Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week:

Macro: Beyond 2023: Bonds, rates, bank failures & real estate

Markets: Vibe change, are we in a bull market?

Company Earnings: ZS bounceback, consumer & TMT trends.

AI: OpenAI Killer, AI Chip Wars: LPUs, TPUs & GPUs

Digital Assets: Narrative vs substance: Ideas for 2024

Heads up - Ram will be in SF next week. If you have time to get together next Tuesday and Wednesday - reach out. Ram is connecting with Lumida Wealth clients, venture capital firms, family offices, and various asset managers.

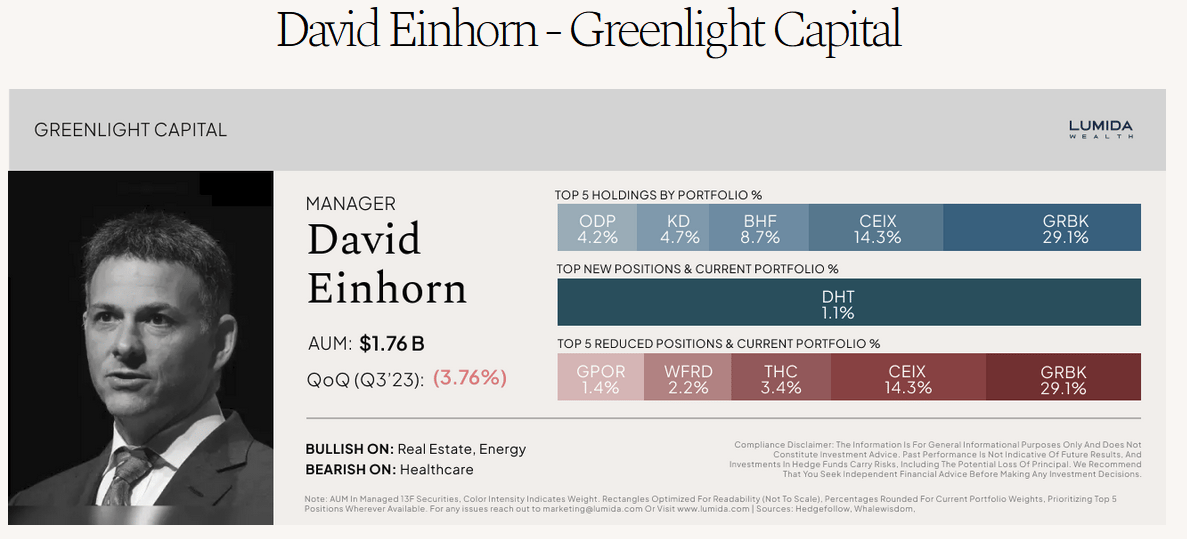

Introducing Lumida Whale Watch

Here’s the Lumida Whale Watch. A visual summary of the moves of the 30 most iconic hedge funds.

Druckenmiller, Soros, BridgeWater, Michael Burry and more.

These are great for idea generation, spotting new trends, and detecting overcrowding

Select the fund style and dive in. Tweet your favorites with the tweet buttons at the end of each manager summary.

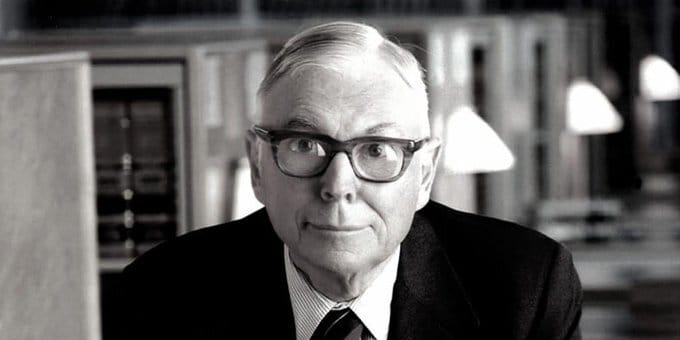

Honoring Charlie Munger

Charlie Munger, investment legend and Buffett’s right hand, passed away this week.

Munger taught us invaluable lessons about investing & life - always with wit and humor.

‘Buy wonderful businesses at fair prices’. That’s Charlie Munger.

The concept of ‘Mental Models’ - that’s Munger.

Munger was a voracious learner.

I have compiled several threads below to dissect what Buffett and Munger in their honor.

Munger advised buying See's Candy for $25 MM. That business is still owned by Berkshire and has returned a whopping $2 Bn. 80X.

Blackstone would have sold See's Candy in 8 to 10 years. That's how PE works.

Berkshire holds great businesses and lets them internally compound forever.

The key: If you believe the business has a 'long tail of cash flows', then you can afford to pay up.

Macro

Have you noticed?

