Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week.

Russian Insurrection

Macro: Consumer Strong, Initial Claims Up, Housing Starts Surge

Fed Chair Powell on ‘Crypto as an Asset Class’ and Rates

EDX Markets Launched, Prime Trust Consent Order & More

Blockrock ETF Filing & Impact to Other Issuers

Tech & AI: Service Replaces Search

We enjoyed sharing ideas on AI at the Two Sigma event with friends Marc Weill (Two Sigma), Sixth Man Venture (Carl Vogel) and Differential Ventures (Nick Adams).

Also be sure to check out Ram’s interview with Alex Thorn, Head of Research at Galaxy Digital. Ram shares his views on the crypto market structure bill and lays out a path for industry self-regulation inspired by the history of the NASD (creator Nasdaq).

There’s a joke in venture now. There’s a shift from the VC adage “What happens if Google does this?” to “What if the next-gen LLM does this?”. The change signifies the emerging dominance of AI. It's not just industries that are being disrupted, but also previous disruptions. Case in point - Jasper - built on OpenAI, getting overshadowed by the arrival of GPT4. Note: We’re bearish on SAAS that that is nothing more than a front-end built on a database for this reason.

Russian Insurrection

We’d like to thank the Russians for starting their civil war after the Friday close and ending the conflict before the Sunday open. By the way, did you notice Bitcoin holding strong during the moment?

Jokes aside, it’s a reminder that the post-WWII period has been unusually kind not just for humanity but for common stock returns.

In no other period in history was there a reliable, even measly, 2% compounding return. Wars and famine destroyed humans and the capital stock time and again.

We live in a special time - the age of modern medicine, pet care, and Costco - and we shouldn’t take this state of affairs for granted. The best time to be alive is somewhere between “Now” and “Tomorrow”.

Macro: Consumer Strong, Housing Starts Surge, Reverse Repo

Consumers aren't just surviving; they are thriving. Cruise stocks are up by 90% indicating consumer robustness. The majority of this rise originated in May, linking to our previous observations about the potential broadening of the market's narrow breadth. Active money managers indexed to the S&P 500 have some ground to cover, and they're looking at sectors that are yet to participate.

The Conflict Between Housing vs. Initial Claims. Housing, a key leading indicator, continues to shrug off higher mortgage rates and may be bottoming. despite higher rates. The question is ‘Can the housing sector continue to grow despite rising initial claims?’.

We believe the answer to that when these forces ultimately resolve is ‘No’.

Incomes fund mortgages. Keep an eye on these two indicators.

Fed Chair Powell on ‘Crypto as an Asset Class’ and Rates

Fed Chair Powell provided testimony to Congress as part of the annual Humphrey-Hawkins. There are two takeaways. First, Powell acknowledged ‘Crypto as an Asset Class’. The head of the most significant central bank globally added legitimacy to Digital Assets. Recall that Powell approved the launch of a stablecoin that was denied by Treasury Secretary Yellen. Different regulators have different opinions.

Second, Powell also corrected the ‘dithering’ from the FOMC conference which we pointed out last week. Powell reiterated that the Fed may need to raise rates further.

Stepping back, what you’ve seen is a Fed that was late to the game. They raised rates at jumps of 75 bps to catch-up. Then then lowered the ‘gear speed’ to 25 bps rate hikes. Now the Fed is using the spacing of time to calibrate rate hikes further.

Fed Futures have now come around to our ‘higher for longer’ view. Fed futures expect no rate cuts for all of 2023. Undoubtedly, the market will forecast a pivot at some point in the future, and we would want to fade that.

The Fed's Tight Spot: The 'Higher for Longer' Rates Game Holding interest rates high for an extended stretch comes with its own set of dramas. Picture this: strong consumers and sky-high asset prices are painting the Fed into a corner. If you had chatted with the folks at the FOMC a year ago and told them that the S&P 500 would be up and that job reports would be smashing records for 14 months straight, they’d probably have laughed you out of the room.

Now the Fed is like a juggler with too many balls in the air, all thanks to inflation. Put simply, inflation is what happens when there’s too much income (think company profits and wages) chasing too few goods. The Fed needs to get inflation under control to save face, and that means keeping interest rates up until consumers and corporates start to feel the squeeze.

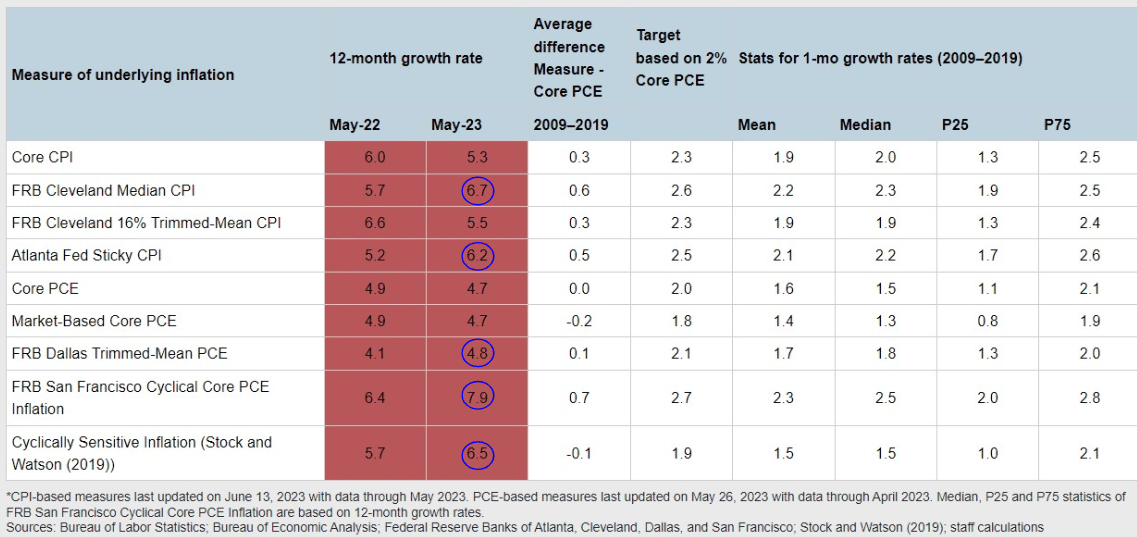

Note that 5 of the 9 measures from Atlanta Fed show higher inflation than a year-ago. We do agree that good/commodities price inflation will continue to abate.

