Here’s a preview of what we’ll cover this week:

Macro: BOJ Raises Rates, Optimism Phase, US Growth vs. China, The Bubble in Quality

Markets: Peak Sentiment Events, U.S. consumer, Magnificent 7

AI: “Stargate” AI Infrastructure Project, Deepseek, Larry Fink on DataCenter Demand

Lumida in the News (Benzinga): What Comes Next After Donald Trump's Meme Coin Launch?

Mr. Market is a Manic Depressive

It was only two Mondays ago that we were facing a gap down open.

Fast forward to weeks later and we are at all-time highs.

I hope you followed our analysis and bought into that.

Where we are now in market is on the other side of the sentiment pendulum.

This past Thursday, we had two Peak Sentiment events:

Trump’s comments at Davos World Economic Forum

Project Stargate: Firms spending $500 Bn to build a portal to AGI

(The symbolism of an American President effectively Zooming into Davos rather than attending in person when he is the object of attention is striking.)

A peak sentiment event is when everyone gets giddy and throws caution to the winds and buys stock indiscriminately.

When that happens everywhere you get a “blow off top”. That would be the opposite of a “capitulation.” You can take a look at our analysis of China in Feb 2024 where we discuss capitulation - indiscriminate selling.

When I look across large cap financials, semiconductors, and several of the fabled Mag 7 I see names at their over-extended reflecting a local Peak Sentiment.

Trump called on central banks around the World and the United States to lower rates this past Thursday.

That caused every sector in the S&P 500 to finish in the green and hit all time highs. (Futures were indicated to open lower.)

The comment also sent international stock indices higher such as Brazil, China, and even Mexico.

On the same day, you had Sam Atlman, Microsoft and others announce Project Stargate. They want to spend $500 Bn to create a super data center.

Stargate sounds like a metaphor to unlock a wormhole into an unknown future. (A more appropriate name might be Event Horizon or Singularity.)

That sent Nvidia and the semiconductor category higher.

We love the datacenter theme and have bet in the past or today on names such as Nvidia but also themes around the ecosystem including Celestica (CLS), Flextronics (FLX) and various independent power producers that are needed to fuel the energy (Vistra, Talen) and the natural gas leaders. Those themes have worked very well.

Midstream has worked well. Big Tech has worked well. Financials have worked well.

If you recall, just prior to the election every major theme was underperforming or had some kind of correction : GLP1s, Big Tech, Defense, etc.

Now we have the opposite situation.

We are a few days after the inauguration. And the market is at all time high.

A natural question is: Why can’t the market just move higher just like the weeks following the election?

Well, in the medium and long-term we believe they will. The earnings growth is there. Animal spirits confidence is strong. The consumer is strong. Deregulation is coming. Long-end rates are on the higher side and biased to come down over time as inflation ebbs lower.

A highly constructive fundamental backdrop meets expensive valuations.

However, going into the election, many market participants were wrong way positioned. That means they were expecting a long drawn out contested election. There was a lot of hedging and cash on the sidelines as people “wait for clarity”.

That surprise decisive election outcome forced people offsides and led to a major gap up.

(We should note Lumida correctly called the election on 5pm ET the eve of before results were announced in a post titled “Post-Mortem of the Harris Campaign”. We were fully invested.)

Take a look at the MTUM Momentum ETF for example:

This ETF contains names that have high quality and high momentum.

This is what an overbought chart looks like. You can see how we went from the Monday gap down to a Peak Sentiment condition.

Add to this you have the BOJ hiking rates 25 bps. That also took place in early July and was one of three drivers to the Yenmageddon correction. We don’t expect that repeat by any stretch (it’s anticipated this time).

Still, it does make the cost of the Long US equities carry trade that Warren Buffett and others are doing more expensive on the margin.

