Welcome back to the Lumida Ledger.

If you find this valuable, we’d greatly appreciate you sharing it far & wide with your network. That’s how we grow and keep the content free to read.Here’s a preview of what we cover this week:

Macro: Small Cap Debt Bomb: Rate Cuts or Bust

Markets: LNG fueled AGI? Dell & NVDA, Factor Investing

Company Earnings: Strong Performance by Homebuilders

AI: Sonnet Crushes GPT-4o, Apple Vision Pro is dead

Digital Assets: ETH vs SOL

Explore becoming a Lumida Wealth client: learn more about our Crypto White Glove Service or Click here to explore our Wealth & Family Office Services.

This week, we had an exciting episode with Giuliano Bologna, Managing Director at Compass Point Research & Trading.

We dove deep into the SoFi performance and unpacked the bull and bear cases for SoFi.

We explored other alternative exciting fintech plays on Giuliano's radar.

SoFi is a name that was $10 at the beginning of the year. Now it’s $6.30.

Lumida made 3 short calls on SoFi on Twitter with a 100% win rate.

Don't miss this insight-packed episode here on Youtube; don’t forget to subscribe.

Listen here on Apple Podcast | Spotify

Timestamps:

00:00 Introduction and Welcome

01:10 Giuliano's Background and CompassPoint Overview

04:49 Discussion on SoFi and Its Bull Case

06:11 Analyzing SoFi's Financials and Valuation

14:01 Understanding Fair Value Accounting

19:08 Comparing SoFi with LendingClub and Market Valuation

33:45 Impact of SOFR on Revenue and Profitability

34:27 Discount Rate and Loan Valuation Challenges

35:36 Management Discretion in Discount Rate Determination

38:01 SoFi's Loan Sales and Market Transactions

41:58 Loan Performance and Delinquency Trends

47:37 SoFi's Earnings and Revenue Quality

53:16 Tech Business and Future Prospects

59:11 Mr. Cooper Group: A Mortgage Servicer Play

01:08:06 Valuation and Earnings Potential

01:09:53 Challenges in Loan Approval

01:11:31 SoFi's Financial Strategy

01:14:48 Growth Projections and Market Share

01:32:15 Life as an Analyst

Benzinga picked up our insights on NVIDIA.

The thesis is the breadth deterioration we’ve seen in recent weeks is due to the ‘Nvidia effect’.

We’ve written about this in prior newsletters.

Note: We think the effect is over now, so the breadth should expand.

We’re already seeing that in Energy and in both of the energy picks we shared last week: Chenerie (LNG), Marathon Petroleum (MPC), and CVS.

Macro

On Fed Rate Cuts & Effect on Small Caps

When we see US rate cuts, we will see the mother of all small-cap rallies in the Russell.

Why?

Many small firms are loaded with debt hanging on their fingernails.

Example: I saw a firm with $2 Bn in debt and $100 MM in free cash flow.

Good business… but for the massive debt overhang.

Their equity is trading like a call option in line with changes in interest rates.

That’s because a stock's equity value is the difference between its enterprise value and the value of its debt.

The debt could kill the company unless the Fed cuts rates. That’s when they have a shot at refinancing.

They trade like call options because the business value fluctuates with every whiff of changes in interest rates.

This is just one example.

Like the CRE sector, there are various small caps hanging on by their fingernails.

(Note: Plenty of other small caps are just fine and growing anyway. We own several!)

Unlike midcaps or large caps, small caps cannot easily access debt capital markets and instead rely on private credit or bank financing.

There are many small caps that fit a similar profile.

Historically, small caps rally after the Fed cuts rates.

I believe that Mr Market will front-run that by a few months.

Remember we saw small caps rally from November through January on rate-cut hopes?

And again, last Wednesday morning?

Markets are on 2x speed.

Moves that would take a year are getting done much faster.

The pressure on the Fed to cut rates has never been higher.

I hear it everywhere.

That said, don’t expect rate cuts in July.

Housing Sector

Multifamily housing startclined precipitously. Note: This isn’t anything new per se; we shared a similar finding several months ago.

It’s hard to get financing for new construction projects.

This will create more demand for single-family homes - especially the starter family home unit.

That’s why KB Homes had strong results this week, while Lennar (a homebuilder focused on higher-end units) disappointed.

