Here’s a preview of what we’ll cover this week:

Macro: Retail Sales Surprise; Who pays for Tariffs;

Market: Banks Report Strong Earnings; TSMC shines

Recognition

The False Promise of 1%

If short-term rates go to 1%, here’s what to expect.

- A Repeat of Covid 2021 boom bust

- Another generation gets locked out of the housing market as long-end rates increase

- Massive bull market in small caps

- Cathie Wood stocks fly to Alpha Centauri

The United States has quasi-gracefully exited a regime of ultra low interest rates.

Countries like Japan that have experimented with unnaturally low rates have struggled to exit these regimes.

I believe the U.S. managed to transition from a low-rate to high-rate regime without a severe recession, because the action was paired with massive fiscal and immigration stimulus.

We can't afford to do that again.

Rates are perfectly fine where they are.

Higher rates also generate income for boomers who are spending on services.

Boomers don’t need a boom bust cycle and more entitlement spending.

Stock prices and Bitcoin are near all time highs.

Non Farm payrolls are beating again, and again and again.

Corporate earnings are strong.

Only commercial real estate needs rate cuts, and those stocks are rallying as C&I loans increase too!

Macro

We’re sitting near all-time highs on the S&P and Nasdaq, and yet sentiment hasn’t blown out.

Both AAII and Investors Intelligence bull–bear ratios have rebounded, but they’re sitting close to long-term averages.

That’s a good place to be. We want to see optimistic positioning, but not mania.

There’s still room for markets to move higher without triggering extreme sentiment signals.

Notably, we have monthly options expiration today. That coincides with weak negative seasonality for a week or so.

We believe the same will take place here given how certain names like Robinhood and Coinbase are extended.

Retail Sales Surprise

Retail sales came in strong, surprising to the upside.

We continue to believe consumer discretionary names will outperform. Norwegian Cruise Lines is one expression here, but there are plenty of others.

The airlines reported this week and also exceeded expectations.

Drilling into the data, store retailers and motor vehicle & parts dealers showed the most meaningful deltas. This aligns with what we've been seeing on the ground.

Many investors had left retail-indexed names for dead, but that narrative is increasingly disconnected from price action.

They reflect a broader rotation back into ignored, under-owned discretionary names.

The 'left for dead' ignored bucket can continue to do well.

That’s the bucket we’ve been focused on, and it’s exactly where we found Norwegian Cruise Lines (NCLH).

I flagged NCLH weeks ago, both qualitatively and quantitatively, and the name has continued to outperform.

Forward P/E is still just 10.9x.

The stock was up 2.8% yesterday alone. We believe if you compare it to RCL or CCL, there’s significant upside over a 12- to 24-month horizon.

Watch our video breakdown on NCLH here.

Who Pays for Tariffs? U.S. Small business and Consumers

We continue to see mounting evidence that tariffs are falling on U.S. consumers, not overseas producers.

Let’s take the case of China:

The effective tariff rate rose from 11% in January to 48.2% by May (per the U.S. International Trade Commission).

If you model a hypothetical U.S. buyer importing $100 of goods monthly from China, the data shows that 95% of the increased cost is passed directly to the importer, only 5% is being "eaten" by Chinese producers.

Despite rising tariffs, the import price index dropped just 2%, even as tariffs increased by 37 percentage points.

Germany tells a similar story.

Even with a relatively low tariff burden (around 11%), import prices have continued to rise.

In practice, tariffs are a wealth transfer from small and mid-sized businesses, who lack scale to pass costs on or re-factor supply chains, to large, publicly traded firms.

Big-box retailers, multinationals, and commodity processors are better positioned to absorb or shift costs.

Main Street - especially low-income retirees - will face a double whammy from (i) higher tariffs and (ii) lower income from Treasuries.

(We don’t see how it’s actionable from an investment perspective.)

Market

Banks Report Strong Earnings

Big banks posted solid results reinforcing our thesis that there is no recession.

JPMorgan, Bank of America, Wells Fargo, and Citi all reported this week.

