Here’s a preview of what we’ll cover this week:

Macro: Rate cuts, Small Business Optimism Index

Market: Healthcare, The State of Venture Capital, A Rotation from Growth Back to Value, Momentum, Data Center Power Needs, Tech on Tech Violence, Waymo's Market Share (Guest Post)

Digital Assets: Pro-crypto winds

Bits + Bips

Where do Digital Assets go from here?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Macro: The Neutral Rate

(aka How would Aliens do Central Banking?)

The Fed is poised to cut rates this week by 25 bps.

My expectation is we see a December rate cut - but it will be a “hawkish cut” with Powell suggesting that further reductions are far from guaranteed.

The Fed’s desire to cut rates is driven by the theoretical belief that the ‘neutral rate’ is lower than the rate currently.

The neutral rate is defined as the level of the fed funds rate set by the FOMC that neither encourages nor discourages growth.

Here’s the rub.

There is no static neutral rate (r*)

Any more than there are electrons with definite position and momentum.

The Key is Psychology

What John Maynard Keynes called ‘Animal Spirits’

Positive momentum can exist even when policy is constraining such as the housing bubble post 2006.

And, Animal Spirits received a significant boost after the Trump Election win.

So much so, that small caps and risk markets rallied far more significantly than when the Fed cut rates 50 bps in September!

Fed officials do not recognize this phenomenon because they cannot measure Animal Spirits or incorporate psychology.

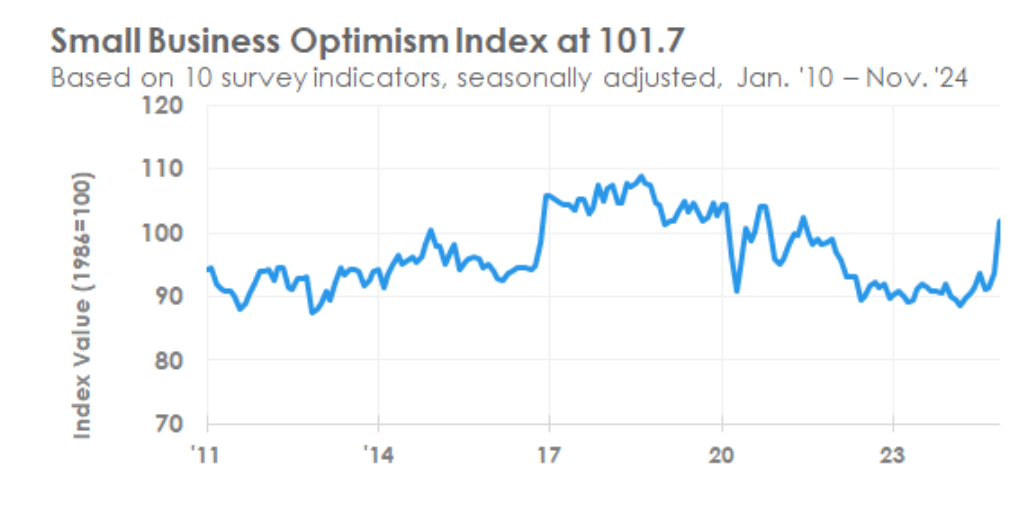

They can measure the NFIB Small Business Survey which shot up to a 3-year high. (We made this prediction the day after the election here.)

How does that happen?

People simply choose to re-rate each others assets higher by believing in a brighter future (up until everyone is ‘all in’ and levered)

A President can change r* by giving a chilling speech or a warming speech (like GW Bush in Oct ‘08 or after 9/11 ‘go shopping’ speech)

Psychology is dynamic. And it is volatile.

If you truly wanted to define a neutral policy rate, the rate would be changing far more frequently.

For example, a rise in stock prices and tightening in credit spreads improves financial conditions.

That lowers ease of access to financing via IPOs, secondaries, and debt financings.

And that’s what we are seeing now. Corporates are refinancing their debt despite Fed policy being in ‘restrictive territory’

When you realize that there is no such thing as the Neutral Rate, You arrive at another conclusion…

Fed policy setting is highly prone to being wrong and offsides.

Even if the FOMC is ‘right’ for a day, wait for an event or time to pass and the FOMC will be wrong.

For example, the FOMC unintentionally eased financial conditions via their Dec policy statement announcing a bias towards easing.

Viewed from this lens, the task of central banking as conducted today should be an exercise in ‘risk management’.

How to make decisions that cause the least damage from being mostly wrong on policy?

Another novel question: ‘Can you set policy purely thru market forces?’

