Here’s a preview of what we’ll cover this week:

Macro: Non-Farm Payrolls Surge + Economic Surprise Index

Markets: Uranium Quant Funds vs. China

Company Earnings: CARS, HIMS, CELH

AI: AI & Education, Open AI

This week, Ram took the stage at the Mainnet Panel alongside Franklin Templeton, Van Eck, and Bloomberg.

Next week, Ram will be at Permissionless III in Salt Lake City. Email [email protected] if you’d like to meet.

Macro

Non-Farm Payrolls crushed expectations. 250K+ jobs created versus expectations of 150K+

What we are seeing is a normalization of economic activity back to 2019-ish levels.

I spotted the world ‘Goldilocks’ appear a bit early - we’ll see much more of this word in the months ahead.

Notably, Goldilocks is an apt description of economic conditions - but it is not the vibe.

Skepticisim abounds.

Or, consider this article headline: ‘Are We In an AI Bubble?’

Skepticism is what you want to see in a bull market.

Remember John Templeton’s dictum?

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria”

Markets are about psychology.

Markets have a few phases.

Phase 1: Non-Consensus / The World is Ending / Deep Fear

Phase 2: Wall of Warry - We are here now

We are on the climb a wall of worry phase. Let’s worry about recession. Geopolitical risk. Is AI in a bubble. Housing will break the economy. Long and variable lags. The list goes on and on.

Phase 3: Optimism

I expect we will soon be entering the ‘optimism’ phase.

Phase 4: Euphoria

Then we will enter peak euphoria - that’s likely during IPO season next year.

What might cause the bull market to end the euphoria pahse is the Fed discussing adjustment hikes to offset the 50 bps rate cuts we just saw.

I’m not alone in my non-consensus criticism. Really pleased to have none other than Stanley Duckenmiller join us in the foxhole.

I’ve been saying the same for month and as recently as last week:

Thematic Analysis

When I look across themes, we see quite a few themes that we expect to do well into year end as well.

I still prefer a tilt to value and owning the best of growth - and growth at a reasonable price.

Recall, valuations are in the top decile.

I expect money to shift from over-priced themes such as the ‘Best vs. The Rest’ theme into value names.

Where? Insurance, insurance, insurance.

These are world class businesses - just like names in the ‘Best Companies in the World’ theme which has rocked this bull market: Nvidia, Meta, FICO, Axon, Berkshire Hathaway, S&P Global, etc.

Some of these quality ideas are way over-priced. By quality, I mean investors focus on owning names that have a competitive advantage and quality business model.

Everyone is investing like Warren Buffett now so the ‘quality’ theme is bid up.

Take a look at FICO for example at 68x forward earnings, 100x trailing PE.

I find it amusing people are wondering whether Nvidia is a bubble, and we are looking at a bubble right in front of our noses - quality is in a bubble.

Here’s Axon at a 111x trailing PE ratio.

Quality businesses have crushed it this year, and benefitted from momentum.

Costco has a forward PE of 50x. Hardly a value stock.

What I expect happens is these large investors increasingly realize there is no recession.

Then they rotate to small, mid-caps, large cap value.

Insurance for example.

AI themes will continue to work.

However, datacenter related themes will work better. This is why we invested in CoreWeave - the neo-GPU cloud that powers Microsoft and OpenAI.

Incidentally, we just closed our second investment into CoreWeave.

We are up 3x from our first investment in CoreWeave around last year this time.

(Unfortunately, I am not permitted to notify you of any deals we have in process due to the SEC marketing rule.)

So, please shoot [email protected] a note if you are an accredited investor or qualified purchaser and want to be in the loop on our next deal.

Bloomberg is now calling CoreWeave one of the hottest AI startup deals.

OpenAI meanwhile is spending billions of dollars on CoreWeave - and brought on SoftBank and Cathie Wood as an investor.

What other themes do we like?

Regional and community banks. More rate cuts are coming. That will help banks that are almost upside down on their net interest margin.

lower rates will also spark an M&A cycle. Regional banks look to bulk up as they aspire to become too big too fail.

They will acquire community banks. Small community banks will seek to bulk up also.

Don’t forget - GPT 5 will hit in December.

Prefer Nvidia over Semiconductors

The AI theme is still alive and well. I am less excited about semiconductors, but remain high conviction around Nvidia. (AMD is now pricier than Nvidia on a forward PE basis - that doesn’t make much sense when the margins and earnings growth are lower.)

On Nvidia, this past week, I analysts lift Nvidia to $150 price targets over the last week.

Natural Gas

Here’s a theme I am excited about. I expect we’ll see natural gas names do very well.

