Here’s a preview of what we’ll cover this week:

Macro: Initial Unemployment Claims: Fraud?; Mortgage Refinance Boom

Markets: Seasonality Around FOMC Meeting; Cyclicals > Defensives; Non-Consensus: Small Caps

Digital Assets: BlackRock: from BUIDL to tokenized ETFs; Nasdaq: tokenized shares on the same book; Freeing trapped collateral

Lumida Curations: Real World Assets Are True Hedges; Control Tech With Your Mind; Powell: Tariffs Lift Prices Briefly

Real World Asset Summit 2025- Brooklyn

It is always a treat to speak at the Tokenization conference - joined by ParaFi, Stripe, Arrington Capital.

Proud that we helped shape the debate around on-chain assets when it was Non-Consensus. I remember writing op-eds in the WSJ and American Banker criticizing then Chair SEC Gensler and former OCC Chief. We’ve come a long way.

I’ll walk you through the highlights in this newsletter.

Recognition

Digital Assets

I attended the RWA Summit in Brooklyn this week.

Real World Assets on Chain has mostly been a massive headfake.

It started with the concept of tokenizing real estate (which never made since given the county clerks need to tollgate each transaction).

Now, you have JP Morgan, Blackrock, and Nasdaq all announcing tokenization offerings or plans.

Those institutions are going to bring their customers along - and this is inevitable.

BlackRock: from BUIDL to tokenized ETFs

BlackRock is moving beyond its tokenized money-market fund BUIDL. BUIDL launched on Ethereum via Securitize and has surpassed $1B AUM in March and ~$2B by spring.

BlackRock is now exploring tokenized ETFs.

The firm’s framing has been consistent: tokenization should “solve real problems for clients” (24/7 transferability, faster settlement, programmability) rather than exist as a side experiment.

When ETF shares or other assets move on-chain, they become programmable collateral that can sit in on-chain funding and margin workflows.

Nasdaq: tokenized shares on the same book

What’s Nasdaq doing?

Nasdaq has filed a rule change to permit tokenized equities and ETPs to trade on the same order book, with the same priority, as their traditional counterparts.

Tokenized securities are treated as first-class citizens.

In operational terms, NASDAQ would send the investor’s tokenization/settlement instruction to DTCC, and they would execute it under their rules.

This keeps the official record and finality at DTCC while letting venues innovate on speed of execution.

Nasdaq essentially acts as an omni-bus account which executes at a much faster speed.

This is a hybrid architecture. It’s not a true crypto-native architecture.

A hybrid architecture means that the token representing the asset is on-chain, but the general ledger is still off-chain.

In a true crypto-native architecture, there is no ‘digital wrapper’ for the underlying shares - the shares themselves are native tokenized securities and their ownership is represented on-chain. It will take many more years to get there.

By anchoring tokenized instruments at DTCC and trading them on Nasdaq, tokenization enters the core U.S. pipes rather than a parallel market.

This is a pragamatic approach to innovation.

Freeing trapped collateral

Tokenization’s first real win is collateral mobility.

There is a massive amount of collateral that is trapped due to slow settlement speeds or due to their illiquid nature.

Private credit alone is already ~$1.5–$1.7T AUM and much of it lives inside funds/SPVs that are slow to pledge or transfer.

An investor in these assets cannot use those assets as a source of liquidity.

Moving these claims onto token rails turns “end-of-day, paper-heavy” assets into same-day, postable collateral, which is material even if only a slice is unlocked.

Dan Doney, CTO of DTCC: “Collateral mobility is the ‘killer app’ for institutional use of blockchain – … the speed and openness of this technology can safely and reliably unlock liquidity in traditional markets at scale”.

Faster collateral lowers funding costs, improves margin efficiency, and adds liquidity optionality exactly when markets need it.

At the beginning of ‘24, we wrote an op-ed in the American Banker in defense of decentralization. It discussed how decentralization opens up capital and innovation across the long tail. People are realizing it now.

You can read the op-ed here . We also did a detailed thread in defense of decentralization. Read it here.

Lumida On Rails

We’re evaluating a tokenized equity offering so eligible investors can own Lumida on modern rails: cleaner settlement, better transparency, and easier participation.

If you’d like to be considered when we open the book, apply at https://lumidadeals.com/ to get on the list.

