Here’s a preview of what we’ll cover this week:

Macro: Nike and Vietnam: A Case Study, Powell Isn’t Budging, Retail Investors vs. Professional Investors

Market: The End of the Safe Haven Trades

AI: Amazon Scales Up AI Infrastructure, Meta Commits $1B to AI Compute

Lumida in Spotlight

Ram on Yahoo Finance

Ram Ahluwalia appeared live on Yahoo Finance to discuss current market dynamics and investor sentiment. The conversation touched on macro trends, trade policy, and implications for equity markets.

State of the Banks and the Housing Market

In a new episode of Non-Consensus Investing, Ram Ahluwalia sits down with hedge fund manager Skyler Weinand for a timely discussion on markets and macro risk.

The episode covers tariff policy, CLO market dislocations, housing, credit, and the outlook for regional banks.

Skyler shares insights on reading underlying economic signals and managing capital in uncertain environments.

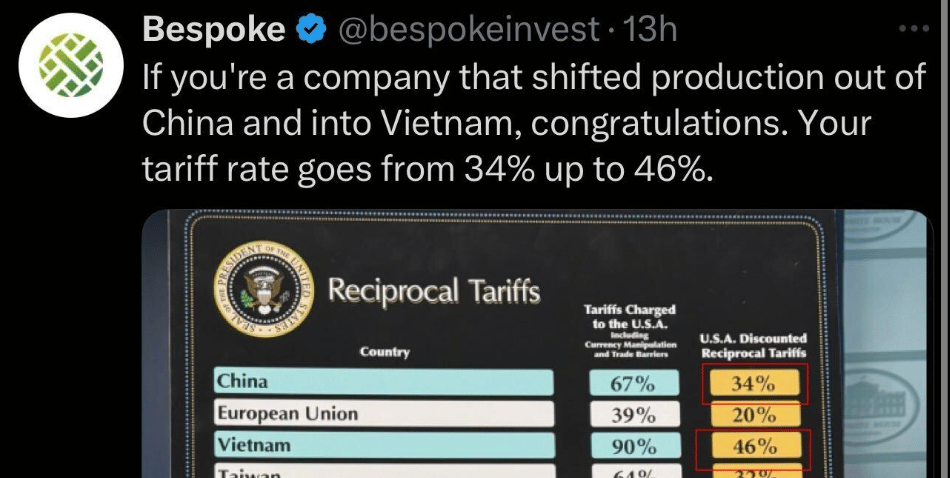

Trade Wars are Mutual Assured Economic Destruction

Trade wars are a form of mutually assured economic destruction

Tariffs (e.g., big corporate sales tax hike on Americans) bring in $300 Bn vs. $10 Tn in wealth destruction since the start of FAFO.

Nike has 100+ factories in Vietnam employing 500,000 people far below minimum wage.

That’s a complex supply chain as large as a fielded army.

(And no one wants to thread needles and get measured against a quota in the Carolinas.)

The fact is it is cheaper for NKE to pay the sales tax (‘tariff’).

Robots can’t handle eggs yet, much less do fine stitching.

Capitalism and free trade work rely on execution and know-how embedded in processes and human expertise, refined over decades.

Hayek called this tacit knowledge.

At the highest level of its expression, we call it craftsmanship or excellence.

There’s a reason the Swiss make the best watches in the world.

There’s a reason the Japanese have such precision in aesthetics.

There’s a reason why the United States excels in entrepreneurship and technology.

The best form of leadership is enabling decentralized spontaneous order to take root against rules of the road.

The desire to ‘reorder global trade’ is a technocratic impulse.

The desire to rearrange global supply chains on a map like a McKinsey consultant fixes a PowerPoint is something I would expect out of AOC, not business oriented capitalists.

Unless reversed, this tariff policy will go down as the biggest own goal in American history since Herbert Hoover.

The stock market has already lost $2 Tn+ in a single day.

That’s far more than the expected tariff revenues..

1) Federal tax receipts will decline - exacerbating the deficit.

2) Inflation will increase, increasing malaise and hurting the worst off.

3)Unemployment will increase.

There’s still a chance to remedy.

A timely about face now is much cheaper than a stimulus package 9 months from

now.

We started last week referencing Humpty Dumpty (e.g., Mr. Market) and his fall, and how it might not be possible to put him back together again.

