Here’s a preview of what we’ll cover this week:

Macro: The Economy Is Resilient; The Consumer Is Strong; Corporate Confidence is Solid; AI Is Becoming A Real Efficiency Engine

Markets: GPUs Aren’t iPhones; The Attention Asset With A Solid Story; Software: Dead Or Alive?; Constellation Software; International Value; Timing is Everything

Lumida Curations: Fiscal Discipline Is the Market Risk; VO₂ Max Is the Longevity Signal

Software: Dead Or Alive?

Back in 2023, I made the case that AI is highly disruptive to firms like Adobe and SaaS more generally. I also made the case that Software as a category was over-priced.

What we see now is an inverse position.

We see quite a few software stocks whose share prices are battered, yet their sales and earnings continue to rise.

We’ll show you a few examples.

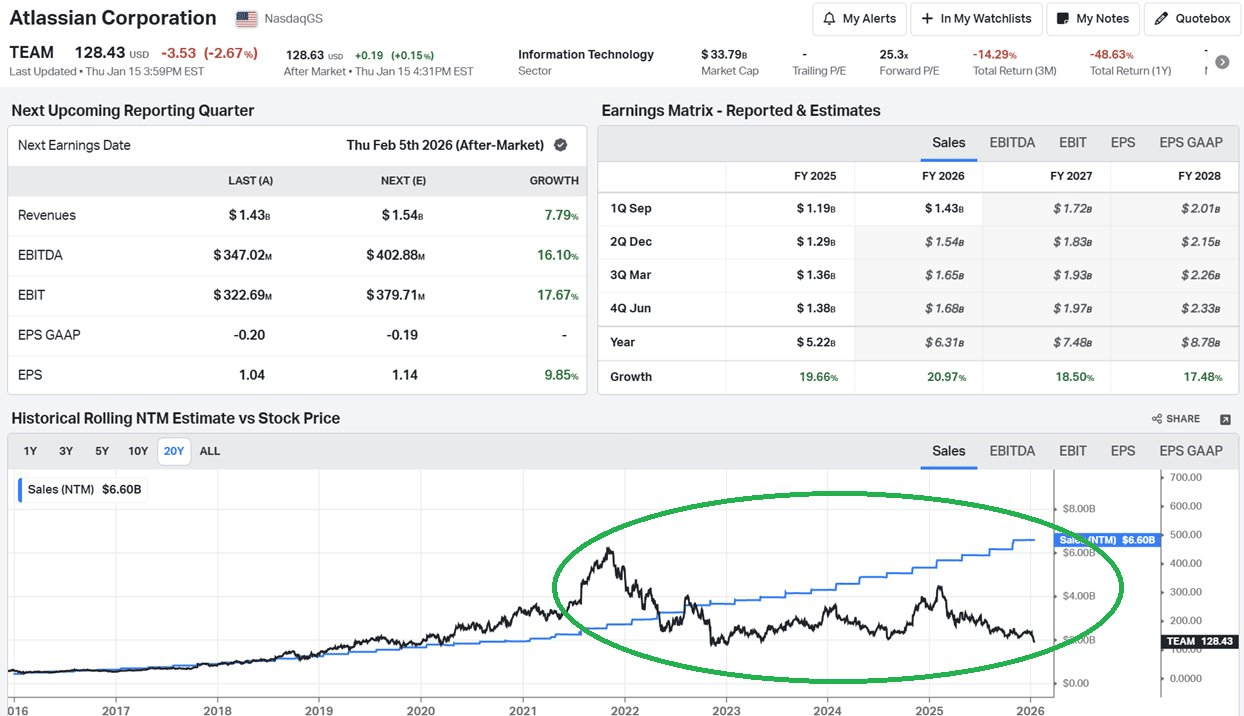

Take a look at Atlassian Corps’ sales growth vs. stock price.

Notice Sales (the blue line) is stair stepping higher year after year, but the stock price (the black line) has sold off.

Now let's look at Salesforce.

Same story.

Sales and earnings are headed up, but the stock price is dislocated.

