Here’s a preview of what we’ll cover this week:

Macro: Fed Rate-Cut Remorse Is Creeping In; Did Rate Cuts Affect the Labor Market?; Housing Policy Whiplash

Markets: TechnipFLP - The Upstream Play Around Venezuela; Atlassian Corp - Quality on Sale

Lumida Curations: The Hidden Credit Crunch; CoreWeave's Secret Sauce; The Toxic Insider Wrecking Your Metabolism

Spotlight

This week, I had a podcast with Danny Goler.

More and more studies from Johns Hopkins, NYU, and Imperial College are documenting the therapeutic benefits of psychedelics.

Danny is a ‘psychonaut’ and one of the few human beings to take a sustained DMT drip. He shares his experience and lessons.

Here’s what we talk about:

The “Code of Reality”: What Danny Goler Claims to Have Discovered

Quantum Physics, Double-Slit Experiments, and Consciousness

Are We Living in Parallel Worlds or a Holographic Universe?

Humans as AGI: Intelligence, Alignment, and the Future of Civilization

Run It Hot

GDP is running north of 5%.

The Fed cut rates into a blistering hot economy — rate cuts the economy does not need.

Stimulus checks are still to come..

Mortgage rates now have a five-handle.

That’s the setup.

Add to it Trump’s economic agenda, which taken together, is center-left and inflationary.

Overall, we have a populist economic policy mix. It’s designed to win mid-term elections. It also has longer-run inflationary consequences.

Consider the mix:

Tariffs

Milton Friedman would say no. AOC would say yes.

Ban on institutional ownership of homes

“Corporations don’t live in homes.” Mitt Romney would disagree.

Corporations rent out homes to people. They are pass-thru intermediaries that often can buy a home at a lower-cost of capital than renters locked out of a mortgage market,.

Cutting rates despite 4–5% GDP growth

Elizabeth Warren has always pushed for rate cuts at every Humphrey-Hawkins FOMC Chair congressional testimony.

Tax cuts framed as wage support, not for capital formation

Bernie Sanders would say yes. Glenn Hubbard would say no.

Opposition to entitlement reform

Deficits stay large.

Drug price controls

Both Elizabeth Warren and Bernie Sanders support this.

Buying mortgage-backed securities

An Obama–Bernanke era policy. It inflated housing prices and priced out the next generation.

Capping credit card rates at 10%

Sounds consumer-friendly. In practice, it restricts credit and pushes risk into unregulated markets.

You can debate each item individually.

But taken together, the direction is clear: more demand stimulus, more intervention, more inflation pressure.

What are the implications?

First, why would you own bonds here? Owning sovereign debt is a truly foolish proposition.

Especially when you consider there are dozens and dozens of public market securities with a 7% free cashflow yield and real earnings growth.

If you’ve followed us closely over the last two years, you know we have been consistent in the view that the U.S. consumer is strong, and the real economy does not need rate cuts.

The 5%+ GDP print supports that view – as does inflation prints that are running at a 2.8% level three years after the Fed started raising rates.

What we have witnessed over the last several years is the game theory of rate cuts and inflation.

We are seeing how and why inflation cycles and rate cycles happen. All of this exacerbates the business cycle and leads to greater asset price volatility.

The simple fact is that the incentives of whomever is in power is to spend, cut rates, and win the next election.

The Fed Reaction Function

The Fed undoubtedly is having rate cut remorse.

Note: The effects of the most recent rate ‘adjustment cuts’ have barely hit the real economy.

Monetary policy and fiscal policy should be counter-cyclical.

The logical response to all of this - after my hand-wringing - is to stay bullish on real assets.

The ‘run it hot’ policies mean you have an imperative to own assets that benefit during inflationary regimes.

Notice commodities of all stripes - Gold, Copper, Silver, Uranium - are rallying. Material stock indices and names like Freeport McMoran are breaking out.

Mr. Market sees inflation coming. I see it too.

The right way to approach this - stick to the trend. Avoid sovereign debt. Own assets that can pass thru inflation efficiently or re-price in nominal terms efficiently.