We noted that a tradeable bounce Monday morning is likely but that “such a bounce may be short lived”

We believe financial markets will look back on Liberation Day as the greatest self-own since the infamous advice attributed to Andrew Mellon, Treasury Secretary under President Herbert Hoover: “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.”

Markets are path dependent and reflexive in nature.

At the outset of the Wednesday press conference

After the initial roll-out of tariffs after hours, markets moved higher by about 50 bps.

However, after the cardboard placards with tariffs higher than Smoot Hawley rolled out, markets promptly tanked.

Later that evening, multiple sleuths on X revealed that the ‘reciprocal tariff’ formula was nothing but reciprocal.

Powell Isn’t Budging

Powell reiterated on Friday “our obligation is to keep long-term inflation expectations well anchored”. That means no rate cuts soon.

The likely course of action for the Fed is to hold the line as much as possible (e.g., no cuts in May).

The Friday jobs report was too strong. The Fed won’t come to the rescue in May.

However, as soon as weakness in “hard data” (e.g., non-farm payrolls materializes) then the Fed will cut aggressively.

Something people do not seem to understand… If the Fed is cutting due to a recession, Fed cuts are not enough to prevent a significant decline in market valuations.

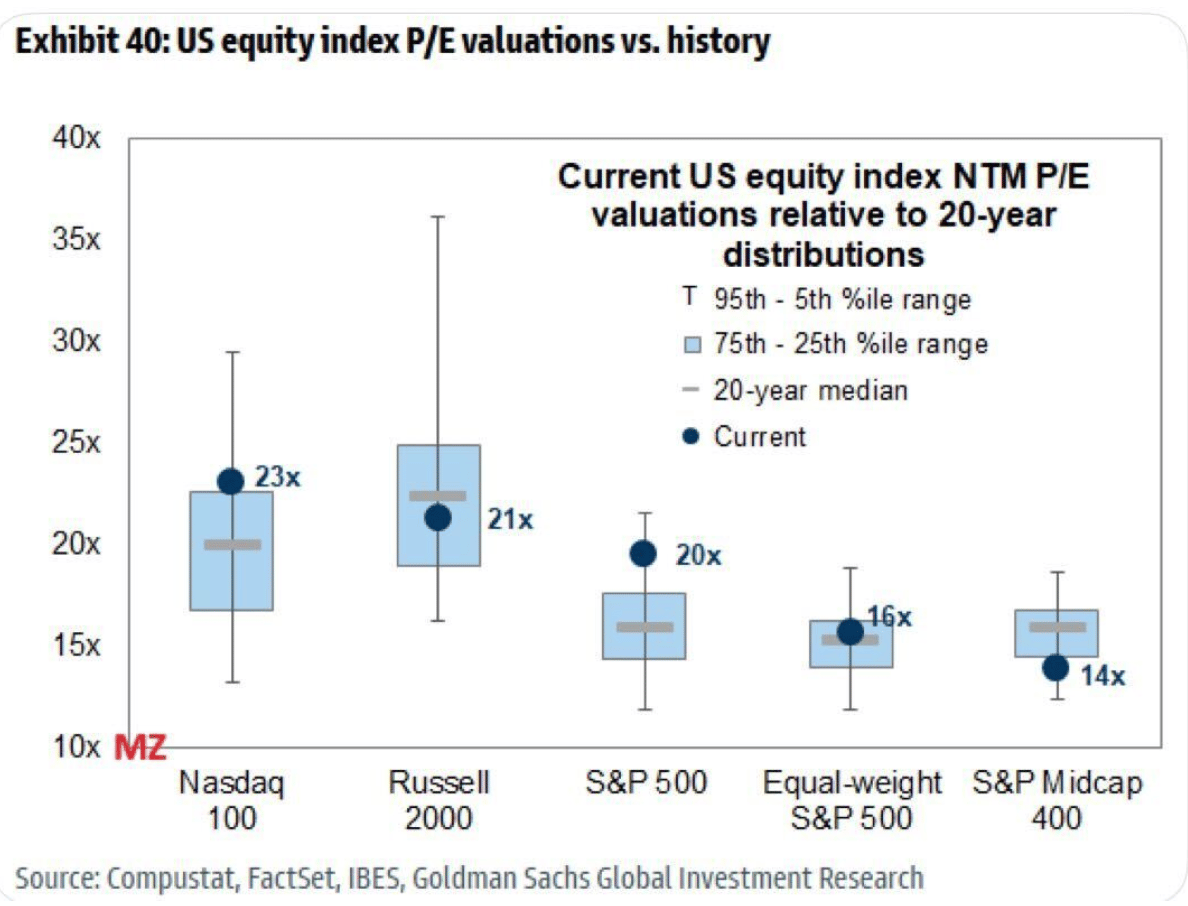

Valuations remain elevated and have not fully discounted a policy cocktail that is hostile to corporate earnings and inflation.

