Welcome back to the Lumida Ledger. Happy Fourth of July!

Apple is the first company globally to hit a $3 Tn market cap. A handful of tech stocks - the Magnificent 7 - are generating the bulk of the market returns.

This week, we’ll draw lessons from the Nifty Fifty - a similar period in American history where tech firms - DEC, Xerox, Polaroid - dominated and offer lessons for today. There’s a great lesson there for quality Digital Assets when it seems like the unending negative newsflow can’t get any worse. We’ll come back to our bull thesis for Digital Assets in subsequent newsletters.

Before we dive in, we want to recognize the talent at Galaxy Digital’s debate session this week. Among the many talented individuals, pictured below is Mike Novogratz (CEO, Galaxy Digital), Chris Perkins (Coinfund), and Austin Campbell (Columbia Business School).

What to Listen To

Be sure to check out Ram’s interview with Alex Thorn, Head of Research at Galaxy Digital. Ram shares his views on the crypto market structure bill and lays out a path for industry self-regulation inspired by the history of the NASD (creator Nasdaq).

The Rise, Fall, and Lessons of the “Nifty Fifty”

In the annals of financial history, few periods are as fascinating, instructive, and, let's face it, eyebrow-raising as the Nifty Fifty era of the late 1960s and early 1970s.

The US dominated the global economic and tech scene. Kennedy sent a man to the moon. In 1969 unemployment was as low as it is today and inflation was at 5%.

Investors sought refuge in these “one decision stocks” - a select group of stocks that bear some resemblance to the Magnificent 7 today (e.g., Tesla, Microsoft, Apple, Google, Nvidia, Netflix, Amazon) that are driving the bulk of equity market returns.

Imagine the allure: buy once, and never sell! It's the financial equivalent of finding the perfect life partner on your first date.

The Nifty Fifty were the rock stars of the market at the time, with groupies (read: investors) clamoring for a piece of them. But like all rock stars, they had their peaks, their downfalls, and their infamous moments. Among this golden lineup were companies such as Coca-Cola, IBM, Johnson & Johnson, McDonald’s, and Walt Disney - firms that, to put it in a vernacular of the era, were totally groovy.

The backdrop for this financial concert was a time when the Vietnam War had caused a significant increase in national debt, sparking fear of inflation among investors. Private ownership of gold was prohibited, and government bonds were as popular as disco at a rock concert, largely due to the debt issue. This led investors to the stock market - their Woodstock, if you will - where large, dominating companies reported high growth rates, making them appear as safe havens.

This optimism, however, eventually inflated a bubble as bloated as a bell-bottom pant leg. The Nifty Fifty's average P/E ratio reached a staggering 41.9 in December 1972, more than double the S&P 500's 18.9.

The surge in multiples for these stocks resembles the surge in PE ratios for Big Tech today (pre-2022 crash). Polaroid’s PE of 90 can’t hold a candle to Amazon’s PE ratio.

However, just as the disco ball eventually stops spinning, the market soon experienced a harsh reality check. The bear market of 1973/74 wiped out large segments of the price gains, and the unfettered belief in the indefinite growth of these stocks evaporated faster than a lava lamp in a heatwave.

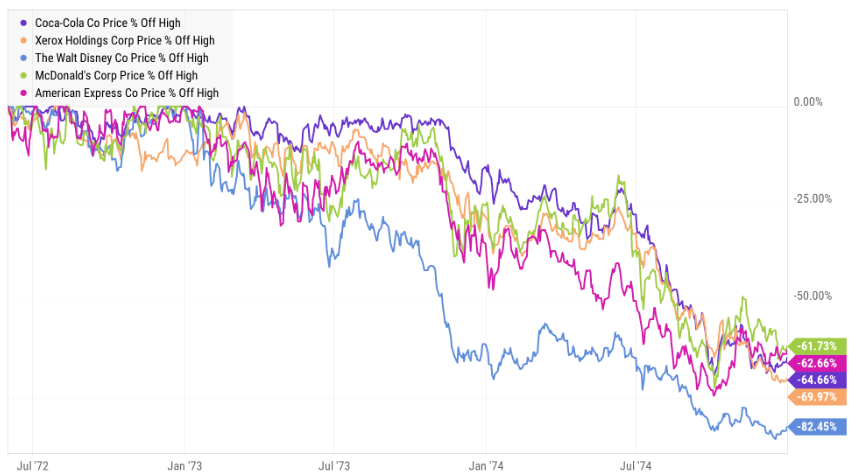

Here are the price declines for select stocks in the Nifty Fifty:

Now, let’s shift to the lessons learned. There are several lessons as it relates to growth stocks and AI today.

Valuation lesson - Avoid the most expensive growth stocks.

