Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week.

Macro: Fed Skip, ECB Hike, Rates Higher for Longer

CRE Dislocation Ahead as Banks Prepare for CRE Losses

Quick Takes on AI and BigTech: Apple, Nvidia, TSM

Coinbase/Binance Lawsuits

BlackRock Files Bitcoin ETF. Larry Fink as Treasury Secretary?

Bank of China Embraces Blockchain

PGA & Liv Merger Connects to the Trade Deficit & AI

We believe that to be the best, you have to surround yourself with the best. We head the pleasure of talking markets with Bloomberg’s David Westin, Host of “Wall Street Week”.

Happy Father’s Day! And sorry for missing the week. I had appendicitis last week so we tabled it for the week.

Good news is you are getting a Double Header this week. In the spirit of Father’s Day, below is a snap with my Dad at the hospital post surgery. (We had a small family reunion this weekend. I was away for less than 16 hours - the miracle of minimally invasive surgery).

We were also pleased to see our analysis on the DCG-Genesis-Gemini saga highlighted in Wired magazine. Take a look at the link below.

Macro: Markets Now Pricing in Higher

We’ve been arguing that inflation and rates will stay ‘higher for longer’. We were pleased to see this headline hit our desk.

Betting on ‘higher for longer’ and expressing that view directly via interest rate futures would have been a homerun - larger even then the folks that made money on ‘The Big Short’.

Over the last 60 days we saw a steady drumbeat join the ‘higher for longer’ club. Most notable was Jamie Dimon at the annual JPM conference. We like non-consensus bets. You have more upside if you are right, and less downside if you are wrong.

Fed Watch

The Fed chose to pause this week calling it a skip meeting. Meanwhile, the ECB led by Christine Lagarde continued the ECB rate hike campaign. This FOMC showed a break in the consistency of tone.

The Fed dithered this meeting. The FOMC is displaying indecision on the path of rates. Our view is the inflation fight isn’t over. The easy gains are done, but the consumer remains a locomotive. Service wages continue to grow above trend.

Remember, one person’s income is another person’s spending. So the stronger the consumer, the stronger the inflation.

A non-consensus view? We expect the FOMC raises rates again between now and year-end.

Note, the ECB is more hawkish in tone and substance than the FOMC.

That is also setting up some bargains. For example, we noticed Barclay’s Bank and other quality European stocks are at deep discounts relative to US counterparts. Here’s a snapshot on Barclay’s

Trading at PE ratio of 5

P/B ratio of .4

Divididend Yield of 4%.

For conservative investors looking to beat inflation, with earnings growth, and low volatility we do believe the banking sector has a number of mispriced securities offering compelling valuations.

Note: this is not a recommendation to buy Barclay’s — we haven’t dug in deep there. We are saying that valuations look cheap on hated sectors with good fundamentals.

Taking a look at the health of the US economy - this sums up most of the picture: “the levels are good, but the direction is weak.”

Inflation is high, but declining

Unemployment claims are at low levels, but rising

Consumer spending is strong, but declining

Excess savings is high, but declining

We have a nice study below on the rise of AI stocks. We show which stocks are rising due to improving fundamentals vs. multiple expansion (e.g., expectations). This puts the current AI driven rally in context.

Right now, the obvious play in AI is the infrastructure: firms that benefit from growth in datacenters, hardware demand, and LLM build outs. There are firms starting datacenters now that had no such plan last year.

But the firms spending hundreds of millions on datacenter capex - it’s not clear they are the winners. They need to demonstrate product market fit and show a viable commercial model. The beneficiaries of that spend - Taiwan Semiconductor and ASML - have the upper hand (and yes their stock prices are showing it).

What’s the lesson? If you’re going to get on the AI train, focus on firms that have true revenue growth and proven models.

What’s the new UX form factor? Spatial Computing, Metaverse, AI UX

Apple’s Vision Pro - sporting a $3,500 price tag - is adding to the tech frenzy.

Apple is betting on Enterprise adoption and the rise of ‘Spatial Computing’. Spatial computing is an umbrella term for digital experiences that reference objects and locations in the physical world. It includes augmented reality, mixed reality and virtual reality recreations of real-world places.

Both Apple and Nvidia are accelerating Meta’s vision of the Metaverse. Although spacial computing and the metaverse are distinct concepts, we believe these nuances will be lost on the public.

What’s really at stake is ‘What is the new UX form factor?’. Remember the ‘Browser Wars?’. The browser was a new UX form factor. Every 10 years give or take a new mode of engaging with information emerges.

This tweet highlights those historical shifts.

Our view? We believe the AI UX form factor will ultimately win out. It’s not fully developed yet - but imagine AI digital assistants and AI that can interact with multiples modes of information (text, image, voice). That form factor has product market fit in all its variations.

The other takeaway here is that the big tech giants are so large now, they are bumping into each other in search for revenue. The stakes are high so the BigTech firms are spending an extraordinary amount of capital on bets to win. Higher capital spending means higher expenses and loftier PE ratios.

The Platform wars are back and sharper than ever. There is significant uncertainty on who will win.

Focusing on players that have true PMF or is an arms-dealer to all the Big Tech firms is a good way to play this - or consider the Nasdaq-100 and call it a day.

Narrow Breadth gives way to Wider Breadth

Most of this year’s rally has been led by 7 tech stocks. There was a lot of commentary on how this is unhealthy for markets.

This conventional wisdom is a mistake and it’s easy to disprove with a chart. When breadth is awful, our analysis shows that’s usually a good time to invest. When every stock is hitting new highs it means you’re near a top.

What we expect is a broadening of breadth. And we’re seeing it now. Meaning stocks that were down the most (including regional banks, REITs, and small caps) will start to get a bid.

Portfolio managers that missed the tech rally are going to look to cheaper pastures to catch the next wave. (Also, we’re sticking with our call that March marked a bottom for financial stocks.)

Speaking of Small Caps…

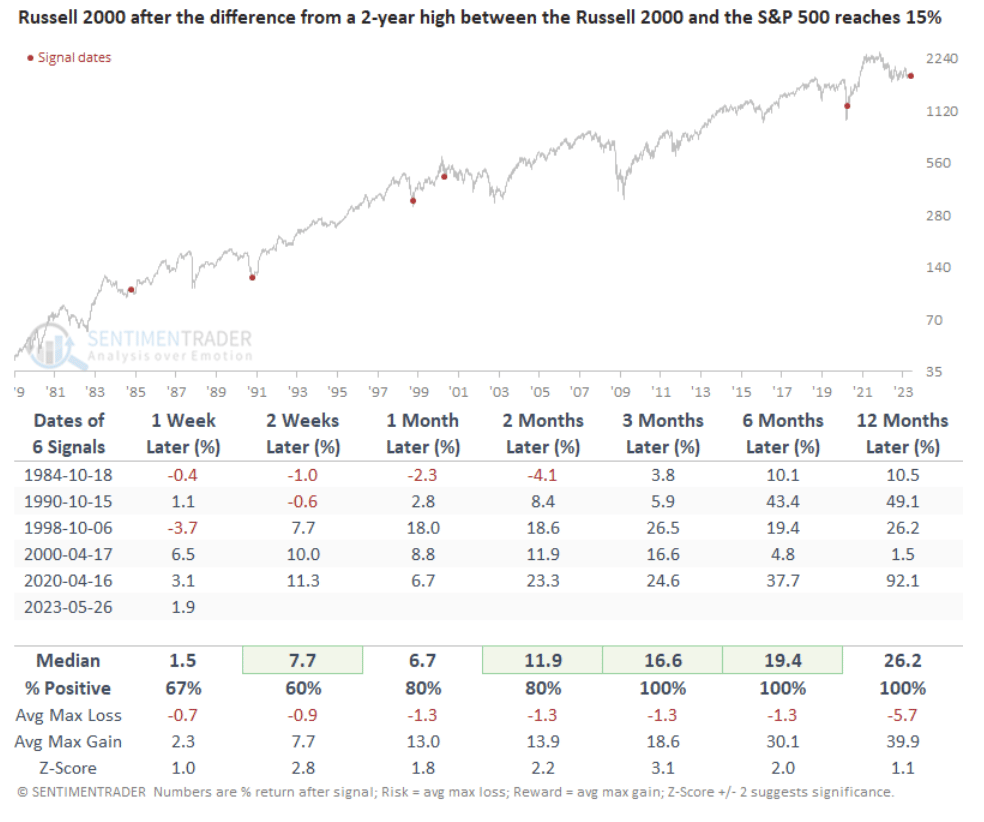

For only the 6th time in 40 years, the distance between the Russell 2000 and the S&P 500 widened to 15%.

After similar disconnects between small and large-cap indexes, the Russell 2000 was higher over the next three, six, and twelve months every time.

The weight of the evidence looks compelling, as several other patterns triggered an alert with bullish implications for small-cap stocks. Here’s a chart showing the subsequent performance:

It’s always important to seek countervailing evidence so we can weigh the risks. The big fly in the ointment now is there is a lot of FOMO in the markets.

You can see this in one of our favorite indicators - the ‘Smart Money vs. Dumb Money’ spread. Each component measures a range of activity (the behavior of retail traders, professional investors, small dollar options activity, etc.).

This indicator is at a level that usually coincides with weaker performance going forward. The other fly in the ointment is initial claims. Initial claims remain elevated at 260K two weeks in a row now.

That said, we do believe many professional investors are under-invested. And Q4 did cause a washout panic. We haven’t quite arrived at ‘capitulation’ - the moment where professional investors throw in the towel and join the trend.

That said, we believe the more nuanced ways to approach this rally given the cross-current:

- Stick to quality names as always with good fundamentals and reasonable valuations. (Avoid ‘unprofitable tech with debt’ for instance.)

- Focus on sectors that are hated but have strong fundamentals. We believe energy, financials, and select tech stocks.

- Don’t chase. Corrections will happen.

The Long View

There are several cross-cutting factors at work acting on varying time horizons.

In the short-run, momentum and under-positioning are driving this rally. Those are two powerful technical drivers that are forcing a steady grind higher. That trend can continue to over-extend just until under-positioned folks have capitulated.

However, on the medium time-frame (e.g., 1 to 3 years) the macro crowd will prevail - M2 is negative, credit growth is slowing, the lagged effects of rate increases will kick-in, the corporate default cycle is turning up. Fiscal spending has a budget cap.

One of our best idea today remains opportunities in distressed commercial real estate, niche uncorrelated strategies that have generated equity-like returns with low correlation to the S&P 500, Consumer ABS strategies, and ‘Value Venture’.

We believe each of these strategies can compound 14 to 18% tax-efficiently. Those returns are higher than the average annual return from the S&P. As an asset class, alternative investments look attractive.

CRE Dislocation Ahead as Banks Prepare for CRE Losses

Mainstream media is picking up on our commercial real estate market dislocation theme.

The Wall Street Journal discussed the $1.5 trillion in commercial mortgages coming due over the next 3 years.

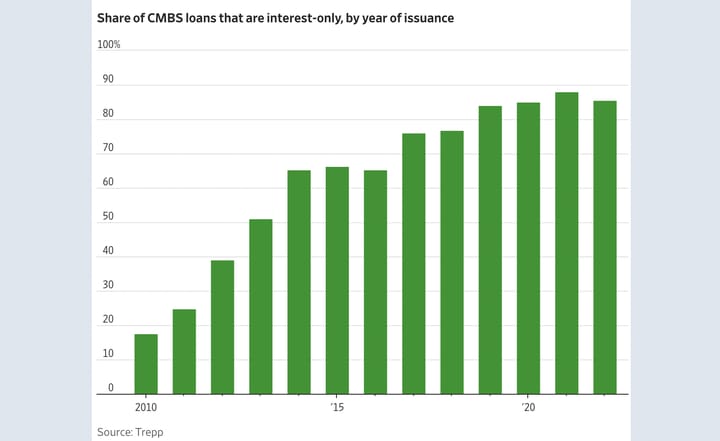

Interest-only loans as a share of new commercial mortgage-backed securities issuance increased to 88% in 2021, up from 51% in 2013. Many banks have severely cut down on issuing new loans for office buildings.

Meanwhile there’s ~$450 Bn coming due in CRE debt this year and for the next several years in a row... Regional banks originated 70% of this debt.

Our single best idea in the alternative investments space is in Distressed CRE. You’ll hear more about this in the coming weeks.

We’ve recently completed a thorough manager diligence. We have a 40-page write-up on the way to play this.

Distressed CRE has many properties we like:

Dislocation and Forced selling

Too much CRE refinancing needs, not enough deposits and capital

Depreciation tax shield

Inflation hedge

Our high conviction idea is real estate dislocation - here is a link to our walk through.

SEC is Priced In: Takes on Coinbase/Binance Lawsuits & Industry Updates

The SEC raised the stakes against Coinbase and Binance. The SEC alleges that Coinbase is an unregistered securities exchange.

We had a 2-hour Twitterspace with leading crypto securities regulatory attorneys last week. Here is an AI generated transcript if you want to dig in deeply.

Our high-level view is the ‘SEC is priced in’. These are not surprising actions. The SEC has previewed this for 18 months now.

The reveal of Prometheum, a broker dealer than can custody Digital Assets, we believe is a positive development that is overlooked by market participants.

(Folks are dismissing Prometheum because the CEO worships at the house of Chair Gensler during Congressional testimony).

Don’t let emotion get in the way. It’s inevitable that crypto will trade through broker-dealers and licensed clearing firms. This is a big step for the industry.

Chair Gensler may be buckling under pressure and awarded this license to save face. Other firms that qualify and meet the standards can obtain the licenses as well.

The SEC suing Binance & Coinbase only after approving Prometheum is no accident.

This upcoming week, I’ll be joining Alex Thorn, Head of Research (Galaxy Digital), and we’ll discuss what a regulatory path forward for crypto looks like. It starts with a self-regulatory organization in the spirit of the National Association of Securities Dealers (NASD).

The NASD birthed the Nasdaq marketplace and eventually merged to become what we call FINRA today.

We compare Gensler to Anakin Skywalker in this thread, offering an explainer about how he went from a blockchain enthusiast to where he is today.

Crypto Dislocation

We believe there are attractive dislocation plays in crypto.

The discounts on Grayscale products are attractive. ETHE was on sale last Friday. Did you buy?

We believe we will look back on these discounts and marvel at them.

There are several catalysts in the next 12 months that may cause the discount to tighten.

BlackRock files a Bitcoin ETF

We don’t expect the SEC will approve BlackRock’s ETF. If and when the SEC inevitably approves a Bitcoin ETF, we will also see ETFs from Van Eck and Stone Ridge approved at the same time.

The SEC does not approve ETFs on the ‘merit’ or ‘track record’ of the issuer. The SEC’s objection to a Bitcoin ETF has nothing do with the issuers.

So why would BlackRock, the largest asset manager globally, file a Bitcoin ETF in during a regulatory crackdown? We believe Larry Fink is positioning to run for Treasury Secretary.

It’s incredible how many Presidential hopefuls (Miami Mayor Suarez, RFK, etc.) are lining up and embracing crypto.

Larry Fink is poking a finger in the eye of Chair Gensler who also has ambitions for Treasury Secretary.

Larry Fink is also a consistent supporter of crypto and blockchain. He has numerous videos extolling the benefits of blockchain in improving payments, settlement.

Larry Fink is the ‘protagonist’ in crypto and he doesn’t even know it. Maybe that’s the only way you can be the main character and survive?

Bank of China Embraces Blockchain: Issues $28M Digital Structured Note on Ethereum

Despite perceptions otherwise, China is more engaged in crypto that you might think. It’s home to 30,000 registered blockchain companies and holds 84% of the world’s blockchain patents.

An important question is whether this poses a threat to our democracy. The Hoover Institute certainly thinks so, warning of China’s growing influence in the digital economy.

It will be interesting to see if regulators and politicians change their tune at all. We see two options: 1) reject crypto and China’s growing influence, and maintain the status quo; 2) see this as strategic tech innovation, recognize the need to keep up with global competitors, and re-evaluate our position.

The world is moving fast, and regulators and politicians need to keep up with these changes.

It’s a reminder that crypto is truly global.

How the PGA & Liv Merger Connects to the Trade Deficit & AI

Here is our video which dives deeper into how the PGA Tour is part of the US needs to finance its current account deficit via the sale of capital assets.

Until next week, let’s continue to seek non-consensus and correct, making the most of these interesting times.

Meme of the Week

Quote of the Week

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." - George Soros

"I cannot teach anybody anything, I can only make them think." - Socrates

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.