Here’s a preview of what we’ll cover this week:

Macro: Main Street Still Strong; Credit Normalization; Private Credit Risk Is Controlled

Markets: AI & Productivity Growth; The AI Buildout Isn’t a Bubble; Energy Companies are Major AI beneficiaries; America’s Defense Machine Is Running

Digital Assets: BlackRock Is Tokenizing the Financial System; JPMorgan Brings Bitcoin Into the Banking System; Fed Bear hugs Crypto

Lumida Curations: Meme Coins Are Changing Finance; Omega-3 Deficiency: The Hidden Brain Drain; Gold’s Rally Nears Exhaustion?

Spotlight

This week, I was invited to a podcast with Pio Vincenzo for a wide ranging discussion on investor psychology, fears around the US economy and opportunities in equities and crypto.

Here’s what we discuss:

Fear vs fundamentals + Political perception

Goldilocks economy & global peace narrative

Fear gauge & political polarization

Banks, Insurance and Mortgage plays

Options & covered-call strategies

Bitcoin 4-year cycle & market attention dynamics

Watch the podcast here.

On Thursday, Lumida hosted a Best Idea Dinner in NYC with an incredible group of family offices. If you want to join, shoot us a note at [email protected] and tell us a bit about yourself.

Each guest shared a two-minute idea from market views to emerging trends, companies, and opportunities they’re most excited about.

We got some thoughtful insights - overall, great energy around the table.

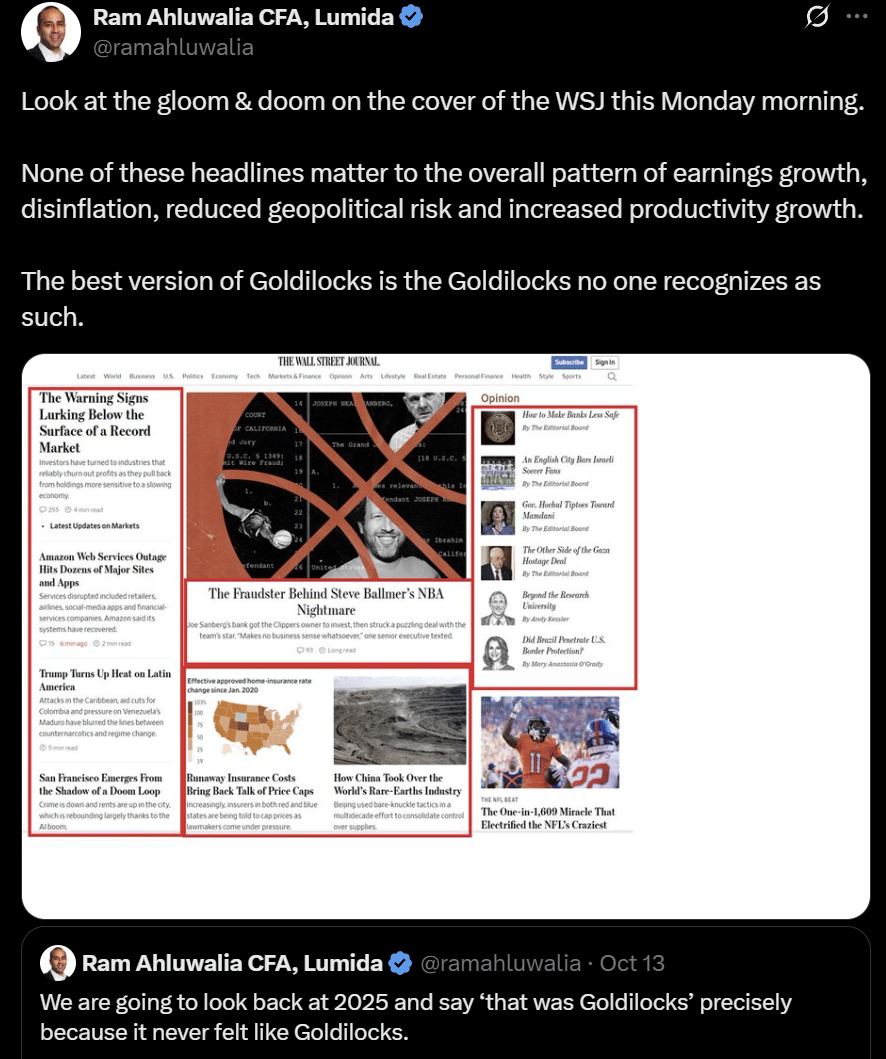

The S&P started the week with gloom & doom all over the headlines.