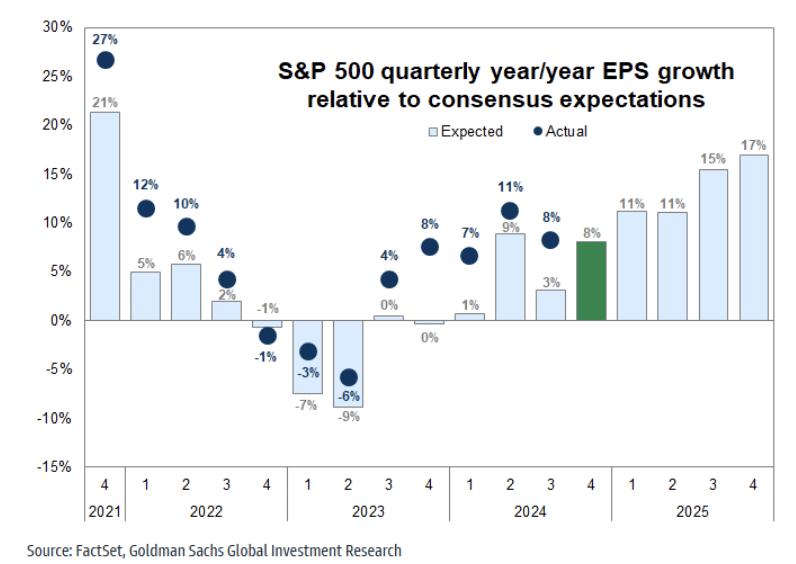

On the bullish side of the ledger, corporate earnings are coming in strong. 60% of companies reporting have beat Consensus estimates vs. the historical average of 46%.

We expect strong earnings for this year so you should Stay Invested.

Most stocks are popping on earnings release date. People were overly dour - and they really should not be.

As we’ve been saying repeatedly, this is Goldilocks.

Also, the corporate blackout period whereby firms cannot buy back their stock just ended.

That creates a bid in the market. (Still, you are a nutty CFO if you are buying at these levels.)

Lastly, GS notes that we have the “most postiioning and sentiment backdrop we have seen into Mag 7 prints in quite some time”.

Also, we have earnings from Meta and other tech leaders coming up. We expect Google, Meta, and Nvidia will do well.

The AI story is real and firms like Meta are already seeing a return on their AI spend from greater ad efficiency.

The primary issue is technical: investors looking at their charts will wait for a pull-back. I expect we’ll get a temporary buyer strikes.

Here’s an assortment or charts we’re looking at..

Kinder Morgan: A Midstream Energy Play

Vistra - A Leading Independent Power Producer

JP Morgan Bank

An area we believe may be overlooked? Coal stocks.

Trump indicated he wants to enable coal to power datacenters. Coal stocks have been left out in the… cold. More to come as we dig in.

US Growth Versus the World

There’s no doubt that US equity markets are the most desirable in the world.

Closed-end funds in Hong Kong and South Korea trade at a premium to NAV. People will pay more than something is worth to access the US.

Trump has an America First agenda. Elon, leader of Tesla, is at Mar a La Go. The whole world effectively went long the United States … leaving their home markets cheap.

Take a look at the Red and the Green this past Friday.

Obviously this represents only one day.

The general idea - when the crowd is all on one side of the boat, go the other way.

That doesn’t mean sell US equities - these are the best businesses in the world with secular growth. But, tactical adjustments are in order.

You do need to be conscious of how to trade dance partners though.

Take a look at China for example. It’s also at an elevated technical level.

When all assets are over-extended - the pair and the counter-pair (such as US vs. China) usually you get a pullback.

These aren’t certainties, it’s a probabilistic game. But, if you are playing poker, this is the time to play tight and fold on a lot of hands.

Incidentally, in China, over the last several weeks we picked up Tencent, PDD, and QFIN.

The story that is under-hyped is rapprochement. Trump wants to get on a plane and go to China and work out a deal.

The deal is something like ‘Stop Russia. Let us get Greenland. We’ll re-state One China Policy. And if you don’t, we’ll squeeze you at the Panama Canal and raise tariffs at a measured pace based on your behavior.

China US Relations

The most central geopolitical axis that matters in the world is US vs. China. In my view, Russia is essentially a vassal of China - relying on China to purchase it oil and equip it with semiconductors and other technology.

The difficult part of a detente is that China’s ROI on cybersecurity pacing is very high.

They have what appears to be a replica of the F-35 Joint Strike Fighter.

What you see on the headlines regarding China’s cybersecurity intrusions is a small fraction of what is taking place. The FBI has noted this is a significant and increasing threat.