If the Fed is making ‘adjustment cuts’ - like an insurance policy - then markets are poised to rally.

In 2008, there were plenty of Fed cuts and liquidity facilities. None of that mattered. The point here is don’t count on the Fed to bail out your stock portfolio.

Retail Investors vs. Professional Investors

The behavior of retail investors and professional investors couldn’t be any more different.

Retail investors are buying every dip. That’s what the market trained them to do.

Meanwhile, institutions and hedge funds are aggressively de-risking.

Hedge funds recorded their largest net selling day since 2010 on Thursday, while retail investors marked their most significant buying day in a decade.

Analysts like Dan Ives are calling this ‘economic armageddon’. Howard Marks is saying ‘investors are facing a sea change that requires a new playbook.’

What people miss is that tariffs (e.g., corporate sales taxes) add to inflation or reduce company earnings.

Neither is good for markets.

Ed Yardeni expects an increase to the PECD inflation rate from 2 to 3% up to 3 to 4%. He expects potentially 6 to 12 months of stagnation. I can’t disagree - unless there is an about face in policy.

The mistake is retail investors will wait to see the impact on markets then react. Professional investors are looking 3 steps ahead.

Here’s an example from my friend Skyler Weinand and our podcast.

An American imports hockey sticks from Vietnam for $30. He sells them for $70.

That’s a typical retailer's gross margin of 50%+. After overhead, the net profit is $250 K.

Tariffs cause the cost of the hockey stick to jump to $80. Now Walmart won’t accept his order and they have a fixed price contract.

That small business is kaput. This tax payer has to let go of his staff. The staff goes on to receive unemployment benefits. And the tax revenue generation diminishes, and public expenses go up.

The great irony of a global trade war - if it isn’t halted immediately - is that it will increase the deficit.

In the last 6 weeks, equity markets have melted $10 Tn in value away.

In the last 2 days, about $1 Tn has disappeared from equity markets.

Meanwhile, Lutnick’s goal is $600 Bn in tariff related revenue.

Everyone would have been better off with a socialist style, AOC style wealth tax.

If we see retaliatory tariffs, then global growth expectations should ratchet down along with earnings.

The lifeblood of stock markets are company earnings - and the backdrop inflation rate, confidence, and interest rates.

Is Lutnick Negotiating to Open Barriers or Do They Like Tariffs?

We think it’s the latter, but the admin is creating the room to flip and drop tariffs.

The admin has targeted an island populated with penguins as a part of this trade war. It’s really silly and won’t inspire market confidence.

Here’s a collection of Lutnick comments:

Will Soft Data Translate to Weak Hard Data?

This is one of the key questions we’ve noted.

Non-Farm payrolls came in nicely this Friday. However, that’s old news and the market is more focused about layoff announcements from the Challenger survey that suggest we’ll see layoffs in the months ahead.

We are also seeing weak hard data in the form of Delta Airlines and other companies report weak consumer demand spend.

That weakness is now creeping into hiring.

Hiring Weakness Signal

Job Openings came in 100K below expectations.

Additionally, the March 2025 jobs report indicated that the U.S. economy added 228,000 jobs, surpassing economists' expectations of 135,000.

The goal of reshoring manufacturing is to lift middle-income jobs. But the chart below shows the long arc of U.S. economic evolution: middle-income households are shrinking not because of decline—but because more Americans are entering high-income tiers.

Here’s a collection of quotes to get you a sense of what is happening in the real economy.

In a post on Twitter, Fejau notes the labor market was already starting to crack—before the latest tariff headlines even hit.

The End of the Safe Have Trades

Safe Haven?

All safe haven trades ended on Friday (apart from bonds).

