation is surging, and is reaching its 2021 high.

Small businesses drive most employment growth - this is encouraging.

If new firms are being created at this pace, then economic strength is structural.

New companies create new payrolls, new capacity, and new competition, which helps the labor market and economic growth.

Labor Market Is Cooling

This week’s labor market data agrees with the theme we have seen in the last few months. Labor market is stabilizing.

After spiking over the summer (like last year, and the year before that) claims have rolled back over, and the 4 week average is now back to January level.

Continuing claims reinforce the point.

At 1.9 MM , they’re well below the 1.92 million threshold that would suggest compounding layoffs.

If labor stress were building, displaced workers would be lingering longer.

Instead, reabsorption remains fast enough to prevent duration pressure.

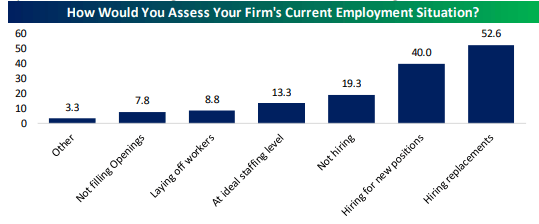

The Duke–Richmond Fed CFO Survey explains why the labor market is holding together.

Revenue growth expectations are broadly stable, unit cost pressures are easing, and wage bill expectations are stable.

CFOs showed confidence in the economy, and the future business environment.

Hiring behavior reflects the “low-hire-low-fire” environment.

Most firms are replacing open roles, 40% are still hiring, and fewer than 10% report layoffs.

Only 13.3% say staffing levels are ideal, implying labor demand hasn’t disappeared — it’s become more selective.

Is Automation Replacing Workers?

Based on the CFO survey, When firms do slow hiring or reduce headcount, the dominant drivers are demand uncertainty and financial constraints.

Automation is a secondary factor at best, cited by just 16.2% of respondents.

Firms are not cutting labor because of AI - they’re investing alongside it.

84% of CFOs expect non-zero AI spending over the next 12 months, up from 56% last year, with adoption broad rather than concentrated.

CFOs also attribute AI to faster decision-making, higher efficiency, improved customer outcomes, and more time spent on higher-value work.

We also see this trend in Vanguard’s study.

Occupations most exposed to AI are outperforming.

Job growth in high-AI-exposure roles is running 1.7%, more than double the 0.8% pace seen across all other occupations.

Real wages tell the same story: +3.8% for AI-exposed roles versus +0.7% elsewhere.

Rather than displacing workers, AI is raising output per worker, increasing bargaining power and wage growth where it’s actually being deployed.