As a free market guy that worshipped at the altar of Milton Friedman and Hayek, I have a bias toward this from a first principles perspective.

Here’s the flaw.

Rate markets are pro-cyclical just like any other risk asset class.

When equities go up, credit spreads tighten.

That means it’s easier to borrow and refinance.

And that increases the value of levered assets.

And you get something like the Housing Bubble.

When credit spreads widen, you may potentially hurt the ability of good businesses to refinance.

You can get vicious debt deleveraging cycles that lead into the Great Depression.

So, the boom bust cycle would be more frequent and extreme. That was the 19th century in a nutshell.

The truth is our civilization is relatively new to central banking and fractional banking.

We have less than 100 years of experience with modern central banking.

Liquidity transformation and rehypothecation - the two functions of a bank - are paradoxes built upon public psychology.

One of the two questions I would like to ask an Alien species:

‘How does credit creation and intermediation work on your planet?’

At the very least, I’d expect a transparent, decentralized, cryptographically secured form of money that has low trust assumptions.

How else can you engage in trade over large distances? You can’t rely on a counter-party that is subject to Sovereign risk.

I wish someone had explained it this way when I was in school!

This video pod explains the magic financial alchemy of banking:

What is credit and liquidity transformation?

How is credit created?

ANIMAL SPIRITS

The NFIB Small Business survey hit a 3 year high.

Two calls we made after the election: The NFIB survey would shoot up.

and (2) we would enter a Momentum Market

Market

Momentum vs. Mean Reversion

Last week, we discussed the tension between Momentum and Mean Reversion.

As if on cue, momentum stocks tanked both Monday and on Thursday.

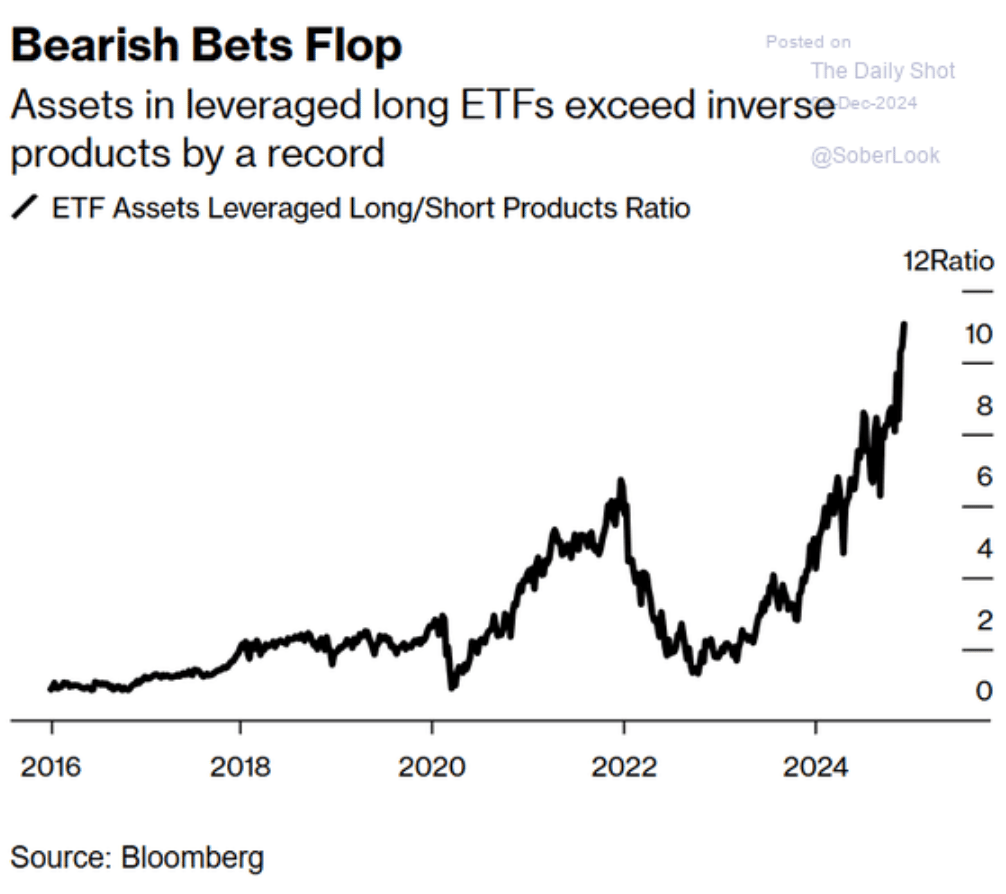

The setup going into this is that levered long ETFs have record inflows.

