Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week.

Macro: 10-Year Yields, Mortgage Spreads, Inflation, Fed Watch

Earnings, Financial Overview: Mid-2023, State of the Consumer

Crypto: XRP win, Celsius/Mashinsky, ETHE

Stay tuned this week for an enlightening discussion on the latest in the DCG-Genesis-Gemini on the Laura Shin podcast.

The Avengers assembled and discussed all things Digital Assets.

Friends from left to right: Sunny Parikh, Christine Moy, Ram Ahluwalia, Azhar Hussain, and Austin Campbell.

Thank you Legends & Howard Hughes for hosting a great event.

The Avengers. Not all heroes wear capes.

Macro

Our friend the 10-year rate has decreased to 3.78%. Last week, we flagged that it was teetering around 4.1%, in caution territory. Concurrently, mortgage spreads have shown signs of tightening. Both metrics tightening helps the real economy and asset prices.

On inflation, the ‘headline’ rate was reported at 3%, surpassing expectations of 3.1% due to a drop in energy prices. However, Core - which strips out the more volatile components of food & energy - fell to 4.8%. The last inflation battle will be on ‘services’. It’s going to take some time, and like climbing a mountain, it gets harder the farther you get.

A big drop was due to a decline in used car prices. Time to get that minivan for the kiddos.

The inflation story has three pillars: (i) good and services (improving quickly), (ii) shelter (set to improve), and (iii) wages. Leisure and hospitality wages are increasing at a robust 5%.

We await improvement in the wage sector - the last piece of the inflation puzzle. It’s going to take time.

Consumers are stretching their legs and spending excess savings on travel, leisure, and even at shopping malls.

FedWatch

Markets expect the inflation battle is nearly won and the Fed's credibility is restored. We see this looking at longer-term breakeven inflation rates and Fed funds expectations, which show a return to 2%+ inflation.

Despite these market predictions, we expect rates will remain higher for longer, as the last inflation pillar proves to be sticky. Markets expect a Fed pivot in 2024 now rather than this year.

Markets have come around to our view for 2023. Now the battle is moving into 2024 expectations.

The Fed has more work to do and the underlying economic strength shows it.

Minneapolis Fed President Kashkari this week said the Federal Reserve is walking a tightrope battling inflation and ensuring bank stability.

To which we say: "No kidding."

Earning Season

Earnings seasons started this Friday with the big banks.

JP Morgan beat expectations. Profits were up a whopping 67%. Consider this is the largest bank in the United States and it is growing faster than most tech startups.

The First Republic acquisition played a big part of that. Our analysis in March was really simply. JPM has 0% deposits. If it acquires First Republic, then it picks up $100 Bn+ in mortgages and captures the spread. And it gets a wealth management franchise to feed the JPM machine.

We have a thread here. We issued a non-consensus call in the middle of March banking crisis saying it was time to go long banks.

Here are other highlights from earnings call transcripts:

BlackRock CEO: "BlackRock generated an industry-leading $190B of total net inflows in H1 2023, including $80B in the second quarter"

JPM CEO: "Consumers are slowly using up their cash buffers, core inflation has been stubbornly high (increasing the risk that interest rates go higher & stay higher for longer)...."

Delta President: "Robust demand is continuing into the September quarter where we expect total revenue to be similar to the June quarter, up 11% to 14% compared to the September quarter 2022 on capacity that is 16% higher"

Pepsi: Demonstrating strong pricing power. Inflation pass thru. Q2 23: Volume: -3% (convenient beverages), Organic: +13%

No recession here folks.

Fun Fact: This earnings season will mark the 5th straight season that analysts were bearish heading into earnings. In each period, the results wasn’t as bad as expected. During those seasons, the S&P 500 was higher each time with an avg gain of 6.09%.

That seems to be shaping up again this quarter, although we still have thousands of firms that have yet to report.

Energy Has the Lowest Expectations

So where have analysts lowered expectations the most? Energy. Earnings expectations are down 47% due to declining commodity prices. (The same commodity prices that caused Headline CPI to improve).

