Here’s a preview of what we’ll cover this week:

Macro: Rate Cut Odds Are At 100%; Import Signals were Optimistic

Markets: Capital Rotation Is ‘Still’ On; Semiconductor Capex Receiver Thesis; Consumer Discretionary Brands Aren’t Reflecting Optimism

Digital Assets: STRIPE: Imperial Overstretch

Lumida Curations: Will DATs Create Value; Trump Slams Powell for “Late” Moves;

Recognition

Featured On Bits + Bips

On Wednesday, I joined another episode of bits + bips with Steven Ehrlich, CoinFund’s Chris Perkins and Upexi’s Brian Rudick to talk about digital asset treasuries, and what their future will be. Here’s what we discuss:

Are markets set for another September swoon?

We debate whether DATs are in a bubble or not

Are DATs better products than ETFs for investors?

How the math behind premiums shows DATs create value

Whether this is the time for altcoins to shine

Where macro is heading and what investors should watch?

Why Galaxy’s tokenized-share move on Solana is a big deal for Internet Capital Markets

You can watch the episode here.

Do You Have Accountability In Your Life?

What would happen if accountability didn’t exist?

Simply put: nothing would change.

Without accountability, there’s no reason to improve, no reason to challenge yourself, and no reason to grow.

People would continue doing just enough to get by, but real progress would stall.

Goals would remain out of reach, and success would be elusive.

Accountability is the catalyst for change.

When you hold yourself accountable, you make a commitment, not just to others, but to yourself.

But here’s the thing: accountability isn’t easy. It’s often the hardest choice at the moment. It requires discipline, consistency, and the courage to confront the reality of where you stand.

It demands that you prioritize long-term success over short-term comfort.

Accountability is an investment. Like any investment, it requires an upfront cost, but the returns? They’re significant.

The alternative is procrastination. You get the cash inflow today and then you're bleeding losses forever. It's the path of convenience, where you avoid what’s difficult and take the easy way out.

In the short term, that may feel good, but over time, the cost of neglecting accountability becomes clear.

So, ask yourself: What are you holding yourself accountable for? What are you willing to invest in today that will pay off tomorrow?

Because true progress begins when you commit to holding yourself accountable.

Macro

Confirmation Bias

Each of the last two years, the summer months have shown negative NFP numbers. And each summer, there’s been some kind of panic that causes for calls for rate cuts.

Then the economic data firms into Q4.

We don’t expect this summer to be any different. Rate cuts are not needed - but we will get them anyway - and they will help small caps with levered balance sheets, and fuel breadth expansion - two themes we are positioned for.

This is one element which makes investing hard — you have to play the hand you expect to be dealt, not the hand that should be dealt.

We continue to believe many investors remain offsides on the hated category of small caps. Meanwhile, we’re seeing weakness in large cap tech and out-performance in this category.

Macro investors are starting to recognize this trend that started a few months ago. So, this theme is going from non-consensus to a momentum idea now which will attract more flows.

Rate cuts mean lower interest expense burdens for small caps. Small caps can re-finance their debt. The 10-year has dropped considerably from where we were a few months ago — that helps.

So, why is it that we get seasonal weakness?

I believe the Birth / Death labor model - a statistical tool to estimate job creation - is a big culprit,

Add to that the human tendency to fear a sequence of bad revisions, then you setup for rate cutting cycles.

Here’s the thing — lower labor supply growth is a structural feature of secure borders. Interest rates can’t fix ‘lower labor supply growth’.

Central bankers will cut rates. And then the inflation cycle repeats… How much of this is driven by the combination of confirmation bias and bad statistics?

In this microcosm, we can see the folly of central banking policy. If you want to increase NFP, you need to increase the eligible labor population.

Lower interest rates transfer wealth from savers/retirees to borrowers. It will stimulate housing, but it will come at the expense of labor flowing into other categories (like healthcare).

On rates, we expect we’ll get a couple adjustment cuts rather than a full-blown easing cycle. In Q4, esp in mid-October you want to be positioned long.

Note: There are few company buybacks during this blackout period for the next month or so.