Here’s what FOMC officials are saying.

Minneapolis Fed President Neel Kashkari acknowledged the ‘higher for longer’ narrative on Friday.

He noted policy “pretty close to neutral,” and the economy doesn’t appear to be under meaningful downward pressure at all.

Philadelphia Fed President Anna Paulson reinforced that message, signaling that further cuts could be “some way off” and would be modest and conditional.

That’s exactly what rate-cut remorse sounds like.

In an environment with strong nominal growth, fiscal stimulus, and a policy mix that leans demand-side, why would you own bonds here?

This is a higher-for-longer setup.

The third implication?

60/40 portfolios are not poised to do well here.

Defense Spending Is Resetting Higher

Proposed defense spending is set to target a whopping $1.5 Tn.

That’s also inflationary.

President Trump called this week for U.S. defense spending to rise to $1.5 trillion by 2027, more than 50% above the current $901 billion budget.

This spending cycle is increasingly about autonomy, robotics, sensors, and AI-driven systems, not just traditional platforms.

Defense agencies are directing multi-year budgets toward technologies that reduce reliance on manpower and can operate at scale across large, complex environments.

Companies like Anduril, and its peers, are well positioned in that environment.

They focus on autonomous systems, rapid deployment, and integrated AI platforms designed for modern defense missions.

These are no longer experimental programs. They are becoming core infrastructure for how missions are executed.

The U.S. is refactoring its “defense tech stack”.

Trump has also been explicit that higher budgets will come with pressure: faster delivery, domestic manufacturing, and tighter control over cost overruns.

That dynamic favors agile, tech-first defense firms over traditional primes.

Lumida Ventures is focused on investing in defense tech.

We have had a string of successful investments across CoreWeave, Kraken, and Brad Jacobs QXO, and Canva. All of these but Canva (too new) have had markups or realizations..

Our strategy is simple. Front-run Pentagon spending. Find private companies priced attractively with product market fit that are poised to win government contracts.

Do reach out now if you want to be in the flow of our next deal.

If you are an accredited investor or qualified purchaser, sign up here to receive communications about our private deals.

Macro

Did Rate Cuts Affect the Labor Market?

The one thing the Fed wanted rate cuts to do was help the labor market, and the one thing that rate cuts have not changed is the labor market.

The labor market was never cracking as the hyperbolic media would like you to believe, it was cooling and moving into balance.

New hires match fires and quit rates.

Even as hiring cools, economic growth remains intact thanks to the magic elixir of productivity growth.

Hours worked are barely increasing, yet output continues to rise.

In effect, the economy is growing with less labor input.

That shift carries important inflation implications.

When productivity rises faster than wages, unit labor costs fall.

Firms can pay workers more without passing those costs through to prices because each worker produces more.

Automation and AI are the structural drivers behind this dynamic.

Companies are not aggressively cutting headcount; they simply do not need to hire at the pace they once did.

Software, automation, and AI are substituting for incremental labor, lifting efficiency and lowering marginal costs.

The result is slower hiring, stable employment, and rising productivity—not labor market distress.

This is actually how AI flywheel strengthens.

Companies are experiencing a positive return on AI and automation - This validates further investment in AI infrastructure, software, and compute.

And, higher investments means the AI flywheel continues to expand.

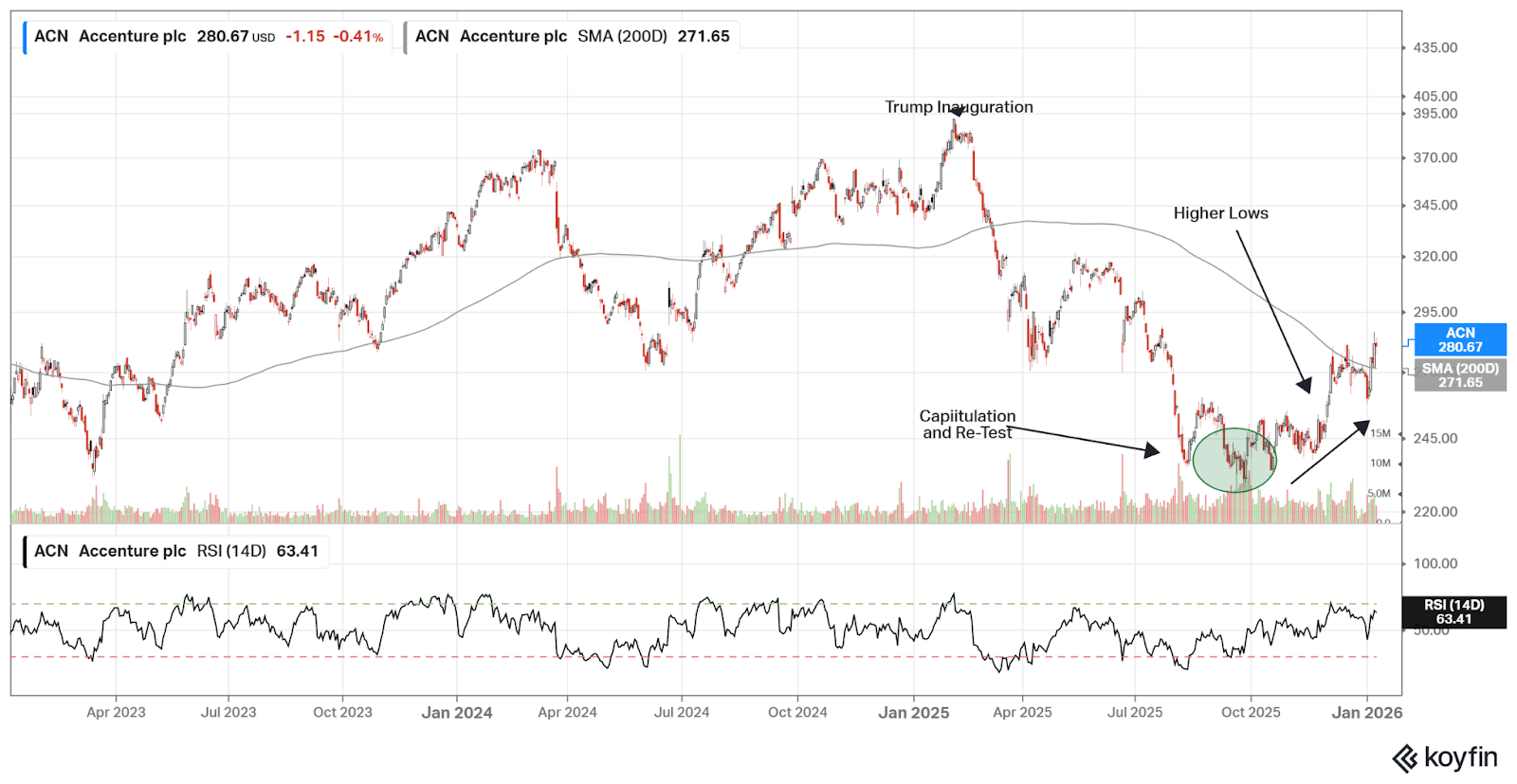

One of the ways we are betting on AI adoption is thru an investment in Accenture.

The name entered a deep correction shortly after the Trump inauguration. It now has a 7% Free Cashflow Yield and the technicals have turned up.

We believe Fortune 500 companies need change management to re-factor their workflows around AI. Names like Accenture should do well.

Here is a chart of Accenture’s Free Cashflow Yield.

Here is a chart of Accenture’s stock price overlaid with key technical events.

The entry isn’t ‘perfect’ right now, but might be worth accumulating on the next down day.

I ask you again: why would you own bonds yielding 4% when you can own a business with a 7% yield and earnings growth?

Housing Policy Whiplash

Housing markets were hit with conflicting policy signals this week, and prices moved accordingly.

First, President Trump said he would push Congress to ban large institutional investors from buying single-family homes.

Markets reacted immediately.

