Welcome back to the Lumida Ledger. Here’s a preview of what we’ll cover this week:

Macro: Housing Cracks; Animal Spirits

Markets: 13F Tracker is Out!; Tech overbought; Q4 Views

Company Earnings: State of the Consumer; Spend Trends

AI: OpenAI is pivoting to building God; Sam Out but Back Soon?

Digital Assets: Altcoins; Liquid Venture

Tune into the latest Lumida Legacy Podcast: 'The God Molecule: 5-MeO-DMT & Psychedelics.'

Host Justin Guilder and Ram interview a ‘psychonaut’.

We delve into topics such as insights from 5-MeO-DMT, its comparison with other psychedelics, Carl Jung, and the philosophy of consciousness.

The episode also covers intriguing themes such as self-love vs. entitlement, the enigma of consciousness, and the impact of psychedelics in various religious traditions.

We also discuss how Johns Hopkins, NYU and Imperial College are researching psychedelics for mental health treatments.

It’s the perfect listen for the plane trip home, or that one-hour car ride.

Find the video on Youtube or twitter and save it on Lumida Legacy for Apple podcast and Spotify as we release the audio version soon.

Ram vs. Jim Bianco

If you own equity growth stocks, this clip is worth watching. There's a lot of complacency in owning certain Mag 7 stocks. And leadership changes. (Remember when Netflix was part of FAANG and has since been kicked out?)

AI

Sam Altman was terminated abruptly by his board this Friday citing “lack of candor.” The President of OpenAI resigned as well in solidarity.

It looks like Sam may be back by this Monday. Microsoft, which holds the purse strings, and other VCs are pressing for his return and the ouster of the board.

If you take a shot at the king, you best not miss.

Here’s our wargame of what’s happening in Silicon Valley:

The War Across Big Tech to Win AI

There’s an expression in warfare: "Amateurs talk about tactics, but professionals study logistics."

The quote highlights the importance of logistics (e.g., supply chains) in military strategy.

OpenAI is dependent on GPU providers such as Nvidia for Compute.

Nvidia is wary of Microsoft, Amazon, and Google.

The 'hyperscalers' each have taken steps to re-factor their GPU supply chain and build their own competitive GPU chips working with players like Broadcom. (We are long Broadcom.)

So, how does Nvidia respond?

Nvidia is prioritizing supply to non-competitors such as Oracle, Coreweave, and Inflection.

OpenAI has significant equity investments in the latter two.

This hamstrings OpenAI. And OpenAI needs billions more in fresh capital to fund increasing LLM competition from all corners.

In fact, OpenAI can rent compute more cheaply from Google - another competitor - than it can from Microsoft.

According to Semi Analysis, ironically, “It makes economic sense for OpenAI to use Google Cloud with the TPUv5e to inference some models, rather than A100 and H100 through Microsoft Azure, despite their favorable deal.”

Sam Altman is looking out into the future.

He sees supply constraints.

He sees that Nvidia has juicy 80% profit margins that are greater than software.

It's a capital light business model with licensing revenue.

My bet is he will focus on a RISC-based quasi open-source architecture.

He might also benefit from funding from the CHIPS act.

He'll make more money on his next venture than OpenAI.

Google Gemini Delayed

We continue to believe Google Gemini will trounce OpenAI.

Google's capability set is not widely appreciated by the market. Google has an advantage both on the Silicon Layer and Application Layer as we wrote in last week’s newsletter.

Google has delayed the roll-out of Google Gemini. Meanwhile, we hear that Google employees who are testing it say it beats the competition hands down…

Hope you are accumulating Google folks.

Our google thesis is here. No one is talking about this, and hedge funds in our 13F filing have mixed views. That means it is Non-Consensus, our sweet spot.

Macro

Last week, we wrote that we detect a ‘vibe change’ in markets just as the soft landing narrative sets in.

That theme of weakening data continued this past week.

New data from housing, increased initial claims, and a reduction in avg hourly hours worked is reinforcing a weakening economy narrative.

Markets

Notice markets rallied and the 10-year tightened this week closing at 4.4%.

We’ve come a long way from 5%. That is a sign of declining ‘risk aversion’.

Risk aversion is the CFA term for what economist John Maynard Keynes dubbed ‘Animal Spirits’.

We want to be tactically cautious when rates are rising as that implies a higher discount rate for equities, and higher relative value in bonds. When bond yields are declining, that’s bullish for equities.

