Welcome back to the Lumida Ledger.

If you find this valuable, we’d greatly appreciate you sharing it far & wide with your network. That’s how we grow and keep the content free to read.Here’s a preview of what we cover this week:

Macro: Recession? Non-Farm Payrolls, ISM, and Fed

Markets: When Will The Correction End?

Company Earnings: Tech, Financials Shine; Consumer Mixed; Industrials, Utilities solid

AI: AI & Healthcare; Nvidia leads, AMD chasing; Micron and Qualcomm strong potential

Lumida Curation: Chip Giant x Open Source AI King

MARKETS & MACRO

I wanted to focus on Markets and Macro. Get the big picture right, and you’ll do well.

But, briefly on earnings.

The CapEx Receiver thesis is intact.

As a refresher, that thesis is the idea that Big Tech firms such as Meta, Google, Microsoft, and Amazon will continue to spend tens of billions (each) on Semiconductors for years to come.

They said that in Q1, and they are following through with those spending plans in Q2. We saw significant QoQ capex spending.

The risk of not being AI-relevant is too high for these cash-flowing firms.

So, you want to own leaders with dominant market positions that are linked to this secular trend.

That’s a great sign for Nvidia and the various monopolies in its supply chain.

Overall, we see earnings beat rates elevated and revenue beat rates in line with history.

We also continue to see corporate profits continue to move higher. This is a key driver for understanding where we are in the business cycle.

However, market expectations and valuations are above where the releases are coming in, so we see price declines on earnings.

Narrative Follows Price

Remember GDP came in hot last week?

That’s the old narrative.

Now, markets are pricing in a recession. See the 10-year, a proxy for nominal long-term growth, drop to 3.8% - the low for the year.

We had weak non-farm payrolls and ISM print.

The question is now: Is this a recession? Is the Fed behind the curve?

Our thesis started as a positioning / technical-driven correction, and now the recession narrative is attached.

Let’s talk through what’s happened.

Several distinct factors…

1) The USD-Yen carry trade unwind is a key part of this.

Macro funds borrow in Yen — rates are cheap there.

When you borrow in Yen, you must pay back in Yen.

The Yen shot up in value as the Japanese central bank hikes rates, and as the US Fed eases.

That caused the ‘debt’ payable in Yen to spike.

At the same time, your dollar-denominated assets are worth less. So, these macro funds are getting squeezed on both the asset and liability side (asset value down, liabilities up).

Look at the velocity of the change in the USD vs. the Yen since July 11th.

Markets will stop correcting in the near-term when the USD-Yen pair stops crashing. Judging by the magnitude of the decline, we are close - sometime next week.

You may have noticed that markets were up Thursday, then down sharply on Friday. I suspect that firms in this Yen carry trade took the opportunity to de-risk Thursday. That could very well happen again - meaning a strong rally could be faded.

We might or might not get this, but if you see a WSJ article about a hedge fund blowing up, that’s a good sign, and that day would mark a bottom likely.

Some of you might be asking, ‘Why can’t these funds hedge?’.

You can’t hedge out FX risk completely in these carry trades because the cost of hedging undermines the carry trade itself.

The cost of the hedge is equal to the cost of the interest rate differential between the two markets. Otherwise, there would be a free lunch.

Remember the perfect hedge for an asset is selling the asset.

When your liabilities are in Yen and the price of Yen is rising, that creates a massive global macro margin call.

Global macro funds express views in futures markets where we see these large pre-opening swings.

2) Positioning

We saw unusual extremes in sentiment in early July.

- We saw record call option buying in early July

- Tesla and other meme stocks go parabolic. We wrote about that here:

- Cathie Wood capitulated and bought AI stocks marking the top to the day

- Momentum favorites were crowded. Chipotle’s Forward PE was pricier than NVDA

- In the background, there was a Growth to Value rotation that was quietly punishing overvalued tech stocks (especially in Saas)

- Valuations for tech stocks started the year at the 99th percentile plus of valuation. Valuation issues inevitably catch up…

(See ARM, SNOW, PLTR)

3) We had a ‘Trump Bump’ boosting animal spirits in market on expectations of tax cut renewals and deregulation.

