Here’s a preview of what we’ll cover this week:

Markets: Zoom Out; Growth To Value Continues; The Bubble In Venture Capital; Databricks Wants To IPO; GS: Software Is The New Newspaper; How Does OpenAI Compete With Google?; 2026: The Trough For Managed Care; An International Value Stock Pick

Lumida Curations: The Digital Twin Stack Goes Real-Time; Dollar Weakness Is Optics; Dry Sauna Is the Longevity Baseline

Spotlight

I did a FSD live stream, this week, titled ‘How Sam Altman Broke the World’. I recommend giving it a listen. I’ll identify the high level ideas below.

We are in a new market regime, and it started after Sam Altman’s disastrous interview in Oct where he noted OpenAI has $1 Tn in committed spend obligations across the datacenter and semiconductor ecosystem.

I explain how you should position the current market regime in this FSD stream. Watch here.

How Sam Altman Broke The World?

OpenAI has $1 trillion in committed spending.

A more common name for committed spending is ‘Debt’.

Now the reason these spending obligations—what OpenAI owes to Oracle and Microsoft—don’t show up as debt on the balance sheet is because they are a form of off-balance-sheet financing.

It’s not a loan in the accounting sense.

But functionally, OpenAI has an obligation to pay out roughly a trillion dollars over the next couple of years.

So how does OpenAI fund it?

OpenAI can fund the capex from cash flow from operations (CFO), or they can fund it through raising capital (CFF).

Let’s look at the revenues first.

OpenAI generated $23 billion in revenue last year.

Let’s say somehow their growth curve inflects higher than Gemini. (Gemini is growing faster than OpenAI, November usage of GPT shows a decline[!!]).

Let’s say OpenAI does a miraculous $100 Bn next year.

Let’s assume that’s pure profit. (Hardly, these are massive cash burn enterprises).

It’s still not enough money to fund a trillion-dollar obligation. Not even close.

OpenAI will close a $100 Bn round soon — led by its suppliers and SoftBank. That’s still not enough.

OpenAI will go public and raise $100 Bn. That’s still not enough.

Add to the picture the competitive landscape.

Freemium pricing models from Google and Meta are pushing pricing power lower.

XAI is priced at zero. Gemini is priced at zero. You also have Microsoft Copilot, which is taking enterprise business away from OpenAI.

OpenAI wants to roll-out ads, but Anthropic is making fun of them. Now, Sam Altman is walking back ads a bit.

Competition is the enemy of high margins and rapid growth.

So, OpenAI is going to have a significant gap to fund these obligations.

So, if OpenAI hits revenue and raise gets you to $200 billion, now you have $800 billion more to go.

OpenAI is forced to go public to raise money.

This is the recognition moment markets are going through.

Microsoft dropped 10% on earnings because half of their backlog is tied to OpenAI.

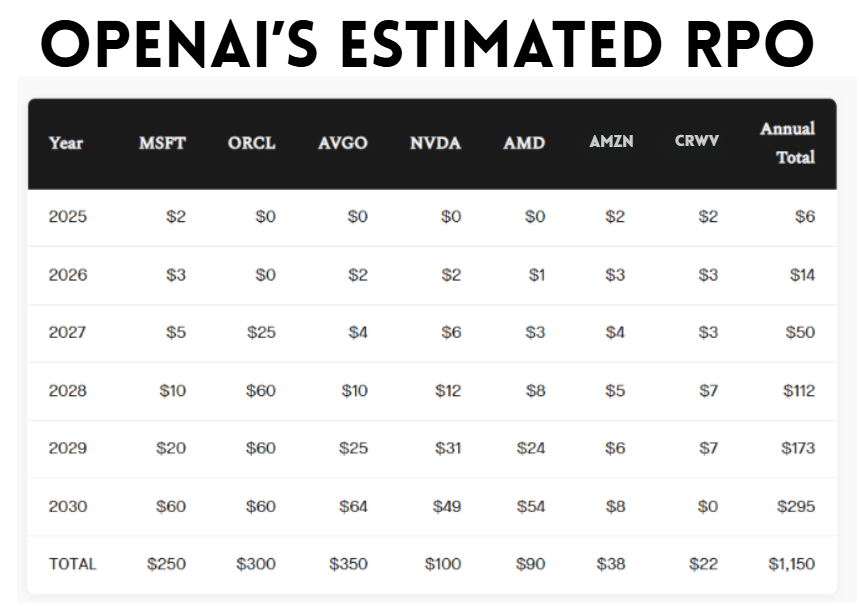

Broadcom and Oracle also have over $100 billion in RPOs tied to OpenAI.