The S&P and QQQ are surging. Recall we said ‘stay long’ and resumed market weight. Don’t succumb to your amygdala.

Earnings are beating expectations.

One of the reasons this quarter is that analyst expectations were 0%. And analysts are often wrong. We like stepping over low bars.

For this and a host of reasons we remain of the view that Q4 is bullish for equities. That’s the primary headline.

Now, within equities, Big Tech stocks are overbought. So you don’t want to chase these names.

And stocks can stay overbought for longer. That’s what happens in bull markets.

Indeed, the gap ups and frenetic buying we saw in early November is characteristic of bull markets.

There’s still a lot of liquidity out there and low analyst expectations. That combination is creating a rally.

Tech as we noted is approaching overbought.

We love our portfolio, and bought a variety of tech names during the October correction, which we shared in our October newsletter, including: Broadcom and ASML.

These stocks are at All Time Highs now.

We don’t want to sell those as we are tax sensitive and want long-term capital gains.

I bought some puts on Affirm - a rapidly growing unsecured lender that recently hit YTD highs. It got ahead of itself. They rang the bell on the Nasdaq exchange on Wednesday.

The same day it hit a YTD high. That’s a simple way to protect a portfolio by hedging via a name that has credit & liquidity should a ‘slowdown’ narrative come to the fore.

It may seem counterintuitive to buy puts on a stock the day it is re-ringing the bell on the Nasdaq.

Think of it this way: Sentiment and enthusiasm hit a local peak… it can only cool from here.

Here’s a chart of Affirm - notice the rally on declining volume and overbought condition.

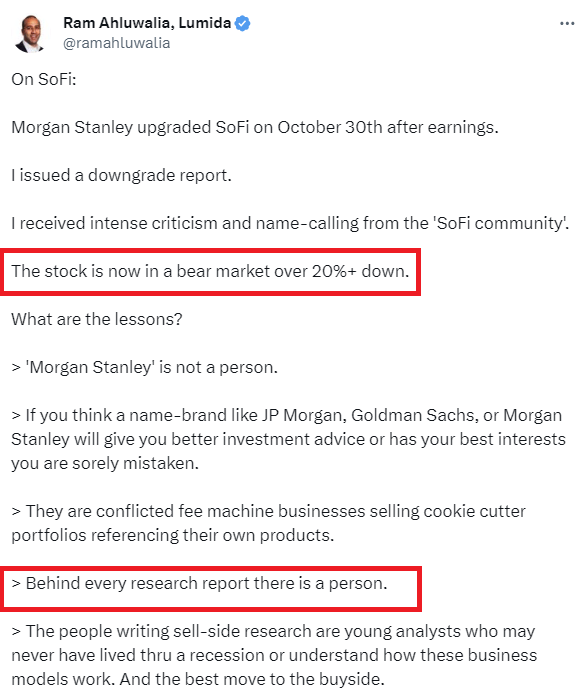

Similarly, we took a Victory Lap on our SoFi call.

Recall, SoFi released earnings on October 30th.

Morgan Stanley upgraded the stock. We did the exact opposite

We published a critical take on the same day which received 120K views on X.

SoFi is down 20%+ since then.

Markets are sniffing out the risks we see and are starting to conclude SoFi is one of the cheapest asymmetrical hedges against deteriorating credit & liquidity risk conditions.

Read the thread if you want that thesis. (Note: It’s easier to short these broken businesses when their stocks are nearing highs, rather than when they are oversold.)

State of the Consumer

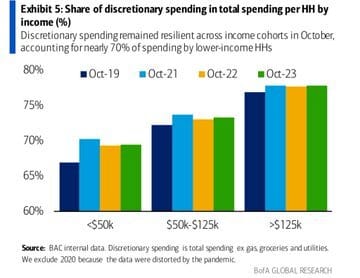

Although there are fears of a slowdown, and the economy is missing expectations as much as it is beating, we do believe the Consumer is solid.

Look at Visa - the consumer stock is near an all-time high.

There’s a lot of talk about Consumer delinquencies. They are increasing on the lower-end, but that doesn’t swing the economy. The low-end consumer is about ⅓ of consumer spending.

Consumers are pulling back on high-ticket items (e.g., kitchen remodels). They are shifting their spend to Travel & Leisure and services.