So, the natural bid to equities could be softer here tactically. That said, we remain in a strong bull market driven by disinflation, strong earnings growth, and productivity gains.

Rate Cut Odds Are At 100%

The NFP miss on Friday has raised the rate cut odds to 100%; markets reacted to it with SPY hitting all-time highs and Russell 2000 reaching its YTD high.

However, rate cuts won’t solve the problem of unemployment (if we have one).

We did a complete analysis of the cooling labor market following July’s miss. Read it here.

In short, it is the supply of labor and demand for labor that is diminishing. Higher productivity growth is also helping businesses.

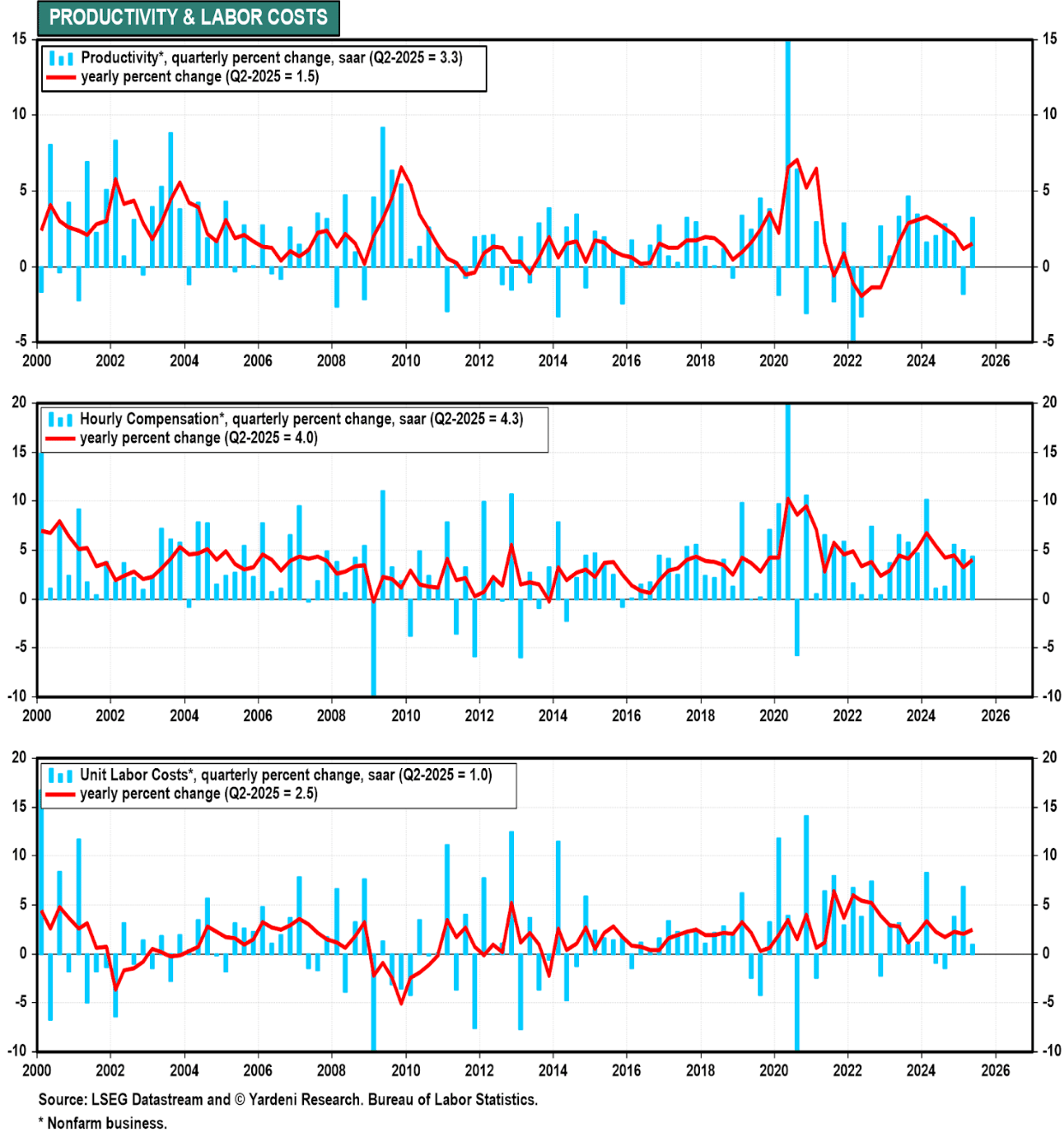

This week’s revised Q2 productivity data confirms our productivity boom story - something we’ve been talking about since 2023.