Those firms have downstream providers in the datacenter space linked to revenues from OpenAI.

Many firms made capex investment decisions based on trusting Sam Altman.

So here’s my theory:

OpenAI went one by one by one to different providers and said, “Hey, look, I have massive compute demand. Can you help me build a data center?”

One a one-off basis, each decision to invest makes since. In aggregate, however, it looks like madness.

So, multipe providers committed $100B+..

OpenAI was worth $500 billion in September and $86 billion a year before.

The providers would have looked at OpenAI’s growth, and equity, and thought OpenAI will have the capital and customer demand to pay the bills.

But, then Gemini started getting traction. And, equity values in Mag 7, Nvidia, and the datacenter space experienced a correction.

(OpenAI’s stock price went ‘higher’ because they pick their valuations - it’s not real.)

My hypothesis is no one knew OpenAI was in bed with everybody.

It’s because If you look at their balance sheet during counterparty diligence, you wouldn’t see that off-balance-sheet liability show up as debt, because it’s not debt.

It’s a contractual obligation.

We saw some of this with Enron, by the way.

Enron had a lot of off-balance-sheet financing.

I’m not saying OpenAI is Enron.

I’m showing you how investors can be misled.

So, cumulatively, OpenAI signed up hundreds of billions of dollars in revenue performance obligations across the datacenters.

For compute providers, these obligations show up as an asset – accounts receivable – on their balance sheet.

As these providers deliver the services, they’d recognize the revenue.

That’s how these contracts are supposed to work.

But here’s the problem.

OpenAI doesn’t have enough cash flow—by any of the methods we discussed—to pay those obligations.

The datacenter providers are now realizing this.

What did Oracle do?

They had to raise $25 billion in debt and $25 billion in equity.

Why?

Because they have the potential of bad debt expense vis-à-vis their commercial arrangement with OpenAI.

The U.S. equity market is about $60 trillion. A trillion dollars in OpenAI spending is big.

OpenAI’s debt is a trillion dollars socialized across the ecosystem.

And how much of that is actually worth its face value? Those commercial obligations have real risk of default.

Each OpenAI contract corresponds to an accounts receivable with its customer. The debt does not show up on OpenAI’s balance sheet, but the asset does show up on the statements of its suppliers as Revenue Performance Obligations (or accounts receivables).

Why did Microsoft stock drop 10%?

The hundreds of billions in ‘assets’ linked to OpenAI aren’t in fact worth face value. They are worth a fraction of face value. That causes an impairment to equity.

Markets wiped over $300 Bn in Microsoft equity due to these RPOs.

Similarities to 2008

I remember seeing this back in the 2008 crisis.

Big investment banks - I was the youngest VP at Merrill at the time - had hundreds of billions of ‘assets’ backed by suprime loans.

Those loans weren’t worth par value. Writedowns and impairments to equity started.

That hurt equity values.

This is why Oracle is raising equity capital.

I would be cautious on the datacenter space right now. We still have highly targetted ‘clean’ exposure - names like Taiwan Semiconductor, and Flextronics. But, we’ve reduced our exposures quite a bit to names that directly touch OpenAI.

We’re keeping this sector on a tight leash.

That doesn’t meant that we aren’t in a massive and early cycle of investing in thousands of new GPU led datacenters.

Both statements can be true.

How much Market Cap Is Linked to OpenAI?

A lot.

If we look at OpenAI's spending, most of the money flows back to NVIDIA. They capture the lion’s share in semiconductors and data centers.

It’s a well-run business, incredible CEO, dominant competitive advantage—75% margins.

I assume 75% of OpenAI’s $100B raise will flow back to NVIDIA, and with 75% profit margins, you’re talking roughly $50 billion in earnings.

Put a 40x multiple on the $50B earnings and that’s $2 trillion in market cap from Nvidia’s 4.5T.

If the market starts discounting the probability of those earnings, Nvidia gets discounted.