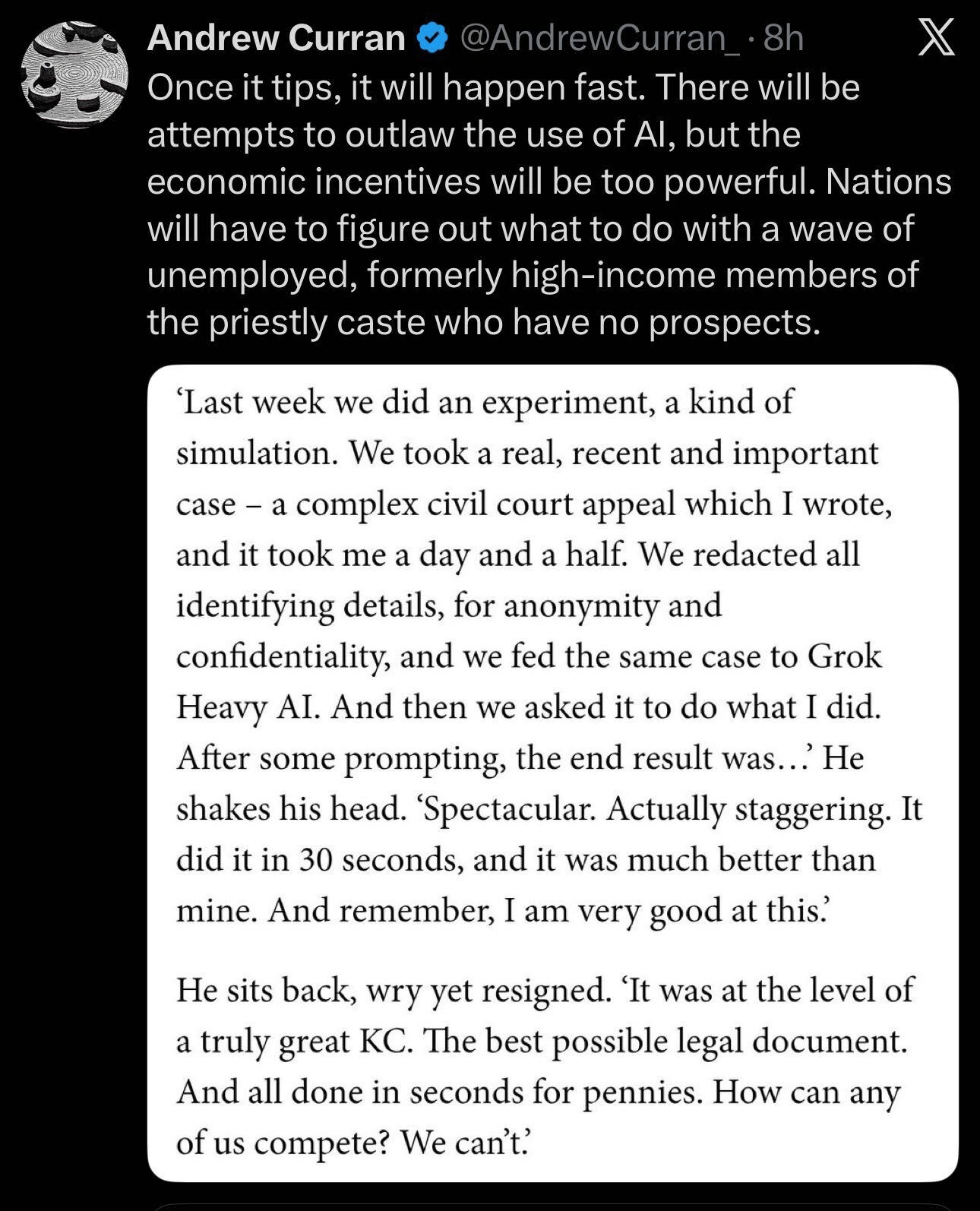

This is an interesting post from a lawyer citing how AI crushed him at preparing a long legal brief.

But, here’s the thing. Only lawyers are licensed to carry out legal actions.

AI will cut the pricing for legal services and improve their margins.

That’s not mass job displacement.

Our legal frameworks - even beyond the law - require a concept of Accountability.

There’s always a “throat to choke”. So, while there will be shifts in hiring in certain markets (less demand for financial analysts and coders), labor markets will clear and aggreate earnings will increase.