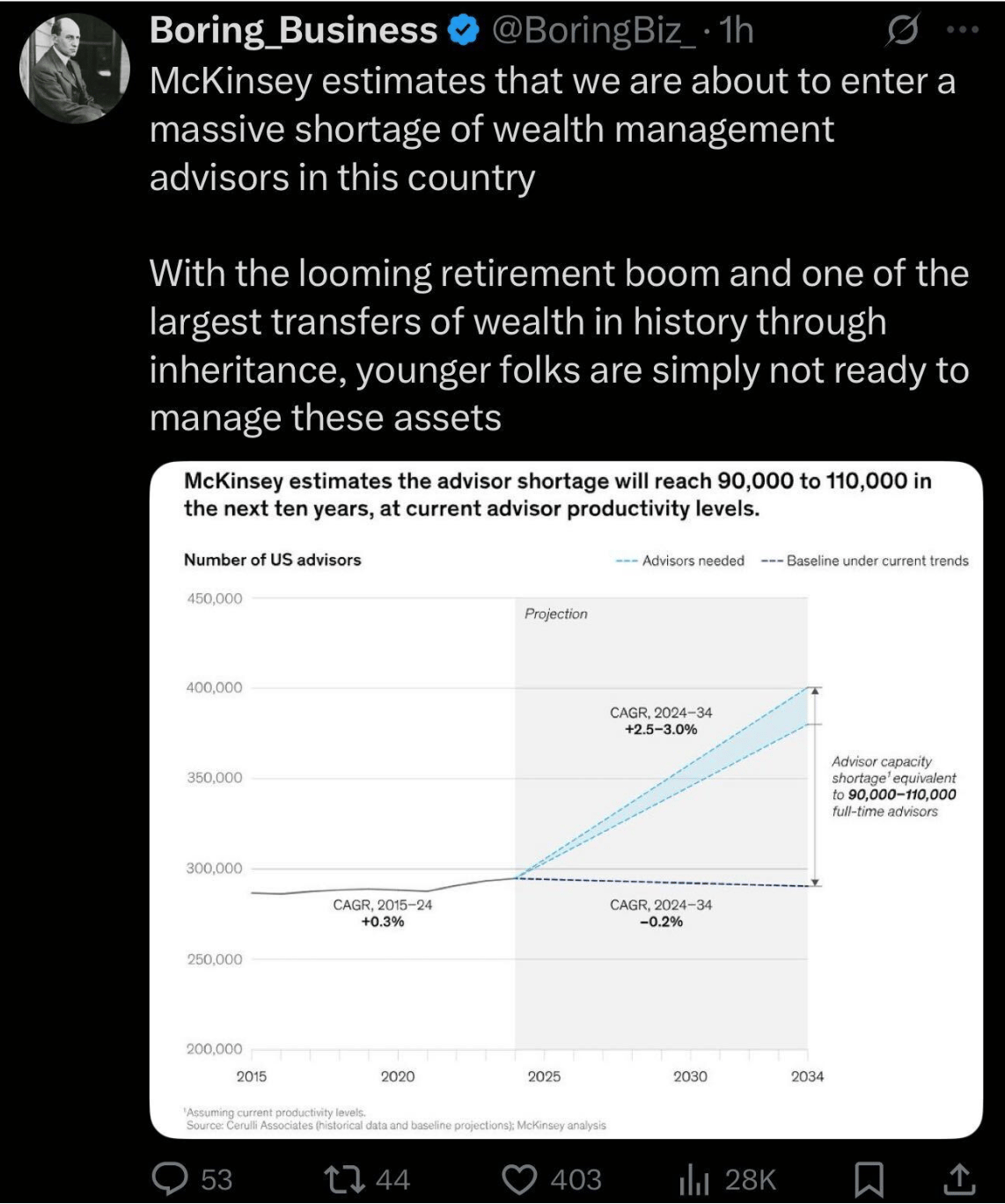

Who’s Going to Manage the Money?

The U.S. faces a ~90k–110k advisor shortfall over the next decade just as Boomers retire and a historic wealth transfer accelerates. The gap won’t be filled by call centers or model portfolios.

Families need a CIO + family-office partner who can generate high-quality returns, navigate taxes, manage liquidity events, and provide a real investment edge – Some qualities we excel at Lumida Wealth.

Lumida is a SEC registered investment advisor specializing in alternative investments and digital assets

We provide our clients with access to venture capital, private equity, digital assets and credit investments, all with high touch client service.

We give you the confidence in your financial future so you regain your time.

If you’d like to explore a relationship with Lumida, please shoot a note to [email protected], or book your call here.

Macro

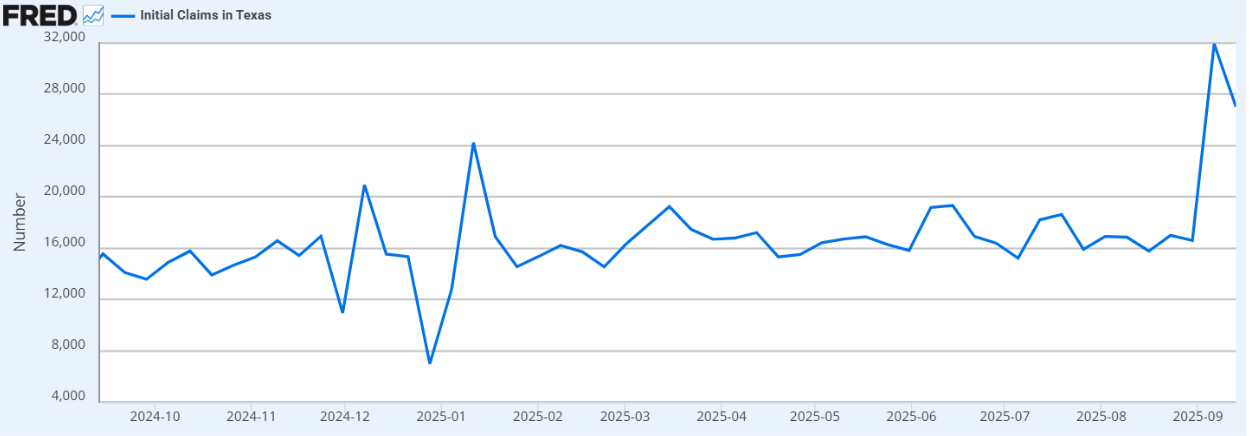

Initial Unemployment Claims: Fraud?

There was a spike in initial unemployment claims last week -- one of the best leading indicators on the state of the economy.

Texas accounted for a large part of the increase from ~16,600 to ~31,950 last week.

The spike spurred Fed to cut rates by 25 bps. Markets rallied on Powell's comments about labor market weakness.

Now, there is reporting that this spike was caused by Fraud in Texas.

Kind of amazing, isn't it?

Fed policy driven by UE claim fraud?