The sell-off continued on Friday with Interactive Brokers CEO noting the build up in margin debt in the last 3 months:

We believe his comments contributed to the sell-off continuation on Friday.

That build up in margin debt has coincided with a lift-off in Animal Spirit stocks – high momentum ideas, Twitter stocks, and Digital Assets.

Margin debt is a contrarian indicator when at record levels.

We aren’t at record levels - but also the proliferation of 0-Day options - a substitute for leverage - makes it difficult to use that once reliable indicator in the same way.

Overall, we believe it is a good idea to under-weight high beta stocks and own low beta.

Animal spirits are softening, and that theme is overbought.

Healthcare

After the UNH CEO healthcare assassination, we noted we were taking a bearish view on Healthcare stocks.

Take a look at the Healthcare XLV ETF now. The sector tanked.

The sector has now done a re-test.

It is at the same levels as when RFJ Jr. was appointed to lead the Department of Health and Human Services.

One of the best ways to get a handle on a sector is to review the charts and news for the leaders and dozens of names in the sector.

There’s a good chance that we get a bounce here. (If the $140 level in XLV fails to hold, that would mean more downside risk ahead.)

Here’s a quick check-in on CVS. We sold most recently at the ‘Sell Here’ point which we noted on a livestream two weeks ago.

We need to take a closer look this weekend, but we are inclined to pick up some names in healthcare again.

The State of Venture Capital

We spotted a SPAC launch this past week.

That’s another sign the IPO market is coming.

We enjoyed this analysis from VC Sam Lessin.

The Venture Capital ‘Regatta’ is what is Replacing The VC Factory Model ::

The way VC works now is that there is a ‘start’ line for companies when you cross from early round financing(s) into ‘series’ raises, A,B,C,D — but MOST of the actual race now takes place before the ‘gun’

A Rotation from Growth Back to Value

We like to check-in on Growth vs. Value dynamics.

Last week, we noted there was a ‘Growth’ pump starting in early October and that accelerated after the Trump election win.

We believe Growth is once again at an extreme, and now its time for Value to shine.

This study from Jason Goephert supports that thesis.

The total return from value stocks has declined for 10 consecutive days.

Since 1926, this has happened fewer than 10 times

The average returns on value stocks are generally positive after such incidents.

That coincides with our internal research on Animal Spirits stocks. Our thematic baskets show recent deterioration in this theme.

Here’s the nail in the coffin.

Take a look at the 10-year.

Notice the 10-year has gone up just as value stocks have retreated.

That makes sense since value stocks have more debt and therefore are more sensitive to long-term rates.

Value stocks have also been hurt from lowering of Fed rate cut expectations.

We don’t see the 10-year exceeding 4.5%. It could go somewhat higher - sure.

But, value stocks should out-perform just after the Ten-Year tops out.

That would benefit rate-sensitive categories such as Insurance stocks and Banks.

Tomorrow, we will be dusting off our factor model to identify which names in our coverage universe benefit the most from falling 10-year.

My guess: Insurance stocks and Regional banks. After all, these entities are mostly balance sheets with a customer acquisition arm.

