Here’s a preview of what we’ll cover this week:

Macro: S&P Surge; Druckenmiller Comments

Market: S&P Hits our 6,000 Prediciton; Animal Spirits

Company Earnings: Big Tech Capex, CoreWeave's IPO, App Loving

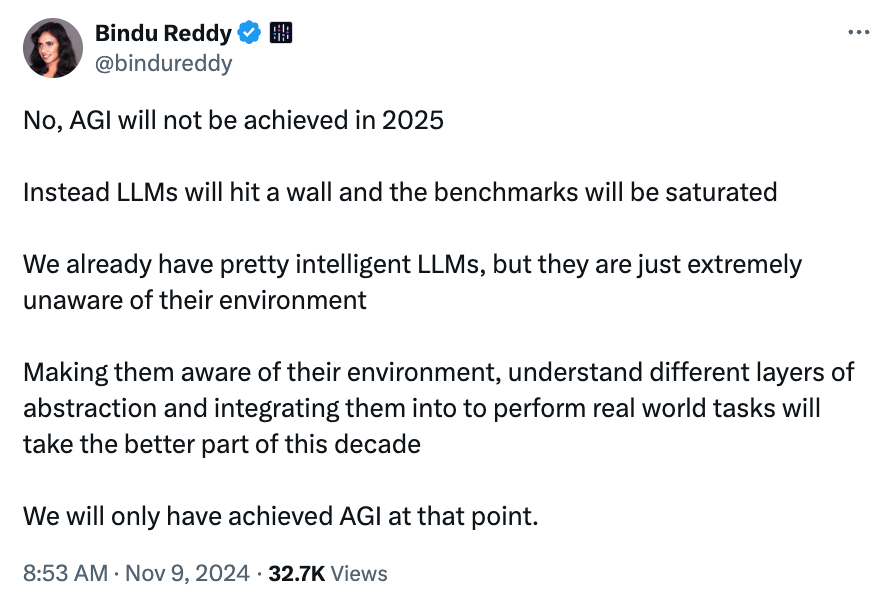

AI: AI Hitting Limits

Digital Assets: The Trend is Up

It’s been a busy week for Lumida! Ram featured on two podcasts exploring pressing themes:

Bits + Bips: Trump’s Victory & Crypto Needs

Angelo Robles Podcast: Buffett, Harvard, Tesla, and Nuclear Energy

Next week, join Ram on the panel at CryptoMondays - Stamford as he explores Crypto Crystal Ball: 2025 Projections. Don’t miss it — check their website for details!

Bits + Bips Podcast

Buffett, Harvard, Tesla and the Nuclear Renaissance

This past Friday, we sat down with Angelo Robles for an intensive session, exploring unique perspectives on the current investment landscape.

We’ll dive into the heart of the investment landscape, exploring perspectives and opportunities that evade the mainstream.

Ram and I will dissect:

Non-Consensus Investing in Public Markets

The Nuclear Renaissance and the Future of Energy

Berkshire Hathaway Without Munger: The Impact on Buffett’s Legacy

Harvard’s Underperformance: Why Endowments Are Struggling

Tesla’s Coming of Age in Robotics and RoboTaxi

Identifying Deal Flow Amid Growing Bureaucracy

Topical Insights: Inflation, Commodities, and the China Bull Market

Exploring Emerging Theories, Trends, and Potential Conflicts

Watch the full session here: https://www.youtube.com/watch?v=028NJhcaTX8

CryptoMondays Stamford Panel

An engaging panel discussion on the topic “Crypto Crystal Ball: What to Expect in 2025,” chaired by Jason Cabral from Gibson Dunn.

With an impressive lineup of panelists for this timely discussion to include :

- Chris Tyrrell, Chief Risk & Compliance Officer at Ondo Finance

- Ram Ahluwalia, CEO & Founder at Lumida.

- Amanda Castellano, VP, Wealth Advisor at Berstein

Macro

We are in full agreement on these statements. We’ve been consistent on these views - glad to see Druck is in alignment.

Stan Druckenmiller:

▫️ No material signs of US recession

▫️ Inflation may not have peaked: deregulation, tariffs

▫️ Never invest in the present: look out 18-24 months

▫️ Bullish Nvidia after grads went from crypto to AI

▫️ Wake up 5:30, drink coffee, read WSJ / FT / NYT

The Vibecession is Over

A point we’ve raised for the last few months: we are in Goldilocks.

Goldilocks doesn’t mean everyone is happy.

It means that corporate earnings and real incomes are up, inflation is on the mend, and the conditions for economic growth are sound. That’s what matters for markets.

