We hope this message finds you safe and sound, and healthy. Your well-being is always top of mind for us.

Here’s a preview of what we’ll cover this week:

Macro: Trump aides ready tariff plans, Technical Studies, Animal Spirits, VCs vs PE: Who is smarter?, Economic Boom, Uber, Startup Optimism, Nvidia VS Tesla

Market: Manufacturing is Strong, Global Demand for US Equities

AI: AI Capex Surge

Digital Assets: Dogecoin, Stablecoin Shift

WOYM: Podcasts are Bad for Your Health

This week we did a “What’s on Your Mind?” podcast.

We discuss analyst estimates for earnings growth by category - and we share where we believe analysts are overly optimistic and pessimistic.

We emphasized healthcare stocks which have a 19% EPS growth at the category level. At the same time, healthcare stocks are cheap. Even if the analysts are over-optimistic, it’s worth an overweight.

Healthcare stocks were one of the few areas of green on the screen this week - outperforming the S&P 4 out of 5 days.

We also discussed our view on Quantum Stocks which can be summed as ‘more hype than substance’ and ‘It’s a trade not an investment’. Two days later several quantum stocks dropped about 40%.

Reminds me of something we say often: “If you want to make money investing, invest in what makes money.”

Our quantum stock of choice? Google.

The Animal Spirit is correcting

We’ve been looking at Animal Spirits as a factor almost every week the last few weeks.

The headline is that this factor - often consisting of the most popular momentum and growth stocks especially those on Twitter - is correct.

It was showing signs of weakness in late December.

On Monday, it topped out and rolled over.

We noted this on Tuesday and had taken steps to minimize our exposure. It’s timely risk management.

This raises another point — good asset allocation should be responsive to market conditions — not an annual check the box exercise.

.

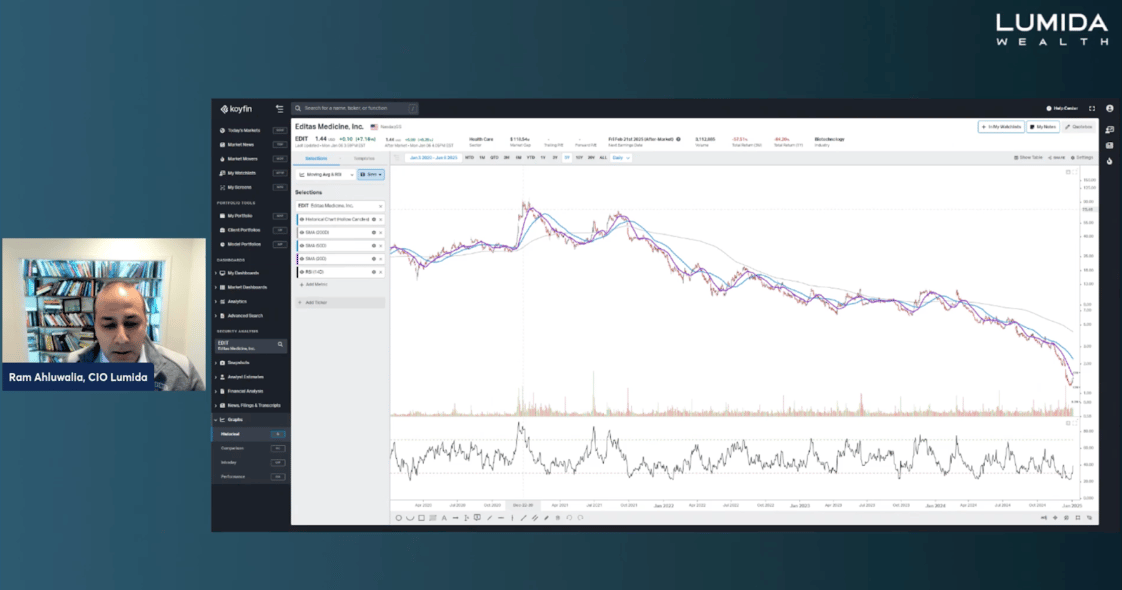

Catching inflection points is hard. We use tools from in-house analytics like you can see in the charts above.

In the hyper frenetic modern market, moves are happening in very short periods of time rather than a full year.

Remember, the average annual return on the S&P 500 is ~11% (nominal) and ~8% (real).

Certain sectors of the market are indeed crowded and over-valued – and those mini-bubbles are leaking. The ‘Best and the Rest’ theme has names like FICO and Costco which are now coming back to earth…and yet are still pricier than Nvidia.

Other sectors remain cheap and attractive. We put Healthcare and Financials in that bucket.

Looking back

The week started with a big gap Monday morning gap up in Nvidia as the attention focused on Nvidia.

