Here’s a preview of what we’ll cover this week:

Macro: S&P 6,000, IPO Market, Inflation Watch

Market: Post-Election Effect, China Semiconductors

Company Earnings: Fertility Clinic

Digital Assets: Crypto IPO Market is Coming?

This Week’s Highlights:

Hedge Fund Moves: 13F Insights on Druckenmiller, Point72 & Top Funds

Digital Assets: Tokenization

Portfolio Construction

Macro: Producer Price Index concerns

Markets: S&P 500 Executes Project Rugpull

Hedge Fund Positioning: 13F Analysis of Druckenmiller, Point 72, and more

This week, we break down key moves from industry titans like Druckenmiller and Point72, highlighting trends and high-conviction plays.

Download the full overview on our website: www.lumidawealth.com/13f

Druckenmiller’s 13F analysis is always a site to behold.

Druck is misunderstood and he says as much on his podcast interview recently with the head of the Norwegian Sovereign Wealth Fund.

He relies on bottoms-up company results to inform his top-down macro picture.

I ran a poll this weekend to see how people perceive Druckenmille’s strategy. 80% of people got it wrong.

Druck has over 75 positions - many of them at a 0.3% weight. He has some larger positions such as an investment in the KRE (Regional Bank Index).

And he has positions such as Coupang which he owned year ago and he let his winners run.

Druck’s approach is philosophically a lot closer to the quant strategies you might see at Two Sigma, Citadel, Ren Tec, or Millennium.

He likes to invest in themes. He has exposure to over 10 banks! He isn’t, at least in that case, trying to pick the winner. There are limits to analysis.

He has no exposure to Nvidia, Meta, Google, Amazon, or Microsoft. He is Non-Consensus. (And anyone that says you need to closet index to perform is wrong - here’s a case in point).

I do recommend listening to the first 30 minutes of the pod where I focus on analyzing Druck’s thematic views and his holdings.

We picked up an Argentinian bank based on his 13F.

Funny enough, every single name I analyzed in Druck’s 13F was up the following day despite all the major indices and most of the US sectors down in the red.

That’s the Druck Effect. People are undoubtedly copying and following Durck’s trades.

The man has an easier job in the sense that he can create his own follow-thru simply by owning a name.

But, it is well deserved, and arguably he may be considered a better investor than Warren Buffett if you consider that he has had one down year.

In the rest of the video, I cover other themes and names from other investors.

I also share my views on which funds I believe have skill vs. those that do not.

13F filings are one of several inputs into the Lumida investment idea generation process. As a cross-asset class investor, we are generalists, not sector specialists.

Knowing which managers have skills in specific sectors helps to create an edge. And, when everyone once a quarter ‘shows their hand’ it’s a nice way to see what trends you might be missing out on.

Here’s one. We noticed Teva Pharamaeceuticals, an Israeli based pharma company specializing in generics, appear on several managers we like and respect.

Teva is a bet that governments and insurers will insist on generics rather than high-cost branded drugs. It’s a great idea.

The stock has a forward PE of 6.2x, P/ FCF of 13.6. Here’s the chart – if the 200 Day provides support - this will mark an excellent entry.

(If Teva were to drop ~7% below this entry I would take a tax loss harvest. It’s not uncommon for a stock to test below its support to shake out stops.)

This is just one of 5 or 6 ideas that we will research and may be actionable.

Mr. Market doesn’t wait for your investment committee to assemble over lunch next Thursday.

We’ll research these and other names over the weekend and determine our approach.

If you think our approach to non-consensus investing may make sense for you, please reach out to [email protected] to learn more.

Given this weeks recent pullback, we believe now is an opportune time to start getting exposure into the best seasonality of the year.

Crypto Crystal Ball: What to Expect in 2025

This past week, I was invited to speak on a panel about Digital Assets at Sacred Heart University.

An engaging panel discussion on the topic “Crypto Crystal Ball: What to Expect in 2025,” chaired by Jason Cabral from Gibson Dunn.

The discussion is far-ranging. The main point I was conveying was the need for a rational securities law framework that encourages tokenization.

Stablecoins are one form of tokenization. Enabling creators to monetize their creative works on chain (e.g., David Bowie Bonds) I believe is an incredible opportunity to equitize the long-tail of creators and disintermediate legacy studios.

Macro

The initial unemployment claims once again came in benign. I feel like each week we are beating a dead horse on this recession idea that seems to never go away.

If you recall, the day after the election I noted that we would see a surge in small business confidence in the NFIB survey.

Check out that surge. I did not expect that but, sure we’ll take it.

Animal spirits are back. The deregulatory agenda and greater clarity will drive more capex.

Note: We spent a good chunk of last weeks letter identifying winners – and areas where we need more clarity on policy (e.g., pharma, medicare advantage, etc.). Take a look at that ledger if you’d like to dig in.

