Here’s a preview of what we’ll cover this week:

Macro: The Problem of Central Banking, Early Signs of Soft Survey Data Impacting Hard Data, Why oil prices are down, and gas prices are up?

Leading Indicators: Container Traffic, Onlyfans VS Miniskirt indicator

China: How to Handle China

AI: DeepSeek R2 Leak

Lumida in Spotlight

Milk Road

Ram was interviewed on the Milk Road podcast this weekend.

Will Trump Drop Tariffs to Save the Economy? with Ram Ahluwalia, Lumida Wealth

Link to the full episode here.

Olivon Advisors Conference

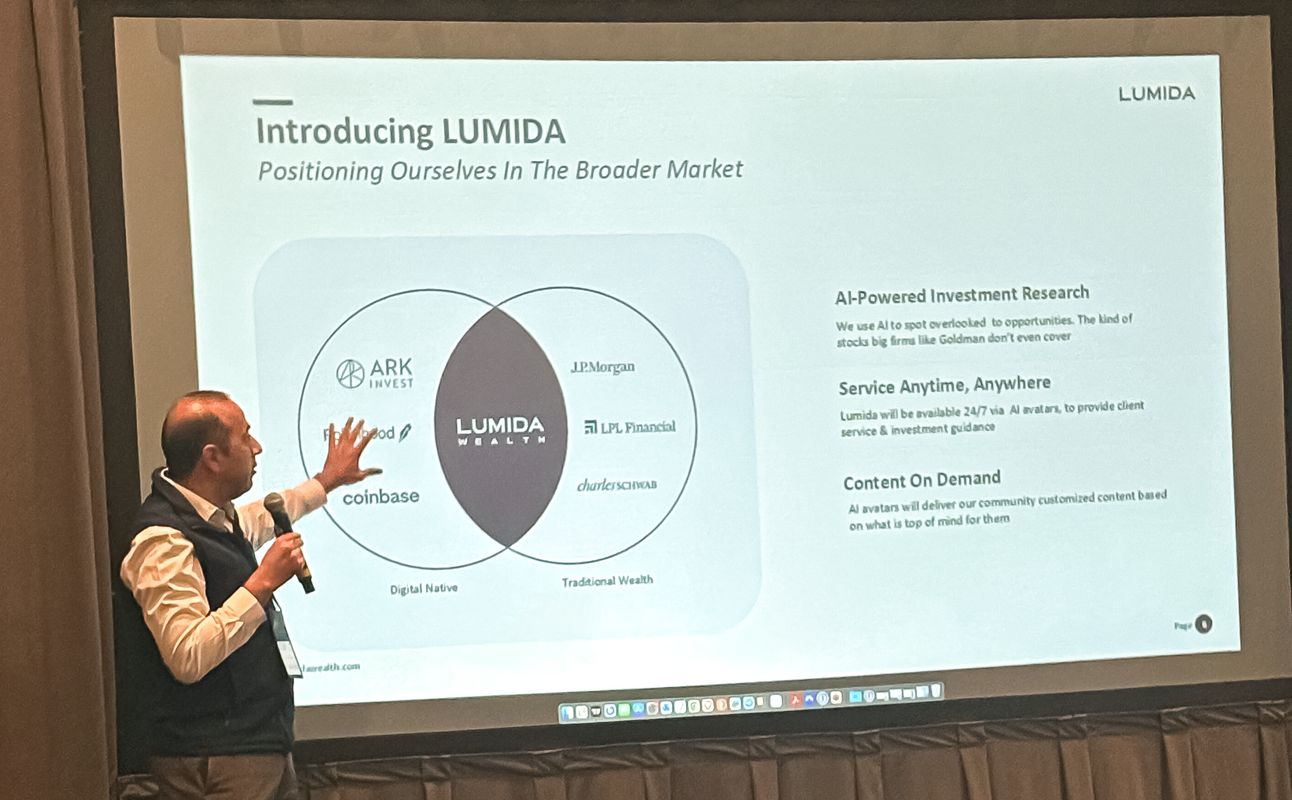

This week, we had the opportunity to attend the Olivon Advisors conference in Austin to showcase our services.

If you're interested in learning more, feel free to reach out to Marc at [email protected].

Macro

We are living thru historic times.

The level of sustained market volatility we have seen in the last two months is consistent with the type of volatility seen in Covid and the 2008 crisis.