Overall, consumer spending remains resilient and stable. It’s not accelerating, but it’s not declining.

We’ll continue to monitor the Consumer in the months ahead.

On China

Despite fundamentals improving equity managers are actually more underweight China than before the re-opening of the Chinese economy.

China Premier’s visit to the United States is capitulation.

We write about that here:

On the other hand, in China, we see firms like Alibaba getting pounded after earnings.

That stock now has a PE ratio that is sub-10%. Analysts expect low future growth. We view that as a market over-reaction.

Rather than try to predict what markets will do - look for market over and under reactions. It looks to us that investors have grown impatient with China and are throwing in the towel.

Read this thread if you want to explore BABA further and our thoughts.

I expect in the next few days BABA will put in an intermediate bottom.

Meanwhile, the China Premier’s visit to California is a sign of capitulation and China is stimulating its economy with fiscal and monetary policy.

China’s Re-Opening in the fall of last year created a lot of hype. The substance never materialized.

We are seeing data that retail sales are climbing.

The fundamental mismatch between equity prices and improving monetary and fiscal policy sets up an interesting question.

Lumida Wealth will be interviewing a portfolio manager who has 12 on-the-ground analysts in China to discuss China Big Tech and their view on the economy.

We look forward to learning more.

We Remain Excited Semiconductors

We have said many times that the AI bet is to focus on the Silicon Layer not the hyper-competitive, overvalued Application Layer (e.g., Open AI $86 Bn Valuation).

We don’t know who will win the AI Super App wars. But we know they need to spend on GPU capacities and that supply chain.

In the gold rush, focus on the picks & shovels.

Take a look at this technical study which supports our fundamental thesis.

The study analyzes the performance of the SMH semiconductor ETF when it reverses from a low-level:

Statistically, this generates a 91% win-rate over the next 2 weeks, and an 80% win-rate 1-year later with average and median returns of 23 to 25%.

Semiconductors are much more attractively priced than slow growth Mag 7 stocks as well.

Looking back in 10 years, we expect to see a crop of 10x firms in the Semiconductor space.

It’s a highly technical space. We have a model portfolio focused on the leaders of the category and are continually researching…

We are also interviewing some long/short semiconductor hedge fund managers, as we believe the winners will substantially outpace the losers.

Company Earnings

We love to study Company Earnings. Unlike government statistics that use surveys or sampling, we have real numbers to work with and forward guidance.

Take a look at select companies we reported on. We also cite any relevant KPI or Highlights.

We study company earnings to get sense of the major trends and themes in the economy. Where are Consumers spending? Is Capex increasing or declining? Is the banking sector healthy?

We can also test against our themes such as cybersecurity, nuclear renaissance, bank disintermediation via Private Credit and so forth.

A few observations:

Home Depot’s overall revenue and earnings is in decline. The Housing sector is having its own mini-recession.

Target YOY revenues are also in decline. Shrinkage is an issue, and consumers are spending more on e-commerce and on services.

Commodity prices for Chicken (and Copper) and others are declining. The battle for inflation on the commodity leg has been won; TBD on the services component of inflation

WalMart revenues are up 5% - that’s about the inflation rate. Consumers are downshifting spend to the lower-cost provider.

Macy’s YOY revenues are down 7%. Macy’s seems to perennially disappoint. We are adding Macy’s to our ‘legacy brands in decline’ list.

More on AI

Open AI is pivoting to building God. Or, the ghost in the machine.

So, suppose we subscribe to OpenAI. And Google’s AI. And then Metas. Are we polytheistic then? 😂

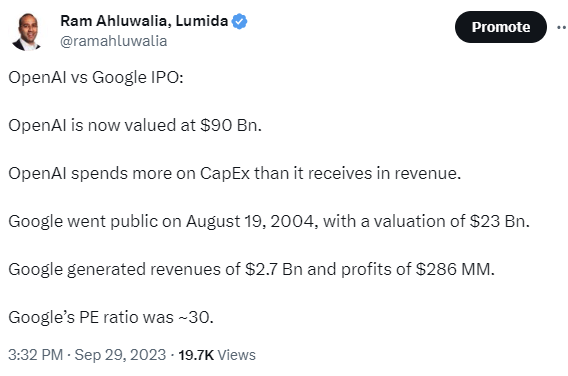

Jokes aside, the valuations at the Application layer for AI are absurd. Consider the following stats comparing Google’s IPO to OpenAI:

Smart investors make their money on the buy. That means keep focus on good valuations.