Also, the first 15 minutes of the Angelo Robles interview this past week is a sector-by-sector analysis of which sectors benefit or are hurt in a Trump administration.

Buybacks are Back, When IPO Market?

At the end of October, we noted you want to get back in the market. One reason: the resumption of buybacks.

Next year, Consensus expects about $1 Tn in buybacks.

Many, many securities Lumida owns, but not all, have buybacks. Swim with the tide…

Take a look at this chart below.

BAC: “Tthe net supply of US equities has shrunk -$473bn. The steady growth of buybacks, a key source of demand, has overwhelmed sources of new supply such as share issuance, IPOs, and stock-based compensation."

Inflation Watch

The main left-tail risk to the economy is if there is a policy error (e.g., going overboard on tarrifs which could spark inflation, or Fed easing too much.

If inflation comes back, the heady multiples we see will come back to earth. Equities are far more sensitive to inflation than to interest rates.

Notice US equities had another banner year - while inflation was falling and long-end rates were rising (amidst continuous ‘higher for longer’ Fed policy as well).

The super-core PPI is not going in the right direction. Tariffs can exacerbate this.

Before we were looking at initial claims obsessively. Now it is the PPI.

Recall the supply chain shortages played an important role in creating inflation.

Tariffs deliver the same effect on prices albeit they may be more targeted.

Mr. Market Executed Project Rugpull when S&P at 6,000

Could the minor pullback we've seen this week have been anticipated?

Yes.

Last week we wrote the following:

We de-risked somewhat this week by hedging a portion of our portfolio by shorting ETFs and names like ARKK (animal spirits), Consumer Staples (don’t need defensives if no recession), Biotech (animal spirits), and XLY Consumer Discretionary.

Speaking of Defensives… take a look at the XLP (Consumer Staples) ETF.

Notice immediately after the Fed 50 bps cut this index has been in a nosedive.

It makes sense in a world where you don’t see a recession on the horizon.

That likely is also weighing in on healthcare, although potential DHS nominee RFK Jr. is also spooking pharma.

Take a look at the Healthcare ETF (XLV)

Interestingly, several of our recent healthcare picks such as DVA (kidney analysis) and Tenet Helathcare are up despite XLV pulling back. And Merck, although down, is showing relative strength.

Sub-sector positioning matters.

Here is DVA.

I can’t help but rubberneck at Coca Cola (ticker: KO).

Coke has a forward PE of 21x - matching the S&P. We don’t think the pain in Consumer Staples is done yet.

We’ll get an overshoot. And when that happens, like we did in healthcare or in the banks last year, we’ll poke around for the highest quality dislocated assets.

Until then, focusing on financials, insurance, retailers seems like a good idea.

Biotech is also going “on sale”.

Mr. Market seems to help us out each quarter by marking down a category. Then we step in, look around at the wreckage, and try to pick up a few assets.

Our 13F analysis revealed three or four biotech names we’ll research as well.

(Biotech investing is highly risky. You want to have several small positions - something like 10 to 20 bps in size rather than one big bet if our approach.)

Where do we see Mr. Market going from here?

Time to get more bullish again, and certainly by end of week.

We’re shaking out excess, that’s all.

The Vibecession is over

Thought this was funny. It summarizes our point last week that people will reconcile themselves to the outcome.

Elections and other major events are a cathartic clearing event.

By the way, is anyone else upset that Mike Tyson did not TKO the Youtuber guy?

