Here’s a preview of what we’ll cover this week:

Macro: There is No Neutral Rate; Where is Inflation post-Tariffs?

Market: US Indices at ATH - What’s Next, Rise of the Super Apps

AI: AI Diagnostics Co-pilot Use Case

Happy Independence Day

This Fourth of July is a story about Founders.

From the Founding Fathers to today’s Founders, we’re celebrating the leaders who shaped America into what it is today.

Throughout our history, founders have continued to light the way forward.

We made this video using Google’s VEO3 to honor them.

Hope you enjoy it!

Full Video: Link

The Last of the Capitalists visits Harlem

This week I took a walk through Harlem and decided to make a quick video on the go.

These are the topics I talk about:

Gentrification is Progress

Capitalism and Culture

Robinhood's announcement to offer OpenAI

Consensus Vs Non-consensus investing

Watch the full video: Link

Lumida Deals: CoreWeave - $7B to $70B

One of Lumida’s first private deals was an allocation in CoreWeave, an AI-focused cloud infrastructure company.

At the time, we facilitated an investment for eligible clients at an approximate $7 billion valuation, sourced through our network (special thanks to Andrew S., a long-time friend and reader - uncompensated).

CoreWeave was a classic “East Coast” deal – priced efficiently, with institutional capital from Magnetar on the cap table rather than a traditional Silicon Valley venture structure.

Less than two years later, CoreWeave went public and its market capitalization has reportedly grown to over $70 billion, with the stock trading approximately 4x higher since its IPO.

Investors who entered at the $7 billion valuation may see an approximate x gross valuation increase.

To discover how we source private investments for eligible investors, visit lumidadeals.com

Important: The figures above are approximate, based on public sources, and reflect gross valuations only. Actual returns may be significantly lower after fees, expenses, carried interest, and taxes. Past performance is not indicative of future results. Private investments are speculative, illiquid, and involve a high degree of risk, including possible loss of principal.

Are Capital Gains Taxes Optional?

Many early investors in names like CoreWeave and Circle now have a high-class problem.

Price action has pushed these positions to outsized weights.

Two choices:

Sell and trigger a large tax bill.

Or hold and stay overexposed.

We offer a third.

At Lumida Wealth, we build tax-aware structures that help crypto-native investors reduce — or eliminate — capital gains taxes while managing risk.

One strategy involves ‘tax aware long-short’.

This is a relatively new algorithmic strategy that gets you exposure to an index, while generating significant tax loss harvest that can be used to offset capital gains anywhere.

We strongly believe this strategy has a real shot at disrupting low-cost index ETFs which offer similar returns but no tax shield.

If you’re sitting on or expecting a large capital gains tax this is a great strategy.

Book a Call or learn more about tax aware long-short here.

Markets

US indices are stretched — two standard deviations above trend.

This is a chart I like to trot out periodically to see where we are regarding Growth vs Value stocks - the second most important factor after Market Beta.

You can see Growth stocks have run up quite a bit. See Robinhood, Coinbase, Palantir, and Mag 7 type names.

It’s time for value oriented names to perform and we believe positioning around these ideas makes a lot of sense.

Also, the market is over-bought short-term.

A pullback starting Monday is highly likely.

Nonetheless, we still have a bull market and any pullback should be bought given how offside institutions are.

If we get it, treat it as a chance to add risk, not panic.

We note that we are in a period of unusually strong seasonality that ends around mid-July.

The Consumer is Strong

Take a look at U.S. Consumer delinquencies. They are dropping.

One of our favorite themes here is non-bank consumer finance stocks. We own several of them.

In the coming weeks, we’ll share our favorite pick.

SUPER APP SUMMER

X is building a Super App.

So is Coinbase, Robinhood, Revolut, Kraken, Square, Paypal.

A SuperApp enables:

- Peer to peer payments

- Cross asset class trading

- DeFi

- Alts

- Tokenized equities

The backbone for all of these apps are Stablecoins.

Focusing on the picks and shovels layer is a way to bet on the growth of the Super Apps.

The institutions are here.

Not the JP Morgans, but the next gen players.

Macro

Where is Inflation?

One of the most interesting dynamics is the inflation survey data vs. headline inflation.

Survey data has been largely coincident with inflation.

However, for the first time in decades, inflation is receding even as expectations remain high.

Notice in Q4 '18, the "bark was worse than the bite".