That hit ‘peak’ after the Assassination attempt.

At peak, you can only go in one other direction.

The Trump Bump is materially deflated from just 3 weeks ago - and swiftly.

Here’s the good news.

If you are worried about a crash, the crash already happened.

This is the worst two-day period for the S&P since September 2022

The VIX, a popular fear gauge indicator, spiked to levels not seen since the ‘banking crisis’ 18 months ago.

We haven’t seen back-to-back declines in the semiconductor and QQQ ETFs we haven’t seen in many years.

73 MM option contracts traded on Friday, an all-time record. (Most panic-buying puts will see those expire worthless, just like those FOMO-buying calls saw those go worthless in early July

This crash will wrap up within days.

Much of the excess optimism has been wiped out.

I see that in multiple measures I look at. Here are a few:

A Fear and Greed model is now oscillating in the buy zone. Arguably it could go a bit lower, but the bias should be to look for longs.

We saw a Vix spike that has coincided with intermediate bottoms in past years

Statistically, gains are positive when you see the Vix cycle higher from low levels:

Here’s another chart showing 3-month VIX vs VIX below indicating a tactical capitulation.

Equity Put/Call Ratios went from the ‘Red Zone’ and are on their way to the Green Zone. It should arrive in 1 to 3 days.

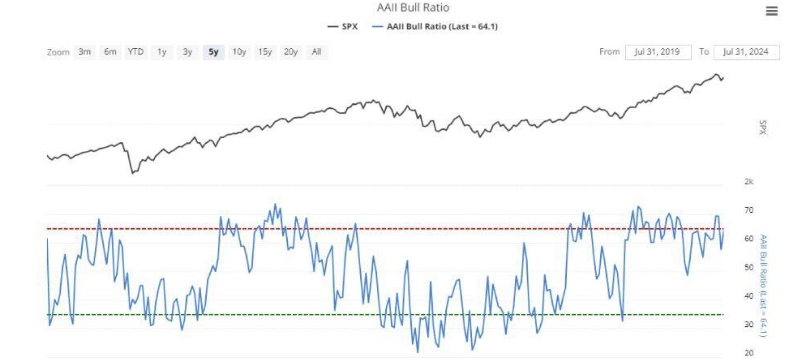

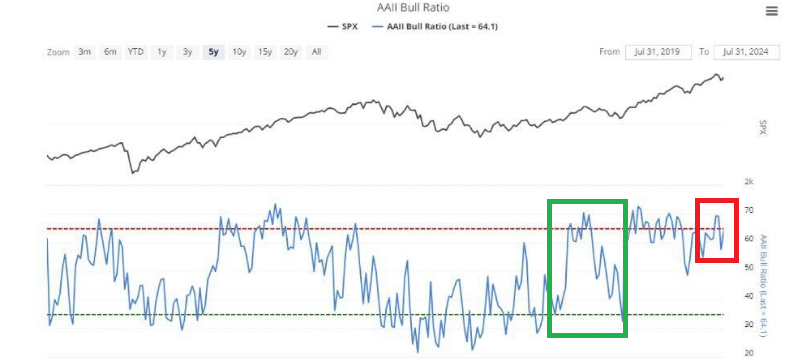

A fly in the ointment for an ‘all clear signal’ is the AAII Bull Bear Sentiment survey:

This weekly survey measures the risk attitudes of retail investors nationally.

In the July thru October correction took retail sentiment from the mid-30s to the teens. Sentiment is still elevated, although it will downcycle once the survey is conducted.

In October of last year, we didn’t have a perfect ‘all clear’, but we came close.

A wash-out in sentiment creates an enduring bottom. We don’t have that. So, if we get a nice relief rally, we might just go sideways.