The best time to invest is when the fundamentals look bad, but the outlook is bright. The demand for energy is strong, and electrification can’t keep up - much less the laws of physics and chemistry.

Over the last several months, we’ve done deep research on how to approach the energy space and you’ll be hearing more on this theme. Did you know? The US is starting a new nuclear reactor - the first in decades? The demand for uranium and old energy is increasing, and we believe, mispriced…

If you’re a bull, you really couldn’t have asked for a better run of events this week.

Soft Landing is Now Consensus

Whether it was inflation data, jobless claims, or market breadth, everything came up roses. Even James Bullard, who has recently been one of the most hawkish members of the FOMC, announced he is stepping down from his position as president of the St. Louis Federal Reserve.

Soft landing is Consensus. Check out this headline in the New York Times from Paul Krugman:

Here’s a set of news clippings from Michael Kantro. It shows that across cycles, soft landing was also a meme. Keep your wits about you and always question consensus. Sometimes consensus is right, but even when correct it’s often expensive.

Bull Case vs. Bear Case

The bull case for earnings centers on several factors: the 94th percentile being in the macro data, an strong positive guidance revisions, improving corporate sentiment, the fiscal stimulus from the Infrastructure Investment Jobs Act, and the Inflation Reduction Act.

The bear case is the Nasdaq 100 hasn't seen aggregate earnings increases over the past 12 months. The price-to-earnings ratios have risen, fueled by the promise of AI and expectations of earnings growth. Big Tech firms need to deliver earnings growth to meet higher expectations.

We’ve also just exited what has historically been one of the best two-week periods for equities and will soon be entering August and September which tend to have more downside volatility.

Zooming out, overall, we believe we are back to a ‘buy the dip’ type of market.

Valuations on the S&P Are Back to Highs

The big negative we don’t like is S&P valuations. The S&P PE is at 21 now. If you invert the PE ratio you get the earnings yield.

Valuations don’t matter in the short-run (e.g., 1 to 3 years). In the short run, returns are driven by factors like sentiment, technicals, corporate earnings, and policy.

But in 10-year valuations are the single biggest predictor of returns. This is what makes investing hard - you can miss out sitting on the sidelines while the next valuation bubble inflates.

The way to address this is to have alternative investments. Having choices allows you to be more discerning. The average annual return on the S&P ranges from 9 to 12% - if you have alternatives that can beat that tax efficiently then you don’t need to be anxious about elevated valuations.

For these reasons, we strongly believe alternatives that can outperform the S&P on an after-tax basis.

Within the S&P, we like tilts to energy and financials which remain cheap and we believe will show strong gains over 3 years. We also like technology names that have great earnings growth prospects and real moats.

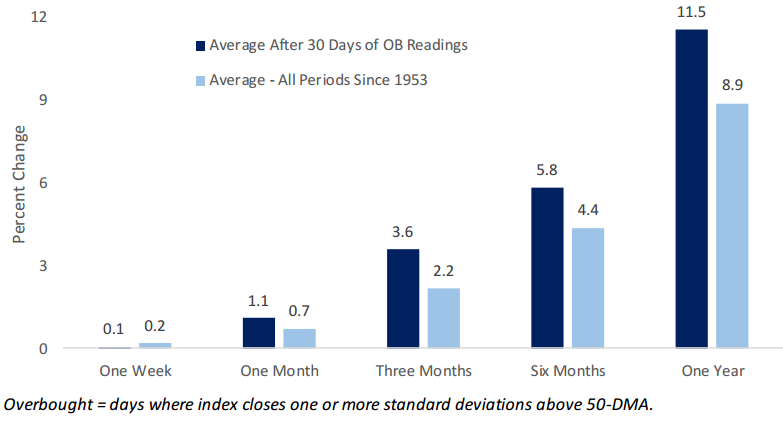

The S&P Tends to Outperform when Overbought

The market continues its record overbought streak.

What happens when markets are overbought? Well, they can stay overbought - and it presages better than average returns ahead. This is the momentum effect in markets.

Source: Bespoke Investment Group

Here’s a good analysis showing what we mean. You want to own equities when breadth is absolutely horrible (bet on mean reversion), and when breadth is uniformly positive (bet on continued momentum).