Meaning, expectations for inflation in surveys was worse than realized.

I expect that will happen today too.

However, it's remarkable that we haven't seen inflation trend up at all in recent months.

Some of this is explained by "inflation avoidance", acceleration of purchases for cars for example, and changing of consumers' consumption baskets.

If you want to know why the Federal Reserve is confused, this chart explains why.

The lack of an inflation hit while expectations are high is bullish.

What could throw cold water on the risk assets is if we see inflation show up for several months in a row... but I'd expect that to be a temporary one-off.

There is No Neutral Rate

The neutral rate is defined as the level of the fed funds rate set by the FOMC that neither encourages nor discourages growth.

Currently Powell views rates as ‘restrictive’.

Stocks and bitcoin are at all time highs.

Strong job report, falling UE rate.

The economists were wrong.

We should reject the null hypothesis that there is a ‘neutral rate’.

There is no neutral rate.

What matters more than this concept of the neutral rate is what John Maynard Keynes called ‘Animal Spirits’

Positive momentum can exist even when policy is constraining such as the housing bubble post 2006

How does that happen?

People simply choose to re-rate each other's assets higher by believing in a brighter future (up until everyone is ‘all in’ and levered)

A President can change r* by giving a chilling speech or a warming speech (like GW Bush in Oct ‘08 or after 9/11 ‘go shopping’ speech)

Psychology is dynamic. And it is volatile.

If you truly wanted to define a neutral policy rate, the rate would be changing far more frequently.

For example, a rise in stock prices and tightening in credit spreads improves financial conditions.

That lowers ease of access to financing via IPOs, secondaries, and debt financings.

When you realize that there is no such thing as the Neutral Rate, You arrive at another conclusion…

Fed policy setting is highly prone to being wrong and offsides.

Even if the FOMC is ‘right’ for a day, wait for an event or time to pass and the FOMC will be wrong.

Viewed from this lens, the task of central banking as conducted today should be an exercise in ‘risk management’.

How to make decisions that cause the least damage from being mostly wrong on policy?

Another novel question: ‘Can you set policy purely through market forces?’

As a free market guy that worshiped at the altar of Milton Friedman and Hayek, I have a bias toward this from a first principles perspective.

Here’s the flaw.

Rate markets are pro-cyclical just like any other risk asset class.

When equities go up, credit spreads tighten.

That means it’s easier to borrow and refinance.

And that increases the value of levered assets.

And you get something like the Housing Bubble.

When credit spreads widen, you may potentially hurt the ability of good businesses to refinance.

You can get vicious debt deleveraging cycles that lead into the Great Depression.

So, the boom bust cycle would be more frequent and extreme. That was the 19th century in a nutshell.

But Central Bankers screw up too

They and Congress panicked during Covid and unleashed massive stimulus and QE.

(Easy to call it a panic in hindsight)

The Federal Reserve’s balance sheet is upside down due to losses on long-duration mortgages and Treasuries

Where does that leave us?

The truth is our civilization is relatively new to central banking and fractional banking.

We have less than 100 years of experience with modern central

banking.

Liquidity transformation and rehypothecation - the two functions of a bank - are paradoxes built upon public psychology.