Take a look at Homebuilder ETF (ticker: HXB).

ice the 200-day mo average rushing up to provide support. The category has consolidated after a major rally over the last several months.

In a month or two, this could be poised to head higher.

If the Fed cuts rates in September, this will lift off.

It's less clear if the Fed cuts rates in December. At that point, we’ll have to re-assess based on the data.

We believe that the best ways to play homebuilders are M/I Homes (Ticker: MHO) and Forestar Group (ticker: FOR) - a provider of developed lots for homebuilders (and partly owned by national builder D.R. Horton).

Quick Take from Earnings (Homebuilders):

Beat Earnings by ~5% & Beat Revenue expectations by ~3%

Total Revenue: $8.77 Bn, up 9% YoY, up 20% QoQ

Net earnings: $954 MM, up 9% YoY, up 33% QoQ

Shares were down ~3% after results owing to weaker guidance as mortgage rates hover at a two-decade high.

Key Takeaways:

New orders up by 19% to 21,293 homes; dollar value up to $8.2 Bn.

Homebuilding operating earnings at $1.3Bn, with a gross margin on home sales of 22.6%.

Repurchased $603 MM of common stock & increased stock repurchase program.

Co-CEO Stuart Miller On Consumer:

"Although affordability continued to be tested by interest rate movements and simultaneously challenged consumer sentiment, purchasers remained responsive to increased sales incentives, resulting in a 19% increase in our new orders and a 15% increase in our deliveries year over year,"

Nvidia is the Most Valuable Company in torld

NVDA is the most valuable company in the world.

Now I just need the price to drop so we can buy more.

This was a call Lumida made several times - here’s a recent one from March.

The Bad News?

Cathie Wood, founder of ARKK Invest, bought Nvidia and Taiwan Semiconductor—another picks and shovels name we discussed glowingly here this past Thursday.

itten about Cathie ’s wealth destruction before.

It’s so bad, if you go to Wikipedia and type in Cathie Wood, you will see this:

believe Semiconductors are Overbought, and It’s to Trim Exposure.

We suggest bringing your semiconductor exposure back to a benchmark weight.

We still believe Nvidia is a dominant market leader and will outperform other names should there be a correction due to the demand for this security.

But the category as a whole is over-extended.

Look at this chart, which shows the valuations of semiconductors versus historical valuation bands.

You can’t fit it on the chart anymore.

The issue is this…

It will take time for foundries to ramp up production to meet the demand.

Lumida did a study last week. We found that, on average, 75% of the price increase we’ve seen since the April 24th semis low was multiple expansion. 25% was grounded in positive earnings revisions (e.g., fundamentals).

Maintain exposure to the theme. But reduce your exposure to your benchmark’s weights.

We figure you can buy back in October (give or take) at a better price.

And there are many opportunities we see now.

The breadth deterioration caused by the Nvidia FOMO rally has meant quite a few quality businesses are trading cheap.

We haven’t seen that in a long time. We are heavily focused on insurance and small caps.

Take a look at this technical study, which shows what happens when the Technology sector's price momentum places it this far above its 20—and 200-day moving averages. This has only happened 13 times in history.

The last time was September 2020. The tech sector declined 12% in the next two months.

Cathie certainly doesn’t ins confidence, either.

We believe the back- of this year will favor names with free cashflow, buybacks, valuation, and momentum. We see that in the energy and insurance sector and even homebuilders.

Funny enough - that describes most of Warren Buffett’s portfolio thematic bets. (And he’s selling Apple).

Brazil Check-In

Last week, we wrote Brazil was on the verge of capitulating.

Brazil is up for the week.

establd a starter position in Pag Seguro (Ticker: PAGS)

Thepany is like Square, except for Brazil. Except it’s growing much faster and is much cheaper.

We like Brazil - great demographics, energy-rich, growing capital market.

Take a look at PAGS - it’s right near support.

The stocka decent entry, but not quite perfect. Look at its competitor Stone Co (ti: STNE). That name also needs to rally, and STNE may need to capitulate.

We may have bought PAGS a few days early. It won’t matter in a few years.

A few years ago, STNE showed that it had real credit risk issues. PAGS did not. Most PAGS loans to merchants are essentially a credit risk bet on Visa.

They provide short-term financing while waiting to get paid by Visa. We believe Visa is good for the money.