I posted this snapshot from the WSJ on X Monday morning. The pessimism is thick. Notice the headlines have nothing to do with what matters — earnings.

Then the several indices finished the week at all-time highs.

I did a solo-podcast on Friday about how we are in Goldilocks, precisely because no one realizes it’s Goldilocks. Watch Lumida Non-Consensus Investing here or on Youtube or Spotify.

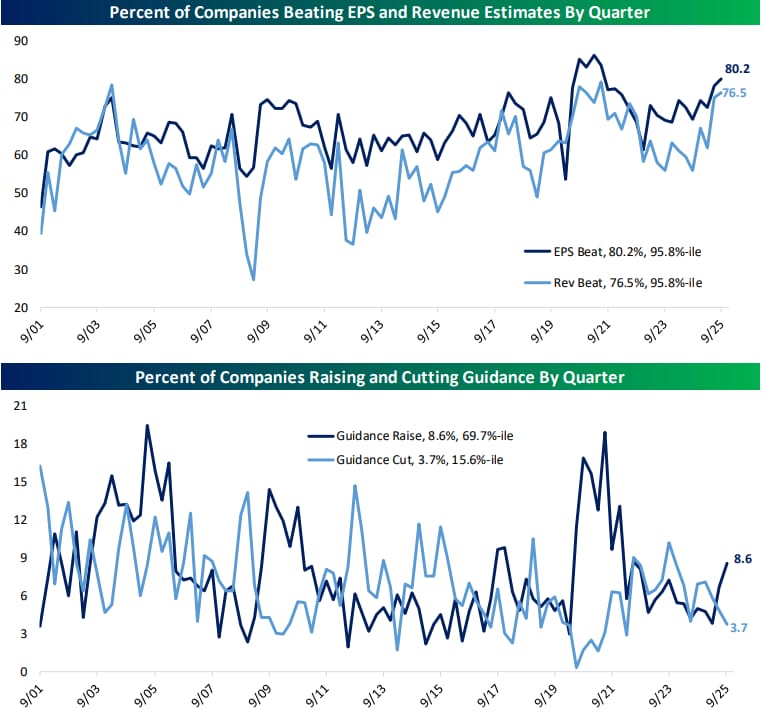

Earnings Season Highlights: Regional Banks

Over the last few weeks we have been writing about how bank earnings are set to do well.

This past week we saw regional bank earnings, and they were better than most expected.

The KRE rose ~5% as a result, recovering after last week’s sell-off which was muchado about nothing.

Here was a link to my FSD livestream the week before when KRE index fell to multi-month lows. The main message here is that this is not a credit risk story.

Main Street Still Strong

The broader themes in regional banks were exactly the same as major banks, and they second: economy is strong, the consumer prevails, and credit risk is near lows.

Ken Vecchione (CEO, Western Alliance Bancorporation): "Right now, I think the overall backdrop to the economy is pretty good.”

“You’ve got GDP growing at 3.8% to 3.9%. You’ve got the 10-year rate coming down to under 4%. Employment, for as much as people are talking about and nervous about it, is still in a rather low 4% area.”

“You have greater investments being made into the country from foreign countries. That should help continue with economic growth. You’ve got a pro-business president. That’s the backdrop to a lot of things that we’re seeing.”

Richard Fairbank (CEO, Capital One Financial) shared a similar view:

“The US consumer and the overall macro economy have been quite resilient so far in 2025.”

“Unemployment has ticked up a bit recently but remains quite low by historical standards. Wages are growing in real terms and debt servicing burdens remain stable and close to pre-pandemic levels.”

Bruce Van Saun (CEO, Citizens Financial) reinforced that the consumer remains intact:

“Credit continues to perform better than expected. Consumers are adapting well to higher rates and maintaining strong balance sheets.”

