Tick tock, next block. This week at the Bitcoin Conference, we spoke to dozens of investors and founders about the path forward for the digital currency. There’s confusion regarding Bitcoin’s direction. BRC-20s have grown dramatically.

As Bitcoin conference CEO David Bailey put it, BRC-20s are Bitcoins’s CryptoKitties moment.

That’s a reference to the congestion on the Ethereum network from the now famous NFT project.

But why are we comparing Bitcoin to Ethereum? Bitcoin seeks to serve as ‘digital gold’ - a zero duration spot commodity. Ethereum is a platform. It better resembles a long-duration growth platform like an App Store (albeit decentralized and permissionless).

There’s a debate on whether Bitcoin should serve as digital gold or evolve into a platform. Miners love the greater fee revenue - and miner’s have an influential role in shaping the destiny of bitcoin. One plus? The fee revenue does augment the security model for Bitcoin. Another? Ordinals create another vector to attract creators and grow cultural relevance.

However, the purists believe that Bitcoin and Ethereum (and other chains) are better suited to specialization. We don’t envision a LOTR ‘one chain to rule them all’. Each chain has specific properties and technical trade-offs that lend themselves to certain use-cases.

Another topic of discussion: declining crypto market liquidity. Crypto market liquidity is down dramatically. A $2 MM spot transaction can move the price of Bitcoin, whereas it would take $50 MM to achieve the same impact during the bull market, according to the market makers we speak to.

This viral thread explains why there are fewer market makers - we explain how this goes back to the unraveling of bank settlement layers: Silvergate & Signature.

Another emerging theme is the rise of the Asian market? Several top VC firms are pointing to the increased adoption of Bitcoin, and crypto more generally, in Asia. In our prior newsletter we have already explained how Singapore, Japan, Hong Kong and the European MICA framework are causing capital and talent to move offshore. We’re also now seeing growth in users as well.

Source: Valkyrie

On the venture side, we attended the Van Eck conference with Jan Van Eck (CEO of Van Eck), Howard Lindzon (Founder, Social Leverage), and Nick Van Eck (General Catalyst).

Our view is we believe private venture market returns are still adjusting to higher real rates. On average, we expect venture as an asset class to under-perform the next ten years. There’s still too much VC money chasing not enough qualified companies with product market fit.

The best time to invest in venture was shortly after the 2008 crisis. Uber and Twitter were birthed in ‘capital deserts’. We are far from that type of climate today. That said, there are exceptional VCs that we remain excited about due to their team, thesis, and focus. For example: we are excited about cybersecurity. AI will increase new fraud threat vectors - and everyone is going to need to invest in their cybersecurity defenses in the same way home security or auto insurance is commonplace.

What other themes are we excited about? The banks are pulling back due to a 6%+ drawdown in deposits and CRE. There’s a major opportunity to fill that gap with private direct lending and distressed CRE investing. Indeed, we spoke with a fund manager that is exploring bidding 70 cents on the dollar on performing assets seized by the FDIC from recent bank failures. We like that type of instinct.

On the macro side, we enjoyed sharing ideas with Lyn Alden on macro, Bitcoin and portfolio construction. We both agree that the traditional 60/40 portfolio may struggle in a higher real rate environment.

Macro

Turning to macro, jobless claims hit an 18 month high in potentially the first weakening in the employment market. Reading macro can feel like parsing the tea leaves. There’s so much conflicting data. And we look at all of it via our Macro Chart Book (email us for a copy).

We recommend focusing on jobless claims. When jobless claims widen credit spreads soon follow.

