Here’s a preview of what we’ll cover this week:

Macro: Is the US Economy Shock Proof?; How’s The Labor Market?; Credit is Re-Accelerating

Markets: The AI Flywheel Has Just Begun; Delta’s Q3 Shows Consumer Strength

Digital Assets: Polymarket: the Market for Information; Wall Street’s Blockchain Moment; Coinbase and Mastercard in UK Battle for BVNK; IPOs on Solana And Ethereum

Lumida Curations: Jamie Dimon Warns on 2026 Outlook; Jeff Park: Capital Rotates to Bitcoin; Dollar isn’t Collapsing

Spotlight

In this week’s Bits + Bips, I joined FalconX’s Joshua Lim and NYU’s Austin Campbell to unpack Bitcoin’s rally to All time highs, and whether we are at Euphoria.

Spoiler: it’s not “debasement.” as Bloomberg (and everyone else) suspects.

Here’s what we discuss:

How the options market is quietly driving bitcoin’s price

Why this isn’t a “debasement trade,” despite what everyone thinks

Whether we’ve hit peak euphoria—or not even close

How bitcoin, altcoins, and tech stocks trade together and how they don’t

What kind of shock could finally take bitcoin down

You can watch the podcast here.

This week, we spent some time in Puerto Rico, hosting dinners and meeting new clients.

We held dinners at the Ritz in Dorado, La Concha, and Santaella in Condado. All amazing.

I shared a few livestreams on Puerto Rico’s real estate market and investing opportunities here.

Watch them here:

Macro

It the U.S. Economy Shock Proof?