1. Silver broke down on Thursday, previewing the weakness in Gold miners on Friday.

2. Utilities $XLU are down 6%

3. Healthcare is down 5%

4. Gold is down 3%

5. Staples are down (Costco down 5%)

The defensive trades became crowded.

Really, the only safe haven is cash.

(Bitcoin miraculously is up 3% in a sea of red, likely betting on a flood of global liquidity)

It looks like we are set up for a capitulation on Monday.

Rumors of Bessent leaving the Treasury (see Stephanie Ruhle comment) aren’t helping.

How much is the S&P worth with or without Bessent?

3% in the short-run and 10% in the long-run?

A trillion dollars in market cap give or take?

From my vantage point, the key level in the S&P to watch for a technical bounce is 4900.

S&P Comparison to 1987

Correction or Bear Market?

Monday we expect a local bottom or possibly Tuesday.

But, buying at the open may be risky.

The Thursday and Friday leading up to the Monday October 1987 crash was also marked with gap downs.

The issue here is the policy. If the policy stands firm and stubbon, then equities are over-valued as they should discount a recession scenario. They are only mid-swing in discounting such as a scenario.

If tariffs go away, or get to a nomal level, and there is clarity on policy (are GPUs tariffed etc?) then certain stocks (esp certain mag 3 stocks) are cheap and should be bought.

The only thing you can do here is watch the headlines and man the desk.

That itself creates its own risk premium.

There’s a lot of reflexivity in markets.

We are due for a bounce imminently. However, not sure one can trust such a rally if the broader earnings climate is negative.

Band-Aids to fix the Self-Cutting

The tariffs are self-harm disguised as strategy. Now even the usual backers are reaching for the band-aids.

Reactions from Market Participants

A number of conservatives and Trump allies - including Dan Loeb - are coming out against tariffs.

Geiger, a MAGA conservative, notes that Trump 2.0 is a break from the past—this time, it’s blanket tariffs on all countries, not targeted trade actions to achieve narrow objectives.

Trump is weighing a bailout for U.S. farmers—an admission that his own tariffs are inflicting damage on the domestic agricultural sector.

William Green shares Howard Marks’ warning: tariffs have ended an 80-year era of free trade prosperity—marking the biggest economic shift of his career.

Dan Ives compares the global trade war to economic armageddon.

Manufacturers are warning that tariffs are squeezing margins, stoking retaliation abroad, and pulling forward demand—classic signs of a policy doing more harm than good.

Interested in our investment strategies? Schedule a call to learn how we can help you navigate the markets.

The Goal was To Keep the USD High so Foreign Countries Foot the Bill

Steve Miran's theory was that the US Dollar would increase in value after the Tariff Regime.

The USD is dropping as Europe and Asia sell U.S. assets and bonds.

That dollar tariff theory is invalidated.

Feel free to reach out to Marc, our Senior Advisor, at [email protected] for more about Lumida’s services.

The Bull Case: Nasdaq Rebounds After Big Drops

The bull case is very simple.

What starts the correction is often what ends the correction.

In Q4 ‘18, Trump said it was a good time to buy stocks. Powell, at the same time, stopped the adjustment hikes.

The 19% correction was over.

Trump needs to walk back tariffs. We don’t think he will - he stubbornly believes the United States is “charging” other nations.

If he changes his mind, and quickly, we will turn bullish within hours and shift to a fully invested position.

At the same time, significant psychological and technical damage is done to markets, so positioning in that world won’t be the same as prior to this correction.

The bear case is: valuations go to 17x earnings. That’s the lower end from Yardeni.

In a high inflation regime with lower profit margins, I’m surprised he doesn’t have a lower trough PE multiple. That’s likely due to the higher weight assigned to Mag 7 stocks now vs. prior years.

But, Apple is still over-priced in this world - and arguably Netflix and Amazon. In any case, a 17x valuation is a 20 to 30% decline from current levels.

When you assign probabilities to different outcomes you can see why markets are gapping down quickly. Institutions are doing this math and getting ahead of it.

Bretton Woods

Bretton Woods was peak Pax Americana.

Why change what’s working?