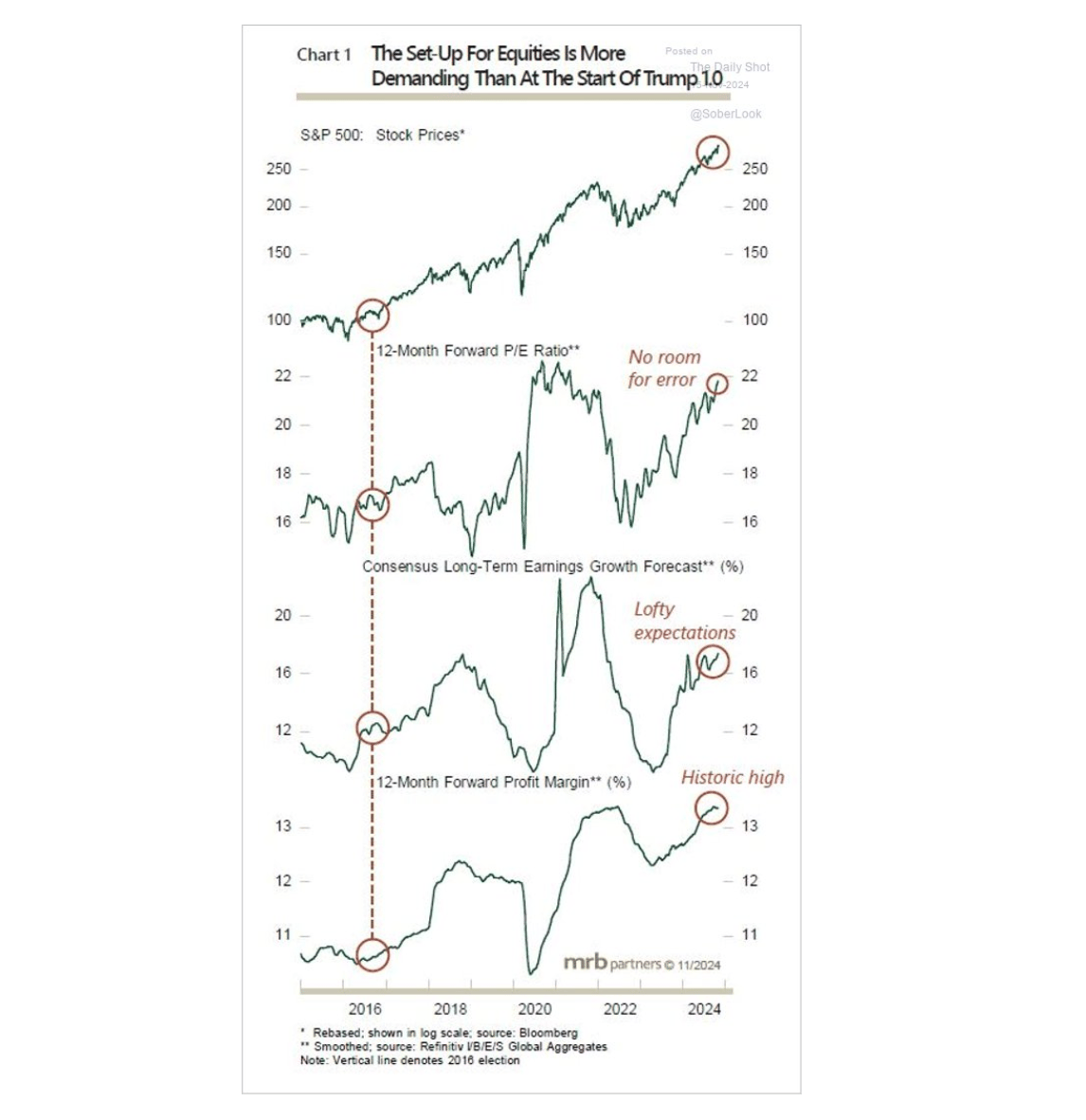

Trump 2016 vs. Trump 2024 Setup

Trump is walking into an economy and market that has a vastly different setup than when elected in 2016.

Semiconductors

We noted last week that Trump’s policies towards China export controls and Taiwan are highly uncertain.

That has weighed down the semiconductor sector.

Analyst Dan Nystedt who we previously interviewed on the Lumida Non-Consensus Investing Podcast [ Youtube | Spotify ] has this to share.

Company Earnings

We picked up two companies going into earnings.

One didn’t work - it was terrible, and one worked very well

Progyny is a fertility play with a 10x forward PE (and too much share based compensation!).

The stock dropped 10% on a miss. We think that name has bad news mostly priced in, but we tax loss harvested and will re-assess a quarter from now.

Our other idea was FinTech lender Dave which we called out in January and is up from $10 ish dollars to $80 ish dollars now.

Dave did a 100% return after earnings in about a one week time frame.

This goes to the earlier point on Druckenmiller’s portfolio. We believe the main idea is diversifying your edge across a broader opportunity set can lead to better returns.

Net net, we’re up on these two. But if we were forced to stick to a smaller portfolio we would own a smaller opportunity set.

The idea is to ‘Be the Casino, Not the Player’. So long as you have an edge in your research and entries, you should seek to apply that edge regularly to harvest your skill.

It is a mistake to prune down opportunities when there are limits to analysis.

The automobile sector is a good example of this. We own and like GM very much. We think it’s the best player in a bad industry.

But we also picked several other auto investments (not manufacturers, but other players in the supply chain) that we thought would do well. We didn’t pull the trigger on those, and we should have.

They are also up nicely, and we are wincing a bit for the opportunity cost is real.

We are incorporating these ideas and taking inspiration from Druck to adjust our strategy to take on more positions.

Don’t forget - the best investors in the world in terms of risk-adjusted returns (e.g., Citadel, Millennium, etc.). Invest and operate against a broad opportunity set.

The constraint is time. That’s where our investment in AI we believe will continue to provide a competitive advantage.

Digital Assets

Check more on crypto in the recent Unchained article “Will There Be a Wave of Crypto IPOs Following Trump’s Victory?”

As Featured In