Productivity growth rose to 3.3% (SAAR) from 2.4%, with both output and hours worked increasing.

Employers are adapting to fewer workers by boosting efficiency.

Similarly, firms are raising wages to attract workers.

Annualized wage increase in Aug was 5%, following a 7% sharp increase in July. As long as wages continue growing, consumer spending will stay intact, which will eventually help labor markets’ recovery.

If we look beyond the NFP, the employment data is again stable; the unemployment rate is practically at full employment. Prime age employment has been increasing since 2023, and Aug had an uptick.

Overall, strong, productivity-led growth means current interest rates are appropriate. Lowering rates now can potentially cause a stock market melt-up. (Friday showed a demo.)

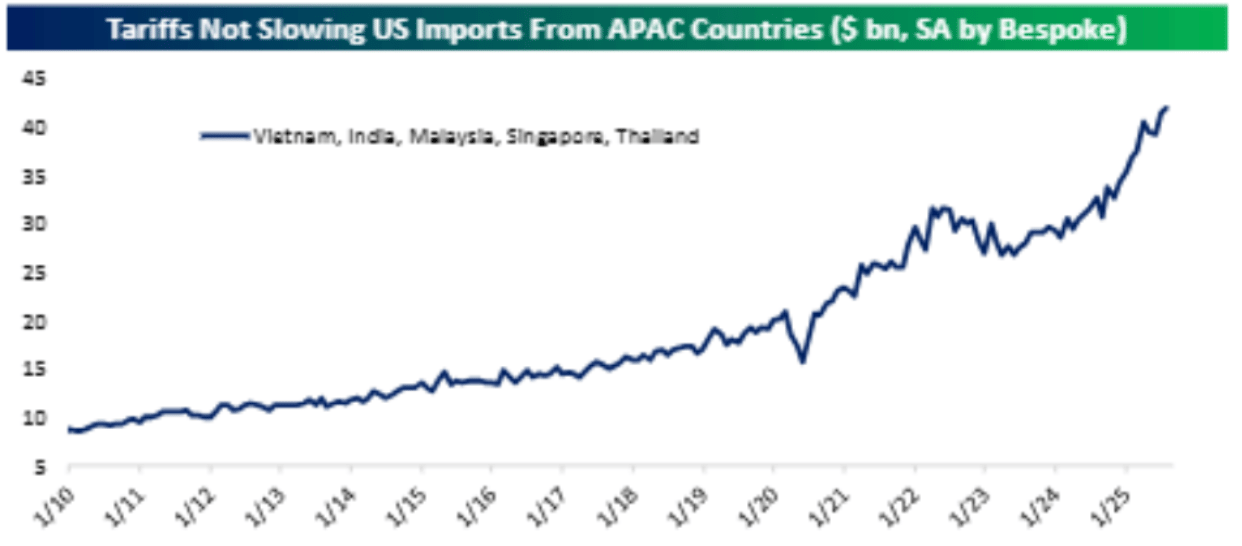

Import Signals were Optimistic

Imports are telling a story of economic optimism.

Companies are turning to Southeast Asia– Vietnam, Malaysia, Singapore– where imports are climbing to avoid high tariff imports from China.

Ali Baba crushed earnings (we have exposure). A story not told here — importers from China that previously imported from middle-men are now sourcing from Ali Baba. And, they are seeing lower costs from ‘going direct’ than from the prior world with the middlemen - even after tariffs.

We learned this from one of our Lumida clients.