Markets

Everyone Is In Markets

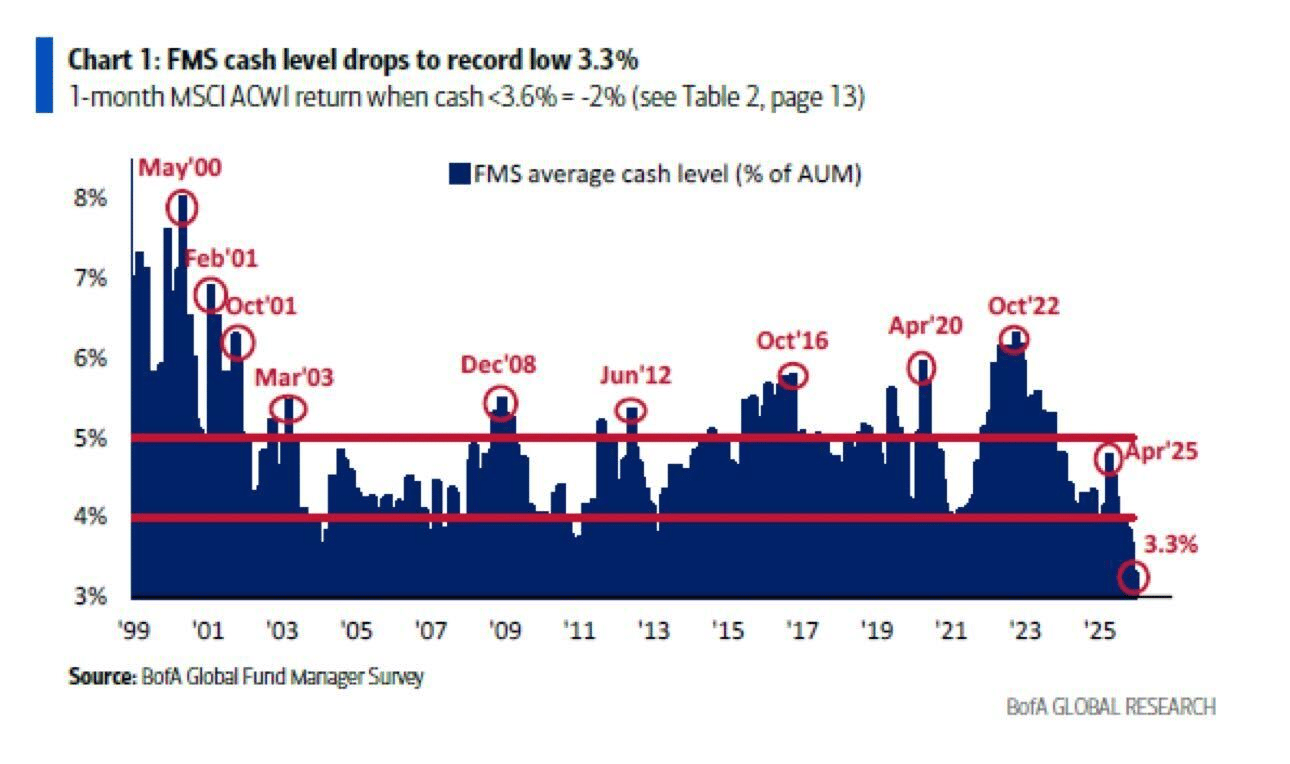

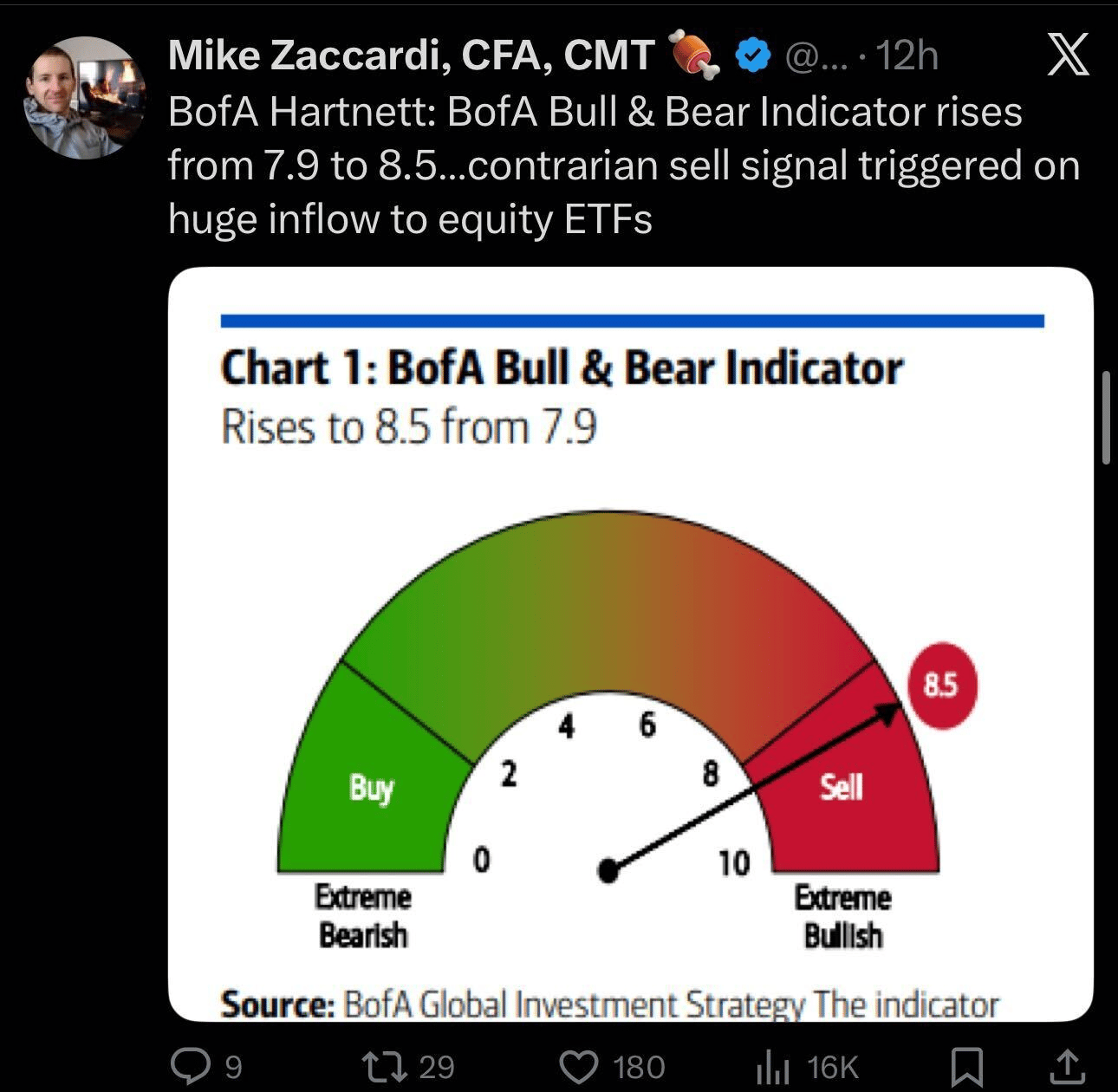

As a contrarian, I don’t like this chart. Not one bit.

Cash levels in the BofA Global Fund Manager Survey have fallen to a record low ~3.3%, which tells you something simple and uncomfortable: investors are already all-in.

Historically, when cash drops below roughly 3.5%, forward returns compress sharply.

One-month forward returns after similar readings have skewed negative (averaging -2%), even in otherwise healthy macro environments.

The BofA Bull & Bear Indicator confirms the same dynamic from a flow perspective.

It jumped to 8.5, firmly into contrarian sell territory, driven by massive equity ETF inflows.

I don’t like that either.

It reinforces my belief that you should position around Value rather than Growth.

When the 2021 market cycle topped, this Flow Show indicator also topped. Low cash levels also indicate there’s not much buying firepower left.

This shows investors positioning for what’s already happened.

We’re already seeing the early signs.