This theme is still early and not widely appreciated.

Utility plants need energy.

Wind and solar are not reliable. Folks are waking up to nuclear - but the build and permitting times - not to mention the lethargy that is the NRC - are too slow.

Natural gas is the least dirty energy source for utilities.

I was listening to Bloomberg Wall Street Week this weekend - an analyst noted that nat gas demand is up 170% year over year.

If you want to pre-position like we do into the next theme - the natural gas theme is still early and room to run.

You might recall we had a bet on Chenerie (LNG) back in March or April under our ‘Follow the Money’ thesis: AI App Layer spends on Data Center spends on Utilities which spends on Natural Gas.

That worked out well.

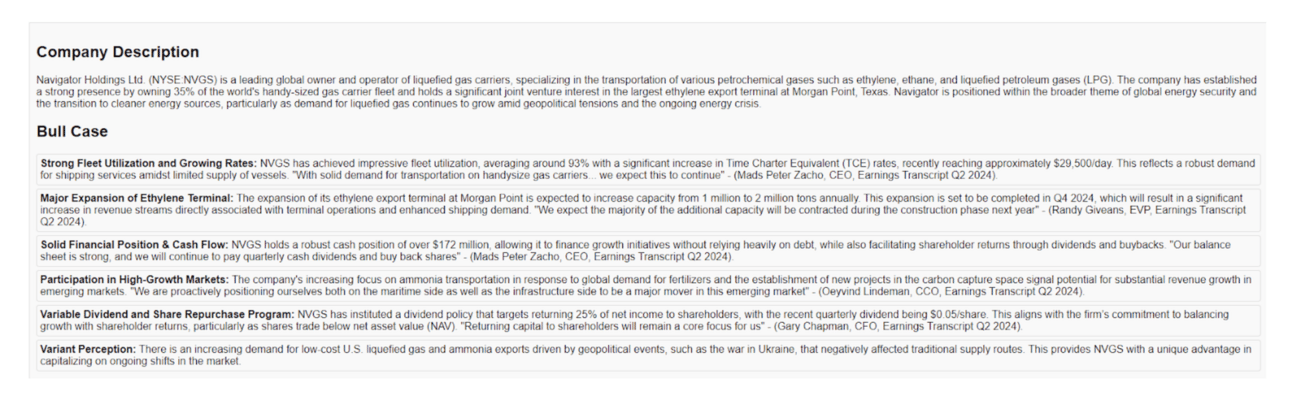

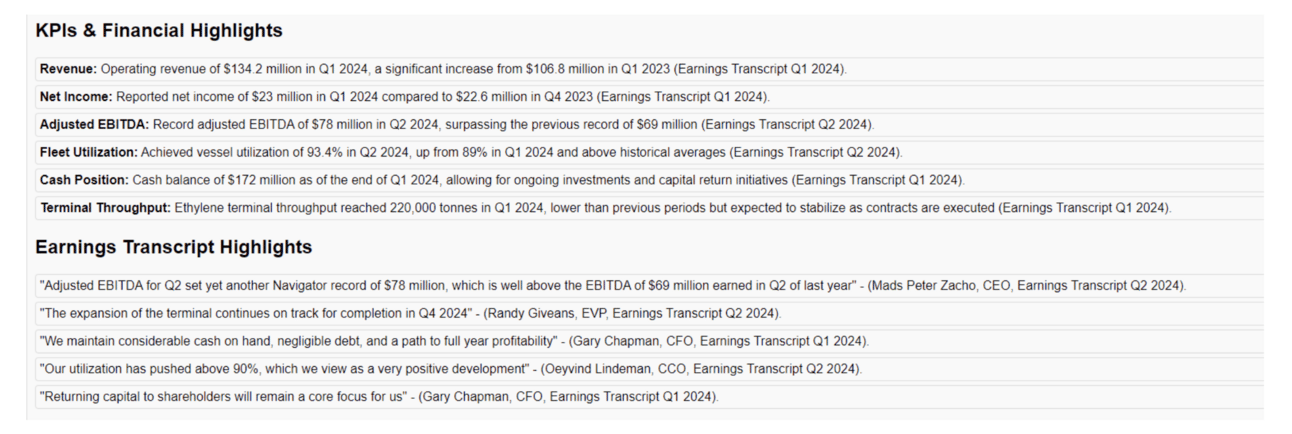

Here’s another we own: Navigator Holdings (NVGS).

I’ve asked my AI to write-up the bull and bear case for you. We use this in-house tool EVERY SINGLE DAY.

The bear case is debt maturity risk: $250 MM is due in 2025, volatile shipping market dynamics, and potential over-capacity concerns.