Stocks tied to institutional housing ownership—Invitation Homes, Apollo-linked platforms, and related exposures—sold off sharply.

Institutional buyers act as a clearing bid for housing inventory.

Whether a home is owned by a family or a corporation, it still gets occupied.

What changes is ownership structure, not demand for shelter.

Removing institutional capital reduces one source of demand and slows inventory absorption—especially problematic when homebuilders are already sitting on rising inventories and weak earnings momentum.

Less clearing demand means longer sell-through times and more pressure on prices. From that perspective, the market reaction made sense.

Banning institutions from owning homes doesn’t address home ownership affordability.

Affordability turns on mortgage finance costs.

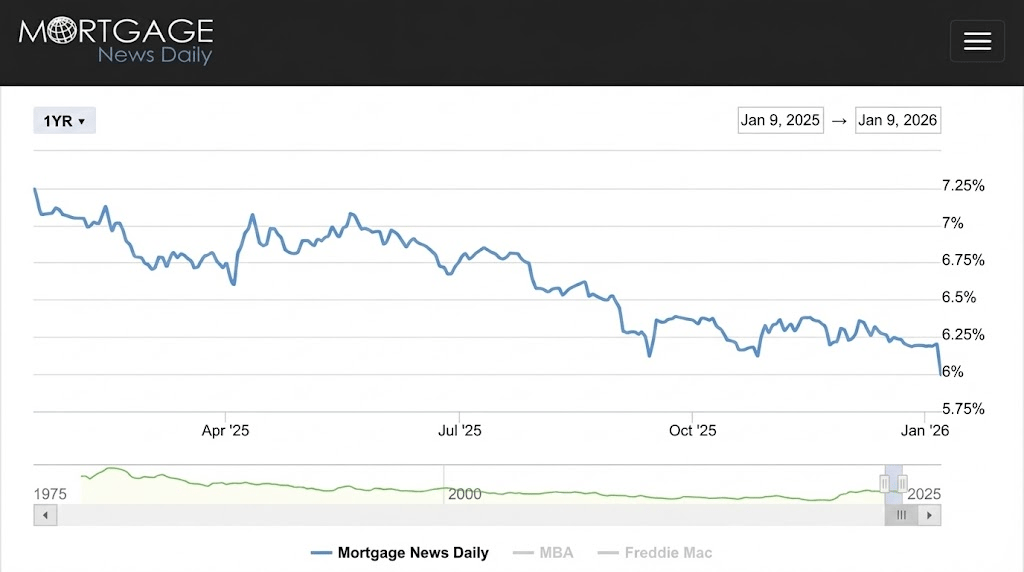

Trump followed up with a call to purchase MBS.

Trump followed by calling on Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities, explicitly targeting lower mortgage rates.

Markets immediately understood the implication.30-year mortgage rates dropped 0.22% to 5.99%, first print (barely) below 6% since August, 2022.

The mere announcement of this intention caused benchmark mortgage rates to hit a 5% handle for the first time in many years.

This is bullish for U.S. consumers who can tap their home equity.

Lower rates improve affordability, and homebuilders rallied sharply on the news. XHB reflected that shift.

Between the two - this policy is the one that matters.

But lower rates come with trade-offs.

Demand for housing will increase. That will spur home price asset inflation (not unlike Covid, but less pronounced).

In already tight markets, that dynamic risks pushing prices higher rather than improving affordability in the long-run.

Until policy makers address supply - via permitting, deregulation, NIMBY concerns, and allowing accelerated depreciation - it’s hard to see a sustained fix to housing supply..

Markets

SELL ME THIS PEN

OpenAI is building a pen.

This pen does not have product market fit.

Neither did the Apple Vision Pro.

(Is it made of silver, at least!?)

Question...

What financial projections attached to the 'pen' are baked into OpenAI's capital raise?

I've said it before, and I'll say it again.

The bubble is in OpenAI stock.

Google’s Gemini is growing more rapidly.

Do the math.

OpenAI wants to raise $100 Bn.

75% of that will go to Nvidia, who has a 75% margin.