Except this time, we have neither a global pandemic nor worthless subprime CDOs stuffing bank balance sheets.

What’s more – the real economy – as measured by various “current conditions” and disinflation trends is in good shape!

One measure that must distinguish humans from animals is the ability to imagine - things are great but humans are concerned about the proverbial asteroid of tariffs coming for the American economy.

That’s not quite the right metaphor though. Because the asteroid is in a state of superposition.

The tariffs might or might be severe. It might not even be there. And it might be expanding or contracting based on the latest Trump comment.

At the same time, you see unusual call option buying ahead of major policy announcements that would make Nancy Pelosi blush.

The shelf life of any view is measured in days.

On Monday, we started bearish we had broad evidence of a capitulation low around 3:30pm ET.

We noted this in our telegram group.

Then we had 4 back-to-back days of rallies on White House newsflow that, on balance, was positive.

The WH also put a leash on Lutnick, and they wheeled out Secretary Bessent who has a better track record at lifting markets – although we think his credibility is coming into question due to the incessant vacillation of American policy objectives.

It helps to zoom out and look at first principles.

We are watching what Turmp says very closely, each day. You have to in this environment.

Trump’s economic philosophy is centered on this mistaken belief that American are screwed by other countries and the European Union and Canada.

Nevermind that the standard of living as measured by Per Capita GDP for the United States has gone up 20% whereas Canada is a standstill. Europe is falling behind. China is in deflation - and exporting deflation - which would help improve real incomes.

Secretary Bessnet in his Tucker Carlson interview referenced Ronald Regan’s first term. He noted that Regan’s policies were not popular initially - but that Regan went on to win re-election in a landslide.

It seems that the Trump White House believes that what they are doing is legitimately good policy, and it is not.

The scope and definition of national security has broadened to include refrigerators and Nike sneakers. It’s a kabuki theater of the absurd.

We continue to see distance between Bessent and all other members of the White House.

Bessent’s message this Wednesday was conciliatory. He threw out an olive branch to the European Union. We did a livestream breakdown of his messaging here.

Bessent has a reform message for the IMF and World Bank – focus less on DEI and ESG and get back to your core mission. (That makes sense.)

Trump’s message is that the European Union was formed to “take advantage” of the United States. The message is adversarial not conciliatory. And it’s impacting foreigners demand for US products, services, and assets.

I spoke to a VC friend in Canada. He noted that Canadians are not buying American products on the store shelves. It’s not top-down policy. It’s bottoms-up national pride.

Relatedly, it’s remarkable to see how the Conservative party - polling at 90% after the Trump election win - is now set to lose in a landslide.

It’s hard to see how these behaviors reverse quickly.

The binding constraint to Trump’s Tariff policy are (i) political fortunes and (ii) market risk.

On the former, Trump does respond to polls (it seems) and these tariffs are unpopular. It’s also hitting his approval ratings which are at the lowest ever for any President in their first 100 days.

Market risk is another factor. The rising ten-year - despite a market risk off environment - seems to have activated the Trump put.

Trump probably does not want to see stock prices drop below his “buy stocks” call either.

The higher stock prices, the more aggressive we expect Trump will be on tariffs. The lower stock prices, the more reserved he will be. That’s a recipe for continued volatility.

We increased our exposure to ten-year bonds this week - accumulating at the 4.3% to 4.4% range – these seem like a no-brainer when you have a policy mix that will lower nominal US GDP growth. The ten-year is a good proxy for long-run growth expectations.

Although tariffs are inflationary, if they are steep, then the initial spurt would cause a demand shock that would hurt inflation and jobs.

At the same time, there are quality names out there that are generally immune from tariffs. Name in large cap tech - Meta, Google, Nvidia - and healthcare names where we see value. There are also names in telecommunications.

Our approach is to scoop up bargains when we see them, but remain nimble.

There are bargains today that in one years time should generate attractive returns. You need to hold your nose. Another example of a buy along these lines was buying pharma leader Merck.

Why did markets rally this week?

We believe the answer has to do with the VIX decay.

Volatility is melting.

Markets experienced extremely high reading for the volatility index. As the volatility index comes down that creates a mechanical bid for assets.

It’s like warm air lifting asset prices.

Investors chose to ‘sell volatility’ which contributes to the volatility decay. Part of that selling of volatility may be driven by the fact that Bessent at a JP Morgan event on Tuesday indicated that the current tariff war with China was unsustainable.

