Welcome back to the Lumida Ledger.

If you find this valuable, we’d greatly appreciate you sharing it far & wide with your network. That’s how we grow and keep the content free to read.Here’s a preview of what we cover this week:

Markets: Growth vs Value, SaaS under pressure

Company Earnings: Software Booming, Media Struggles, EVs Uncertain

AI: Sovereign AI, FSD

Digital Assets: Trump Embraces Crypto; Wither Dems?

If you’re interested in learning more about Lumida’s wealth management services, click to explore becoming a client

This week, we had a fantastic conversation with Doug O’Laughlin, creator of Fabricated Knowledge, a leading semiconductor newsletter.

Tune in below, and don’t forget to subscribe.

We talked about:

Nvidia's Datacenter Strategy

Hardware Based Memory (HBM) and Edge Computing

Hyperscaler Capex and Nvidia's Growth & Competitive Position

When will Custom Silicon eat into Nvidia’s growth

In case you missed the Berkshire Hathaway annual mega-event, here’s Lumida curation of the best insights on the market trends from the Oracle of Omaha.

Click here to watch & don’t forget to subscribe.

Where Are All the Great Tech Investors?

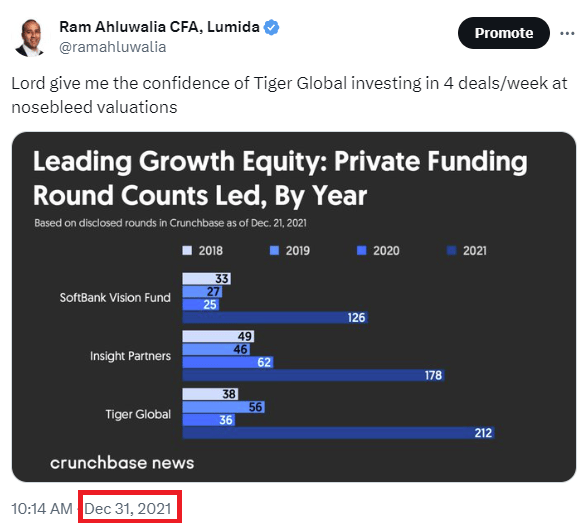

Tiger Global blew it. Coatue blew it.

Both paid 100x price/sales for unprofitable startups in 2021 and saw terrible performance.

Altimer blew it.

The fund tanked due to a massive concentrated bet on Snowflake (see 13F excerpt below).

Cathie Wood's (ARKK) fund is so bad the WSJ wrote an article about how it’s one of the greatest wealth destroyers of all time.

So, here is the question? Why are there no great tech investors?

Why does QQQ beat every tech investor?

How is Lumida managing to beat QQQ sticking with Nvidia, Meta, and Google in Mag 7 and avoiding Tesla and Apple?

We will lay out our thesis and explain why there are no great technology investors.

Reason #1: Familiarity Bias: Insider Trading & Crossover VCs

A well-known VC once told me: “What VCs do in Private markets is illegal in public markets. VCs regularly engage in insider trading. We want to know everything about the company...”

Altimeter knows Frank Slootman. They know the board.

They and other cross-over VCs traffic in information flow through informal means such as social events or WhatsApp groups.

You can bet Cathie Wood has some insight into Tesla’s latest plans. Cathie interviewed SoFi’s CEO (another money loser) on her pod.

Investing is social. These allocators believe they have an ‘edge’ because they know board members and the CEO. They believe these morsels of information confer some kind of advantage.

The fallacy is the proximity to power creates an illusion of confidence.

On the contrary, those tidbits or the ‘vibe from the CEO’ are distractions that lead to bad decision making.

Of course Elon is going to be perpetually optimistic on Tesla. That doesn’t make it a great investment.

The reality is distance creates perspective. That’s why Warren Buffett has an edge living in Omaha, removed from the madness.

It’s better to be a monk distanced from the action.

Reason #2: What Works in Private Markets Doesn’t Work in Public Markets

Venture capital valuations are driven by sales growth.