The macro backdrop is supportive — inflation is cooling, growth is holding, labor is easing — yet markets are struggling to build momentum.

Growth has failed to keep up with value which recovered to all time highs first.

Add to the fact that we have mid-term elections coming and a typical drawdown during that period, and you should have more defensives.

We have over-weights in Healthcare and Utilities. We also like Financials - and especially Consumer Finance and Regional Banks - which are breaking out on strong fundamentals and monetary easing.

I think Utilities as an ETF will do quite well the next 3 to 6 months and that’s a cleanr expression. The 10-year is likely topping out around here, or at least capped, given the benign inflation print we saw.

Exploiting the Low-Beta Anomaly

Most people want to achieve outsized returns by owning high beta.

That can work in a bull market... unless you get caught up in a correction after which you can get wrecked.

It's a high risk strategy, and most people will not implement it correctly.

There is a different way...

Oftentimes, there are higher risk-adjusted returns in low-beta stocks that are set to out-perform.

For example, in last week’s ledger, I had a write-up on Comcast.

Interestingly, Comcast is a "low beta" stock. It had a nice run up of 7% this week. We really nailed the bottom.

Now, if we had an ETF, I would have bought cheap call options on the name - because the beta of Comcast is low.

The main issue with a low beta asset portfolio is your total returns will lag the overall market in a bull market.

Utility stocks, insurance stocks, and staples - the kinds of businesses Warren Buffett likes - don't move higher for a given change of the S&P as high beta stocks.

But, their risk adjusted return is higher.

Meaning, the return you generate per unit of volatility is higher.

Mathematically, the right way to own this asset then is with appropriate leverage.

This is the same concept as owning the 'tangency' portfolio - something every finance student learns in school - and then using leverage to extend his returns and calibrate the volatility to his desired risk budget.

You own the asset mix that has the highest risk adjusted return.

Then, if you are benchmarking to the S&P 500, you apply leverage such that the beta of this portfolio now matches the S&P 500.

If you've selected that portfolio correctly, you should now outperform the S&P 500.

Warren Buffett does exactly this.

He owns low-beta assets.

He uses non-callable permanent financing with AAA debt to bring his beta higher.

The assets he owns have durable cash flows and wide moats - so there is no margin call risk.

Buffett's usage of leverage brings his portfolio beta higher.

He needs to do that otherwise he would lag his benchmark.

Buffett never tells people explicitly that this is what he is doing - but rest assured it is one of several pillars to his strategy.

What's the point?

There are a lot of high-beta chasers on FinTwit.

That strategy works...provided you are on the right side of the beta factor.

When the tide goes out, it can be vicious.

You're actually better off identifying low-beta assets and then calibrating to your desired level of risk.

I hesitate to write this, because you need sophisticated systems and factor models to implement this correctly.

But, this is the correct approach to modern investing.

And no one talks about it.

Here's one last way to make this point.

I have strong conviction Utilities will out-perform the S&P on a risk-adjusted basis with lower volatility over the next 3 to 6 months.

But, utilities have lower beta and volatility than the S&P.

So the S&P can still "beat" utilities... even though it is taking more risk to do so.

A more efficient strategy is gaining exposure to Utilities in a format that comps to the risk budget of the S&P 500.