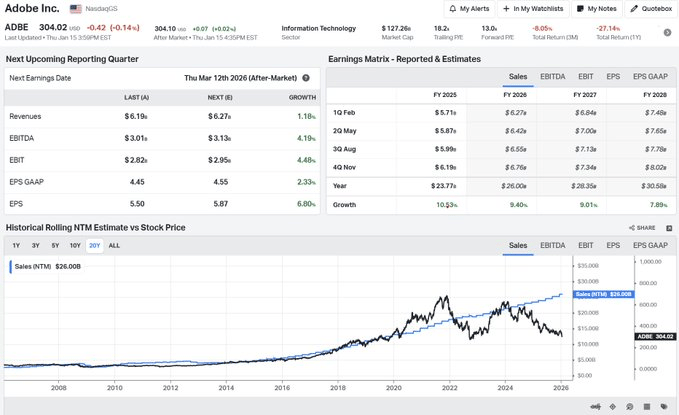

Adobe has transitioned to a Cash cow - it's no longer a growth machine.

But, sales are still growing, and the installed base is sticky. The stock now has a 17X trailing and 12.6X forward PE with free cashflow yield of 6.6%.

HubSpot has the same story. Sales keep growing, but stock price is severely dislocated.

When an entire category sells off, but the fundamental sales are improving, then you have two situations:

(1) Narrative pressure. Here the narrative is ‘Death by AI’.

(2) Valuations are too high

For software, the valuations were indeed too high and some names are still too pricey.

But, the EPS growth relative for at least some of the names, is looking attractive now.

(I say “some of the names”, because you still have firms like DataDog, MongoDB, and other software firms that trade at pricey valuations.)

Let’s look at narrative pressure.

Is AI truly disrupting SaaS?

Earnings calls shows management is incorporating AI.

And many of these SaaS firms have an installed customer base (e.g., data, integrations, hooks, etc.). It's not that easy to transition.

Timing is the hard part.

Software reminds us of Restaurants. Both topped out around the same time and we were bearish on both back then.

Fast forward, restaurants appear to have exited their bear market, and are rallying.

We believe Software will do the same.

The last phase of a bear market is the most difficult. 2/3 of losses happen in the last 1/3 of a bear market.

The best strategy here is to only be ‘feet’ in the water. You don’t want to be fully exposed to the price swings. You want to wait for ‘pivot points’ to emerge and demonstrate there is a change in trend. Then add to a position.

We believe software should bottom this coming week. We are within 5 business days of an intermediate low. Software probably bottoms around the same time as semiconductors top.

The two sectors continue to move in inverse directions.

IGV ETF

I

Semiconductor ETF

We purchased TEAM two weeks ago, but took an 18% tax loss harvest on the name and had a position size of about 2%.

At the same time, we purchased Hubspot (HUBS) and Intuit (INTU). TEAM is still a high-quality story.

Hubspot is Approaching 2022 Lows Despite Higher Sales

Intuit

But, not taking advantage of a tax loss harvest and rotating into another dislocated name that shares the same factor exposure would be a mistake.

If your marginal capital gains tax rate is, say, 42%, the IRS is effectively reimbursing ~42% of that loss in the form of lower taxes owed. That is a real, cash-equivalent value.

By selling our loss-making positions, we realize losses that can offset our gains - dollar for dollar.

It helps us mitigate taxes for our client, and achieve higher after-tax capital return. If you’d like more details about it, view our strategies here.

The Rise Of Defense Tech

The USA’s attack on Venezuela led headlines last week. Trump has another long weekend, and Iran is on the radar.

Polymarket also has non-zero odds for an attack on Mexico, Somalia, and Colombia.

Geopolitical tensions are intensifying, and it is not just the USA.

China is on the brink of a war against Taiwan.

Russia is already at war with Ukraine. Iran and Israel have been the headline for over a year now.

Countries are sensing the fear, and they are countering with increased defense spending.

World military expenditures rose 9% last year - the sharpest increase in more than three decades.

Defense allocations are headed toward military autonomy and AI. Countries are aiming to have intelligent mechanisms that work on their own.

