Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week.

Macro Update: Payrolls, Leading Indicators & Rates

Investment Positioning: Good News is Bad News Again

Crypto Update: DCG & Gemini + GBTC & ETHE Discount Narrowing

The July 4th holiday did not slow down the DCG-Gemini-Genesis saga, with Cameron Winklevoss writing a letter to Barry on July 3rd in support of a settlement.

We’ve been covering the topic in earnest since July 2022, mainly because when we see non-banks rehypothecate like banks without a lender of last report or deposit insurance something goes wrong. Forbes has a write-up on the latest which we encourage you to check out here.

Macro Update: Payrolls, Leading Indicators & Rates

Starting with a macro perspective - the ADP Payrolls Report has outdone expectations, indicating a strong economy. The consumer is Rocky Balboa. The consumer is proving resilient to the most aggressive rate hiking campaign since 1981.

Key contributors to this resilience are that (i) consumers and corporates locked into low-borrowing costs and termed out their debt, meaning they are less sensitive to rates; and (ii) The US Congress's extraordinary stimulus in the form of $2 Tn in CARES act.

This led to a record level of consumer bank deposit levels and a low excess savings rate. Consumers are spending down their excess savings, which is the flip-side of too much money chasing not enough goods/services.

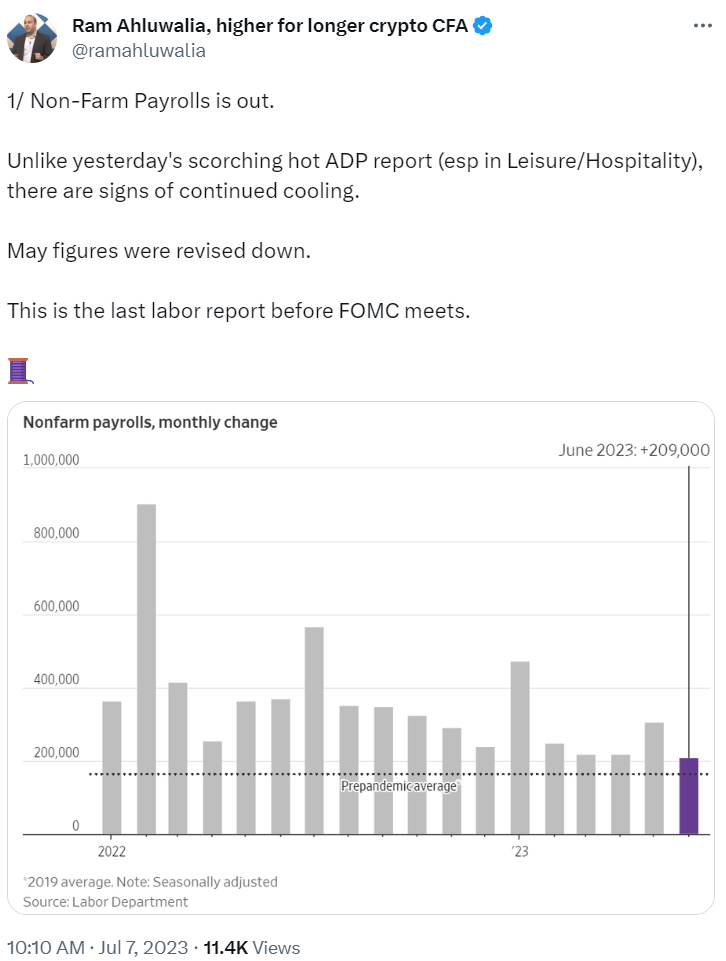

Meanwhile, May non-farm payrolls were revised down. Zoom out and the trend shows signs of cooling.

This should mean lower inflation pressure. Already, 2 out of 3 inflation drivers are behaving well: (i) goods inflation (fixed with supply chains) and (ii) shelter inflation leading indicators are improving. The third pillar - service/wages - is not coming down fast enough.

Wages in leisure/hospitality are up 5% YOY. That’s also fueled by that excess savings. We discussed before how Cruise Stocks are up 90%. Robust consumer spending (the same as a low excess savings rate) is flowing into travel.

Review of Leading Indicators

Turning to leading indicators, we see improvements. The ISM New Orders Index shows improvement and also housing starts.

Big bills such as the CHIPS Act and Inflation Reduction Act - forms of industrial policy under Bidenomics - are creating a bid for domestic manufacturing.

The housing market is gaining strength as home builders strive to meet the demand for new homes due to the unwillingness of current homeowners to sell.

Home prices still remain down YOY (say, 4% to 7%) depending on the region.

Rates Staying Higher for Longer

The biggest news on the macro front is the 10-year yield which has closed at 4.07%. We haven’t seen a 10-year above 4% since…well over 10-years.

We started our newsletter commenting how the 10-year was at 3.4% — supportive for equities and risk assets. Markets are starting to price in ‘higher rates for longer’.

Should yields remain elevated, this creates another kind of “two in one” checkmate for the Federal Reserve. Not only do higher rates pressure the banking system, they also pressure the Treasury Department. The US can refinance its debts if long-rates stay low.

This explains why US Treasury Secretary Janet Yellen was in China. The US needs bond buyers to keep rates low.

There are two end-games looking out in the years ahead. Either the Fed starts Yield Curve Control so the Treasury can refinance. Or the Fed jacks up short-rates further inducing a recession. A recession will lower the yield on the 10-year, as longer-term bonds are a good approximation for the market’s expectation of nominal GDP growth.

We believe the Fed will choose the latter. We expect two more interest rate hikes representing 50 bps at a minimum, and 100 bps is not out of the question.