The recession is always 2 quarters away. Sentiment is thawing a bit, but the Wall Street strategists at BAML and JP Morgan are still bearish. So there are other layers of capital not in markets.

Markets are overbought, and they usually get more overbought in a bull market. I suggest focusing on areas that haven't run-up so much. Tech & Semis had a November to Remember.

And I'm not adding risk capital to those sectors now. (The time for that was mid to late October - which we wrote about and did.) I expect we'll see moves in small caps this December…

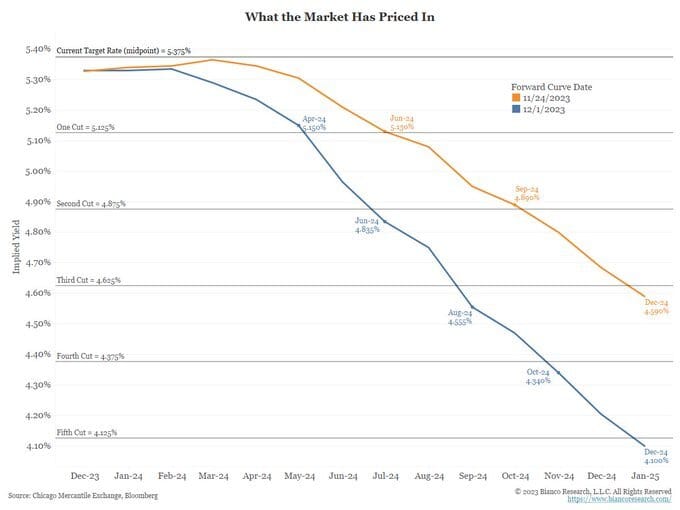

How much have Fed expectations moved this week? Jim Bianco has a nice chart.

Last Friday (orange, Nov 24) had 3 cuts priced in for 2024, with the first in June.

Today (blue, Dec 1) has five cuts priced in for 2024, starting in April (straddling the March 22 and May 1 meetings).

We expect no rate cuts until Q4 of next year, and possibly none at all. The ghost of higher for longer continues.

Global Financial Conditions Are Easing

Global rate cuts surpass hikes for the first time since Jan 2021. That’s something to take notice of.

Liquidity is entering the system - especially in emerging markets.

Macro Highlights - Fed Beige Book highlights:

The Beige Book is telling us that rates are slowing auto, Tesla / EVs, luxury, CRE, and housing.

That’s why we are not fans of owning Tesla. It’s over-valued – and the stock has gone nowhere in three years.

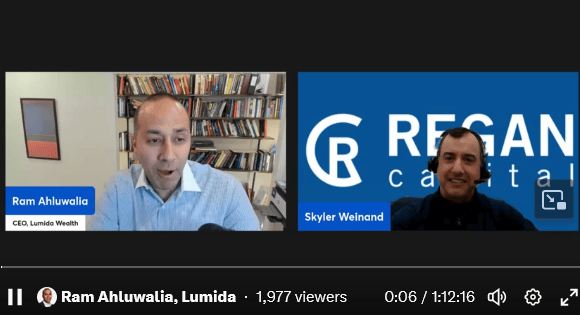

If you want to dive deeper into macro & how to generate equity like returns for credit like risk check out our interview on Beyond 2023: Bonds, rates and real estate with Skyler Weinand, Hedge fund manager, Regan Capital.

Skyler specializes in trading agency and non-agency mortgage bonds.

We discuss:

- The health of the US Consumer Balance sheet

- The state and outlook of the housing market

- New Issue mortgage vs. old credit

- Expected bank failures, and the characteristics of banks with weakness

- Mortgage Bond Primer

Markets

November was a month to Remember.

Equities were up ~8.6% for the month. The first week marked 6% of the move.

This is the nature of markets. It’s not new.

This was a “pre-position and anticipate” coming out of the Q3 correction.

On October 29th the Sunday after the 10/26 bottom, we laid out our reasoning for the statement: “Statistically, there is a good chance that markets are bottoming.”

On July 30th, we wrote: “Over the next two months, however, we do want to highlight a ‘yellow light’. Higher yields mean higher discount rates for equity valuations. Economic surprises should mean revert soon. expectations are a bit ahead of reality.”

During that three month window, after reducing exposures in model portfolios we were mostly “twiddling thumbs” and then waiting for a vibe change and signs of capitulation.

Fast forward, we are twiddling thumbs again.

Markets are overbought - especially in technology. Take a look at some of these tech names.

If you feel like you missed the rally, in tech we like Google. It’s non-consensus due to the fear of OpenAi displacing search.

How do we feel about equity markets?

We are in a bull market. Markets are overbought. And in a strong trending bull market, like we have now, markets tend to get more overbought.

Stay long, but be cautious about adding risk capital - especially to technology. The time for that was in mid to late October - which is exactly we said and did - right here in this newsletter.