And, it’s not only Nvidia, it’s across the AI flywheel – all the way from chip producers to power companies.

Nvidia wants to make sure OpenAI meets its commitment, and it has decided to invest in the current round.

But, this isn’t a Nvidia-like decision. It would have been smart for NVIDIA to invest in OpenAI when it had a cheap valuation.

NVIDIA is buying an asset that’s not actually worth $860 billion.

So what’s it actually worth? Maybe $100 billion. It’s not worth 80 times price-to-sales.

Especially with a growth rate that’s declining and they’re no longer the leader because Gemini is taking share.

Maybe it’s 20 times if you’re generous. Maybe it’s 15. Maybe it’s 10.

So if NVIDIA is showing up at an $860 billion valuation, the true value they’re acquiring is closer to $200 billion.

They’re losing on that transaction, but they do make sure the commitment spending is met, and they get their earnings at the back end.

But net net, what’s happening is NVIDIA is accepting lower margins.

They’re paying for the future revenue by buying inflated company stock at a premium.

Investing equity stakes made sense when they were cheap because you got the double benefit: the AI companies grow, you mark up the position internally, you win both ways.

But when the asset is overvalued, you get the opposite effect and it starts to hurt margins.

That’s the issue.

I’ve been on this for the last two months.

The bubble is OpenAI.

What If You Had A Copilot?

Markets are tricky - you need to be accurate and quick in every decision.

But, there are thousands of stocks in hundreds of themes, and sectors.

Keeping a constant track on all of them seems impossible.

But, what if you had a copilot.

That’s what Lumida has been cooking.

Lumida Copilot is an investment super app that is your one-stop shop to investing.

It provides you AI fundamental and technical analysis, regular news updates, themes tracking, hedge fund monitoring and more.

Our portfolio connect feature lets you connect your retail portfolio to the Lumida app, and see which factors and themes you’re most exposed to.

You can sign up here to become one of the first few external testers for the Lumida Copilot.

Markets

This is your friendly reminder that 'old guard high beta' names are in a bear market.

That includes darling social media stocks that did quite well and have since given up 30 to 40% of their returns in a few months.

The vast majority of crowd favorite names that worked in 2023 to 2024 are now in a bear market.

If you made money in those categories, your instinct is to buy the dip because you "know" the category or have some unique insight and feel that confers an edge.

Now is not the time to be ideological and fall in love with your thesis.

You should be making, or have already made, hard pivots in your portfolio to new themes you likely have had zero exposure to before.

That means:

- value stocks

- international stocks

- commodities and materials

- select consumer staples

- energy

I bought a British Tobacco company (BTI) recently for example.

You need a 180 degree flip in thinking.

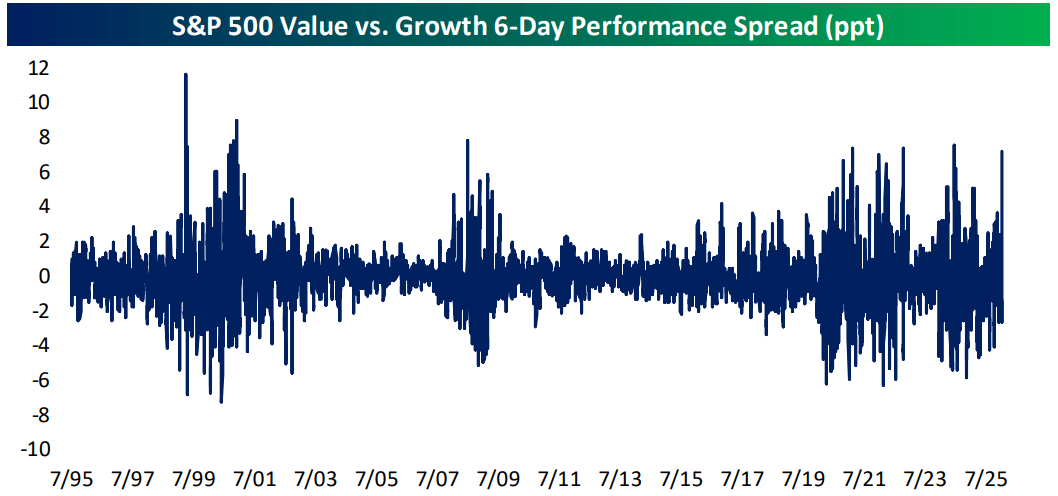

Growth To Value Continues

Back in Nov, we noted markets were shifting from growth to value. The transition is becoming mainstream now.