Big gap ups on Monday are caused by weekend investors. They put ‘market buy’ orders. Those orders aggregate.

Then the market maker - a Virtu, Citadel, Jane Street - has to find a clearing price to match the demand for shares with sellers of shares.

That creates a gap up. Gap ups are often not a good idea to change - especially on Mondays (those are price insensitive retail investors).

So, the gap then closed and Nvidia fell 6% the next day.

That has nothing to do with the content of Nvidia CEO’s talk. It has everything to do with this technical dynamic.

Indeed, we saw the opposite of this behavior on Monday August 7th after ‘Yenmageddon’.

Monday morning markets were gapping down at the index level ~2%. Again, retail investors that were scared by headlines around a ‘missed jobs report’ scrambled to hit ‘market sell’.

Sure enough, markets rallied and that was the low.

Here you have FOMO and panic both marked by Monday morning.

By the end of the week, we had a big Friday gap up in the exact opposite of futurism AI stocks.

Tanker Stocks were cranking.

That - combined with the start of earnings season this week - suggests the worst may be behind us.

Nvidia Breakdown

We had a 2 hour discussion with Micheal Parekh, former All Star Goldman Sachs Internet Analyst from the late 90s

Michael is a repeat guest.

The title is “Are Nvidia and Tesla on a Collision Course?”

We cover a lot of other ground here including:

China vs. US competition

Mag 7 (or is it Mag 11)?

Satellite as an investment these (Starlink, Iridium, etc.)

Nvidia, Meta, Apple, Broadcom

Custom Silicon vs. Nvidia

Deepseek

Wearables

Both of us are in agreement that Nvidia is well-positioned in the secular growth trend that is AI.

I shared on the podcast that the FY2 PEG ratio for Nvidia is 0.3. It’s the lowest of all the semiconductors and Mag 7 names.

And the demand for GPU shows no signs of slowing.

We also discuss how a China-based startup, Deepseek, apparently built an LLM that is comparable to OpenAI for less than $100 MM. (Some reports say $6 MM but that seems too low.)

Economy & Markets

The Friday jobs report exceeded expectations. 200K+ jobs were created well ahead of Consensus.

Markets sold off in a ‘good news is bad news’ as Fed rate cuts were priced out, and the long-end of the curve increased to new local highs as fears of inflation shaped the zeitgeist.

Commodity prices and energy stocks also ran up confirming Mr Market is focused on inflation.

Readers following us will know we thought the 50 bps cut in September was a mistake.

The economy was fine then and it’s fine now.

(Did you see the Visa 4% YOY retail spend growth in December? It trounced last years ~1.6% figure.)

The cacophony of voices saying the Fed is late and offsites pressured the Fed to cut rates.

Bond vigilantes see it differently and are tightening even as the Fed has possibly finished this series of adjustment cuts.

The September Fed cuts kicked off a massive rally in Animal Spirits. They are the hottest them in markets thru end of December.

So, what’s the problem?

Meltups are followed by meltdowns. And we’re seeing the meltdown now.

The party is great until there is a hangover.

The Ten-Year and Markets

(Here’s a post made on X showing exactly when we saw the risks of the 10-year on the market. Major indices especially the IWM slid thru the rest of the week.)

Lumida was able to de-risk and bring down our net long exposure to blunt somewhat the effects of this shock from interest rates.

Our net long in taxable accounts was around [ 85 to 90% ] and we did that via a diversififd basket of targeted hedges.

We appear to be getting better and better at the hedging strategies – they allow us to hold long positions without selling them and incurring a capital loss.

In any case, we’re kicking off a process to get a 3rd party auditor to analyze Lumida’ returns so we’ll share that when the process wraps up.

If you’d like to consider a relationship with Lumida, please email [email protected]. He grew up at UBS and Fidelty - and has entrepreneurial experience at Messari and has been an invaluable addition to the team.

The Macro Is Good

Big picture, the economy is great.

As we noted previously, the Vibecession is over.

Small business and consumer confidence is high. They are spending.

Yes, inflation is elevated and likely remains elevated. (Inflation stats still have a ~3% handle – far from the 2% target rate.)

However, the Fed has shown their hand – they are not likely to raise rates.

Jobs are increasing. Corporate profits are increasing. Tax cuts will increase corporate earnings yet more, and consumer spending.

The volatility we are seeing in markets is technical over-positioning driven – very much like what we saw in late July when there was record retail call option buying.

We saw that same dynamic again going into this week.

When everyone is on the same side, go to the other side.

As we’ve noted previously, the biggest risk to markets is persistent inflation pressures.

Gasoline prices are trending higher - and gas prices are a leading indicator for CPI in our statistical research.

Last year, Q1 featured a number of CPI reports that disappointed market expectations.