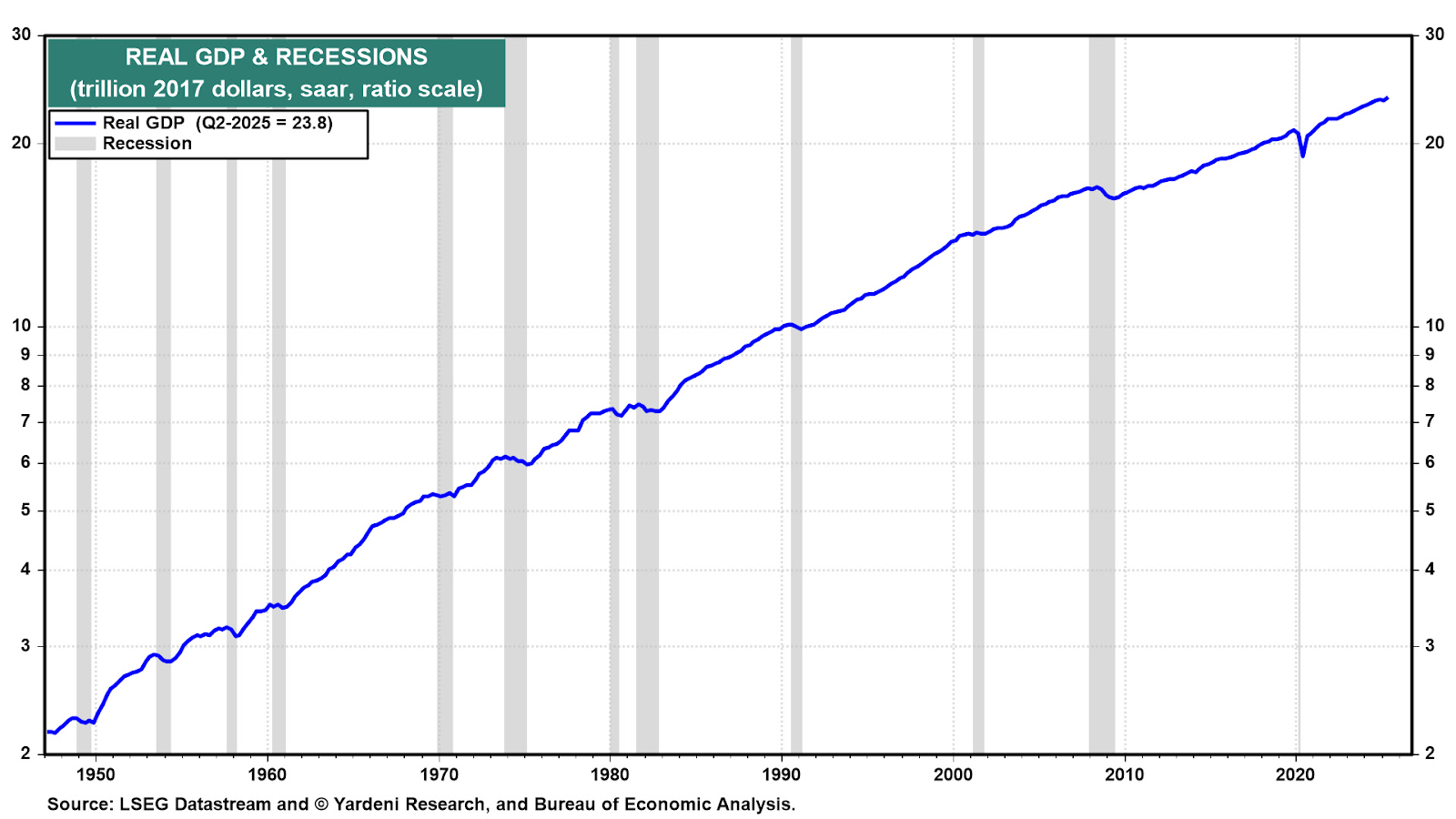

Since the two-month recession in 2020, the US economy has absorbed one shock after another: pandemic aftereffects, supply-chain snarls, an inflation spike, the steepest Fed tightening in decades, tariffs, and even a shutdown.

But, it has kept expanding.

The latest data say the same thing.

Q2 real GDP was revised up to 3.8% SAAR with consumption at 2.5%. Q3 tracking sits near 3.8% with consumption around 3.2%.