Growth has sold off hard since new year, briefly declining to its April 25 lows.

On the contrary, value has posted steady gains, leaving the performance gap far narrower.

The recent rotation has been unusually fast.

Over a six-session window, value has outperformed growth by more than seven percentage points—an outcome that sits in the extreme tail of historical observations.

These moves have previously occurred during the Financial Crisis and the late-90s unwind.

This shows you investors are tired of paying up for high valuations when global growth is on.

We used to say ‘There is No Alternative’ (TINA). Now we have alternatives all over the place. We should call it TACO - There Are Countless Options.

The near-term preference is in assets with high cash flows, stronger balance sheets, and pricing power.

We wrote about CMCSA, Manulife Corp and other value stocks in our Lumida 2026 picks.

We expect more boring names to do well in 2026, especially international stocks.

Read here.

THE BUBBLE IN VENTURE CAPITAL

What you are seeing unfold is a massive unwind in the venture capital market.

Private market valuations bear no resemblance to reality. OpenAI is the poster chiled.

The Brex take under 50% of 2021 valuations is evidence of that.

IPOs of dozens of VC darlings that tank is another.

Companies staying private and avoiding the mark to market discipline of private markets is another example of that.

75% of 2021 IPOs are below their IPO price (despite 20% inflation since!)

Over $1 trillion in private capital is now tied up in unicorns valued on internal marks, not clearing prices.

Secondary markets trade at steep discounts.

It’s price discovery - delayed, painful, and unavoidable

DATABRICKS wants to IPO.

They are valued at $134 Bn.

Meanwhile, SaaS multiples have crashed to earth.

Do you think Databricks is worth $134 Bn in public markets?

No.

Venture capital is making the world a better place for all of us.

The tech, innovation, and moonshots…

we need that.

But, this is another example of the bubble in private venture markets.

Maybe Lumida should open up an outsourced CIO service to help big money managers navigate.

We see, study, and participate in ALL of the asset classes: public markets, pre-IPO, private credit, venture, commodities, etc.

That gives us a unique perspective and ability to synthesize.

(Helps that we are obsessed as well.)

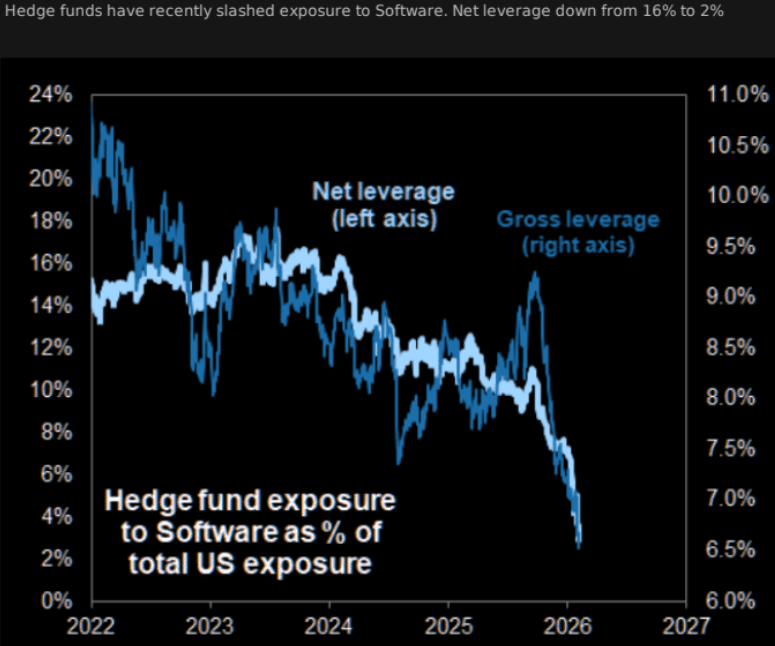

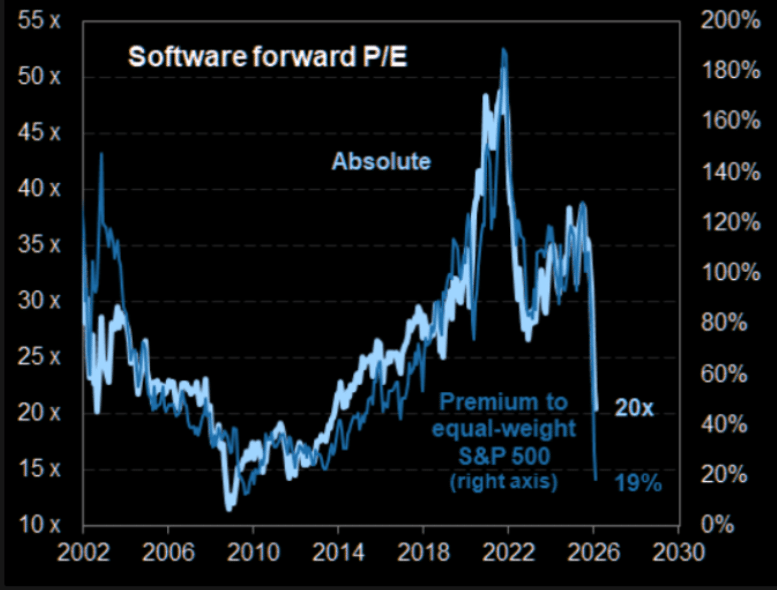

GS: Software Is The New Newspaper

Goldman comparing software to newspaper stocks is about as bearish as it gets for IGV.

It is a snapshot of where sentiment on SAAS has landed.

Analysts are flirting with “structural wipeout” language after a violent de-risking.

Historically, that’s the type of framing you hear when expectations have already collapsed and positioning has already been washed out.

The data supports that read.

Hedge funds have been dumping software and cutting risk aggressively, with net leverage compressing from roughly 16% to about 2%.

Prices and multiples have already adjusted.

Software valuations have de-rated sharply on price-to-sales, falling from roughly 9x in September 2025 to about 6x today. This places the sector around the middle of its historical range since 2010.

Importantly, the sector still trades at a premium to the equal-weight S&P 500 on P/S—about a 260% premium—roughly in line with the historical average.

The real difference shows up in earnings valuations. P/E NTM have shrunk to 2014 lows, with the premium to S&P 500 nearing its all-time bottom.

Software names have high margins and operating leverage to drive earnings higher even with lower sales growth.

Overall, software stocks aren’t dirt cheap. Many still are pricer than the S&P 500 (like Mongo DB). Others are much cheaper than the S&P 500 (like Salesforce and Adobe).

But, there is light at the end of the tunnel.

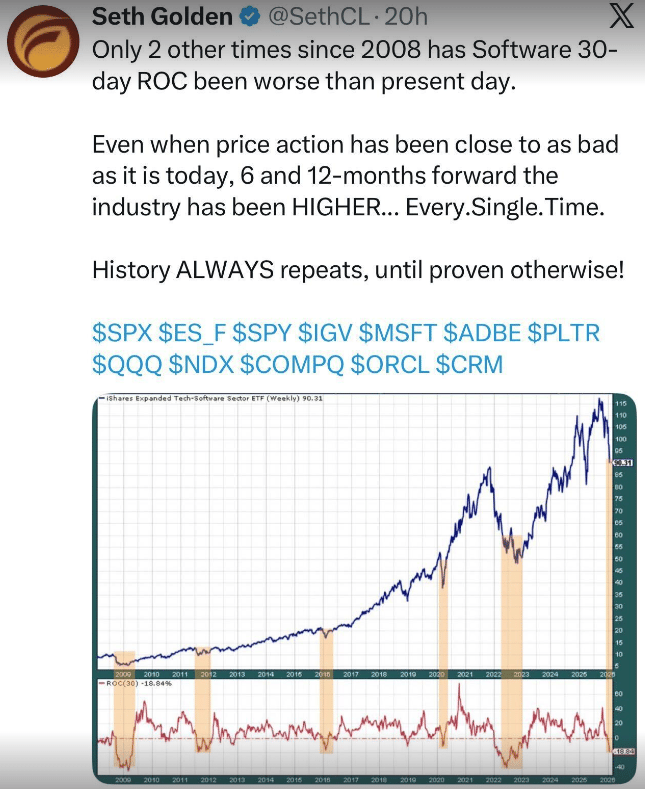

Software’s last 30-day rate of change is among the worst readings since 2008.

In the few prior instances when downside momentum was comparable, the group was higher six and twelve months later each time.

Overall, software has gone from crowded to avoid.

Exposure has been cut. Leverage has been reduced. Multiples have compressed. Commentary has turned apocalyptic.

Those are the ingredients that typically precede stabilization.

Lumida added to software exposure on Friday. We were early to purchase into the theme.

But we feel pretty good that our names - Salesforce, Adobe and Hubspot will do well in the next 6 months to a year.

Google Earnings

Google announced earnings this week with revenues surpassing $113B for Q4 (+19% YoY), with EPS coming in at $2.8, up 32% YoY.

Cloud was the growth driver with revenues up 47% YoY with operating margins north of 50%.

But the real talking point of the quarter was capital intensity. Google guided $175–180B of capex for 2026.

Sundar Pichai notes Google has been “supply constrained even as we’ve been ramping up our capacity”. Demand across services and Cloud remains “exceptionally strong.”

Anat Ashkenazi (CFO) noted that the “vast majority of our CapEx was invested in technical infrastructure, approximately 60% in servers and 40% in data centers and networking equipment.”

The capex is driving returns. Gemini usage and engagement are scaling rapidly.

Pichai highlighted that “our Gemini app now has over 750 million monthly active users,” with “significantly higher engagement per user, especially since the launch of Gemini 3.”

He added that Gemini 3 Pro has “seen the fastest adoption of any model in our history,” processing “three times as many daily tokens” as the prior version.

Across the ecosystem, “first-party models like Gemini now process over 10 billion tokens per minute via direct API,” underscoring both scale and throughput.

Importantly, this growth is coming alongside falling unit costs.

Google disclosed it was able to “lower Gemini serving unit costs by 78% over 2025 through model optimizations, efficiency, and utilization improvements.”

That combination—rising usage and falling cost to serve—is what enables capex to compound returns.

How does OpenAI compete with Google’s improving returns, and cash-flow funded capex?

Crucially, AI is not cannibalizing Google’s core businesses.

Search revenues grew 17% YoY, with management describing the moment as “expansionary,” driven by longer, more complex queries and higher engagement.

YouTube’s annual revenues surpassed $60B, supported by both advertising and subscriptions, while subscription, platforms, and devices revenue grew 17%, helped by demand for AI-enhanced plans like Google One.

Google was our pick back in July 25, when the fears of ‘AI-kills-search’ had led it to a ~20x P/E NTM valuation.

It has been re-rated significantly since then, and is now priced rather high amongst its comps.

We aren’t buyers here. A benchmark weight seems appropriate.