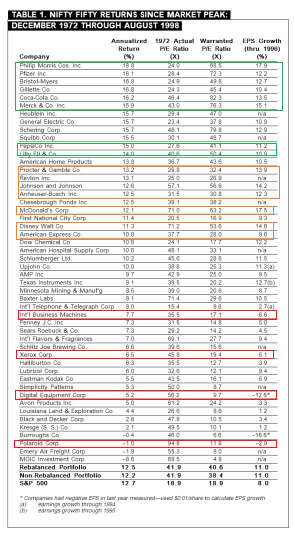

Wharton’s Jeremy Siegel's research noted that within the 50 richly valued stocks , "the 25 stocks with the highest P/E ratios yielded half the subsequent return as the 25 stocks with the lowest P/E ratios."

If you had a basic rule avoiding the most expensive Nifty Fifty stocks you would have done very well. Those who bought in at peak valuations suffered significant losses in the bear market that followed. This highlights the importance of maintaining a rational, disciplined approach to investing, even amid market enthusiasm.

Avoiding PE ratios over 30 and 40 as a rule would have improved your returns on the Nifty Fifty basket substantially. Focusing on the cheaper end of these most prized securities would have out-performed.

Consider that Apple, now hitting a $3 Tn market cap had a P/E ratio just north of 10x back in 2015.

Focus on Tech Stocks that Are Utilities

The tech side of the Nifty-Fifty started strong, but ultimately did not do so well. The companies started out super dominant, but ended up being disrupted by new technology over the decades (IBM, Kodak, Polaroid, Xerox, Digital Equipment, etc).

The best performers from the Nifty Fifty were boring consumer staples: Philip Morris and Coca Cola (a Warren Buffett favorite).

Who would have thought that a boring soft-drink manufacturer would outperform all these fancy tech stocks: Digital Equipment Corp, IBM, Polaroid and the like?

Back to Apple.

I often say “tech stocks should have higher discount rates, because they are prone to disruption”.

That means tech stocks, all things being equal, should have lower valuations.

Friendster begat Myspace begat Facebook begat TikTok. BUT… some tech stocks can become ‘utility stocks’ - and those are worth quite a bit.

A utility stock is indispensable. You can’t live your life without it. And because the cashflow streams those securities earn are reliable, they deserve higher multiples. Maybe that’s the case with Nvidia and a few others - topic for another time…

Apple is a good example of “tech stock that is a utility”. I've been renewing or upgrading my iPhone with the loyalty of a golden retriever since the day I got my hands on the first model. And at the rate we're going, I wouldn't be surprised if I'm one day rocking the Apple iPhone Superbowl Edition XLV.

Apple has generated an attractive long-duration, sticky, cash-flow stream. Apple is essential. They have a strong consumer brand and a moat. They haven’t blown billions of dollars on LLM models in a competitive race-to-the-bottom winner take most dynamic. No wonder Apple is a Buffett company and is the first to hit a $3 Tn market cap.

Note: We are not recommending buying Apple stock - we think it’s a fitting celebration and are sharing our thought process:

It’s no wonder Philip Morris and Merck also did well. Philip Morris is literally selling addictive consumer staples, and Merck was selling prescribed 3rd-party payer drugs.

Similarly, Apple is a tech company today that is selling the equivalent of dopamine-on-demand machines.

Healthcare & Pharma

Some of the other top-winners from the Nifty Fifty were pharma companies - Merck, Schering Plough, Johnson & Johnson. Pharma stocks also have long-duration cashflows and an excellent customer that pays on-time and is price insensitive (the US Government).

Today, healthcare stocks have a PE ratio at the 99 percentile of their historical range - so I think it’s a mistake to over-weight. But that general pattern we keep coming back to - sticky long-duration cashflow streams at reasonable prices with a moat - is instructive.

Bargain Hunting

During the bear market, there was a lengthy period where Nifty Fifty stocks experienced a painful drawdown - worse than the 2022 tech period and about as bad as Digital Assets last year.

If you had accumulated quality assets using some of the frameworks here, you would have done very well. At the same time, the fundamentals for the US economy were atrocious - stagflation, mounting debt, a war, and a decline of trust in public institutions. Sound familiar?

Source: Jeremy Seigel, Wharton

The lesson here is that when the fundamentals look bad and the sentiment is bleak, load up on quality assets. And be patient. You may have to wait 5 to 10 years. Patience is rewarded over FOMO.

There’s a great lesson there for quality Digital Assets when it seems like the unending negative newsflow can’t get any worse.

(We’ll come back to our bull thesis for Digital Assets in subsequent newsletters).