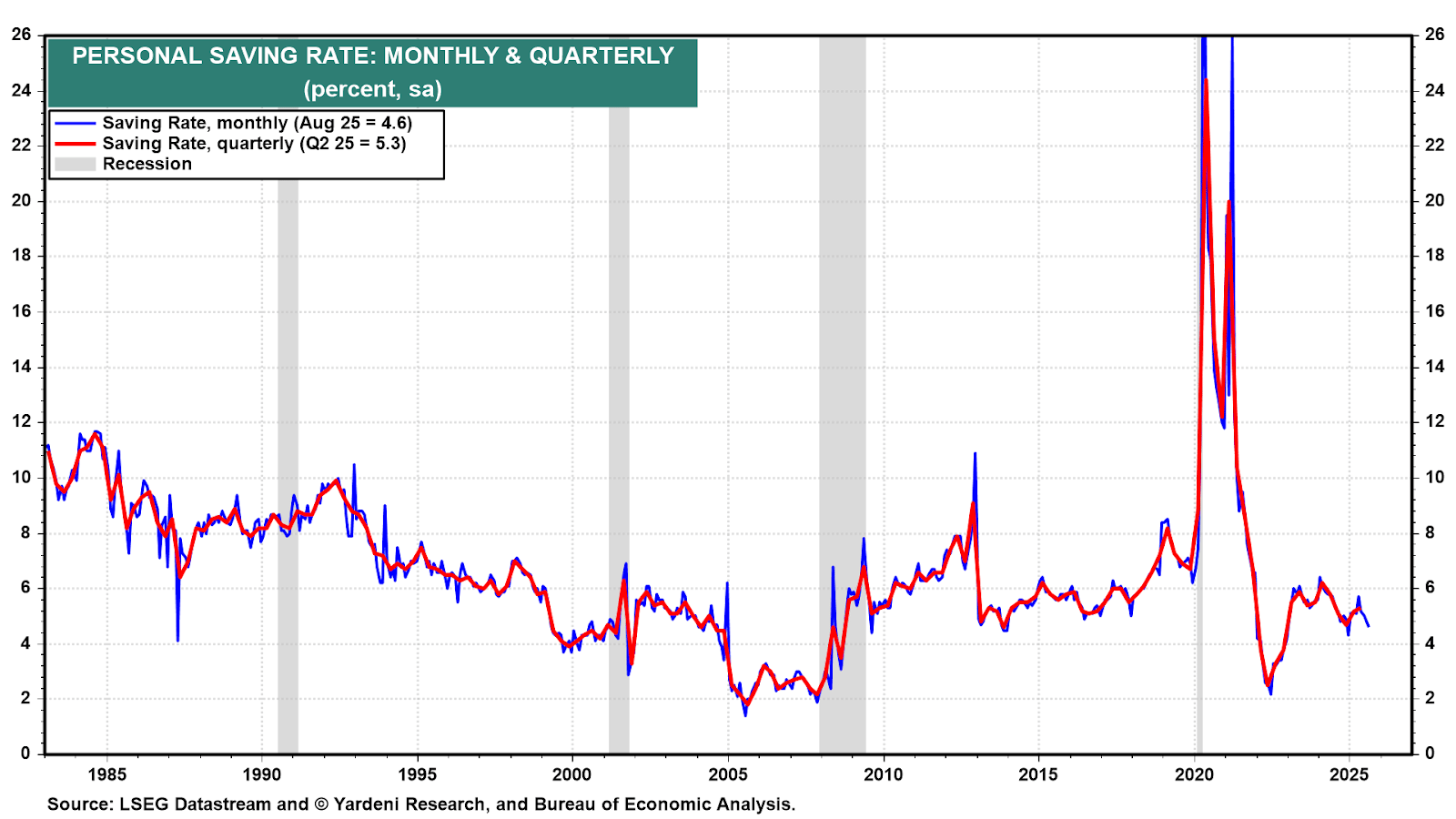

Household behavior shows consumer confidence.

The saving rate is drifting lower as wealth effects rise and Boomers decumulate, which sustains consumption, helping economic growth.

You can see the discretionary spending growing in Delta’s Q3 results (we own it and other discretionary stocks). We will discuss it shortly.

Outside of an exogenous shock or a self-own in policy, it’s hard to see a recession coming folks.