Now that the election is behind us, consumer and investor psychology is set to rebound.

The most recent Michigan Consumer Confidence Survey jumped higher, and these results were recorded before the election.

People were already beginning to feel the benefits on the economic side, and that was positively impacting their sentiment.

The election, like other major events, is a major catalyzing event.

Before the election, 100% of people were in a funk.

Now, 52% of people think the country is on the right track.

It doesn’t matter that 48% don’t because vibes are contagious. Animal spirits are contagious.

People will start reconciling with a clearer future and will plan with greater certainty.

We’ll see more CapEx spending, more investment, and more small business formation. I expect we’ll see a jump in the Small Business Confidence Index (NFIB Index) in the next print.

Currently small business confidence is at the lows.

Elections serve as a focusing event.

What we saw by the end of the week was the S&P 500 back at all-time highs, touching our $6,000 price target.

You might recall that after the Fed cut rates in mid-September, we noted it was likely we would reach S&P 6,000.

Well, here we are.

The Fed cut by 25 bps—not the real surprise. The more notable takeaway is that the Fed doesn’t appreciate that a Trump win is akin to stimulating the economy with at least 50, if not 100, bps in cuts.

This comes down to animal spirits: you’ll see it in stronger retail spending, more small business formation, and a broader sense of optimism.

I’m not making a political point here.

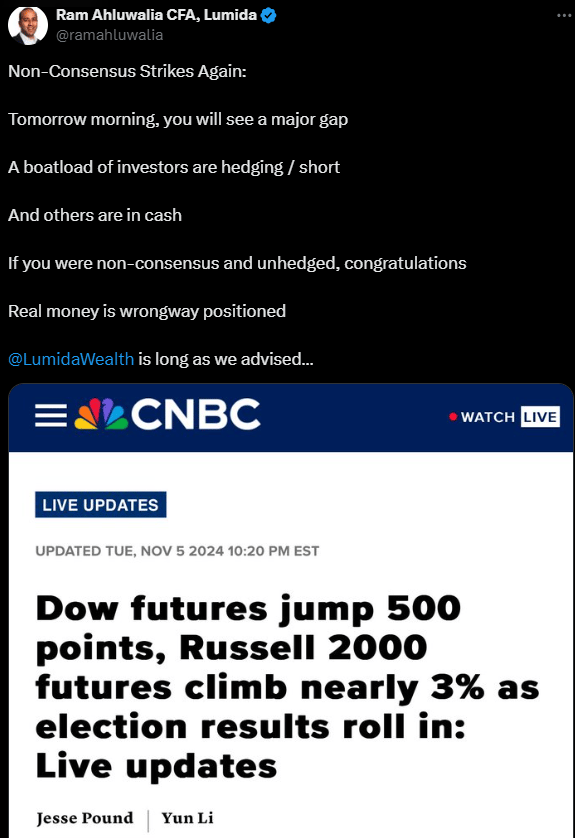

What we also observed this week were wrong-way positioned institutions and hedge funds scrambling to get long.

On the morning of the election, I noted that it might seem wise for someone on an investment committee to hedge or reduce exposure until there was greater clarity on the election.

That sounds prudent, but it turned out to be a costly mistake as these investors missed out on the substantial gap-up that occurred Wednesday morning.

They had to scramble and ended up chasing performance.

Mr. Market is tricky. If everyone is hedged, there’s no reason to hedge - it’s priced in.

Wrongway positioning plus contrary newsflow and cash on the sidelines led to a melt-up.

That melt-up caused an 8% rally in the small cap index which is the same as the average real return in the S&P 500.

The S&P at 6,000 is a nice round number.

It’s also a number where Mr. Market might want to execute a rug pull for latecomers to the party, testing those with the most conviction.

We’re noticing very elevated call option buying and a massive junk rally. In the last couple of days, there’s been a significant short squeeze, where firms with low quality, high debt, or marginal profitability have seen gains of 50%, 60%, even 70%.

That kind of price action often signals the end of the animal spirits component leg of the rally, typically the last part of a rally.

From here, we might see a consolidation period lasting one or two weeks before a year-end rally resumes.

Consider how many left-tail risks are now off the table.

Geopolitical risks are significantly lower, though there remain questions about how a Trump-China trade war might evolve and whether tariffs will be used as a tactic or policy

We certainly hope it’s the former. There’s also uncertainty around Trump’s policy toward Taiwan, which has implications for semiconductors.

We expect Trumps policies will enable more exports to China and Saudi Arabia. Some more evidence of that:

Trump previously suggested that Taiwan may have stolen U.S. semiconductor industry —that’s simply incorrect, but it’s something to watch since the AI theme is the big driver in the market.