Notably, markets bought the dip on all of those prints. We could see a similar dynamic play out.

Manufacturing is Strong

Take a look at the ISM New Orders indicator. As our friends from RBA Advisors note - it continues to expand and “Fed is once again somewhat wrong footed”.

Trump Aides Ready Tariff Policy

A few weeks ago the latest view was to expect ‘bilateral and reciprocal’ tariffs. That made a lot of sense to us from a negotiating posture. (We don’t think across the board tariffs are good policy as they are inflationary and hurt the cost of automobiles, electronics, etc. for consumers.)

Now it looks like tariff policy according to a leak in the Washington Post will be ‘universal and targeted’.

Apparently Bessent and Lutnick are in a room trying to hash out the right approach.

One observation:

It is extremely difficult to craft a rational tariff policy.

There are trade-offs everywhere.

You squeeze in one area and you feel an acute pain elsewhere in the body politic.

Here are examples:

1) Tariffs on steel would increase the price on consumer goods such as Automobiles.

That would hurt Tesla and GM.

Tariffs increase Defense costs (American warships, fighter jets, etc.).

That doesn’t help the US deficit.

2) Tariffs reduce the competitiveness of American Defense exports.

Steel producers benefit.

Higher value added and high margin steel consuming industries are hurt even more.

Defense stocks such as Lockheed Martin, General Dynamics, and Raytheon are all in severe bear markets now.

Take a look at Lockheed Martin for example:

(We think this category needs a few more weeks to settle, not a good idea to catch that falling knife before we have some glimmer of insight into US defense budget.)

So, how do tariffs help national security, reducing gov’t spending, or closing the trade deficit?

2) Foreign Dependance

I understand the principle of not having a dependency on a foreign adversary for essential equipment.

That makes perfect sense.

Are universal tariffs really the answer?

Australia is a major commodity exporter and ally to the U.S.

Does slapping import duties in a ‘universal’ way help the consumer or national

security in any way?

And if the materials are ‘rare earth’ shouldn’t we exhaust foreign supplies first at low cost?

China slapped rare earth export controls in retaliation to US export controls.

Forcing Americans to pay more is consistent with China’s retaliatory policy.

3) Manufacturing

There is a desire to increase ‘manufacturing jobs’.

This is one of those ideas that sounds great on paper, but bad in practice.

Do you want your son or daughter making masks or clothes, furniture, or handling steel bending equipment?

Those are low paying or hazardous jobs.

Unless you want them to join the Union.

All of that is Yesteryear.

Or, do you want them designing chips, providing healthcare services, or starting a small business?

The best jobs are at the end of the Value Chain, this is why the American economy is the envy of the world

4) Service Economy

BlackStone’s Ric Reider made a note saying America’s service economy makes it nearly immune from recessions.

There is some truth to that.

Manufacturing is highly cyclical — the United States avoided a recession despite negative ISM prints these last two years.

The American economy has only had two services led recessions in the last 75 years.

The demand and supply of services are stable.

Manufacturing exposes you to the ‘commodity bullwhip’

Manufacturing is over-rated; let Canada and Mexico do that.

That is American first.

Nvidia’s Jensen is Thanos?

The Week Ahead

Many assets, especially names indexed to Animal Spirits (e.g., popular retail stocks) are at key support levels.

Take a look at the XLY Consumer Discretionary ETF for example:

It’s right at the 200 DMA level.

The pivotal datapoint this week is CPI on Wendesday - and bank earnings.

The 10-year is rising due to higher nominal growth and inflation expectations.

That’s the central idea that is weighing on risk assets.

Tell me if the 10-year is going to 5%+ or lower, and I will tell you how to position.

Here’s how we read the current setup.

If the CPI is cool or benign, the ten-year bond will rally.

Long-term rates will come down. The fever will break. This will causing markets to surge quickly, and spark short covering. The XLY and other risk indices will rally.

However, if the CPI comes in hot, markets, then markets sell off and XLY will fall.

It’s very difficult for anyone to know how CPI will come in.

However, the two views are not equally priced. There is an asymmetry.

Mr. Market has already priced out rate cuts. And the Fed will not raise rates.

It’s not part of the conversation, and the risk the indepdenence of the Fed would go up if they countenanced that idea.

So, the asymmetry is to the upside. We believe going into Wednesday morning (meaning by the close of Tuesday), it’s better to be fully invested in risk assets.

And we also expect bank earnings to be strong.

Also, the % of bank stocks that are below their 50 Day Moving average is at levels historically associated with rallies.

Now, should the CPI come in hot and markets sell off, we would expect a 1-day sell-off.

This is the pattern we saw last year in Q1 where we has CPI prints hotter than expectations. Markets sold off leading into these or on these days, and then subsequently recovered.