If PAGS does capitulate, we will buy more.

Note: PAGS has a 25% free cashflow yield, a PE ratio of 10.2, and a forward PE of 8.6. It also has positive revisions.

On the bear side, PAGS likes momentum. You are betting on mean reversion. That can take months.

earninhmd and the current valuation holds steady, then we should get a 19% return purely from earnings growth.

If we get the holy grail - multiple expansion - then we can do much better.

If the dollar weakens due to year-end rate cuts (which have already wrecked Brazil and other emerging market stocks) - that adds another tailwind.

It’s all about “stacking edges”.

I can see ourselves holding PAGS for 3 years and doing 50 to 70%.

Again, see if there is a capitulation in Stone if you want a better entry.

Follow The Money

What’s going to power the utilities…

that power the data centers…

that power the clouds…

that power the apps?

Liquid natural gas.

Mr Market hasn’t figured this out yet.

Liquid natural gas is a transitional fuel.

Oil and coal won’t power ESG hyperscalers.

Renewables need another 5 to 6 years.

The gap will be filled by LNG.

Liquid natural gas is also used increasingly by Europeans who can no longer rely on Russia.

China and India are also building out LNG terminals.

The byproduct of using LNG is not C02 (It’s methane - which has various sequestration techniques…)

We wrote on Tuesday night on Twitter, that we thought that was the best time to buy Chenerie (LNG).

We nailed that - the stock is up daily since then and broke through resistance.

ld p win the next election, the upside for LNG will ggher as the DOE will lift the pause on new permits to sell natural gas to export terminals globally. We think the stock is fine even without that, but it’s something to consider as we get closer to the election.

Take a look at Marathon Petroleum. We wrote about this last week as well - the Green Bar.

It’s up this week, and we like the technical picture and fundamental backdrop.

pport fthe should help this advance further.

We’ve loaded up on our energy exposure, and now we’re done.

I doubt you’ll hear us talk more about Energy.

Think of it this way… Mr. Market has a ‘Black Friday Sale’ for different market sectors at different times of the year.

We pay attention, then buy the very best assets we can find. The rest of the time, we wait.

In October, that meant we were buying semiconductors.

In March of last year, we were buying JP Morgan and Bitcoin.

What are we focused on now? Insurance and small caps. We continue to like oil tankers like TNK and STNG.

abour purchases of these names in our Telegram channel.

You should in on the conversation. It's free, full of ideas and insights, and growing fast (there are 250+ members now)!

We don’t have the time to do a full write-up on oil tanker firm STNG, but have a look at the free cash flow yield, the buybacks, the earnings growth, and the valuation. In one year, this stock is up 83% (momentum).

That’s better than almost every name in Mag 7 except Nvidia.

Yes, you can make money in value stocks (via multiple expansion)!

If you are looking for a wealth management partner, Lumida is now welcoming a limited number of new clients.We offer a range of services, alternative investments (such as our CoreWeave deal), white-glove crypto management, to public equity management, and high-touch family office services, including trust, tax, and estate planning.

Ready to explore? Click here to fill out our form to start the discovery process.

Interested but not ready to commit? Build a relationship with Lumida and stay informed. Click on the poll below if you want our advisors to reach out.Investor Tip: Factor Analysis

Lumida performed a study to analyze what factors have worked best over multiple timeframes - from 10 years to year-to-date and the recent bear market.

Most stock price returns can be explained by exposure to its factors.

Factors include concepts like Momentum, Value, and Quality.

Those are some of our favorites.

Factors also include inflation sensitivity - that's working really well year-to-date.

You can see a couple of factors work regardless of the regime.

And certain factors get crushed regardless of the regime.

I wrote about how the Volatility Factor was overbought in December of 2023. The prime expression of the Volatility Factor was ARKK.

Look how ARKK has done since that call.

Factors can help you identify hidden risks in your portfolio... and identify opportunities.

There are certain factors we always want to tilt to. You can probably guess what they are looking at this non-exhaustive table.

Now, imagine you have analysts actually researching the best stocks within these factors. Testing for which stocks link to secular themes.

That's how we found DELL.

Dell had a high Earnings Yield.

Our bottoms-up underwriting also checked out—we saw Jensen parroting Dell on each earnings call back in 2023!

Dell is part of a secular theme called 'AI'.