Nevertheless, I expect we will finish the year at all time highs driven by robust corporate earnings and that we have rate cuts on the horizon.

Could we go lower? It’s possible, of course. But I expect this ‘margin call’ to wrap up this week.

The bear case is this technical study from Merrill Lynch. I include it only to show both sides of the argument.

If you are a long-term investor, this chart shouldn’t bother you.

A good approach is a mixed strategy. Start rotations and build into positions.

However, if investors realize by Monday that the issues in the Non-Farm Payrolls (‘NFP’) report are due to a major weather fluke, investors could re-calibrate quickly.

Overall, you should be more bullish now looking out 1 to 3 months, not bearish.

We believe one should rotate from fixed income into equities — especially US Treasury bonds that are now yielding much less vs three weeks ago.

Market crashes are the best times to build non-consensus positions.

If you are looking for a wealth management partner, Lumida is now welcoming a limited number of new clients.We offer a range of services, alternative investments (such as our CoreWeave deal), white-glove crypto management, to public equity management, and high-touch family office services, including trust, tax, and estate planning.

Ready to explore? Click here to fill out our form to start the discovery process.

Interested but not ready to commit? Build a relationship with Lumida and stay informed. Click on the poll below if you want our advisors to reach out.What about the ISM and NFP disappointments?

First off, recognize we just had a strong GDP print just last week. Maintain perspective.

Analysts look to the last data point without zooming out and processing data in a shared context.

The survey data is noisy. It’s based on samples and weather issues.

And there was a major weather issue in Texas that gummed up the July payrolls.

1.54 million workers were either not working or only part-time due to weather, far above the historical average (Yardeni)

I believe this Non-Farm Payrolls was a head fake, and we’re going to see a major reversal in August. If market participants realize that, then by Monday this correction is over.

What about the hard data?

Corporate earnings are not estimated. They are accurate and subject to audit, unlike these surveys.

The earnings beat rate is strong, and the revenue beat rate is OK (at similar historical levels).

Back at the end of q4 ‘21, we saw corporate earnings fade as the stimmy check sugar rush faded.

That’s not happening here.

That’s crucial because corporations cut employees when profits are contracting…and not when we see earnings growth.

You can see that in the chart below.

Corporate earnings decline in each and every recession.

That makes sense if you think about the causal relationship between corporations and willingness to hire or lay off staff.

Also, in that chart, you can see the Coincident indicators holding steady. Objectively, they have not declined.

Also, Corporate capex spending is not rolling over. Capex topped after Y2K marketing at the end of the DotCom bubble.

Here we have quite the opposite.

We saw significant capEx spend growth from Google, Meta, Amazon and others.

How about the Consumer?

Real incomes, in aggregate, are growing.

Yes, it is a K-shaped recovery where the bottom half is not doing so well. That’s OK too and is a marker of the last 10 years of expansion too.

Productivity growth is strong. Productivity growth is the one free lunch in economics.

Productivity growth drives growth in Corporate Earnings and Personal Real Incomes.

Even Government spending is up (much to my chagrin).

So, you have the key drivers of the GDP demand equation up.

GDP = Consumer + Investment + Government + (Exports - Imports)

So, the three major components are going up.

Back to the scary reports.

The ISM New Orders indicator, a once-time-effective leading indicator, has grown less effective.

The US is transitioning to a services economy. There’s less manufacturing in the US (and that’s a good thing, as manufacturing is cyclical like the ‘commodity bullwhip’).

The ‘Sahm Rule’, triggered by an uptick in unemployment, is driven by an uptick in immigration.

Is there a data point that bothers me?

Mortgage rates remain elevated despite the 10-year tightening, and the Fed signaling easing.

Housing is a core pillar of the economy - driving construction and myriad downstream activities.

Agency MBS is a mispriced asset.

(I could envision chatter about the Fed buying MBS coming back if this doesn’t drop).