We haven’t even had a hot CPI print yet. We haven’t seen incremental tariffs hit. The tendency of capitalism and competition is to drive down prices.

As for Monday morning, it’s quite possible we get a downside open. Given the foregoing view, that would be buyable in our opinion.

Technical Studies

Jason Goephert has a nice study examining what happens to the S&P 500 after its 4th greater loss of more than 1% in the past 10 days, while within 30 days of a record high.

Conclusion: Odds are markets are higher within weeks, months, and quarters.

That conclusion makes sense to us.

After all, it is a bull market and earnings growth is here.

There are positioning shifts under the surface, however.

The biggest one of all is the Growth to Value Rotation.

Notice value stocks beat growth stocks this week.

(Although the first to rally when the current malaise is over will be those names that were beaten down the most.)

Animal Spirits

This chart tells you all you need to know about what's driven markets over the last 3 months.

Best performer: Animal Spirits

Worst performer: Dividend Yield

When do we start to see the gap close between those two?

My guess is sometime this week.

VCs vs PE: Who is smarter?

I will do a live WOYM shortly, drop in Qs

One topic will be this terrible idea to buy CDS

In public markets, pay less attention to VCs and more attention to PE

What is Jonathan Gray at BlackStone doing?

Investing in Datacenters

Most, but not all VCs, are really bad at public markets

VCs are successful if 1 in 20 names works; PE needs to get 19 out of 20

VCs focus on sales growth and exit timing; PE focuses on earnings growth and entry timing

VCs focus on disruption and TAM; PE focuses on moat and sustainable growth

VCs focus on whatever Wall Street is selling; Wall Street is a service provider to PE

VCs can be successful via luck and separation from skill is hard;

PEs are successful from operational know how and business acumen

Note: Many of our clients are VCs, even moreso than PE. I am obvs generalizing here, so don’t take offense

There are talented crossover VCs now and then (not Tiger Global tho)

Check the video here: https://x.com/ramahluwalia/status/1876320502588821770

ECONOMIC BOOM

Non-Farm Payrolls generate 256K jobs versus 164K forecast.

Do you still think there's a recession?

All eyes on the Ten-Year: at 4.79% now.

Uber

UBER & NVIDIA PARTNER

There it is.

12/29: ‘[Uber] will announce something. Partnership perhaps’’

Well, they picked NVDA

And, UBER announced $1 Bn+ in my favorite - buybacks.

Let’s keep track of which podcasts talk about UBER after the fact 😂

Media is always focused on what happened - that’s ‘news’ - not forward looking.

‘Podcasts are bad for your health’

Startup Optimism

NVIDIA VS TESLA

Nvidia is going after Tesla.

And it’s not just EVs & autonomy.

Both news items are old news if you’ve been focusing closely.

Nvidia & TSMC are the new WINTEL

GLOBAL DEMAND FOR US EQUITIES

One way to look at the strength in the USD, other than rate expectations, is the ferocious demand foreign investors have for US assets.

Take a look at the USD Yen.

Notice this bottomed around the local lows in equity indices in September.

Are we near a local top in foreign demand?

Take a look at the attached FT article highlight insatiable demand for US equities from South Korea

We are seeing a global retail pump of U.S. stocks play out.

Kind of amazing.

I think this trend is approaching an inflection point soon.

THEY DON'T RING A BELL AT THE TOP

...or do they?

Check out this video from 12/24.

I call out AAPL specifically and ring a bell.

The black arrow on the attached chart is where this call was made.

Catching inflection points is the hardest and most satisfying.

Here's the link to the original broadcast and time stamp.

I would recommend listening to our Monday WOWM show titled 'Podcasts Are Bad For Your Health' and see how we did this week.

Notice how analsts have 20% EPS growth expectations on Apple

A Consensus approach says 'the valuation is justified'

A Non-Consensus approach says 'analysts are crazy and are stuck in their models instead of looking out their window'.

AI

Check the interview here: https://x.com/tsarnick/status/1877856200349331521?s=12 Source: https://www.youtube.com/watch?v=7k1ehaE0bdU

AI Capex Surge

Digital Assets

GOLDMAN ON DOGECOIN

Goldman discusses Dogecoin it their PWM 2025 Outlook (see attached)

The best time to buy DOGE was in the bear market of ‘22.

It was .05 then and .33 now

It’s up 6.6x since my 10/22 post 👇

The best time to invest in crypto is when it is hated and ignored

I remain substantially de-risked from December and am waiting for Animal

Spirits to reset

What is as non-consensus today?

I would say Solar names.

The psychology and stomach to do a real

non-consensus investment and pull the trigger when it counts is maybe 1% of the population

Side note: If Goldman had alpha they would have mentioned Bonk or dogwifhat

Stablecoin Shift

As Featured In