Public markets are driven by earnings growth.

Crossover VCs get offsides by applying the framework from private markets to public markets.

If you look at deciles of stocks and sort by max revenue growth, you will find that stocks with rapid sales growth lag substantially. Look at Peloton or Zoom.

VCs look for high revenue growth in private markets. Then, they lift these stocks into the public markets with an IPO.

Peloton is a good example of this.

But the Crossover VCs have a blindspot. They mistakenly believe their private markets insight confers an edge in public markets.

Quite the opposite.

One of my favorite books is “What Works on Wall Street” by Jim O’Shaughnessy.

There are several statistical phenomena in the book.

One is that rapid revenue growth and high-valuation stocks underperform.

Businesses can blow lots of spending to acquire customers without true LTV/CAC discipline. That is unsustainable.

That’s what we’re seeing now:

Reason #3: Rapid Sales Growth is Kryptonite

Technology captures the imagination like no other.

My kids think of the iPad as a magical device.

When we let our minds wander on the potential of AI, we let our minds wander.

Humanoid robots, nanotechnology, quantum computing – how do I bet on that!?

It’s easy to let our checkbooks wander too.

The reality is technology is cyclical.

What are the cycles? Animal spirits, CapEx cycles, and disruption cycles.

Animal Spirits refers to the excitement investors feel when they look at an investment.

Peak enthusiasm during the DotCom era, or 2021, is a good example. When the inevitable ‘exhale’ comes, these stocks collapse.

Take a look at ARKK below. The S&P and QQQ are near All-Time Highs, and the hype stocks - broken promises - backing ARKKs ETFs are still in the dumps.

(It’s so bad there is a support group on Reddit where ARKK holders debate whether to sell now or hope for a rally)

The Tech Investors fallacy is that rapid growth = stock price growth

Markets price in expectations. When stocks run up, they receive a lot of attention. Expectations and multiples start to soar.

This deprives expensive growth stocks of the most powerful driver of returns: multiple expansion.

This means the risks to the stock are also elevated. So they are at risk of multiple compression.

In the last few weeks, we’ve noticed growth stocks re-rating lower - despite beating revenue and earnings!

All of these growth stocks dropped on earnings:

Take a look at our Lumida Stocking Stuffer stocks. It’s full of value names like Build a Bear and American Public Education.

Those stocks have benefitted from Multiple Expansion.

Lumida Stocking Stuffer YTD Returns

Those small stocks don’t rapid revenue growth.

They were dirt cheap, doing buybacks, and had a nice niche with limited competition. They were also growing earnings.

You want to find the Goldilocks in earnings growth. Not too low (value trap) or too high (growth to value trap).

Reason #4: Technology Valuations Are Cyclical

David Einhorn is having his best years. Last year, he was up by 50% on value stocks.

But, most people think that investment returns comes from growth stocks.

Timing matters.