1) Established USD as global reserve currency

2) Price of oil & energy trades in USD

3) Foreign debt denominated in USD (giving the RoW a stake in America)

4) Hazardous manufacturing jobs were moved offshore in exchange for higher paying healthcare and services jobs

5) Lower cost of capital for American enterprise and the US Treasury

6) Established the United States as the pre-eminent investment location

7) Accompanied multi-decade economic boom

8) Established the United States as pre-eminent superpower

9) No nation can impose sanctions on the United States, but the U.S. has enormous economic leverage

10) Greatest anti-poverty program globally.

The U.S. is better off when our neighbors grow in wealth and we each have more productive trading opportunities

11) Bretton Woods regime meant the best advantages and specialization of allies accrue to the United States

‘Access’ did not require ‘control’

The ‘cost’ of Bretton Woods is you must have trade deficits…

as you are stuffing foreign banks with US Dollars and US Treasuries

They go together.

Much of this market mayhem is due to a serious misunderstanding of how trade deficits finance American growth.

If you want to Make America Great Again, the trade deficit is the scoreboard

Curious how Lumida can optimize your portfolio? Book a complimentary consultation with our team.

Manufacturing Weakens Further

ISM Price Pressure

Want to discuss how this market volatility affects your portfolio? Book a meeting with our team for tailored insights.

AI Insights

Key Takeaways: The State of AI and Datacenter Capex

Amazon invests $4B+ in Anthropic and launches Project Rainier to train frontier AI models on Trainium 2 chips.

Meta commits $1B to a new AI datacenter in Wisconsin to scale LLaMA and open-weight model research.

GPT-4.5 passed the Turing Test — judged more human than actual humans 73% of the time.

Mercor, a contractor platform helping train AI models, hit $100M ARR in under a year — but pays out 60%+ to freelancers, raising margin concerns.

LumidaAI is our proprietary investment research and portfolio intelligence platform. Join the waitlist at LumidaAI.com for a chance to secure early access.

AI News & Developments

Amazon Scales Up AI Infrastructure

Amazon is developing Project Rainier, a massive AI data center powered by Trainium 2 chips.

It’s designed to support large-scale model training, including workloads from Anthropic.

The project reflects Amazon’s $4B+ investment in Anthropic and long-term bet on AI infrastructure.

Trainium aims to offer a lower-cost alternative to Nvidia GPUs.

AWS continues to position itself as a key player in the AI stack.

Source: Time

Meta Commits $1B to AI Compute

Meta plans to invest nearly $1B in a new AI data center in Wisconsin.

The facility will expand its compute capacity to support LLM training and inference.

Meta continues to back its open-weight LLaMA series and AI research efforts.

The move follows similar infrastructure pushes by Amazon and Microsoft.

Competition for energy, chips, and real estate is accelerating.

Source: Reuters

GPT-4.5 Passes the Turing Test

In a recent study, GPT-4.5 was judged to be human 73% of the time.

That’s higher than real human participants in the same test.

The result highlights how advanced LLMs have become in mimicking natural conversation.

Researchers say most people can no longer reliably distinguish humans from machines.

The bar for AI believability is getting higher — and blurrier.

Source: arXiv

Middleware Momentum

OpenAI is adopting Anthropic’s Model Context Protocol (MCP), a step toward making AI systems work better with external tools and data.

But the technology is still in its early stages.

There are gaps in coverage, security risks, and limits on what models can actually do with these tools.

The ecosystem is growing, but standards are still taking shape.

Opening the LLM Black Box

New research is helping unpack how large language models work.

Models like Claude, Gemini, o3, and DeepSeek are now being evaluated along axes like factual accuracy, reasoning, and robustness.

These systems don’t operate in absolutes. Performance varies with prompt structure, training data, and model design.

Interpretability tools like causal tracing are helping isolate the components behind reasoning and failure.

This shift matters. As LLMs are adopted in regulated sectors such as finance and healthcare, transparency is becoming as important as performance.

Models that are explainable and auditable are more likely to gain trust and see enterprise adoption.

Source: Nate’s Newsletter

Unicorn Startup Founders Coming?

Some AI startups are reaching $100 million in annualized revenue faster than in past tech cycles. Mercor, which provides expert contractors to help train AI models, says it grew from $1 million to $100 million in less than a year.

Most of that revenue is paid out. Mercor gives over 60 percent to its contractors. Its reported operating profit is just over $1 million per month.