Attach a 40x PE ratio to $50 Bn in earnings and you have about $2 Tn in market cap, give or take, linked solely to OpenAI capital raise.

Right now, Mr. Market will 'advance' OpenAI as it achieves financing milestones.

The semi market was set to crack a few weeks ago.

But, the reports in the WSJ and Information saved semis.

The semi market was set to crack last week.

But, Softbank saying they are committing $40 Bn to OpenAI saved the day.

Each day, those news announcements arrested emerging downtrends.

The market is saying ‘So long as OpenAI can raise financing for capex, the show will go on.’

There’s a good logic to that. After all, earnings numbers for the semi ecosystem will hit if OpenAI gets financing.

We are now in the game of musical chairs. One of the most important variables to watch in markets is OpenAI’s ability to raise financing. When that dynamic stops - and we are in the later innings the IPO being inning #9 - you will want to be cautious around risk.

Each successive financing check is hard than the last.

OpenAI now needs to find another $60 Bn to close out the raise. That's bigger than most public offerings, and it's happening privately in non mark-to-market valuation land.

OpenAI must go public - by necessity.

OpenAI is not going public as a "win" - but because they need capital to fund its capex obligations.

So, here we are.

Fanciful projections meet increasingly skeptical capital markets.

We are in the Sam Altman 'It's so over' -> 'We're so back' cycle.

If Brad Gerstner or 'smart money' doesn't invest in OpenAI's private round, markets will call bullshit on Sam Altman.

With Google Gemini gaining market share and growing even faster than OpenAI, it's clear to me OpenAI is not in a good place.

We’ll continue to keep an eye on this variable…

TechnipFLP - The Upstream Play Around Venezuela

The Venezuelan attacks led actions since last week - the obvious trade was Chevron.

They stand to make real money from this—hundreds of millions in incremental annual free cash flow.

But the better opportunity is not the operator.

It’s the infrastructure behind it. That’s oilfield services. The subsea work. The execution layer.

If you look at that category—Halliburton, Schlumberger, Weatherford, and FTI—one name stands out.

TechnipFMC (FTI)

TechnipFMC is the oil field service names most levered to Latin America—Brazil and Venezuela in particular—and it sits directly inside the execution layer of offshore projects.

FTI was already moving before the news broke.

It was up hard late last week, then gapped again on Monday, and it’s been up every day since. No pullback.

That usually tells you something. When a stock doesn’t give you an entry, it’s because investors are waiting for a good entry that never comes.

FTI spent years redesigning itself to make offshore oil projects attractive again. These are large, complex projects that take years to plan and billions of dollars to execute.

What FTI changed is how those projects get built.

Subsea 2.0 is their new operating model for building the equipment that sits on the ocean floor. Think pipelines, connections, and other systems that bring oil and gas up to the surface.

About 80% of FTI’s work is now directly awarded, meaning clients don’t even put the job out to bid.

They’re saying: “we trust you, we know you’ll deliver, and we’re not taking the risk of shopping around.”

FTI has a backlog—around $18 billion as of Q3—but the quality of that backlog matters more than the size.

The risks are straightforward. The Venezuela story is dynamic and evolving. It’s not clear how the regime will respond to the will of the United States. (We’re optimistic though.)

Atlassian Corp - Quality on Sale

We added to our Atlassian position on Friday.

This was already a Lumida 2026 pick, and after the recent drawdown, the setup improved enough for us to size it up.

The stock, along with software as a category, had been out of favor for months.

Valuations compressed to levels we rarely see for software embedded in daily operations.