The slowdown doomers have been expecting hasn’t arrived (and isn't likely to arrive).

Credit Normalization

Credit metrics are normalizing. Charge-offs and delinquencies are ticking up from record lows, but remain well below historical averages - a sign of a healthy credit cycle.

Stacy Kymes (CEO, BOKF) described the trend:

“These are abnormally strong credit numbers.” “There will be a time where both charge-offs and criticized levels kind of revert to the mean. That doesn’t mean credit’s deteriorated. It just means there’s been a reversion back to normal.”

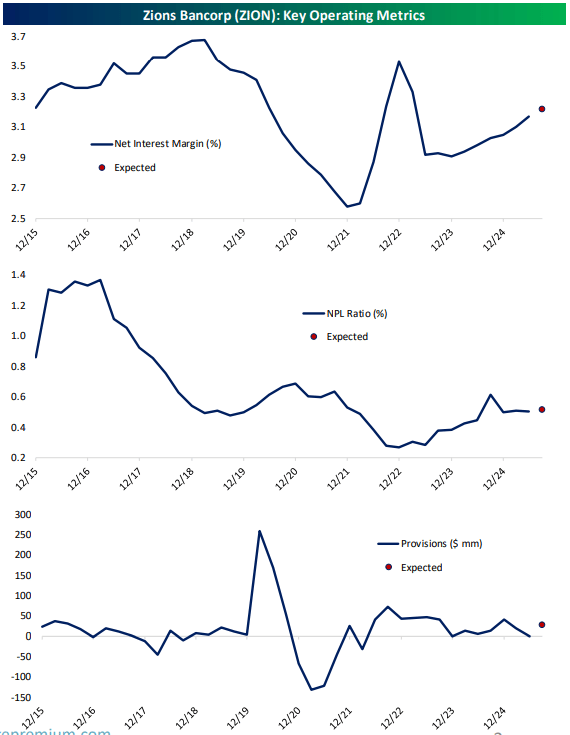

Harris Simmons (CEO, ZION) echoed that same macro framing:

“We’ve continued to see solid credit quality across the portfolio. Nonperforming assets remain low, and reserve levels are very healthy relative to risk. What we’re seeing now looks like a normalization to pre-pandemic levels, not deterioration.”

We saw similar sentiment in large banks’ earnings as well. Consumers are strong - they are taking new loans, and paying back on time. Read the last newsletter here.

Private Credit Risk Is Controlled

Last week, ZION’s $50MM write off and WAL’s $100MM fraud case led to a sharp sell-off in regional banks. Markets had fears of GFC crawling all over again.

Nonetheless, banks’ leadership muted fears of any systemic risk, and showed confidence in their credit portfolio. They highlight private credit as well-capitalized, collateralized, and diversified.

Harris Simmons (CEO, ZION) addressed the issue directly:

“We’ve reviewed our portfolios and believe this was an isolated incident [Canton Group]… We continue reviewing with an external party to make sure that we’re learning from experience and seeing what we can improve upon.”

Other than the $50MM related to Cantor, ZION reported only an additional $6MM in write-offs in Q3, highlighting the one-off nature of the default.

Kenneth Vecchione (CEO, WAL) also showed confidence in their private credit quality:

“We have operated in the private credit business for over 15 years.”

“We view our underwriting expertise, ability to evaluate structured credit and sophisticated approach to minimizing uncovered risks through strong collateral with low advance rates as core competencies of the bank that prevent and mitigate losses.”

“Over the past 5 and 10 years, our net annual charge-offs averaged just 10 and 8 basis points, respectively, placing us among the top 5 U.S. banks with assets greater than $50 billion.”

Derek Steward (Chief Credit Officer, Zions) detailed how their nonbank exposure is structured:

“NDFI exposure is actually about 3% of our total loans… The majority of it would be equipment leasing type transactions; yellow iron, trucks, things like that… It’s very well diversified across a lot of lending segments.”

Stacy Kymes (CEO, BOK Financial) noted that even within specialized finance, risk remains tightly contained:

“Our exposure to NDFIs is approximately 2% of total loans, with the vast majority in the two highest credit quality subcategories: subscription lines and residential mortgage warehouse lines. ”

Bank private credit exposure is minimal and controlled. Credit risk is idiosyncratic - financials look in good shape.