Anthony Antognoli, USCG’s executive officer: “Our vision is to have robotics and autonomous systems as the foundation for the way the Coast Guard operates its missions.”

“It is impossible to do that work [defense missions] with humans and patrol cutters alone.”

These spending increases are creating massive demand for defense tech names.

Venture capital has realized this.

In 2025, defense tech venture investment was already more than double 2024’s total. We don’t see it stopping anytime soon.

The funding is concentrated in large, late-stage rounds of autonomy focused defense companies.

Companies like Anduril and its peer group are benefitting from these financing rounds.

Those financings are only available to sophisticated private markets investors.

Lumida Ventures is also focused on investing in this category. We have had a string of successful investments across CoreWeave, Kraken, and Brad Jacobs QXO, and Canva.

Past Results are not indicative of future returns.

Do reach out now if you want to be in the flow of our next deal.

If you are an accredited investor or qualified purchaser, sign up here to receive communications about our private deals.

Macro

Earnings Highlights: Large Banks

Earnings season started this week, with large banks –- Goldman, Morgan Stanley, JP Morgan, Wells Fargo, Bank of America, and Citi — reporting.

Bank earnings have been our gauge for the broader economy.

These releases tell us exactly where the economy is headed, and unlike official government data, the comments don’t have revisions.

The Economy Is Resilient

The Q4 earnings commentary second what we have been saying about the economy.

Economic activity levels are healthy: jobs are steady, business customers are operating with confidence, and growth is supported by a mix of consumer health and ongoing investment.

Bank of America’s Brian Moynihan: “It was a pretty good environment as we moved through the year 2025… Unemployment in labor market is stable.”

He described business conditions as constructive: “When you go to our corporate commercial customers… They had a pretty good year and good profits, including good credit quality and good money movement activity.”

Morgan Stanley’s Ted Pick framed the same story at a high level, calling out the durability of growth drivers:

“In 2025, the U.S. economy proved resilient as ever. As predicted, the capital markets are kicking in with well-capitalized corporates and higher-end consumers driving the economy forward.”

Citi went even broader on the macro setup and why growth can keep carrying:

“Turning to the macro. The global economy has powered through many shocks over the past few years, creating optimism and confidence that economic growth is poised to continue. With inflation now at normal levels globally, almost every central bank is becoming more accommodating.”

“Capital investment remains strong, especially in tech. And it's the combination of that CapEx, the health of the consumer, the tax bill benefits and anticipated rate cuts that should be enough to sustain growth.”

Wells Fargo also stayed in the same lane: “The economy and our customers remain resilient…”

The common message is that the economy is still producing the things that matter most for growth—jobs, corporate activity, and ongoing investment.

The Consumer Is Strong

Across the calls, banks are describing a consumer that is spending, confident, and not showing any kind of broad-based stress.

Bank of America’s Brian Moynihan (CEO) signaled towards stabilizing growth:

“Consumer spending grew 5% over the 2024 levels. Account balances in the consumer business for that broad base of the U.S. consumer were stable through the year.”

“Delinquencies and charge-offs improved in 2025 consumer credit. Unemployment in the market remains stable… This strong consumer health bodes well for the continued improvement in growth in 2026.”

His CFO, Alastair Borthwick, reinforced that the trend is still moving in the right direction:

“So we're still seeing the growth in each of the consumer categories. And that feels like it's in a position where it's likely to continue to grow from here.”

Wells Fargo described the same dynamic from a fundamentals lens: “consumers continue to be resilient as income growth has generally kept pace with increases in inflation and debt levels.”

Michael Santomassimo (CFO, WFC): “both credit card and auto losses were lower than a year ago.”

Citi’s Jane Fraser pointed to engagement rather than retrenchment: “Branded Cards revenue grew 8% driven by robust engagement from customers in spend, borrowing and new account acquisitions…”

And Citi CFO Mark Mason noted credit health was stable as well: “as we look at delinquencies, we're not seeing anything unexpected in either of the portfolios. And even when we cut it by different FICO scores and income brackets and the like.”

