Here’s a preview of what we’ll cover this week:

Macro: Still No Signs of Recession Anywhere; What contrarian looks like

Market: Google Beats; Ziff Davis is Mispriced

Crypto: Stablecoins vs. Interchange; Bitcoin won’t get past $125K in the near-term?

Recognition

Strange times we live in.

Hunter Biden is explaining the nuances between crack and cocaine.

President Trump is touring a Federal Reserve building led by Chair Powell who is grimacing like a guy having a colonoscopy without anesthesia.

The Epstein files went from a Deep State theory to Fake News.

Meanwhile, in the real world, we continue to see no signs of a recession anywhere despite the gloom and doom vibes.

Still No Signs of Recession Anywhere

Remember when everyone panicked about the inverted yield curve?

Or cited the Sahm Rule as a sure sign of recession?

Today’s economy is different than the manufacturing era of 30 years ago.

The economy is being driven by services.

Boomers are sitting on piles of T-Bills. And they’re spending that on travel & leisure. (Cruise are up 50 to 100% from the lows.

I always tune into to see what Brian Moynihan says after BAC reports earnings. He sees 4% nominal spend growth. There’s nothing to see here folks.

And check out company earnings. Record level of earnings beats.

Corporates will continue to hoard labor and hire so long as earnings growth is positive.

Healthcare is a standout.

We bought Quest Diagnostics (DGX) and Labcorp this week ahead of earnings. Labcorp shot up ~16% so then we sold it. That wasn’t our plan per se, but Mr. Market took something cheap and overlooked to overbought in a single day.

Quest had a similar phenomenon but now has a good entry.

Both of these buinesses quality compounders linked to the inexorably rising level of medical tests that seniors demand. They aren’t going to see less demand from the Big Beautiful Bill.

On the climate, this is not peak 2021 folks. Amazon had a PE ratio in the 80s then - it’s in the 30s now.

Animal spirits are cooling, but quality names are holding up.

Also, Trump has called for Tax-cuts for low income Americans.

This should help consumer discretionary stocks which we’ve been talking about for month.

Skywest, a name we own, did well against market expectations after reporting.

The EPS rose to $2.91 from $1.82 last year (a 60% jump).

Approximately 80% of SkyWest’s revenue comes from long-term capacity purchase agreements with major carriers, ensuring stable, contract-based revenue.

This structure protects them from the volatility of passenger demand and fare fluctuations.

They are not exposed to day-to-day fluctuations in demand. It’s a neat way to invest in Consumer Discretionary but with a higher quality business model in case I am wrong.

You Must Be Contrarian To Identify Value

I look for mispricings.

Benicio del Toro is a mispriced actor.

Christopher Nolan was mispriced after he made Memento (back in 2000).

The Audi A6 is mispriced relative to luxury brands.

CoreWeave was mispriced at 15x PE in private markets.

The ETHE/GBTC trade were mispriced at a 50% discount to NAV.

A 2.5% 30 year fixed rate mortgage in Covid was mispriced.

Uranium was mispriced when we interviewed the CEO of ASP last year. (Podcast Link)

(Ditto Virtu financials and Better Home and Finance both interviews on Lumida Non-Consensus Podcast.)

Solana was mispriced when Lumida Wealth interviewed Kyle Samani in Sept 2023.

Hot sauna and cold dips are mispriced.

JP Morgan and UBS were mispriced during the 2023 banking crisis.

I believe the long-term benefits of having a family and memories to cherish is mispriced (eg, under-rated).

Physics and Philosophy majors are mispriced.

Rocket Lab was mispriced when Elon was ex-communicated from Trump’s orbit.

Capitalism & entrepreneurship is mispriced.

Certain business models are mispriced.

Carl Jung and Joseph Campbell are mispriced philosophers.

Stand up comedy is mispriced.

I enjoy recruiting talent on Telegram or Discord because their intensity is mispriced.

Consumer discretionary and semiconductors like NCLH and TSM were mispriced after tariffmageddon.

People often classify strategies as momentum (trend following) or value (mean reversion).

There is another bucket.

I love mispricings.

There are a lot of things that are overpriced.

English Majors. France.

Legacy brands in decline.

Don’t get me started.

Some people have an eye for mispricings.

If brand names and status seeking and social climbing is your thing, you will be chasing growth stocks at tops forever.

So many names in my portfolio are mispricings.

Clint Eastwood movies are underpriced.

Michael Bay movies are overpriced.