(I’m not worried about the debt from an earnings perspective - and firms with debt I expect outperform due to lower rates and the benefit to net income from refinancing.)

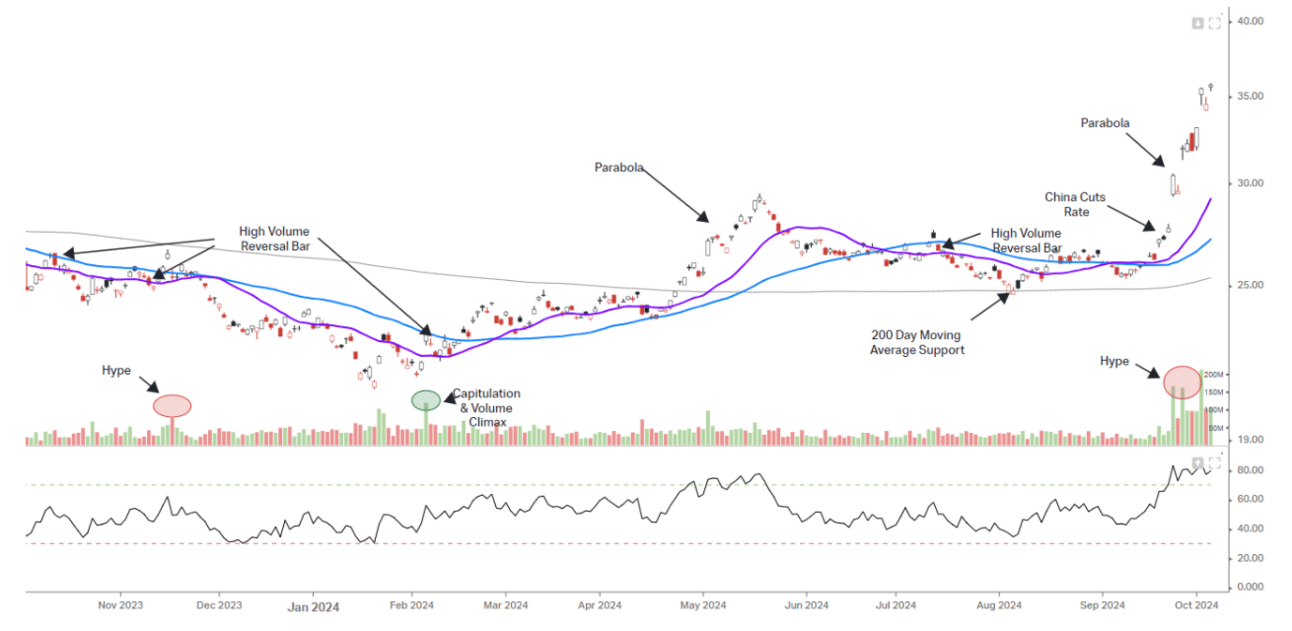

Here’s a chart of NVGS.

Here are other quotes from management - notice they are shareholder friendly and focused on ‘returning capital to shareholders’.

Navigator is buying back 5% of their shares and has a shareholder yield of 20%. The price to free cashflow is 5.3x.

The stock also pays a dividend of 1.7%. As Fed rate cuts continue, we expect boomers will rotate into dividend payers.

We’re still early in the natural gas cycle.

We believe there are other opportunities in natural gas and are actively researching them.

Note: If you are a family office / VC that sees the promise of our AI capability and wants to join our mission to disrupt wealth management,, shoot me a note.