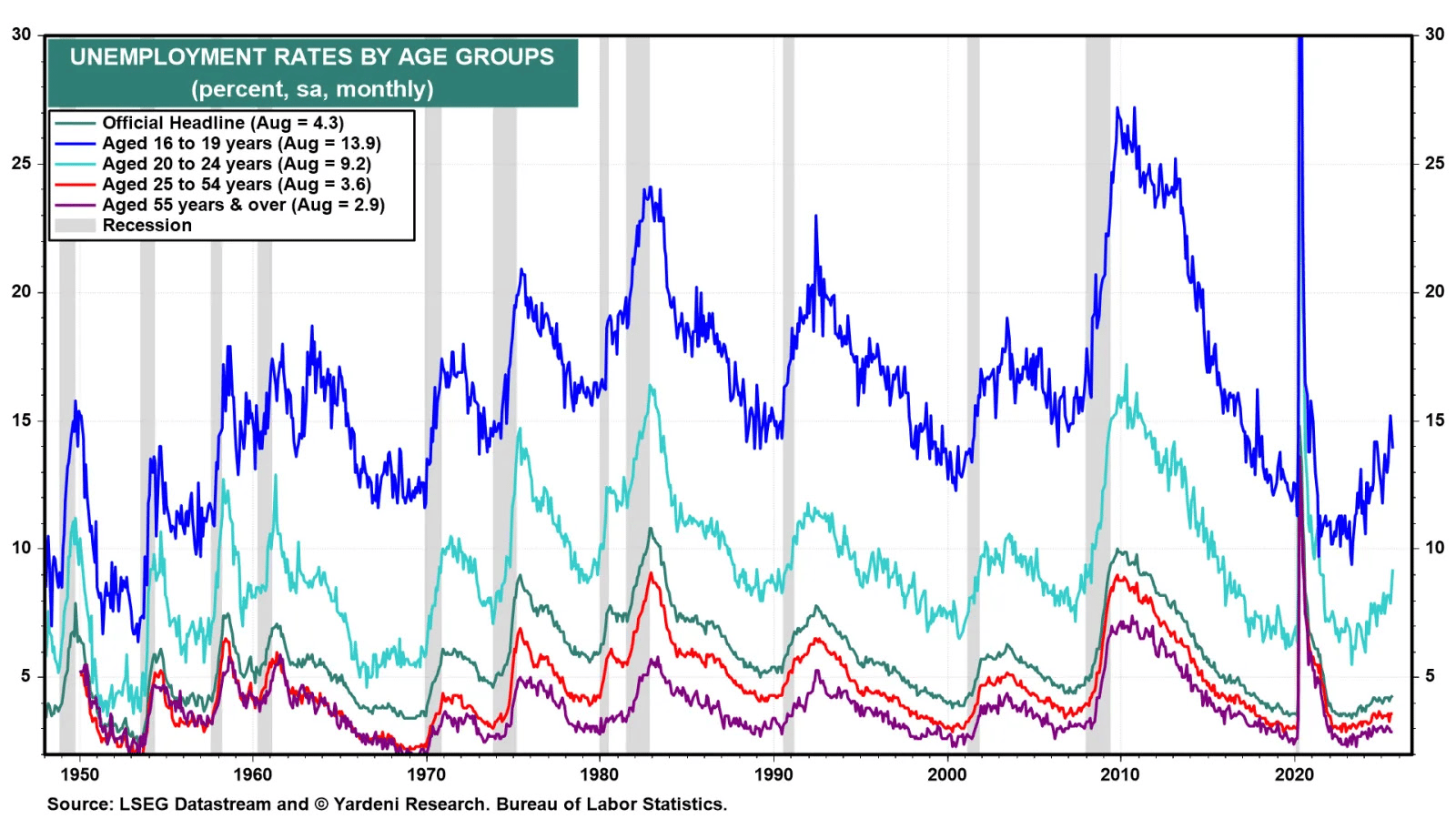

How’s The Labor Market?

Surface-level payroll numbers reflect shrinking labor demand and supply, but behind the scenes, we have productivity gains, with AI doing real substitution at the margin.

You can see it in the age splits.

Since April 2023, unemployment jumped for younger cohorts: 16–19 rose from 9.4% to 13.9% and 20–24 from 5.5% to 9.2%.

For older workers, jobless rates remained below 4%. Firms are automating entry-level tasks and upgrading requirements; experienced workers stay bid.

Labor supply has tightened too.

Layoff announcements remain low (54,100 in September, Challenger), which argues against a classic recessionary unwind.

Nonetheless, Fedwatch shows Oct rate cut probability rising to 98.3% this week. Rate tweaks can’t fix these structural frictions.

More likely, easier policy fuels asset prices and raises the risk of a melt-up while the labor market reconfigures toward higher productivity.

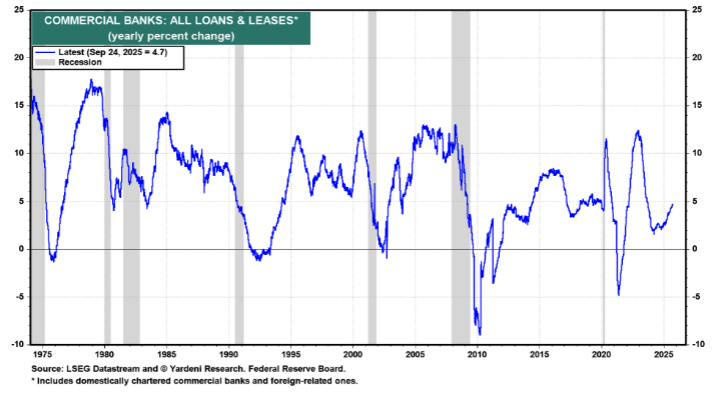

Credit is Re-Accelerating

Commercial bank loans and leases are growing 4.7% y/y, roughly twice the pace at the start of the year.

Credit is re-accelerating. That supports our standing view: economic activity is picking up.

A faster loan book is an impulse to nominal GDP. This backdrop tilts the near-term balance toward equities over duration and keeps cyclicals and select financials bid.

Banks are positioned to surprise. Volume tailwinds plus healthy spreads and moderating credit costs create operating leverage.

We own Bread Financial, Citi, CFG, Western Alliance Bank, and Santander (love the Spain story).

Credit related names including BDCs and banks are reeling due to fears of consumer credit risk - namely, fall out post TriColor’s fraud. We believe those fears are misplaced in the same way that the demise of First Republic did not imply impending doom to the banking system.

Crypto Liquidations

We saw the largest ever liquidations in the crypto market this Friday.

I was flying back from Puerto Rico and watching my phone notifications fire like crazy. Fortunately, we are largely immune from these risks as we aren’t in the ‘perps’ market - levered derivatives.

We believe ETF volumes will continue to grow because they are not subject to hacking, and are protected from automatic margin liquidation risks.

There are quite a few threads that explain what happened.