Let’s cycle through our three-prong market compass.

10-Year: The 10-year is at 4.22%. Wow. It touched 5% in October. Now, bonds have had a tremendous bid - and equities - positive correlation.

Lower 10-year yields are constructive for long duration risk assets like equities. This is a great sign longer-term.

Also, the violent rally indicates there is a ton of liquidity out there. There’s a lot of cash on the sidelines. We can see that in different charts as well which we won’t get into here.

USD. The dollar continues to decline. That’s bullish. However, there are signs of extending.

Semiconductors

These took off like a rocket in early November. Now they are stalling and trending a bit lower. Nvidia was down for the week.

So, we have a mixed bag.

What about fundamentals?

On the Fundamental side, Q3 delivered 4% YOY earnings growth.

We noted a few months back, Analysts expected 0% YOY earnings growth for Q3 and we like to “step over low bars”.

Markets are all about expectations.

This is another call we believe has worked out well. We like to line up technicals, fundamentals, and sentiment, and valuation in our multi-faceted approach.

Where we stand today, we have a lukewarm hand. It’s like you are playing poker with a friend and you have a high card Jack.

Whereas at the end of October, the pot was big, and we had a pair of Jacks.

Where is the value today?

Small caps and REITs.

Small caps have strong seasonality in December and January.

They have lagged the market because they are more exposed to higher interest rates than Big Tech firms that don’t rely on debt.

So, find small caps that have solid growth (say, 10 to 15%), low debt. Other traits to look far: #1 market share leadership in their niche, cash flow growth, strong management, and a reasonable valuation.

Over the last several weeks, we researched small caps with our trusty 13F tracker.

We’ve identified hedge funds that have a strong track record in picking small caps.

And we use that to short-cut our research process. We love it when we can get even cheaper entries than when hedge funds put on their position. (These tactics are something legacy wealth management doesn’t even think about.)

We’ll share a few small cap ideas in the coming weeks - first we want to position our clients in them - and there’s less liquidity there.

It’s time to look for greener pastures.

Our general market outlook is that we will see all-time highs in the indices in the coming weeks and months.

Vibe Change

We detected a vibe change this past week.

A vibe change is an expression we use to describe a change in the activity of market participants - something underneath the currents.

Vibe changes usually lead markets by a few weeks to months. In June we say a vibe change ahead of the July top, and in October we saw a vibe change with hedge funds starting to go long.

Here’s another one.

First, we saw last week that hedge funds have record crowding and the momentum factor is over-extended. That’s a Yellow light.

This week, we say in the Goldman Sachs positioning and flows report the following statement: “Overall US equities were net sold for a 3rd straight week, driven by both Single Stocks and Macro Products. asset Managers finished the week $950mm better for sale, as we finally started to see signs of LOW supply out of "Mag 7" longs and into "the rest" (pockets of quality software/YTD laggards)

From a sector’s perspective, Info Tech saw continued de-grossing activity led by long sales (largest in nearly 7 months).”

Funny enough - that’s the conclusion we arrived at in the analysis above. The institutions have a lot of money - and they are moving on to new pastures.

What that means is the most recent buyers this week were not hedge funds - they were retail investors. We generally don’t want to be on the same side of retail investors.

When retail investors are the bid, that’s like ‘last call’ at the bar. Things start to get a bit sloppy!

What’s working and not working?

Unprofitable tech companies have trounced Mag 7 this past week. Unprofitable tech would include Bitcoin Miners, Coinbase, Affirm, Peloton, etc.

And the hedge funds favored positions are losing - whereas hedge funds most shorted positions rallied.

In 2021, everyone thought they were an investing genius. Retail investors are going to start feeling that phenomenon soon. That's a sign we are in Phase 2 of the market rally.

Phase 1: Non-Consensus to Phase 2:

Phase 1 was the Non-Consensus Rally.

Most capital was offside, and wrong-way positioned and value was abundant.

Phase 2 is where sentiment is thawing (a bit too quickly perhaps).

People are leaning in.

There is still skepticism, but another layer of capital has added a bid to markets in the last month.

Valuations are higher but not excessive.

Phase 2 is where markets climb a wall of worry.

Phase 3 is when Consensus is all-in and public markets valuations are excessive.

Usually you have a Goldilocks backdrop and a new economy or AI narrative. That takes a few years to get going.

We have a ways to go. That's my sense today.

I'm always evaluating incoming data to test and falsify these hypotheses

What’s Non-Consensus?

The question we ask ourselves today is ‘What’s Non-Consensus?’.

Not sure we have a clear answer. Our non-consensus ideas have rallied…and we still like many of them.

But certainly China is Non-Consensus..