The takeaway is optimistic: the spending engine is still on, and the credit data is not contradicting it.

Corporate Confidence is Solid

Bank earnings also signaled towards confident corporate boards.

Deal Pipelines are rebuilding, and strategic activity is accelerating—usually the first sign that boards and sponsors are getting more comfortable putting capital to work.

Wells Fargo’s Charles Scharf (CEO) said, “We entered 2026 with our deal pipeline meaningfully greater than it has been at any point in the last 5 years…”

Morgan Stanley framed the same shift across sectors: “Investment Banking pipelines remain healthy, global and diversified across sectors. Strategic activity is accelerating.”

Goldman Sachs’ David Solomon (CEO) also echoed the same narrative:

“Over the last year, we’ve seen high levels of client engagement across our investment banking franchise, and we expect the activity to accelerate in 2026.”

“I think the world is set up at the moment to be incredibly constructive in 2026 for M&A and capital markets activity.”

Citi’s earnings show they are already seeing the results of increasing corporate deals: “Investment banking fees increased 35%. M&A was up 84% reflecting a record quarter that closed a record year with momentum across several sectors…”

The read-through is bullish: strategic decision-making is restarting.

When M&A, underwriting, and sponsor activity begin to accelerate, it typically means the corporate side of the economy is regaining confidence in the path ahead.

AI Is Becoming A Real Efficiency Engine

Banks are increasingly describing AI as a margin lever: less manual work, faster delivery, and more capacity without adding headcount.

At Bank of America, Brian Moynihan quantified the impact in software: “We have 18,000 people… who code. And by using AI techniques, we’ve taken 30% out of the coding… That saves us about 2,000 people… it’s several hundred million dollars.”

He also framed this as enterprise-scale enablement: “We have rolled out 365 Copilot across 200,000 teammates… we expect to get good leverage from that.”

BAC is also implementing AI in client service - Brian Moynihan flags how they have reduced service “touches” through proactive alerts: “you can set up alerts… the alerts are up to… billions a quarter…”

Brian Moynihan highlights AI in client service helps them in providing the “best customer experience at the lowest cost… which help [us] grow the business for 7 straight years in checking accounts”.

Citi’s Jane Fraser described AI as part of an operational transformation:

“When combined with how we're deploying AI, this bank is being truly transformed in terms of its operational capabilities…”

She backed it with adoption: “Colleagues in 84 countries have now interacted with our proprietary tools over 21 million times… It’s now above 70%.”

The end goal is straightforward: “use AI tools and automation to… reengineer and simplify our processes… to improve client experience whilst reducing expenses.”

Goldman is still early in the journey, but is eyeing AI as an operating-model reset:

“Goldman Sachs 3.0, our new operating model propelled by AI. We are excited to embark on this effort, starting with 6 work streams we identified as ripe for disruption. We will invest to reengineer these processes from the ground up.”

David Solomon tied it to multi-year productivity compounding: “GS 3.0 creates an ability for us in the next 5 years to accelerate the pace of Revenue per employee once again.”

AI is now being managed like a cost and productivity program.

On a side note, the AI enterprise implementation is essential for the AI flywheel.

