Welcome back to the Lumida Ledger.

If you find this valuable, we’d greatly appreciate you sharing it far & wide with your network. That’s how we grow and keep the content free to read.Here’s a preview of what we cover this week:

Macro: Rate Cuts Inch Closer; Housing Market Rebound; Goldman’s Late Calls

Markets: CVS Check-In, Turnaround Tuesday, Why Buffett Is Building Cash

AI: OpenAI Exodus, Zuck’s Masterplan

Company Earnings: Strong on Tech, Travel Rebound, Healthcare Ramps Up

Digital Assets: Crypto Future in Limbo?

This week, we had a surprise AMA event with our newsletter subscribers.

Thanks for the overwhelming support. We had a blast; we ran out of time, but not the questions!

We plan to do it more frequently, continue providing value, and build a deeper relationship with our community.

A lot of you weren’t able to fill out the post-webinar form.

ETF TAX ALPHA

One of the questions that came up was around the idea of “Tax Alpha” in an ETF.

The central idea is this: the IRS does not view “in-kind” transactions as taxable. An in-kind transaction is a barter instead of a cash payment.

Instead of paying for Ally Bank stock for dollars, you can pay for it with appreciated Nvidia stock - without paying the tax on Nvidia.

As I’ve noted before, today’s markets are “accelerated”.

You see that in many places. Dell’s stock, for example. Or the dramatic run-up in Semiconductors and drawdown. Or Uranium names.

We have noted and spotted these points of market weakness several times. It’s hard to get out of harm's way if the cost of transitioning is paying short-term capital gains taxes.

Compounding an investment over ten years and not paying the tax man is one of Buffett’s secrets.

We think we can have our cake and eat it too, with an ETF. That’s why we are studying this closely.

A lot of an ETF's success comes down to building a distribution team to sell into RIAs and tripling down on content and social media.

We’re having initial conversations with strategic family offices and VCs. If you know someone who shares our vision, please contact me.

Also, please fill out this waitlist on www.lumidaetf.com. When we get to a critical mass of interest where we can cover the costs of the ETF, we intend to pull the trigger.

Staring Into The Abyss

What a week.

We wrote about the shift in psychology the weekend before this past Monday's market sell-off.

Notice the contrast:

Market Peak:

- Record call option buying, Vix low

- Cathie Wood buying AI stocks

- ‘Trump Bump’ at peak

- Earnings expectations high

- Jensen autographs

- AntiTrust has no teeth

- Rate cuts are coming

Market Low:

- Put/call ratio spike, Vix high

- Cathie Wood sells SOFI at the lows

- Candidate Harris at peak

- Recession fears pervade

- Nvidia chip delays

- AntiTrust has teeth (Google)

- Need emergency rate cuts (Jeremy Siegel)

Last Friday evening, after a weak NFP/ISM, I tweeted that a bottom was in days and that the crash was behind us.

Monday morning, markets gapped down. That was the bottom.

We were buying in the early part of this week and had a strong week.

Last Sunday, we laid out our reasoning and why we thought risk-reward was favorable overall. Mr. Market never makes it easy.

We appreciated this note on Twitter:

Thank you for that. You may be surprised to know that we grow via social media, referrals, and reverse inquiries.

Last Sunday, we wrote:

Indeed, the 10-year also bottomed Monday morning. It got as low as ~3.7% and is now back to 4%. (It's Wild to see the 10-year move 30 bps in a week—that's a topic for another time.)

We had a small short for SMAs, that had cash available to short both the 10-year and the VIX to add some tactical alpha to the portfolio.

This Thursday, we saw Unemployment claims beat expectations.

Recession fears abated. So stocks ramped up.

Macro

Investors woke up Monday with their hair on fire, expecting a recession and a Fed behind the ball.

This week we saw the ISM Services a (leading Indicator) suggest things aren’t as bad as they may seem.

Recall that last week, we noted that the ISM Orders (leading indicator for manufacturing) aren’t terribly relevant given the structural changes to the U.S. economy.

Goldman Sachs: Late is Wrong

Goldman published a report last Friday saying not to read too much into the weak NFP report.

Better late than never, I guess?

These guys are slow and crusty. This is an accelerated market. If you’re late on the insight, you’re losing the opportunity cost of money.

You can read my analysis Friday night, the day of the NFP, which was certainly non-consensus at the time and has proven accurate.

We have onboarded quite a few former Goldman Sachs clients. As part of that transition, I have access to their holdings.

What I see does not impress… I’ll leave it at that.

Late is wrong.

Nevermind, Those Layoffs Were Temporary

Goldman Sachs notes that the increase in the Unemployment Rates was driven by Temporary Layoffs.