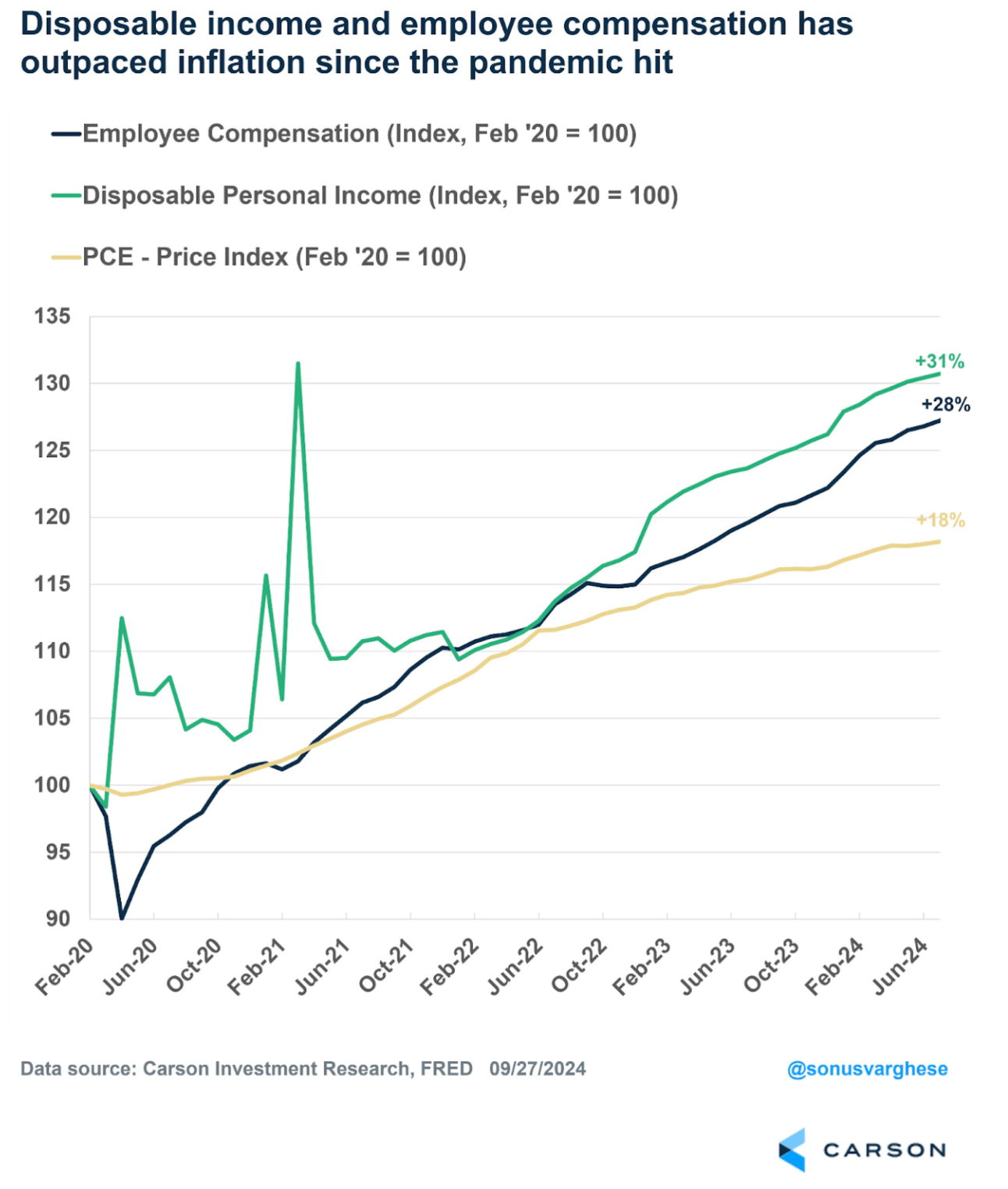

Real Incomes Are Up

One of the macro points we have hammered away at is that real incomes are out-pacing inflation.

That’s partly driven by productivity growth. It’s also driven by folks taking on two jobs.

Either way, although the backdrop isn’t ideal, it is constructive.

Disposable income is up 31% and compensation is up 28%.

This is why we didn’t get a recession - both corporate and personal incomes increased over the last several years.

Economic Surprises Are Positive Again

This is good news for cyclical categories and small caps.

The fact that economist expectations are low despite indices are high suggest that the bull market has plenty of room to run.

The time to get concerned is when Goldilocks is on the cover of Time Magazine.

ISM Services PMI surged to 54.9, significantly above estimates and the highest since Feb 2023.