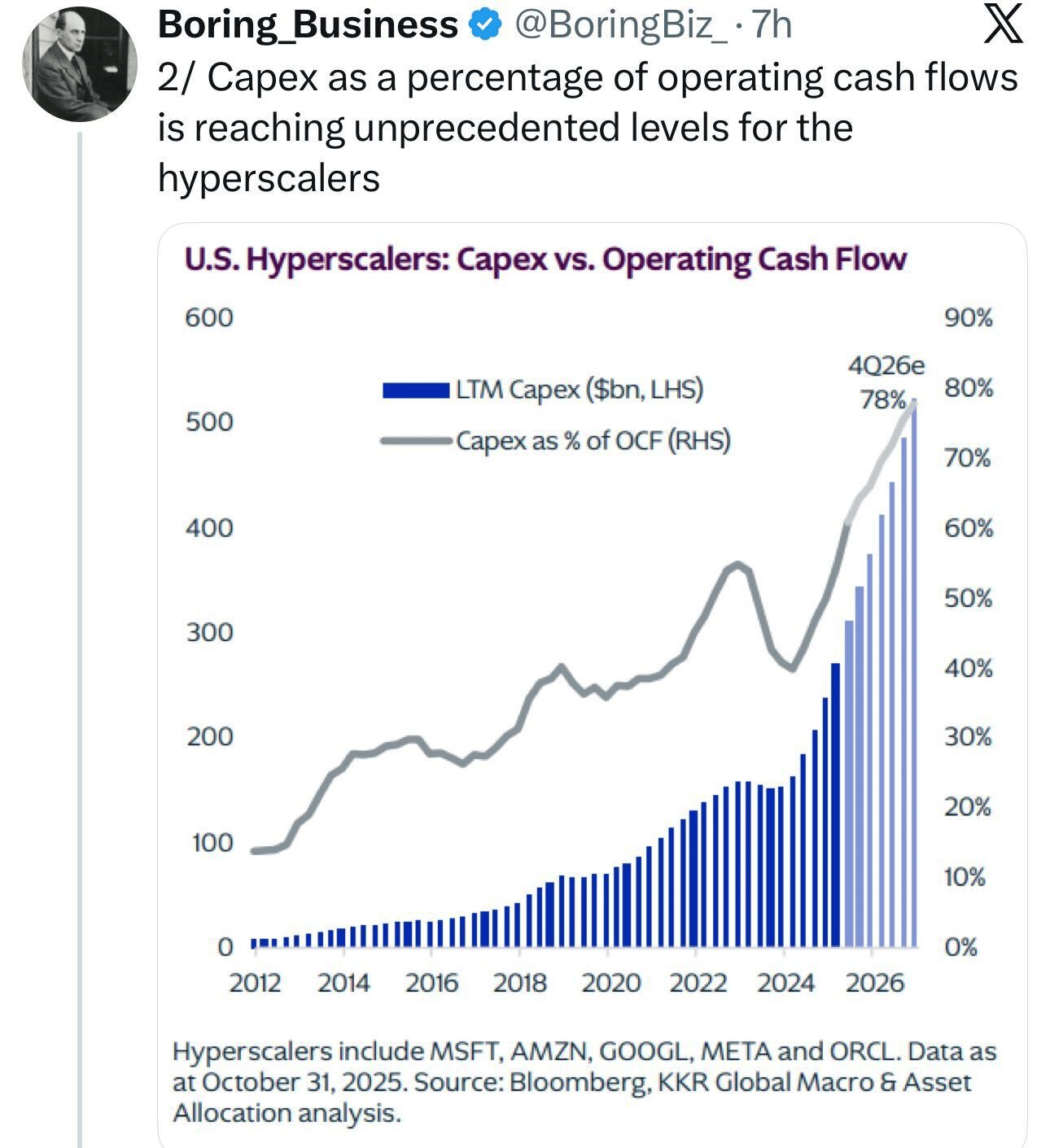

Hyperscalers’ capex as % of OCF has reached its all time highs, and it doesn’t seem to slow any time soon.

The capex trickles into revenues and earnings across the flywheel from datacenters, chips, packaging, energy, infrastructure and more.

If this capex doesn’t drive returns, it will eventually slow down, hurting the flows for the entire chain.

So far, banks’ commentaries show enterprises are actively considering and investing in AI implementation, which drives demand for the application layer. This gives us a reason to be confident.

Claims Say Labor Market Is Healthy

This week, we got initial jobless claims and continuing claims, both coming in better than expected.

Initial claims are running below 2025 and 2023 levels and only modestly above the unusually low 2024 prints.

This shows layoffs remain contained and the labor market is cooling through lower hiring.

Continuing claims tell the same story.

They are sitting roughly where they finished 2025 and have performed better than expected.

Although the labor market looks stable holistically, we see increasing weakness in younger segments.

The unemployment rate has ticked up to 15.7% for 15-19 age, and 8.2% for 20-23. It has been in an upward trend since 2023, and spurred higher in 2025.