In last weekend's newsletter, we wrote that the recent weakness in NFP payrolls is (i) part statistical and seasonal artifact, and (ii) function of less labor supply growth (immigration control) and labor demand (productivity growth).

We said don’t read much into the recent weakness in NFP reports, and a lot of the recent hysteria is fear combined with confirmation bias.

Now we see initial claims dropping significantly.

Mortgage Refinance Boom

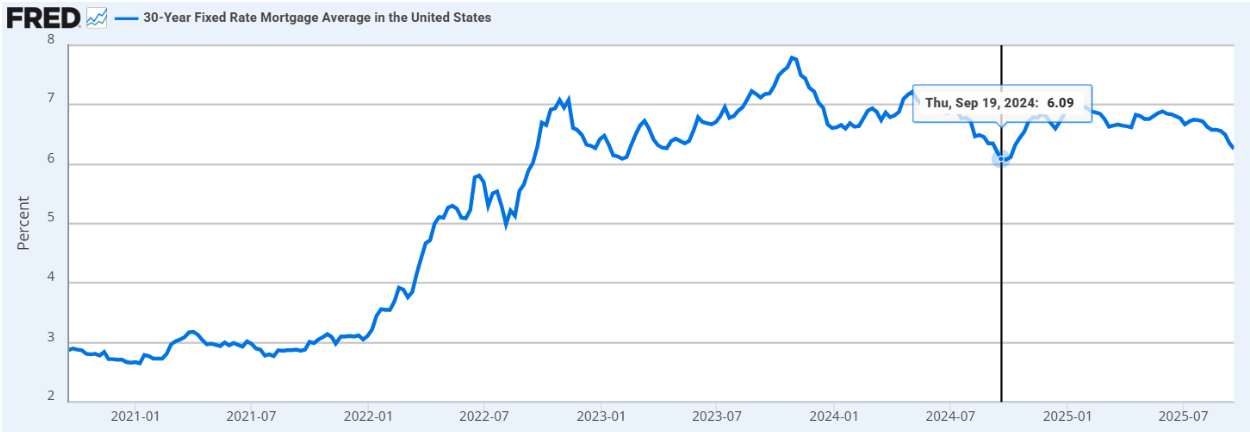

A lower ten-year has caused a mortgage refinance boom.

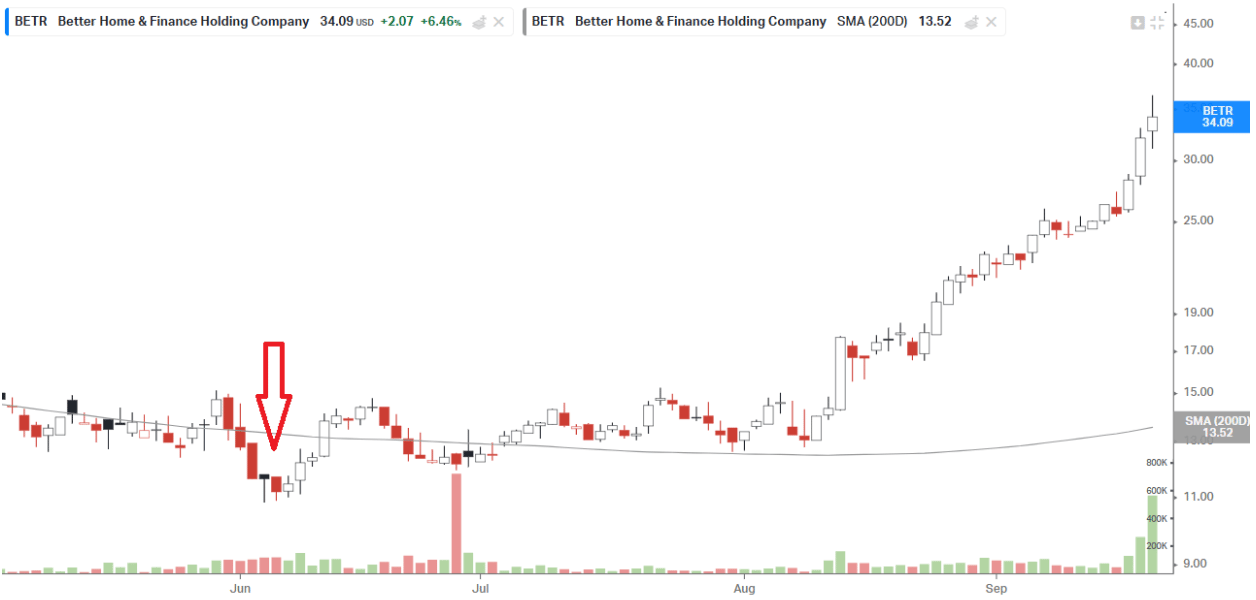

You can see stocks like BETR making new YTD highs with wall to wall headlines about a refinance spike.

This is a theme we’ve been focused on for a few months. We also flagged it in a newsletter a few weeks earlier. Read it here.

Here’s the funny thing:

The best time to invest in the mortgage refinance theme was in May when Dalio doomerism about higher forever rates was the topic.

The ‘higher for longer’ idea was a theme we were on in 2023 and 2024… but you need to be mentally flexible and change your view.

Back in May, all these assets were cheap and that news was priced in.

Now, everyone is talking about mortgage refinance — but the assets have already quietly run up 100% since then.

Have a look at BETR’s chart.

This is classic Non-Consensus investing.

It’s the quiet investment when no one is focused on the opportunity.

Interestingly, the same mortgage refinance bump took place the exact same week last year. The 30y rates bottomed out on Sep 19 '24.

