Here’s a preview of what we’ll cover this week:

Macro: Fewer Openings ≠ Recession; Consumers are Confident

Markets: What Causes A Top?; High Valuations Aren’t A Problem; Did the Data Center backlogs hold up in Q2 2025?; Datacenters in Space

Artificial Intelligence: Bezos says datacenters are going to space

Digital Assets: Visa Rolls Out Stablecoin Pilot; Sell me this community bank

Lumida Curations: Cracks Beneath a Strong Market?; Digital Banks: The Bridge to Crypto; The Death of the 4-Year Cycle

Spotlight

This week, I joined the Bits + Bips podcast to debate one of the perennial questions in investing: Are you better off holding gold or stocks?

Vinny backed gold, and I backed stocks.

You can watch the episode here.

On the same note, we have a $10,000 bet on whether SPY outperforms gold over the next 9 months. We will come back to it sometime on July 4 ‘26.

This Time Is Different: Vegas Edition

A savvy markets friend pointed out that:

(i) Las Vegas bookings are down, and

(ii) similar downturns led and preceded the recessions in 2001 and 2008, and therefore

(iii) a recession is coming.

Not this time.

Here’s what happened.

Millennials and Gen Z are locked out of houses.

That down payment?

It’s going into meme stocks, crypto, Draft Kings, sports betting and prediction markets.

Vegas is Decentralized

You don’t need to get on a flight to Vegas when you can speculate from your phone.

I’m not saying this is good or bad (it’s both), it is what it is.

Don’t read too much into these antiquated indicators.

Who Fears A Recession?

The point from all this?

Sentiment indicators are not that reliable.

We are 3 years into a bull market and doomerism prevails - that means we don’t have the euphoric conditions that coincide with a top.

Your Health Is Your Most Important Investment

We've launched Lumida Health to capture the best insights around how to live a long and healthy life.

You won’t need to read the 400 page Dr. Peter Attia book. To get you started, here is an curation on ‘why we crave sugar’.

Macro

Fewer Openings ≠ Recession

September’s ADP report was the softest since March 2023, with just 32k private payroll gains, far below expectations. August was revised down to a net job loss. On the surface, this points to a labor market rolling over.

But context matters. ADP has always been noisy, with limited correlation to the official BLS report.

And beneath the weak headline, the broader story aligns with what we’ve been highlighting for months: labor demand is cooling, but not collapsing.

The U.S. economy is still expanding; real GDP growth is positive, consumption is intact, and corporate earnings remain stable. What’s changing is the composition of demand.

Companies don’t need to hire aggressively to sustain output. Productivity gains, driven by automation and AI, are reducing the need for incremental labor. In effect, output is decoupling from headcount.

However, with FOMC members speaking on Tuesday, and no NFP print this week, the case for October cuts is strengthening. Polymarket odds are at 93% now.

We didn’t need the September cuts, and we don’t need October rate cuts. But, we’ll get them anyway. We wrote about it last time. Read here.

