Welcome back to the Lumida Ledger.

If you find this valuable, we’d greatly appreciate you sharing it far & wide with your network. That’s how we grow and keep the content free to read.Here’s a preview of what we cover this week:

AI: Intelligence is Killing Software

Markets: Correction risk is elevated

Company Earnings: It’s a boomer economy

Digital Assets: Why we are selling ETHE

Macro: Unemployment claims & wage inflation

This was a big week for us, we launched our white glove service for Crypto Natives.

We thank our community for the love and support you showed us on twitter.

We are the first SEC registered investment advisor to offer a compliant service to enable crypto-natives to invest and maintain control of their assets.

The service model enables crypto-natives to enjoy the benefits of staking, providing liquidity on-chain, and participating in airdrops – while having direct access to a crypto-native financial advisor.

Read the press release here and interested clients can check out the service here.

Crypto should be treated as just another alternative asset class, and whether it has a place in your portfolio should depend on your risk profile and long-term goals.

For those of you who are still wondering if anyone makes any money in crypto, check out this clip. Both BTC and ETH ETFs have been big value unlocks for this asset class.

Explore becoming a Lumida Wealth client: Click here to fill out our form and schedule a call.

Podcast Alert

Did you know that Michael J Fox Foundation's goal is to go out of business in 10 years?

We sat down and had an enriching conversation with Veronique Kaefer, Vice President of Philanthropy at Michael J Fox Foundation who explained their plans to help cure Parkinson’s disease in 10 years.

She shares insights into how a top 3 American foundation operates, its unique approach to funding research, their latest scientific breakthroughs, and the importance of donor relationships.

Click below to jump into a segment of your choice and don’t forget to subscribe to Lumida Legacy Podcast.

00:34 Introduction to Veronique and Michael J. Fox Foundation

01:04 Early Challenges and Milestones

04:43 Building a Successful Foundation

07:57 Unique Funding Model of the Fox Foundation

10:31 Philanthropy and Community Engagement

23:50 Scientific Breakthroughs and Future Goals

28:11 The Role of AI and Data in Parkinson's Research

29:28 Funding Decisions and Strategic Planning

39:24 Growth and Organizational Culture

43:25 Personal Reflections and Legacy

AI: Its Killing SaaS

Remember Marc Anderseens’s adage ‘software is eating the world’?

Now it is ‘Intelligence is eating software’

SaaS is dying.

See Adobe, Snowflake, and Duolingo.

The moat is in data & networks - that’s why names like Google and Meta will do well.

Software Names Were Shellacked This Week

MongoDB was down 25% after earnings. Salesforce is down 18%. UI PATH down 30%

That’s just one of many examples.

We wrote this on 4/21: ‘Software is approaching the upper band of tolerable valuations’

We also cautioned against owning any stocks that are more expensive than Nvidia.

Guess what? SaaS is full of them.

What’s worse?

These names are prone to the double whammy of AI disruption like Duolingo. Further, CFOs are spending on GPU Compute, not SaaS. So SaaS will see slower sales growth ahead.

This is a thesis we’ve been all over.

In April of last year, we wrote: “SAAS business models are most at risk”

SaaS business models are most at risk of ChatGPT disruption:

In May, we noted Adobe was at risk of AI firms like Midjourney.

Mr. Market has woken up to this fact and is re-rating software stocks lower.

Fortunately, we own only 3 tech stocks: Meta, Nvidia, and Google. They continue to perform while the rest of tech is wrecked.

We own those names for the reasons in our newsletter two weeks ago titled “Why There are No Great Tech Investors”.

The rest of our portfolio is heavily skewed to “quality value with earnings growth” – classic compounders in the Buffett sense of the word.

Interestingly, we owned software in Q1: names like MongoDB, Atlassian, CloudFlare.

We sold them all when we saw valuations going parabolic.

We sold them for the same reason we sold Dell two Friday’s ago (receipts here).

Dell reported earnings and the stock dropped 20%.

We bought Dell when it was Non-Consensus, and we sold Dell when it was fully priced.