The flip-side… If mortgage rates do drop, we will see a lift in housing. Not a 1:1 lift since most people re-financed at much lower rates. But, we will see a boost to consumer psychology.

Consumers will expect they can refinance at lower rates.

Psychology is everything.

The lesson here? When prices fall, people go on to the latest bear narrative.

Recession went from Non-Consensus to Consensus in 3 weeks.

Stay the course.

On Latin America

BAML notes that "Latin America has never been this cheap relative to the United States"

Yes.

That's why we bought Pag Seguero in Brazil last month. If you missed exposure to emerging markets, you are about to get another shot at it.

Here’s a chart of Pag Seguero - it’s re-testing the 200-day now. Solid entry opportunity setting up.

We like Brazil due to maturing capital markets, good demographics, near-shoring beneficiary, and we expect weakness in the US dollar as the Fed Cuts..

I expect Brazil and Mexico will outperform the United States over the next few months…

THE FED PUT IS BACK

Here are key quotes from Powell:

"If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we are prepared to respond"

"If the Fed test is met, the [ policy rate ] could be cut as soon as September... we are not at that point yet."

"If inflation continues to move down and growth remains strong, a rate cut 'could be' on the table."

"If inflation is sticky and higher readings, then we weigh that."

"All of the data points point in the direction we want to see."

"We are seeing progress in [ services ]. The quality of this disinflation is higher. But it's only a quarter. But our confidence is growing."

Long-time readers will know I've been in the 'higher for longer' camp since 2023. We did not expect any cuts in 2023, even when Bill Ackman and Goldman Sachs continually parroted this narrative.

That's changed.

We will get rate cuts this year - adjustment cuts - starting in September.

The 'edge' from fading Fed Futures markets is no longer there.

The risk to this view is if we see a hot CPI or PCE in August. As I note above, we should get a strong NFP next month due to the reversal.

Stay tuned for Powell’s speech at Jackson Hole this August.

Another point Powell is making - the economy is 'normalizing'.

This is a point we've made consistently.

We are stair stepping down from 6%+ GDP growth to something more sustainable.

That's not a recession.

MARKETS

Learn to Like Market Corrections

I liked this post from Ross Hendricks.

Friendly reminder: if you're under the age of 55, you should welcome a bear market like a gift from the gods.

It never feels like it at the time, but bear markets are when fortunes are made.

Assuming you aren't gambling with options, leverage, or total shitcos, there's no better or easier way to create life-changing wealth than consistently putting money to work in a deep and prolonged market downturn.

And all evidence suggests we're on the verge of one.

Valuation Matters: Always Did

Valuation is almost all that matters in the long-term

Avoiding names more expensive than Nvidia is a good strategy. Look at the shellacking ARM received this week. And it’s still pricier than Nvidia.

Take a look at Celsius Holdings. Same idea.

Be careful of glam stocks.

Explore becoming a Lumida Wealth client: learn more about our Crypto White Glove Service or Click here to explore our Wealth & Family Office Services.

On Microsoft

It turns out Microsoft peaked on or about that day we made that call.

Microsoft’s cloud growth is slowing.

The stock has lagged QQQ and SPY because it is Consensus AI.

I’d rather own memory names like Micron (MU) or edge AI such as Qualcomm.

I believe both of these assets are mispriced.

Intel and AMD Shellacked

We wrote back in March how Nvidia has a dominant advantage over AMD and Intel.

Mr. Market woke up to that fact - Intel dropped double-digits on its earnings day and announced layoffs.

QUALCOMM ‘stock jumps as results guidance exceed strong chip demand’

Qualcomm and Micron both look like winners in an oligopoly setup attached to long term secular growth trends

Qualcomm’s forward PE is 14.8x. That makes it cheaper than Lululemon, Nike, Starbucks and all sorts of other stocks

That’s not too far from median midcap valuations… and it’s linked to the AI cellphone theme.

And their customers are high quality: Apple, Samsung, Xiaomi

We also believe Micron is mispriced.