Consumers are Confident

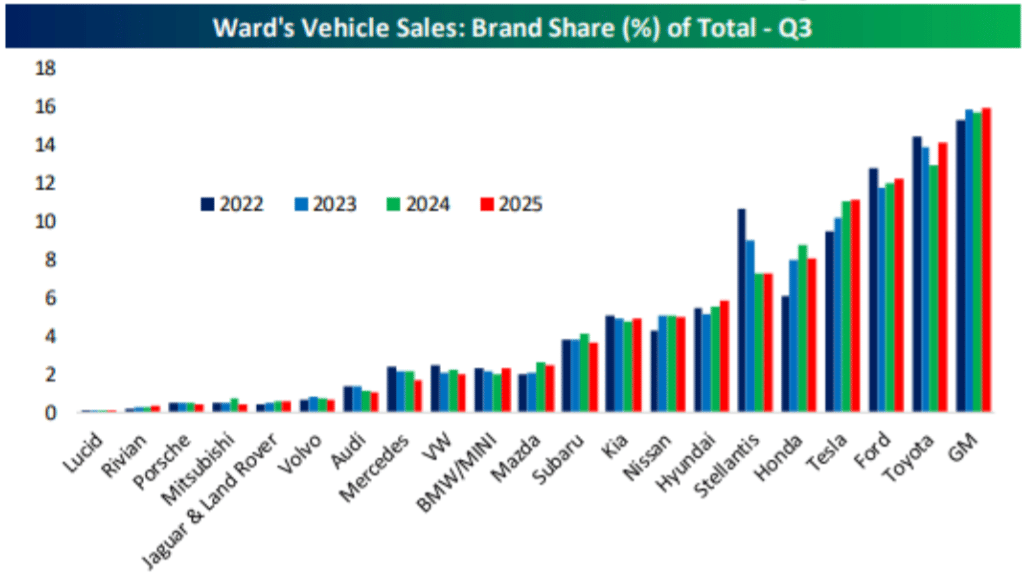

September auto sales came in hot at 16.39M SAAR, topping expectations of 16.2M. Most auto-manufacturers had an upgrade over their 2024 record.

GM led the pack with record EV deliveries and an 8% YoY increase, while Ford also posted record sales.

Tesla remained competitive, though its market share narrowed. Even Rivian and Lucid surprised to the upside.

The broader message is that the U.S. consumer is still spending.

Durable good purchases are a strong signal of consumer strength, and the increase in sales reflects improving confidence.

Retail sales earlier in the month also confirmed the trend, rising 0.6% MoM.

Economies don’t go into recession with confident consumers and corporations.

Market

What Causes A Top?

One cause?

When bulls see something that forces a re-assessment.

The metaphorical concept is a ‘turd in the water’ - to use a public swimming pool analogy.

When Cathie Wood bought Nvidia in June of last year, investors collectively said ‘I must be in the wrong boat’.

They sold their AI stocks and caused a correction in the semis.

Nvidia experienced a 9 month give or take correction.

A social cue caused investors to lose trust

This tweet below marks the exact day I spotted this last year.

This year, I believe at the end of Q4, we’ll have conditions for a top in Quantum stocks.

High Valuations Aren’t A Problem

The S&P 500 ended the week at 6,715- its new all-time high. NASDAQ and Russell 2000 also made new highs this week.

With this latest rise, P/E NTM for SPY reached 24x, its highest in the last 3 years.

But, is it a problem?

Short Answer: No!

Valuation is a translation of two things markets care about: the slope of forward earnings and the price of time (real rates).

When those inputs improve at the same time, multiples rise, even when they already look full.

Remember investors are paying for future earnings and cash flows, and as long as expectations keep up, the valuations stay high.

This isn’t 1999; free cash flow quality is better, buybacks are steady, and fewer unprofitable names drive the index.

The distribution of valuation clarifies the story further:

Leaders (Mag 7) with pricing power and network effects carry the premium; The small and mid caps still trade at humble valuations of 15-16x.

Did the Data Center backlogs hold up in Q2 2025?

AI and cloud workloads are fueling a new infrastructure super-cycle. Every major hyperscaler is expanding capacity to train and deploy frontier models at scale.

CapEx by big tech is projected to grow 25–35% annually through 2030, topping $500B by 2025.

The backbone of this investment is data centers, the new “factories” of the digital era.

Backlogs across the ecosystem underscore the strength of the build-out. T

Broadcom ($110B, +8% YoY), Quanta ($35.8B, +14% YoY), MasTec ($16.4B, +23% YoY), Vertiv ($8.5B, +21% YoY), Powell Ind. ($1.4B, +8% YoY) and Sterling ($2.0B, +24% YoY) among others show multi-year visibility.

These rising backlogs represent committed AI and edge infrastructure orders, not speculative growth.

Even after a year of explosive expansion, order books are still swelling, not normalizing.

That suggests the AI build-out is in its early innings. Still capacity constrained, not demand constrained.