Seasonal patterns like Back to School (fear of changing kids school mid-season) plays a role in this - supported by a lower Ten Year.

For similar behavior reasons, I’d expect the refinance wave to taper. For that reason we have a partial hedge on our BETR position by shorting Rocket Mortgage. It’s not that we expect Rocket to go down so much as we think we have excess beta risk on mortgage refinance, and that’s a decent hedge for the position.

We also trimmed about ¼ to 1/3 of our position in BETR. It has run up 140%+. It’s annoying to pay ST capital gains taxes on the name. But, it did feel like a prudent move.

An interesting question then is if that’s the case should refi ideas trade lower?

I believe names like Better will continue to work even after post-mortgage refi bump digestion.

The reason is that momentum creates its own demand. Better is now attracting momentum investors. What started as a value name is now a momentum name. So, dips will be bought.

Market

Seasonality Around FOMC Meeting

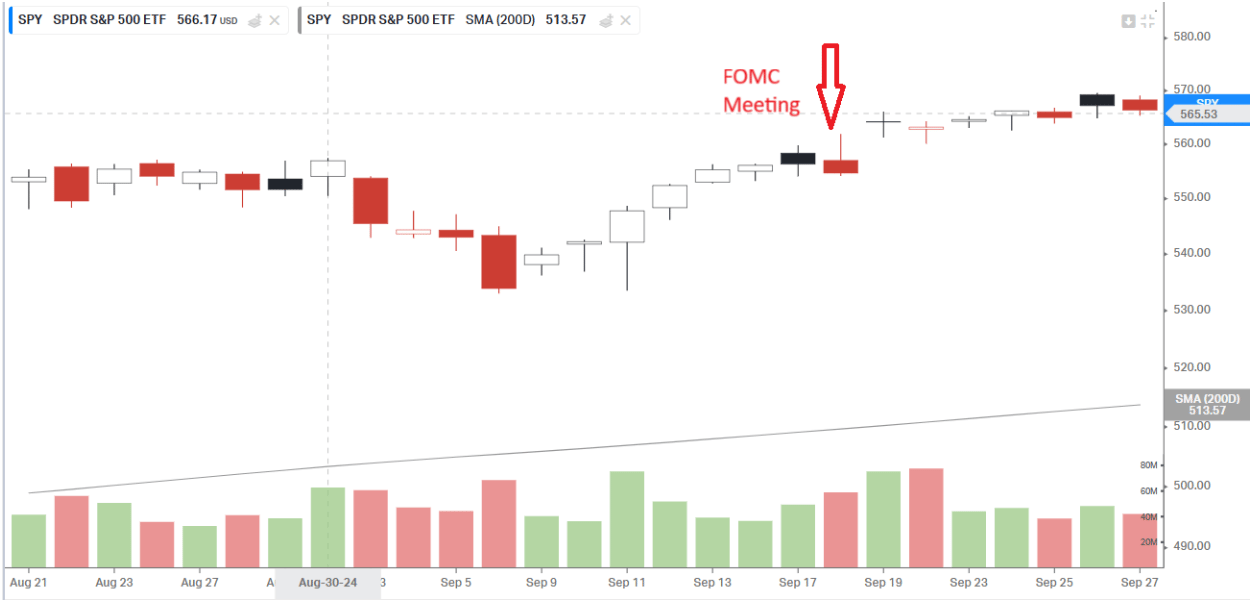

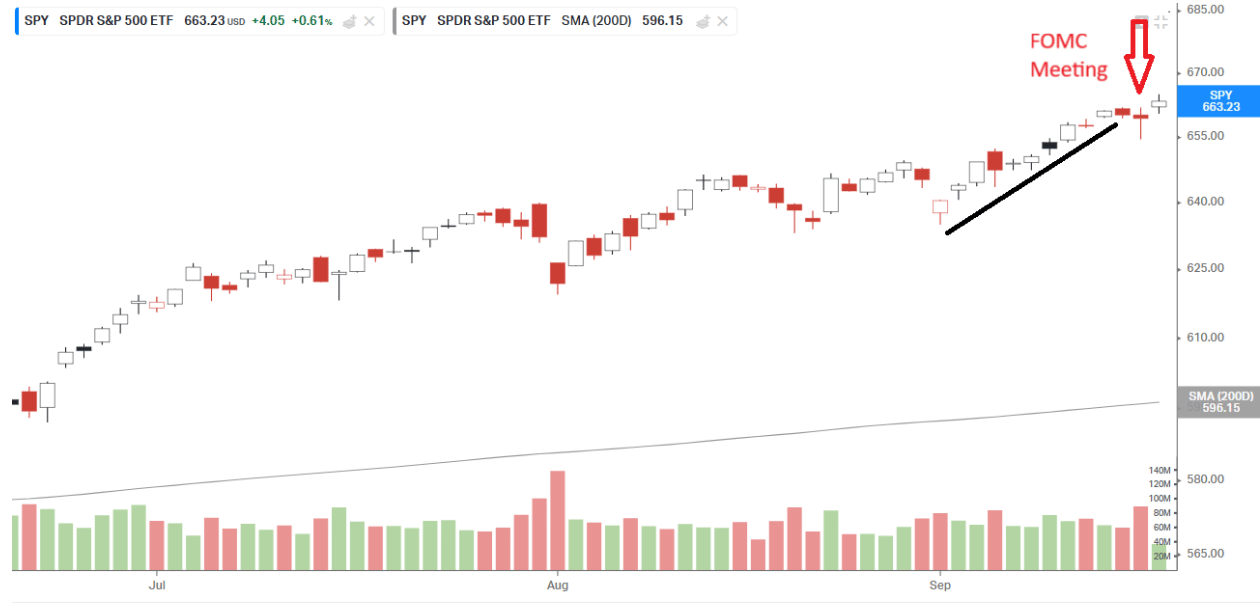

We had the same playbook, two years in a row.