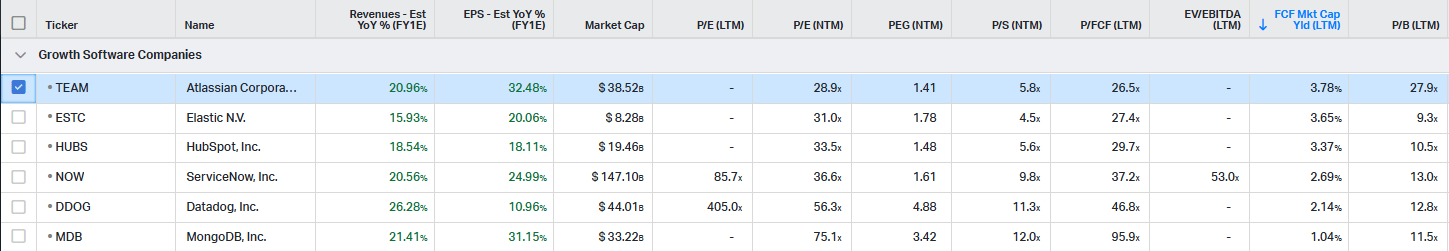

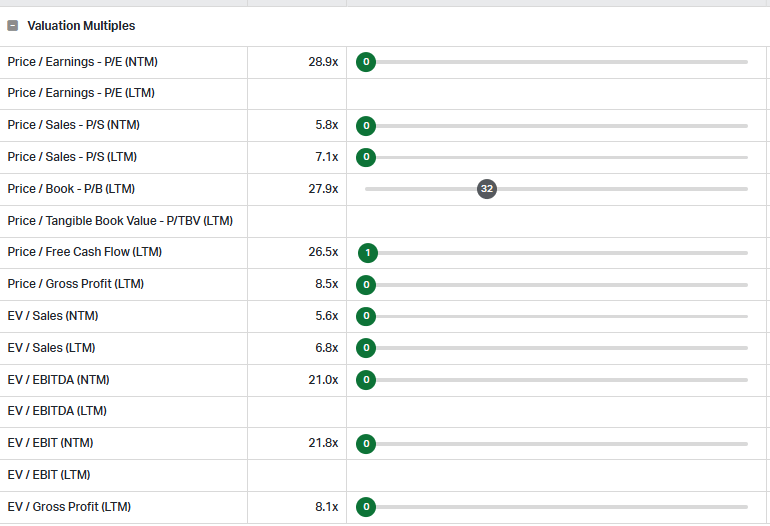

See TEAM against its peers. At current prices, Atlassian trades around 29x forward EBIT, with a free cash flow yield near 4%.

Atlassian is the leading software engineering platform.

The market leader continues to grow at high-teens to 20% year-over-year revenue growth while free cash flow scales and margins expand.

Atlassian’s products include: Jira, Confluence, and Trello. These tools run planning, execution, and collaboration across engineering-driven organizations.

Once workflows are built on Atlassian, switching costs are real.

That’s why retention remains strong and why the company continues to deepen penetration inside large enterprises.

The concern weighing on the stock is that generative AI undermines Atlassian’s relevance or compresses its economics.

We think that framing is backwards.

AI doesn’t replace coordination—it amplifies it.

Atlassian is moving customers from on-premise software to the cloud while investing aggressively in AI capabilities like Rovo.

That transition pressures reported margins and earnings in the short run.

Management has also shown confidence on their AI implementation. They note "AI is one of the best things that’s ever happened to Atlassian."

Over 300,000 customers including Ford and Wells Fargo are using Atlassian’s AI offerings. Cannon-Brooks(CEO) stated, “We are proud of our ability to deliver AI to customers, with over 3.5 million monthly active users leveraging our AI capabilities.”

He also highlighted, “Customers using AI code generation tools are managing over 20% more projects than their peers.”

Better customer experience means higher retention, which keeps revenues secured for longer.

The risk is if cloud migrations slow, AI monetization takes longer, or competition from Microsoft and ServiceNow intensifies, then the re-rating stretches out.

But after the drawdown, the stock is priced like a growth company that stopped growing—which it hasn’t.

Atlassian is durable, mission-critical software trading at discounted valuations, with a growing cash-flow base and structural tailwinds still intact..

Bullish On International Value

I did a FSD livestream on how international value offers a compelling opportunity. Watch it here.

These markets have outperformed the SPY, and by a significant margin.

Look at the charts.

Green (EWY) and blue (GREK) are market returns for South korea and Greece.