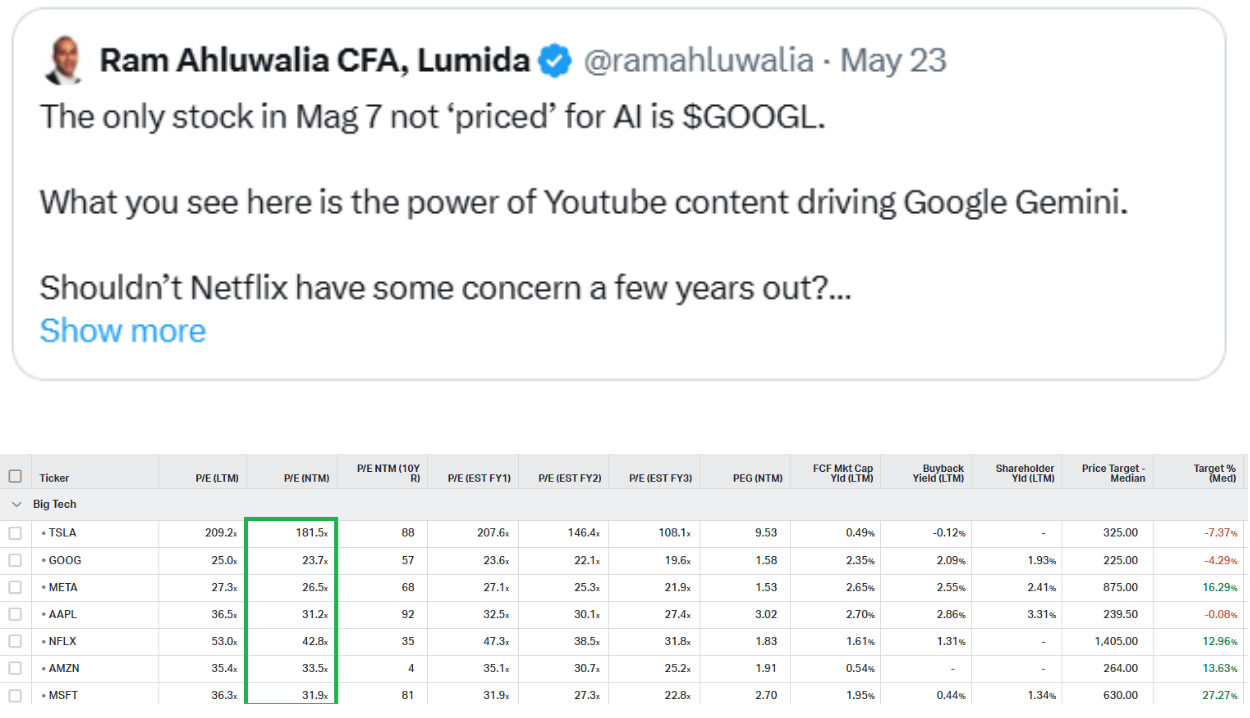

Google was the main driver; it gained 11%, across the week, following the favorable anti-trust ruling. In short, remedies for anti-trust are far weaker than anticipated.

Google remains of our major holdings. It has many ways to win: Personal Assistant AI, Youtube, Driverless cars, and Cloud.

Google made three consecutive all-time highs this week. Despite that, It’s still trading at P/E NTM of 23.7- below its peers in Mag7.

We covered Google in our July’s newsletter. Read it here.

At Lumida Wealth, we blend traditional wisdom with cutting-edge strategies in digital assets and alternatives, helping families and founders grow and protect their wealth in a modern, meaningful way.

Send Marc an email if you’d like to explore what Lumida can offer around tax mitigation or holistic wealth management ([email protected]), or book a call here.