It’s hard to imagine how the US and China can get into any kind of equilibrium if China won’t stop its aggressive cyber hacks on American companies, US government, and US. infrastructure.

Perhaps the best proposal is simply to let loose American hackers and do the same in reverse.

China is ahead of the U.S. in the following areas:

Battery: BYD has more efficient batteries than Tesla. China more generally has better EV technology as a result.

Nuclear: China has the know-how to build nuclear plants, the U.S. lost this decades ago.

Robotics: China’s robots put Boston Dynamics robots to shame. China is far ahead in robots.

AI: China is behind in AI. But, DeepSeek shows China can “fast follow” quickly and close the gaps.

Why not have an open policy of hacking Chinese companies and sharing non-dual US IP with the global public?

I don’t know if that is a serious idea or not - it’s just a conjecture around the issue of “What does a stable equilibrium look like that both sides can live with?”

DeepSeek

China has a hedge fund that incubated Deep Seek for $6 MM.

The LLM is as good as Open AI and yet they build it for $6 MM.

There are people on X that dispute this. But, the plans are fully open source (unlike, ahem “Open”AI.). Various firms have replicated aspects.

Intelligence is globally distributed.

What this means for the AI layer is bad news. AI LLMs are in a competitive slug fest.

In a November 2023 newsletter, we noted it is a mistake to bet on the “App Layer”. It’s the Search Engine wars all over again.

Remember Lycos, Alta Vista, and Excite?

The real winners are the picks and shovels players such as Nvidia.

What about the demand for CapEx? Won’t that decline?

In the near-term, no. The capacity planning and commitments are in place for the next 1 to 2 years.

And the urgency to be #1 means you are committing to spending a lot of capex dollars even if it is “inefficient” in another sense.

The goal of a hyperscalar like Microsoft, Meta, or Google is not “cost efficiency” - the goal is hegemony and market dominance.

They can’t risk having their business and the trillions in market cap disrupted.

The promise of AGI is too attractive to pass up. The game theory is “Spend, Spend, Spend”.

They are spending as responsibly as they can within certain limits. But, it is causing the stock price of players like Microsoft to lag considerably. (They raised prices on their software to help offset that.)

That said, if you are an OpenAI investor, you must be in panic mode.

A knock-off competitor just rivaled your model with a small dollar of investment. And now you need to fund your buy-in to the $500 Bn Stargate.

At the very least, OpenAI will face (i) dilution from further share issuance, and (ii) pricing pressure.

As Joe Weisenthal (Odd Lots) noted, the switching costs to DeepSeek are essentially zeo and it’s free. Plus you can see the Chain of Reasoning.

Also, the DeepSeek news should benefit Meta and Google. If LLM providers can develop a capable model with substantially lower costs AND they can lower their capex, then these cash generators will have lower expenses and higher profitability. In this scenario, Nvidia gets hurt and the hyperscalars benefit.

Note: This is not the base case — there is no intention for hyperscalars to slowdown their capex spending this point.

It’s just a possible scenario.

Inauguration Highlights

What do I expect from the Inauguration?

Animal Spirits will go up. We saw that on Tuesday when Lunar, Nuclear, and Space related stocks ramped higher as we predicted on Monday.

(Note: That’s a 1 day effect, don't chase it.)

In the real economy, here’s what we expect.

Consumer confidence. Higher.

Small business confidence. Higher.

Small business lending. Higher.

Beige Book. Better.

Trump dropped a heavy dose of Animal Spirits.

He talked about putting people on Mars and ushering in a Golden Age.

Unusually, millions of Americans had the day off and watched the inauguration.

The night before 25 MM Americans saw Trump’s pep rally live on X.

Trump mainlined Animal Spirits into the blood stream.

We wrote this on X on Monday:

That’s in part what led to this Peak Sentiment idea we are talking about.

We saw it shortly after the election as well.

Inauguration - Tariffs

Trump was light on tariff policy detail, there was mention of External Revenue Service.

People are still skeptical of Trump's tariff policies. We think that’s a bad read.

Although we disagree with the approach on tariffs (we prefer bilateral and reciprocal to pry open foreign markets), we recognize that Trump is serious about using tariffs as a revenue generator and instrument of foreign policy.