Over the past 12 months, Greece is up nearly 80%, more than 4x the return of the S&P 500.

France is up over 30%. Japan, Brazil, Mexico, Canada, and large parts of Europe are all ahead of U.S. equities.

These markets are experiencing non-consensus rallies ever since the March and April Trade war.

Sure, Europe is behind on technology and has all sorts of demographic issues.

Even markets with well-known structural issues—regulation, bureaucracy, energy constraints—are delivering stronger returns.

The reason is simple: valuations, earnings, and momentum are all aligned.

International stocks are not unlike small cap stocks or value stocks. They lagged for several years… now we see a non-consensus rally in all of these areas.

Skepticism is yielding to momentum, and that momentum should continue.

We especially like the banks. You can buy banks at 10x earnings or less, often with improving balance sheets and positive operating leverage.

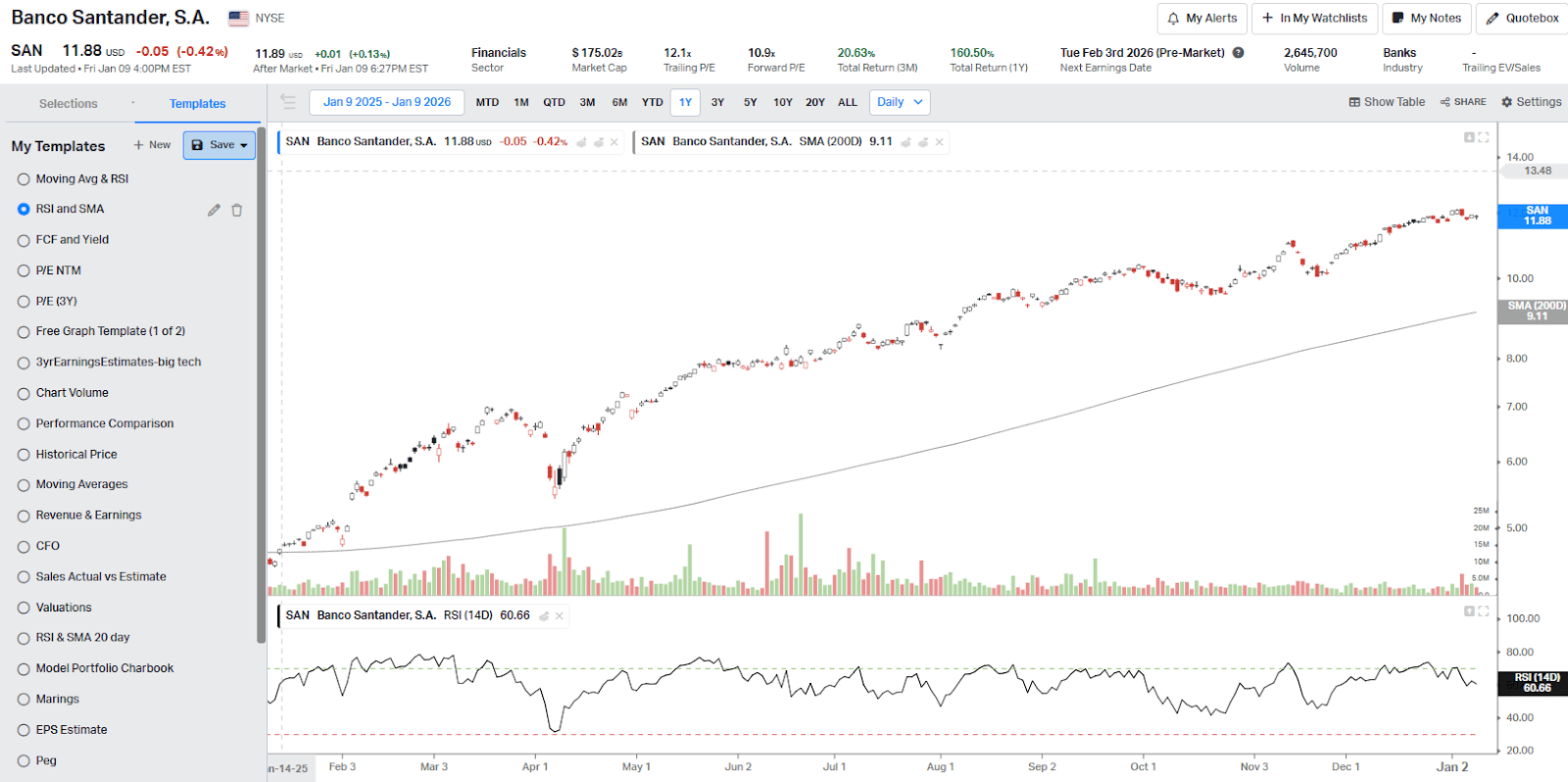

Santander being up over 160% in 1Y is a good example— it’s cheap, profitable, and benefiting from improving fundamentals in Spain.

“Home-market bias” - the tendency for investors to invest in their local economy - has returned in international markets.

French capital flowed into France. The Brazilian capital stayed in Brazil. Japanese investors leaned into domestic banks and industrials.

That shift coincided with international outperformance—and it hasn’t reversed.

There’s also been a deeper market change.

In prior cycles, risk-off meant bonds rallied.

This time, gold replaced bonds as the safety trade.