Lumida tracks multiple themes, including Housing Shortages, GLP1s, Energy Transition, Nuclear Renaissance, Data Centers, and more.

Some themes are attractively priced with good earnings growth and ten-year stories - we want to own those themes.

This synthesis is what makes the Lumida approach different from every wealth manager out there.

We are feverishly adding an Agentic AI layer to all of this, which will create two benefits: speed and coverage expansion.

The Fundamental Law of Active Management (Grinold & Kahn) states that a manager's performance is the product of skill (e.g., call accuracy) and the Universe of Opportunities.

Universe has two buckets: frequency & scope of the universe (e.g., your coverage set)

Agentic AIs will help us increase both speed and opportunities.

We're doing pretty well in the accuracy department. If we can increase scope of coverage, we can reduce risk while preserving return by diversifying (idiosyncratic) risk away.

The investment management firms that will win in the age of AI are not the legacy firms stuck with consensus-driven "conviction lists."

They will be forward looking firms like Lumida Wealth that are taking a 'quantamental' approach - combining the best of qualitative insights with quantitative approaches.

If you are an analyst or investor who wants to be part of this story, send me a DM on Twitter or comment in the newsletter.

Tho should tell quite a few powerful ghts.

One is: Momentum works. But so does Value. And Earnings Growth.

That sounds like the types of ideas Lumida focuses on, right?

Investor Tip: Combining Growth & Value Investing

In physics, there is this idea of a Grand Unified Theory.

A unification of the seemingly irreconcilable theories of gravity and quantum mechanics.

It’s a lot like Growth Investing & Value Investing.

Buffett can’t bring himself to buy Nvidia, Meta, or Google; similarly, Tiger Global can’t get on an oil tanker stock.

If you combine both schools of thought in a coherent framework, you are golden.

That’s what we try to do.

But how to do that?

They are seemingly at opposite ends.

Well, we’ve definitely demonstrated it can be done in practice.

Our growth names are: Nvidia, Meta, and Google.

And others in the CapEx receiver thesis.

And then we have value names.

Like CVS (already up 15% from last month’s lows…)

But… What is the principle that allows one to organize two distinct approaches into an internally consistent framework?

Answer:

Axiom 1: Look for opportunities with Multiple Expansion!

Corollary: Avoid multiple compression (eg, growth to value traps)

Axiom 2: Look for Earnings growth!

Corollary: Beware the siren song of Revenue growth without earnings

Growth and Value investing can live and interact with one another in this framework…

There’s a lot more to this.

I am opening the door to integrating these distinct schools of thought.

Don’t forget this one:

Axiom 3: Thou shalt not exceed the speed or light (e.g., don’t buy stocks more expensive than Nvidia! Like Costco!)

That got us out of CloudFlare, MongoDB, Elastic, and Atlassian in Q1.

Axiom 4: Markets are thematic…

Mr. Market loves a good story.

Company Earnings

Consumer Sector (Homebuilding):

Lennar (LEN) beat both earnings and revenue expectations.

Revenue grew significantly, up 9% year-over-year and 20% quarter-over-quarter, reaching $8.77 billion.

New orders increased by 19% to 21,293 homes, with the dollar value rising to $8.2 billion.

Stock price fell on weak guidance, citing concerns over interest rates.

Information Technology Sector:

Accenture (ACN) slightly underperformed, missing both earnings and revenue expectations, albeit by small margins.

Revenue decreased by 1% year-over-year but increased 4% quarter-over-quarter, totaling $16.5 billion.

Despite the slight revenue decline, new bookings showed strong growth, up 22% year-over-year to $21.1 billion.

Based on mperih it back in Feb, I had et the flaws as a consumer.

Move Over Open AI, Anthropic is Back with a Stronger Mode

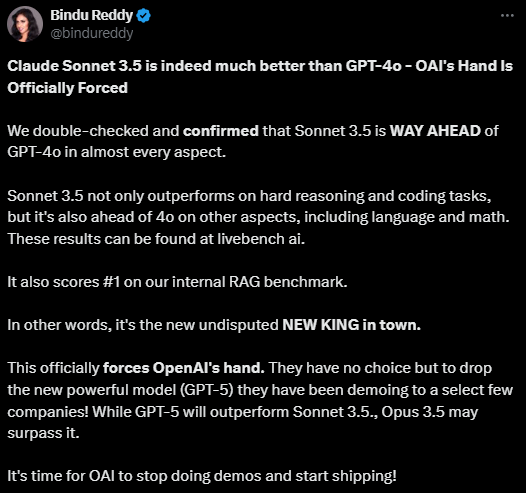

A quick take from Bindu Reddy (Abacus Founder):

Nucleenaissance

Morgaanley now joins Lumida Wealth in our nuclear renaissance call.