We continue to like Financials as an overweight given the backdrop of regulatory relief and strong consumer and corporate balance sheets.

Jamie Dimon, CEO JP Morgan, emphasized the resilient U.S. consumer, albeit with caution: “The U.S. economy continues to be resilient … but the storm clouds remain on the horizon.”

Brian Moynihan, CEO BAC, highlights consumers are back with their trust in the economy, with BAC’s average deposit rising to over $9,200.

However, Moynihan pointed out, “We’re being careful... we still have unemployment predicted to go up in most of the surveys we look at,”

Nonetheless, he showed optimism around AI implementation for expansion and cost reduction. "We are beginning to see the impacts of AI, again, aiding our efficiency,"

Here is the link to his earnings discussion with Bloomberg.

Meanwhile, one of the bullish signals this earnings season: credit growth is accelerating, and not from stretched consumers.

JPMorgan, Wells Fargo, and Citi all showed meaningful pickup in loan activity in Q2.

Commercial and industrial (C&I) lending ramped to an 11% annualized pace, the strongest growth since early 2022.

This is capex-driven lending, signaling that businesses are grabbing liquidity to fund growth and inventory ahead of potential cost inflation.

Taiwan Semiconductor Shines

TSMC reported strong Q2 2025 numbers with an EPS beat [~60% YoY growth, in local currency] and Revenue beat [~39% YoY growth, in local currency]

It also beat the management midpoint guidance across all metrics, despite the unfavorable foreign exchange rate.

The High-Performance Chip [HPC] segment saw a 14% QoQ growth.

HPCs contributed to 60% of Q2 revenue, signalling strong AI and data center chip demand [Where order backlogs remain strong as usual], reflecting a boost in cloud and enterprise tech industries.

The Smartphone segment rose 7%, accounting for 27% of revenue, which still shows growth in mobile device and app ecosystem markets.

The Automotive segment however remained flat at 5% of revenue. Indicating stable but slower growth for electric vehicle and autonomous driving chip markets - This also shows how the consumer is not actually pouncing on EVs yet.

Source: TSM Q2 2025 Earnings Presentation

TSMC’s 60%+ global foundry market share makes it a critical enabler of AI, smartphone, and automotive industry innovation.

We have made consistent calls on TSMC being absurdly mispriced in the past. Here’s Lumida Ledger’s June 15th Edition:

Link to the Newsletter

We had made our initial call on TSMC in May 2025 when it was trading at a 15.3x forward PE.

We eventually increased our position till it was up to being the second largest and made our next call on June 15th, when TSMC traded at a 16.9x forward PE.

Today, the stock is trading at 19.7x forward PE. The 3-month return is ~60%.

And, we do not have any plans to sell.

TSMC dominates AI chip manufacturing, leveraging advanced technology and strong customer relationships with market leaders like Nvidia, Apple, and AMD.

With the stellar Q2 results and raised guidance in Q3 reflecting a 39-41% YoY revenue growth, the company has proven its ability to consistently generate strong profits demonstrates its economies of scale, cost efficiency, and pricing power due to its leadership position in chip manufacturing.

Wins and Misses

Ethereum has quietly taken leadership in the crypto space.

We highlighted ETH’s setup on Twitter, just before Tom Lee and other institutional strategists began pounding the table.

Our thesis was simple:

ETH’s storytelling has been terrible despite its capabilities around tokenization and decentralized compute.

It was deeply discounted, regulatory overhang was lifted, and the ETH/BTC ratio was setting up for a bounce.

That’s now playing out, and there’s still room for ETH BTC to run.