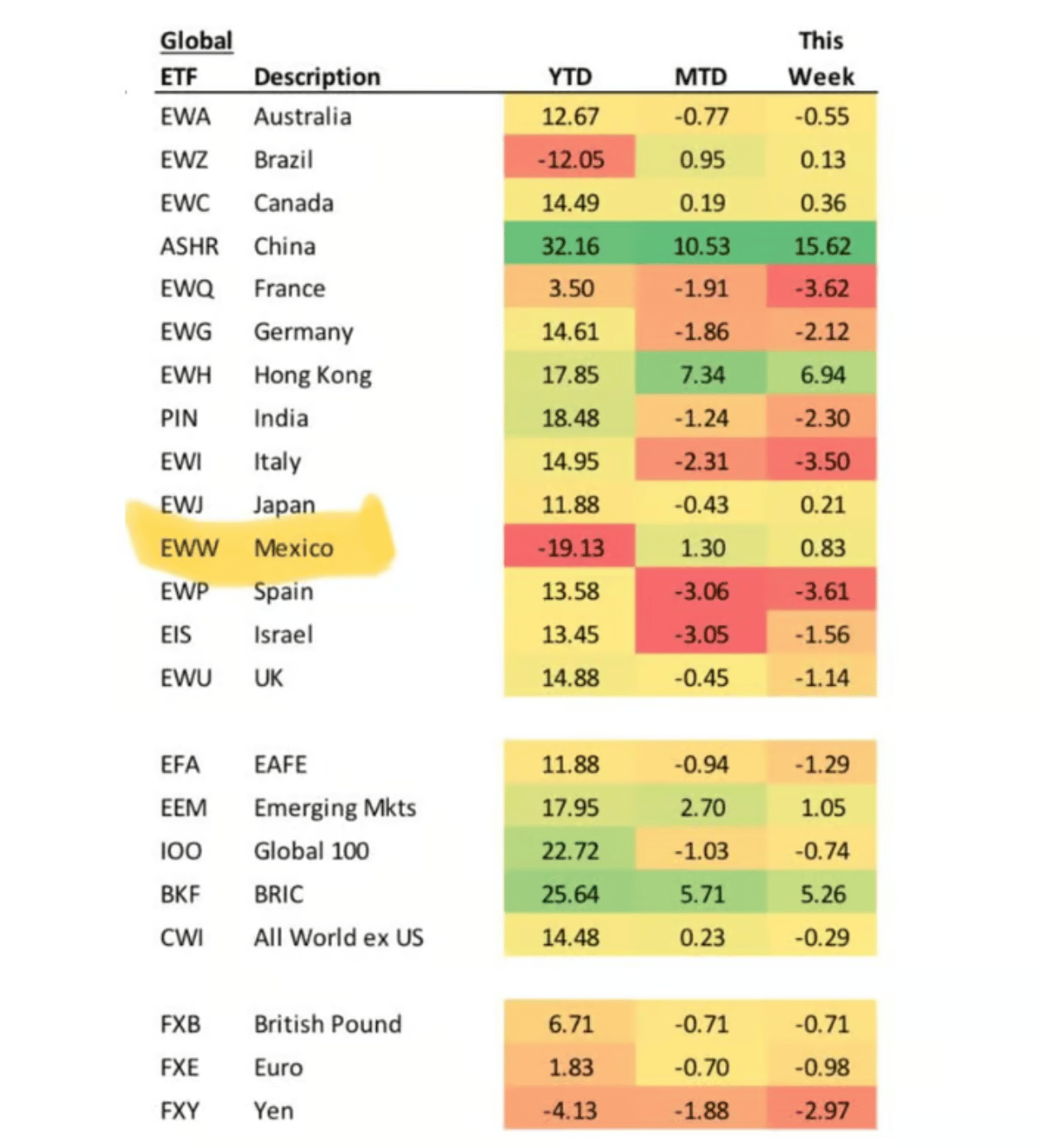

CHINA & QUANTMAGEDDON 2.0?

Something I didn’t realize until earlier this week – quant funds are short China and are experiencing a major short squeeze.

The short interest in FXI is a whopping 60%.

Quant Funds are facing a short squeeze and margin call due to China positions.

The last time we had a major quant fund snafu was August 2007. In one week, quant funds that had the same correlated bets experienced a 30% drawdown — despite their market neutral exposure.

This included AQR and Goldman Sachs Global Alpha (since shutdown).

This time, the quant funds are Dow 3 to 5% over three past week. What you are seeing in China is a major short squeeze.

Take a look at the short interest in FXI which is at double digit levels.

These quant funds are usually long momentum, value and quality.

I would wager that the volatility we saw yesterday reflects an unwind of the long position of the quant strategies needed to fund the margin calls on the short side.

This is different from the Yen Carry Trade — but both have the similar feature of long U.S. assets and funding with foreign assets.

Shorting China stocks is the same as funding via your U.S. positions via China stocks.

You are replacing the Yen funding leg in the USDYEN carry trade with the China remnibi and China securities.

When quant funds cover their short China positions, they will push that market higher.

Add to that - the fundamental bid around China and we should see big quant funds under pressure.

That short squeeze I believe is what is keeping the China rally going tactically.

China’s FXI index is now up 48% YTD, easily beating the S&P 500.

The rally should end when the short squeeze is over. I don’t believe it’s a great idea to chase into the China rally from here.

Kind of amazing how one interview with David Tepper on CNBC transformed the market perception on China.

Uranium

Peter Thiel is on the HALEU train.

HALEU = High Assay Low Enriched Uranium.

This is a theme Lumida Wealth has been investing against before the big VCs started talking about the need for nuclear energy (see BG2 podcast).