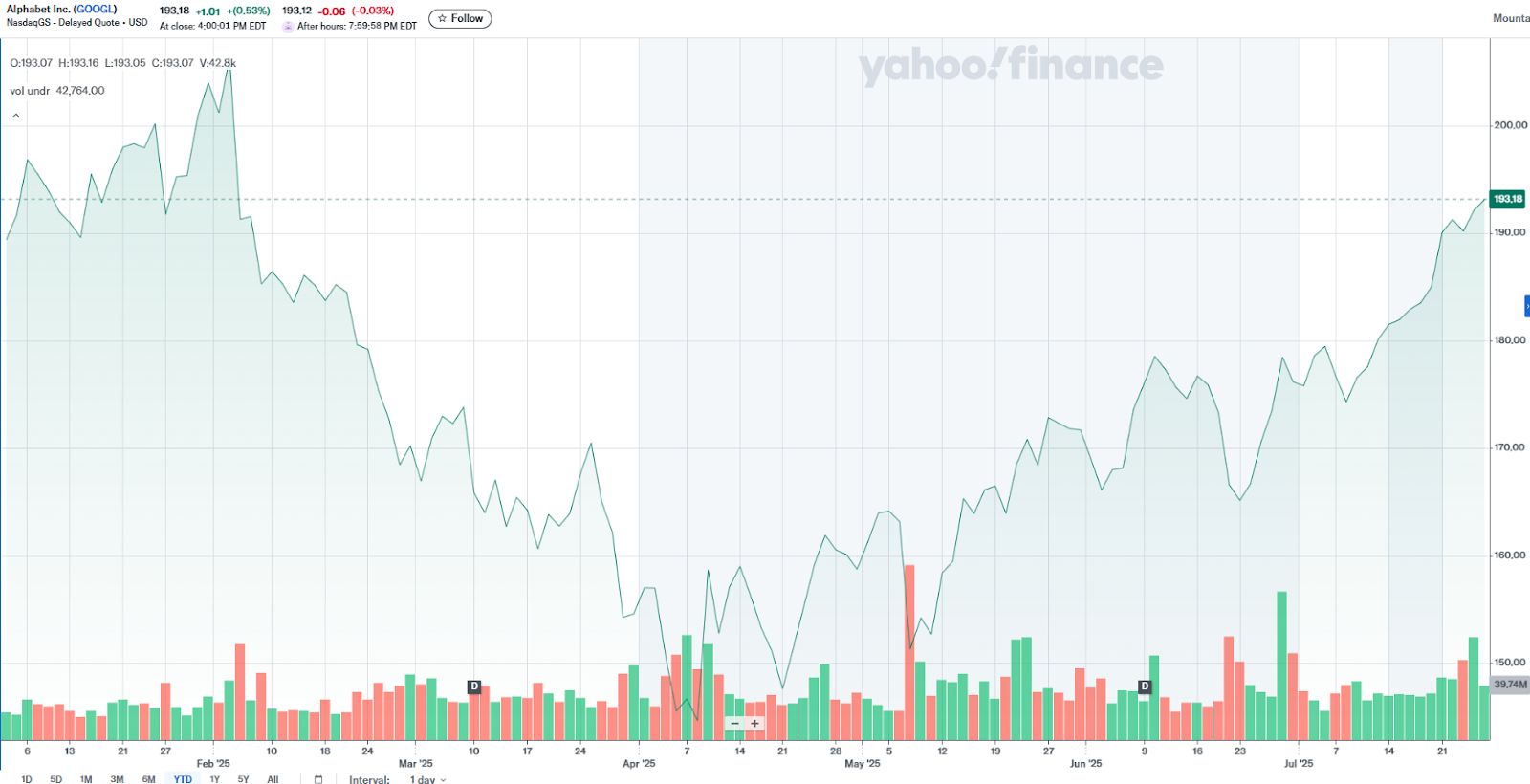

Top Bet: Google

The only stock in Mag 7 not ‘priced’ for AI was Google.

It is now within spitting distance of all time highs.

This is one of my top 3 positions, and their Q2 results were solid.

The infographic is from Lumida Earnings AI. It helps you keep track of latest earnings releases, and make informed decisions.

Each day this AI is now going thru hundreds of earnings reports and posting on twitter at the handle @lumidaearnings.

It’s also taking the very best reports (potential longs) and very worst reports (potential shorts) and creating a dynamic watchlist for our CIO team. It’s like an analsyst screening resumes who never sleeps.

Google Breakdown

Google’s Revenue grew 14% YoY to $96.4 Bn.

EPS up 22% YoY to 2.31.

Cloud revenue grew 32%. It is now a $13.6 Bn business with 21% margins.

Mind you, that Cloud Revenue is AI related. So, when people say ‘The ROI on AI’ is not there - they are wrong.

The infrastructure layer is doing very well.

YouTube ad revenue was $9.8 Bn, +13% YoY. The average daily views have increased to 200 billion.

Search revenue was reported at $54.2 Bn, 12% growth compared to 9% consensus, challenging doubts about AI replacing Google search.

Gemini’s AI overviews are now driving over 10% more queries globally.

Sundar Pichai: "We are actually seeing traction, particularly in the last quarter, ever since we introduced Gemini 2.5 Pro."

Gross margins and Net margins remain consistent, around 60% and 30% respectively.

Free cash flow over the last 12 months was $66.7 Bn.