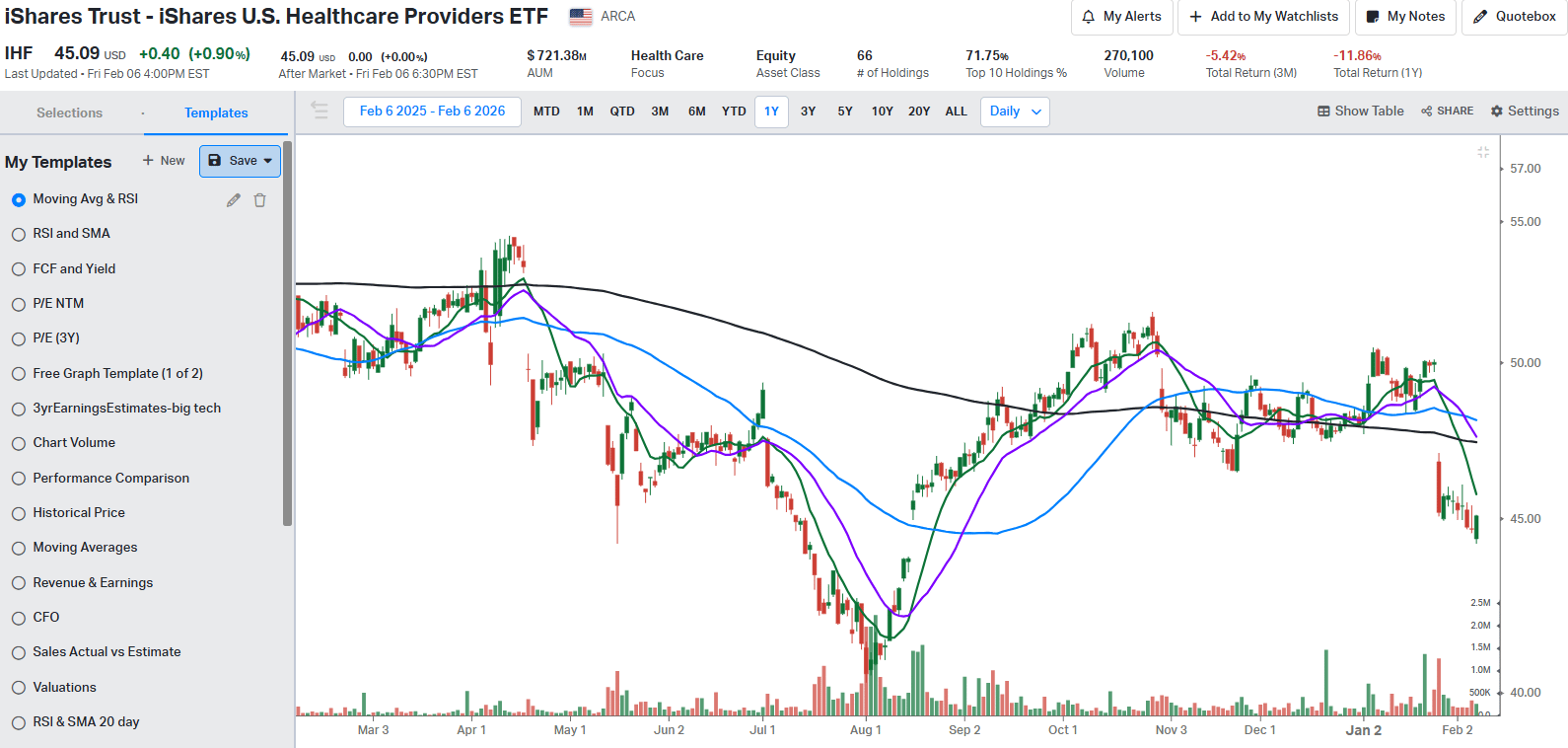

2026: The Trough For Managed Care

Molina Healthcare reported earnings this week, and the stock sold off sharply, down more than 30%.

The headline numbers were weak - EPS was down 154%.

The earnings commentary tells exactly why the sector is struggling.

Molina reports results deteriorated because medical costs rose faster than state rate updates.

CEO Joe Zubretsky described 2025 as unusual: the medical cost trend accelerated from 4.5% to 7.5% in a single year. He remarks this as “an aberration, an anomaly by historical standards.”

A key driver of that inflection was redeterminations.

As pandemic-era eligibility rules rolled off, lower- and no-utilizers exited Medicaid first. That mechanically raised the average acuity of the remaining population.

Zubretsky quantified it: “250 basis points of this 7.5% trend is attributable to the acuity shift from membership declines related to the final stages of redeterminations.”

This is a critical context.

Utilization did not spike because behavior changed overnight; reported costs rose because the mix changed.

That mix shift exposed the lag in the rate-setting process.

Molina’s CFO: “rates have not kept up with trend over the past six quarters.”

Management believes “Medicaid plans are underfunded by 300 to 400 basis points.”

The sector is under-earning because rates are stale

However, Zubretsky expects 2026 to be the “trough for managed Medicaid margins,” since the impact of redeterminations end by 2025.

We can see margins improving in 2027 and beyond.

Overall, US healthcare providers have struggled over the last few weeks- they have lost over 10% in the last 9 days.

The decline began after lower than expected rates revision for Medicare Advantage.

We see the sector as an avoid.

AI Infrastructure Isn’t “Compute-Constrained”

Flex reported earnings with revenue of $7.1B (+8% YoY) and adjusted EPS of $0.87 (+13% YoY).

More important than Flex-specifics, the call offered a clean sector read-through on where the demand is directed within AI picks and shovels.

AI capex is still accelerating, but the bottleneck has moved downstream into execution and deployment.

Flex’s CEO Revathi Advaithi: “there’s tremendous complexity in the data center deployment”.