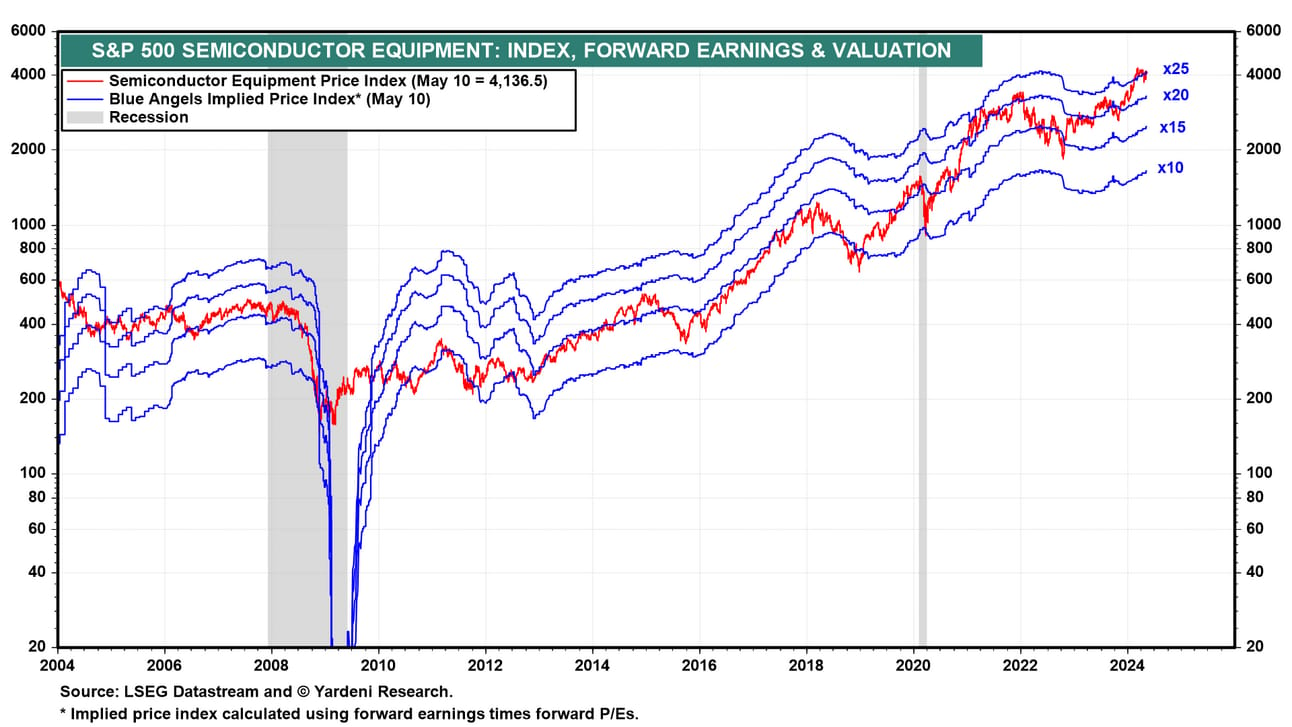

Take a look at the valuations of the S&P 500 and Tech over time:

Valuations are cyclical.

Everyone knows it’s best to ‘buy low, and sell high’.

But at the highs, the fear of missing out sucks everyone into the market due to recent outperformance.

Great investors are counter-cyclical.

When tech stocks are at the upper-end of their valuation deciles, you should underweight tech, rotate, and pick the best non-consensus tech names.

Take a look at semiconductor valuations today. This is as close to ringing a bell as you’ll get.

(We still own 2 to 3 positions like Nvidia and TSMC. And, older accounts own ASML and AVGO for tax reasons).

AI is transformative. It will re-shape how we live, work, and play.

Who disagrees with that statement? The point is the valuations have priced in this story, if not more.

Reason #5: The Disruptors Get Disrupted

Technology stocks have the highest dispersion of all the sectors.

That means the spread between winners and losers is wider than anywhere else.

That’s because tech disrupts tech.

Asana (ASAN) was founded by Facebook Founder Dustkin Moskovitz. It’s getting pressure from other collaboration software firms like Atlassian (TEAM) or Monday.com or scores of others.

Adobe is getting disrupted by Midjourney. Adobe’s stock is getting mauled down 20% YTD - a risk we anticipated last year.

Investors don’t receive sufficient compensation or ‘risk premium’ for bearing these disruption risks.

In finance parlance, one would say: “The discount rate for tech stocks should be higher.”

Reason #6: The Search for Novelty

In October 1999, Michael Lewis published a book called ‘The New New Thing’.

That was 6 months before the Nasdaq top.

The title "The New New Thing" is a play on the concept of constantly evolving technology and the relentless pursuit of innovation in Silicon Valley.

It suggests that what's new today will quickly be outdated, and there's always a focus on the "next big thing."

Humans have an exploratory instinct. There is a taste and desire for the novelty.

Routine bores the dopamine seeking human mind.

We like to try out new foods, cuisines, exercise routines. Or, in the case of Andrew Huberman, mating partners.