Legacy, Legacy, Legacy

Trump referenced Mount Rushmore, McKinley, Manifest Destiny.

This may come as a shock to you. But, I do believe he is gunning for a spot on that: ‘McKinley was a business man’.

His speech has concepts of salvation and mission wrapping his identity statement.

He cited American achievements: SpacEx rockets, railroads, and winning WW2.

His focus on releasing hostages on Inauguration day to the nose was called back to Regan.

Tesla

Trump cancelled a key $8K credit that would benefit Tesla.

That’s not good for Tesla or EV stocks. That’s a material impact to consumer demand.

The Vibecession Is Over

Something we come back to again and again…

Perception is reality.

Trump re-rearranged the number of electrons re-arranged, and just like that, meaning in the matrix shifted.

The matter and molecules are as before, except people relate to themselves and the world around them with more optimism.

It doesn’t matter who voted for whom.

Vibes and animal spirits are infectious.

GDP growth and the US consumer will exceed expectations this year once again (barring any geopolitical surprises).

Entering the Optimism Phase

Immediately after the Trump election, I made this video titled ‘the Age of Optimism’ with several predictions around what sectors would do well and how the Small Business Confidence survey.

Take a listen - our views then mirror to our views now, and you can see how those forecasts turned out.

Back then, the Trump Win was equivalent to about 100 bps in rate cuts.

We saw that in blockbuster job creation.

Stock prices. Small business confidence.

The Inauguration speech is equivalent to another 50 bps in rate cuts.

If you are still pessimistic on the US consumer or economy…

… check your premises.

Take a look at American Express results for instance:

Layer Zero is Psychology.

And it doesn’t matter whom you voted for. I’m not making a political comment, just calling balls and strikes.

Stay invested. (But mind the valuations.)

The Bubble in Quality is Deflating

Last year around this time, I noted that there is a group of stocks I call 'The Best & The Rest' that investors were gobbling up.

That theme did extraordinarily well. It includes businesses like Costco, Walmart, FICO, AXON, S&P Global, MSCI.

These are the classic Quality Compounders.

Stocks that you can own for a decade or more as they are seemingly monopolies that appear indestructible and have high ROE.

These are stocks that have "Quality" factor.

Buffett says you are supposed to own because of their moat, market leadership, and ability to re-invest and grow earnings.

It's hard to see how they can be disrupted in any way.

So, investors pay a higher valuation for them.

The most expensive of this group is experiencing a correction:

The cheapest in the group, names like Visa ( V ) which we highlighted as a buy a few months ago as a buy, are at All Time High.

One of the lessons here:

There is such a thing as paying too high a price for Quality.

"Price is what you pay, value is what you get"

Market

Mr Market is the captain now

Futures were indicated to gap up the went red after this CNBC headline about tariffs hit the market.

Futures re-bounded after the tariff risks appear kicked out at least a few weeks.

Trump is the first stock market President. He explicitly points to the S&P 500 nearly every in a way no other President has.

I’m not concerned of a policy mistake about tariffs because Mr Market will provide rapid feedback.

Think of the trade deficit this way…

The Trade Deficit measures how much capital & liquidity the rest of the world provided the United States.

The Trade Deficit measure of Trust and Confidence in the United States, and how the United States trusts… merchandise.

We get the real stuff, we sell bills with faces on them.

The U.S. imports real stuff (eg, cars, TVs, furniture, etc) and the U.S. exports IOUs called dollar backed bonds with Presidents faces on them.

There is an expression in banking…

If you owe the bank $1 MM dollars, you have a problem.

If you owe the bank $1 Bn dollars, the bank has a problem.

The Trade Accounts - due to its inverse and perfectly offsetting twin the Capital Account Surplus - exports US dollar denominated assets around the world.

It advances US dollar hegemony.

Softbank investing $100 Bn in the U.S. is what Americans get for buying Toyota cars from Japan.

That is an incredible deal.

Make The Trade Deficit Great Again.

Don’t apply untested word salad economic theories.

The trade deficit has grown alongside the economic boom starting in 1982.