This removed one of the structural supports for U.S. assets and made relative equity valuations more important.

From a portfolio perspective, this raises a simple question: do you own enough international stocks?

If you’re not forced to be U.S.-centric, that flexibility is an advantage.

Momentum trends tend to last 1.5 to 2.5 years. We believe this trend continues until you see global central banks hike rates or dollar strengthening.

Greece, once written off, is one of the best-performing equity markets globally.

We had taken all opportunities to scoop international names in the last couple of months.

If you want an international value idea - Coupang is a good one. You can read our thesis here.

The name is completing its re-test now and we believe is putting in higher-lows.

Lumida Curations

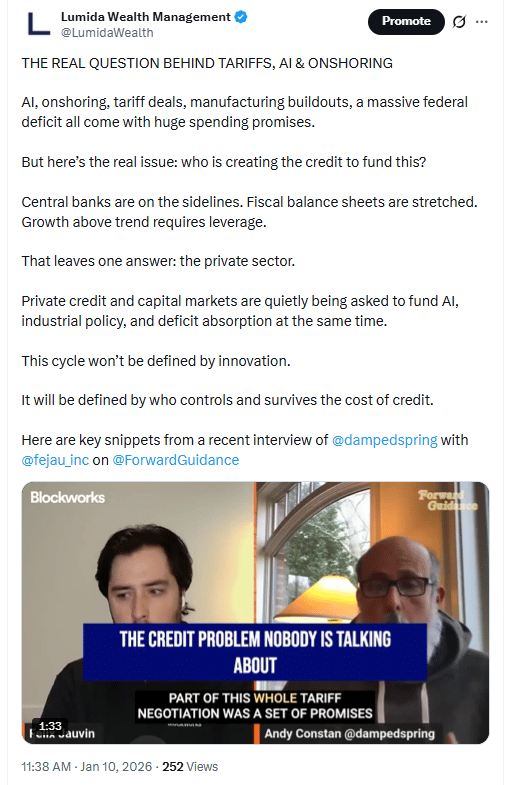

Governments are piling up trillion-dollar promises on AI, factories, and industrial policy—but with central banks sidelined and public balance sheets maxed out, the trillion-dollar question is: who is going to lend the private credit to actually pay for it?

CoreWeave's Secret Sauce

Intrator says CoreWeave has quietly built the world's largest GPU fleet and uses its proprietary software stack to transform off-the-shelf hardware into a high-margin, premium AI cloud service that hyperscalers can’t replicate.

The Toxic Insider Wrecking Your Metabolism

Visceral fat acts like a rogue endocrine organ, pumping out inflammatory toxins that rapidly trigger insulin resistance, hormonal havoc, soaring triglycerides, plummeting HDL, and serious metabolic damage—far more aggressively than harmless subcutaneous fat.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.