Ripple Effect Of OpenAi’s Raise

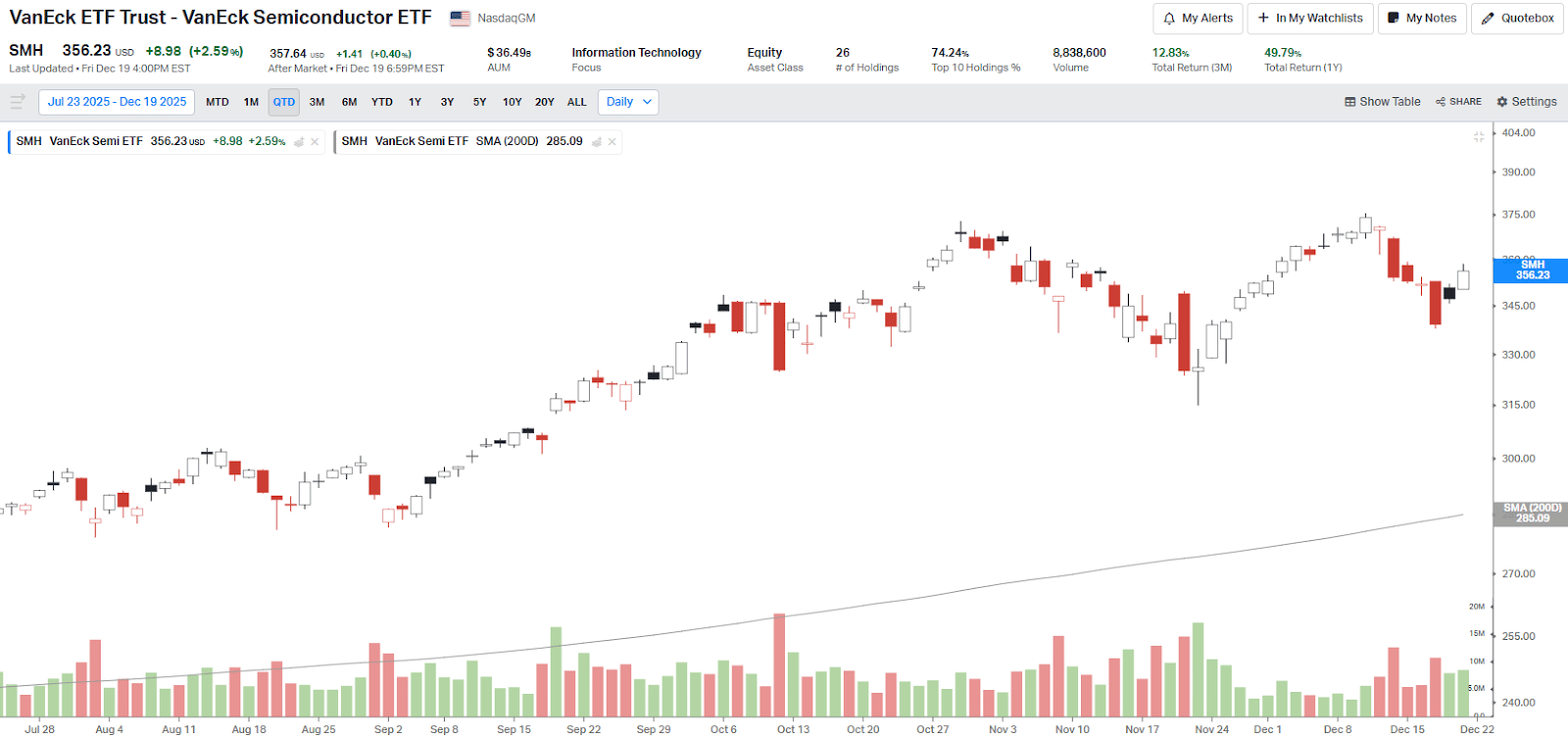

Last week, we wrote how we weren’t convinced on semis going forward due to OpenAI’s financing risks, and exaggerated valuations in the sector.

The Semiconductor, SMH, had three down days on its correction, but this changed on Thursday.

Reports leaked that OpenAI is raising roughly $100 billion at a valuation that could approach $800+ billion.

The S&P 500 jumped ~1% that day. Semiconductors stabilized almost immediately.

In prior weeks, the primary driver of market beta was Fed rate cut expectations for December, now it all hangs on the probability of OpenAI closing out a $100 Bn raise by end of Q1.

This is the most important news item to follow.

The central issue hanging over AI infrastructure has never been “Is demand real?”

It has been: Are the buyers solvent, committed, and capable of funding multi-year data center obligations?

That question got some answers after the news.

OpenAI sits at the center of the data-center buildout. In particular, it is a key counterparty behind Oracle’s rapidly growing backlog.

Those contracts only work if the customer can fund them.

If the customer cannot put real equity behind those commitments, projects slow or get re-priced.

A raise of this size reduces that risk materially.

It improves visibility around Oracle’s ability to execute on its backlog. It lowers the probability of delays, renegotiations, or cancellations tied to customer funding constraints.

That is why semiconductors stabilized almost immediately- we saw the effects across the flywheel.

The market was not repricing AI demand. It was repricing balance-sheet risk.

I am rooting for OpenAI to complete this raise - it’s crucial for the sector.

However, the $100Bn revenue projections used to justify OpenAI’s valuation remain unrealistic in my opinion.

It assumes rapid monetization across products that are still early. They assume pricing power in a market where competition from Google and Meta is intensifying.

Google and Meta are players with durable cash flows, profits, and an already used ecosystem.

The adoption of their AI models is significantly more easier because the models are seamlessly integrated within their product suite.

Also, I hardly see AI running its current pricing models in the long-run. Freemium ad models - those offered by Google and Meta - should rule the roost.

We will see more models, more free tiers, and more enterprise options, putting pressure on returns over time.

However, this Competition does not stop capex. The infrastructure still gets built, which is why semis saw recovery.

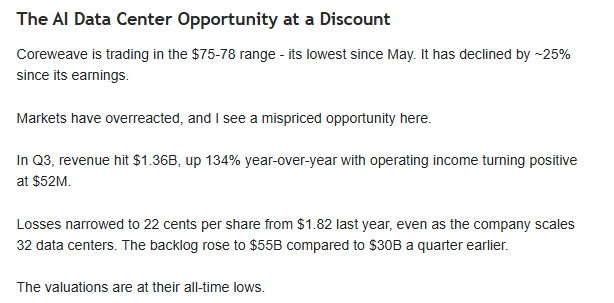

Coreweave Join Genesis Mission

CoreWeave joined the Department of Energy's Genesis Mission.

DOE’s Genesis aims to speed up research by giving U.S. labs and institutions shared, scalable access to advanced computing for large AI models and datasets.

Coreweave provides the execution layer with on-demand GPU and AI-optimized cloud infrastructure.