We love the Silicon Layer - that means select semiconductor that are ‘CapEx Receivers’

At some point in the future when the market catches on, we believe the P/E ratios for those firms will be in stratosphere. We’re not yet in an AI bubble.

Digital Assets

We believe Liquid Venture is the most compelling opportunity in Crypto.

This entire year we’ve focused on the Grayscale ‘discount to NAV’ products.

Why buy Bitcoin or ETH at retail prices when you can buy them at 30 to 50% off.

We had a major position in ETHE and was building in May. That position has rallied something silly like 240%.

I’ve said it before, we will miss when these discounts go away. We intend to hang on to ETHE to lock-in long-term capital gains.

There are other moves to make now.

I’d be remiss if did not point out Multicoin is distributing Solana to its fund investors now.

We do believe ETH accumulation and its ecosystem is a good move to make.

We can’t be more specific at this time as we have to prioritize positioning our clients into our ideas.

Same with ETHE - we did not write about those ideas until we felt we were well positioned. We have a duty of care.

Believe you me - we have strong views on how to position in Digital Assets. It may take a month or two before we can call out what we like.

That said, we will publish a super thread on Crypto based on dozens of interactions with market leaders in the coming days.

Stay tuned!

On Crypto Venture:

Our view here is Liquid Venture will out-perform Crypto Venture, just like QQQ out-performed Venture Capital.

Wait until there is capital scarcity in venture capital.

Excess returns come from capital imbalances.

Robert Lesher’s SuperState raised at a $100 MM+ valuation. That’s FOMO, not a capital imbalance.

Crypto VC still hasn’t bottomed. In terms of both deals done and total capital invested, Q3 was the lowest quarter since Q4 2020.

Companies building in the broad Web3 category dominated deal count, while companies in the Trading category raised the most total capital. The Q3 results continue a trend we’ve seen throughout the year. Interest in AI demanded the creation of a new sector in our dataset, with interest increasing for the overlap between AI and crypto.

The United States continues to dominate the crypto startup landscape, but other jurisdictions are catching up. While US-based crypto startups accounted for more then 35% of all deals completed and raised more than 34% of the capital invested by VC firms, the US is now notably losing share on both deals and capital to countries like the United Arab Emirates, Singapore, and the U.K., all of which have more progressive crypto regulatory frameworks.

VC fundraising environment remains extremely challenging, but may be improving. More than $1bn was raised by venture funds in Q3 2023, the first uptick since declines began in Q3 2022. New fund launches also ticked up to 15 (from 12 in Q2). Median and average fund sizes are down significantly from their bull run highs.

Hedge Fund 13F Analysis

We dropped our seminal 13F analysis

We study the moves of the 30 most iconic hedge funds: Drunckenmiller, Soros, BridgeWater, Michael Burry and more.

These are great for idea generation, spotting new trends, and detecting over-crowding.

It’s amazing that the wealth management industry is mature, and yet Lumida is the first firm to create, organize, and publish this research.

It tells you how low the bar is in wealth management!

Highlights:

1. NVDA, MSFT the most favored stock in the top positions

2. NVDA had 4 reduced positions. Some HFs are selling into strength.

3. NVDA, TSM, AMD, AMAT, major players in the semiconductor industry, is among the top holdings, held by 12 funds

4. No real sign of Tesla as a top position...

5. David Tepper capitulated in China (sold BABA and BIDU) and reduced semiconductors. Contrarian bullish?

6. Meanwhile, Drunckenmiller, Michael Burry, and Tiger Global picked up BABA.

7. Michael Burry sold Expedia, a top position, and profited. He also picked up BIDU wich Tepper is selling.

8. GOOGL has the most reduced positions (5), but also the most 'New' Positions' (4). It's a 'high view dispersion view.'

(@LumidaWealth we believe Google is the best risk-adjusted return in Mag 7.)

9. TSLA, NFLX, not among top holdings among funds. These are crowded retail stocks in our view.

10. No sign of crowding in semiconductors and energy themes. But: AMD, INTC, and TSM getting some love.

Work with us: we are are looking for a client associate to help us with sales and client service support. Send referrals here.

Quote of the Week

An investment in knowledge pays the best interest.— Benjamin Franklin

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.