In the short run, we are seeing market pricing driven significantly by flows and these technical factors. However, we are seeing fundamentals express themselves on earnings day.

For example, we bought Comcast (CMCSA) the day they reported. The stock initially was down several points but then closed higher 2 days later nearly 10% – a common pattern we are noticing (see Wells Fargo for example).

We are seeing signs of select names in stocks that are attractively priced.

We are also seeing ‘animal spirits buying’ popular retail trading stocks. In fact, we continue to see retail traders buy the dip.

Institutions appear to be on the sideline as market liquidity remains thin. (We see small cap stocks we’d like to buy with P/CF ratios of 1x and dividends but cannot buy due to near zero liquidity).

We expect tech earnings this coming week will be strong - just like Google - and that can create a bid for equities.

However, we do think there is an air pocket on Monday before these firms report.

4 back to back up 1% days for the Nasdaq usually precedes market weakness.

Further, when we look around the world, we see developed market indices in Europe recovering to all-time highs…despite a weakening fundamental backdrop.

We view the recovery to ATHs as driven by technical flows and global investor re-positioning.

We haven’t yet seen a large red bar indicating the move is done – but those markets are overbought.

It’s hard to see how France gets to ATHs when the luxury demand bid is in retreat.

Container Traffic Has Slowed Shortly

The American economy is primarily services driven rather than manufacturing. That’s a good thing - it means it takes a lot more to induce a recession when healthcare, financial services and other service sectors are larger part of the economy.

It’s notable that trucking freight indicators are negative. Trucking is a leading indicator for the economy, along with other measures such as Dry Bulk Shipping.

(These indicators gave false recession signals in Q4 ‘22 - because the U.S. economy is more services and not manufacturing / good oriented.)

The remarkable feature about all of this is that Current Economic conditions are fine!

There are signs of a slowing growth, but we’re not in recession yet.

This is why we view the current policy mix will be one of the biggest self-owns of economic policy in decades should the administration choose not to pivot.

We see business leaders like Citadel’s Griffen call out the issues with tariff policy that we’ve been noting for several months now.

Has the US Isolated Itself?

We do believe the United States has overplayed its hand.

Further, Japan - a longtime historical adversary of China (see Manchuria WWII) has said they will not participate in a bloc that isolates China.

China is reaching out to Europe - and Europe is taking the phone call.

Germany is entering its third year of recession. Wage growth is stagnant.

Europe needs China to keep prices low.

A bloc that isolates China actually makes sense. This is the Bessent plan – too late for that now given the goodwill destruction among American allies.

Trust takes decades to grow and diminishes quickly.

Gold, Swiss Frances, and Japanese Yen are now benefiting from ‘flight to safety’ rather than US bonds.

You have to go back to the Carter administration to see this kind of market behavior.

Foreign leaders don't like Trump.

Other countries are playing 'wait and see' and inflicting a steep political price on Trump.

In fact, I would wager the finance ministers are all talking to each other on Signal group and passing newspaper headlines around.

Japan and China are all slow walking negotiations.

It's in the best interest of other countries to force Trump to fold isn't it?

They see this as a point of maximum leverage.

These countries also see their market caps outperforming.

Why would they pivot?

Trump this week noted that the U.S. has trade talks with China.

China denied that. Twice.

Xi Jinping, unlike his predecessors, prioritizes his political self-interest over growing prosperity for his people.

He can outlast Trump. China got thru a pandemic. They are gaining in relevance to Europe.

Their stock market is outpacing the United States. Although China has plenty of long-term structural macro issues, China has a better hand to play than Trump.

If Trump stays the course, thinly capitalized small businesses that import - and generally vote Republican - will get liquidated.

The Problem of Central Banking

The easiest way to ensure a bear market is to eliminate Fed Independence.

Trump comforted markets and said he won’t do that – that created a strong rally off the lows.

Central banking is one of civilization's oldest problems.

How to offer the public sound money with accountability and oversight?

While, at the same time, protecting against abuse of oversight that leads to excess money creation?

There's no real good answer to this...

The idea that Fed Governors have terms appointed by an elected President is a solid middle ground.

The idea that elected Senators have staggered terms and vet nominees is another mechanism.

I've been a vocal critic of the Fed arounds it QE policy and stifling bank innovation, faulty bank supervision and more (and I'll link to an example below).

