Here’s a preview of what we’ll cover this week:

Macro: Happy Mother’s Day, First things first, Performance Chase Dynamics, Tariff Hike Outlook, Taxing the Rich

Markets: Earnings Season Highlights

AI: AI Buildout Boom

Happy Mother’s Day!

Invest your time today in the ones who matter most. Celebrating mothers and the lasting impact they have on our lives.

First things first

Last week we noted that an early week sell-off was possible. But that downside would be limited due to positioning and “performance chase dynamics”.

That’s played out and it’s largely our view today.

A 3 to 5% pullback is possible - there is a lull in earnings until Nvidia reports - but such a pullback (should we get one) should be viewed as a buy.

What we continue to see is fear re-enter the market - even when markets are slightly down. That’s a very good sign.

Consider that a lot of investors are out of the market and off sides. They need to get back in. And they will buy dips.

The background dynamic that will support all of this is Vix Decay:

The Vix “fear gauge” index remains elevated despite a 20% ish rally in the indices from market lows.

Interestingly, we did a Vix decay study and found that the average rally off the market low when the market bottoms and found that the average rally is about 20 to 21%. That’s where we are now.

Statistically, we have done the average rally. Now, averages are a point in the distribution. I would still expect a bid given very high buybacks and earnings season that is solid.

Add to that rhetoric from the admin which is uniformly bullish (even if tariff policy is destructive - that’s a longer-term issue that will weigh on long-run growth).

How much lower can the Vix go? Lower. Lower than most people think. This is how markets work.

Market Comp

The best analogy for this market is January 2019 -- the month after the end of the Q4 '18 Trump 1.0 trade war which also had a 19% decline in the S&P.

Market conditions are overbought...but crucially, staying overbought.

This is a new dynamic. What we saw thru most of March is indices getting quickly sold after rallies.There is a new technical behavior.

So long as Trump stays the course you can see 6,000 by June.

Buybacks Are Back

By the way, take a look at the pace of buybacks here:

Management views their stock as cheap. We agree.

Take Google for instance. The stock dropped 9.5% intraday on reports that Apple is looking to AI alternatives such as Anthropic to power search.

Google is now trading at 16.7x earnings.

Below is a chart of the historical valuation multiple for Google.

We looked into this and concluded that if Google loses the incremental ad revenue growth from not have placement on Apple iPhones, that incremental growth would lower 25%.

That’s not nothing. But, given that this is a ‘maybe’ not a foregone conclusion (why wouldn’t Google have a bid in serving Apple - after all they have the scale and infrastructure and the data) - and given the valuation and earnings growth - Google is still a good bargain.

Google is cheaper than many high quality utilities now. Google is a utility if you take a step back. (Aren’t all the best tech companies consumer staples in the sense of daily usage?).

We increased our position in Google. It’s a top 3 holding now.

Here is an excerpt from our www.lumidaai.com earnings transcript analysis on Google.

Google remains the leader in driverless cars (not Tesla), leader in content (Youtube), leader in Search – and has ample distribution.

Google is a high quality dislocated asset.

Zooming out, we are seeing bargains in small cap value and other areas - including internationally.

Have a listen to our Monday podcast of Lumida Non-Consensus investing and we walk thru a few off the beaten track ideas.

The 200 Day Moving Average

The big question for markets now is how will the QQQ and S&P 500 face with their first tests with the 200 Day Moving average?

Both indices are testing from below now.

Positive news such as a major trade deal with China could cause a pop.

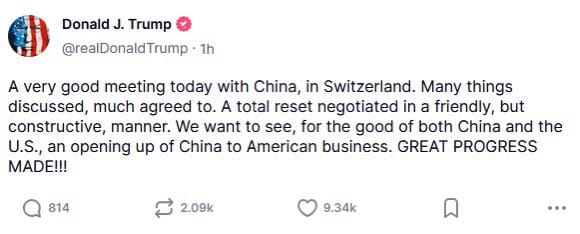

Have a listen to this video of Trump discussing China and his win win vision of trade. This is an about face.

Trade deals take time to work out. But, intentions are ste starting point, and markets are forward looking.

Markets will discount a trade deal. China is preserving self resect and autonomy via staged walk outs. Their economy is weak. Youth unemployment is high. Laborers are protesting. They need a deal.

Trump on China:

Would not surprise us to see some consolidation this week between the 200 DMA and these upward sloping EMAs.

It may take Nvidia earnings causes the pop above the 200 DMA. Recall, last year, Nvidia’s earnings at this time created renewed enthusiasm for the Datacenter them.

A policy shift allowing Nvidia to sell to Saudi and UAE is also inevitable.

A period of digestion here is normal.

Negative newsflow from the ports could add to the volatility when images of empty cargo ships show up.

Our base case is a continued rally thru summer.

We expect that tariffs would cause a bout of stagflation in the summer. Looking at the UK deal, American business will pay 10% for imports from UK.

This is still a sales tax. Actually, one can interpret it as an increase in the highest marginal tax rate for small business owners.

Stagflation will have a negative effect on markets - so summer volatility seems likely.That would line up with historical seasonality and a time when the Vix has likely fully reset.