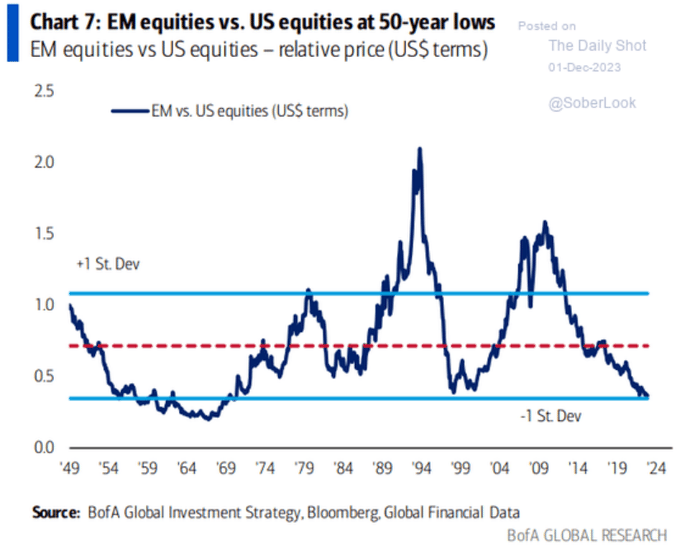

Emerging market equities are at 50-year lows relative to the United States. China and Brazil are a big part of that.

Investing in China does take some deep specialization. The country is not growing all that quickly, and a demographic implosion will slow that further. So, we’re going to interview a China portfolio manager in the coming weeks to get smarter on the sector.

Maybe there is something to do?

Markets Have gone nowhere in Two Years

S&P 500 close on 11/30/23: 4,567.80

S&P 500 close on 11/30/21: 4,567.00

How funny is that? So, rate hikes have had their effect on equity markets. But, markets are looking past that to rate cuts.

Mag 7 Vs. The Rest

Take a look at this data on Mag 7. What would you own?

If you were an alien looking at these stats fresh, where would you focus?

What would you avoid?

Meta's YTD rally was driven by cheap valuation at the beginning of year, combined with expense reductions.

Tesla is a retail sentiment indicator.

Chamath is wrong in saying that Mag 7 has trounced all the rest. It has trounced the 493 companies in the S&P.

But many, many companies are not in the S&P.

Take a look at this list. You’ll see there’s plenty of good fishing to be had.

On Venture Capital

What are realistic return expectations for Limited Partners investing in venture capital funds?

David Clarke & Meghan Reynolds posted recently about top quartile DPI performance.

Top quartile delivers 3x DPI (cash back to investors). That’s the best 25%. On average, you are not accessing that.

Only 15% of venture funds delivered 2x or higher.

Markets double every 8 years assuming 9% growth rate. And you get liquidity.

You have to get into the top 5% to make more than 3X+.

Revenue Beats are Declining, Earnings Beats Are Increasing

Take a look at this chart of the 5-year rolling Earnings and Sales beat rates for reporting companies.

Notice how Revenue beat rates are declining. Earnings beat rates are increasing.

Earning going up with lower revenue due to capex and HC reductions (see Amazon, Salesforce, Meta, etc.)

The takeaway? Focus on companies that can deliver true earnings growth.

Why was 2021 such a big spike? That was the $2 Tn+ in Covid stimulus

Israel’s Performance After Its 9/11 [ On October 7th ]

With a gain of 16.3%, the Israel country ETF $EIS was the top performing ETF in our asset class performance matrix in November.

Read our thread here to see how we parsed the asset in real-time.

Don’t let your amygdala run your investments.

Company Earnings

Zscaler with a double beat:

CEO: "We had a strong start to our fiscal year with all key metrics coming above our guidance"

Zscalar shares dropped about 6% + on the announcement in the after-market. We bought in the PA account. It’s back to the new ATH.

When Mr. Market gives you a deal on a company you like, you take it!

Themes This Week:

Sign of consumers pulling back on cosmetics and consumer discretionary

AI

Ram interviewed Jonathan Ross, co-inventor of the TPU at Google.

He has built an OpenAI killer called Groq. Listen to the interview below.

They discuss:

Who's going to win the race for AGI?

How to build AI software and hardware products?

What does it take to compete against Open AI, NVIDIA, ARM?

What is a Language Processing Unit (LPU) and AI inference speed and quality?

Cut through the noise, whether you're a tech investor or an AI enthusiast, this episode is a must-listen!

Digital Assets

Want to know what narratives will drive crypto adoption into the next bull market and how to create a portfolio accordingly?

Listen to Ram’s full interview with Scott Melker.

They discuss the next big opportunities in DeFI, gaming, crypto & Tokenization

Work with us: we are are looking for a client associate to help us with sales and client service support. Send referrals here.

Quote of the Week

’I think you would understand any presentation using the word EBITDA, if every time you saw that word you just substituted the phrase, ’bull**** earnings.″ -Charlie Munger

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.