The problem isn’t really demand weakness - It’s skill mismatch.

See this tweet from Robbie Hendricks.

Employers are “short labor” in specialized roles (engineering, technical manufacturing, defense/industrial work).

Fewer students are completing rigorous STEM/technical tracks that companies actually need.

These jobs stay open for months, while more candidates compete for general roles, where competition is intense.

This dynamic pushes up unemployment for workers who are newest and least credentialed, while the experienced labor pool stays employed and the layoff data stays quiet.

Women Moved Left

The partisan gap between young men and women has almost doubled in the last 25 years.

And, it isn't the case for US alone. You can notice it in the UK, Germany, South Korea and most other nations.

While the street argument suggests men have become conservative, it's the opposite.

Ideology-wise, men have stayed with the same right-tilt, while women have drifted far more towards the left.

The article by Vittorio discusses why this happened, and what it implies - a really interesting read.

Markets

GPUs Aren’t iPhones

H100 rental pricing has been rebounding since the November lows. It’s now near an 8-month high.

Datacenter linked names including CoreWeave have rallied along these results.

This shows compute demand is running hot.

But, it also pushes down on a more critical bear claim against AI infrastructure names that “GPUs become obsolete quickly once a new generation ships.”

Compute isn’t consumer hardware.

Each GPU generation gets slotted into a workload ladder.

New chips handle the hardest training. Older chips migrate to inference, fine-tuning, and cheaper, performance-per-dollar work.

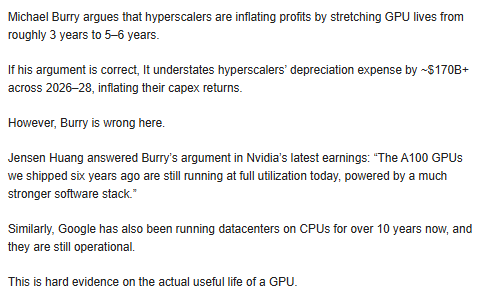

This is why we said Michael Burry was wrong in his October claims.

His argument was that hyperscalers are stretching GPU life to understate depreciation and overstate profits.

But his view assumed GPUs were short-lived and get replaced in a hurry.

Here’s what we wrote back in Nov refuting his argument.

The rental market offers the most compelling evidence on how he was wrong.

If older supply were being stranded, pricing would be breaking down, not moving higher.

GPU Demand is also widening. They are no longer just required for frontier model training, but are also used for inference everywhere, across more companies, more products, and more use cases.

That keeps older hardware economically relevant.

The rising rental prices for older GPUs is also a bullish evidence for CoreWeave. Longer useful life means the capex keeps generating returns for more years to come. This creates operating leverage, and better profitability.

We wrote how Coreweave is misunderstood in our previous newsletter. Read our thesis here.