Market

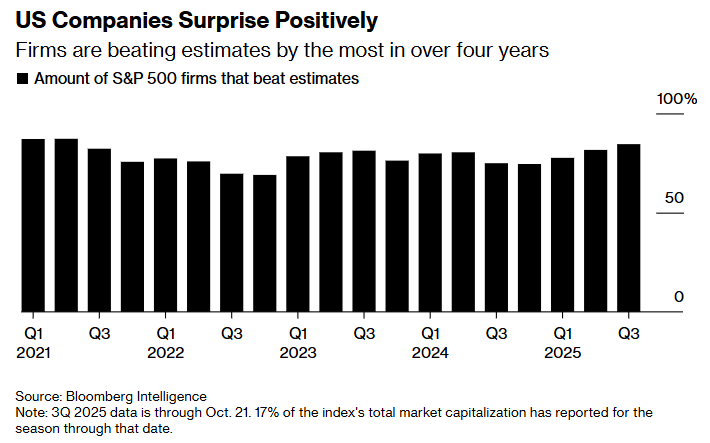

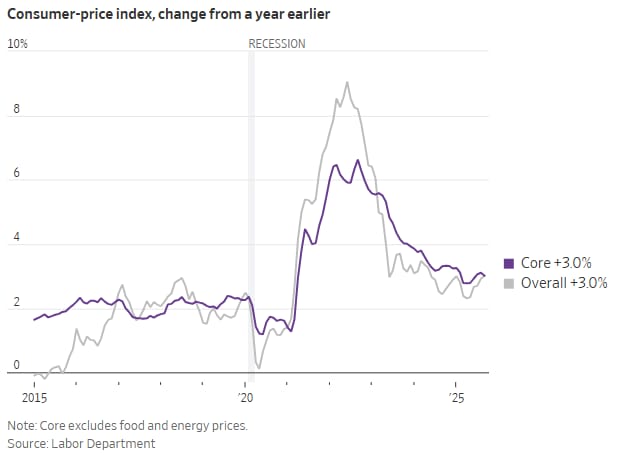

Friday’s cooler-than-expected CPI report spurred equity markets to new highs after odds of rate cuts increased. CME Fedwatch shows a 90% probability of two rate cuts in 2025.

What’s funny is the economy doesn’t need rate cuts at all, any more than it needed them last year.

The non-farm payrolls reports which is notoriously noisy and public psychology is ushering in rate cuts.

That’s fine - we are well positioned with exposure to small caps that will benefit.