But, undermining Fed independence is a step backwards.

We can't have short-term interest rates subject to the whim of a twitter post, or as a band aid for bad tariff policy.

The consequence of undermining Fed independence: (i) already heightened inflation expectations start to anchor, (ii) long-term interest rates increase, (iii) USD dollar would decrease.

All of this is negative for asset prices, household wealth, raise the financing cost of capex investment, and the ability for the US to finance its debt.

Eliminating Powell would be the second biggest own goal after FAFO global trade war.

Also, the mere discussion of such a possibility creates a 'risk premium' that markets must discount.

Markets need to incorporate the material non-zero probability of an ouster of Powell.

Between tariffs and Fed independence, markets are going to struggle.

In the meantime, consumers and CEOs are 'frozen' as they await greater clarity on tariffs.

That will lower velocity of money and hurt incomes.

Trump really needs to do an about face immediately.

A timely intervention soon would have a dramatic impact.

So, the likelihood of the economy is headed towards a recession sadly is increasing.

However, his comments over the weekend that Tariffs can replace an income tax and Japan's walking away from a deal, and Europe cozing up to China, and China demanding 'respect' -- well, none of this is pointing in the right direction.

The probability we are in a bear market induced by policy is high.

Relatedly, I had a convo with a savvy money manager in Europe the other other day.

His view is this.

"We view these tariffs as a domestic American problem.

You have put taxes on your people.

Now you want us to present you an offer.

You are hurting your own economy. And it is puzzling that you want us to present you an offer.

Why should we respond by taxing our own citizens?"

Onlyfans VS Miniskirt indicator

Back in the day, there was the Lipstick Indicator.

The lipstick indicator is a theory that says during periods of economic uncertainty or recession, consumers tend to purchase small, affordable luxury items, such as lipstick, instead of overpriced Hermes handbags.

The term was coined by Leonard Lauder, chairman emeritus of Estée Lauder.

There is also the Hemline Indicator aka Miniskirt Indicator.

The hemline index is a theory that suggests that hemlines rise or fall along with stock prices.

The most common version of the theory is that skirt lengths get shorter in good economic times (1920s, 1960s) and longer in bad, such as after the 1929 Wall Street crash.

Today, OnlyFans and 0DTE has disrupted both indicators.

How to Handle China

First, China continues to hack American IP at significant scale.

It's hard to get to a stable equilibrium.

China has an edge in batteries, solar, EVs, nuclear and drones.

Why not adopt a policy where the United States opens up China to hacking.

Then any IP is shared open-sourced to the public.

At least you get to an equilibrium

Second, authorize StarLink to provide free uncensored Wi Fi to all of its citizens.

Offer a modern version of Voice for America.

Food for thought.

Early Signs of Soft Survey Data Impacting Hard Data

Soft survey data is now translating to weak hard data.

Cargo container rates and trucking freight - two leading indicators - are dropping to Covid levels.

China said this morning there are no trade talks with the U.S. — directly contradicting what Trump said last night.

Markets are built on trust.

Institutions already pulled back - as shown in thin market liquidity and rallies marked by animal spirits names only.

As I noted last week, it’s clear major trading partners are slow walking negotiations.

and why shouldn’t they?

The know tariffs are self inflicted economic damage; the bargaining leverage is with the rest of the world.

The United States is poking itself in the eye with a pen and then demanding other nations ‘make an offer’.

The leverage other nations have shows in the stock prices of international markets vs the United States.

It also shows in the value of the dollar declining.

The main difference is you have a policy malotov cocktail that is hostile to earnings, inflation, and employment.

Why oil prices are down, and gas prices are up?

Gasoline prices are up 5% over the last 4 month.

I spoke to someone who grew up in the Oil & Gas industry and is based out of Alberta.

He pointed out that the American refineries in the Midwest are entrained on Canadian heavy crude oil.

Canadian crude oil is cheaper than, say, Western Texas Intermediate (WTI) oil.

Midwest refineries, particularly in states like Illinois, Oklahoma, and Texas, rely heavily on Canadian heavy crude (e.g., from Alberta’s oil sands), transported via pipelines like Keystone.

Canadian crude oil is thicker and requires specialized refining processes, which limits flexibility to switch to lighter crudes like Brent Sweet Crude or WTI.

Net net, the refineries are passing the cost on to the consumer holding other factors equal.