In Sept ’24 and Sept ’25, SPY rallied into the FOMC, wobbled on the announcement, and then firmed up.

Last year the decision-day dip was noise. The very next session reversed higher, and post-September, SPY finished +11.27%.

This September looks similar. We had strong gains into Fed week, a gap up and fade on the decision day, and higher the next day - just like last year.

Near-term, next week is the softest seasonality of the year, and OpEx can amplify volatility.

We are also seeing a number of parabolas and ‘victory laps’ on X. We are also now squarely in the ‘blackout period’ before earnings which limits ability of firms to buyback their stock. So the market is more vulnerable to softness in the weeks ahead.

Big picture, Q4 positive seasonality is ahead of us, and macro remains bullish (earnings up, productivity rising, labor supply cooler but orderly) - people overly concerned about recession risks.

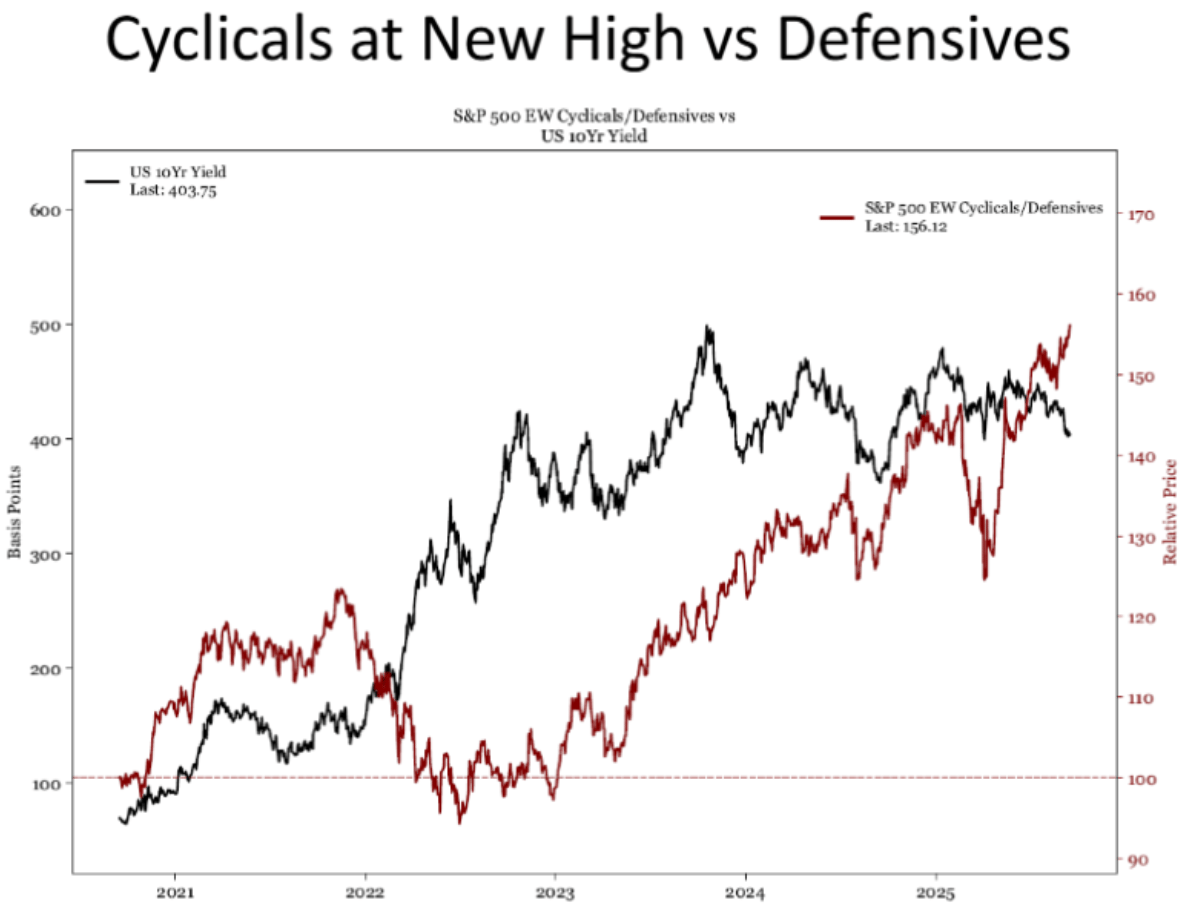

Cyclicals > Defensives

Markets are leaning toward economic expansion rather than contraction.

Cyclical stocks are outperforming defensives. The equal-weight ratio of cyclicals to defensives has reached a new high.

Over the past century, periods when cyclicals outperform have often been followed by further gains in the next 12 months.