How do we know that? It had never been more expensive over the last 10 years.

Plus, Jensen was pumping the stock regularly on CNBC. “Call Dell” started at the GTC conference.

(We first noticed this in Nvidia’s earnings calls last summer - that was our clue.).

Meanwhile, notice Hewlett Packard (HPQ) rallied 15% on earnings – because it’s cheap and under-owned!

“You make your money on the buy, and you protect your money on the sell!”

Where does SaaS go from here?

We believe SaaS and Software is in a bear market. We don’t own a single name here.

We see one bargain - but we aren’t touching it. Markets will overshoot on the downside.

The “theme” is in a bear market. It’s going to take time for that theme to bottom.

Here’s a chart of software valuations today.

SaaS has a couple of issues.

The promise of SaaS was that it is ‘CapEx light’.

The idea was you could generate significant recurring revenue and free cashflow without having to invest much in capital expenditures (e.g., all the logistics, property, plant and infrastructure build out that, say, an Amazon has).

But that is false.

Look at Snowflake spending $1 Bn to acquire an AI startup. That’s heavy CapEx.

And, at the same time, Google and Fabric are making in-roads to these spaces.

Microsoft is rolling out Fabric. Fabric is an analytics layer that let’s an enterprise analyze data in Microsoft’s Cloud, Azure.

Google is doing the same.

Both have better strategic positions than Snowflake. SNOW is also facing competition from Databricks.

As a reminder, hedge fund Altimeter reportedly had a 40% position size in Snowflake in its Q1 filing!

Snowflake and other SaaS firms have no choice but to invest heavily into AI.

It’s damned if you do (CapEx heavy), damned if you don’t (AI irrelevance).

The way to play AI has always been at the picks & shovels layer: Nvidia and (select) Cloud Providers.

The other way to play AI is to bet on Distribution (Users), Proprietary Data, and - something none of the VCs are talking about - Networks.

This is why we like Google and Meta. In addition to being cheaper than most names in Mag 7, these firms have networks that are not easy to replace - and data.

Google has the Youtube franchise. Meta has billions of users uploading training data in the form of video and text.

Microsoft has a few shots on the AI target - but we believe it is priced for perfection. If you look at YTD performance, our thesis is correct - Microsoft is lagging.

Here is the Mag 7 scoreboard. Notice our picks are right at the top, and the names we dislike are right at the bottom:

Own the best and forget the rest!

Note: the more and more these names rally, the less and less our variant perception holds.

So, we need to remain constantly vigilant about our positions. That said, for Meta and Google we still expect relative outperformance.

Nvidia is fully priced here.

Back to software.

SaaS models exhibit the following components:

(i) dashboard / interface

(ii) back-end database

(iii) some output (analytics, reporting)

Dashboards are merely a user interface.

An AGI can spin-up tailor-made dashboards or communicate in a manner most compatible for the end-user.

It's not even clear we need dashboards. We need context-aware notifications to prompt a shift in focus. Less is more.

Take Carta for instance.

An AGI within Carta can interact with HR systems, email, and sift through employment agreements and board resolutions to generate a cap table.

Similarly, an AGI within DataRobot can surveil the codebase and identify issues that must be addressed while providing dynamic and personalized notifications.

The AGI calls the CTO on their cell phone with an alert and recommendation.

The worst about Salesforce? The data entry and configuration.

AGI can comb customer interactions across channel and make all of this easy. The AGI can identify next steps and handle follow-ups.

CRM is really an organizational tool. AGI will keep us organized.

But what about the security and privacy of customer data?

Who will trust the AI to manage payroll, the cap table, sensitive finances?

No one. Enter Blockchain.

By moving from database to blockchain, SaaS companies can ensure the security and privacy of their customers' data, even when integrating with AGI

The AI delivers convenience. The Blockchain delivers trust, security, and privacy.

Which SaaS models are most secure?

(i) proprietary data & content (Google, Meta);

(ii) marketplace biz models;

(iii) reg Tech or compliance driven; and

(iv) SaaS models with brand & relationship.