Other firms in this segment, including Scale AI and Turing, show similar dynamics. Heavy reliance on contractors creates margin pressure, even as top-line growth looks strong.

Despite this, valuations remain high. Mercor was valued at $2 billion, with limited recurring revenue and thin margins.

The takeaway: revenue is accelerating, but cost structures are still evolving. The focus for investors may shift towards margin quality and business model durability. Not just growth.

Source: Michael Parekh on Substack

Interested in capitalizing on the AI megatrend? Reach out — our advisors can help you position your portfolio to capture the upside.

Lumida Curations

Bit and Bips

Speaker/Guests: Ram Ahluwalia, Quinn Thompson, James Seyffart, Steven Ehrlich

Key Insights:

Trade deficits lead to capital inflows, with foreign investments like SoftBank increasing U.S. asset ownership despite tariff rhetoric.

Consumer sentiment is weakening, with lower-income households feeling the pinch and retail giants like Walmart and Target seeing shifts in behavior.

Cutting deficits from 6% to 2% could hurt stock markets as liquidity fades.

70% of family offices invest in the U.S., driving trade deficits and enriching entrepreneurs through foreign investments.

Tariffs and their impact are highly correlated with income brackets, with immigration and Fed delays ranking higher in economic concerns.

Businesses and consumers face tariff chaos, increasing recession odds, with midterms offering potential short-term relief but grim 6-12 month outlooks.

Scott Bessent with Bloomberg

Speaker/Guests: Scott Bessent

Key Insights:

After-hours market movements are driven by the "Mag Seven" stocks, not broader economic issues.

The U.S. is focused on realigning trade with China, addressing fentanyl tariffs, and ensuring fair deals, including TikTok scrutiny.

Tariffs and tax reforms are part of a broader strategy to secure U.S. economic interests on its own terms.

Trump on April 2

Speaker/Guests: Donald Trump

Key Insights:

Tariffs are necessary to restore U.S. production of essential goods like antibiotics, electronics, and ships, addressing national security concerns.

Reciprocal tariffs aim to balance trade, with a 25% tariff on foreign cars implemented to protect domestic industries.

Microsoft CTO Kevin Scott with 20VC

Speaker/Guests: Kevin Scott

Key Insights:

AI development will face a scaling asymptote where further improvements become impractical due to costs.

AI models should prioritize reasoning over fact recall to create more effective and valuable applications.

Advancements in inference are making AI models more efficient and cost-effective, unlocking their full potential.

AI will transform user interaction by anticipating needs, reducing the need for coding, and enhancing user experiences.

Future AI agents will incorporate memory, enabling personalized and context-aware interactions.

BG2 Podcast

Speaker/Guests: Brad, Bill Gurley, Brad Gerstner

Key Insights:

AI development will eventually hit a practical limit, emphasizing the need for sustainable growth strategies.

Reasoning-focused AI models are essential for creating applications that add real value beyond data recall.

Optimizing inference will drive efficiency and cost-effectiveness in AI applications.

AI will revolutionize user interaction by anticipating needs and streamlining processes.

Memory-enabled AI agents will enhance personalization and user context understanding.

Scott Bessent with Tucker Carlson

Speaker/Guests: Scott Bessent

Key Insights:

Under Trump, working-class Americans experienced real wage gains, with the bottom 50% growing wealth faster than the top 10%.

The U.S.-Ukraine agreement ensures mutual benefit, avoiding exploitative practices and focusing on shared success.

COVID exposed fragile supply chains, highlighting the need for U.S. reindustrialization in critical sectors like medicine and semiconductors.

Proactive measures are being taken to address economic vulnerabilities and avoid financial crises.

Mounting debt and geopolitical uncertainties require smart cuts and avoiding massive tax hikes to maintain stability.

Ram on Yahoo Finance

Speaker/Guests: Ram Ahluwalia

Key Insights:

A market bottom may form soon, presenting opportunities in high-ROE, low-debt businesses.

$AAPL is particularly vulnerable to trade war risks among the "Mag Seven" stocks.

Insurance remains resilient due to mandatory demand for auto and property coverage.

Consumer and business confidence is low, with signs of weakness in travel, restaurants, and CEO sentiment.

Markets are in panic mode, with high volatility (VIX > 30) and indiscriminate selling, signaling a potential relief rally despite earnings pressure.

High Yield Laughs

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

As Featured In