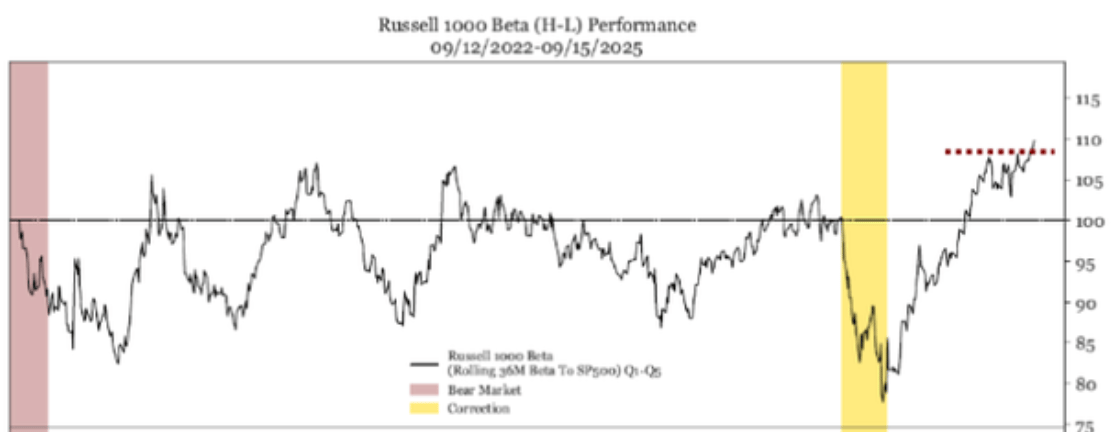

Similar investor sentiment is reflected in high beta names. The high-minus-low beta index made a new high, confirming trust in economic expansion.

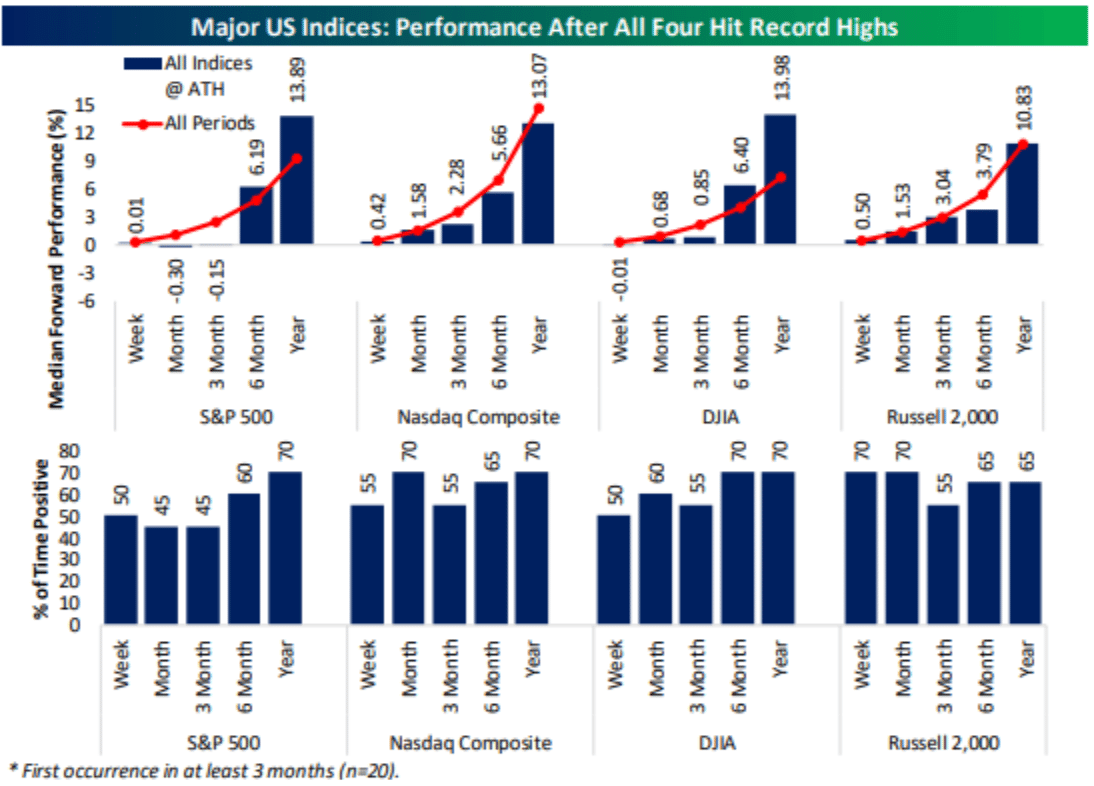

To add to the above data point, this week, we also saw Russell2000, NASDAQ, S&P500, and DJIA, hitting new highs together.

It has only happened 20 times in history, and long term (6M-1Y) returns are positive across indices from here.