In sum, SaaS firms:

(i) need to refactor their UX. Dashboards, data & analytics alone won't cut it;

(ii) move from database to blockchain; and

(iii) develop hooks into customers via relationship, service, and brand.

It’s a classic Innovator's Dilemma - and it’s going to be a wild ride ahead.

The internet disrupted Tower Records, Circuit City, Virgin Music. Online disrupted brick and mortar.

This time tech is disrupting tech. Why own the QQQ when you can pick winners and losers?

Software stocks this year are *more* expensive than 2021 levels!

I’ve been writing about this like the guy in the corner meme.

‘The Market is Looking Forward’.

Sure… good luck with that one and ‘permanently higher plateaus.’

Explore becoming a Lumida Wealth client: Click here to schedule a call.

Markets

Mr Market was buying CVS by the boatload today.

CVS was up 6% this Friday.

Mr Market just realized CVS owns Aetna. Mr. Market confused CVS with Walgreens.

CVS’s PE ratio has never been lower.

CVS throws off massive free cashflow generation.

The free cashflow yield divided by the market cap is in the teens.

CVS likes to buyback stock. They stopped doing that this year - but I expect they will do so in 1 year after their Medicare Advantage program is back on track.

So, what happened? Why is CVS cheap?

First CVS owns Aetna. That’s the crown jewel. Competitors like United Health (UNH) have a 19x multiple. By contrast, CVS is priced at 8x.

(Other insurers, like Elevance, are priced at 14x forward earnings.)

CVS signed on 1 MM+ Medicare Advantage accounts. The ‘utilization’ of these accounts was very high. Meaning, they consumed a significant number of healthcare services which insurers are on the hook for.

All the insurers are seeing increased utilization. (If you’re not taking advantage of insurance for physical therapy aka massage, you’re missing out is a new trend.)

But, CVS was particularly egregious. They opened up the door to too many unprofitable policies.

Here’s what hurt CVS:

People respond to incentives. You make something free, they consume a lot of it!

What’s the fix?

You don’t need to pay McKinsey $10 million for the fix.

Management has announced they will tighten the policy. That will cause 1 MM unprofitable accounts to churn. That will take about 1 to 2 years to “flow thru” to earnings.

That’s the fix. Super simple. This is not a complicated turnaround. Change the underwriting policy and implement.

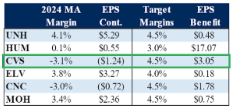

Take a look at this table:

CVS has the worst 2024 Medicare Advantage margins. The benchmark is 4.5%.

Ask yourself, what CVS’s stock price will look like when margins go from -3.1% to 4%+?

Crucial to this analysis - the bad news is priced in, and the good news is priced out.

This is core to our philosophy of non-consensus investing.

Management is already assuming elevated utilization now thru the end of the year.

There are no rosy assumptions from sell side analysts either. Here’s a quote from management:

“But the 2025 rates are simply insufficient because for our bids, core trends, we will assume for a 3-year period. '23 into '24 into '25 will be consistent and consistent at a level that we have not seen in any of our pre-COVID history. And so we're assuming that a very high level of trend persists as we prepare our bids.”

If CVS gets to a 10 to 12x multiple up from 8x where it is now, that’s a 50% return.

Over that time frame, earnings should also improve substantially via the margin improvement.

It’s conceivable we get a 50 to 100% return in 2 to 3 years from Multiple Expansion (the most powerful driver of returns), and earnings growth.

Another reason we like CVS? Value is beating growth.

Tech stocks are getting shellacked. Nvidia is fully priced, so is Amazon and Microsoft.

We’re seeing value stocks perform - look at Energy or Consumer Staples.

CVS aligns thematically with our top-down views on Value and Aging Demographics.

It also passes the Peter Lynch test. I go to CVS 1 or 2x a week to pick up a prescription or a Hershey’s candy bar.

The risks to CVS are e-commerce competition, or a failure to turnaround.