VCs are always on the search for the New New Thing.

In private markets, that works. In public markets, that doesn’t work.

QQQ beats all the technology hedge funds because the best tech firms in the world have extraordinary competitive advantages.

Microsoft has extraordinary reach and distribution. The software ‘lock-in’ and recurring revenue are fantastic. (There is no position; it is too pricey.)

Google and Meta hold the attention of more individuals on Earth than other companies globally.

These moats are not at risk of breaching anytime soon.

That’s why these businesses are the most valuable in the world. (Some are at risk of losing value like Apple & Tesla, as we’ve pointed out).

Reason #7: The Big Firms Eat the Lunches of the Little Firms

In the 9th circle of Dante’s Inferno, you see people eating the heads of others.

It’s worse than dog eat dog.

Technology is the same way.

Microsoft announced Figure, a new data and analytics platform built on Azure.

That platform poses a new source of risk for Snowflake and Databricks.

Snowflake is down over 30% while tech indices are up:

Google recently announced an entry into the Cybersecurity space.

This may pose a risk to scores of cybersecurity firms focused on Cloud security.

When they want earnings growth, Big Tech firms copy and paste the business models of smaller firms.

They plug in the product to extensive existing distribution channels.

This is a story as old as time. Remember Borland? Wordperfect? Netscape Navigator? They were all gobbled up by Microsoft.

Reason #8: There Are Limits To Thematic Investing

The best venture capital investors are thematic. Thematic investors outperform non-thematic investors.

Lumida is also thematic.

We nailed the theme last year in our ‘Semiconductor CapEx receiver thesis’. But Mr. Market has caught up to our thesis. The thesis is now Consensus.

We have a set of investment themes that we believe will re-shape the world over the next ten years: aging demographics, nuclear renaissance, digital assets, the rise of AI and more.

Thematic Investing is powerful.

But there is one big flaw.

The best companies in the world are monopolies.

They are a class unto themselves.

There is no category to lump them into.

Example:

S&P calls Google a ‘communications stock’ and lumps it in the XLK index alongside Comcast. That doesn’t make sense.

FICO. They has a monopoly on credit scoring.

JP Morgan has extraordinary barriers to competition.

Visa & Mastercard have no real competition.

S&P Global has the license fees from the S&P 500 index.

(I have a thread on ‘the best businesses in the world’ identifying quite a few of these companies with incredible moats. Sadly, they are also Consensus and pricey.)

Human beings love a good story. Themes are stories.

Themes can get hot and bid up. Like 3D printing, Genomics in the 2000 era, or EV stocks.

We track dozens of themes.

No wonder Stanley Druckenmiller rotated out of Nvidia.

If you’re interested in learning more about Lumida’s wealth management services, click to explore becoming a client

Macro

Economic reports have been disappointing.

While that may be welcome to some as it could help sway the Fed to cut rates, a deteriorating economy is not generally a welcome background for stock prices.

Much of the surprise decline has come from "soft" economic releases, such as surveys. "Hard" data, such as retail sales, have held up relatively better than expectations.

The difference between soft and hard surprises has plunged to one of the lowest levels in over 20 years.

How to bet on illegal immigration?

1) Travel, Leisure & Restaurants

Those categories are seeing reduced costs of labor and greater spending on boomers

Might this explain, somewhat, why Cruise Lines $RCL and Chipotle $CMG have done well YTD?

Take a look at this chart from GS:

Food services is a beneficiary of immigration

2) Another: AXON and other security services firms?

(We used to own this, sold it in recent months)

3) Daycare services like Bright Horizons Family (BFAM)?

(We used to own this, sold it in recent months)

4) Money Transmission plays (crypto? Visa?)

5) Homebuilders focused on affordable entry price points

(We still like this if you have a 1 to 3 year timeframe)

6) Retail lenders

(One of our top positions is a retail lender. We haven’t revealed the name yet.)

7) Gig Economy

UBER is an obvious one

I’m going to build a thematic basket and see how it’s done.

