Here’s a preview of what we’ll cover this week:

Macro: The Goldilocks Economy, Trade Deficits Explained, American Exceptionalism Continues, What happens after a strong US Dollar Rally?, International P/E vs USA P/E

Markets & Psychology: What to Expect in Q1: A Pullback and Rebalancing, Momentum, Rotation to Value, Sector Insights: Healthcare and Semiconductors, Why semis are lagging, Korea’s stock market, Bezor has buyers remorse over wapo deal?

Company Earnings: Geopolitical Risks to U.S. Tech Companies

AI: AI and the Next Wave of Innovation

Bits + Bips Podcast

Ram is a new co-host for the Bits + Bips podcast.

Have a listen here.

Macro

Macro: Trade Deficits Explained

MACRO: Trade Deficits The last time the US had a trade surplus was 1975.

The late 70s was terrible for the US economy and markets.

It was also marked by stagflation and malaise.

Since then, the US has had 5 decades of trade deficits.

Trade deficits are a sign that the world wants to extend American business credit and finance growth. The trade deficit is exactly matched and offset by the 'capital account surplus'. But, no one complains about the 'capital account surplus'.

A trade surplus, which is equivalent to a capital account deficit, would occur if Americans were investing abroad, in say, China or Europe.

But the reality is the United States has the best set of investment opportunities globally, better capital markets, higher productivity growth and a culture of entrepreneurship. So the world is 'banking' (e.g., financing) the United States and selling their stuff to us for cheap to have the privilege of buying our stocks and bonds.

The 'capital account surplus' exactly offsets the trade deficit. It is a mathematical identity in the balance of payments. This is the part that trade deficit hawks miss. The real economic issue to focus on is the Rise of Robots.

Consumers earn income and spend income. Robots don't. As robots displace workers, you're going to see less consumer spending. That automatically will reduce the trade deficit, and it won't feel good.

In fact, it will widen the gap between owners of capital (e.g., robots) and providers of labor.

If you want to better understand these ideas - copy paste this post into GPT and ask 'explain the balance of payments to me'. Mind boggling that the public discourse is distracted by trade deficit and not focused on what truly matters.

China is envious of the US Trade deficit.

Meanwhile, they have double digit youth unemployment and a bunch of goods that no one wants and investors that are fleeing their capital markets

China has a Trade Surplus. Do you want to be China’s banker, or do you want the world clamoring for American investments?

Do you really want to trade positions?

American Exceptionalism Continues

Others are catching on to the US productivity growth story, a theme we’ve focused on since the beginning of the year.

What happens after a strong US Dollar Rally?

Comparing major advanced economies' productivity to that of U.S., all have seen declines over past couple decades

International P/E vs USA P/E

International P/E vs USA P/E has fallen off a cliff

Macro Context: The Goldilocks Economy

Despite signs of exuberance, the macro backdrop remains supportive of a strong bull market. Friday’s nonfarm payrolls report exceeded expectations, reinforcing the narrative of robust employment. While Thursday’s initial claims missed, sparking a minor sell-off, the Friday rally erased any doubts.

This is the essence of a Goldilocks economic setup: strong growth, low inflation, and monetary policy that remains accommodative.

Even as this narrative becomes consensus, the market continues to climb.

However, markets love to humble complacent bulls. Investors must stay vigilant for shifts in sentiment or a decisive technical break.

As Keynes famously warned, “Markets can remain irrational longer than you can remain solvent.” Stick with the trend until the evidence demands otherwise.

Markets & Psychology

The Forces Driving Markets: Momentum and Mean Reversion

The two dominant forces shaping financial markets are momentum and mean reversion. Momentum reflects the psychology of the crowd, driving prices higher in short bursts fueled by optimism and speculation.

Mean reversion, by contrast, acts like gravity, pulling valuations back to intrinsic levels. Together, these forces dictate market cycles.

These forces are supported by fundamentals such as earnings growth and disinflation. The trend around long-term earnings growth is human psychology.

Ever since the Fed cut rates, we’ve seen a strong rotation into growth stocks, particularly those driven by animal spirits—speculative names like Tesla, Coinbase, and Square.

These "animal spirit" stocks thrive on concentrated bursts of price action but often bleed interest and value during quieter periods.

Bitcoin is a good example of that.