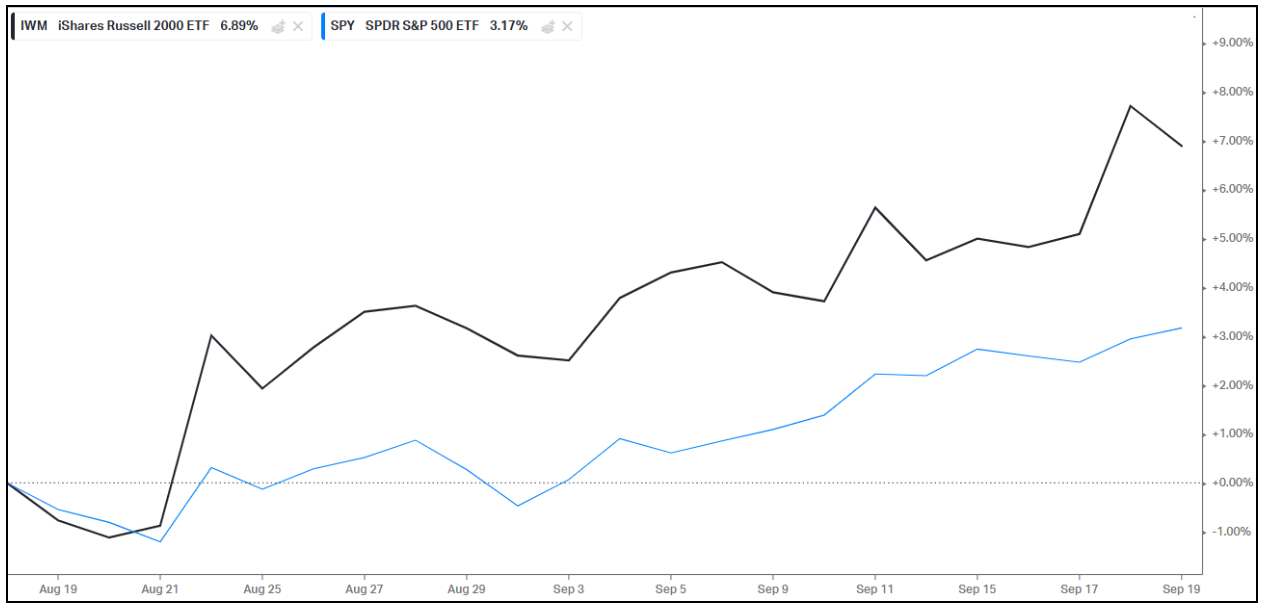

Non-Consensus: Small Caps

The Fed is telegraphing 3 back to back adjustment cuts - akin to last year.

Take a look at small caps. I’ve been shouting from the rooftop on this asset class.

Small caps are transitioning from a non-consensus, hated and under-owned asset to a momentum asset.

They gained ~7% in the last 1 month compared to SPY’s ~3%.

Guess how much large cap value did in the same time. (Hint: it is between -1.8% and -2.0%)

If you are looking for something to buy, we think Norwegian Cruiselines will present an attractive entry sometime this week. We are seeing bullish wicks and consolidation above trendlines.

INVESTOR TIP: SETUPS

Here are a few setups I look for.

1. ‘The No News Sell Off’

A stock is down for no discernible reason.

The peer group is still performing and both peers & names remain in an uptrend.

SkyWest is an example of that vs Delta and United.

2. ‘Thematic Sell Off’

This is when a theme is in a correction.

But, earnings growth remains strong as is management guidance.

In this scenario, you buy the highest quality company - ‘the Mercedes Benz’ in the field.

An example: bank core processors have all sold off. The best in the field is Fiserv. We got it.

3. ‘Narrative Sell Off’

This is when earnings growth and management and execution is fine.

But, some scary news comes out and the stock sells off.

This happened to Uber at the end of last year on fears of autonomous driving.

We were bearish on Uber and then turned bullish when the fears were too great relative to price.

4. ‘The Parabolic Hangover’

A stock gets a sudden bout of good news.

It goes parabolic. Then it has a bunch of trapped buyers who bot in at the wrong time.

Chipotle Mexican Grill in May ‘24 and FICO this year and CAVA are examples.

Most momentum names eventually have a parabola that does them in at some point.

Sell the parabola.

5. ‘Crowded Theme’

Everyone and their tennis coach owns the stock.

The stock is legitimately a good idea. But, it is ‘over positioned’. No one is left to buy.

This is what happened to Nvidia in June ‘24 when Cathie Wood top ticked the market.

The entire semi theme was over positioned.

It can take 6 to 9 months to work off.

MicroStrategy was over positioned by the end of ‘24, and needed to cool off.

Berkshire was over positioned, to the day, at the time of their annual summit.

5. ‘The Monet’.

This is a concept

It describes a stock with a story and attributes that are so one-of-kind and an on-theme narrative and they are the only game in town.

My Monet stock was ASPI last year, a uranium idea with a novel story.

6. ‘The Rebound’

A stock has legitimately good news: like Sydney Sweeney driving sales for AEO.

People forget the name two weeks later. The stock heads back down to a moving average.

That’s where you buy.

This happens quite regularly during earnings season.

Pay attention to stocks that crushed earnings but then give back a big chunk of their gains.

Recent examples: HALO and Western Alliance (WAL).

7. ‘The high quality dislocated asset’.

A truly world class business goes on sale due to fears of an asteroid delivering impending doom.

The Google correction was a great example of this.

Anti-trust fears were over blown because I’d make more money if Google was broken up anyway (like the GE spin-outs).

Buying JP Morgan during spring ‘23 ‘banking crisis’ was another.

Buying United Health was another.

8. The Ignored & Non-Consensus Rally

Here, you have a background lingering perception.

The market is overly fixed on the older and inaccurate perception.

Fundamentals have improved, and LT investors are stepping in that have done the work.

Many recent examples of this:

WBD - Warner Brothers had a 17% FCF yield and a giant IP library. Now it has a bid from Paramount

BETR had $100 MM cash on a $200 MM market cap

ETHE and GBTC everyone thought the Grayscale trade and digital assets were dead after FTX.

NCLH is another name here.

Ngl, the contrarian in me, loves these setups and has many examples of this.

9. Short Interest & Momentum

Stocks that have animal spirits and are heavily shorted but also have a cult can sometimes make large moves.

Usually the shorts are correct about the terrible fundamentals. And, shorted stocks do lag on average.

But, those that do not lag are ones to watch and can do well.

Defense stock- KTOS- is this example (careful, it is parabolic now).

10. ‘The Close Second’

Now and then you find a stock that is the only way to satisfy investor appetite for a theme.

Ex: SpaceX is private and worth $750 Bn.

Retail investors look for a proxy in RKLB.

11. The Momentum Breakout

This is very popular on X.

Microsoft earning and follow-through is an example.

You have a trend line break. Half the time these fail. They require close risk management.