Short Lived Trade Deficit Scare Tuesday Night

Magnificent 7

U.S. consumer

Just insane levels of strength in affluent U.S. consumer.

American Express consumer spending up NINE percent year-over-year for the fourth quarter

Up ELEVEN % for Travel & Entertainment (T&E)

Millennials & Gen Z up SIXTEEN %

For the whole year, up 7%. Very solid

Q4 2024 annual growth rate (9%) above Q4 2024 growth rate (7%) with inflation lower.

Loan growth is slowing down so this spending growth isn't coming from consumers running huge balances (i.e. they're paying it down)

Charge-offs and delinquencies remain below 2019 levels.

Major caveat: it's definitely a lot worse for consumers in the middle and low-income range. Capital One actually reported declining delinquencies (a good thing) but the real subprime credit companies haven't reported yet and will do so over the next few weeks.

AI

Open AI details $500B “Stargate” AI Infrastructure Project

OpenAI announced its role in Stargate, a $500B venture with $100B being deployed immediately.

Tech Collaborators: ARM, MSFT, NVDA, ORCL, & OpenAI

Partners: SoftBank (lead funder), Oracle, MGX, and OpenAI (operational lead).

Purpose: Build U.S.-based AI infrastructure to boost re-industrialization, strengthen national security, and create hundreds of thousands of jobs.

The project begins in Texas, with plans to expand. OpenAI noted Stargate is an extension of its partnership with Microsoft, while also deepening collaborations with NVIDIA and Oracle.

OpenAI says, "This will drive innovation in AI and AGI for humanity’s benefit."

Stargate is a great name but the $500b is a ridiculous number and no one should take it seriously unless SoftBank is going to sell all of their BABA and ARM.

SoftBank has $38b in cash, $142b in debt and generates $3ish billion in FCF per BBG. They own $143b in ARM and $18b in BABA. If they start selling ARM, their stake will be worth much less very quickly.

Oracle has $11b in cash, $88b in debt and generates $10b in FCF.

OpenAI is burning cash.

MGX did not commit to a number and is a $100b fund. Maybe 10% of the fund goes into this best case.

Nvidia will limit how much they invest in any one model company (they don’t need a monopsony). Maybe $5b.

Barring the aforementioned SoftBank ARM sale, might be able to put together $50b in equity funding over several years. Can obviously finance the GPUs and put debt on the JV.

Nowhere close to $500b. Everyone should just start issuing press releases for $1 trillion AI projects.

BTW love it that the ticker MGX which is a biotech company is up 33% on this.

If you a professional investor or analyst and you took $500b at face value - or even worse wrote a note about this - you should resign in disgrace.

Softbank, Startage and Tariffs

SoftBank wouldn’t have the US dollars to invest in Stargate without the trade deficit.

When Americans buy Japanese cars, they pay in US dollars.

Toyota then goes to the bank and converts the USD to Yen.

Someone must hold the USD.

Who buys the USD?

Anyone who wants (1) US exports or (2) US bonds or stocks.

More foreigners want American bonds Nd stock. (in fact, foreign demand is at a record high)

Softbank takes those dollars and buy US assets.

Those dollars must be put to productive use and they are only productive if they are used to buy US exports and assets.

That causes the Balance of Payments to net out to zero.

So, in a broader sense, there is no ‘deficit’ if you include the boomerang effect.

The boomerang is the Capital Asset Surplus - the bonds and stocks foreign investors purchase with those dollars.

The fallacy is to confuse part for whole.

In this way, the US Trade Deficit exports US dollars denominated assets and reserves around the world.

That advances US dollar hegemony.

And the trade deficit provides the liquidity for foreign investors to take the dollars received and turn around and buy stocks and bonds.

It creates more capital investment in the US.

It’s a beautiful virtuous circles, and Americans get the better end of the deal.

Americans get ‘real stuff’ today (eg, Toyota, Canon, etc.) and we sell Promises (eg, IOUs or projections to back stock sales) to foreigners.

Lastly, foreign purchases for US assets has been insatiable (see chart)

Foreign investors generate the capital & liquidity to bid up your stocks and back American entrepreneurs via ‘the trade deficit’

Automated Stock Trading

DeepSeek was incubated by a China based quant fund. Here’s some background.

As Featured In