The optimism surrounding Trump’s election win further supercharged this trend, igniting a shift from value to growth stocks.

However, momentum does not last indefinitely. Markets will always oscillate between exuberance and sobriety.

For now, momentum prevails, particularly in our portfolio’s core holdings like Applovin, Celestica, Flex, and Dave. We have our favored momentum picks.

Here’s a few of those charts. Our investment in Applovin is now a 4-bagger in less than 6 months.

Here’s Dave. We wrote about Dave in January of this past year and bought back in just ahead of their recent earnings. We think Dave can continue to run more than other momentum names as it is still cheaper than its FinTech lending peer group.

But as the year ends, mean reversion should come into focused.

We should expect to see opportunities created in names battered by tax-loss selling.

Tankers and energy services companies are a good example of that.

Here’s Valaris for example - although you could pull up Tidewater, Schlumberger, Haliburton or plenty of others.

Notice the name is in the throes of capitualtion.

We bought this name where you see those two green lines. And then when the name didn’t work out as we expected it to we sold at that red vertical line.

This is a good example of active management. Not all of our ideas will work out. We were too early here. But we were able to get out and break even and get a tax loss harvest.

Another good case-study is Regeneron. A few months ago we wrote how we bought REGN. We added a green line to show where we entered, and a red line to show an exit.

Notice the name fell below the 200 DMA and was accelerating. We exited and took a small loss and avoided a much larger loss.

And we bought back in last week. We’ll see how it goes.

But, the general point is that if you can address left tail risks quickly, while identifying good entry points, and expose your portfolio to asymmetric opportunities with right tail rewards we believe you can do very well.

I share those examples - two winners and two losers - to show that investing is not about ‘being right’.

As my friend and hedge fund manager Neal Berger tells me: “Would you rather be right, or make money?”

Yes, you want to have a disciplined approach and have views. But, if the market is working the way you expect it to then you may be too early or wrong. You need to put ego aside and risk manage.

We’re looking forward to sharing our performance with you at year-end and will get a 3rd party auditor firm because we are very proud of those results.

Incidentally, if you’d like to establish a relationship with us and tax about tax mitigation please reach out to [email protected].

Here is a nice testimonial from one of our clients Kevin Churko. Kevin signed up with us in the late Spring.

He is beating the S&P 500 and hasn’t even had a full year of exposure.

What to Expect in Q1: A Pullback and Rebalancing

Looking ahead to Q1, I expect a pattern similar to last year: an initial pullback or correction.

Investors sitting on significant capital gains will aim to rebalance their portfolios but delay action until January to defer taxes.

By rebalancing in January instead of December, they extend their tax payment deadline by 15 months, a meaningful incentive.

This phenomenon could lead to a temporary front-running effect, especially in digital assets. Additionally, stocks that underperformed in 2023—despite earnings growth—could rally as tax-loss selling subsides. A prime example is tanker stocks, which have endured bear markets despite solid fundamentals. Emergin markets - Brazil, Mexico, China could also do well - but it’s too early in our view.

Take a look at Mexico for example, a category we’re watching closely given Trump’s focus on tariffs.

We’d rather be a seller here than a buyer.

Mexico ETF (EWW):

As mean reversion takes hold, international value names may stage a recovery. Need to be patient and wait.

Momentum and Market Psychology

Investor sentiment often gets ahead of itself during periods of optimism.

This is exactly what we’re seeing now: the Fed is cutting rates, employment is at all-time highs, credit spreads are low, and stock indices are reaching record levels. Markets reflect this euphoria, particularly in sectors driven by retail buying.

However, when investor sentiment becomes excessively bullish, markets tend to correct. For example, last year’s November-December rally gave way to a January pullback in growth stocks.

This symmetry could repeat, as enthusiasm eventually hits its natural limits.

You can also see the ‘hopeful optimism’ appear in consumer confidence surveys.

The economy is going to do just fine next year.

Rotation to Value: Watching the Rubber Band Stretch

While US momentum names dominate, opportunities are emerging in international value. China, Mexico, Brazil, and UK energy companies look increasingly attractive, even as they lag US peers.

These undervalued assets may continue to get cheaper, stretching the metaphorical rubber band.

Eventually, the forces of mean reversion will prevail, allowing value stocks to outperform growth. There’s no need to time it. We are maintaining our overweight US exposure and ‘waiting for the turn’.