Along with semiconductors - access to high assay low enriched uranium - will be viewed as a strategic national interest.

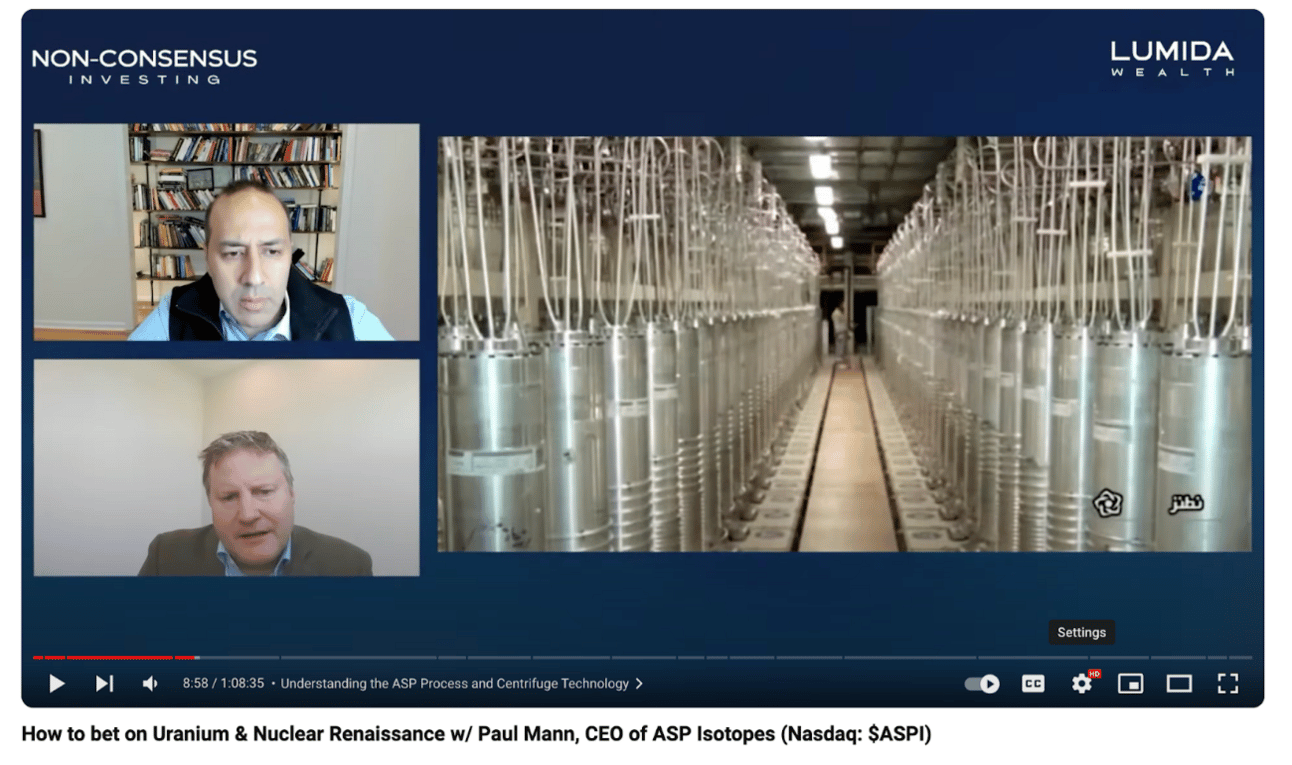

Please see our video interview with aul Mann, Chairman and CEO of ASP Isotopes (ASPI) explaining HALEU.

Momentum & Mean Reversion

China went from worst to first in a matter of two weeks - beating the S&P YTD.

What’s ‘the next China’?

I like to have momentum ideas paired with mean reversion ideas - and both grounded in good fundamentals.