But, the e-commerce competition is really a risk for Walgreens. Stay aware from Walgreens - it’s a value trap. Look at free cashflow yield for these two businesses:

CVS’s Aetna insurance business is protected from competition. Amazon can’t easily enter that market. And if they do, we’ll see weakness in United Health, which commands a significant market premium.

People still need to get a flu shot. Amazon is testing e-commerce for pharma and is expected to expand to 10 cities soon.

That transformation will take quite a lot of time. Consumer behaviors for the elderly are slow and sticky. And, again, the prize here is Aetna.

We have been buying CVS over the last few weeks and are patient.

If you are looking for a wealth management partner, Lumida is now welcoming a limited number of new clients.We offer a range of services, alternative investments (such as our CoreWeave deal), white-glove crypto management, to public equity management, and high-touch family office services, including trust, tax, and estate planning.

Ready to explore? Click here to fill out our form to start the discovery process.

Interested but not ready to commit? Build a relationship with Lumida and stay informed. Click on the poll below if you want our advisors to reach out.Market Color

We believe markets have heightened downside risk - especially growth stocks.

This is a point we’ve raised repeatedly and have positioned our portfolio around ‘Quality Value’.

The 3 tech stocks we own are Nvidia, Meta, and Google. That gives us Growth & Value exposure.

Our concern is that software valuations are dropping. That is going to cause a continued markdown of other comparable assets that price on these multiples.

Also, breadth is deteriorating. The market is narrowing on winners.

This is not an ‘Everything Go Up’ Market. It’s a Best vs. the Rest market.

And the best are quite expensive. Look at Chipotle - it’s more expensive than Nvidia. Bill Ackman sold ⅓ of his position last quarter and has ⅔ to go. (We are short CMG as a partial hedge against our tech exposure, FYI)

Look at Cava. It’s pricier than Chipotle! (Restaurants we believe are the next to re-rate lower).

There are two paths the market can take. We can see leadership rotation. Or we can get a correction in high priced growth stocks.

If we get a correction, we believe it will be in the 5 to 10% range - not more severe.

Speaking of Cava, take a look at the volume spike on this chart. That can sometimes be a sign of a top.

We are fundamental thematic investors first and foremost. Not technicians. But, if you were to ask me to give a name to this technical setup, I would call it ‘ugly.’

Here’s another risk consideration.

There are significant divergences - the number of new lows is spiking while we see new highs.

That pattern has led to a correction nearly every time.

Take the time to scrub your portfolio of vulnerable spots.

Focus on quality value with earnings growth. Sell hype names.

Did you sell your Restaurant stocks?

BTIG published this note this week:

‘Russell 3k Restaurant Index threatening multi-month breakdown with relative strength at multi-year lows.

There are idiosyncratic stories that are working in this group, but broadly it's weak. Seven of the 77 new lows in the R3k today are restaurants.’

Lumida Wealth was the first to call this out and then we saw Bill Ackman doing 1/3 of CMG on his 13F

Note: We hedged our homebuilder exposures with XHB. So we are market neutral there.

Housing data looks rough (inventories building).

It’s OK to panic if you are the first to panic :)

Rotate to Quality Value with stock buybacks.

Company Earnings

Tech/Media/Telecom:

Salesforce delivers modest growth amid macro headwinds, with subscription revenues leading the way

Pure Storage sees a robust demand pipeline though near-term revenues impacted by elongated sales cycles

nCino benefiting from accelerating cloud adoption across financial services verticals

Dell aided by enterprise IT spending on servers and networking, offsetting PC weakness. However, stock fell due to margin compression on AI servers

Marvell’s datacenter sales remain a bright spot

Zscaler and MongoDB posted strong revenue beats, reflecting a critical need for cloud security and database scalability

Asana and Elastic execute well in the collaborative work management and search/observability segments, respectively

Consumer:

Pet supplies retailer Chewy delivered improved profitability on steady topline growth

Dollar stores like Dollar General gained wallet share amid consumer trade-down, though margins were pressured by markdowns

Department stores Kohl's and Build-A-Bear facing negative comps, reflecting pullback in discretionary spend

Costco's value proposition resonates with shoppers, enabling it to hold off on membership fee hikes

Beauty retailer Ulta seeing a deceleration in comps as cosmetics demand normalizes post-COVID

Apparel giant Gap showing signs of a turnaround with expanding margins and positive comps

Healthcare:

Cooper Companies missed revenue estimates due to FX headwinds and logistics challenges, though underlying demand remains healthy.