So your gas prices are higher from tariffs despite higher energy production.

Alphabet Inc. (GOOGL) - Q1 FY25 Earnings Highlights

Alphabet’s earnings, reported April 24, showcase a strong core business, with revenue beating expectations.

Alphabet’s earnings benefitted from a mark-to-market increase in the valuation of SpaceX.

If you strip that out, you have a business growing earnings in the low-teens on a PE multiple of 18x. The cloud business is where you want to focus - that business continues to grow at a nice rate of 28% YoY.

Overall, we continue to like Google. The name has a growing cloud business and is the leader in driverless cars. (Tesla still has zero passengers despite talking about this for years). Google also has a leadership position in the attention economy with Youtube.

There’s a lot of fear around whether Google can survive the rise of AI. However, the top searches on Google are not really around AI type queries. And Google, although slow off the starting line, has built Gemini into a potential leader.

People forget that the real prize in AI is ‘Personal Assistant AI’. Google has the content, the distribution, the email and form factors to have a real shot of winning this.

OpenAI doesn’t have an email client. Isnt’ that tablestakes?

The reported net income and EPS were significantly boosted by an $8 billion unrealized gain from its SpaceX investment.

But even without it, adjusted net income and EPS still beat consensus.

Lets look at the performance in-depth.

Earnings Overview:

Revenue: $90.23 billion, up 12% year-over-year from $80.5 billion, beating the $89.12 billion expected by $1.11 billion.

Net Income (Reported): $34.54 billion, up 46% from $23.66 billion in Q1 2024.

EPS (Reported): $2.81, up 49% from $1.89 YoY, beating the $2.01 expected by $0.80.

Net Income (Excluding SpaceX Gain): $34.54 billion - $8 billion = $26.54 billion, up 12.2% from $23.66 billion in Q1 2024.

EPS (Excluding SpaceX Gain): $2.27 (adjusted EPS, as reported), up 20.1% from $1.89 YoY, still beating the $2.01 expected by $0.26.

Key Metrics:

Google Search revenue up 10% to $50.7 billion

YouTube ad revenue at $8.93 billion, slightly below $8.97 billion expected; Google Cloud revenue up 28% to $12.26 billion, just under $12.31 billion expected; operating margin at 34%, up 2 points.

Performance Analysis:

With SpaceX Gain: The reported net income of $34.54 billion reflects a 46% year-over-year increase, and EPS of $2.81 shows a 49% jump, both heavily boosted by the $8 billion unrealized gain from SpaceX. This gain, tied to SpaceX’s valuation rising to $350 billion in December 2024, accounts for about 23% of the net income, inflating the headline figures.

Without SpaceX Gain: Excluding the $8 billion, net income drops to $26.54 billion, a more modest 12.2% growth from $23.66 billion in Q1 2024. The adjusted EPS of $2.27 still reflects a solid 20.1% increase from $1.89, beating expectations by $0.26. This growth aligns closely with the 12% revenue increase, showing that the core business—driven by Search, Cloud, and subscriptions—remains healthy but not as explosive as the headline numbers suggest.

Insights: The $8 billion gain masks the true organic growth rate. Without it, net income growth (12.2%) mirrors revenue growth (12%), indicating stable but not spectacular profitability improvements. The operating margin of 34% (up 2 points) and Cloud’s 28% revenue growth highlight operational strength, but the SpaceX gain creates a distorted perception of Alphabet’s earnings power in Q1.

Management Quotes:

“We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this growth is our unique full stack approach to AI.” Sundar Pichai, CEO

“What has not changed is the core business momentum that we brought from 2024 into 2025… I mentioned the $370 million of servicing fee sales over the last four quarters.” Anat Ashkenazi, CFO

Insights on Consumer Trends:

Digital ad demand remains robust, with Search revenue up 10% to $50.7 billion and total ad revenue at $66.89 billion (up 8.5%), showing businesses in finance, retail, and travel are still investing heavily in Google’s ad platform despite tariff headwinds, a trend likely persisting into late April 2025.

Subscriptions surpassed 270 million, driven by YouTube and Google One, reflecting consumers’ growing reliance on digital services for entertainment and storage. AI Overviews, with 1.5 billion monthly users, signals strong engagement with AI-enhanced search, suggesting consumers are adapting to AI tools even in a volatile economic climate.

AI

DeepSeek R2 Leak

Meme of the week

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In