Back in 2021, the crypto industry learned the lessons from pretending to be a bank when you don’t have a lender of last resort. Everyone learned the danger of ‘Re-hypothecation’ and seemingly became an expert in banking. Now, everyone is learning how derivatives, clearinghouses, and the issues around the 1987 ‘Portfolio Insurance’ pro-cyclical crash — which bear some resemblence to what happened here.

Overall, our bias here would be to look for opportunities in quality names. Quite a few people have been selling Bitcoin at $125K ± for the last several months. That means there is plenty of dry powder out there.

We have some ideas - but they are low/thin market cap. We’ll research more this week and share later.

We’re about to enter bank earnings season - the big bank CEOs will say the consumer is fine. And that will re-invigorate animal spirits.

Market

Friday was Brutal.

The Trump news combined with 'overbought' conditions led to a sharp decline. US stocks suffered their worst selloff since April.

The S&P 500 tumbled 2.7%, its worst day since Apr 10. The Nasdaq 100 Index sank 3.5%, with the Mag 7 plunging 3.8%.

I expect if there is a gap down Monday open with a Vix spike, that would be buyable.

The froth is getting cleared out quickly.

Earnings season is just around the corner and the banks will report just fine this week.

The traders who exited their positions will be back soon.

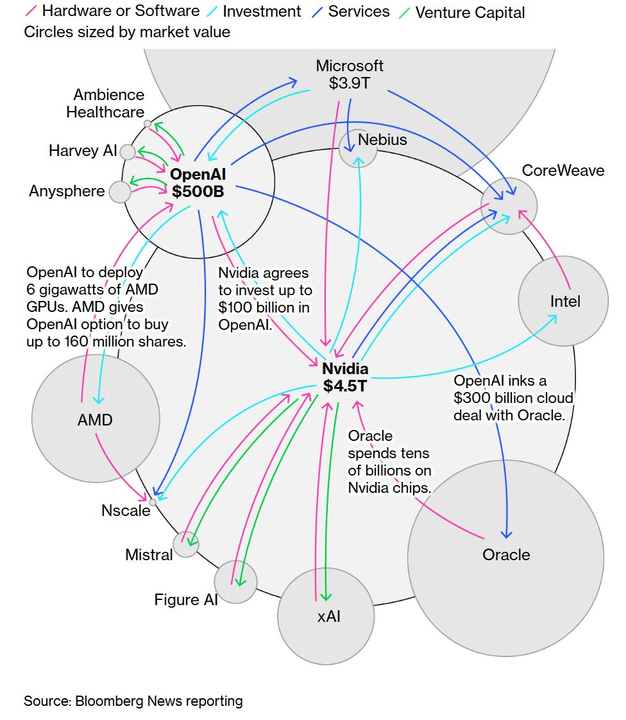

The AI Flywheel Has Just Begun

Last month, Nvidia ag to invest up to $100 billion in OpenAI, while OpenAI locked in long-term GPU purchases from Nvidia.

This week, OpenAI partnered with AMD to deploy 6 GW of GPUs and received an option to buy 160 million AMD shares.

The graphic perfectly summarizes the interdependence in the AI loop.

Nvidia, OpenAI, and AMD are building a self-financing loop where compute demand creates cash flow that fuels the next leg of capacity. And, the loop is expanding.

The winners are firms that fund their own growth: Google, Meta, and Nvidia. They generate the cash to reinvest in compute, model training, and deployment without external capital.

The demand numbers are showing up.

Sam Altman recently mentioned ChatGPT has crossed 800 million weekly users, and it’s only 1 of the many platforms.

You can argue it is not even the best one. (We are team Grok).

Here’s a gem to see how the world may look like in a few years.

AI isn’t a bubble. It’s a capex supercycle driven by structural productivity gains.

The loop is compounding outward, pulling in every firm that can supply power, chips, or models.

See our last newsletter, where we discussed how AI picks and shovels can soon include rockets, and space hardware.