This deal diversifies CoreWeave's customer base toward institutional, public-sector demand, securing long-lived, less price-sensitive workloads that improve visibility and reduce reliance on volatile AI training demand.

This fits our long-term bullish view on CoreWeave.

We picked up 0.5% (on average depending on account) at the middle of this week before the 20% ish run-up. My only regret is not buying more. But, that’s how I always feel when these run-up. And, when it doesn’t work out, I’m glad I only bought 0.5%.

More generally, because we are constantly sourcing ideas, we never feel compelled to FOMO into anything or let positions size on any name get too large. We believe in diversifying our idiosyncratic risk. This is an important concept to understand - and it’s why Citadel, Millennium, and other quant shops do so well.

They have a small edge on many securities. They seek to capture that edge at scale. It takes a lot of investment infra to execute against this.

We have something like 50 positions and are up about 40%+ since the April lows. We are ‘diversified’ in several themes we like.

Did I tell you about the Wolfe Quant Factor holiday party we went to? Was funny to see the name tags of those in attendance - Point 72, Two Sigma… and Lumida.

It was a quiet party, not popular. Lot of nerdy quant types. I felt right at home. We are still very, very early.

Modern investing is not modern. Bill Sharpe and Harry Markowitz are still considered the leaders who ushered in ‘modern investing’ — that was 1950s technology… The investment philosophy has yet to evolve.

Incidentally, Coreweave was our very first private deals. We liked it because it has a good secular trend, a forward PE of 15x, and it was an ‘East Coast’ deal - not bid up to the moon by West Coast VCs.

We got in at a $7Bn valuation, and once it had an IPO, investors enjoyed a net realized gain of ~219%.

If you are an accredited investor or qualified purchaser, you can sign up with Lumida deals to get priority communication on our latest private deals.

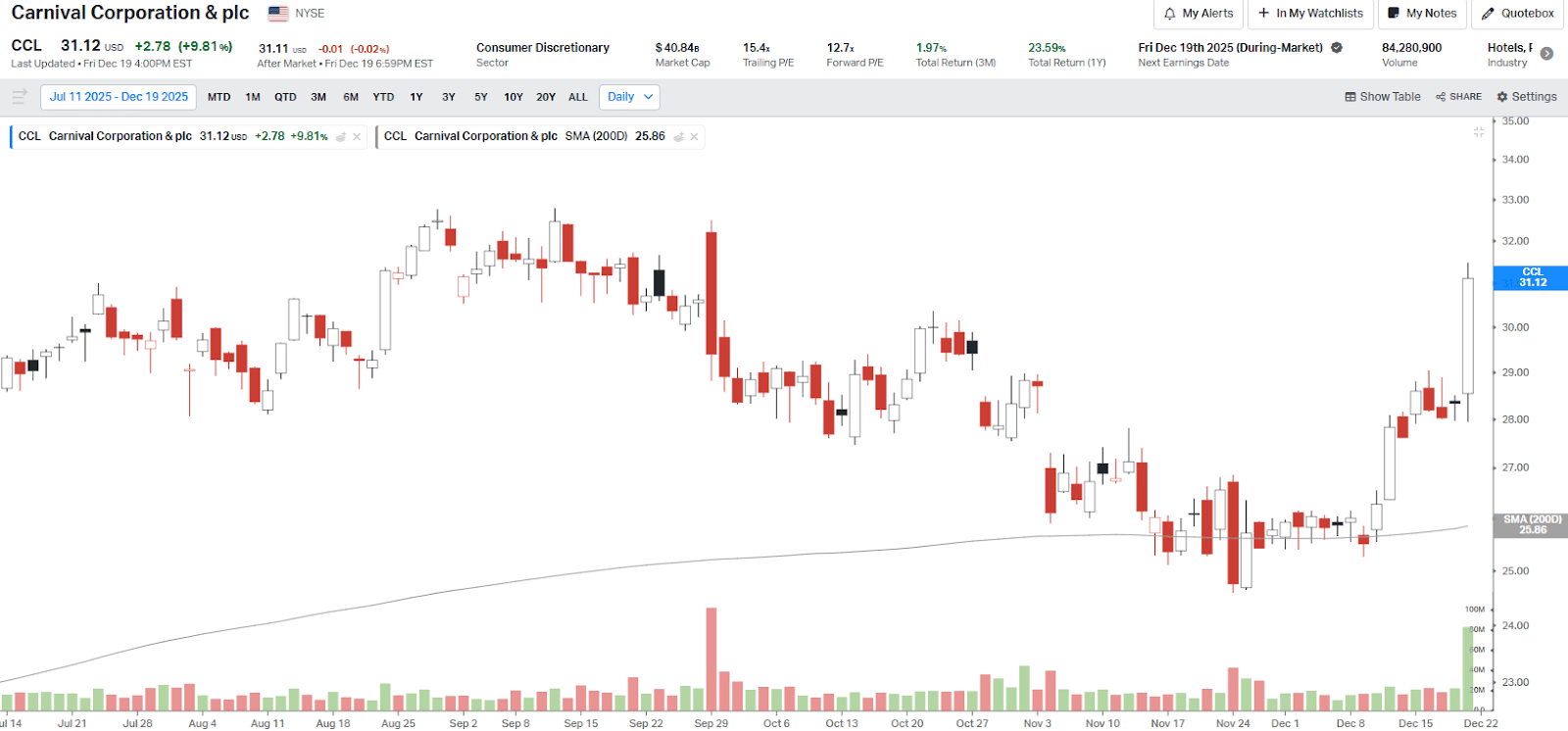

Cruise Line Names Shined This Week

Cruise line names moved higher this week after Carnival Corp (CCL) reported.