AI Names Have More Fuel

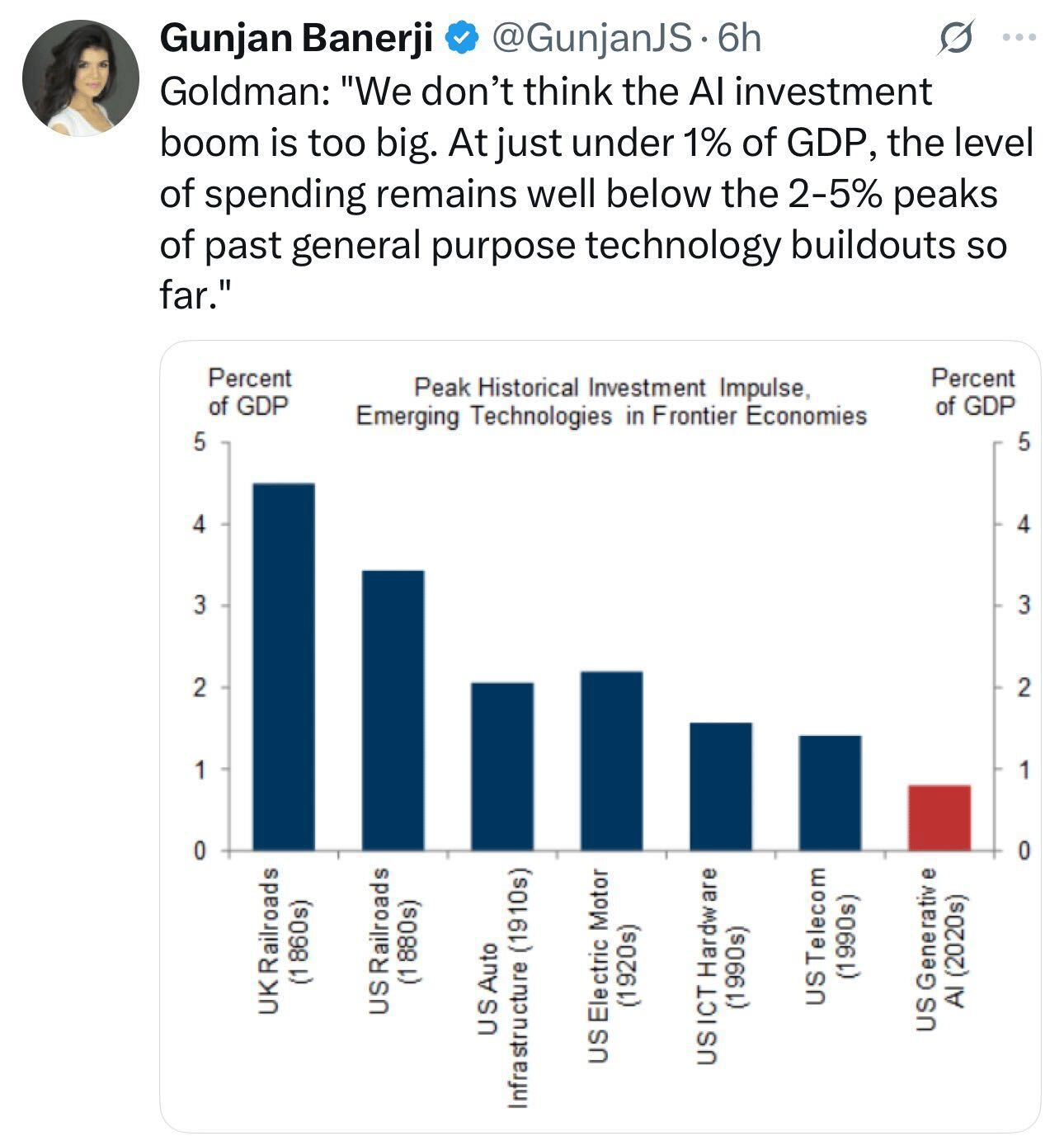

The narrative that “AI spending is overheating” doesn’t hold up under data.

Goldman Sachs estimates that total U.S. investment in generative AI is running at just under 1% of GDP, a fraction of past general-purpose technology buildouts.

Today’s capex cycle is financed by cash-rich balance sheets.

Hyperscalers are funding the infrastructure directly from operating cash flows, with net-cash positions and triple-A credit quality, a far cry from the telecom overbuilds that ended in defaults.

Supply bottlenecks in power, GPUs, and land are enforcing natural discipline, stretching deployment curves rather than inflating them.

The capital is also productive.

Datacenter expansion is the foundation of a new compute substrate for inference, workflow automation, and labor leverage.

The payoff is in measurable productivity gains already visible across cloud, advertising, and enterprise software.

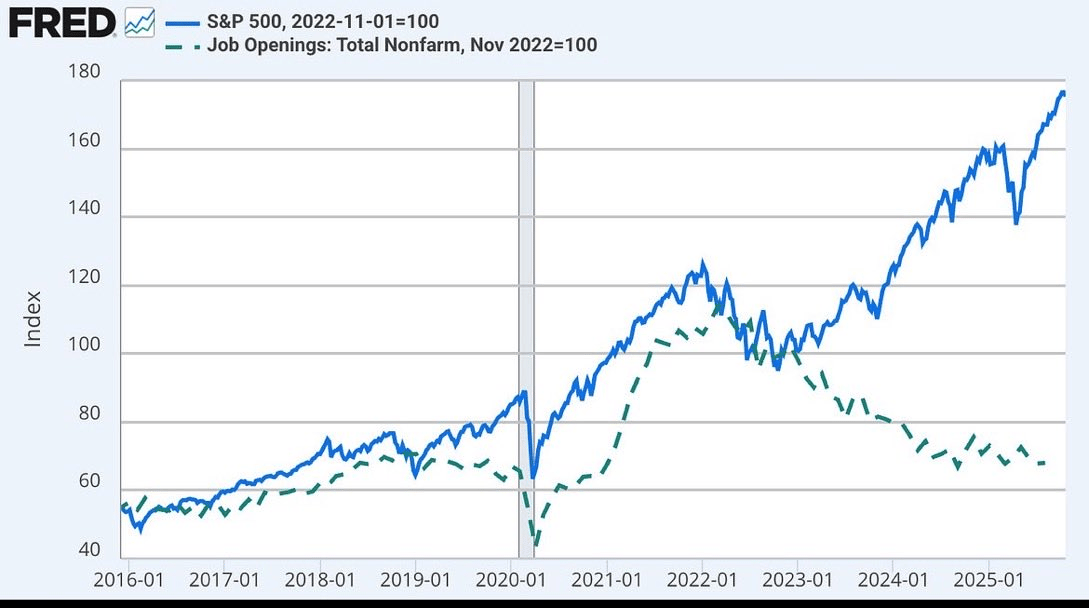

Look how the correlation between SPY and Job openings have changed post Dec 2022, exactly the same time ChatGPT launched (Nov 30th 2022).

I don’t believe the the spread is entirely driven by AI productivity, but it’s playing a role.

Financial services firms (think big banks) are adopting AI at a much greater rate than anticipated.

AI & Productivity Growth

Had a wonderful dinner on Thursday night with Bob Dewey. We talked about major secular investment trends.

I was one of two AI productivity thesis bulls at this 8 person dinner.

I shared this stat that Amazon is planning to replace 600,000 jobs with robots.

Multiple people corrected me and said it was 6,000 - I must have misread it.

I checked the news and confirmed - yes, 600,000 jobs will be replaced by Robots.

This is called Cognitive Dissonance. People are under-estimating the rate of change.

Exponentials look like lines when you zoom in.

This is why the brilliant Andrej Karpathy is wrong.

He is right on the technicals.

But, the commercial and consumer impact of AI will arrive faster than most think

The ‘test’ is not whether how AI learns is similar to humans.

Showing that RL is terribly inefficient (it is) and under-performs humans and lacks entropy / creativity is not the ‘test’.

The pragmatic operational test is this:

Is AI ‘good enough’ to displace knowledge workers and by when and what scope?

The answer is yes and now.

Energy Companies are Major AI Beneficiaries

Several energy companies reported their earnings this week, and one theme was consistent across the leadership: AI demand is driving the sector’s outlook.

Executives now describe a once-in-a-generation surge in power demand tied directly to AI infrastructure.

Kinder Morgan’s (KMI) Chairman Rich Kinder: “There will clearly be huge additional demand for electricity, primarily to serve AI data centers.”

“The combination of AI-driven electricity needs and LNG feed gas expansion ensures a massive and growing market for natural gas in the years and decades ahead.”

Kinder Morgan projects a 28 Bcf per day increase in natural gas demand by 2030, nearly double today’s level, driven by AI power loads, and LNG exports.

EQT’s CEO Toby Rice added that the same dynamic is strengthening local gas prices, as “power demand in the region is starting to rise”

Halliburton’s CEO Jeffrey Miller captured the shift in one line:

“The demand for power and for AI is like nothing I’ve ever seen in terms of demand growth.”

America’s Defense Machine Is Running

Defense companies (Lockheed Martin, RTX, Northrop Grumman) also had earning releases this week.

Every major contractor pointed to strong defense budgets, growing backlogs, and a wave of next-generation programs tied to autonomy, space, and AI.

Northrop Grumman’s Kathy Warden (CEO): “There continues to be strong bipartisan support for national security priorities… reflected in a significant increase in defense spending that is expected to carry well into the next decade.”

Lockheed Martin’s Jim Taiclet (CEO) put it simply: “We continue to see broad support for national defense priorities given the unsettled geopolitical situation.”

The numbers back it up.