These big, stodgy firms are way too slow.

Recall that we first spoke about nuclear power on the Angelo Robles Family Office podcast, in July last year.

Time to Buy o.

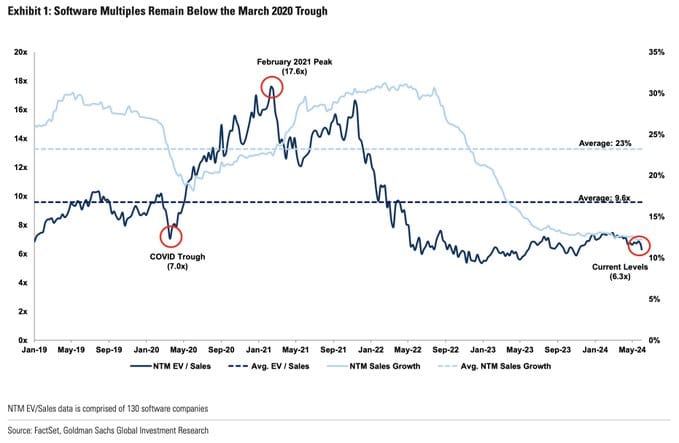

This t flog around shows that SaaS valuations haven’t been this lowce the Covid trough.

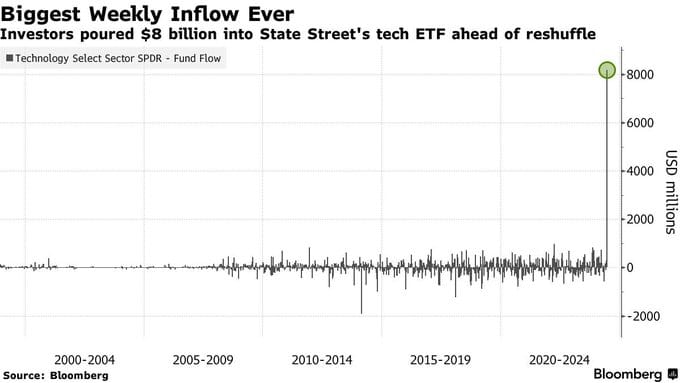

Andsaw record inflows into tech ETFs - probably people saw this.

This is a flawed analysis.

I remember seeing Merrill Lynch slap a 5x P/S ratio on SoFi… SaaS firms that make money are mature now.

They should be valued on earnings.

Especially when they are binging on CapEx - like Snowflake and their $1 Bn acquisition.

P/S multiples are relevant for AI startups, which are the “New, New Thing” and disrupting SaaS.

Take a look at this chart instead.

It shows Software Valuations using Price-to-Earnings.

Notic’re jshy of 2021 leve

a lookthe WisdomTree Cloud In

ice how this theme is stuck r its moving averages and is now ibear market.

This is an easy fade on rallies.

Stick to themes in uptrends. Software is a big headfake.

And the All-In Podcast refuses to talk about the wreckage in that category.

Perhaps it is no surprise one of those VCs paid for scooter startup Bird at a P/S ratio of 100!

I can assure you we will never make that type of mistake.

Or, email us if you think I am wrong and I’ll splash some water on my face.

Stay Non-Consensus.

Digital Assets:

Time for Ethereum to Outperform SOL?

This week, we wanted to shine a light on Quinn Thompson, who runs a crypto hedge fund called Lekker Capital.

This is an excerpt from his latest investor letter:

Quinn e on our Bitcoin ETF podcast ban January. He’s a good account to follow and a friend of the Lumida Tribe.

are interestn the Crypto e Glove iceif, click to learn more.

Lumida is hiring

We are hiring a Business Operations leader / Chief of Staff who would work directly with Ram.

Check out the role, and please help us get the word out!

Quote of the Week

"The market can stay irrational longer than you can stay solvent." - John Maynard Keynes

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.