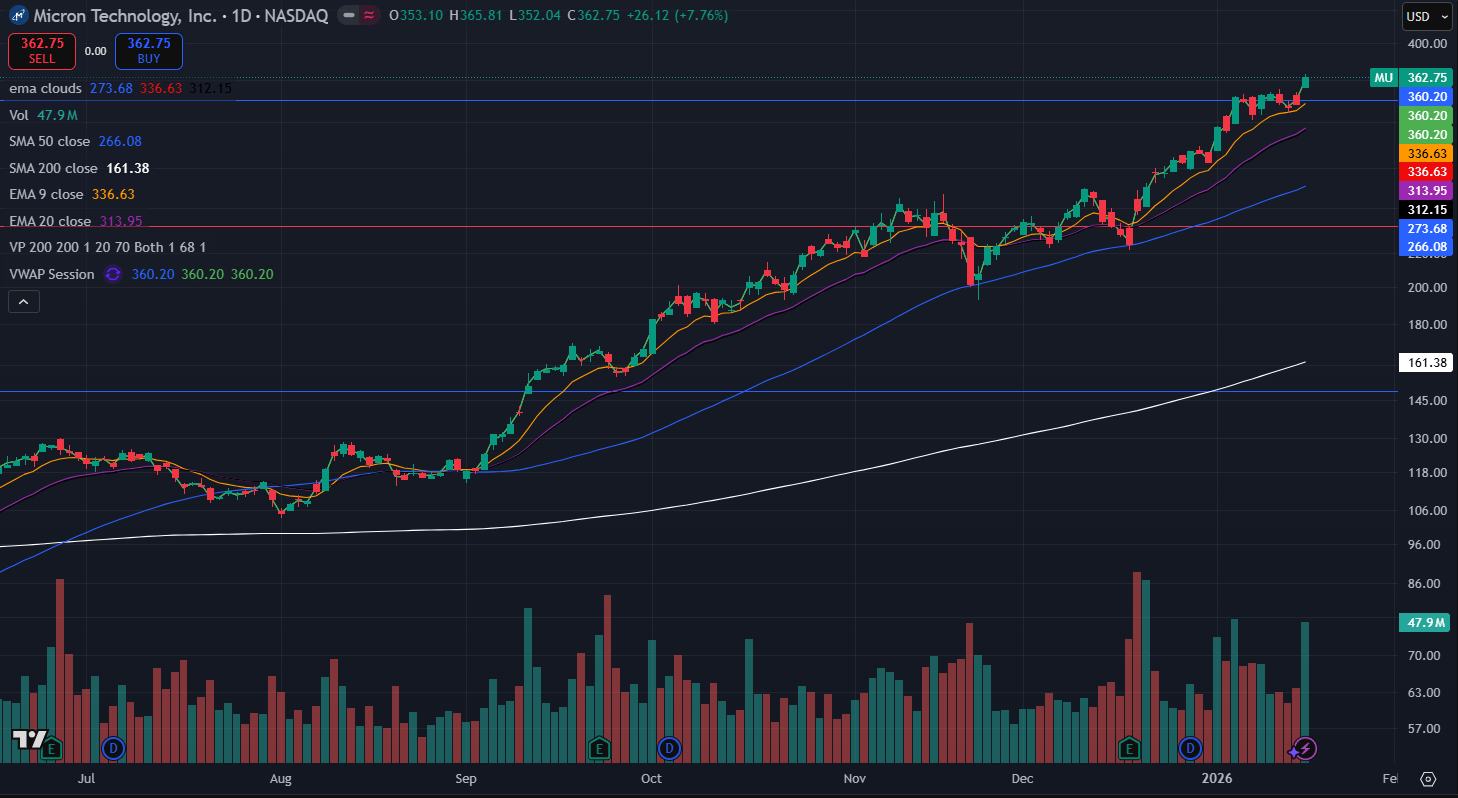

Micron - The Attention Asset With A Solid Story

Micron was up ~8% on Friday, after they initiated a ~$100B semiconductor manufacturing facility near Syracuse.

Sanjay Mehrotra (CEO, MU) says this manufacturing facility will “power the AI revolution.”

The project is also being supported by more than $6B from the CHIPS Act, plus over $8B in federal, state, and local tax incentives.

Chuck Schumer, Minority Leader of the United States Senate, said it will give the U.S. “the lead in semiconductor manufacturing for generations.”

Micron had an investor group meeting this week, and the takeaway was consistent with what they said in Q1’26 call: customers want more bits than the industry can deliver.

Mark Murphy (CFO,MU): “We are only able to meet about 50% to two-thirds of our demand from several key customers.”

Mehrotra (CEO) echoed the same dynamic: “We see a very, very tight supply environment… there is a large gap between the demand and the supply.”

Mehtora mentioned MU is expanding capacity at a 20% YoY rate, while demand is expanding at 30%. He expects “Demand will likely continue to outstrip supply” till 2027.

When the gap is that wide, the market clears through price.

Murphy highlighted MU’s pricing power in Q1 '26 call: “We expect higher price, lower cost, and favorable mix to all contribute to gross margin expansion in Q2.”

And, you can already see the initial signals in Q1’s numbers.