If you are looking for a wealth management partner, Lumida is now welcoming a limited number of new clients.We offer a range of services, alternative investments (such as our CoreWeave deal), white-glove crypto management, to public equity management, and high-touch family office services, including trust, tax, and estate planning.

Ready to explore? Click here to fill out our form to start the discovery process.

Interested but not ready to commit? Build a relationship with Lumida and stay informed. Click on the poll below if you want our advisors to reach out.Lending Conditions Are Improving

The Fed loan officer surveys are key leading indicators we use to gauge the credit cycle.

Bank credit growth has been nearly zero since the banking crisis last Spring.

Banks are two years into a four-year commercial real estate window of pain.

Some, like our bank holding ALLY, are in good condition.

As lending conditions improve, that will bolster bank profits for quality banks and provide a fundamental support for the ‘breadth expansion’ we have discussed extensively.

That’s especially good news for the other 493 stocks and small caps.

Take a look at this chart below.

Historically, these recovery patterns have been seen after recessions have already passed.

Inflation is Beat

This chart is one reason we believe the Fed will cut rates.

Shelter inflation is rolling over.

It wouldn’t surprise us if we saw sub-2% YOY inflation. Seeing shelter inflation move this quickly is a bit of a concern.

Mortgage Rates Down, Nature Is Healing

Last Friday, I noted that the fly in the ointment for me was Elevated mortgage rates and weakness in the housing sector.

I could see chatter about the Fed buying MBS come back; agency MBS is a mispriced asset.”

Mortgage rates have fallen to their lowest level in 15 months, with the 30-year fixed-rate mortgage averaging 6.55%.

This is excellent news. Housing is a key pillar of the economy.

We don’t expect a major refinance way - most fixed-rate mortgages are locked in well below 6%.

However, the impact on psychology is tremendous.

It’s yet another reason we expect continued breadth expansion.

MARKETS

CVS Check-In

Here are some notes from CVS (e.g., Aetna) recent earnings call.

Look at our earlier Lumida Ledger for our bull case on CVS. This is a 2-year investment, not a momentum play.

1) Expects $9 Bn in free cash flow in ‘24, on a $72 Bn market cap

8.1x forward PE and 11% free cash flow to market cap.

Compare that to United Health’s multiples at 19.2x and fully valued.

2) CVS’s turnaround is in motion.

Turnarounds are hard.

This one is pretty easy - you change your underwriting policy and shut down unprofitable stores.

From the earnings call:

“In June, we submitted our bids for the 2025 Medicare Advantage plan.

Our bids went through a rigorous internal review and we are confident in our pricing for 2025, which reflects prudent assumptions for utilization trends.

Our actions are expected to drive 100 to 200 basis points of margin recovery in 2025 off of our current baseline and start the multi-year pathway to achieving target margins of 4% to 5%.”

Those target margins are the margins of their peer group, UNH and ELV.

If CVS gets to 2% or 3% target margins, the turnaround will be a success. I see no barrier to CVS accomplishing that.

With value plays, you can have lower expectations.

3) On Pharmacy sales:

” Same-store pharmacy sales were up over 9% versus the prior year, and same-store prescription volumes increased by 6.5%.

We continued to increase our script share during the quarter, achieving a 27.2% retail pharmacy share.

Our results continue to demonstrate we are the best-run national pharmacy chain in the country.”

5) CVS on Margin improvement:

‘We feel good that we’ll achieve the 100 to 200 basis points of margin recovery - that’s what we expect.

6) Bear Case?

The Bear Case is that health utilization remains elevated.

It takes a year or two to churn these older, unprofitable policies.

CVS does see a continued elevation in utilization. The new policies mitigate this (eg, the $0 deductible needs to stop)

Here’s what they say:

"We had a substantial amount of contingency as we look at our 2024 baseline for those bids, and remember for 2025, we assumed that the same level of trend persists for effectively a third year in 2025 at essentially a double-digit rate, very, very high abnormal trends.’

In other words, they are modeling the numbers conservatively.

CVS also dismissed the executive running Aetna. That’s accountability.

Straightforward management talk.

I added to our position here.

It’s not a fast idea. It’s a classic investment in a high-quality insurer attached to strong demographic trends that made a mistake in its underwriting.

Buffett bought into American Express after the latter had a major screw-up called the ‘Salad Oil Scandal.’

All I’m betting on is that margins will get to baseline historical levels and that the multiple will as well.

This type of position also adds a unique kind of ballast to the portfolio; it’s idiosyncratic and has no factor momentum…

Turnaround Tuesday did its thing.

What is Turnaround Tuesday?