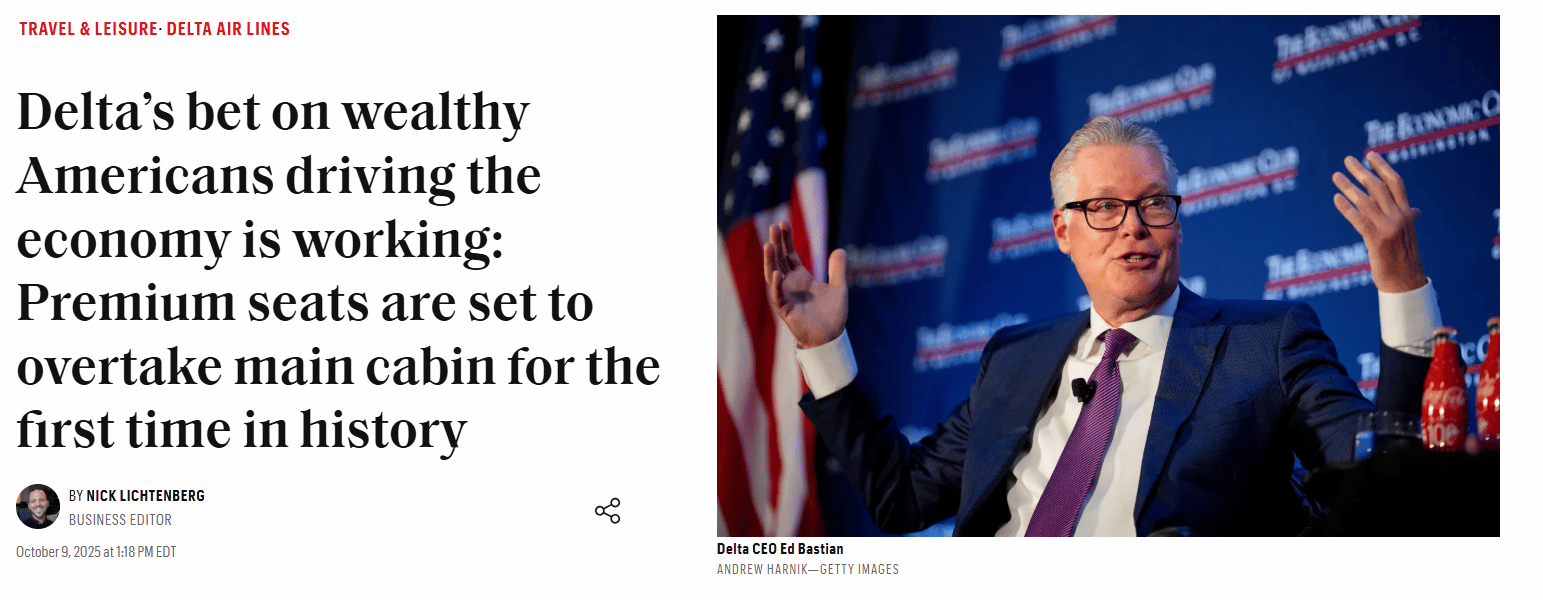

DAL’s Q3 Show Consumer Strength

Delta traded 12% higher post its Q3 earnings.

Sales grew and profitability improved year over year, with guidance nudged up as demand strengthened.

The transcript tells us why recession fears are just noise.

Ed Bastian (CEO): “The US economy remains on solid footing, and our customer base is financially strong with rising preference for premium products and services.”

“Premium revenue grew 9% with improvement across all products driven by strong demand.”

“Consumer spending on the Delta Amex co-brand card is up double digits year to date, with a recent acceleration in travel and entertainment that mirrors the improvement that we’re seeing in bookings.”

DAL and UAL were beaten due to recessionary fears.

DAL is now up 56% since its April lows, while UAL is up 71%.

We onboarded them at the right time, and are enjoying the gains now.

You can also be part of the Lumida family, and let us maximize your after-tax returns. Lumida employs an endowment style approach to investing, which focuses on long-term growth and diversification.

This approach aims to diversify investments across a range of asset classes, reducing risks and enhancing potential returns.

Our team optimizes your portfolio for maximum after-tax returns by using tax loss harvesting strategies. If you’d like to use our services, drop an email to [email protected], or book a call here.