In fiscal Q1’26, Micron did $13.6B (57%+ YoY) of revenue with 56.8% gross margin. DRAM revenue was $10.8B (69%+ YoY) and NAND was $2.7B. Free cash flow was $3.9B. Operating income was $6.4B (20% higher YoY with a 47% operating margin).

HBM capacity is sold out through CY26, and management expects the demand growth to continue at the same rate till 2028.

MU has returned 80% in the last 3 months. This is one of Markets’ attention assets for 2026, alongside other memory stocks like Sandisk.

Attention stocks are often driven by momentum and liquidity even when the valuations go bizarre, although not the case for MU with P/E NTM under 10x.

I did an X post on how the animal spirits basket for 2026 is different from 2025. Read it here.

We bought MU on Dec 30th, when the stock traded at around $282 - today, it has risen to $362 - a 28% surge in 12 days.

Micron is an example of a lockout rally. The stock runs higher and doesn’t create an attractive entry for an investor. The main goal in these situations is to “get involved”.

When the trend breaks on a high momentum name like this, then we would sell.

Constellation Software

I guess it’s fashionable to point out how ‘quality’ darling Constellation Software is down 40%.

CSU was on Goldman’s conviction list last year if memory serves.

I pointed out Constellation was insanely over-priced back in q4 ‘24 at 100x.

You will have great grandkids before you see your principal.

Interestingly, the name rallied 6 more months on momentum.

Then it rolled over.

A lot of other ‘quality’ names like FIGO and CAVA and others also cracked.

A lot of ‘quality’ investors that went to school studying Buffett forgot that valuation matters.

1) Price is what you pay, value is what you get.

2) There is no single correct investment style for all times.

If you identify as a growth investor or value investor or GARP investor or momentum investor, that’s picking ideology over science.

3) The best investors in the world - Two Sigma and Citadel - have no such bias.

International Value

International markets are running circles around U.S. markets.

Greece, South Korea, Turkey, China, Brazil, Mexico, Canada.

Even France.

And Vietnam.

We continue to add international value names to our portfolio.

We discussed our thesis about international outperformance in our last newsletter. Read here.

I also did an FSD stream detailing how geopolitical uncertainty is also one of the reasons behind International value leading.

Timing is Everything

Bitcoin purists see decentralized money as naturally having value.

I see it differently.

Bitcoin wouldn't have achieved adoption, nor value, without the platform formerly known as Twitter.

That's especially true for non-cashflowing assets that are stories about the future.

Value is social.

It's not a coincidence that Bitcoin took root just as X was taking off as a platform.

And, by the same logic, social media has transformed investing forever.

You really have to think differently about assets that build community around them...

This is the main lesson for the performance of Palantir, Tesla, and Robinhood stock prices.

But, like other attention assets, you need the concentric circles to keep growing to propel values to higher levels.

And when competing assets enter the picture - drone stocks, space stocks, <insert hot thing here> stock - those assets compete for attention and fragment liquidity.

Lumida Curations

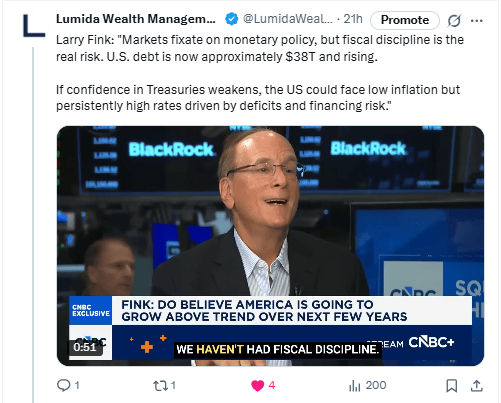

Fiscal Discipline Is the Market Risk

Markets keep watching the Fed, but Larry Fink argues the bigger swing factor is Washington’s balance sheet. With US debt nearing $38T and deficits still rising, financing risk can push long rates higher even if inflation cools.

Longevity: VO₂ Max Is the Longevity Signal

Cardiorespiratory fitness is the clearest single proxy for long-term healthspan—because it reflects how efficiently your heart, lungs, and muscles deliver and use oxygen under real-world stress.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.