Chipotle is a name that benefits on the supply and demand sides, right?

(Especially in NYC, where you can’t get any decent TexMex)

That said, I believe chasing into many of these ideas is a mistake…

We did a good job rotating out of those hotter names into energy services, quality financials, retail lenders, and a precise set of tech and semi names in recent months.

We went from hot to boring.

Boring is working.

S&P is down, boring up 3% in the last month.

I have no problem selling winners if they go parabolic.

Look up my posts on semiconductors from mid-March.

The key is idea generation

We know we can find a good rotation that meets our criteria (unless markets go bananas).

Over time, our edge and investments compound…

Markets

Growth stocks, especially those pricier than NVDA, continue to get shellacked after reporting earnings.

These firms are beating expectations, but it's not enough.

Here is a chart showing the Growth vs. Value spread.

Notice Value is beating Growth.

Why?

Our theory: Higher for longer rates disproportionately hurt growth stocks

Some people are afraid of the Jabberwocky.

I am afraid of 'Growth to Value' transitions.

There has been a re-rating in growth stocks over the last two months if you're paying attention.

Study the chart below and ask yourself:

(1) How long do these take on average?

(2) When value beats growth, how long before that trend stops?

(3) Why is value beating growth

(4) You need to own tech. So, how do you position it, given all of the above?

My answer on the last is Google, Meta, Nvidia (in that order)...and certain stocks in Brazil.

Correction: No one is afraid of the Jabberwocky.

People have a fear of missing out.

That crowd is paying its dues now.

On AI and the risk to Microsoft:

Nvidia: ‘We’re moving from the world of software to producing digital intelligence’

Why do we need Microsoft Windows, Office, Adobe, Salesforce or your favorite SaaS company when AI can spin up interfaces on the fly?

All we need is data, ideally, on-chain.

Microsoft’s acquisition of Inflection was borne out of necessity (panic) to de-risk bad potential timelines.

Yet another reason to avoid owning software stocks.

Software companies are experiencing weaker demand conditions and longer sales cycles.

Here’s an excellent analysis from our friends at Clouded Judgement - read it in full here.

Earnings reports have been below expectations and companies are guiding down for Q2.

The only bright spots have been companies tied to AI tailwinds, such as the hyperscalers (AWS, Azure, GCP).

The median revenue multiple for SaaS businesses is 5.7x.

High-growth SaaS businesses are trading at a median multiple of 13.2x NTM revenue.

There is a correlation between growth rate and valuation multiple.

The median CAC payback period for SaaS businesses is 45 months.

Shopify and Uber are the latest growth stocks to take it on the chin today

Shopify is down 16% after a beat/beat.

Shopify has a forward PE of 70+ — far more than Nvidia.

UBER is priced like Nvidia

None of that makes sense.

Have you sold stocks that are more expensive than Nvidia?

If not, why not?

Today, the defensive rotation is to quality value with earnings growth.

We are buying something this morning…

We Are Not the Same

X’s favorite stock, Palantir (PLTR), reported.

PLTR is at 70x forward PE. Up 15% in 3 Months.

Expectations are high.

Meanwhile, Build a Bear is up 32% over the same time frame.

Forward PE is 8.4x.

Expectations for teddy bears are much lower, too.

Build a Bear is on our Stocking Stuffers list.

See how this works?

That said, I can attest that Palantir knows how to sell to gov’t agencies really, really well.

I saw this during the FDIC RPP program (google it)

But all of that good news is priced in.

Fully valued at best.

Build a Bear is my favorite company.

It always gives me a chuckle…especially when you compare them to hardcore Defense/AI tech.

Can you imagine anyone in an investment committee saying, ‘Look, it’s time to buy Build a Bear. Forget <meme>’

It’s not just Build a Bear.

Look at SLQT. SHAK. TDW. DAVE.

Stay #nonconsensus

APEI is up 39% in the last 3 months.

That was also on our stocking stuffer list.