Micron has a 12x forward PE ratio. Micron has a contract with Nvidia to sell High Bandwith Memory chips attached to the new Nvidia Blackwell system.

We believe Nvidia GPU demand is strong, so by extension, Micron will benefit. So will SK Hynix, the leader at this game, but Micron is cheaper.

Micron is also US-based which takes the Taiwan risk off the table.

Take a look at Micron’s share price vs. the low (red dashed line) and the high (green dashed line) of analyst price targets. When the stock gets this low, you see a bounce.

I could see Micron rallying 30 to 50% over the course of one year, and we own it.

The bear case is that Micron runs a cyclical memory business. It can get stuck with too much inventory and needs to slash prices. You have to believe the memory cycle is intact.

Also, a number of assets are getting cheaper. At the bottom of a correction, you want to upgrade to the most attractive assets that also have good valuations.

We own Visa for example.

So, as you look at Micron, you should also look across the field of semiconductors and other equities more generally to do a good relative value analysis.

We also own ASML now - but it’s not as cheap as it once was in the 2015 thru 2017 semiconductor cycle.

We aren’t at a place after a major bear market where you can simply by your best names and you are good.

We have attractive entries here, but you still need discernment in your relative value analysis.

Thank you for reading, and we’ll see you next week.

Buffett and Apple

Buffett sold half of his massive position in Apple

He sold that $50 Bn+ in one quarter - while the stock was rallying.

Buffett did the Great Rotation out of Tech through the May and June parabola.

He also sold a major chunk of his $BAC position, timing the top in mega-cap financials.

Buffett is a great investor… but less appreciated is he is also great at timing his entries and exits.

Now he has a cash war chest and we’ll see what he buys this quarter

My guess: is insurance and energy.

Company Earnings

Financials:

S&P Global (SPGI): Beat on EPS and revenue. Revenue grew 14.5% YoY. Strong growth in Ratings and Commodity Insights. Rising demand for financial data and market analysis.

PayPal (PYPL): Beat on EPS and revenue. Revenue up 8.2% YoY. Venmo saw strong payment volume growth. Increasing adoption of digital payments and mobile wallets.

Coinbase Global (COIN): Missed EPS, beat on revenue. Revenue more than doubled YoY. Growing interest in cryptocurrency and diversified revenue streams.

Intercontinental Exchange (ICE): Beat on EPS, slight revenue miss. Revenue up 21.1% YoY. Increasing demand for financial exchange services.

Technology

ON Semiconductor (ON): Beat on EPS and revenue. Revenue down 17.2% YoY. Anticipates strong future growth in the silicon carbide market.

Apple Inc. (AAPL): Beat on EPS and revenue. Revenue grew 4.9% YoY. Continued strong performance in the tech sector with robust product demand.

Advanced Micro Devices (AMD): Beat on EPS and revenue. Record Data Center revenue. Growing demand for data center and client segment products.

Arm Holdings (ARM): Beat on EPS and revenue. Significant YoY growth. Strong performance in the semiconductor market.

Intel Corporation (INTC): Missed on EPS and revenue. Revenue slightly down YoY. Challenges in the semiconductor market affecting performance.

Lam Research Corporation (LRCX): Beat on EPS and revenue. Revenue up 20.6% YoY. Continued strong demand for semiconductor equipment.

Microsoft Corporation (MSFT): Beat on EPS and revenue. Revenue up 15.1% YoY. Strong growth in cloud services and productivity software.

Qualcomm Incorporated (QCOM): Beat on EPS and revenue. Revenue up 11.3% YoY. Robust performance in the QCT segment driving overall growth.

Atlassian Corporation (TEAM): Beat on EPS, revenue in line. Revenue up 20.3% YoY. Increasing adoption of cloud services and project management tools.

Meta Platforms (META): Beat on EPS and revenue. Revenue up 22.1% YoY. Strong growth in ad impressions and user engagement.