When they work, gains pay for losers.

12. High momentum stocks

These stocks have momentum and great stories.

The value guy in me prefers filtering these by valuation and trend duration (I like early trends).

There are dozens of these ideas out there.

I try to find a way to participate. Even 50 bps. They rarely admit good entries.

Find a way to get involved.

13. The Capitulation Vomit Comet

China in Feb of last year capitulated.

It forms a massive V in a single day after a waterfall decline. No one is left to sell.

14. The Wall of Worry

People have anxiety about a recession and yet earnings growth is sound.

There are ‘fears’ - like Iran / Israel conflict - but nothing that matters to earnings.

Buy the fear.

15. Macro Rate sensitive proxy

When the ten-year is heading down, own rate sensitive names like small caps.

When LT rates are heading up, homebuilders, levered firms, and other rate sensitive names lag

16. Macro Dollar Proxy

When the dollar is heading lower, own emerging markets like Brazil that are commodity exporters.

Lower US dollar costs reduces emerging market financing costs

Focus on the direction of the US dollar rather than the level, usually the same with rates.

17. The Dominant Market Leader

Taiwan Semiconductor, when it was 15x forward PE, was a great example of this.

Look for a moat, backlog, quality clientele and mission critical picks and shovels.

We are always learning.

Lumida Curations

Real World Assets Are True Hedges

Solana’s Anatoly Yakovenko explains why real-world assets and creator-linked tokens could unlock a new funding model once regulatory clarity is achieved.

Control Tech With Your Mind

At Meta Connect 2025, the company unveiled a breakthrough neural wristband that reads brain signals, letting you control devices without lifting a finger.

Powell: Tariffs Lift Prices Briefly

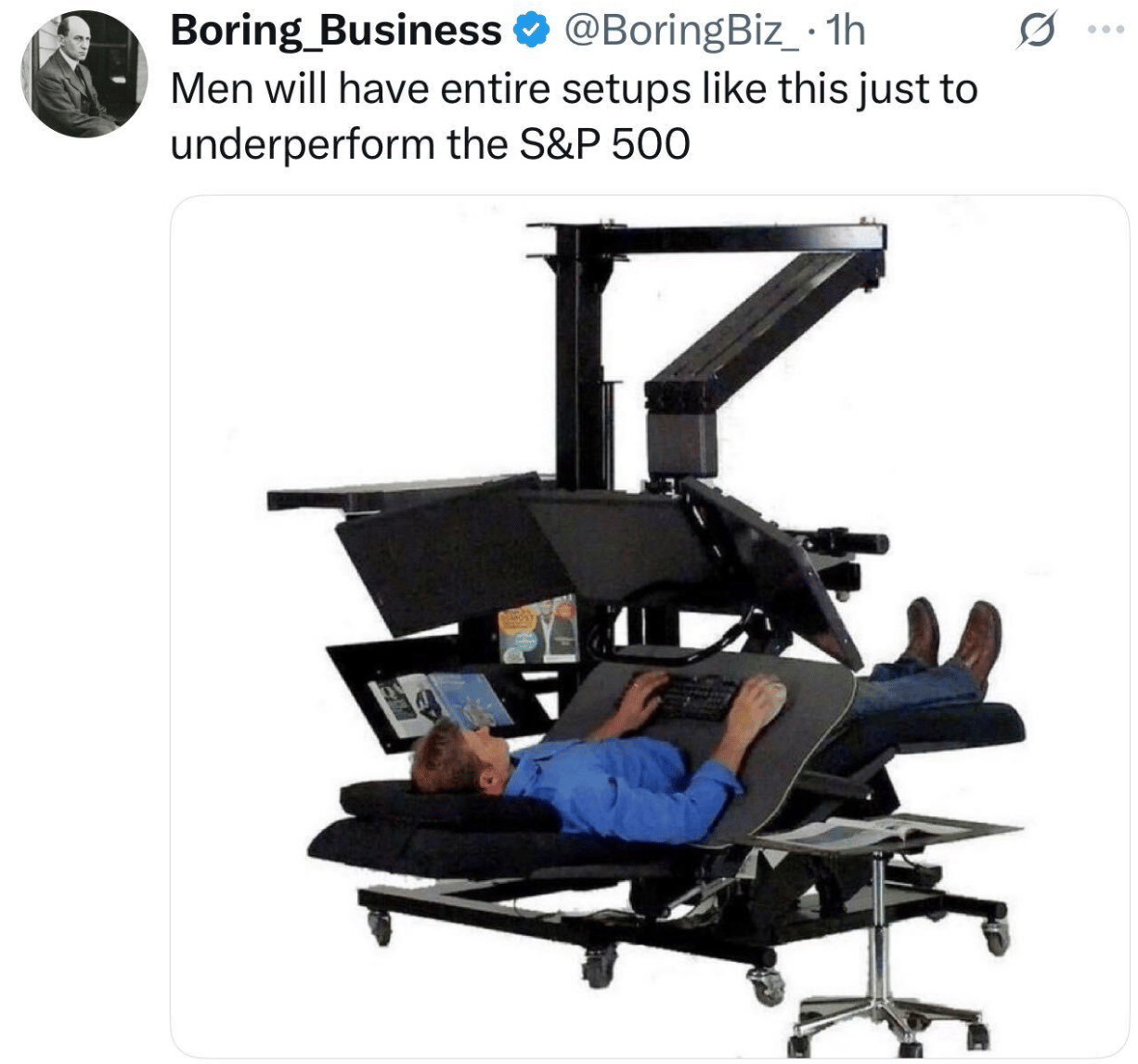

Memes

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.