The reason: demand for experience-based spending remains strong.

Geoffrey T. Martin (CEO, CCL): “Demand for cruise lines is proving far more resilient than traditional macro indicators would suggest.”

Geoffrey pointed specifically to forward indicators:

“Customer deposits are up 7% year-over-year, hitting an all-time high.”

“Two-thirds of the business is on the books at higher prices.”

The improved bookings and prices highlight stronger demand going into the next year.

This is why we saw rapid jumps in this sector.

NCLH was also up 15% this week- I flagged this name a few weeks ago, and that it was trading at a bargain then. The stock is up 30% since the post. Read our thesis on NCLH here.

However, our call on Resmed (RMD) was a miss. The stock dipped below its 200D this week.

But, we are confident in its strong growth potential fueled by ongoing product innovation and a significant addressable market.

Hence, we are holding it.

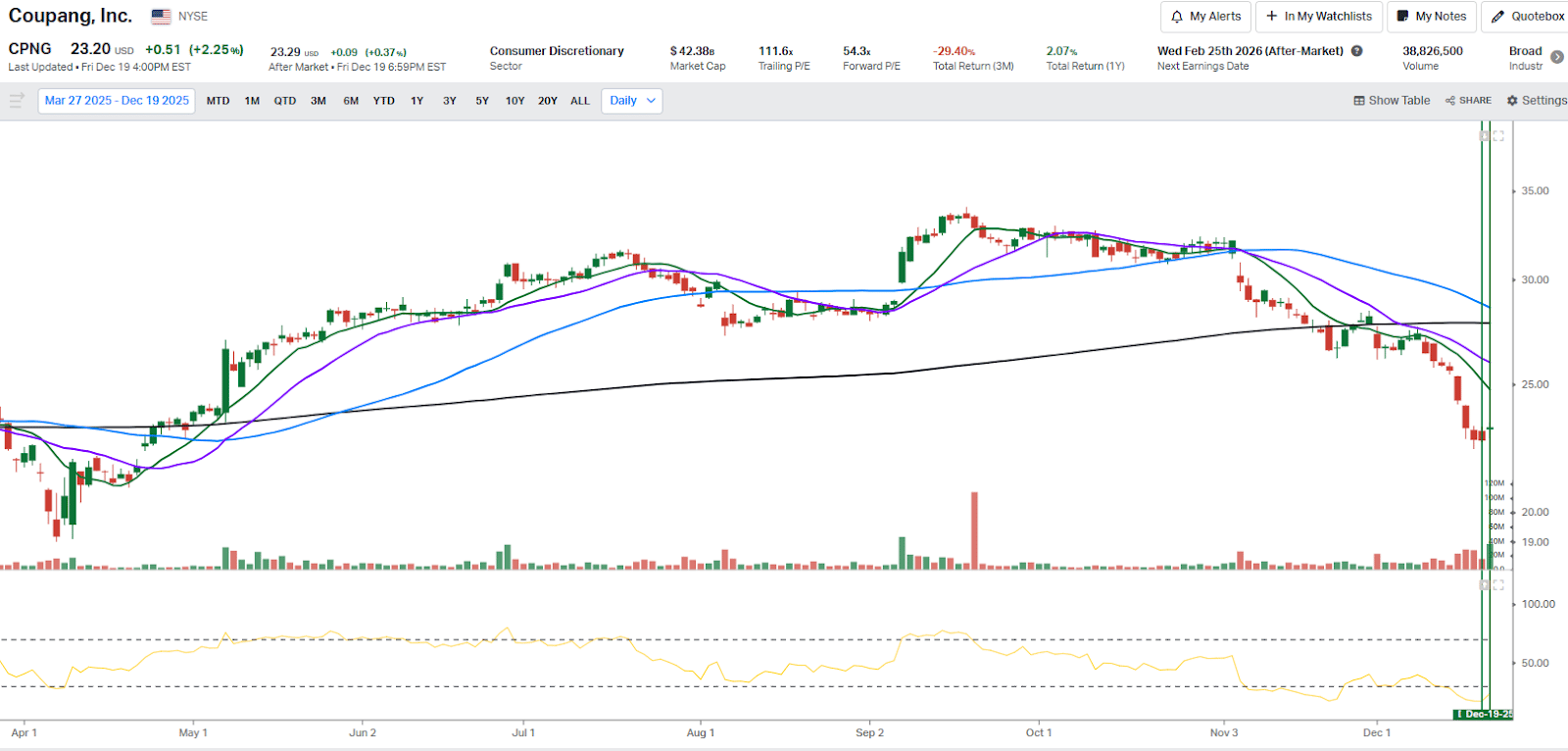

Coupang- The Opportunity In Sell-Off

CPNG, the Amazon of South Korea, went on sale this week after a customer list data breach.