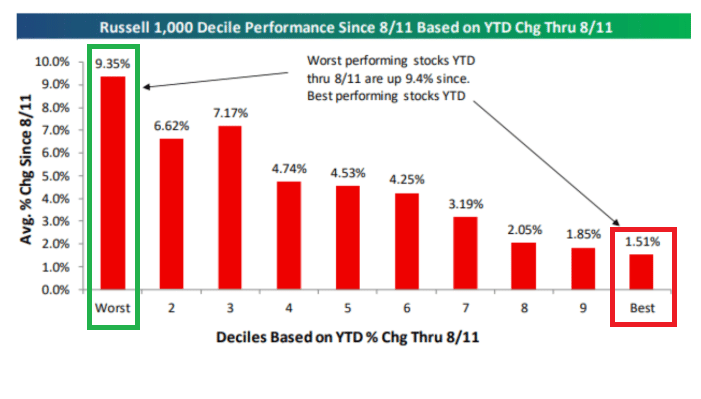

Capital Rotation Is ‘Still’ On

In mid-August, we observed the first clear signs of rotation out of the year’s winners and into the year’s laggards. That trend has persisted.

Stocks that had led the market earlier in the year have largely stalled, while investors have been rotating into areas that were previously weak.

Laggards of S&P 1500, which were down more than 50% year-to-date in mid-August, have since rebounded an average of 17%.

The S&P 1500 has gained only 2.1% in the same timeframe.

Looking at the Russell 1000, the worst-performing decile has gained 9.4%, while the best-performing decile is up only 1.5%.

This is a mean-reversion non-consensus rally.

The rally has broadened beneath the surface, with laggards driving recent performance. The sustainability of this rotation will be an important theme to watch in the coming months.

Semiconductor Capex Receiver Thesis

It's hard for me to understand the doomers who compare the GPU cycle to the Global Crossing of the Dotcom Era.

Amazon, Microsoft, Meta, and Google have increased their 2025 capital expenditure by about 33%.

These aren't telco companies. They are the most valuable companies in the world -- and they have both FCF and positive ROI on their cloud spend.

AI-related capex is projected to grow by 53% in 2025, and total US AI investment could reach $406 billion (1.3% of GDP).

The AI capex cycle still has quite a bit of room to run.

Here’s my Semiconductor thesis from back in 2023 - the takeaways are still valid! View it here.