We expect Trump will likely allow more exports to China and Saudi Arabia, which would benefit NVIDIA, our largest semiconductor position.

For other semiconductor firms like ASML, Lam Research (LRCX), and Applied Materials (AMAT), understanding Trump’s policies is crucial.

We’ve already seen several consumer-facing firms like Starbucks and Nike take hits due to a weak Chinese consumer. If semiconductor exports face headwinds, it could negatively impact those companies.

Overall, we expect continued breadth expansion.

Small caps and mid caps look well-positioned because they have room for valuation expansion, and favorable financing conditions alongside deregulation should benefit them.

The big picture is clear: the bull market remains intact.

Market psychology has shifted from the vibe session to a full-on market with a breadth thrust. Last week, we had oversold conditions across the major market themes - now we are overbought.

While a brief consolidation may occur over the next week or two, it pays to stay long.

Lastly, I’d encourage you to listen to the podcast I did with Angelo Robles, founder of the Family Office Association.

The conversation runs over three hours, covering a range of topics including the election, non-consensus investing, CoreWeave, the nuclear renaissance, Meta, and speculation on Trump’s antitrust actions. It’s a wide-ranging and engaging discussion, and I had a great time. I hope you enjoy it—let us know what you think.

Subscribe on Youtube, Apple or Spotify to Lumida Non-Consensus Investing to have a list, or click on this X link here.

Stop Paying Too Much in Capital Gains

Lumida is pleased to release our Tax Guide. It has a checklist for investors to take action now, before year-end, to minimize capital gains. Check it here.

In addition, we cover a variety of other tax strategies that can be valuable as we approach the end of the year.

We also invite you to visit www.lumidaetf.com and fill out the form if you’re interested in seeing Lumita launch an ETF. Our goal is to reach 500 form fills, and we’d appreciate your participation. We’re also excited to see you in our next session, where we’ll be discussing the progress of form fills and related topics.

As always, we’re taking on additional clients, and as mentioned earlier, this is an excellent time to invest in the market.

S&P Surge

I flagged this call in September here.

The first two days of this rally were very orderly.

The last two days we see a massive amount of short covering and hedge unwinding taking place.

Hedge funds were caught offsides on their favorite shorts

These include names in the IWM and TSLA

There’s also a major rotation out of Defensives as Recession Risks are priced out

S&P 6000 is a pivot point.

And it’s a good round number from which Mr Market may want to execute a rug pull too keep folks offside (not sure yet, but it is a conjecture to explore)

I’ll dig into it more in the Lumida Wealth Lumida Ledger this weekend

See our S&P 6,000 call

Fed cutting rates into Goldilocks…

Earnings Season Beat Expectations

The Fed Cut 25 Bps Despite Animal Spirits

The Fed cut by 25 bps. No surprise there.

The more notable takeaway is that the Fed doesn’t appreciate that a Trump win is akin to stimulating the economy with at least 50, if not 100, bps in cuts due to knock-on improvements to small business confidence and animal spirits.

This is the flaw with a purely ‘data dependent’ approach. In their bones, they must know that sentiment and real economic activity is on the mend - and that’s what the stock market is saying.

You’ll see stronger data in stronger retail spending soon. I expect Q4 retail sales will be strong, and retailers will do well. Have a look at the Retail ETF index.

(We like Abercrombie & Fitch and Dick’s Sporting Goods. Risks are that Consumer Spending is flat due to higher insurance costs.)

When you have newsflow that contradicts positioning, that creates a performance chase and rush to get long.

What caused this wrong way positioning is - it was smart to say two weeks ago ‘we should hedge election risk or wait for clarity’. These are the sensible sounding types of statements that didn’t make any sense once market participants were already bracing for a Consensus Harris win.

We took a victory lap Tuesday evening as the election results rolled in and noted the major gap up in market futures.

Where are we now?

In the last couple of days, there’s been a significant short squeeze, where firms with low quality, high debt, or marginal profitability have seen gains of 50%, 60%, even 70%.

The better ideas are in mean reversion themes. For example, we’ve been accumulating Bumble (BMBL).

With 25% in buybacks, free cashflow growth, and < 7x forward PE it looks quite interesting. I would own that business if it was private. To find an asset mispricing like this in public markets looks interesting.

(There are reasons Bumble is cheap fyi - namely dating app usage is declining. We don’t have time to do a full write-up here, but as always do your homework.)