South Koreans love to trade. That also means they panic sell.

The stock sold off quickly, but the fundamentals didn’t change.

On valuation, Coupang is meaningfully cheaper than AMZN on price-to-sales and price-to-gross profit, despite faster revenue growth.

Unlike U.S. hyperscalers, it also doesn’t carry a looming datacenter capex overhang that pressures near-term cash flow.

We scooped it at the lows, and then added to our position again on Friday after the 2.25% recovery.

Coupang’s core advantage is not e-commerce. It is the logistics density.

The company has already built the hardest part of the business: a nationwide, vertically integrated fulfillment network that enables same-day and next-day delivery.

That infrastructure is now being leveraged across higher-margin adjacencies like Eats, advertising, fintech, and media.

That shows up clearly in the numbers:

Revenues has grown high double digits in last 3 quarters.

Gross margins is near 30%, at the top of its historical range

Gross profit growth (30%) is outpacing revenue growth (18%), signaling operating leverage

This is not a company burning cash to buy growth. It’s one converting scale into economics.

As for the breach headline, it didn’t cause user churn, engagement decline, or logistics disruption. But, it gave us an opportunity to buy the stock 10% cheaper.

However, one can argue that high P/E TTM valuation (~110x), despite the dip, shows investors are already pricing in future growth, and any execution below perfect can hurt the stock.

What Actually Creates 10x Stocks?

This week, quant science published a quantitative study of 464 stocks that became 10x-baggers over 24 years.

They studied hundreds of companies.

Only a small fraction compounded 10x.

Let’s walkthrough the top 3 takeaways.

1. Size helps but only as runway

Small-cap stocks outperformed mid and large caps in 11 out of 12 cases.

But size itself isn’t the edge.

Smaller companies simply have more room to grow into their valuation.

That only works if expectations are modest at the start.

Small + expensive rarely compounds.

Small + reasonable can.

2. The “value effect” is really a warning: don’t overpay

Stocks with low book-to-market ratios — meaning investors paid far more than underlying assets justified — consistently underperformed.

This isn’t philosophical. Overpaying compresses future returns.

Multibaggers don’t start life as consensus favorites with heroic assumptions baked in.

They start with valuation slack.

3. Free cash flow yield is the most important factor

This was the key result of the study.

Across decades and hundreds of cases, free cash flow yield was the single strongest driver of 10x outcomes.

Why?

Cash does three things:

Funds reinvestment

Absorbs mistakes

Compounds quietly while attention is elsewhere

Revenue growth tells a story. Free cash flow tells the truth.

Multibaggers are created by not overpaying, buying real cash generation, and letting time do the heavy lifting.

You will notice in nearly all (maybe all?) of our stock write-ups we are looking at Free Cashflow yield…

Lumida Curations

Code Red or Code Slow?

Sam Altman argues that simply bolting AI onto search won’t be enough for Google. Real disruption comes from rebuilding products AI-first, where agents don’t just assist, but decide.

The AI Bubble Isn’t the End of the AI Boom

Demis Hassabis argues that froth and excess are inevitable in every major tech revolution, and while parts of AI will deflate, the underlying transformation is only accelerating.

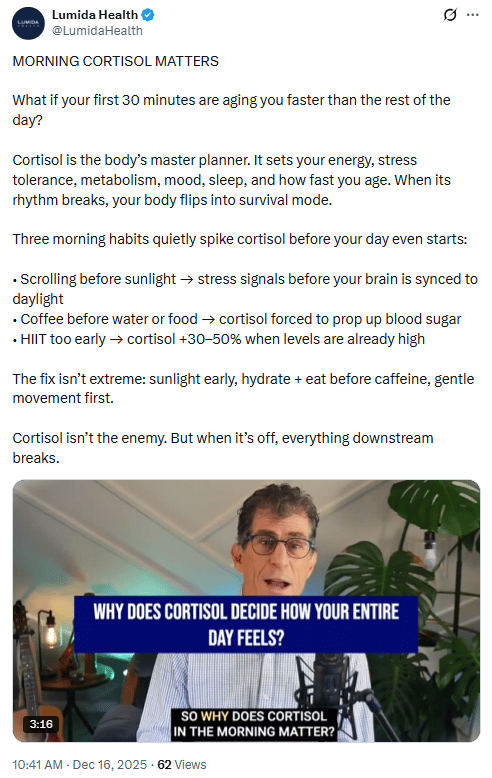

Morning Cortisol Is the Longevity Lever

The first 30 minutes of your day quietly shape stress, energy, metabolism, and aging. Small morning habits can either stabilize cortisol or push your body into survival mode before the day even begins.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.