Performance Chase Dynamics

Hedge funds have high gross long exposure, but low net exposure.

They have lots of short in small caps.

Small caps are rallying more than any other category.

So, hedge funds are forced to cover those shorts. That propels those names higher.

And the cycle repeats.

There is nothing pre-ordained about a performance chase. Those conditions don't require a performance chase.

But, the Trump admin talking up markets and pivoting on tariffs is enough to ignite Animal Spirits and light these markets.

What you have here are retail investors squeezing hedge funds.

(We also discuss this topic in the Lumida Non-Consensus Investing podcast.)

That's an important technical level.

More trend followers will step into the market.

Tariff Hike Outlook

It increasingly looks like the best case scenario on tariffs will be roughly the 60% China and 10% all others, amounting to a roughly 15% hike in overall tariff rates.

While there was a lot of hoopla about the UK deal, more than anything it solidified this path.

The UK will lower their own tariffs - that means UK citizens will get a tax cut and Americans will get a tax hike.

That’s not a win for Americans. I will share below a more rational framework to charge foreign countries for perceived free-riding on American Global Security and pharma innovation.

If you want to see what tariff rates are around on the world - the image below will help. It’s easy to see that global tariff rates are low.

Sure, there are non-tariff barriers. The Argentines like home grown grass fed beef. The Europeans don’t like GMO products and skew organic.

There are legitimate opportunities in the automobile sector. But, it’s also hard to get an Escalade thru a Parisian cobble stone road that was created during the reign of Louix XIV.

It’s hard to see how these deals will open up incremental revenue when you consider the backlash against American products.

Here is a nice table from our friend and podcast guest Bob Elliot showing the tax revenue generation from the tariffs.

Now, we will see tax cuts that will offset this.

But those tax cuts will accrue to sub $150 K income workers more likely, and the taxes will be borne by small businesses and large caps that import and their shareholders.

The tariffs are regressive for low income consumers, but progressive after the proposed tax bill is put thru.

Economic populism is now a central pillar of both the political left and the political right.

An Alternative Tariffs

"The Market Access Fee"

It's true that certain countries benefit from U.S. investments in global security, pharmaceutical innovation, and IP theft.

There is a free rider problem where United States is leaking value in a public good problem.

But, tariffs are the wrong answer because forcing a tax hike on Americans just adds a deadweight loss.

Below is a constructive alternative that has none of these drawbacks that is economically efficient.

Market Access Fee

Consider a 'market access fee'.

A market access fee is an annual lump-sum payment charged to countries seeking to access the U.S. market.

When you tax something, you get less of it.

Tariffs are paid by Americans as a sales tax or import duty.

Tariffs creates less output, less earnings, and less income.

But a lump-sum fee avoids all of those drawbacsks.

The market access fee is paid by the Treasury of the Sovereign - China, United Kingdom, etc.

There is zero question of who actually bears the burden of market access.

A market access fee establishes a clear, explicit cost for the value derived from U.S. contributions to global stability, innovation, and technology.

Tariffs Have Drawbacks

American small business will experience the 10% UK tariffs as a sales tax - or an increase in their marginal tax rates.

Tariffs can trigger retaliatory trade wars, as seen in historical U.S.-China tariff disputes.

The United States is the largest consumer end market, so the bargaining power in working out a market access fee is significant.

Play it out.

Would China charge a market access fee to the United States?

No.

The U.S. barely has any access to the China market.

To the extent they would retaliate, the China market access fee would 'net out' against the American market fee in a negotiation.

The 'market access fee' forces clarity on the value of market access vs the costs of free-riding or cost of IP theft.

If you are China and want to lower your [ $200 Bn ] market access fee, you can open up your markets.

Economically Efficient

Economists hate sales taxes because they distort behavior.

Lump sum taxes do not distort end consumer or producer behavior.

A lump sum tax does not interfere with price signals.

This ensures producers and consumers operate efficiently.

The magic of the invisible hand can continue to operate.

The lump sum approach preserves productivity growth and real incomes, allowing capitalism and welath creation to thrive.

Shift the Burden

The market access fee shifts the financial burden to nations that benefit from U.S. global leadership.

The U.S. can continue importing disinflation (low-cost goods) while making free-riding countries pay their share for offering, for example, American pharma at prices that do not allow such firms to recover their R&D.

A market access fee is similar to the "Golden Visa" for market access- except it is charged to a Sovereign.

Sovereign Flexibility

Countries facing the market access fee decide how to fund it.

They can do this through taxes, debt, or monetary polichy. This makes it the political responsibility to resolve of other nations to resolve.

This insulates the U.S. from domestic backlash.

A market access fee is a minimally invasive way to address the free-rider problem.

It ensures the U.S. is compensated for providing a security umbrella and IP innovation while preserving trade, innovation, and prosperity.

Taxing the Rich

AI Buildout Boom

Market

Earnings Season Highlights

Lets take a look at some insights for Novo Nordisk (NVO), Royalty Pharma (RPRX) and Talen Energy (TLN).

These updates from healthcare, biopharma, and utilities reveal how each company is tackling tariff pressures and economic uncertainty, with strong growth in key areas but cautious outlooks ahead:

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In