Earnings Highlights / Read Thrus

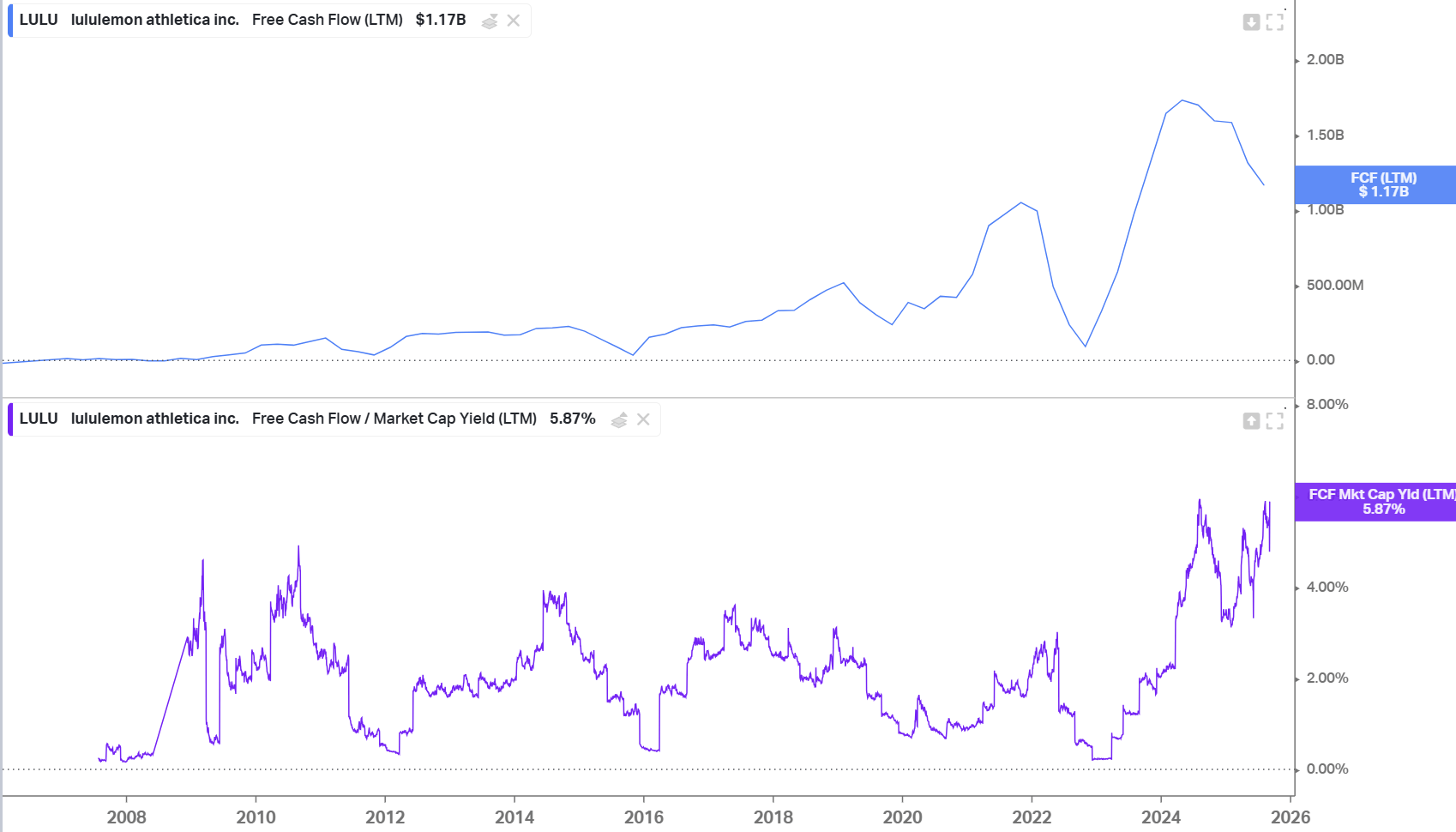

Lululemon's (LULU) Q2 results highlight U.S. consumer caution, with softer apparel spending and selective buying.

CEO Calvin McDonald noted: "Consumers are spending less on apparel overall, spending less in performance active wear and are being more selective in their purchases, seeking out truly new styles."

The U.S. market remains challenging: "The overall market for premium athletic wear in the U.S. remains challenging with declines continuing in quarter 2."

High-value customers show loyalty but reduced spend on familiar items: "We feel that our opportunity remains in frequency and conversion, which is impacting their total spend."

Traffic trends weakened: "We did see store and e-commerce traffic slow a bit as we moved throughout the quarter."

Athletic apparel hasn’t worked as a sector overall; Nike, UnderArmour, and VF corp are down from their valuations at the start of the year, while the index spiked to all time highs.

Lululemon dropped 18% this Friday.

We believe in the next few weeks it will be time to go shopping for Lululemon - but we need to do our homework here.

Lululemon is a quality business. The valuation was over-extended. The Free Cashflow Yield in Lululemon suggests that the sell-off is now overdone.

Digital Assets

STRIPE: Imperial Overstretch

Stripe, until now, has been the epitome of perfect strategy and execution.

But, their new chain- Tempo, which follows Robinhood’s news last month, will upset:

Visa / MC, Card issuers, and amazingly both decentralized chains AND regulators (since it is permission less).

Stripe’s Tempo has an audacious goal to be the ultimate blockchain for payment settlement.

Stripe wants to own the payment rails, not just sit on top of someone else's rails

Stripe put their hand on the board and said: ‘We want all the marbles.’

We might look at the launch of this chain as peak hubris for Stripe.

Unless you are an online merchant customer of Stripe, Stripe has made itself public enemy #1.

Its objective: ‘The one chain to rule them all’

Lumida Curations

Most Dats Will Never Create Value

Although 95% of altcoins have already lost nearly all their value, the real story is that only a handful of durable assets will survive the noise, compound over time, and create life-changing fortunes for those who spot them early.

Trump Slams Powell for “Late” Moves

Criticizing Jerome Powell’s delayed rate cuts, Trump argues that while the economy shows strength, squeezed mortgages demand urgent and serious action from the Fed.

Private 401(k)s Could Supercharge Retirement

By adding just 1–2% in extra annual returns through private diversification, investors can unlock the power of compounding to boost retirement savings by 50–100%.

Meme

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.