Digital Assets

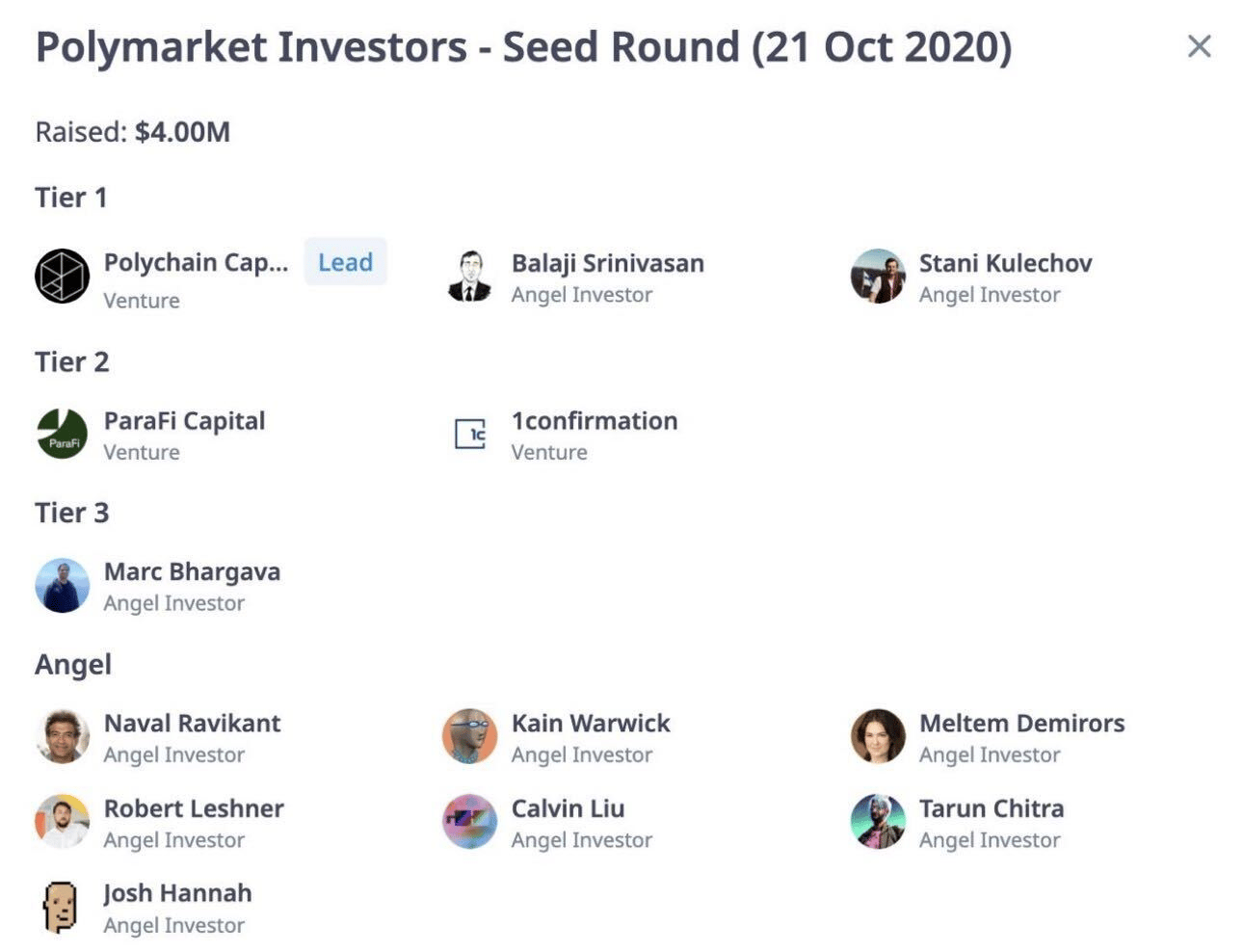

Polymarket: the Market for Information

Polymarket’s valuation curve mirrors the broader tokenized-finance story.

In mid-2024, it was valued around $1 billion after a $200 million raise.

In October 2025, ICE agreed to invest $2 billion for roughly a fifth of the company, implying an $8–10 billion valuation, a near-ten-fold re-rating in under 15 months.

That leap isn’t just about investor hype.

Polymarket is a crypto-native exchange built on Polygon, where every market, elections, policy, macro events, is tokenized and settled in USDC through smart contracts.

Each contract pays out $1 on resolution, effectively turning information into an on-chain asset. ICE’s entry signals that prediction markets are migrating from crypto’s fringe into mainstream market infrastructure.

Polymarket’s 10X valuation gain in 15 months will surely look good on any portfolio, but with the restricted access to such deals, only few could get in.

Lumida deals unlocks access to private equity and venture capital opportunities, so you can buy new businesses with massive future potential..

If you are an accredited or qualified investor, sign up for Lumida deals, where we bring exclusive deals that often go unnoticed by the broader market.