Small caps…

Is it possible to ‘acquire’ or LBO Berkshire Hathaway like a corporate raider?

You don’t need a lot of cash.

You can use the cash on the target’s balance sheet.

You can also borrow.

But you can’t borrow more cheaply than Berkshire.

There is only 1 way to acquire Berkshire Hathaway (hypothetically).

Let’s assume you did not have access to cheap financing.

It’s just your PE firm and an investment bank who will help finance the transaction.

You would ask the investment bank to raise enough debt to acquire Berkshire.

And then saddle the NewCo with the extra debt.

You’re using the cashflow and assets of Berkshire to buy Berkshire like a corporate raider.

This would cause post acquired Berkshire to be an issuer of less than AAA bonds.

They would potentially junk bonds.

This would hurt the ‘spread capture’ Berkshire is capturing between its Return on Equity and cost of capital.

Which does not defeat the point of acquiring Berkshire, but greatly increases the risk.

But… here’s another way to do it…

Issue a bunch of bonds as in before.

Buy Berkshire and saddle BRK with the debt.

(Assume shareholders approve).

Immediately hedge your Apple exposure (not easy!)

Then dump your Apple stock.

Now, use the proceeds from Apple sales to pay off the debt.

Now you own Berkshire Hathaway and have restored your credit rating.

Then go buy Meta and Google :)

The legendary RJR Nabisco transaction in ‘Barbarians At the Gate’ is the same setup as above.

Also: Ritz Crackers are made by RJR Nabisco.

Ritz Crackers were a big deal. They made RJR Nabisco a growth stock!

Other food companies we call staples today were growth stocks back in the day.

If you’re interested in learning more about Lumida’s wealth management services, click to explore becoming a client

Company Earnings

Tech, Media & Telecom:

Enterprise software companies like Palantir, Axon, Datadog, and HubSpot continue to drive strong revenue growth fueled by cloud/SaaS migration and product expansion

E-commerce platform Shopify benefitting from GMV gains, but profitability remains elusive amid growth investments

Semiconductor IP provider ARM Holdings seeing robust revenue growth led by annuity licensing renewals

Ride-sharing firm Uber plagued by persistent losses despite topline momentum from mobility/delivery businesses

Media giants like Disney and Warner Bros struggling with streaming profitability and studio performance

Social platform Reddit outperforming with advertising tailwinds but overall scale relatively small compared to other social media platforms

Financials:

UBS reaping benefits of scale and cost synergies from Credit Suisse integration

Robinhood capitalizing on volatility in crypto and options trading activity

Automotive/Industrials/Energy:

EV companies Lucid & Rivian facing production ramp-up challenges leading to revenue misses

Utility Constellation is posting lower revenues amid an unfavorable pricing environment, though cost control is boosting earnings.

Healthcare/Hospitality:

Diabetes care company Insulet raising full-year guidance on robust pump demand globally

REIT Vornado impacted by lower occupancy rates and lease rollovers in its property portfolio

Travel platform Airbnb delivers healthy booking value growth, benefitting from continued travel recovery

Consumer:

Beverage major AB InBev is navigating volume pressures through premiumization and non-beer innovation

Overall, software/cloud remains a bright spot with enterprises prioritizing digital investments. Media grappling with streaming economics. Financials positioned well. EV startups facing execution hurdles. Healthcare benefiting from innovation. Travel recovery aiding hospitality while discretionary consumer facing cyclic pressure.

AI

Is Sam Altman right that we will see $1 Bn startups with solo founders?

This misses a key point.

Meta and Google will have strong LLMs that can spin-up entire business units with 1 person.

It's those firms that are going to spin up businesses on command before the tech diffuses…

By the way, OpenAI just announced that they’ll be showcasing Chat GPT updates on Monday.

Subscribe to Lumida to get the curation in your feed as soon as it airs.

On Hyperscalers Capex Spend

The capex spending at MSF T, META, and GOOG will eclipse $150 billion this year alone. These businesses differ from their positions five years ago and have a different return on capital profiles.