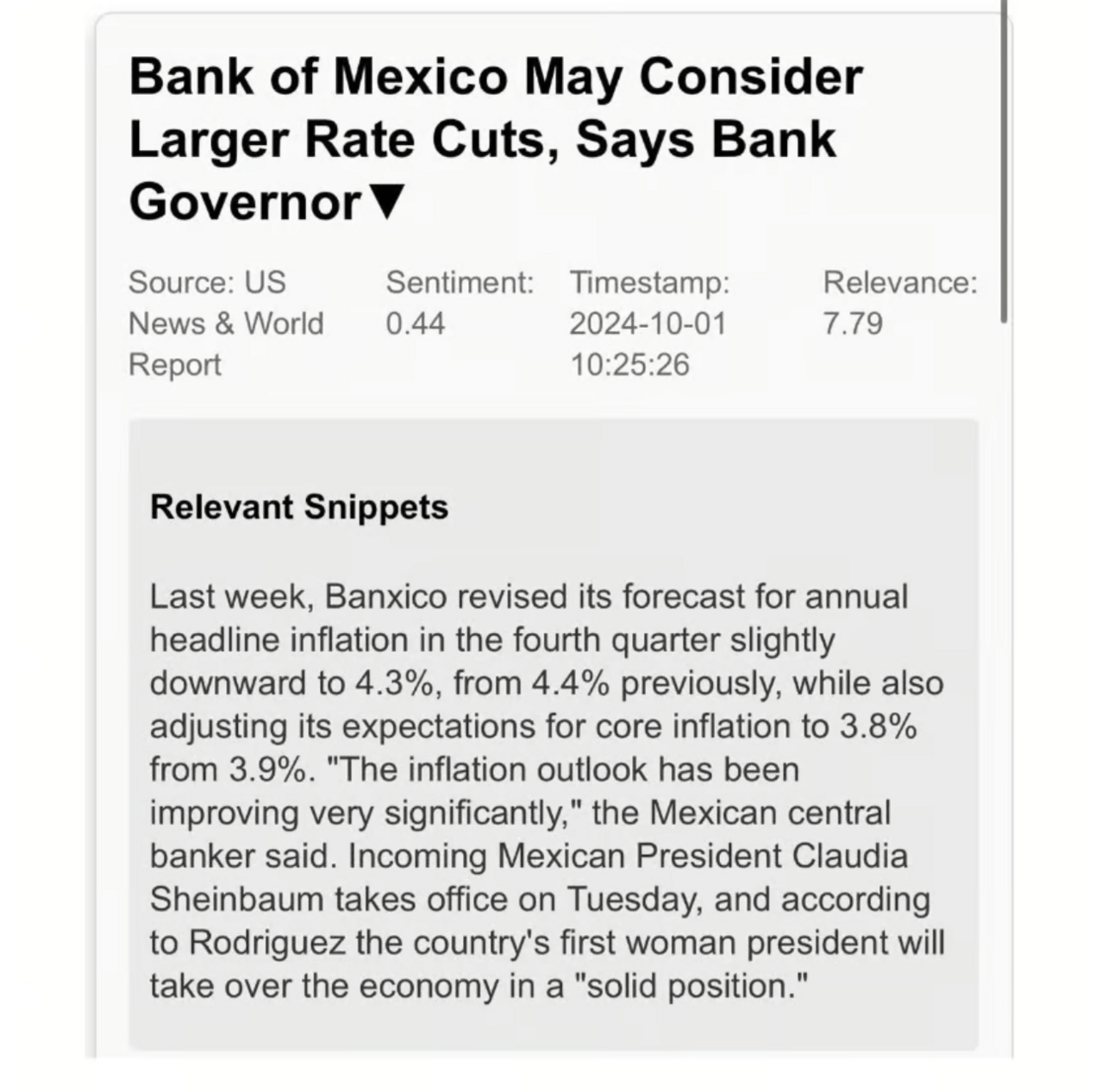

I have my eyes on Mexico.

No one is talking about it. The hot money is elsewhere.

Since the Presidential election, the index has tanked on no real discernible news of major policy shifts.

And inflation is easing.

Rate cuts are coming.

And Mexico is a beneficiary of re-shoring.

When?

Add the end of October to your calendar and re-assess then.

Needs time to digest.

BTW, check out the news clip from our AI tool.

Lumida Wealth is cooking…

The thing with mean reversion ideas is you need patient investors.