Bumble Chart:

Incidentally, there are quite a few charts that look like Bumble. See Legal Zoom for example or various semiconductors or healthcare names. These names were hated, had a capitulation, now they are in rally mode and have room to go.

Left Tail Risk Declining

Consider how many left-tail risks are now off the table.

Geopolitical risks are significantly lower, though there remain questions about how a Trump-China trade war might evolve.

It looks like Trump may relax export controls to China. Leaving aside whether that’s good policy or not, that’s good for semiconductors and Nvidia:

There’s also uncertainty around Trump’s policy toward Taiwan, which has implications for semiconductors.

We need to make sure we’re positioned correctly. We expect Trump will likely allow more exports to China and Saudi Arabia, which would benefit NVIDIA, our largest semiconductor position.

For other semiconductor firms like ASML, Lam Research (LRCX), and Applied Materials (AMAT), understanding Trump’s policies is crucial.

We’ve already seen several consumer-facing firms like Starbucks and Nike take hits due to a weak Chinese consumer.

If semiconductor exports face headwinds, it could negatively impact those companies.

Overall, we expect continued breadth expansion.

Small caps and mid caps look well-positioned because they have room for valuation expansion, and favorable financing conditions alongside deregulation should benefit them.

The big picture is clear: the bull market remains intact.

Market psychology has shifted from the vibe session to a full-on market pep rally.

While a brief consolidation may occur over the next week or two, it pays to stay long.

Lastly, I’d encourage you to listen to the podcast I did with Angelo Robles, founder of the Family Office Association. T

he conversation runs over three hours, covering a range of topics including the election, non-consensus investing, CoreWeave, the nuclear renaissance, Meta, and speculation on Trump’s antitrust actions.

It’s a wide-ranging and engaging discussion, and I had a great time. I hope you enjoy it—let us know what you think.

Taxes, Taxes, Stop Paying Too Much in Capital Gains Taxes

Lumida is pleased to release our Tax Guide, which includes a checklist for investors to take action now, before year-end, to minimize capital gains.

In addition, we cover a variety of other tax strategies that can be valuable as we approach the end of the year.

We also invite you to visit www.lumidaetf.com and fill out the form if you’re interested in seeing Lumida launch an ETF.

Our goal is to reach 500 form fills, and we’d appreciate your participation.

As always, we’re taking on additional clients, and as mentioned earlier, this is an excellent time to invest in the market. Email [email protected] for a consultation.

Market

The Trump Trade: Part Two

There are several sectors that are unambiguous winners in a Trump admin (noted below from our Tuesdayu post).

All of the above has now rallied.

There are still a bunch of open questions.

If you have an informed view on these you have an edge.

Healthcare Policy

Will Trump revisit efforts to lower drug prices through reforms like international reference pricing or changes to Medicare negotiations?

Pharma and biotech firms (PFE, MRK) could face pressure. It’s possible the risks are priced in however.

Trade and Export Controls:

Will Trump relax export controls on advanced semiconductors (NVDA, AMD) for sales to China and Saudi Arabia?

How will auto tariffs be restructured?

Will the USMCA be renegotiated to favor American manufacturers, particularly in the auto sector?

Semiconductor Policy and CHIPS Act:

Will the CHIPS Act continue to receive support, benefiting companies like Micron, TSMC, and Intel, or will it be sidelined?

Could Trump take a more aggressive stance on Taiwan or defend Taiwan vs China aggression?

Energy and Climate Regulation:

Will Trump roll back Biden-era climate regulations, including methane emissions standards and incentives for renewables? Deregulation could benefit oil & gas (XOM, CVX) while dampening growth for renewables (ENPH, FSLR, TSLA)

Financial Deregulation:

Will Trump push for further rollback of Dodd-Frank regulations, easing capital requirements and compliance burdens for banks (JPM, BAC)?

How will fintech and crypto regulation evolve? Expect a potential easing of restrictions, which could boost growth for firms like Square (SQ) and Coinbase (COIN).

Big Tech and Antitrust:

Will Trump intensify pressure on Big Tech with antitrust actions, or focus on platform regulation and content moderation reforms (META, GOOGL, AMZN)?

This is the most significant risk for the market given their market cap dominance.

How will Trump’s administration handle data privacy regulations, especially related to AI and user data protection?

Defense and Foreign Policy:

Will defense budgets increase, and will procurement rules be streamlined to benefit contractors (LMT, RTX)?

Telecom:

Will Trump seek to reinstate the repeal of net neutrality, benefiting telecom providers (VZ, T)?

Media:

Could there be a push for easing restrictions on media consolidation, affecting broadcasters and media conglomerates (DISCA, FOX)?