Meta Llama 3.1 Answer:

‘Turnaround Tuesday 'refers to a phenomenon in the financial markets where the market reverses its trend from the previous days, typically observed on a Tuesday.

This can mean that if the market had been declining in the days prior, it might see a significant upward movement on Tuesday, or vice versa.

The term is often used by traders and investors who look for patterns and potential opportunities to capitalize on these reversals.

It's based on the idea that after a volatile start to the week, the market might correct itself or change direction on Tuesday.’

What if you invested in the S&P 500 every time in the US?

News channel CNBC reported that the stock market was in turmoil.

In that case... your average return after 1 year is equal to 40% with a win rate of 100%.

A Longer-Term View (The Seventh Inning)

This market is different from the 2010s and 2010s…

There is a hot ball of money sloshing around, causing financial boom busts in ‘themes’.

The fact that markets are ‘thematic’ and story-driven itself is a sign that sentiment is or was elevated.

We are still living in the aftermath of the Fed’s grand experiment with quantitative easing.

It has turned financial markets into a video game.

You have to think tactically, not just like a long-term investor, which would be much simpler.

This is a market that benefits the nimble.

I can see why Buffett is building his cash hoard.

The room for multiple expansions is increasingly limited.

You have to turn over a lot of rocks to find long-term opportunities.

Today, we thoroughly reviewed industry to see where we wanted to scoop up value.

We like our ideas. But it’s slim pickings overall.

When our screens don’t generate many ideas at once, and you have to squint and sort, it means you may later cycle from a valuation perspective.

Where we stand today, I expect markets will be fully valued and perhaps more by year-end.

There’s just not much room for valuations to run except in ‘overlooked quality value.’

or dislocations in quality businesses

examples: CVS CMCSA LPLA

A Bullish Technical Study - observation from Ryan Detrick.

What happens when the S&P 500 is down at least 1% on Thursday, Friday, and Monday?

The result is strong returns: 3 months later, higher 90% of the time and up nearly 10% on average.

One year later, up 18 out of 21 times and up 22.5% on average.

Bullish.

Here’s another study from Wayne Whaley:

For example, since 1950, there have been 16 prior years in which a double-digit, first seven months (Jan-July) of the year were followed by a negative first two weeks of August.

Looking at the following Aug 14-January time frame, the S&P has been positive in 14 of those 16 years for an average gain of 9.34%. The 5% moves were 12-0 to the positive.

The weakest time frame was Sep 23-Oct02 which was 6-10 for an avg loss of 0.90%.

The strongest time frame was Oct 27-Jan 20, which was positive in all 16 of the setups, with an average 8-week gain of 7.27%.

What does a typical correction look like?

A great observation from our friend, Ryan Detrick.

The average year sees a peak-to-trough move of 14.1% (since 1980) for the S&P 500.

2024 is down 8.5% from the mid-July peak, yet still up 8.7% for the year.

The Drudge Report Indicator Works Again

This Monday morning, we saw this flash across the Drudge Report.com

That was a sentiment-type buy signal.

The last time we saw something similar was during the banking crisis last Spring. It worked then as well.

See this tweet for our real-time analysis of this indicator. Alpha is hiding in surprising places.

It’s all about Earnings

This is a key reason why we believe the bull market has room to run despite elevated valuations: earnings growth.

Company Earnings

Explore becoming a Lumida Wealth client: learn more about our Crypto White Glove Service or Click here to explore our Wealth & Family Office Services.

Technology, Media, Telecom:

- Palantir Technologies Inc. (PLTR): Strong performance, raising full-year 2024 revenue guidance. Consumer insight: Growing adoption of AI-driven data solutions.

- Uber Technologies, Inc. (UBER): Significant growth in bookings and trips, indicating increased consumer reliance on ride-sharing services.

- Super Micro Computer, Inc. (SMCI): Board-approved stock split signals confidence, but EPS miss suggests potential challenges ahead.

- GlobalFoundries Inc. (GFS): Focus on disciplined capital expenditure reflects cautious growth strategy amidst declining revenue.

- Reddit Inc. (RDDT): Robust revenue growth, but still operating at a loss. Consumer trend: Growing engagement on niche social platforms.

- Shopify Inc. (SHOP): Strong GMV growth, indicating a solid position in e-commerce solutions.

- The Walt Disney Company (DIS): Stable growth in subscribers but declining ARPU shows a shift in consumer preferences.

- Warner Bros. Discovery, Inc. (WBD): Significant goodwill impairment reflects challenging market conditions.

- Robinhood Markets, Inc. (HOOD): Strong revenue growth, driven by increased transaction-based revenues and net interest.

- Bumble Inc. (BMBL): Positive EPS but revenue miss reflects mixed consumer behavior in online dating.