AI

AI as a diagnostics co-pilot

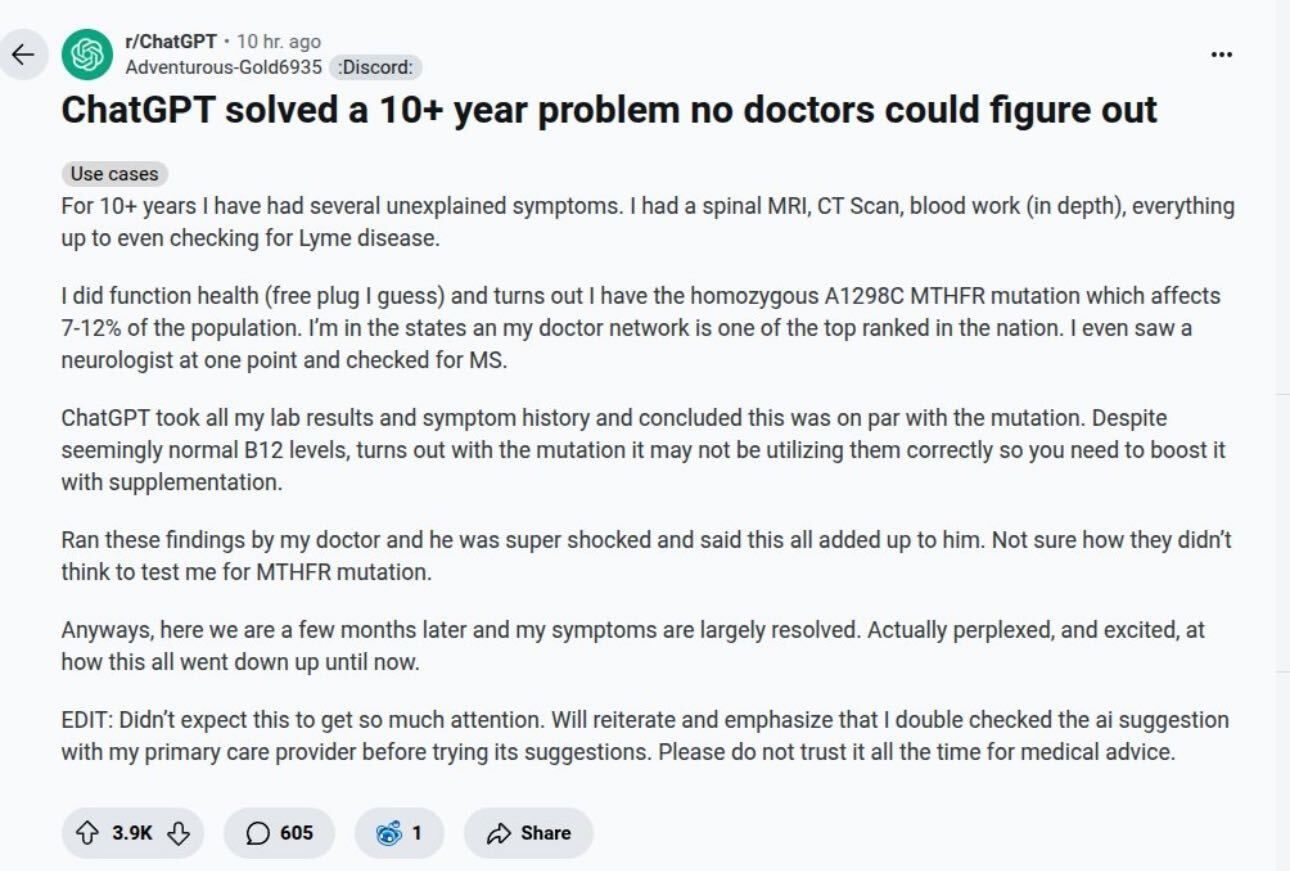

A Reddit user says ChatGPT cracked a 10-year mystery no doctors could nail down.

Symptoms went unexplained for a decade – MRI, CT scan, Lyme test, all clear.

A functional health screen showed a homozygous A1298C MTHFR mutation – affects up to 12% of people.

ChatGPT reviewed labs and history, flagged the link, and explained how B12 levels might look normal but still underperform with that mutation.

The user confirmed it with their doctor – the doctor hadn’t tested for it.

Treatment plan adjusted, symptoms mostly gone within months.

One user’s anecdote, not medical advice – but it shows how LLMs can surface connections doctors sometimes miss.

The takeaway: AI as co-pilot for diagnostics — not a replacement, but a prompt to double-check.

Meme of the week

Disclosures

This newsletter is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security, investment product, or investment advisory service. The CoreWeave example is provided for illustrative purposes only and does not represent a complete investment track record or imply that similar results will be achieved in the future.

Any performance information is presented gross of advisory fees, fund expenses, carried interest, and taxes, all of which will reduce actual returns. Past performance is not indicative of future results. All investments involve risk of loss, including possible loss of principal. Private investments are speculative, may be highly illiquid, and are intended only for sophisticated investors who meet specific eligibility requirements.

Any offer to invest will be made only pursuant to a confidential private placement memorandum, subscription agreement, and other governing documents, which should be read carefully before investing.

Nothing herein should be construed as personalized investment advice or a guarantee of any specific outcome. Lumida Wealth Management LLC is an SEC-registered investment adviser. Registration does not imply any particular level of skill or training. Please refer to our Form ADV and offer documents for additional disclosures.

Before making any investment decision, you should consult with your financial, tax, and legal advisors to determine whether an investment is appropriate for your circumstances.

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In