Our previous deals include Coreweave, Kraken, Canva, and QXO. We have some interesting ideas in the pipeline before the year ends. If you’d like more details about them, write to [email protected].

Wall Street’s Blockchain Moment

After years of skepticism, banks are finally building on-chain.

JP Morgan’s Kinexys and Swift’s new blockchain initiative show that tokenization and instant settlement are shifting from crypto experiments to core financial infrastructure.

Swift is working with Consensys and 30 global banks, including Citi, Bank of America, and JPM, to move cross-border payments and, eventually, tokenized assets onto blockchain rails.

With 11,500 institutions across 200 countries, Swift’s pivot signals that on-chain settlement is going mainstream.

JP Morgan’s Kinexys division is already live.

It processes roughly $3 billion in daily on-chain payments, though still a rounding error next to JPM’s $10 trillion flow, but enough to prove traction.

Corporate clients from Qatar National Bank to FedEx and Axis Bank India are using the network to clear payments in minutes instead of days.

The system now supports dollar, euro, and sterling transactions, with Ant International, even executing on-chain FX swaps.

Kinexys is also testing a deposit token, a digital claim on actual bank deposits, issued on Base, Coinbase’s public blockchain.

Unlike stablecoins, these deposit tokens accrue interest and sit on balance sheets as cash equivalents, potentially redefining how corporate treasurers manage liquidity.

JPM is pairing that with pilots in carbon-credit tokenization, working alongside S&P Global and the International Carbon Registry to create a standardized, portable carbon market.

Tokenization is now mainstream.

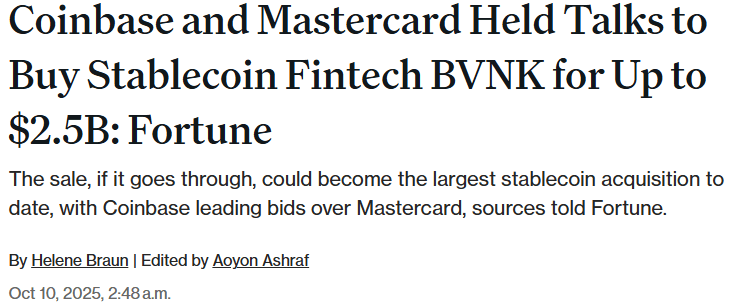

Coinbase and Mastercard in UK Battle for BVNK

Coinbase and Mastercard are reportedly circling BVNK, a UK-based payments and stablecoin platform, at valuations between $1.5 billion and $2.5 billion.

BVNK sits in the middle of the stablecoin plumbing layer, offering APIs for on-off ramps, stablecoin settlement, and cross-border treasury flows.

It bridges crypto liquidity with fiat banking rails across more than 15 currencies, processing billions in monthly volume for fintechs and exchanges.

Coinbase’s interest is clear: BVNK would deepen its institutional and payments footprint beyond trading and custody, complementing its USDC ecosystem with real-world payments.

Mastercard, for its part, has been building tokenized settlement infrastructure since 2021 and sees BVNK as a way to accelerate stablecoin settlement and programmable payments under a regulated European license.

The deal, if completed, would mark the first major stablecoin infrastructure acquisition by a global financial incumbent.

Stablecoins are no longer a crypto niche; they’re becoming the backbone of a 24/7 digital payment system, and the competition to own that infrastructure is just getting started.

Note: BVNK is powered by Cross River Bank (the provider of the ‘fiat ramp’) in the same way Stripe is powered by Leed Bank. We remain of the view that a well-positioned bank can benefit from the Genius Act and provide liquidity to the digital asset market.

We are hunting for U.S. FDIC insured banks with - if you know banks that want to sell - please do introduce them to us.

IPOs on Solana And Ethereum

Thomas Farley, Bullish’s CEO, expects IPOs will soon happen on Solana and Ethereum. The capital markets are evolving, and on-chain markets are now a reality.

You can watch the full video here.

Lumida Curations

Jamie Dimon Warns on 2026 Outlook

JPMorgan’s CEO says markets remain strong but warns inflation could linger and a mild 2026 recession isn’t off the table.

Jeff Park: Capital Rotates to Bitcoin

Altcoin and gold gains, especially from younger investors, often migrate into BTC as portfolios diversify.

Dollar isn’t Collapsing

Despite talk of “debasement,” USD strength shows markets are driven more by momentum and falling rates than by currency collapse.

Meme

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.