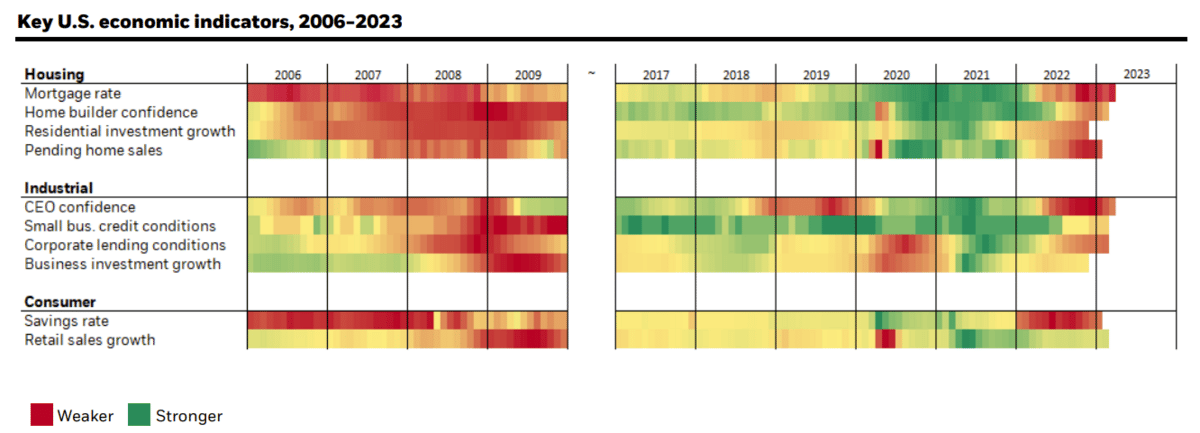

This chart is a nice summary of how this cycle is different than 2008. Notably, we have $2 Tn in stimulus that occurred before the recession rather than after. That dynamic means that consumers have excess savings. They are spending down their excess saving which is why retail sales remain strong.

Source: Blackrock

However, we are starting to see weakening in lower income tiers. The delinquency rate on consumer loans is edging higher. This is consistent with our view that the ‘burn off’ in excess savings will coincide with economic weakness.

Schizophrenic Bond Markets

Meanwhile, the Fed Fund futures market is schizophrenic. Markets are simultaneously pricing in a 20% probability of another rate hike in June, while expecting a 27% chance of a rate cut in July.

We believe the market is mispricing the Fed and we’ll see rates stay higher for longer. The Fed is taking a two prong approach of providing liquidity to the banking system, while also staying the course on combatting inflation. The Fed wants to have its cake and eat it too.

The gap between the market’s expectations of Fed rate cuts and current Fed rates is wide as ever.

Source: Yardeni Research

Markets expect the Fed to do an immediate about face and do 3 to 4 rate cuts. The Fed doesn’t turn on a dime (unless there is a financial market dislocation). We believe markets will be disappointed.

Amidst this backdrop we recommend alternative investments that we expect will benefit from dislocations and create long-term tax efficient wealth creation and are a hedge against inflation. We like niche uncorrelated quantitative hedge fund strategies and distressed CRE as an example. Reach out to learn more.

Large Cap Tech vs. All Else

The top 6 to 7 stocks account for nearly all of the YTD gains in the indices. That in turn is driven by the “AI narrative” with Nvidia leading the pack and sporting a pricey 85 P/E ratio. (How long before Nvidia replaced Netflix in FAANG?)

Tactically, we believe over the next two weeks is a good time to gradually reduce exposure to risk assets that have rallied hard this year.

Why? We see high-yield spreads widening. The 10-year is at 3.6% now - the bond market is tightening while equity markets are running higher. Several months ago the bonds were tightening while markets were rallying - we like to see that pattern.

We would expect to see mean reversion start to assert itself in the coming months with the S&P equal-weight outperform the large-cap indices. The momentum trade has not yet exhausted itself.

There are catalysts in the background that could setup for disappointment in the narrative: (i) AI adoption takes longer than most expect, (ii) Apple’s ‘Google Glass’ reboot gets a cooler reception, (iii) earnings declines from slower weakening consumer spending in the 2H.

Consider that Apple’s revenue has declined over the last several quarters. The large growth stocks we have come to know and love are entering the maturation phase and evolving into value stocks. (That means EPS growth and multiples come down over the next several years.)

Tactically, our ideal trading setup over the next two weeks is if markets run higher while the 10-year and high-yield continue to widen and retail speculation increases - that would cause us to grow risk averse and cautious.

Meme of the Week

Quote of the Week

"The market can remain irrational longer than you can remain solvent." - John Maynard Keynes

If you enjoy the Lumida Ledger, please forward to a friend or subscribe.

If you’re interested in Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.