Consumer Discretionary:

- Lucid Group, Inc. (LCID): Vehicle deliveries increased significantly, but EPS miss suggests cost management challenges.

- Yum! Brands, Inc. (YUM): Modest system sales growth across brands, reflecting steady consumer demand.

- Rivian Automotive, Inc. (RIVN): Technology JV with Volkswagen highlights strategic growth, but revenue miss shows market pressures.

- Instacart (CART): Significant EBITDA growth signals strong consumer shift towards online grocery shopping.

- Hilton Worldwide Holdings Inc. (HLT): Solid RevPAR growth suggests a rebound in travel and hospitality.

Industrials:

- Caterpillar Inc. (CAT): Positive EPS but declining revenue signals potential sector slowdown.

- Axon Enterprise, Inc. (AXON): Strong revenue growth, reflecting increased demand for safety and security solutions.

- Builders FirstSource, Inc. (BLDR): Revenue decline and lower EBITDA margins indicate challenges in the construction supply sector.

- Blue Bird Corporation (BLBD): Record EBITDA points to operational efficiency improvements.

Energy:

- Permian Resources Corporation (PR): Robust revenue growth, but missed EPS indicates cost pressures. Production-focused guidance reflects the ongoing energy sector expansion.

Healthcare:

- Inspire Medical Systems, Inc. (INSP): Raised revenue guidance suggests strong demand for sleep apnea solutions.

- Progyny, Inc. (PGNY): EPS beat, but revenue miss and share price decline reflect investor concerns.

- Voyager Therapeutics, Inc. (VYGR): Exceptional revenue growth due to collaborations, highlighting a trend towards partnerships in biotech.

- CVS Health Corporation (CVS): Mixed results with downward revised guidance suggest challenges in retail healthcare.

- Novo Nordisk A/S (NVO): Solid performance in diabetes care, but Wegovy sales miss points to potential competition or supply issues.

- Astrana Health Inc. (ASTH): Strong revenue growth indicates rising demand for healthcare services.

- Harrow Health, Inc. (HROW): Impressive growth reflects increasing market share in the specialty healthcare sector.

AI

Click here to explore becoming a Lumida Wealth client

3 OpenAI Leaders Are Leaving

President Greg Brockman is going on extended leave, John Shulman is going to rival Anthropic, and product leader Peter Deng is also out.

META IN HOLLYWOOD?

In an AI age of abundance, attention (and longevity) is the scarcest asset.

Zuck is playing the game at another level.

Both short-term game and long-term strategy.

Meta is actually trying to unseat Google (Meta Llama 3), Microsoft (new form factor + Agents), and Amazon (social e-commerce).

Whether they do so or not is irrelevant.

The probability risk-adjusted return says the bet is attractive.

And they continue to execute…

Meta is still not priced for AI dominance.

Why wouldn’t they get into gaming as well?

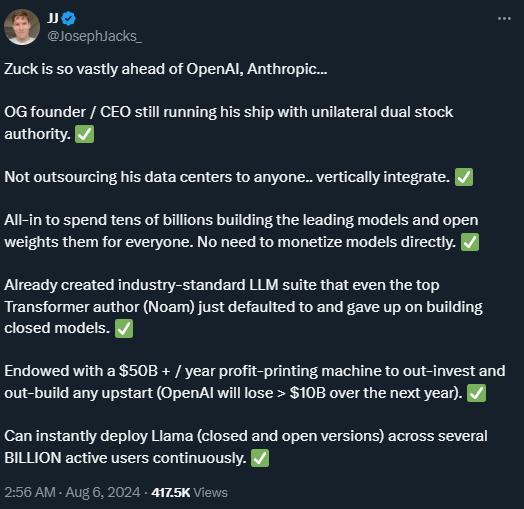

This is a great observation from our friend Joseph on why Zuck is ahead of the competition.

Digital Assets

There’s a lot of drama happening with Candidate Harris and the crypto community.

Our read is this: Candidate Harris is taking a ‘minimal viable engagement’ strategy.

That means - engage but do not commit. Candidate Harris has zero incentive to work out a deal or a framework if she leads in the polls. We expect that to continue until the end of the DNC Convention, as is the historical norm.

The Digital Asset industry can best extract concessions in a competitive two-way race.

We stand by the statements we wrote with SEC Chair Arthur Levitt at the bottom of the crypto market in October 2022. We lay out the issues and address how to create a responsible digital asset framework.

We believe that starts with a tokenization framework that creates competition for entrenched banks and empowers the long-tail of culture and asset creators…

Quote of the Week

“Wide diversification is only required when investors do not know what they are doing.” – Charlie Munger.

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.