Lockheed reported a record $179 billion backlog (up from $166Bn in Q2). RTX logged $251 billion, up 13% year-over-year, with international orders up 18%.

Overall, capex suggests we're moving to drone-based warfare, not big platforms that are easy targets for hypersonic missiles.

Lumida Deals is also exploring opportunities in the defense technology sector. Think of FSD for drones.

You can get on the Lumida deals list using the form here, and receive priority updates on our private deals.

We specialize in sourcing undervalued assets that often go unnoticed by the broader market. We have previously invested in Kraken, Canva, Coreweave and QXO.

We got Coreweave at a 7Bn valuation, and it rose to a 70Bn market cap at its IPO.

Similarly, QXO has done over 100% since our initial investment within 12 months.

Lumida is also exploring tax mitigation strategies that can help you reduce your tax liability for 2025 substantially. Write to [email protected] to know more about the opportunity.

Important: The figures above are approximate, based on public sources, and reflect gross valuations only. Actual returns may be significantly lower after fees, expenses, carried interest, and taxes. Past performance is not indicative of future results. Private investments are speculative, illiquid, and involve a high degree of risk, including possible loss of principal.

Digital Assets

BlackRock Is Tokenizing the Financial System

BlackRock is bringing its entire $5 trillion iShares ETF complex on-chain. CEO Larry Fink called this: “one of the most exciting areas of growth in financial markets.”

The goal is to let investors access stocks and bonds from the same digital wallets that already hold crypto, stablecoins, and tokenized assets.

Today, those wallets represent nearly $4 trillion in global value, but they’re walled off from traditional investment products. BlackRock intends to close that gap.

Blackrock already operates the largest crypto ETF ($100B+ in IBIT), the largest stablecoin reserve fund ($60B for Circle), and a $3B tokenized fund (BUIDL) running across multiple blockchains.

Tokenizing iShares extends that same model to the full ETF universe, turning traditional funds into programmable, composable assets that can settle 24/7 and integrate directly with digital finance infrastructure.

Fink said: “it is young people who are heavy users of tokenized assets, and [if we tokenize ETFs] we could introduce them to more traditional assets sooner in their life path.”

JPMorgan will soon let institutional clients use Bitcoin and Ether as collateral for loans.

The program, set to launch globally by year-end, will rely on third-party custodians to safeguard pledged tokens, mirroring how the bank already handles crypto-linked ETFs as collateral.

It’s the first time Bitcoin will sit inside JPMorgan’s lending infrastructure, treated alongside stocks, bonds, and gold as accepted security.

The move underscores how far crypto has moved from the margins. The same firm whose CEO once called Bitcoin a “hyped-up fraud” is now embedding it in its balance-sheet plumbing.

JPMorgan’s pivot follows a broader institutional trend.

Morgan Stanley, Fidelity, State Street, and BNY Mellon have all expanded crypto custody and financing.

The Trump administration’s rollback of regulatory barriers has accelerated this integration, while client demand has grown alongside Bitcoin’s new all-time highs near $126,000.

The signal is clear: digital assets are no longer sitting outside the system. They’re becoming part of it.

FED BEAR HUGS CRYPTO

Has there ever been a more permissive bank regulatory environment?

Take a look at what Fed Governor Waller said this week:

This is a complete reversal from just last year.

And the SEC is on board and of course it is all stemming from Scott Bessent.

Next decade unicorns will be crypto banks.

Lumida Curations

Meme Coins Are Changing Finance

Meme coins raised 5x more than U.S. IPOs in 2024. When friction fades and gatekeepers fall, markets move faster than regulators.

Up to 90% of Americans lack sufficient omega-3s, especially EPA, fueling higher risks of depression, anxiety, and cognitive decline.

Research from Harvard shows fish oil supplementation can restore mood, memory, and brain health by calming neuroinflammation.

Follow Lumida Health on X to gain latest insights on living a long and healthy life.

Gold’s Rally Nears Exhaustion?

Gold’s surge may be losing steam.

Fueled by China’s pivot from Treasuries and dollar-debasement fears, momentum has driven prices higher. A 5% drop underscores that parabolic runs rarely end cleanly.

Meme

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.