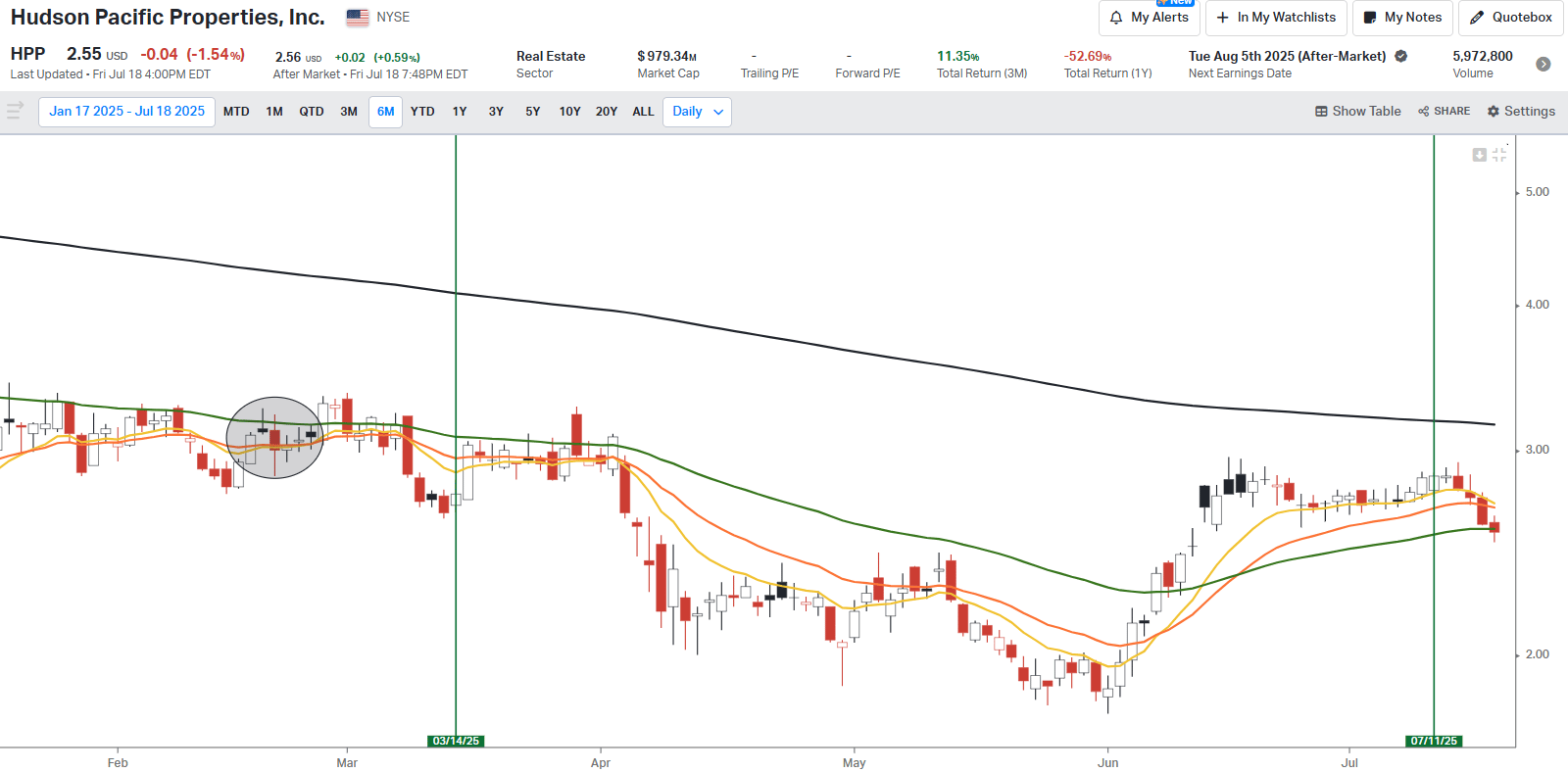

But, a decision where we went wrong was HPP.

With its 200 million market cap, and $2 billion book value, it had high intrinsic value. Increases in Office leasing volumes also added to our optimistic outlook.

However, the recent decision to offer 134.53 million public shares at a price lower than book value, leads to price dilution. We believe it's the right time to exit the trade despite the loss.

The interesting thing is - maybe HPP rallies after it issues the shares due to reduction of left-tail risk from a stronger balance sheet? This is what makes investing hard.

Meme of the week

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In