S&P Performance When Overbought

Source: Bespoke Investment Group

International ETFs were also big winners this week with many surging over 6% as the doller declined about 3%. The Fed is near the end of its rate hike cycle, while the ECB and UK is in full-swing - so the dollar is under pressure.

Keep an Eye on Small Caps

Small caps were one of the largest laggards YTD, but they’ve quietly outperformed the S&P. Smal caps were up 4% this week beating other indices including tech.

420 Days Without a New High. The Russell 2,000's 10% rally from the end of May through July 12th is better than the S&P 500's 6.7% rally over the same time frame.

Despite the recent outperformance, the small-cap index still hasn't made a new 52-week high in 420 trading days dating back to November 2021, which is its third-longest streak without a new high in its history since 1978.

If you are in ‘no recession camp’, then betting on small caps is a good move. Managers need to catch up to their benchmarks and they’ll focus on small caps, financials, and cyclicals that benefit from stronger than expected growth and cheap valuations. Further, the valuations are lower than the index so the downside is limited.

State of the Consumer

Consumer Confidence continues to thaw. The Michigan Consumer sentiment survey reveals for the first time since January 2022 that a higher percentage of consumers expected higher stock prices than lower stock prices.

The 17-month streak of negative sentiment towards stock prices was the second longest since 1987. It trails only the 18-month streak spanning the Financial Crisis from November 2007 through April 2009. We don’t think this is contrarian negative yet.

An Epic Rebound in Housing. Housing related economic data has been surpassing consensus forecasts at a rate and magnitude not seen in over 20 years. It’s quite the sight to behold.

It’s another reason we’re excited about Distressed CRE. Owning real estate is a tried and true method of creating tax efficient wealth. (But, we want to access the category at a discount using off-market methods.)

There’s a tale of two cities - the Louis Vuitton Crowd and Mass Market. This thread, based on a conversation with a UHNW friend in Florida, is quite telling. He wrapped up a tour and shared several telling anecdotes.

The luxury brand-loving group has increased spending, while the low-income tier has reined in their spending.

Crypto

Diving into the crypto ecosystem, Ripple's XRP token has made headlines with a partial victory in its litigation against the SEC.

This decision by the district court establishes that Ripple's sale of tokens via exchanges and algorithms didn't constitute investment contracts. That’s gives an opening for decentralized technology.

Each token has unique characteristics and each must be litigated separately. The high conviction inference is that Ripple is a win for ‘decentralized exchange’. That’s a big deal. Decentralized exchange is the prize!

Consequently, we believe the Ripple case is opening the door to “alt season”. That said, we recommend as always sticking to ‘quality tokens’.

Still, we caution against drawing inferences on what this means for other tokens or the SEC vs. Coinbase litigation. The ruling was explicitly narrow and did not hold that no tokens are securities. Expect the SEC to appeal the decision. The fight goes on.

XPR surged by as much as 91% before giving back gains - a reminder never to chase big green candles.

On June 6th, the date the SEC filed an action against Coinbase, we noted on Twitter several times “The SEC is Priced In”. Coinbase is up about 100% since then.

Source: Marketwatch, Twitter

What’s not priced in (at least longer-term)? BlackRock. Larry Fink is making it intellectually defensible for institutions to own crypto.

Our view: If and when the DOJ brings a negative action against Binance, we’d expect a sell-off. We believe a DOJ action will present an accumulation opportunity for quality Digital Assets in the same way the SEC action against Coinbase created a buying opportunity.

The DOJ actions will ultimately help to clean up the sector. Let due process play out. On that note, it was satisfying to see Celsius CEO Alex Mashinsky face justice. A more egregious fraud than FTX, which is hard to top!

Other digital assets such as Grayscale's ETHE have also enjoyed a substantial rally. We continue to accumulate on dips and have a multi-year horizon.

Laslty, we love this delicious take from Ari Paul. His point: the mere fact the SEC lost on some of their claims means that even the SEC is not clear on the law.

Meme of the Week

Quote of the Week

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” Warren Buffett

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.