The biggest winner from Nifty Fifty? Not Tech. Consumer Staples

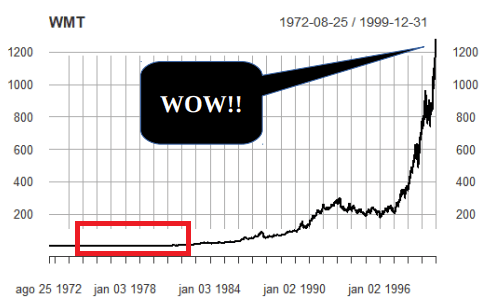

The biggest winner from the Nifty Fifty was Walmart. Walmart generated annual return of roughly 27 percent from 1972 to 2001. Now, Walmart also had a 70 to 80% drawdown not unlike bitcoin.

But the performance of Walmart was so strong you can’t even squint to see the drawdown in 1973 to 1974.

Can you spot the drawdown in Walmart?

Walmart, like Coca Cola and Gillette, also offers lower-priced mass market products a strong brand and benefitted from growth and disruption (not unlike Amazon today). The brands were category leaders and built an emotional relationship with customers through television.

Walmart was also a category leader with limited competition and it could easily have been overlooked while fancy tech names like Kodak were taking the spotlight.

Similarly, Nvidia today is up 290X. These quiet, steady growers with a dominant position in their niche are all around us. Spend less time debating Tesla and spend more energy finding the next small cap growth stock

Diversify across quality & value

If you started with an equal-weight basket of Nifty Fifty stocks, after 27 years Walmart would be 55% of your portfolio. If you missed adding Walmart, you would have lost 2 to 3% of investment returns per year. So another lesson would be “diversify across names that pass your quality and valuation screens because the average return far exceeds the median return”.

This is a lesson Peter Thiel describes in his book “Zero to One”. Translation: a handful of stocks deliver the bulk of the returns - you do want to filter for valuation but don’t want to miss those outlier upside opportunities.

Even though Nifty Fifty stocks suffered big drawdowns in the 73-74 recession, their performance roughly matched the S&P 500 over the next several decades — if you could and if you were lucky enough to have bought and hold Walmart.

You Must Pay for Growth, but Valuation Still Matters

There is truth to the statement that ‘you must pay for growth’. Growth stocks offer high price-earnings multiples, but stocks that are able to consistently maintain earnings growth year-after-year are worth far more than the multiple that Wall Street considers “reasonable.” Coke had a PE ratio of over 40.

Expensive stocks can grow into their valuations - but you need to truly find a quality business - and avoid the most expensive names. Coca-Cola was still penetrating international markets and was #1 in its category. As we noted earlier, the higher the entry valuation - the lower the return.

Disney also built an iconic international brand and grew revenues dramatically with a defensive moat. But its returns were 10 to 11% because you were buying in at a multiple of 70x.

Beware of Hero Worship

Famed investor Howard Marks (Oaktree PE) first job was buying Nifty Fifty stocks programmatically. He was fired and grew disillusioned with the premise that there is any stock one can buy without regard to valuation or having a “nothing can go wrong" mindset.

Human behavior also matters. Although stocks earn 9% over the course of history and generate the miracle of compounding, his lesson is that just earning the average return on equities – that 9% historical return – over a long period is never easy. Most would be better off buying Nasdaq-100 rather than debating whether Tesla will roll-out automated self-driving in the next few years.

He reminds us that even the seemingly invincible companies of the time, such as Xerox, IBM, Polaroid, and Kodak, experienced major downturns, with some even flirting with bankruptcy. It's a cautionary tale that reverberates through time, reminding us that while it's tempting to chase the brightest stars in the market, it's wise to remember that even stars can fall.

What about Today’s Magnificent 7?

We showed several of the lessons of the Nifty Fifty particularly through the lens of Apple.

Consider that Meta is one of the strongest performers this year - and started the year with the lowest valuation across Big Tech.

I recommend studying this to get a sense of relative value for starters.

Still, although there are quite a few similarities to the Nifty Fifty, there are many differences.

One, for example, is how brands engage with customers today. Coca Cola and Michael Jackson were an item, now it’s all about Social Media

In future newsletters, we’ll revisit this topic to the current Big Tech landscape.

Also, consider that these stocks have 2 MM analysts covering them. This is a highly competitive market where professional money managers like Tiger and Coatue were humbled.

A better return on time would be focusing on less-covered spaces of the market (e.g., small cap stocks, digital assets, distressed CRE, etc.) where there is far more inefficiency.

The next time you're tempted to jump on the bandwagon of the next "one-decision stock," remember the Nifty Fifty. Remember the euphoria, the downfall, and the lessons they imparted. As the old saying goes, "Those who cannot remember the past are condemned to repeat it." Or in other words, if you don't want to relive the financial equivalent of bell-bottoms and disco, study your history.

Meme of the Week

Quote of the Week

“It is better to be roughly right than precisely wrong.” - John Maynard Keynes

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdictionch