Here’s a preview of what we’ll cover this week:

Macro: Fear of a Slowdown, Fed Reverse Upside Down, Tariff Endgame and Post-Election Weakness, Bezos: Liberty - Press Advocacy, Argentina’s Economic Surge, Housing Unfreeze Ahead?

Market: Sector Winners & Losers, Walmart, Nvidia, Costco, Is the Bottom in?

AI: Meta's AI Investment, Cloud Instance Availability, AI Demand Shortage, CoreWeave IPO Soon?

Lumida in Spotlight

Our latest Lumida 13F Podcast on Lumida Wealth has received fantastic praise on YouTube. Here’s what one listener had to say:

In this episode Ram covered:

- Hedge Fund Positioning – A deep dive into Q4 2024 13F filings.

- Who’s Buying, Who’s Selling? – Insights on Bridgewater, Coatue, Altimeter & more.

- Market Signals – What these trades reveal about future trends.

Watch it on YouTube: Hedge Fund Positioning: 13F Review

Prefer audio? Listen here: Spotify | Apple Podcasts

Download Tracker – Whale Watch: 13F Q4 '24 Full Report

Interested in our investment strategies? Schedule a call to learn how we can help you navigate the markets.

First Things First

I wanted to share excerpts of a letter we sent to our growing client base Thursday night with slight modifications for clarity.

I wanted to share a few thoughts on markets given the recent volatility.

First, markets are especially seasonally weak. Indeed, this Thursday is statistically the worst day in the worst week of the year in a post-election.

Second, markets are digesting tariff news.

Markets sold off hard near the close Thursday on news that Trump would proceed with tariffs on Canada and Mexico.

However, markets have increasingly factored in tariff-related headlines, and with each announcement, their overall impact on market movements will likely diminish.

What drives stock prices in the long-run are earnings growth and interest rates.

Earnings growth has exceeded expectations. Companies are growing earnings across the board in our portfolio.

Further, 10-year rates have come down to 4.2% -- and it is the policy of Secretary Bessent to lower energy costs and long-term rates. That's good for equities.

Bull markets end with euphoria and then rollover on declining earnings growth.

Nvidia delivered a beat, beat and raise. We see no signs of earnings declining across the broad array of companies' earnings we track.

As a matter of fact during this week's earnings call, Nvidia CEO Jensen Huang said "Next-generation AI will need 100 times more compute than older models".

This is evidence that demand for reasoning will increase rather than decline. (Inference is “one-shot” whereas reasoning requires 50 to 100x more tokens.)

Google, Meta, and Amazon have reiterated their capex appetites.

Stargate, a project with Softbank, and Sovereign demand is also increasing demand for GPUs.

The market is nervous about tariffs on Taiwan (TSMC).

However, this would seriously disadvantage American AI and give China a wedge into the AI market that Trump seeks to dominate.

Fears of tariffs on GPU chips are overblown.

Overall, we see mortgage rates coming down. We also see signs of a market panic with the VIX hitting 21 today.

Note: March is statistically one of the most bullish months for the stock market.

The heightened downside volatility means we are seeing the opposite of what we saw in January.

Stocks like Meta would shoot up significantly on earnings, or Google might shoot up on Quantum news. Now Microsoft is dropping after releasing their quantum innovation.

This is the time you want to buy fear and sell greed.

If you look at the Fear & Greed Index, you'll see that markets are being driven by extreme fear. We want to buy into this type of market.

We are positioned in categories that have below average valuations, earnings growth, and have defensive properties as well.

This includes overweights in financials and healthcare. Notably - neither of these categories is impacted by tariffs (although healthcare policy volatility is creating bargains that we are scooping up with delight).

For a tax-efficient way to reposition your portfolio while minimizing capital gains, explore our ETF strategy here: http://www.lumidaetf.com (An ETF can do an ‘in-kind’ transaction and not incur capital gains tax, very similar to how real estate investors can do a 1031 exchange and avoid capital gains)

We are also acquiring assets linked to the datacenter theme that have sold off and now represent significant value.

One example is Vistra (VST) which we scooped up this Friday morning.

We love data. Here are some additional data points for you.

Investor sentiment is at levels that coincide with strong six-month forward returns.

The sentiment we see shows anxiety not seen since the 2022 bear market.

People are understandably nervous due to tremendous policy uncertainty.

A peace deal that ordinarily would get hashed out behind closed doors is now unfolds live on television. (This is the age of the Reality TV President and everyone is adapting.).

Policy uncertainty is bullish for markets, as this chart from Renaissance Macro shows.

Enjoy time with the family. Watch a good comedy. Remind yourself of the long-term value of investing in equities, especially during dislocations.

We advise staying fully invested at these levels as a news event - such as a delay in tariffs or a peace deal - could easily spark a significant overnight rally in markets. It's important not to be caught offside and remember earnings growth and stock prices head up over time.”

We sent that out Thursday evening, and Friday morning we finally had a gap down in major indices.

Not a large gap down but enough to suggest that sentiment was washed out.

A feature of this pullback is that markets have gapped up in the morning and closed in the red near the close.

(That’s a classic sign of retail investors bulled up and professional investors selling at the close and it’s something you see in bear markets or corrections.)

[ Note: We have updated views since our client note, so read on below… ]

Want to discuss how this market volatility affects your portfolio? Book a meeting with our team for tailored insights.

Mean Reversion

Not too long ago we wrote about the Great Rotation.

The idea is that overbought and crowded themes would give way to under-owned securities.

That started with international value (China, Brazil, etc.) which is now re-treating after a furious rally.

Bespoke is seeing this idea playing out.

There are themes like Datacenter which are oversold and should bounce now.

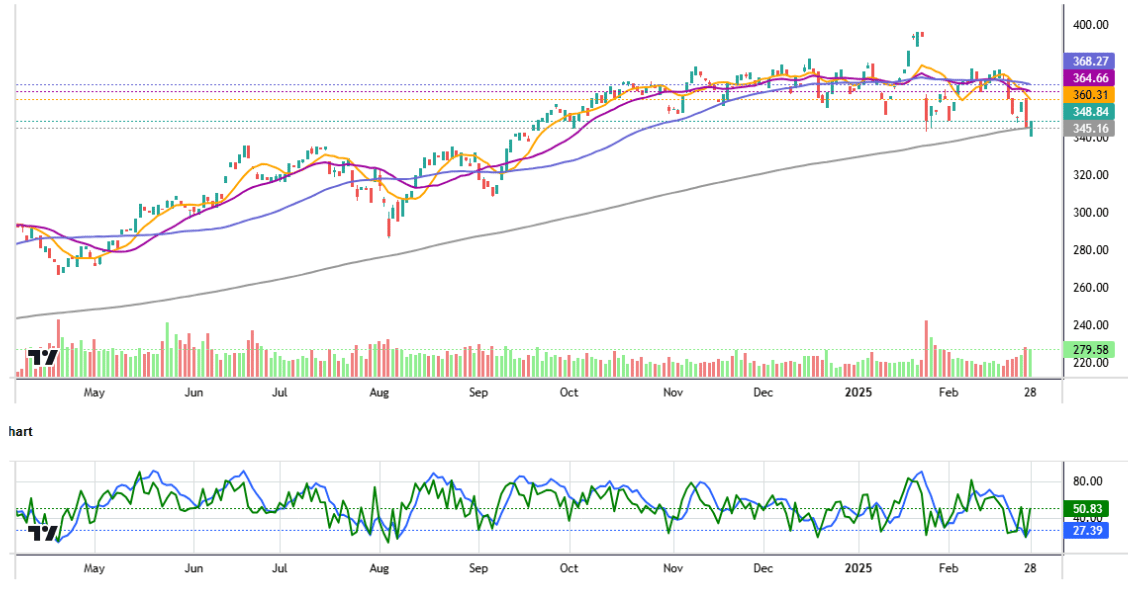

Zooming out, however, you see a pattern of lower lows and lower highs. We also had a peak sentiment moment just after the inauguration.

If you look at NVDU - the 2x levered Nvidia fun that crazed retail traders are buying / selling - you can see it is now below its 200 day moving average.

Nvidia continues to beat, beat and raise – but markets don’t seem to care.

We do think there remains lot of over positioning in markets. People are buying the dips too much. Friday was the first exception.

This Friday’s rally was nice. But - as we got towards the end we saw once again speculative excesses flow in based on Bessent’s interview.

We still think we could still be in for some volatility over the next week or so. Our best guess is that we are ⅔ or ¾ done with the move down.

Markets haven’t really experienced a proper correction. It has felt bad mainly because investors own ‘themes’.

And themes are in correction vs. under-owned ideas across the S&P 500 that are not thematic (like staffing companies, used car dealers, or equipment leasing firms, etc).

Even there however, we see bargains that continue to sell off. For example, Signet had a 20% rally on M&A news (we bought it the week before thru some kind of magic it looks like), but on the same day it closed up only 5%.

This kind of market action is a sign of too many traders in the market and there is still excess to be squeezed out.

Macro

Fear of a Slowdown

There is a lot of fear of a slowdown.

These fears seem to come and go like the flu season.

The fact is earnings are strong. Household balance sheets and home equity are strong. Small business animal spirits are strong.

And mortgage rates are gradually coming down.

There is some fear around a low GDP print. I am not so worried about that.

My main concern is that Growth to Value rotations tend to be a drag on equity performance. They often have a correction in the broad indices.

And, although we’ve seen some recent weakness in Costco, we haven’t seen these names roll over.

We think markets were due for a tactical bounce. But, we’re not entirely convinced we’re out of the woods here.

Fed Reverse Upside Down

There was a nice Forward Guidance interview with Andy Constan (@dampedspring) and Felix Jauvin (@fejau_inc) on Forward Guidance.

Andy leads with the point that the Fed is facing market to market losses and losing money due to a significant asset liability mismatch due to QE.

This is a point I raised in March 2023 showing how the Fed is facing $1 tn+ in losses on its mortgage and Treasury portfolio - and also cashflow negative.

Tariff Endgame and Post-Election Weakness

Related comments like this - first with India, France and now with the UK - suggest Trump’s strategy with tariffs is to pry open foreign markets.

Bezos: Liberty - Press Advocacy

Argentina’s Economic Surge

Not sure why people expect a recession from spending cuts.

Spending cuts are paired with tax cuts.

Housing Unfreeze Ahead?

Market

Sector Winners & Losers

Take a look at the best sectors YTD: financials + healthcare.

We continue to believe those themes will do well.

Financials is an easier idea than healthcare however due to the continued policy risk.

If you have a view that is one year or beyond (exceedingly hard to find these days!) then healthcare should do fine.

CVS is the best performing name in the S&P 500 YTD. We expect other medicare advantage names will follow suit. CVS was the canary in the coal mine. We bought Elevance this past week and have a number of healthcare names in our portfolio.

There are various overlooked Semiconductors linked to the TSMC supply chain look like they have bottomed out. One re-iterated a 100% revenue growth objective for FY 2025. We will tell you what we bought next week.

We do think homebuilders are bottoming sometime in the next few weeks so starting to build a position around here isn’t a bad idea.

We also like Consumer Finance names now which have a chance to rally. We own Enova (ENVA) but there are others as well.

Uranium linked names can do well here too. The uranium hype has deflated the baloon. And, yet, the policy transformation for nuclear is coming.

The categories we are least excited about, but can bounce, are categories like Software.

Even Tesla stock should bounce here… but we don’t think it’s an enduring rally for these categories.

Incidentally, take a look at Nvidia stock from 2015. We think it’s possible we see an evolution like this - we are still on the left-hand side hangover phase.

Lessons From 2015?

We did see excessive valuations in the S&P in 2015 as well while there was a backdrop of a growing economy.

Here is how that market evolved. The markets went largely nowhere for 4 to 6 months.

There was a violent puke fest concluding in a capitulation that lasted one week. Markets then re-tested. Then markets recovered to finish the year higher.

We believe it is important to be psychologically prepared for a possibility like this.

We say that because there are not many themes that have ‘clear skies ahead’ other than financials and names in Mag 7 (Google went under 19x forward PE again). And there is technical deterioration in under themes.

It’s quite possible we get a recovery rally in the next few days. However, we think lightening up exposure in that rally and tiltiing to quality, large cap, high ROE and avoiding expensive names may be the way to go until we get a proper flush.

If we don’t get a proper flush, then markets could just go sideways.

Themes we see as especially vulnerable in the near-term are:

Pharmaceuticals (IYZ)

REITs

Software

China / Emerging markets are overbought tactically

Illiquid small caps

Walmart (WMT) Q4 FY25 Earnings Highlights:

Key Metrics:

Revenue: $180.55 billion, up 5.2% year-over-year, beating estimates of $180.20 billion.

Net Income: $5.33 billion, slightly above the $5.26 billion forecast.

Adjusted EPS: $0.66, topping the expected $0.65.

Key Quotes from Management:

"Customers/members are going to be looking for value." – C. Douglas McMillon, CEO, reflecting a consistent trend of value-seeking behavior.

"U.S. customers remain resilient, exhibiting behaviors that have been largely consistent over the past year. As always, people are looking for value and they want to save time.", highlighting resilience and convenience as drivers.

Customer behaviour remains key in Retail. Below sheds light on what the above mean:

Value remains king: Strong U.S. comp sales growth of 4.6%, driven by a 20% e-commerce surge, shows customers flocking to Walmart for affordable options across grocery and general merchandise

Convenience is critical: E-commerce and fulfillment services growth (e.g., Walmart Fulfillment Services penetration hit nearly 50%) underline a demand for time-saving shopping solutions

Resilience with limits: Mid-single-digit grocery growth and mid-teens health/wellness gains (boosted by GLP-1 medicine sales) suggest steady spending on essentials, though lower-income households are making trade-offs due to economic pressure

Nvidia (NVDA) Q4 FY25 Earnings Highlights:

Key Metrics:

Revenue: $39.33 billion, up 78% year-over-year, surpassing estimates of $38.05 billion.

Net Income: $22.09 billion, or $0.89 per diluted share, compared to $12.29 billion ($0.49/share) a year ago.

Adjusted EPS: $0.89, beating the expected $0.84.

Q1 FY26 Guidance: Revenue expected at $43.0 billion, plus or minus 2%, slightly above analyst consensus of $42.3 billion; GAAP and non-GAAP gross margins forecasted at 71%, below the 72.1% expected.

Key Quotes from Management:

"We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter." – Jensen Huang, same call, highlighting rapid production scaling.

"AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries." – Jensen Huang, underscoring Nvidia’s pivotal role in AI’s industrial transformation.

"AI has gone mainstream and is used in delivery, education, healthcare, and financial services, showcasing a broad base of demand."

Key Inferences:

Blackwell’s rapid ascent: The Blackwell AI GPU drove $11 billion in revenue in its debut quarter, dubbed Nvidia’s "fastest product ramp ever," showcasing its ability to innovate at scale and meet explosive AI demand.

Margin pressures amid growth: Gross margin guidance of 71% (down from 73.5% in Q4) fell short of the 72.1% expected, reflecting potential pricing pressures or cost increases as Nvidia scales cutting-edge tech like the GB200 and NVL72 systems.

AI’s industrial tipping point: Data Center revenue (likely ~$34 billion, per analyst trends) and Q1 guidance of $43.0 billion reflect Nvidia’s dominance in AI infrastructure, with hyperscalers like Microsoft (35% of Blackwell spending) and Google (32.2%) doubling down on AI investments, cementing its market influence.

COSTCO

Is The Bottom In?

Zuck is no longer sleeping on the couch (in the Guest House)

We bought META and GOOGL and VST at the open

Notice… we had our first gap down day in a while with real panic

Every other day this week we had a gap up followed by last hour selling

Google had a sub-19x forward PE once again

Even TSLA bottomed

The bottom is in for at least a week or two, and then we will reassess.

Why did markets rally?

Bessent noted that mortgage rates and the spread between treasuries and mortgages narrowed.

If you were tracking those rates you too would have bought homebuilders this morning too

XHB

Onwards.

AI

Datacenter Spend Continues

DeepSeek Has Consumed Excess H100 Capacity

AI Demand Shortage

CoreWeave IPO Soon?

CoreWeave IPO Next Week?

Pricing at $35 Bn.

First buy in at $7 Bn.

For a diversified approach to AI infrastructure and datacenter investments, visit Lumida ETF to or talk to our team to learn more about our ETF.

High Yield Laughs

Deedy ran the same prompt for L3 to L12 (employee seniority levels) and it's hilarious.

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

As Featured In