Momentum Unwind

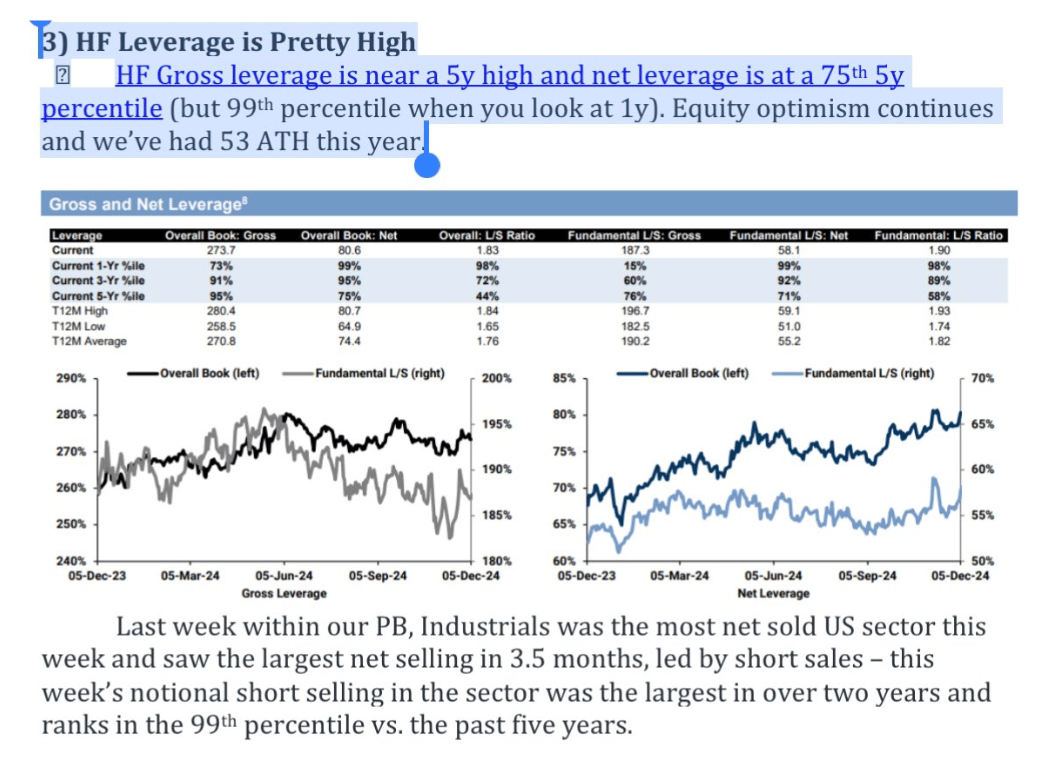

According to Goldman Sachs, Hedge Fund net long exposure and leverage started the week at the 99th percentile looking over the last 1 year.

Hedge funds have crowded into what’s working. And the narrow breadth has forced even more of that concentration.

Anytime you step off the reservation, by say, buying cheap tanker stocks - you get burned.

So Mr. Market has reinforced this powerful dynamic.

We can see evidence of this unwinding by seeing rallies in unfavored stocks and sales of Consensus stocks.

Data Center Power Needs

No matter who's in office, the hyperscalers will keep investing a ton in utility solar/battery storage as long as their data center power needs are growing fast.

Per Eric Johnsa:

CPI PASSES: Mr. Market Passes Go, Collects $200

However, check out the brutal sell-off in Medicare Advantage stocks.

Did you get out of the water in time?

Imagine if your Advisor waited once per year to update their asset allocation.

That's the standard practice in the industry.

You can see our reasoning below…

We sold DVA for example. I marked in green our entry points. Not a bad profit - low teens return for a month or so of exposure.

US to Increase Tariffs on China

This is good news for First Solar.

Nvidia is getting into AI-driven cars now (per Bloomberg news).

N

TECH ON TECH VIOLENCE

Half of investing is avoiding left-tail risks like this name and UBER.

Unlike the Dot Com era where we had Tech vs. Bricks and Mortar, now we have Tech on Tech violence.

Read this post to see our take on Adobe.

Waymo's market share is now equal to Lyft within SF. Incredible.

Network effects is one of the best sources of defensibility. But it's proven to be not that important in ridesharing.

You need a minimum network size, but once you have that, there are diminishing returns. In each geo, Uber and Lyft need enough drivers to have reasonable wait times. Once wait times hit that acceptable threshold, the incremental driver doesn't improve the rider experience (eg if my Uber ride is coming in 2-4 minutes, I don't really care about the wait times getting faster).

When Waymo launched in August 2023, Uber and Lyft were at 66% and 34% share in SF.

15 months later in November 2024, Waymo is at 22% - the same as Lyft - with Uber at 55%.

Both Uber and Lyft lost low double digit % pts of market share, but it's more painful for Lyft. Lyft gave up ~1/3 of their share. Uber lost ~1/6.

This is just when comparing all rides with pickups and dropoffs inside Waymo’s SF operating boundary (ie excludes any ride to / from the airport).

Anecdotally, Waymo's wait times are longer than Uber and Lyft because they don't have enough cars on the road. But they are close enough to that acceptable threshold, that their superior product (clean, nice cars, quiet drivers, etc) tips the riders in their direction.

It's possible when Waymo puts more cars on the road and reduces wait times to be in line with Uber and Lyft, their share could climb even faster.

[link]

Digital Assets

Goldman thought it was important to lead with its crypto capabilities in its recent client note citing top post election-themes

(I won’t be impressed until Goldman is on Deribit for starters)

Many more banks and investment banks want to get active in crypto.

That’s going to happen in a Trump administration.

We read Market Color for bedtime reading.

puts everyone to bed until I have peace and quiet.

Happy holidays people, we hope you cheriah the time with your friends and loved one.

Meme of the Week

As Featured In