Customers increasingly need “an ecosystem of integrated products, capabilities, technologies, and services.”

Flex’s read-through is straightforward:

The winners in the picks-and-shovels stack are the companies enabling faster deployment through integrated power + cooling + systems-level execution.

We also own Flex just in case we are wrong on our bearish assessment of OpenAI’s risk to the category. We can still participate in this way.

We believe we are hedging our views with a good investment in the space.

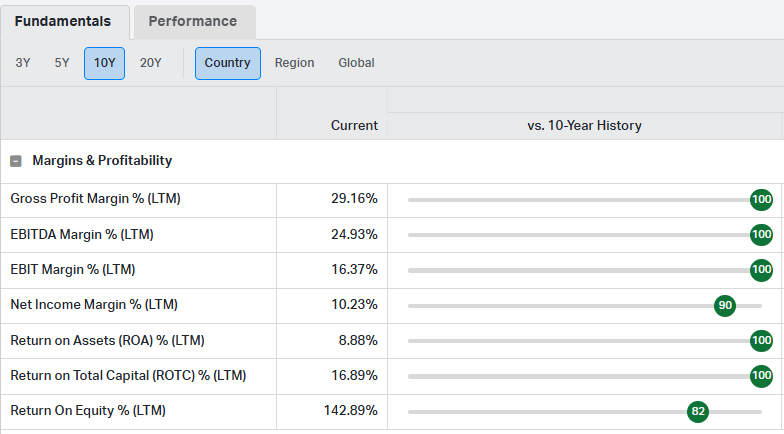

Latam Airlines (LTM): Our International Value Pick

LATAM is the dominant airline across South America, with scale advantages in Brazil, Chile, Peru, and Colombia.

It has an expansive network that connects intra-regional travel with higher-yield international routes to North America and Europe.

The tailwinds are structural.

South America remains under-penetrated in air travel, and tourism flows and regional business travel are rising.

LATAM transported over 87 million passengers in 2025, with full-year capacity up ~8% YoY, reflecting steady, demand-driven expansion.

International routes and premium travelers are enabling a better pricing mix, with leisure and premium demand improving.

What differentiates LATAM in this cycle is discipline.

Coming out of restructuring, management has focused on route profitability, fleet efficiency, and customer experience, rather than chasing market share.

That strategy is visible in the operating metrics: adjusted operating margin reached ~16% in 2025, up meaningfully from pre-restructuring levels. Adjusted EBITDA rose to ~30% YoY in the most recent quarter - highest in 10Y history.

Costs have remained controlled even as capacity expands, allowing yields to stay stable.

Operational execution supports the story.

Customer satisfaction has improved materially, with record passenger NPS of 54, and premium traveler NPS at 58, signaling better service quality.

Capacity growth has been selective.

The fleet has expanded efficiently, and cargo and international operations continue to diversify revenue away from pure domestic leisure demand.

The financial results are simply the consequence of that strategy.

Q4 revenues grew ~16% YoY, net income rose sharply, and free cash generation exceeded $1 billion, enabling dividends and share repurchases.

Despite this, LATAM trades at discounted valuations, with P/E NTM at 12.0x.

The bear case is familiar.

Earnings remain exposed to South American macro volatility, fuel prices, FX, and regulatory or labor risks, particularly in Brazil and Chile.

A sharp global travel slowdown or energy shock would pressure margins.

But these risks are inherent to the airline sector and are more than reflected in the current valuation.

LATAM stands out because it combines regional market leadership, secular international travel tailwinds, and post-restructuring discipline, yet is still priced like a traditional cyclical airline.

Lumida Curations

NVIDIA × Dassault: The Digital Twin Stack Goes Real-Time

NVIDIA and Dassault are collapsing decades of offline simulation into real-time, AI-accelerated digital twins—laying the infrastructure layer for the next generation of product design and engineering.

Ken Griffin: Dollar Weakness Is Optics

Ken Griffin argues recent dollar softness reflects policy noise rather than structural decline, emphasizing that reserve-currency status—and America’s ability to accumulate and deploy capital—remains the core advantage.

Dry Sauna Is the Longevity Baseline

Short, high-heat dry sauna sessions (~20 minutes at ~200°F) reliably raise core body temperature and have the strongest evidence base, while infrared and wet saunas often fall short on heat stress or safety.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.