Where the 10-year yield sits now at 4%, sustaining a rally in equity markets, we believe, is a challenge. Higher long-term interest rates increase the discount rates used to value long-duration growth stocks.

Also, the VIX has risen from ultra-low levels of 12% to 17%, a change we predicted in one of our Twitter videos.

Consider also that the Magnificent 7 just isn’t growing like it used to. Analyst expectations for revenue growth across Big Tech stocks are around 10 to 12%. For Apple the revenue growth expectation is 6%.

The S&P 500 is up this year primarily on multiple expansion. The S&P’s P/E ratio is close to 20. At the same, time S&P 500 earnings have continued to decline from a peak of Q4 ‘21 (peak stimulus).

Let’s take a look at aggregate analyst expectations and how they’ve shifted over time.

Notice how elevated earnings expectations in 2021 were brought to heel through 2023. Although earnings have demonstrated revenue and earnings beats, it’s been off of lower expectations - not true aggregate earnings growth. That’s why the S&P is experiencing multiple expansion.

Investment Positioning: Good News is Bad News Again

AI's potential is real and set to be a multi-year trend. Companies like Nvidia, and those supporting the semiconductor industry, along with data center stocks, are attractive options.

We believe owning stocks that have real earnings growth and a quality business is the move to make. There are other securities besides Nvidia that are demonstrating 30 to 40% earnings growth where the P/E multiple is comparable to slower-growing growth stocks.

The PE ratio for Apple is 32 with a 6% earnings growth expectation. Meanwhile, Taiwan Semiconductor has a PE ratio of 15 and over twice the earnings growth rate expectation of ~10% over the next 5 years. There are plenty of other examples like this where mid-caps which have more upside offer more relative value for long-term investors. Note these are not recommendations to buy Apple or Taiwan Semiconductor, but are indicative of what we look for.

Investors have an opportunity to stay inverted while focusing on growth from new names. FAANG was the Zeitgeist of the 2010s. The Zeitgeist of the last decade is not usually (ever?) the Zeitgeist of the next ten years.

Tactically, we want to point out a few items.

On the bullish front, July is one of the most bullish months for the Nasdaq-100. Second, there is still significant crowded short interest in the S&P 500 futures. It has unwinded about 30%, but has created a technical bid that can’t be ignored.

On the bearish front, one of our favorite indicators suggests markets are poised to go nowhere or perhaps a correction. Also, YTD leaders such as SoFi are showing breakdowns in their charts which suggests weakness ahead.

Amidst this valuation backdrop, Alternative Investments that we believe can generate a higher long-term tax efficient return than the S&P 500: distressed commercial real estate, “value venture”, and strategies that benefit from dislocation and higher volatility.

Crypto Update: DCG/Genesis, Blackrock ETF

Digital assets and cryptocurrency are heating up. Cameron Winklevoss penned an aggressive letter to DCG Chief Executive Barry Silbert, hinting at broader industry movements.

These events may trigger opportunities, particularly as the GBTC and ETHE discount have narrowed significantly to a nearly one-year low following the BlackRock ETF announcement.

We believe the SEC is priced in. DCG/Grayscale is priced in. Binance is priced in. Should there be a one-off “big red candle” from a news driven panic that could represent a tactical entry.

We have been accumulating ETHE which sports a wider discount than GBTC. If a Bitcoin ETF is approved we expect an Ethereum ETF to follow.

However, we aren’t chasing at these prices. Take a look at Coinbase. The stock remains highly correlated to Digital Assets. Although we expect that relationship to breakdown in the years ahead, right now it is close to a triple-top. Either prices breakout from here or they decline.

We don’t believe the SEC will approve the Bitcoin ETF as the application currently stands. (Listen into our interview with Jason Choi on his Blockworks podcast dropping soon). That just means we have more time to accumulate great assets at great prices - we are patient investors.

The bigger point is the long-term drivers are falling into place: (1) Fed Chair Powell says “Bitcoin has staying power”, (2) Larry Fink is laying out the intellectual defense for Digital Assets - and Tokenization.

It gets better. Former SEC Chair Jay Clayton and former CFTC Head Tim Massad are flirting with the idea of a “Self-Regulatory Organization”.

If you’re tracking our views, you’ll know that we’ve been pounding the table on Tokenization and an SRO - as early as our WSJ Op-Ed with former SEC Chair last fall. The industry needs to rally around a core set of principles and stand-up a credible SRO that Congress and the SEC can delegate authorities to. We’re doing our part to layout basic principles and documenting the history of another legendary self-regulatory body - the NASD - creator of Nasdaq.

Here’s a link to a 20-minute video explaining what is an SRO and concrete steps to get one started.

Larry Fink made choice remarks on Fox Business with Charlie Gasparino echoing our defense of tokenization. Take a look at the verbatim quotes in the link below.

The Promise of AI

If you want a glimpse into the future, take a look at this - drones are harvesting apples. AI is one of those “gradually then all of a sudden” type endeavors. The efficiency for Apple picking (or harvesting in general) isn’t there yet. But when investments in automation have good payback periods, it’s hard to imagine that farms won’t adopt en masse, and quickly.

Lastly, we delve into the role of AI in investment and wealth management.

We believe AI has the potential to massively transform wealth management to help advisors be more productive and provide better investments and service to clients.

Stay tuned for our thoughts in future newsletters and on our new TikTok (@ramlumidawealth) and Threads (@ramahluwalia) handles.

Meme of the Week

Quote of the Week

"In the business world, the rearview mirror is always clearer than the windshield." - Warren Buffett

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions, forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.