The sector’s resilience rests on structural tailwinds: AI adoption, energy transition, and digital sovereignty. The underlying backlog growth and CapEx pipelines argue for sustained momentum.

Data Centers in Space

Jeff Bezos forsees giant datacenters in space:

“We're going to start building these giant gigawatt data centers in space… Those will be better built in space because we have solar power there 24/7”.

“There are no clouds and no rain, no weather. So, if you can build, we will be able to beat the cost of terrestrial data centers in space in the next couple of decades.”

The thesis is straightforward.

AI build-outs on Earth are hitting power, and interconnect limits.

Space offers continuous generation, no weather risk, and expandable “land.”

If launch costs and on-orbit assembly keep sliding, Bezos sees batch training migrate off-planet in the next 10/20 years.

If those moves materialize, AI capex broadens from substations and transformers to rockets and space hardware.

How To Get Cheaper Energy?

With Jeff Bezos focused on space and Sam Altman on nuclear, demand for energy alternatives is surging. Ultimately, it comes down to innovation and execution.

In Alberta, innovative O&G companies are turning stringent flaring rules into an advantage.

Flaring regulations prohibit oil and gas producers from venting natural gas during oil production. The alternative, capturing and transmitting the gas via pipeline, can be expensive, sometimes forcing operators to curtail mining.

This creates opportunities for firms that understand both oil operations and the crypto sector.

They capture excess gas, combust it to generate power, and use that electricity to mine crypto or run data centers, earning revenue from both oil sales and mined assets.

Crusoe Energy pioneered a similar model and is now a $10B private company, though inaccessible to retail investors. New players are emerging with significant upside potential.

At Lumida, our team seeks undervalued assets often overlooked by the broader market, offering qualified investors opportunities typically reserved for institutions.

If you’d like to be considered for upcoming deals, please sign up using the form, or email [email protected] or [email protected]. We have several ideas in the pipeline that I’m personally investing in.

Moreover, our private deals team is actively exploring opportunities around tax mitigation to ensure you can optimize your after-tax returns. You can sign up with Lumida's Tax Shield, or write to [email protected] to understand how our existing strategies work.

Artificial Intelligence

A New Channel for E-commerce

Shopify’s upcoming in-chat checkout with ChatGPT is the new distribution layer for merchants.

OpenAI has already turned on Instant Checkout for U.S. Etsy sellers. 1M+ Shopify merchants are next in line.

Stripe powers payments, OpenAI takes a merchant fee, and multi-item carts are on the roadmap.

Why this matters:

Funnel compression leads to higher conversion. If checkout lives where discovery happens, you remove the click-out tax.

Shopify processed $87.8B GMV in Q2’25 (+31% revenue YoY). Even low-single-digit adoption of agentic checkout against that base moves real dollars.

Channel mix resets. If conversational agents steer purchases, search + social ads lose marginal attribution.

Take-rate physics. Merchant adoption will hinge on OpenAI’s fee vs. incremental sales. If conversion outperforms and CAC falls, agents become a profit center; if not, it’s just another toll booth.

This is the first credible at-scale test of shopping by an agent. Watch three prints: (1) conversion vs. web, (2) merchant repeat rate, (3) share of new vs. cannibalized orders.

If the data tracks, the winners are the rails with identity + payments + fulfillment (Shopify).

Ads in the Answer

Google’s way to avoid being displaced by chatbots is straightforward: put the ad inside the AI response.

If the answer is delivered on the results page, the ad sits next to it. The intent still belongs to Google, so the revenue stream does too.

This changes the economics.

The scarce asset is no longer a list of blue links; it’s the space inside the answer.

Pricing will migrate from pay-per-click toward paying for exposure and actions that happen in the response: lead forms, bookings, even checkout.

If those actions convert as well as traditional search, revenue per query can hold or improve even with fewer outbound clicks.

For advertisers, this is a tighter, cleaner funnel.

Google sees the entire path: question → suggestion → purchase. That means better attribution and, for well-structured catalogs, potentially lower customer-acquisition costs.