Warren Buffett is Not the Same

…without Charlie Munger

Is it possible Buffett’s bearishness reflects the loss of his cherished business partner?

As we have noted, Buffett is building cash and selling down his equity exposure. We think here is early (rate cuts, deregulation, goldilocks, etc.)

Might that grieving find its way into portfolio expression?

Buffett is making mistakes

We covered this in our recent podcast—don’t miss our conversation with Angelo Robles here!

Big Tech Capex On Track

These hyperscale capex estimates from MS look pretty reasonable and would be supportive of the AI infrastructure trade if accurate.\ Not too long ago there were investors questioning whether hyperscale capex would grow in 2025...

CoreWeave's Big Win

CoreWeave has selected 3 investment banks for its IPO

That is highly unusuall

Imagine 3 syndicate desks offering shares to its clients

If you lookup Oversubscribed in the dictionary, you might find CoreWeave

I expect CoreWeave to outperform $NVDA (again) based on its earnings growth, committed pipeline, valuation, and dominant market position

If you like our private deals, be sure to go to http://lumidadeals.com and fill out the form so we can notify you on our next deal.

Non-Consensus Wins

We got a 2x bagger in Applovin (APP) in 6 months

Why? The trifecta:

Multiple expansion

Earnings Growth

Variant Perception

This Non-Consensus framework runs rent free in my mind.

I usually have no ideal price target per se but a clear sense of upside vs downside.

And I cut losers like SMCI PAGS or REGN quickly.

I believe you can be right only 60% of the time and do very well if you apply this approach.

You are pulling weeds and watering flowers as Peter Lynch 🐐 used to say.

That’s essentially what big quant funds are doing except over thousands of securities.

‘Be the casino, not the player’

We also seeking to generate ideas better than what we own all the time.

Those ideas are competing for capital.

That forces extremely tough trade-offs.

And those ideas are from different industry groups and factor exposures.

When you are forced to sell something you love for something you don’t own, but want to own, it sharpens the mind.

That activity of continuous research and competition of ideas levels up the portfolio.

At year end, I hope to create audited returns so you can judge for yourself.

Request: If you know of any firm that can do a GIPS compliant audit of Schwab for SMAs I would appreciate any introductions.

Also, help me get to 500 fills at: http://lumidaetf.com

Looking at 3 different ETF concepts

We have other names we think can potentially make a move like Applovin. It’s better to invest in those ideas — ‘you make your money on the buy’. Reach out to [email protected] for more information.

AI

AI Hitting Limits

Marc Andreessen and Ben Horowitz say that AI models are hitting a ceiling of capabilities: "we've really slowed down in terms of the amount of improvement... we're increasing GPUs, but we're not getting the intelligence improvements, at all"

Digital Assets

Check this week’s Bits + Bips podcast for our Digital Assets overview.

Bits + Bips hosted James Seyffart and Alex Krüger, joined by Noelle Acheson and Ram Ahluwalia, to unpack Trump’s return to the White House and what it means for crypto and macroeconomics.

The basic takeaway for digital assets: The Trend is Up.

ALTERNATIVE HISTORIES

I did not get Elon Musk‘s acquisition in Twitter initially.

He overpaid and revenue collapsed.

However, it’s clear the strategic benefits of X are invaluable.

Priceless.

X is a privately owned public square increasing in value as legacy media declines.

Bezos is undoubtedly running ‘what if’ scenarios.

What if Bezos had bought X instead of the Washington Post?

Would that have changed the electoral outcome?

High Conviction: No.

Look, if the Amish are upset about the long reach of government regulation, and they aren’t on X, and they are turning out to vote…

Then

It stands to reason the DNC elites were in a bubble chamber

And had a complete misread of the American electorate

The Progressive wing of the DNC is like wearing boots full of cement in a general election…

Bill Clinton won because he co-opted conservative ideas.

In 1996, he led with ‘The Era of Big Government is Over’

He co-opted Newt Gingrich’s Contract for America ideas.

He reformed welfare, expanded free trade, and cut deficit spending.

Those are all Republican ideas.

Trump is also co-opting historically Democrat party ideas:

Tarriffs, end the wars, attacks on Big Pharma, pledges to support rather than reform Social Security.

Those are historically Democrat ideas.

Trump ran the Clinton playbook - this time co-opting certain Democrat ideas - while waging a modern campaign.

It’s in the best interest of the United States to have a competitive, rational two party system.

Until the DNC exorcises DEI, wokism, pronouns, price controls and blaming American enterprise for inflation they will be in the wilderness.

As Featured In