But the easy wins are behind us. The ‘stickiness’ is in services - travel and leisure. Remember the demand for Cruising and Louis Vuitton?

We've talked before about the choices for where to put your money when rates are high. Real assets like distressed real estate or energy historically do better than asset classes like venture capital (on average). And, guess what, both those asset classes are on sale now, in our view.

Banking on Financials: Usually, when rates go up, sectors like Financials get hit hard. That’s already happened. Way back when banks were in hot water, we put our chips on 'quality financials' during the depths of the banking crisis. And, guess what? That move paid off.

And there's more. Energy stocks are in a similar boat. Both Financials and Energy can pass on the costs of inflation to customers. Plus, if the consumer stays strong, these sectors could see more gains. What we like is that a lot of the bad news is already baked into the prices of stocks in these sectors, so we believe they're a bargain measured over a timeframe of years.

This isn't about grabbing whatever's cheap. It's about playing it smart and selecting sub-sectors and names with ‘quality’ (e.g., growing G-SIBs with plenty of capital, liquidity, and crucially - earnings growth). Look for great businesses that are dominant leaders in their category on sale.

Consider UBS. It holds the esteemed position of being the world's largest wealth management firm globally. We like #1 business positions due to the power law nature of industry structure. UBS sports a 10 P/E ratio and offers a dividend yield of 2.8%. Additionally, wealth management, the cornerstone of UBS, is inherently more stable compared to the rollercoaster of trading or investment banking underwriting risk.

Moreover, UBS now stands unrivaled as the leading private bank in Switzerland. For those eyeing a Swiss bank account, UBS is the only game in town.

And if that weren't enough, UBS acquired its competitor, Credit Suisse, at a bargain basement price well below its tangible book value. Further, the government has provided a safety mechanism and liquidity support. Note this is not a recommendation to buy, sell, or hold UBS. It is designed to demonstrate how we think about investment opportunities and what market conditions we find compelling.

EDX Markets Launched

We recently pulled back the curtain on EDX Markets in a detailed thread. For those who may not know, EDX is an up-and-comer that's backed by a veritable who's-who of industry heavyweights, including Citadel, Sequoia, and Paradigm. Imagine a superhero team-up movie, but in the financial markets.

Prime Trust

Prime Trust is a Nevada state-charted trust company that powered a number of crypto platforms such as Binance.US, Abra, and others. Their state regulator alleges Prime Trust materially and willfully breached their fiduciary duties.

This may be the first time that a Trust Bank has ever lost customer deposits at this scale. We explain what happened and what this means from a policy/regulation perspective.

Blockrock ETF Filing & Impact to Other Issuers

We've recently dissected BlackRock's ETF application in one of our threads. Overall, it bears striking similarities to its peers, with the noteworthy addition of software designed to tackle wash sale trading.

Some speculators are suggesting that there's a hush-hush deal going on between BlackRock and the SEC. Allow us to dismiss that conspiracy theory. If BlackRock gets the nod, anticipate a wave of ETF launches to follow closely.

What's the whisper on Wall Street? Larry Fink and his team at BlackRock seem to be running out of patience with the SEC. As other nations embrace tokenization with open arms, BlackRock does not want to lose ground. Fink has been championing on-chain payments and tokenization for some time now. The ETF application, as we see it, is not just a commercial move but also a significant political statement. And maybe Larry Fink wants to be the next US Treasury Secretary. We would welcome that.

BlackRock's ETF application has the potential to corner the so-called 'anti-crypto army' among progressives. The Progressive influence of Elizabeth Warren and Chair Gensler appears to be waning.

While the SEC could potentially target DeFi protocols next, we maintain our stance that the 'SEC is Priced In'.

We seek to accumulate select, quality digital assets. For instance, consider this analogy: Ethereum is to a decentralized app store as Apple is to the traditional app store. The Digital Assets ‘counter-offensive’ is coming.

Tech & AI: Service Replaces Search

The All-In Podcast recently posed an intriguing question: "What’s the future of Search?" Let's press pause and reflect for a moment. Is that really the question we should be asking? We believe it’s a bit off-target.

The true future of Search is in Service. Imagine a world where you don't just search for a restaurant, but also snag a reservation at the chef’s table. Dream of planning a vacation where the search not only shows you destinations but also curates and books a bespoke itinerary that’s got your name written all over it.

As AI evolves, consumers will have a one-way mirror – a way to share a cryptographically secure glimpse of their preferences without giving away the keys to their inner world. This selective sharing will unlock personalized value that today’s search engines can only dream of.

In essence, we're moving towards a reality where search is not an end, but a means to an immersive, tailor-made service. The search box is about to get a promotion from information teller to a personal concierge.

For a deeper dive into this subject, put on your reading glasses and check out this thread. It’s bound to make your brain gears turn.

Quote of the Week

"Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it." - Albert Einstein

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.