CapEx is ramping. Two third of the $85 Bn Capex went straight to AI infrastructure.

"The vast majority of our CapEx was invested in technical infrastructure, with approximately two-thirds in servers." – Anat Ashkenazi

Sundar is confident in Google’s investments. "Our churn rates are very low, and we are much more efficient in the investments needed to grow those lines of businesses."

AI is already shipping across Search, Ads, and Cloud. The scale advantage is real, and monetized.

Waymo, Alphabet’s autonomous driving technology, continues to make waves.

It was launched in Atlanta in June, doubling its service area in Austin. Service zones in Los Angeles and the Bay Area grew by about 50%.

The Waymo Driver has now logged over 100 million autonomous miles. Testing is underway in over 10 cities, including New York and Philadelphia.

Google’s core cash engines are strengthening while new ones come online.

The market is starting to rate it.

Stock’s near all-time highs. Still not expensive.

We’re long, and staying long.

Ziff Davis is Mispriced.

We bought it on July 1st.

Ziff Davis trades like a broken tech stock. It’s not.

At 4.8x forward earnings and 6x free cash flow, it’s rated well below its peers.

This is a profitable, cash-generating digital media business being valued like a melting ice cube.

The company owns high-quality, high-margin assets: PCMag, IGN, CNET, Everyday Health, RetailMeNot. These brands print cash through performance marketing and subscriptions.

Free cash flow is expected to exceed $290M this year. That’s a 21.5% FCF yield against a $1.38B market cap.

Management is buying back stock aggressively; $34.9 million worth of shares retired in Q1 alone. That’s a positive signal.

They’re also acquiring niche content platforms at low multiples and integrating them quietly. Those are NPV+ investments they underwrite to a 20% IRR.

Suppose they make mistakes and get a 12% IRR. I’m still good.

We believe Ziff Davis fell out of favor and has high upside potential.

Even modest multiple expansion, to just 6–7x forward earnings, get you a 50% re-rate.

This investment reminds me of Bumble. It’s now working (finally) and up 83% in the last 3 months but presently overbought.

Ziff Davis has no bankruptcy risk here. The balance sheet is clean. Margins are stable. Cash flow is consistent.

We think the downside is already priced in. The upside isn’t.

This is what dislocation looks like.

Ziff Davis is what you buy when you want high-quality earnings at a deep discount, and you're willing to wait.

Ziff Davis chart shows a basing. These markets I do believe require ‘pre-positioning’ given the heightened liquidity. We have a 2 to 4% weight on this name depending on the strategy.

Stablecoins: The Inevitable Change

You’re most likely underestimating the impact of stablecoins. It’s significant.

We’ve had ACH for decades. We’ve had wire rails.

Real-time payments? Still not really adopted.

Stablecoins settle instantly, 24/7. Frictionless. Final.

What that means: stablecoins are going to disrupt interchange.

Here’s a short video where I walk thru the thesis “the Blockchain is the Balance Sheet” in greater detail.

Visa. Mastercard. Amex. Those profit pools are in play now.

They’re toll collectors. Stablecoins route around the tolls.

I had a conversation with a banker from PJT Partners.

His word to describe how the incumbents are reacting?

Frantic.

Ben Forman, founder of ParaFi, walked through the TAM at a Web3 summit.

Payments. Custody. Lending. Settlement. All of it gets rebuilt.

By the end, I felt like I’d had a double shot of espresso.

Neobanks, like Stripe, Nubank, Adyen, Revolut, need to refactor around stablecoins too.

They want to be banks.

Coinbase is pushing for a bank charter.

They get it.

But banks still have the master account at the Fed.

They control deposits. They know how to lend.

They’re already in the business of trust and compliance.

The functions are the same; they’re just not on-chain yet.

That’s the big unlock:

The blockchain becomes the balance sheet.

That’s not a metaphor. It’s a shift in ledger architecture.

A few tech-forward banks are going to crush it here.

Most won’t. Most don’t know how to hire engineers, build a UX, or ship products.

But, and this is key, banks don’t have to be first movers.

Look at what happened in 2015 with online lending.

The banks just waited, co-opted the technology, and integrated it.

Same story playing out again.

Banks still have the regulatory moat.

Getting a bank charter is a grind.

Even if you get one, you're stuck within the scope of your submitted business plan for three years.

Anchorage did it, full OCC national charter, but it’s limited. No lending, no payments. Different ballgame.

So here's the setup:

FinTechs want to become bank-like.

Banks want to build like FinTechs. (should)

Very few can do both.

But if you’re a tech-forward bank, if you understand product and compliance, this is your moment.

You become the toll booth between crypto and TradFi.

Between merchants and stablecoin rails.

Digital Assets

We sold our bitcoin earlier this past week expecting to pick it back up sometime in Q4.

I explained my reasoning in the Bps+Bits podcast.

I don’t think Bitcoin will get past $125K and stay there - at least not in the next 60 days.

Meme of the week

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In