Consumer Discretionary:

McDonald's Corporation (MCD): Missed on EPS and revenue. Revenue flat YoY. Digital sales are growing, but challenges in U.S. comparable sales.

Amazon (AMZN): Beat on EPS, missed on revenue. Revenue up 10.2% YoY. Strong North America and AWS growth.

Starbucks Corporation (SBUX): In-line EPS, revenue missed. Revenue down 1.1% YoY. Decline in global comparable store sales, but continued expansion with new stores.

Consumer Staples:

Anheuser-Busch InBev (BUD): Beat on EPS, revenue in line. Revenue up 2.7% YoY. Non-beer segments are showing growth, improving debt ratio.

The Procter & Gamble Company (PG): Beat on EPS, missed on revenue. Revenue slightly down YoY. Steady performance with expected earnings growth.

Industrials:

Eaton Corporation (ETN): Beat on EPS and revenue. Revenue up 8.5% YoY. Record cash flow and strong organic sales growth.

Utilities:

Dominion Energy (D): Beat on EPS, missed on revenue. Revenue up 10.1% YoY. Continued growth in energy demand and operational efficiency.

AI

We quite liked this excerpt from Bindu Reddy on AI vs Humans in healthcare.

Insightful quotes from this earnings season:

QCOM CEO: "Longer term, we believe the benefits of Snapdragon X Series platforms make it clear that the PC ecosystem has begun the transition to an ARM-compatible architecture. As we look forward, we're forecasting that at least 50% of PCs will be AI capable by 2027"

META CFO on AI ROI: "We don't expect our GenAI products to be a meaningful driver of revenue in '24, but we do expect that they're going to open up new revenue opportunities over time that will enable us to generate a solid return on our investment..."

Semiconductors: Datacenter Thesis Intact

The main takeaway from AMD earnings is its data center growth.

AMD datacenter revenue is up 115% YoY and shows $2.8 Bn in spend (see chart), but that is compared to NVDA. Nvidia's data center growth is around 500% YOY, and datacenter spending is around $45 Bn [ ! ]

Further, AMD is required to discount its hardware to gain market share - so it has lower margins, lower ROE.

AMD's stock was down for the year yesterday while Nvidia remains the best performer in Mag 7.

AMD is poised to rally today, along with virtually all semiconductor stocks as they are oversold, and on news of increased CapEx spend from MSFT and other 'hyperscalers'

I believe the best non-consensus play is semiconductors are Micron and Qualcomm.

Micron now has a forward PE of ~13x.

It's priced like a value stock. And Micron is one of three players that are indexed to Hardware-Based Memory. I don't like the capital intensity of Micron.

But, its US presence (a hedge against Taiwan risk) and the valuation more than compensate for the capital intensity - so does the corporate welfare in the CHIPS Act.

And Qualcomm QCOM as a leader in 'Edge AI' (e.g., AI computation on the PC or Mobile - not merely in the cloud)

Apple and Windows Surface and other systems will need Qualcomm Snapdragon chips to power the AI phone/hardware upgrade cycle.

We may need to wait for the Q4 holiday season for the Qualcomm AI edge narrative to gain ground.

Lumida Curations:

In case you missed it, here are some of the best curations from Lumida Wealth on Twitter.

Be sure to follow Lumida Wealth on Twitter, and on Youtube, where you can get more such curations.

Instead of watching hour-long market podcasts - we distill the key insights in 1 min shorts and serve them in threads.

The goal is to maximize insight per unit of time.

Zuck & Huang just leaked the future.

In case you missed out on the hour long conversation between the Chip Giant & the Open Source AI King, here’s the best insights.

Crypto's surprising hotspots & opportunities from Raoul Pal and Richard Teng CEO, Binance

Latest thread on insights with Michael Parekh where we dive into Q2 Tech earnings, AI, humanoid robotics, and more.

Some of the best insights from Bloomberg Wall Street Week

Click here to explore becoming a Lumida Wealth client

Quote of the Week

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.