Sector Insights: Healthcare and Semiconductors

We’ve made tactical adjustments in our sector exposures. For example, we reduced our healthcare allocation following the assassination of UnitedHealth’s CEO, which triggered bearish sentiment and bearish options activity. Medicare and Medicaid cost-cutting under the new administration could pressure insurers, although generics like Teva may benefit.

Meanwhile, the semiconductor sector lags due to geopolitical tensions. Trump's comments about Taiwan’s defense investments introduced uncertainty, weighing on sentiment.

These developments underscore the psychological underpinnings of market movements. Eventually, this will create bargains, and we look forward to selectively adding high-quality names in these sectors.

Mag 7

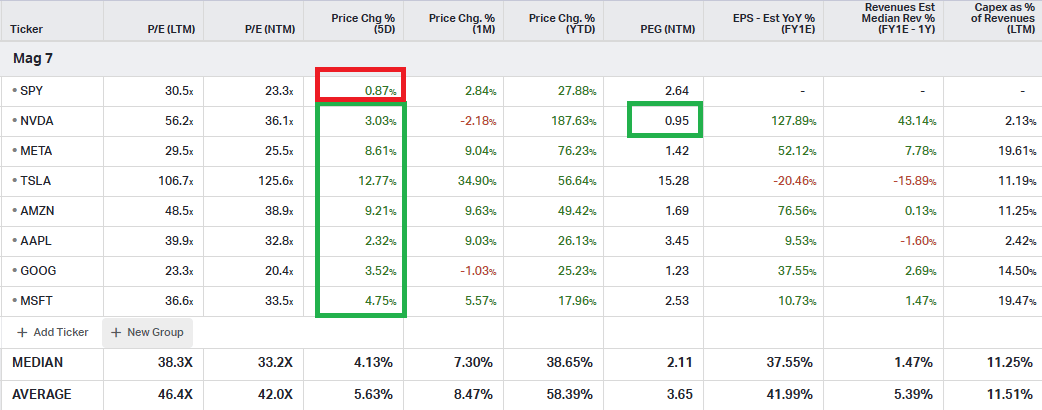

Last week, in our newsletter we made the Case for Mag7 and had a WOYM on Monday here.

Since then Mag 7 rallied 5% while the S&P rallied .87%.

On Nvidia, take a look at the PEG ratio vs peer group. We like to use the P/E divided by EPS growth ratio to compare growth stocks. It’s arguably the cheapest stock in Mag 7.

And we’re hearing that Nvidia is 6 months ahead of schedule on Rubin - the successor to Blackwell.

Nvidia is an easy bet for 2025.

WHY SEMIS ARE LAGGING

The Semiconductor sell off started on July 16th when Trump made comments suggesting Taiwan should defend itself.

Our thesis is that the semi correction is mostly driven by Trump’s potential policy torwards Taiwan.

That said, SMH has now bounced off the 200 DMA.

Still, with many semis having 30% export sales to China at risk of export controls or retaliation, it’s hard to get too excited about the category

With certain exceptions such as NVDA whose primary customers are US based ( MSFT, META, AMZN, GOOGL )

Korea’s stock market

Today’s a good chance to remind the world how cheap (and maybe for a reason) Korea’s stock market is.

If you think China’s market trades at low P/Es, look at Korea: 8x forward, 1.5 sigma below average currently

The Korea discount or the Korea opportunity?

BEZOS HAS BUYERS REMORSE OVER WAPO DEAL?

Bezos genuflected towards Trump.

This follows META's Zuckerberg Pre-Thanksgiving dinner.

And Google's CEO has kissed the ring too.

If I were to edit this CNBC headline re: Bezos here is how it would read.

We are long Amazon.

AI

AI and the Next Wave of Innovation

AI remains a central investment thesis. Nvidia is reportedly six months ahead in developing its next-generation Blackwell chip, and OpenAI is rolling out new features at an unprecedented pace. These innovations underscore the transformative power of AI, not just for markets but for our investment process.

At Lumina, we’ve integrated proprietary AI tools that have revolutionized how we analyze and allocate capital. Next year, we plan to commercialize this offering, making it available to RIAs and individual investors.

We don’t think you need a Bloomberg Terminal with the software we are building.

As Featured In