For publishers and SEO-heavy businesses, the picture is harder: more queries will be satisfied on Google’s AI page, so referral traffic shrinks and organic rankings matter less.

The bigger operational risk is answer quality: if the model steers users to poor results, brands will pull spend. Quality is the gating factor on ad load.

Digital Assets

Visa Rolls Out Stablecoin Pilot

Visa is rolling out a pilot that lets banks and payout providers prefund Visa Direct with regulated stablecoins and draw down into local currencies on demand.

In practice, Visa treats the token balance like cash-on-account, which collapses the need to park float across markets and makes payouts effectively 24/7.

The company targets limited availability by April 2026 and is onboarding select partners now.

This is another stablecoin use case that matters. It isn’t a new consumer wallet, but a better funding layer for existing rails.

Treasury teams get faster liquidity and less trapped capital; networks preserve the front-end experience while upgrading settlement.

In other news, Swift is adding a shared blockchain ledger with major banks to keep pace, confirming that tokens are moving from edge experiments to core infrastructure.

Moreover, we recently wrote how JP Morgan, Blackrock, and Nasdaq have all announced tokenization offerings or plans. You can read it here. The future is now!

‘Sell me this community bank’

Here’s why community banks are facing Stage 4 terminal decline.

Banks lend, move money, and custody.

1) Lending: Post-GFC regulations pushed banks out of credit risk into high quality liquid assets.

Community banks don’t take real credit risk now.

They provide back leverage and lower cost of deposit– Banks that attract deposits have the edge.

2) Payments:

Fintechs like Stripe and others own every niche for payments (with a handful of specialized infra banks like Cross River & Leed Bank benefitting from tollgate flows).

These FinTechs also own Merchant acquiring verticals.

3) UX: Super Apps that are distinguishable from banks are coming with integrated ‘one stop shop’ services competing for the consumer.

Coinbase is one of 200 FinTechs seeking an OCC charter.

4) Next Gen: The next gen is banking digitally.

They prefer a modern experience - a community bank does not offer that.

Community banks are going to age out along with their depositor base.

If you want to sell your community bank and pivot it into the 21st century, shoot me a DM on X, or email at [email protected].

There is a narrow path forward around tokenization, mint / burn, borrow / lend.

But, the vast majority of community banks won’t be able to evade the incoming asteroid.

Thought Experiment:

The Fed is creating winners and losers across generations.

What if the 2024 cuts from last year caused a reduction in spending from boomers relying on T-Bill income?

Boomers, now the largest cohort hitting retirement (with “peak 65” occurring between 2024-2030), hold a disproportionate share of safe, income-generating assets like T-Bills. Domestic investors own about 71% of U.S. Treasuries overall.

Private households (including retirees) account for a significant slice, estimated at 20-25% of total marketable Treasuries.

If you do the rough math, each 100 bps decrease in rates reduces income for spending by about $50 Bn.

Has monetary policy adjusted for demographics and current owners of T-Bills?

Where would you see it first?

Restaurant spending, travel and leisure.

Take a look at any and all restaurant stocks, they are all in bear markets.

Interestingly, if you are a fixed income retiree, a number of credit assets are dislocated and you should scoop them up.

The offset to this is an increase in mortgage refinance, and increases in the value of boomer’s home equity value.

Lumida Curations

Cracks Beneath a Strong Market

At Blackstone’s 2025 CIO Symposium, CEO Jonathan Gray warned that soaring AI valuations, government debt, fragile Europe, and US–China tensions may be masking deeper risks in today’s markets.

Digital Banks: The Bridge to Crypto

Ram argues that the real catalyst for mainstream digital assets isn’t another token but banking infrastructure; specialized banks that connect fiat and crypto to power the next era of finance.

The Death of the 4-Year Cycle

Ben Forman challenges crypto orthodoxy, arguing today’s market is shaped more by ETF flows and DAT buyers than the old four-year cycle patterns of past bull runs.

Meme

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.