Beth Kindig from IO Fund feels that Copilot is expected to make a more significant contribution next fiscal year to Microsoft MSFT. Morgan Stanley estimates the AI tool can contribute $5B in revenue in fiscal 2025.

Nvidia Backs Tesla FSD Competitor Wayve

1) Wayve is a pure technology play - license the tech rather than own/operate vehicles

2) Meanwhile, LCID drops 8% after earnings.

Excerpt:

US chipmaker Nvidia Corp. is investing in Wayve Technologies Ltd., joining a $1.05 billion funding round for the UK startup that wants to get its autonomous-driving technology into cars.

The raise—one of the largest ever for a European artificial intelligence company—was led by SoftBank Group Corp., with existing investor Microsoft Corp. contributing further funds. The valuation was not disclosed.

Wayve wants carmakers and other fleet operators to install its technology into their vehicles, rather than own or operate the cars itself. The company received interest from several car companies about investing, but decided not to close off its options in future by partnering with a single manufacturer, Chief Executive Officer Alex Kendall said in an interview at Wayve’s headquarters in London.

Other autonomous driving companies have faced setbacks. Last October, a woman in San Francisco was dragged under a vehicle operated by Cruise, General Motors Co.’s self-driving unit, after a human driver hit her in a different car. The accident and subsequent withholding of evidence led to Cruise being stripped of its permit and having its cars recalled.

The funds raised will be spent on new staff and computing. The startup had already raised over $258 million from investors, including Eclipse Ventures LLC, Balderton Capital, Baillie Gifford & Co., D1 Capital Partners, Moore Strategic Ventures LLC, Virgin and Ocado Group Plc.

Geopolitics of AI:

This week, we curated some interesting panels from the Milken conference to update our views on our investment themes.

If you want to know what the world leaders think about China and weaponizing AI - check out this short Lumida Curation on Geopolitics of AI

Open AI’s COO, Brad Lightcap, agrees with our Energy thesis and the big divergence in the energy supply & demand for Hyperscalers and Frontier models- check out this short curation here.

Check out this short clip showing Elon’s exasperation with the pace of AI.

Digital Assets

Trump has embraced Crypto.

Crypto is political now. It wasn’t always this way.

SBF contributed considerably to Democrats including Maxine Waters and Biden.

Then SBF blew up. Democrats thought crypto was toxic and rushed the other way to expunge crypto from its ranks.

But, that was the bottom of the market.

That’s called “whipsaw risk”.

Public ledgers shouldn’t be bipartisan.

Dems have a shot at Digital Asset relevance via the following quick actions:

(1) Nominate Larry Fink for Treasury Secretary

(2) Pass stablecoin regulation that permits Circle (USDC), and other stabecoin issuers, to advance US dollar interests globally. Direct the SEC to permit digital dollars to earn interest in our digital pockets

(3) Submit Congressional action to:

(a) create a Self Regulatory Organization in the style of FINRA to propose common sense regs (such as Proof of Reserves, Disclosure of Conflicts, etc)

(b) a Crowdfunding bill that enable the long-tail of creators to have tokenized property rights. The creator economy is bleeding rents to gatekeepers.

When you ‘buy’ a movie from Amazon Prime or a song from Spotify you don’t own a portable or transferable digital asset. That needs to change. Gatekeepers are rent seeking from the public in closed and centralized monopolies that advance the few, rather than open architecture frameworks that advance the public. Empower owners and creators with a modern Digital Rights Management Act

(4) Mandate the executive branch, especially the Dept of Defense which is ‘unable to account for $1 Tn+’ (!!), to put payments to vendors on-chain Sunlight is the ultimate disinfectant.

While the market is recovering, a true bull market might require new investors and innovative applications.

Quote of the Week

“Be guided by beauty, it can be the way a company runs, or the way an experiment comes out, or the way a theorem comes out, but there’s a sense of beauty when something is working well, almost an aesthetic to it.” – Jim Simons

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you want to learn more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.; T