The overall narrative points to enterprise resilience in the tech sector, with cloud, security and data-centric solutions seeing robust adoption.

Consumer remains a mixed bag, with value-oriented retailers outperforming as shoppers get more budget-conscious.

Beauty and apparel face tougher comps after the post-pandemic boom.

Healthcare spending stays relatively insulated albeit with some near-term execution issues.

Digital Assets

The Big Long!

The Grayscale ETHE Trade is Over: End of an Era

The outcome of the DCG-Genesis mess was the creation of one of the best investment opportunities in years.

The big long.

The 'Discount to NAV trades’: GBTC and ETHE

Last year, we were saying 'we are going to miss these discounts when they've closed'.

Guess what? They're gone.

The ETHE discount has closed to a paltry discount of 1.28%.

*ETHE as recently as 11 months ago had a 50%+ discount to NAV*

There is no longer sufficient compensation for giving up staking yield on-chain.

In one year, this investment has gone from $8 to $34: a 425% return.

There were also gains along the way... You could have bought in October of this past year and made 300%

The ETHE investment was easily the most successful investment call Lumida Wealth made last year - overall and within crypto.

Congrats to all those who participated.

What do we do from here?

For clients that are close to hitting long-term capital gains, we're waiting a few more months to sell.

For clients that got in the last 6 months, we've already sold.

Here’s the receipt of the call which was written in the Lumida Wealth newsletter.

We first shared the GBTC and ETHE ideas at the Bitcoin Miami conference.

Kudos to DavidFBailey for his leadership on the Redeem GBTC issue. That played an important role in organizing investors and ultimately changing investor psychology on this names.

Well, coming off a bear market low, you see these kinds of opportunities.

We're on the hunt.

Macro

Good News: Inflation is falling

Bad News: So are wages

Looking at Dick’s Sporting Goods. They beat. They are bucking the retail trend where virtually everyone else (except Abercrombie) is getting smoked.

How? This is a Boomer spend economy.

Golf clubs are sold at Dick’s sporing goods. Boomers are spending on Cruises. And nursing homes. Drug retail.

Invest in the areas where boomers are spending.

This is a super simple and powerful thesis. The boomers are living longer than ever. They have record wealth. They have money to spend.

The ‘18 to 34” demographic is a headfake. Ask Grandma & Grandpa what they are spending on: travel, leisure and hospitality, elderly care.

Is the Yield Curve Dead?

The WSJ article has a great article on the Yield Curve, and it's failure to predict a hard landing.

My take is a bit different...

(1) There is a hard landing in the United States.

It's in the commercial real estate sector.

Take a look at Starwood putting liquidity gates on their REIT for example.

There's still a great deal of pain in the CRE sector.

(2) So... why CRE and not elsewhere?

Well, consumers and corporates have termed out their debt.

Corporates balance sheets are also healthier and better run.

CFOs largely avoided the use of floating rate debt.

Ultimately, the interest rate risks were transferred to institutional investors who bought fixed rate debt (e.g., see First Republic equity shareholders).

(3) But, higher rates are hitting corporates that are or were unable to refinance.

Those issues are well known by the market.

Mr. Market gave CFOs a gift.

The tightening in credit spreads gave CFOs a window to refinance.

These CFOs can now kick out their debt maturities until later.

(4) Finally, capital markets are playing a larger role in financing American Enterprise.

Bank credit growth is still relatively anemic. But, private credit has stepped up to fill the void.

Unemployment Claims Remain Healthy

UE claims, released every Thursday, suggest the labor market and the economy are fine.

MEME OF THE WEEK

Quote of the Week

“Don't mistake a falling price for a bargain. Value investing is about the gap between price and a company's true worth.” – Seth Klarman.

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.