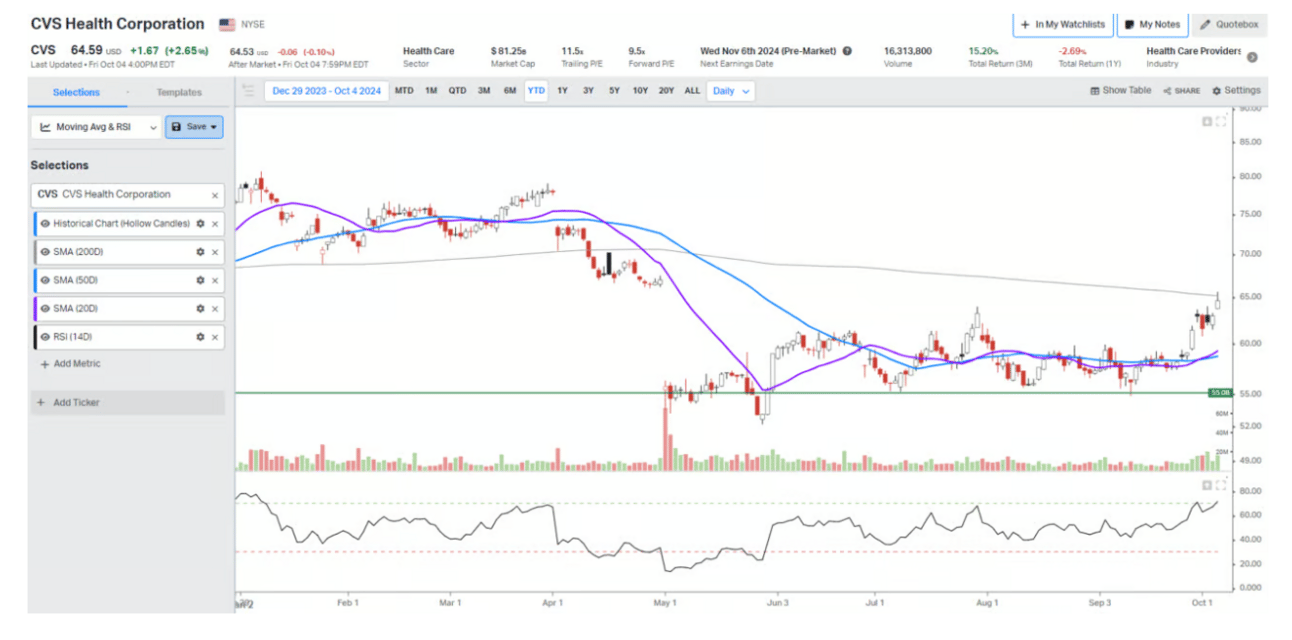

Like China, homebuilders, the banks, or CVS, digital assets - they can do really well.

But they don’t move month to month

With CVS, now up nicely since our first buy, our view was ‘you make your money on the buy’

CVS is up about 12 to 15% from buy points a few months ago.

And if you buy well, you are in a waiting game until Mr Market catches up

They are also safer since risk is priced in

Mean reversion ideas are better at the index level too — you aren’t dealing with catching falling knives per se — the index is not down for company specific reasons but some allergic reaction

But most of that move was recent

So, for a few months you can’t show much while bad news is getting priced in

If you have patience, however these mean reversion opps play a great role in a portfolio

Death of SaaS (Continued)

Beat and no-raise? In the last 6 quarters, the median software company has barely guided the next quarter ahead of consensus.

We remain of the view that SaaS is highly over-rated.

AI

This past week, I had a conversation with former Goldman Internet Analyst, Michael Parekh, on all things AI.

We discuss OpenAI’s valuation and the drama, and also CoreWeave.

Give it a listen! The show should be on Spotify soon as well - look-up ‘Lumida Non-Consensus Investing’

AI & Education

Students are using AI to do homework.

Teachers are using AI to grade homework.

It’s a cat and mouse loop with AI in the middle.

The education system is essentially training the next LLM model.

I propose getting back to writing skills & critical reasoning.

The best founders, leaders and investors are great writers.

Jeff Bezos and his leadership principles and memo approach (no slides).

Steve Jobs insisted on clear writing (and had a passion for calligraphy).

Ray Dalio writes his framework in Principles.

Howard Marks and Warren Buffett write their ideas more than they speak.

The education system should orient to building founders.

The next generation needs the skills of founders as uncertainty and velocity of change increases.

Professions are going to disappear from Longshoreman to accounting to radiology diagnostics.

Why writing?

Writing creates accountability and forces clarity of thinking

Is it any surprise that the greek word ‘logos’ (meaning ‘word’) takes such prominence in the book of Genesis?

In Exodus, the Ten Commandments are written down - they are not passed down via an oral tradition - and that’s what gives these texts a force that has lasted generations.

The act of writing adds permanence and weight to ideas, whether stone tablets, or the words on the Liberty Bell in Philadelphia.

Before I started Lumida Wealth, I had a few weeks to write down my leadership framework to establish clear standards.

I share this document with our team, prospective hires, and as a touchstone for myself.

A lot of the ideas around leadership and investing go hand-in-hand with investing.

- Focus is excellence

- Clarity of vision

- Know your customer

- Velocity and speed are better than perfection

- Stick to winners, cut weaker players

Note: Lumida is opening up new accounts at the $1 MM and $3 MM+ level. Reach out to [email protected] if you’d like to learn more about our services.

We are especially pleased about our new tax loss harvesting strategy that benchmarks to the S&P 500, while generating significant tax loss harvests that can be applied to the sale of a business, concentrated stocks, or any short or long-term capital gains.